Analyzing trading metrics is one of the most important skills every successful trader must develop. With the vast amount of data readily available from price movements and volume to more sophisticated indicators like volatility and market sentiment it can be easy to focus on the wrong signals or interpret the right ones incorrectly. Metrics such as Win Rate, Risk-Reward Ratio, Sharpe Ratio, and many others can help traders measure performance, optimize strategies, and refine risk management protocols.

However, many traders make common mistakes when analyzing these metrics. Sometimes, the error is as simple as relying too heavily on a single metric without looking at the bigger picture. Other times, traders might ignore the relevance of sample sizes, forget about adjusting for fees, or fail to account for emotional biases that skew how metrics are read and applied.

This article aims to provide an in-depth, user-friendly guide on the common mistakes traders make when analyzing metrics and how to avoid them. We will explore fundamental trading metrics, discuss typical pitfalls, and present actionable steps for improvement. By the end, you will have a deep understanding of how to properly use and interpret trading metrics in order to enhance your decision-making and overall performance in the market.

Table of Contents

Understanding the Importance of Trading Metrics

Metrics are the backbone of quantitative analysis in trading. Rather than trading by “gut feeling” or guesswork, metrics allow traders to make data-backed decisions. By tracking relevant indicators over time, you can identify patterns, measure improvements, and weed out strategies that are not profitable.

- Improved Decision-Making: Metrics act as a compass; they guide you toward better trades and help you steer clear of poor decisions.

- Consistency: Tracking metrics allows you to remain consistent in your approach. Consistency is crucial because sporadic changes in strategy or methodology often lead to confusion, increased risk, and inconsistent results.

- Risk Management: Well-chosen metrics offer vital information about your exposure and potential downside, enabling you to adjust position sizes or stop-loss orders proactively.

- Performance Evaluation: Whether you’re using daily returns, monthly profit and loss (P/L), or other advanced performance metrics, the data will show you if you are truly improving or just getting lucky in favorable market conditions.

Why Traders Often Overlook Important Metrics

Traders, especially novices, might overlook important metrics for several reasons:

- Lack of Knowledge: They might not fully understand the various metrics available or how to use them.

- Overwhelm: There are numerous metrics in the trading world, and sifting through them can be daunting.

- Emotional Biases: Traders sometimes choose to focus on metrics that confirm their biases. For instance, a trader might only look at the number of winning trades and ignore average losses.

- Time Constraints: Analyzing metrics takes time. In fast-moving markets, many overlook the step of thorough analysis in favor of real-time decision-making.

Understanding the “why” behind ignoring metrics is the first step to rectifying the problem. In the following sections, we’ll delve into specific key metrics and outline the mistakes traders often make while evaluating them.

Key Trading Metrics and Their Roles

Before we discuss the mistakes, it’s vital to know the most common metrics traders use to measure performance and risk. Each metric has its own strengths, weaknesses, and particular uses.

