Options contracts are powerful financial tools that provide flexibility to traders and investors. Whether you’re looking to hedge risk, speculate on market movements, or diversify your portfolio, understanding options is essential. This guide breaks down everything you need to know about options contracts, from the basics to their practical applications.

What Are Options Contracts?

An options contract is a financial derivative that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (called the strike price) on or before a specific date (expiration date). These contracts are popular because they allow traders to leverage their investments and manage risks more effectively than trading the underlying asset directly.

Options are primarily used in two ways:

- Call Options: Give the holder the right to buy the underlying asset.

- Put Options: Give the holder the right to sell the underlying asset.

How Do Options Contracts Work?

To understand how options work, it’s essential to know the roles of the buyer and seller in the options market:

- Buyer (Holder): Pays a premium for the contract and gains the right to exercise it.

- Seller (Writer): Receives the premium and has an obligation to fulfill the contract if the buyer exercises it.

Key Terms to Know:

- Premium: The price paid by the buyer to acquire the option.

- Strike Price: The agreed price at which the underlying asset can be bought or sold.

- Expiration Date: The date when the option expires.

- Underlying Asset: The financial instrument (e.g., stock, index, commodity) tied to the option.

Example of a Call Option:

Imagine you buy a call option on a stock with a strike price of $100, expiring in one month, and pay a premium of $5. If the stock price rises to $120 before expiration, you can buy the stock for $100 and sell it for $120, earning a profit. If the stock price stays below $100, the option expires worthless, and your loss is limited to the $5 premium.

Why Trade Options?

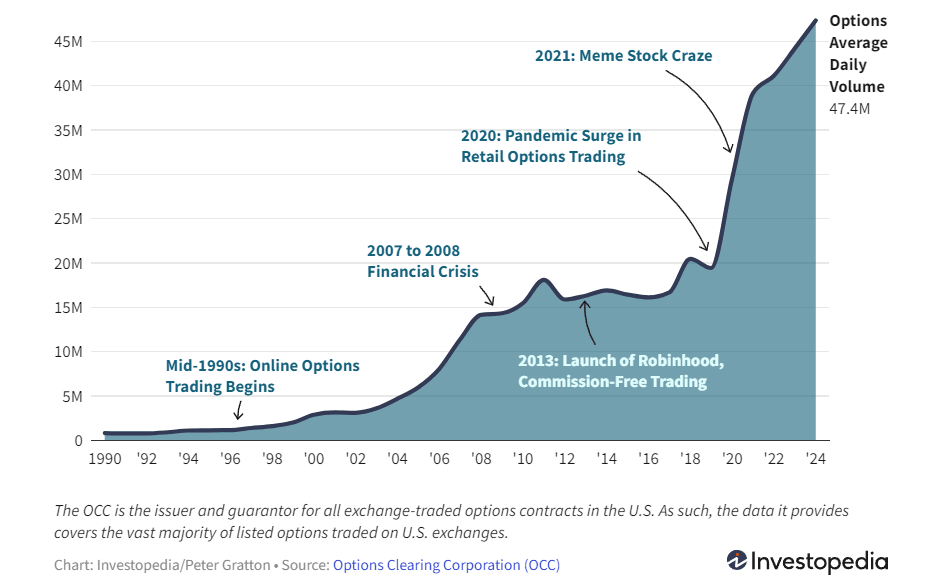

Options trading has grown exponentially, driven by major events like the 2007-2008 financial crisis, the 2020 retail trading boom, and the rise of commission-free platforms like Robinhood. This surge highlights the increasing popularity and accessibility of options in today’s financial markets.

Options contracts offer several advantages, including:

- Leverage: Control a larger position with a smaller initial investment.

- Risk Management: Hedge against unfavorable price movements in your portfolio.

- Flexibility: Use various strategies to profit in different market conditions.

- Income Generation: Sell options contracts to earn premiums.

Types of Options Contracts

Call Options:

- Give the buyer the right to buy the underlying asset.

- Best for bullish traders who anticipate a price increase.

Put Options:

- Give the buyer the right to sell the underlying asset.

- Best for bearish traders who expect a price drop.

Advantages of Trading Options

- Limited Risk for Buyers: Your maximum loss is the premium paid.

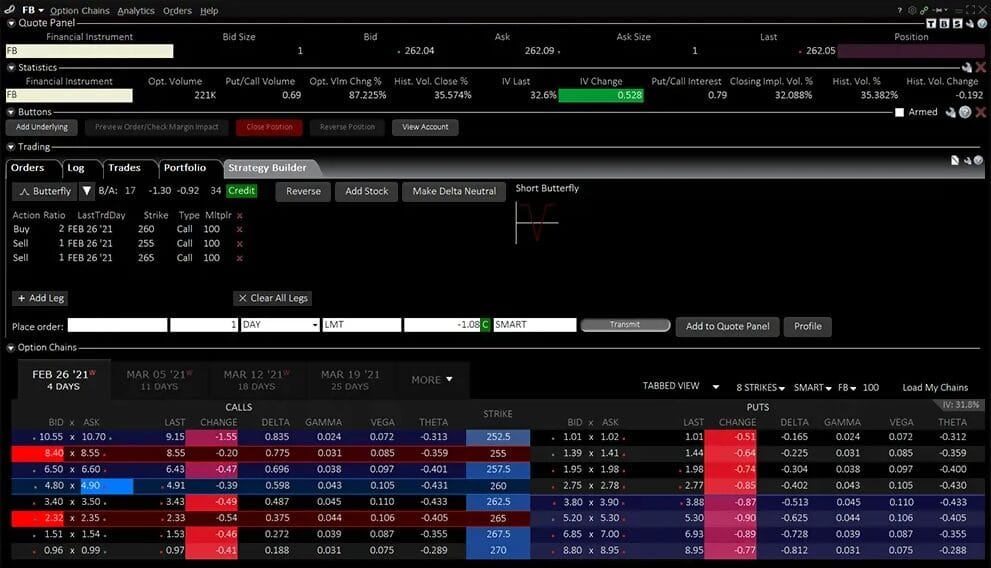

- Diverse Strategies: Combine options to create strategies like spreads, straddles, and strangles.

- High Potential Returns: Profit from market movements without owning the underlying asset.

Risks of Options Trading

- Complexity: Requires a deep understanding of market dynamics.

- Time Decay: The value of options decreases as expiration approaches.

- High Risk for Sellers: Unlimited loss potential if the market moves against them.

How to Start Trading Options

- Learn the Basics: Understand key terms, pricing, and strategies.

- Choose a Brokerage: Find a platform that supports options trading and offers educational resources.

- Start Small: Begin with simple strategies like buying calls or puts before exploring advanced methods.

- Practice Risk Management: Use stop-loss orders and position sizing to limit potential losses.

Common Questions About Options Contracts

1. Can I lose more than I invest in options?

- As a buyer, your loss is limited to the premium paid. However, sellers can face unlimited losses if the market moves unfavorably.

2. Are options suitable for beginners?

- Yes, but it’s essential to start with basic strategies and understand the risks.

3. Do I need a special account to trade options?

- Many brokers require a margin account and approval for options trading.

Conclusion

Options contracts are versatile instruments that can help traders achieve their financial goals, whether hedging risk, speculating, or generating income. While they offer unique opportunities, they also come with inherent risks, making education and practice crucial for success. Start small, stay informed, and explore the exciting world of options trading.