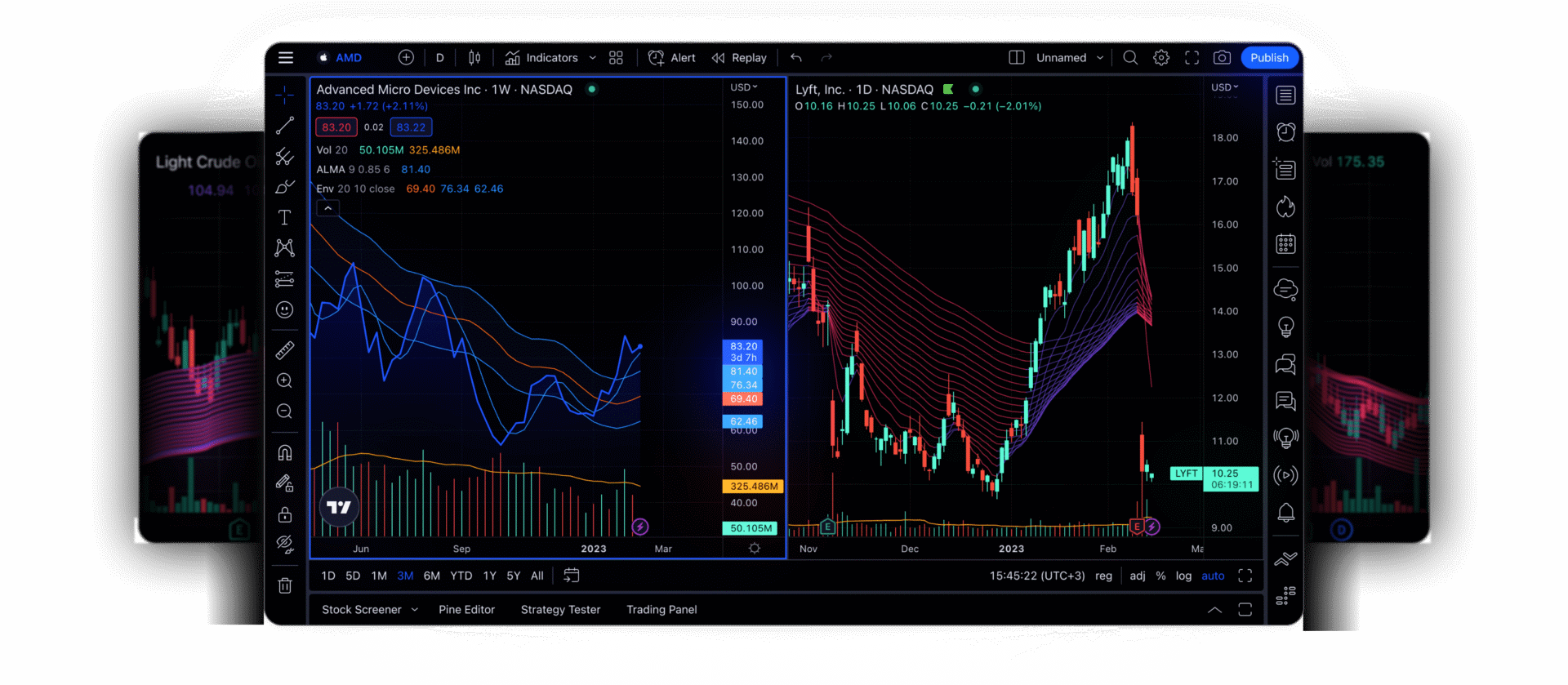

If you’re involved in trading be it stocks, forex, cryptocurrencies, or futures you’ve almost certainly come across TradingView. As one of the most widely used charting and analytics platforms, TradingView serves everyone from casual hobbyists to institutional professionals. Renowned for its intuitive interface, robust feature set, and active trader community, it has solidified its place as a go-to tool for market analysis.

In this TradingView review, we’ll dive deep into its updated plans for 2025. Whether you’re just starting out or a seasoned trader seeking cutting-edge tools, this guide will provide detailed insights into TradingView’s features, pricing, and strategies to help you select the perfect plan for your trading needs.

Affiliate Disclosure: The links provided in this article may be affiliate links. If you make a purchase through these links, I may earn a commission at no extra cost to you. This helps support my work so I can continue to provide helpful guides and reviews. Thank you for your support!

Table of Contents

What Is TradingView and Why Is It Important?