1. Win Rate

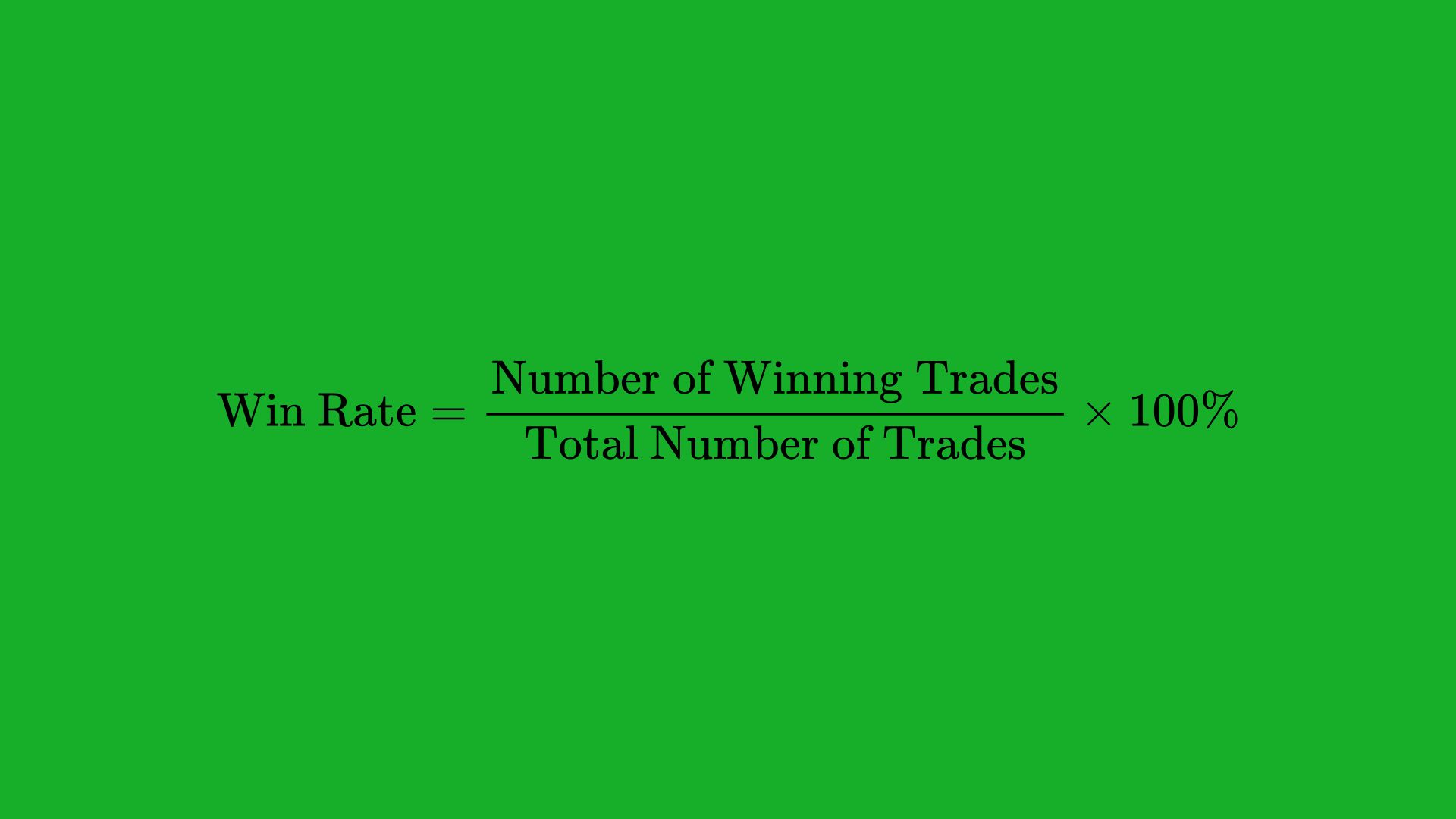

The win rate is the percentage of trades that end in profit. For instance, if you took 100 trades and 55 were profitable, your win rate is 55%.

Role:

- Indicator of Strategy Accuracy: A high win rate often suggests that your entries and exits are timed well, at least with respect to hitting profitable trades more often than not.

- Psychological Comfort: Some traders prefer strategies with high win rates because losing trades are psychologically difficult.

Considerations and Pitfalls:

- A high win rate alone does not guarantee profitability. You can win 90% of your trades but lose money if your losing trades are significantly larger than your winning trades.

- When analyzing the win rate, it’s essential to pair it with metrics like the Risk-Reward Ratio and Drawdown to get a complete picture of strategy performance.

