If you’re new to options trading, the term “put options” might seem intimidating. However, understanding how they work can open up a world of opportunities in your trading journey. This guide simplifies put options for beginners, breaking down key concepts, uses, strategies, and potential risks. Whether you’re exploring options for the first time or looking to refine your understanding, this article has you covered.

What Are Put Options?

A put option is a financial contract that gives the holder the right, but not the obligation, to sell a specific quantity of an asset (like a stock) at a predetermined price, known as the strike price, within a specified time period.

Key Terms to Know:

- Underlying Asset: The security or asset (e.g., a stock) that the option is based on.

- Strike Price: The price at which the option holder can sell the asset.

- Expiration Date: The date by which the option must be exercised or it expires worthless.

- Premium: The cost of purchasing the put option.

- In-the-Money (ITM): When the current price of the asset is below the strike price.

- Out-of-the-Money (OTM): When the current price of the asset is above the strike price.

How Put Options Work:

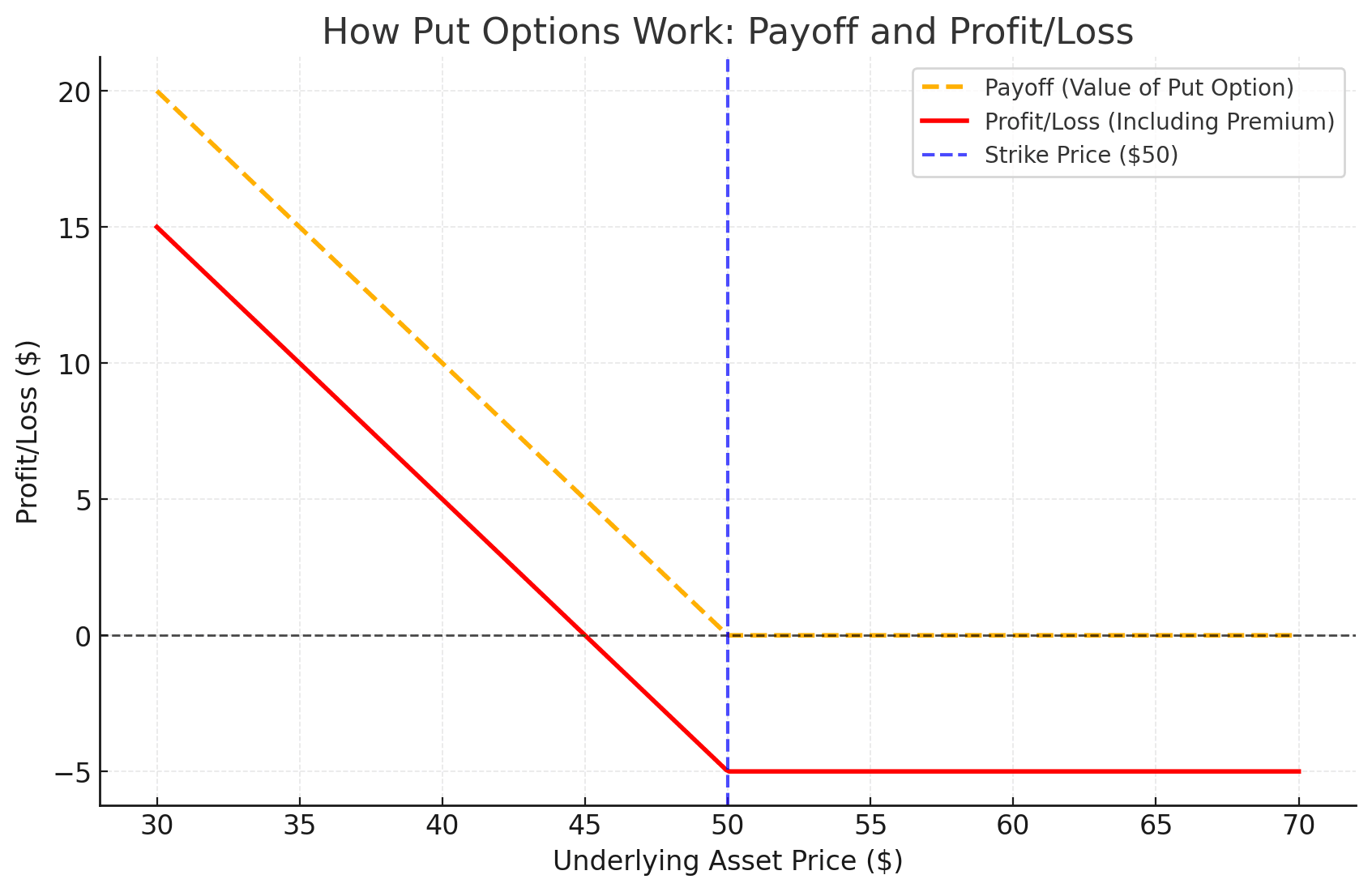

When you buy a put option, you’re essentially betting that the price of the underlying asset will fall below the strike price before the expiration date. If this happens, the option becomes valuable.