TradingView is a premier charting and analysis platform that caters to a broad spectrum of market participants ranging from retail investors to professional traders. Launched in 2011, TradingView’s mission has been to democratize financial data and empower individuals worldwide to make informed trading decisions. Over the years, it has evolved into a highly interactive hub, offering real-time quotes, intuitive charting tools, social networking features, and advanced technical indicators.

Why Choose TradingView Over Other Platforms?

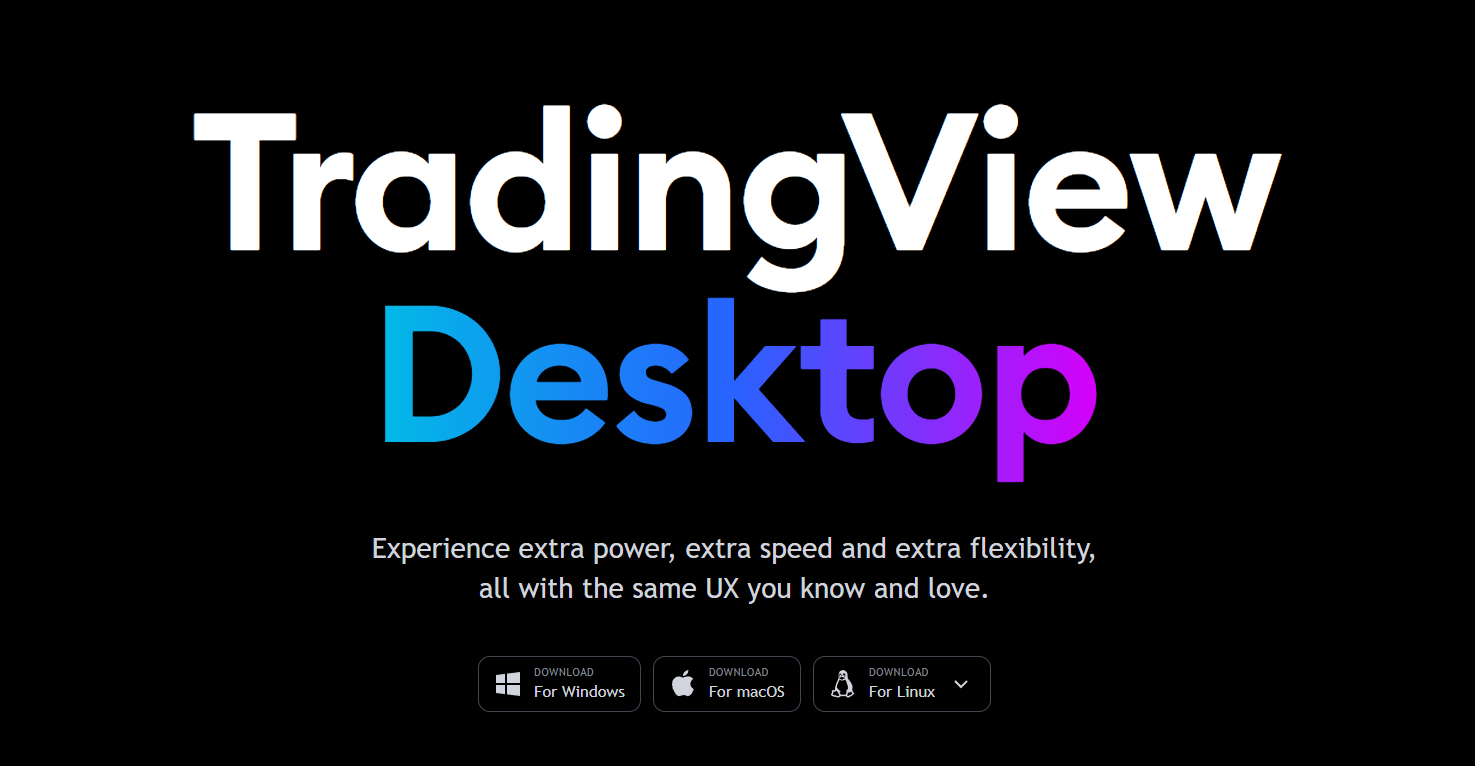

- Accessibility: TradingView operates completely online; you can access it via your browser or the dedicated app, so there’s no need for extensive software installation. This is a huge benefit for traders who switch between computers or trade on the go.

- Community-Driven: With a vibrant community that shares trading ideas, custom scripts, and analyses, you are never alone in your trading journey.