2. Risk-Reward Ratio

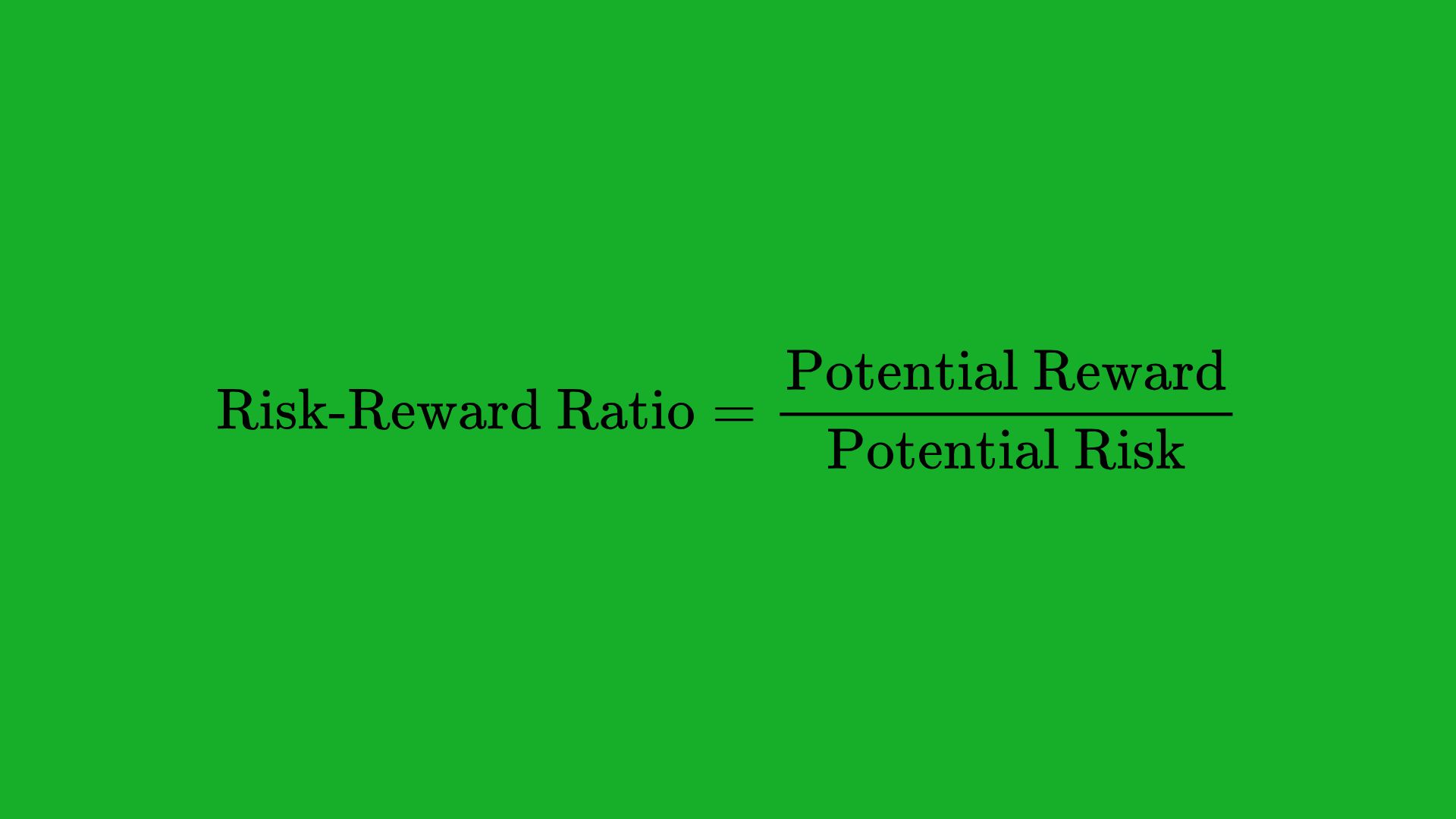

The risk-reward ratio (sometimes notated as R:R) is the ratio between the potential risk and the potential reward on a single trade. For example, if you risk 1% of your trading account for a potential 2% gain, your risk-reward ratio is 1:2.

Role:

- Aids in Strategy Development: Ensures that potential returns are sufficiently high compared to possible losses.

- Aligns with Risk Management: A favorable risk-reward ratio helps maintain positive expectancy over time, even if the win rate is not extremely high.

Considerations and Pitfalls:

- Some traders focus too heavily on achieving a high risk-reward ratio (like 1:3 or 1:4) without considering market context, liquidity, or probability of success.

- A theoretically high risk-reward ratio is meaningless if it’s seldom achieved due to poor trade execution or frequent stop-outs.

3. Drawdown

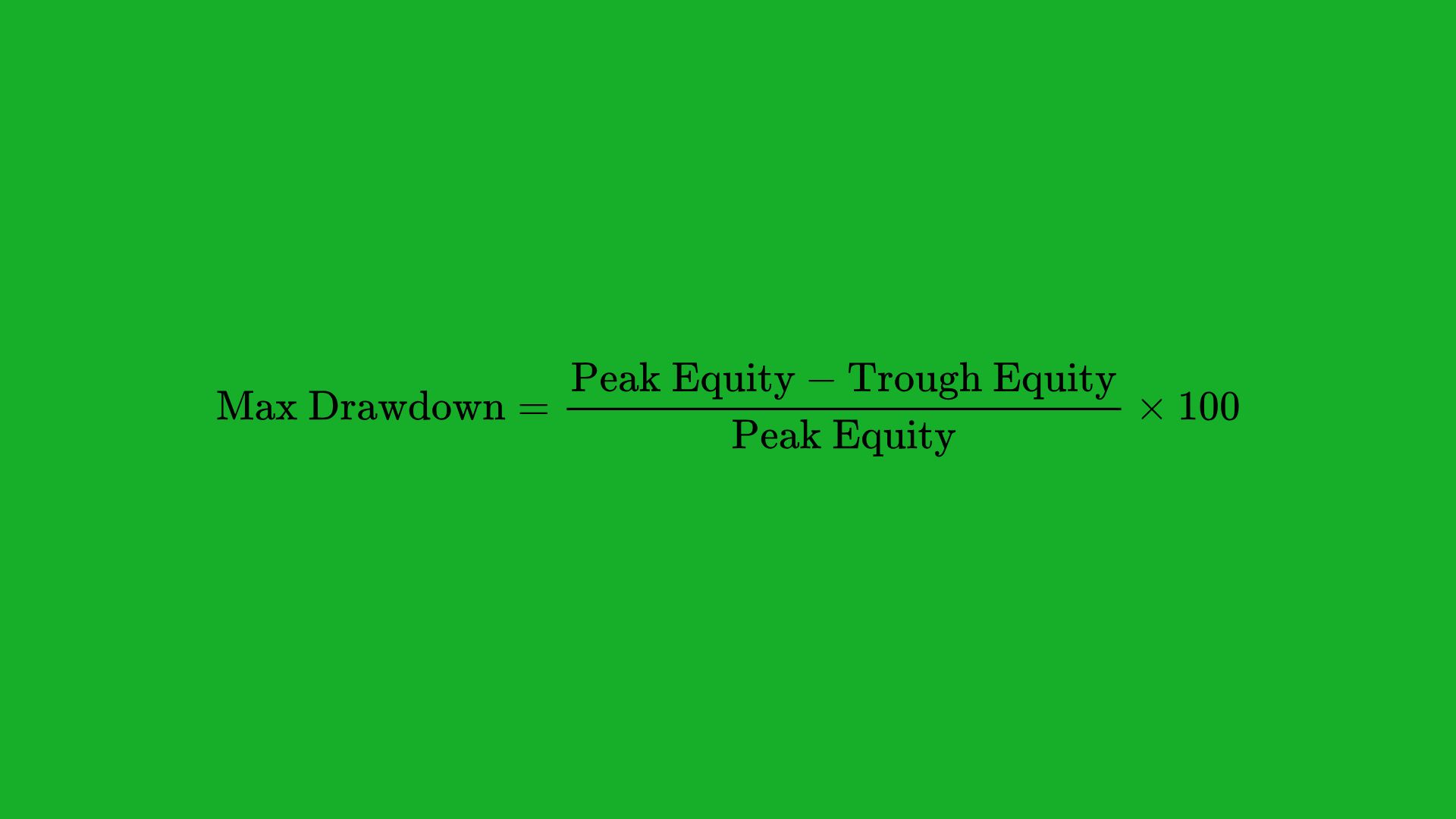

Drawdown measures the decline in account equity from a peak to a trough. It’s expressed as a percentage of the equity lost relative to the peak account balance.