Put Options vs. Call Options

Understanding the difference between put options and call options is crucial to making informed trading decisions. Both are options contracts, but they serve very different purposes:

| Feature | Put Options | Call Options |

|---|---|---|

| Definition | Gives the right to sell an asset | Gives the right to buy an asset |

| Market Outlook | Used when you expect the price of the asset to fall | Used when you expect the price of the asset to rise |

| Hedging Purpose | Protects against price drops | Protects against price increases |

| Speculation | Profit from a price decline | Profit from a price increase |

| Risk | Limited to the premium paid for buyers; high for sellers if the asset drops significantly | Limited to the premium paid for buyers; high for sellers if the asset rises significantly |

Key Takeaway:

- Call Options: You’re bullish, expecting prices to go up.

- Put Options: You’re bearish, expecting prices to go down.

Why Trade Put Options?

Put options are versatile tools used by traders and investors for various purposes, such as:

- Hedging: Protect your portfolio from a market downturn by purchasing puts as “insurance.”

- Speculation: Profit from a decline in an asset’s price without needing to short sell.

- Income Generation: Sell put options to collect premiums, often used in strategies like cash-secured puts.

- Leveraged Gains: With a small initial investment (premium), you can control a larger position.

How to Use Put Options

1. Buying Put Options

- Scenario: You expect the price of a stock to fall.

- Example: You buy a put option for Stock XYZ with a strike price of $50. If the stock price falls to $40, you can sell it at $50 (or sell the option for a profit).

- Risk: Limited to the premium paid.

- Reward: Potentially large if the stock price falls significantly.

2. Selling Put Options (Writing Puts)

- Scenario: You expect the stock price to stay flat or rise slightly.

- Example: You sell a put option for Stock ABC with a strike price of $100. If the stock price remains above $100, the option expires worthless, and you keep the premium.

- Risk: High; if the stock price drops significantly, you may be forced to buy the stock at the strike price.

- Reward: Limited to the premium received.

Advantages of Put Options

- Flexibility: Trade in both bullish and bearish markets.

- Leverage: Control large positions with relatively small capital.

- Risk Management: Protect your investments from downside risk.

Risks of Put Options

- Loss of Premium: If the stock price doesn’t move as expected, you lose the premium paid.

- Time Decay: Options lose value as they near expiration.

- High Risk for Sellers: Selling puts can lead to substantial losses if the underlying asset drops significantly.

Popular Strategies with Put Options

1. Protective Put

- Objective: Hedge against potential losses in a long stock position.

- How It Works: Buy a put option while holding the stock. If the stock price falls, the put offsets the loss.

2. Cash-Secured Put

- Objective: Generate income or buy stock at a discount.

- How It Works: Sell a put option and set aside enough cash to buy the stock if assigned.

3. Bear Put Spread

- Objective: Profit from a moderate decline in the stock price.

- How It Works: Buy a put option and sell another put option with a lower strike price.

Step-by-Step Guide to Trading Put Options

1. Understand Your Market Outlook:

- Are you bearish or looking to hedge?

- Assess the market conditions.

2. Select the Right Strike Price:

- ITM Options: Higher cost but more sensitive to price movements.

- OTM Options: Cheaper but require significant price movement to be profitable.

3. Choose the Expiration Date:

- Short-term options have lower premiums but higher time decay.

- Long-term options (LEAPS) provide more time but are costlier.

4. Calculate Your Risk-Reward:

- Define your maximum potential loss (premium paid).

- Understand your breakeven point: Strike Price – Premium Paid.

5. Place Your Trade:

- Use your brokerage platform to buy or sell put options.

6. Monitor Your Position:

- Track the price of the underlying asset and the option’s value.

- Decide whether to exercise, sell, or let the option expire.

Common Mistakes to Avoid

- Ignoring Time Decay: Options lose value as they approach expiration.

- Choosing the Wrong Strike Price: ITM options are safer but more expensive; OTM options are risky but cheaper.

- Overleveraging: Avoid risking too much capital on a single trade.

- Lack of a Plan: Set clear entry, exit, and risk management rules.

FAQs About Put Options

What is the main difference between a put and a call option?

A put option gives the right to sell, while a call option gives the right to buy an asset.

How do you profit from a put option?

You profit from a put option when the underlying asset’s price drops below the strike price, allowing you to sell the asset at a higher price or sell the option at a profit.

Are put options risky?

Yes, put options involve risk, especially for sellers. Buyers risk losing the premium paid, while sellers can face significant losses if the underlying asset’s price falls drastically.

Can you lose money on a put option?

Yes, if the asset’s price does not fall below the strike price by expiration, the option expires worthless, and you lose the premium paid.

Conclusion

Put options can be a powerful tool for traders and investors when used correctly. By understanding their differences from call options and their various applications, you can decide how to best incorporate them into your trading strategy. Whether you’re hedging, speculating, or generating income, put options provide flexibility and opportunities in a wide range of market scenarios.