- Multiple Markets Support: From cryptocurrencies like Bitcoin and Ethereum to forex pairs, stocks, indices, and futures—you’ll find a wide range of market data under one roof.

- Scalability: Whether you’re a novice or a pro, there is a plan designed to meet your needs.

- Cutting-Edge Tools: Features like bar replay, multi-chart layouts, Pine Script for creating custom indicators, and advanced alerts systems put TradingView miles ahead of many other platforms.

Key Features That Make TradingView Stand Out

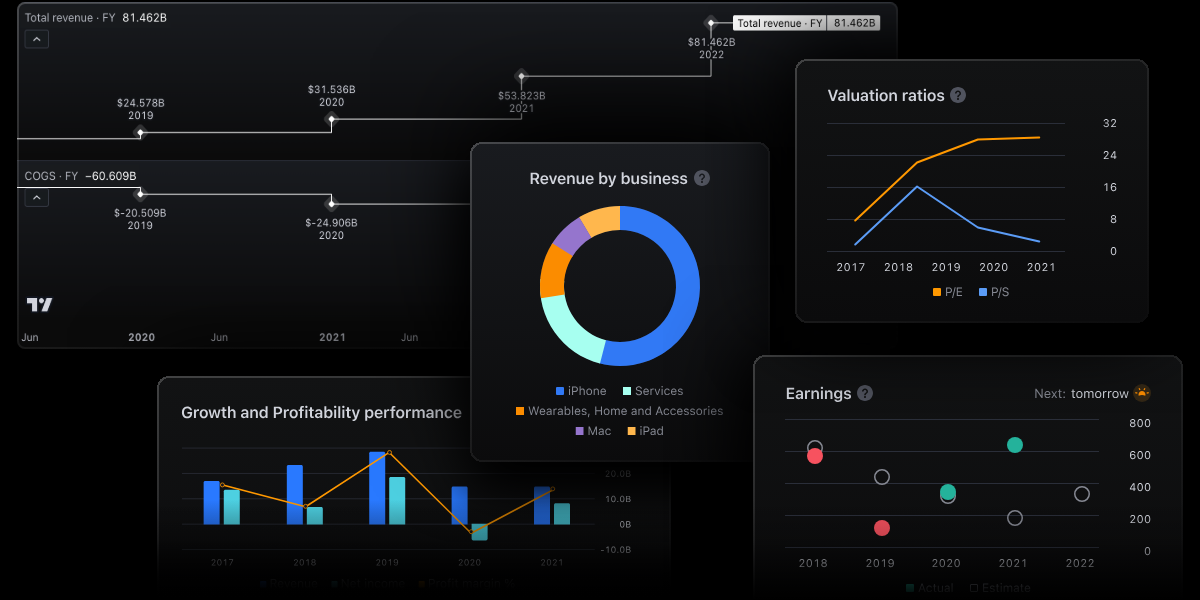

Before we delve into the specific plans, it’s crucial to understand the foundational features that make TradingView such a sought-after platform:

- Real-Time Data and Charts:

- TradingView provides real-time data feeds for major assets, ensuring you can react to price changes instantly.

- The charts are highly customizable, allowing you to overlay multiple indicators, change bar styles, and even split your screen into multiple chart views (depending on your plan).

- Technical Indicators and Drawing Tools:

- TradingView boasts an extensive library of built-in indicators (moving averages, RSI, MACD, Bollinger Bands, etc.) as well as user-generated scripts.

- Custom drawing tools let you annotate charts, identify chart patterns, and plan your trades visually.

- Social Community & Idea Sharing:

- Within TradingView, you’ll discover a vibrant ecosystem where traders post trade ideas, publish scripts, and discuss strategies.

- You can follow your favorite authors, comment on trade ideas, and even share your own charts.

- Alerts and Notifications:

- One of TradingView’s strongest points is its robust alerts system. You can set up alerts for price levels, technical events, or even custom conditions (via Pine Script).

- You’ll receive notifications through email, SMS, or the TradingView mobile app—ensuring you never miss critical market movements.

- Bar Replay Feature:

- This unique tool allows you to replay historical price data as though you’re watching live markets.

- Perfect for backtesting strategies or practicing your reaction to different market conditions.

- Multiple Watchlists and Layouts:

- Organize your favorite assets into different watchlists, and easily switch between them.