Role:

- Key Risk Indicator: Drawdowns measure how much you might lose before recouping the losses. Large drawdowns can signal either high volatility trading or poor risk management.

- Stress Test: A large drawdown can be psychologically challenging, leading traders to second-guess or abandon their strategy prematurely.

Considerations and Pitfalls:

- Traders often misunderstand drawdowns by focusing only on maximum drawdown without considering how quickly they recovered (drawdown duration).

- Not all drawdowns are created equal: A 15% drawdown in a high-risk, high-return strategy might be more acceptable than a 10% drawdown in a low-risk strategy.

4. Profit Factor

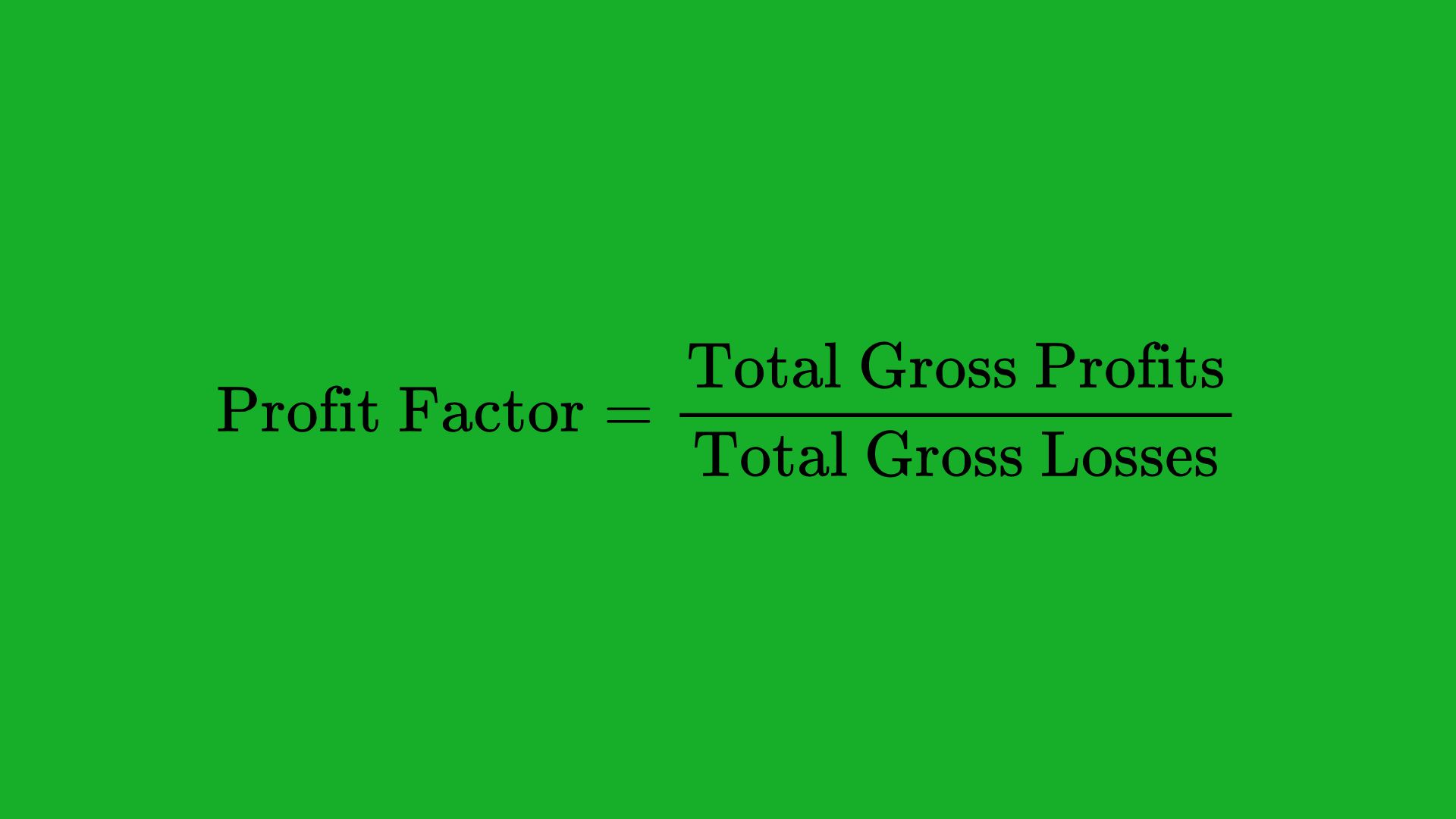

Profit factor is calculated as the ratio of your total profits to your total losses. If you have made $50,000 in profits and $25,000 in losses, your profit factor is 2.0.