- Save multiple chart layouts to quickly switch from a macro (monthly/weekly) analysis layout to a micro (hourly/minute) setup.

- Pine Script (Custom Scripting):

- For traders who love automation, Pine Script offers a straightforward programming language to build custom indicators, signals, and alerts.

- The community also shares thousands of Pine Script-coded strategies, which can be used or tweaked to suit your needs.

Overview of TradingView Plans for 2025

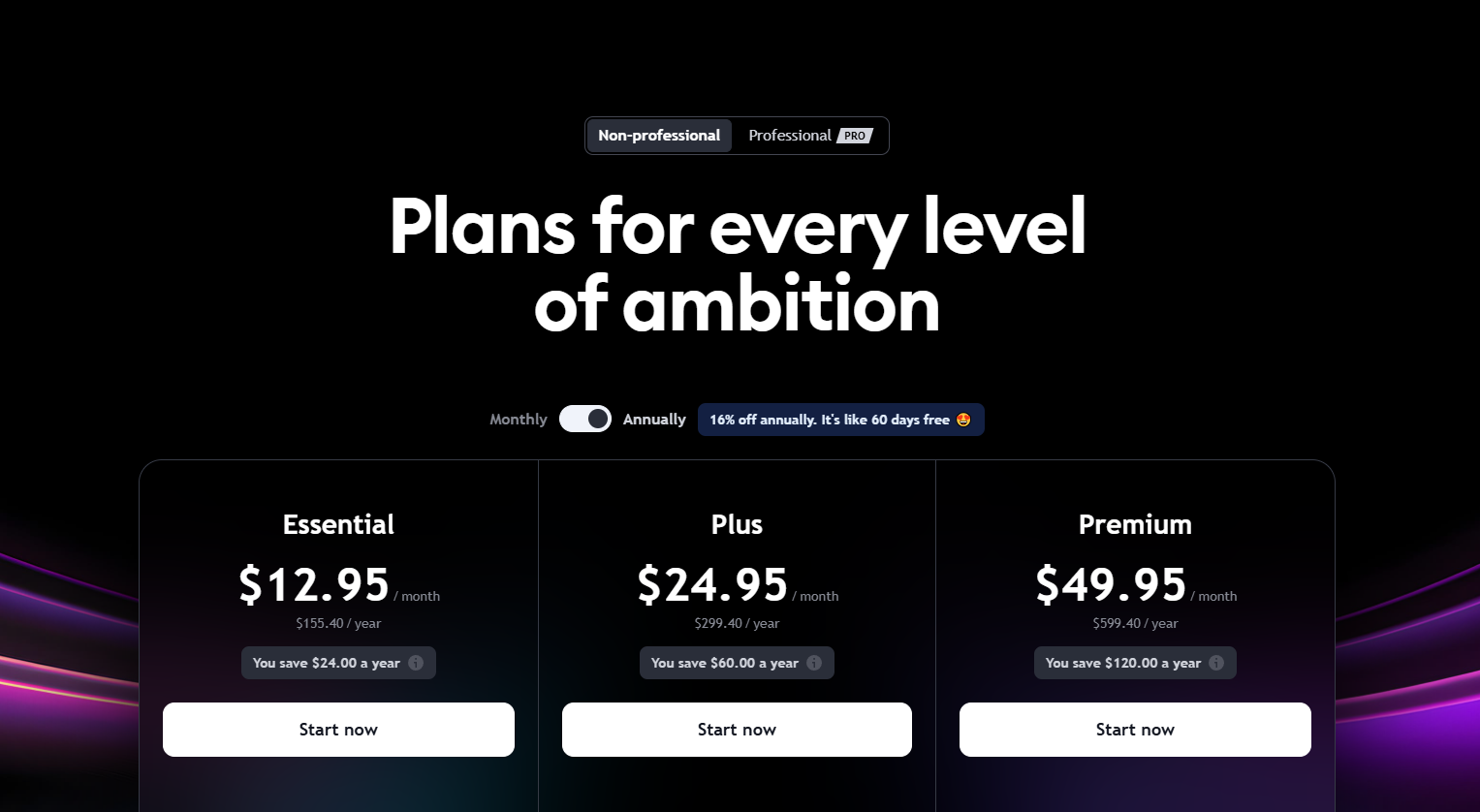

TradingView’s subscription model has been updated, now offering different tiers based on your level of trading experience and your specific requirements:

- Basic (Free) Plan

- Essential Plan

- Plus Plan

- Premium Plan

- Professional Plans: Expert and Ultimate

Each plan has distinct feature sets and pricing. Below, we’ll take a deep dive into each plan so you can determine which one aligns best with your trading approach.

1. Basic (Free) Plan

The Basic Plan is TradingView’s free offering, designed for newcomers and casual traders. If you want to get a feel for TradingView’s capabilities without making a financial commitment, this is where to start.

- Price: Free

- Charts per Tab: 1

- Indicators per Chart: 2

- Saved Chart Layouts: 1

- Price Alerts: 5

- Technical Alerts: 1

- Advertisements: Yes (displayed during usage)

- Community Engagement: Full access to community ideas, scripts, and public chats

- Access to Basic Charting Tools: Standard indicators, basic drawing tools

Key Benefits of the Basic Plan

- No Financial Commitment

Since it’s free, you can explore the platform without any monthly fees. A great option for testing TradingView’s interface and functionalities. - Community Access

Even with the free plan, you can engage with other traders’ ideas, follow published scripts, and share insights. This is fantastic for learning advanced techniques—like custom formulas or pairs-trading scripts—posted by community members. - Basic Tools

You still get a robust charting experience, albeit limited to 1 chart and 2 indicators per chart.

Potential Limitations of the Basic Plan

- Advertisements

Ads can be distracting, especially for time-sensitive intraday traders who need a clean user interface. - Restricted Indicators and Layouts

With only 2 indicators per chart and a single saved layout, it can be challenging to perform more in-depth analysis—such as stock pairs or intraday spread comparisons requiring multiple charts and custom formulas. - Limited Alerts

Only 5 price alerts and 1 technical alert. If you’re monitoring multiple assets or complex conditions (e.g., correlation-based pairs trading), this likely won’t be sufficient.

Example Use Case

A swing trader who checks charts once a day might find the Basic Plan enough for a while. If you only track one or two assets (say, EUR/USD and GBP/USD) and apply basic indicators like moving averages or RSI, the Basic Plan can serve you until you need more advanced functionality.

2. Essential Plan

The Essential Plan is TradingView’s step up from the free tier, intended for active traders who need a bit more flexibility and fewer distractions.

- Price:

- $14.95/month (monthly billing)

- $12.95/month (annual billing; billed once per year)

- Charts per Tab: 2

- Indicators per Chart: 5

- Saved Chart Layouts: 5

- Price Alerts: 20

- Technical Alerts: 20

- Ad-Free Experience: Yes

- Volume Profile Indicators: Included

- Custom Time Intervals: Enabled

- Multiple Watchlists: Enabled

- Bar Replay on Intraday Bars: Enabled

- Multi-Monitor Support (Desktop App): Enabled

Key Benefits of the Essential Plan

- Ad-Free Environment

Eliminates ads, providing a cleaner workspace—helpful for intraday traders who need to focus. - Increased Alerts

With 20 price alerts and 20 technical alerts, you can keep tabs on more instruments or more conditions. This is particularly beneficial for pairs traders who need to track each side of a spread. - Upgraded Tools

- Volume Profile: Pinpoint areas of high trading activity—useful for identifying key support/resistance levels in intraday spreads.

- Bar Replay on Intraday Bars: Helps you simulate past market conditions to test your custom formulas or spread strategies more accurately.

- Custom Time Intervals: If you use unusual timeframes (like 12-minute or 20-minute charts) for refined intraday analysis, you can set them up here.

- Better Chart Management

Having 2 charts per tab and up to 5 saved chart layouts means you can keep multiple perspectives at hand—like one chart for the primary asset and another chart for the comparative asset in pairs trading.

Potential Limitations of the Essential Plan

- Indicator Ceiling (5)

If you rely on multiple oscillators, correlation coefficients, or custom spread indicators, you might feel constrained. - Charts per Tab (2)

Although it’s an improvement over the Basic Plan, advanced day traders analyzing multiple time frames or multi-legged positions might find 2 charts insufficient.

Example Use Case

An intermediate trader following 3–5 stocks or crypto pairs daily can benefit from the Essential Plan. For example, if you’re swing trading Ethereum while also monitoring Tesla, you can have 2 charts open—one for ETH’s intraday action and another for Tesla’s daily trend—without toggling back and forth.

3. Plus Plan

The Plus Plan targets active, possibly semi-professional traders who engage with markets more frequently. It offers a significant boost in features compared to the Essential Plan.