Role:

- Measures Overall Profitability: A profit factor above 1 indicates that you’re net profitable over a period. The higher the profit factor, the more profitable the system.

- Strategy Evaluation: A stable, consistently high profit factor can indicate that your strategy has an edge.

Considerations and Pitfalls:

- Sometimes, a high profit factor is skewed by a few extraordinarily large winning trades.

- During sideways or choppy markets, the profit factor might look weak, but that does not necessarily mean the system is flawed; it might just mean it thrives in trending conditions.

5. Sharpe Ratio

The Sharpe Ratio is calculated by subtracting the risk-free return (e.g., Treasury bills) from your trading strategy’s return and dividing by the standard deviation of your returns. It attempts to measure return per unit of risk.

Role:

- Risk-Adjusted Performance: A higher Sharpe Ratio indicates that you are earning more return for each additional unit of volatility (risk).

- Comparison Tool: Institutional traders often use the Sharpe Ratio to compare different strategies or funds on a level playing field, taking into account the volatility of each.

Considerations and Pitfalls:

- The Sharpe Ratio assumes returns follow a normal distribution, which might not be the case in all market conditions.

- Large, one-time outliers (e.g., a huge single loss or gain) can distort the Sharpe Ratio for the remainder of the measurement period.

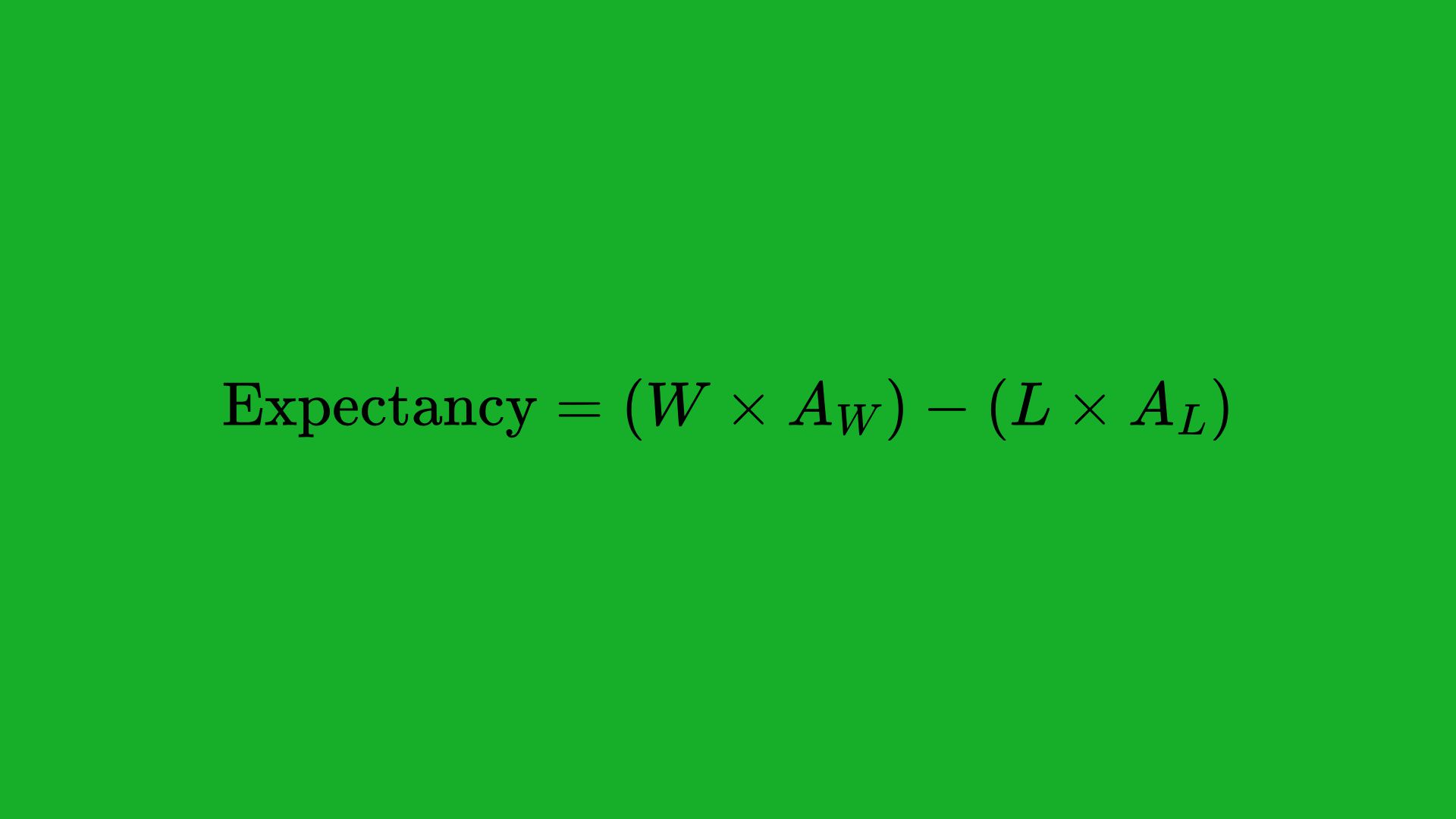

6. Expectancy

- W: Probability of winning (Win rate) – The percentage of trades that are profitable.