- Price:

- $29.95/month (monthly billing)

- $24.95/month (annual billing; billed once per year)

- Charts per Tab: 4

- Indicators per Chart: 10

- Saved Chart Layouts: 10

- Price Alerts: 100

- Technical Alerts: 100

- All Essential Plan Features

- Faster Data Updates

- Priority Customer Support

- Extended Trading Hours Data (pre-market & post-market sessions)

Key Benefits of the Plus Plan

- More Charts, More Indicators

- 4 charts per tab and 10 indicators per chart let you analyze multiple instruments or timeframes side-by-side. For intraday spreads or pairs trading, you can dedicate one chart to each asset, plus a custom spread indicator on a separate chart.

- Greater Alert Capacity

100 price alerts and 100 technical alerts enable you to track numerous conditions simultaneously—vital if you’re watching multiple pairs or a watchlist of correlated assets for spread opportunities. - Extended Trading Hours

Essential for stock day traders who want to analyze pre-market or post-market movements—often crucial in pairs trading when earnings or news are released outside standard market hours. - Priority Support

Quicker response times from TradingView’s customer service can be a lifesaver if you rely on real-time data for day trading.

Potential Limitations of the Plus Plan

- Price Point

It’s pricier than the Essential Plan. Make sure you truly need the extra charts, indicators, and alerts for your strategy. - Indicator Limit (10)

Advanced traders running extensive custom scripts, correlation measurements, and multiple overlays might still feel constrained.

Example Use Case

A day trader focusing on both stocks and cryptocurrencies might place four charts on a single screen—for example, S&P 500, Bitcoin, Ethereum, and a custom formula that tracks correlation or spread between two assets. With 100 alerts, you can set triggers for breakouts, moving average crossovers, or even volatility shifts on each instrument.

4. Premium Plan

The Premium Plan is considered the go-to for professional retail traders, proprietary traders, or anyone needing comprehensive data and top-tier features.

- Price:

- $59.95/month (monthly billing)

- $49.95/month (annual billing; billed once per year)

- Charts per Tab: 8

- Indicators per Chart: 25

- Saved Chart Layouts: Unlimited

- Price Alerts: 400

- Technical Alerts: 400

- All Plus Plan Features

- Auto Chart Patterns (automated recognition)

- Time Price Opportunities (TPO) (advanced market profiling)

- Second-Based Alerts (key for high-frequency strategies)

- Priority Support: Highest level of expedited assistance

Key Benefits of the Premium Plan

- Advanced Charting Suite

With 8 charts per tab and 25 indicators per chart, you can delve into highly detailed multi-layered analyses—ideal for complex intraday spreads, stock pairs setups, or multi-timeframe strategies. - Unlimited Saved Layouts

Seamlessly switch between various strategies (e.g., scalping, pairs trading, macro analysis) without limitations. - TPO and Auto Chart Patterns

- TPO (Time Price Opportunities): An advanced tool for understanding market structure and volume distribution—a significant advantage in scalping or spread trading.

- Auto Chart Patterns: Quickly identify breakouts, triangles, channels, and more without manually drawing, saving time for advanced strategists.

- High-Frequency Alerts

Second-based alerts can be crucial for scalpers or algorithmic traders, and the capacity of 400 price/technical alerts is ample for tracking multiple instruments.

Potential Limitations of the Premium Plan

- Higher Cost

At $59.95/month (or $49.95 if billed annually), it’s an investment. Best for traders who regularly trade or manage multiple portfolios where advanced features can potentially increase profitability. - Complexity Overload

Premium’s extensive feature set can feel overwhelming for less active traders. If you don’t use these advanced functionalities, you might be paying for features you don’t need.

Example Use Case

A full-time day trader or a small proprietary trading firm that supervises multiple markets simultaneously. If you’re combining time-based, volume-based, and market profile analyses for advanced pairs trading or intraday spreads, the 8-chart and 25-indicator capacity plus TPO and second-based alerts—are likely essential for your workflow.

5. Professional Plans: Expert and Ultimate

When your trading or data analysis requirements transcend typical retail usage, TradingView’s Professional Plans—Expert and Ultimate—come into play. These tiers are designed for institutional traders, brokerage houses, or enterprise-level needs where maximum capacity, specialized data feeds, and comprehensive feature sets are non-negotiable.