- AW: Average win – The average amount gained per winning trade.

- L: Probability of losing (Loss rate) – The percentage of trades that result in a loss.

- AL: Average loss – The average amount lost per losing trade.

Expectancy is the average amount you can expect to win (or lose) per trade.

Role:

- Long-Term Viability: A positive expectancy means that, on average, your strategy should make money over many trades.

- Strategic Insight: This metric combines both your win rate and your average gain/loss, giving a comprehensive view of profitability.

Considerations and Pitfalls:

- Expectancy is highly dependent on having a statistically valid sample size.

- Short-term anomalies can skew expectancy calculations, so it’s essential to test expectancy over multiple market cycles.

7. Trade Frequency and Volatility Adjustments

- Trade Frequency: How many trades you execute over a specific period.

- Volatility Adjustments: Adjusting metrics to account for market volatility (e.g., using ATR-based position sizing).

Role:

- Better Context: Understanding how frequently your strategy trades helps you see if your returns are the result of a few big wins or many small wins.

- Risk Management: Volatility adjustments can help you avoid oversizing your position in highly volatile markets.

Considerations and Pitfalls:

- Ignoring volatility can lead to inconsistent risk and massive drawdowns in turbulent markets.

- High-frequency strategies may have more trading costs, while low-frequency strategies can miss multiple market opportunities.

With these key metrics in mind, let’s explore the common mistakes traders make in analyzing them.

Common Mistakes When Analyzing Metrics

While the metrics listed above are essential to successful trading, many traders misuse or misinterpret them. Below are some of the most frequent errors, along with explanations.

1. Over-Reliance on a Single Metric

What It Is:

Some traders latch onto a single metric like win rate or Sharpe Ratio as a definitive indicator of success.

Why It’s Problematic:

- No single metric can capture all aspects of a trading strategy. You might have a high win rate but also a very low profit factor.

- Market conditions can favor certain metrics over others. A strategy that thrives in trending markets may have a great Sharpe Ratio during a bullish run, but that ratio might drastically deteriorate in sideways or bearish markets.

Example:

A trader with a 90% win rate might still be unprofitable if every losing trade wipes out the gains from multiple winners.

2. Not Considering Sample Size

What It Is:

Many traders conclude their strategy’s viability after just a handful of trades (e.g., 10 to 20 trades).

Why It’s Problematic:

- Small sample sizes are highly prone to randomness. A few wins or losses can significantly sway the results.

- Statistical significance in trading often requires a much larger number of trades, depending on the nature of the strategy (swing trading vs. day trading vs. high-frequency trading).

Example:

A trader tests a swing strategy over 25 trades and sees a 70% win rate. Believing the strategy is robust, they scale up capital only to face a losing streak in the next 25 trades because the initial trades were lucky outliers.

3. Cherry-Picking Data

What It Is:

Traders might selectively include or exclude trades or time periods that do not fit their desired narrative.

Why It’s Problematic:

- Leads to confirmation bias, where you only accept information that confirms your strategy is profitable.

- Masks weaknesses in your system. Ignoring losing trades or volatile market phases leaves you unprepared for them when they inevitably occur.

Example:

A trader might ignore the trades taken during a market crash “because it’s a black swan event” and only analyze trades from calmer periods, thus overestimating profitability and underestimating potential risk.

4. Confusing Correlation with Causation

What It Is:

Seeing two metrics or market factors move together and assuming one directly causes the other.

Why It’s Problematic:

- Markets are influenced by myriad factors: macroeconomics, geopolitical events, monetary policy, etc. Correlation might merely be a coincidence or driven by another factor.

- Acting on spurious correlations can lead to poor trade decisions.

Example:

A trader notices that whenever the S&P 500 rises, a particular tech stock also rises. They assume the S&P 500 causes the tech stock to rise, but both might actually be influenced by overall investor optimism about technology, not a direct cause-and-effect relationship.

5. Ignoring Market Conditions and Context

What It Is:

Analyzing metrics in a vacuum, without considering the prevailing market regime—bullish, bearish, volatile, or range-bound.

Why It’s Problematic:

- A strategy might perform exceptionally well in a bullish market (e.g., a buy-on-dips strategy) but falter in a sideways or bearish market.

- Failing to account for market conditions can lead to false assumptions about a strategy’s viability.

Example:

A momentum strategy that soared in a strong bull run might show fantastic metrics (high win rate, high Sharpe Ratio), but if tested or traded in a sideways market, the performance could deteriorate quickly.

6. Misinterpreting Drawdowns

What It Is:

Failing to analyze the nuance of drawdowns, focusing solely on maximum drawdown and ignoring frequency or duration.

Why It’s Problematic:

- Two strategies with the same max drawdown of 15% can have vastly different drawdown durations. One might recover in weeks, the other might take months or years.

- Large drawdowns might occur infrequently but still devastate account balances and trader psychology.

Example:

Trader A and Trader B both show a maximum drawdown of 15%. Trader A recovers losses within two weeks, while Trader B languishes in a 15% drawdown for six months. Merely comparing max drawdowns fails to illustrate the real-world impact.

7. Forgetting Trading Costs and Slippage

What It Is:

Overlooking the impact of commissions, spreads, and slippage on profitability metrics.

Why It’s Problematic:

- A strategy might look profitable on paper but become marginal or even unprofitable once real-world frictions are included.

- High-frequency or scalping strategies are especially sensitive to trading costs.

Example:

A scalper who aims to make 5 pips per trade in a forex market might not factor in a 2-pip spread. Suddenly, the expected profit is more than halved, and profitability plummets.

8. Lack of a Unified Trading Journal

What It Is:

Failing to keep all trading metrics and notes (e.g., emotional state, market conditions, trade rationale) in one place.

Why It’s Problematic:

- Splintered record-keeping makes it difficult to analyze performance trends or identify emotional biases.

- Traders might forget to log losing trades or keep incomplete notes, leading to an inaccurate understanding of real performance.

Example:

A day trader keeps trades in an Excel sheet one week, in a phone app the next, and forgets to log trades executed on a broker’s mobile platform. When analyzing performance, the data is inconsistent and incomplete.

9. Emotional Bias in Metric Interpretation

What It Is:

Allowing emotions such as fear, greed, or ego to skew how you read and interpret metrics.

Why It’s Problematic:

- Emotional biases lead to ignoring negative results, rationalizing poor performance, or overemphasizing certain trades.

- It prevents objective decision-making, which is crucial for consistent profitability.

Example:

A trader sees a high Sharpe Ratio and attributes it to skill alone, ignoring market tailwinds. Conversely, they might dismiss a negative performance month by blaming a “bad break,” rather than addressing real strategy flaws.

10. Failing to Adjust Metrics Over Time

What It Is:

Metrics are treated as static entities, rather than evolving measures that change with your account size, risk tolerance, and market conditions.

Why It’s Problematic:

- As your account grows, your risk profile might shift. Not adjusting metrics (like position sizing or expected drawdown) can lead to misaligned strategies.

- Market volatility changes over time, impacting metrics such as Sharpe Ratio, which relies on the standard deviation of returns.

Example:

A trader who started with a $10,000 account but now trades a $100,000 account continues using the same 3% risk per trade. While that might have been manageable earlier, it can lead to disproportionate risk at the larger account size if the trader doesn’t adjust.

11. Over-Fitting Strategies to Past Data

What It Is:

Tweaking a strategy until it performs extremely well on historical data, without confirming its robustness for future market conditions.

Why It’s Problematic:

- Over-fitting leads to a model that performs great on “training data” (past market data) but fails in live trading when the future differs from the past.

- Metrics can be misleading if they are only measured on an optimized backtest with no forward testing or out-of-sample testing.

Example:

A trader designs a system that looks phenomenal on the last 2 years of data but hasn’t tested it on older data or forward-tested it in a simulated environment. Once deployed live, the system fails quickly when the market changes character.

How to Avoid These Mistakes

Now that we’ve identified the most common pitfalls, let’s examine specific strategies to steer clear of them.

1. Diversify Your Metrics

- Combine Multiple Indicators: Look at Win Rate, Risk-Reward Ratio, and Drawdown simultaneously to get a full picture.

- Balance Short-Term and Long-Term: Use both short-term metrics (e.g., weekly or monthly performance) and long-term metrics (e.g., annual Sharpe Ratio, multi-year drawdowns).

Why It Works:

- No single number can capture market complexity. Diversifying metrics ensures you aren’t blind to potential risks or weaknesses.

2. Use Robust Sample Sizes

- Aim for Statistical Significance: The required sample size depends on your strategy’s variance. For many swing traders, at least 100 trades might be considered a starting point.

- Longer Time Horizons: Ensure you collect data across multiple market conditions—bull, bear, sideways—to understand how your strategy performs in each scenario.

Why It Works:

- Larger sample sizes reduce the impact of outliers and give a more stable estimate of true performance.

3. Maintain a Thorough, Consistent Trading Journal

- Centralized Record-Keeping: Consolidate all trades, including date, time, market conditions, emotional state, and reason for entry/exit.

- Periodic Reviews: Set aside time weekly or monthly to evaluate your journal and identify patterns.

Why It Works:

- A single source of truth ensures data integrity.

- Regular reviews keep you aligned with your strategy objectives and highlight early warning signs (like creeping drawdowns or poor R:R trades).

4. Periodically Review Market Conditions

- Regime Detection: Monitor simple filters like moving averages on major indices or volatility indicators (like VIX) to categorize the market as bullish, bearish, or sideways.

- Adjust Strategy or Expectations: If you notice a shift in market regime, reevaluate your metrics. Some strategies work best in trending conditions and need adjustments during choppy markets.

Why It Works:

- A dynamic approach to analyzing metrics ensures your strategy stays relevant.

- Market conditions change, and so should your interpretation of performance data.

5. Be Realistic About Drawdowns

- Study Drawdown Depth and Duration: Track how far your equity dips and how long it stays underwater.

- Plan for Recovery: Have a risk management plan (like reducing position size) if your drawdown exceeds a predetermined threshold.

Why It Works:

- Being proactive about drawdowns prevents catastrophic losses.

- Understanding the psychology of drawdowns helps you stay disciplined.