Expert Plan

- Charts per Tab: 10

- Indicators per Chart: 30

- Price Alerts: 600

- Technical Alerts: 600

- Additional Professional Features: Advanced data feeds, deeper analytics, custom service offerings

- Pricing:

- $199.95/month (monthly billing)

- $2,399.40/year (annual billing)

Ultimate Plan

- Charts per Tab: 16

- Indicators per Chart: 50

- Price Alerts: 1,000

- Technical Alerts: 1,000

- Comprehensive Professional Features: Maximum data depth, custom integrations, enterprise support, etc.

- Pricing:

- $499.95/month (monthly billing)

- $5,999.40/year (annual billing)

Who Are These Plans For?

- Institutional Traders

Hedge funds, asset management firms, or private trading floors needing maximum charting capabilities, data coverage, and advanced analytics. - Business Entities

Companies that provide real-time market data to multiple employees, requiring multi-user and enterprise-level features. - High-End Retail Traders

Individuals who demand the absolute highest number of charts, alerts, and indicators—often for systematic or algorithmic multi-asset strategies, complex stock pairs, or intraday spread setups across global markets.

Key Advantages for Advanced Strategies

- Unrivaled Chart & Indicator Capacity

- Up to 16 charts and 50 indicators per chart in the Ultimate Plan, enabling you to run multiple custom formulas, correlation studies, volatility metrics, and spread indicators all at once.

- High Alert Thresholds

- Expert: 600 alerts; Ultimate: 1,000 alerts—ideal if you’re running multiple algorithms or scanning a large universe of assets for spread and pairs opportunities.

- Custom Integrations & Data Feeds

- Potential for specialized market data or hooking TradingView into proprietary software solutions, vital for large-scale or institutional operations.

Pricing Considerations

- These top-tier plans come at a significantly higher cost. For non-professional traders, it could be overkill. But if you’re managing institutional funds or need enterprise-level reliability, the higher price may be justified.

- If you’re a high-end retail user looking for maximum coverage of advanced strategies intraday spreads, custom-coded pairs trading, multi-timeframe correlation charts, etc. the Expert or Ultimate Plan can provide a competitive edge.

Final Thoughts

Each TradingView plan serves a different purpose, from the free Basic Plan for beginners to the institutional-grade Expert and Ultimate Plans:

- Basic: Ideal for newcomers; limited but free.

- Essential: Best for traders wanting ad-free charts and modest advanced features like Volume Profile, 20 alerts, and custom time intervals.

- Plus: Geared toward active day or swing traders needing 4 charts, 10 indicators, and extended alerts—helpful for stock pairs and basic intraday spread monitoring.

- Premium: Favored by pro retail traders or small prop firms; 8 charts, 25 indicators, TPO, second-based alerts, unlimited layouts—enabling more complex custom formulas and data analysis.

- Expert & Ultimate: Designed for institutions or elite traders needing maximum capacity, custom integrations, and extensive real-time data coverage.

When selecting your plan, weigh cost against the added value these features bring to your trading—especially if you’re pursuing advanced strategies like intraday stock spreads, crypto-fiat pairs trading, or custom-coded correlation formulas. If additional charting capacity or advanced tools help you execute more profitable trades, higher-tier plans can be a worthwhile investment.

Occasional Promotions: TradingView often runs holiday sales or special promotions where you can grab annual plans at further discounts.

Payment Methods:

- Credit/Debit Cards, PayPal, and sometimes cryptocurrencies (depending on region).

- For professional or enterprise plans, wire transfers or custom arrangements may be available.

Refund Policy:

TradingView generally offers a 30-day money-back guarantee for most of its standard plans, but it’s always wise to read the terms and conditions or contact support to confirm.

How to Choose the Right TradingView Plan for You

Selecting the right plan can feel overwhelming, especially with so many features and price points. Here’s a quick decision framework:

- Assess Your Trading Frequency:

- Occasional / Beginner: Likely the Basic Plan or Essential Plan.

- Frequent / Semi-Professional: The Plus or Premium Plan might be best.

- Institutional or High-Net-Worth Individual: Consider the Professional Plans.

- Consider the Indicators and Alerts You Need:

- If you frequently stack multiple indicators on one chart, aim for a plan that offers enough indicators per chart.

- If you rely on complex alerts (multiple conditions, multiple markets), ensure you have sufficient alert capacity.

- Evaluate Your Budget vs. Features:

- The jump from Basic to Essential is moderate, but the jump to Premium can be significant. Make sure the ROI (in terms of saved time, better trades, or peace of mind) justifies the cost.