6. Incorporate Trading Costs

- Simulate Real-World Frictions: Include realistic spreads, commissions, and potential slippage in your backtests and forward tests.

- Check Different Liquidity Conditions: High volatility can widen spreads. Ensure your cost estimates reflect various market scenarios.

Why It Works:

- By accounting for costs upfront, you avoid unpleasant surprises when you transition from backtesting to live trading.

7. Manage Emotional Biases

- Objective Checklists: Develop a checklist before each trade that forces you to verify if conditions truly match your setup.

- Use Analytical Tools: Automate parts of your analysis to reduce human error and emotional biases (e.g., algorithmic entry signals).

Why It Works:

- By incorporating systematic checks, you minimize the risk of ignoring negative results or overemphasizing positive results due to emotion.

8. Adapt Metrics as Your Strategy Evolves

- Recalibrate Positions: If your account grows from $10,000 to $100,000, adjust your risk parameters accordingly.

- Monitor Changes in Volatility: High volatility might require altering your stop-loss or trade sizing to keep risk consistent.

Why It Works:

- Ensures that your metrics remain relevant and continue to provide actionable insights as your strategy changes.

9. Validate Strategies Properly

- Forward Testing and Out-of-Sample Testing: Test your strategy on data not used in developing it.

- Walk-Forward Analysis: Periodically optimize parameters on one dataset and test them on subsequent, non-overlapping data sets.

Why It Works:

- Helps confirm that a strategy is not merely over-fitted to historical data.

- Increases confidence that performance metrics will hold up in live trading.

Practical Examples and Case Studies

In this section, we’ll solidify our understanding of common mistakes and their solutions by looking at real-world scenarios (hypothetical but representative of the issues traders face).

1. Case Study: Over-Reliance on High Win Rate

Scenario:

- Trader John has a strategy with a 90% win rate, risking $100 to make $50 per trade (a 1:0.5 risk-reward ratio).

- In a month, he executes 20 trades, winning 18 and losing 2. His total winning trades give him 18 × $50 = $900. His losing trades cost him 2 × $100 = $200, leaving him with a net $700 gain.

- Impressed by the high win rate, John continues and decides to increase position size.

What Goes Wrong:

- Next month, an unexpected market reversal hits. In one trade, John loses $300 because the market moves quickly. Another losing trade soon follows. His two losing trades amount to $600, wiping out most of his monthly gains from winning trades.

- Over several months, large losses here and there offset the smaller but more frequent wins.

Analysis:

- John focused solely on the win rate, ignoring his Risk-Reward Ratio and the potential for large drawdowns.

- A high win rate with a poor risk-reward setup can be a ticking time bomb.

Solution:

- John recalibrates his strategy to aim for at least a 1:1 or 1:1.5 risk-reward ratio, thereby reducing the size of potential losses relative to wins.

- He also monitors drawdowns and uses position-sizing techniques to limit the impact of losing trades.

2. Case Study: Neglecting Market Cycles

Scenario:

- Trader Sarah has a trend-following strategy that performed exceptionally well from 2018 to 2021 in a predominantly bullish market. Her metrics show a 65% win rate, a strong Sharpe Ratio of 1.8, and a healthy Profit Factor of 2.2.

- By 2022, market conditions change to a choppy, sideways range. Sarah continues trading with the same strategy, expecting similar metrics.

What Goes Wrong:

- Her Sharpe Ratio drops to 0.5, and her drawdown increases to 20% because the range-bound market leads to multiple whipsaws.

- She keeps attributing these losses to “bad luck” rather than recognizing that the market environment has fundamentally changed.

Analysis:

- The strategy was tailored for trending conditions; ignoring the shift to a range-bound market led to repeated stop-outs.

- Sarah’s metrics were no longer reflective of the current reality, leading to flawed decision-making.

Solution:

- Sarah applies market regime detection by using volatility indicators and moving averages to determine if the market is trending or ranging.

- She switches to a mean-reversion or range-trading strategy in sideways conditions, or she stays out of the market until trending conditions reemerge.

Conclusion

In the complex world of trading, metrics serve as the critical navigational tools that point you toward—or away from—profitable opportunities. However, these metrics are only as useful as the trader interpreting them. Common pitfalls such as over-reliance on a single metric, neglecting sample size, ignoring market context, and succumbing to emotional biases can derail even the most promising trading strategies.

Key Takeaways:

- Diversification of Metrics: Always use a combination of metrics—like Win Rate, Risk-Reward Ratio, Drawdown, and Sharpe Ratio—to capture different facets of strategy performance.

- Robust, Representative Data: Ensure your conclusions stem from statistically significant trade samples across diverse market conditions.

- Contextual Awareness: Adapt to market regimes; no single strategy or metric set works optimally in all market environments.

- Risk Management: Integrate comprehensive risk measures, including realistic calculations of trading costs, slippage, and drawdowns.

- Continual Review and Adaptation: Keep your trading journal updated, review it regularly, and be ready to pivot your strategy or interpret your metrics differently if the market changes.

By following these guidelines, you’ll be well-equipped to interpret trading metrics accurately and avoid the most common mistakes that can undermine your performance. Develop a structured, disciplined approach to analyzing your trades, and your metrics will become a powerful ally in achieving long-term success in the market.