- Try Free Trials and Upgrades:

- TradingView often provides free trials or money-back guarantees. If you’re uncertain, start small and upgrade later.

- Future Growth:

- If you plan on scaling up your trading activities, consider a plan that won’t limit you in a few months.

Extra Features & Tips: Pine Script, Alerts, and More

Pine Script

Pine Script is TradingView’s proprietary language for creating custom indicators and trading strategies. Even on the Basic Plan, you can explore many community-developed Pine scripts, but advanced usage (like running multiple custom scripts simultaneously) is best suited for higher-tier plans due to indicator limitations.

Examples of Pine Script Usage:

- Custom signals for MACD crossovers combined with RSI overbought/oversold conditions.

- Automated chart pattern recognition tailored to your unique trading style.

- Alerts that only trigger when several technical conditions align (e.g., a crossover + volume spike).

Alerts

All paid plans come with robust alert functionality. The more advanced your plan, the more alerts you can set. Alerts can be configured for:

- Price Levels: e.g., “Alert me when EUR/USD hits 1.1500.”

- Indicator Crossovers: e.g., “Alert me when the 50-day SMA crosses the 200-day SMA.”

- Complex Scripts: e.g., “Alert me when my custom Pine Script strategy triggers a ‘BUY’ signal.”

Bar Replay

Bar Replay is a powerful feature for backtesting or simply learning from past market data. Higher-tier plans allow you to replay intraday data, while the Basic Plan may limit you to daily or higher time frames. This tool is invaluable for practicing how you would’ve traded historic market conditions and honing your intuition for price action.

Multi-Monitor Support

Serious traders often use multiple monitors. TradingView’s desktop app supports multi-monitor setups, but certain functionalities like opening multiple chart windows with distinct watchlists are primarily beneficial in Essential or higher plans.

Setting Up Your TradingView Account (Step-by-Step)

- Visit the TradingView Website or Download the App:

- You can either use the web-based platform at TradingView.com or download the desktop/mobile app from the official website or app stores.

- Create a Free Account:

- All you need is an email address. You’ll have immediate access to the Basic Plan.

- Confirm your email address, set up a username, and explore the community area.

- Explore the Basic Tools:

- Familiarize yourself with the interface. Open a chart, add a couple of indicators, try drawing tools, etc.

- Upgrade to a Paid Plan (Optional):

- Navigate to the “Upgrade” section in your account settings.

- Choose your desired plan (Essential, Plus, Premium, Expert, or Ultimate).

- Enter payment details and confirm. If there’s a free trial, you can test the plan before committing.

- Configure Your Layout and Watchlists:

- Name your chart layouts (e.g., “Crypto Analysis,” “Stock Swing Trades,” etc.).

- Create multiple watchlists for different markets.

- Set Up Alerts:

- Click the “Alert” button on your chart or right-click on the price axis.

- Define the alert conditions, expiration, and notification methods (email, SMS, app).

- Join the Community:

- Follow popular authors, read trade ideas, and even post your own if you feel confident.

Examples of Using TradingView Across Different Markets

Stocks

- Scenario: You’re analyzing Apple (AAPL) on a daily chart to plan a swing trade.

- Tools Used: RSI, MACD, Volume Profile, plus a custom Pine Script for identifying oversold conditions.

- Plan: Set a price alert at a key support level (e.g., $170) to trigger a potential long entry if it bounces from that level.

Forex

- Scenario: Monitoring EUR/USD for a breakout of a consolidation range.

- Tools Used: Trendlines, moving averages, bar replay to study previous breakouts, plus real-time alerts for technical breakouts.

- Plan: You might combine the daily time frame with a 15-minute time frame to refine entries, a setup you can easily manage if you have the Essential or higher plan (multiple charts per tab).

Cryptocurrencies

- Scenario: Trading Bitcoin (BTC) and Ethereum (ETH) simultaneously, looking for correlation or divergence.

- Tools Used: Side-by-side charts, volume indicators, custom RSI divergences via Pine Script.

- Plan: If Bitcoin and Ethereum both confirm a bullish divergence, you set alerts for potential breakouts and monitor them in real-time with the Plus Plan or Premium Plan’s advanced alerts.

Futures

- Scenario: Scalping e-mini S&P 500 (ES) on very short time frames.

- Tools Used: Second-based alerts (Premium only), high-frequency data updates, TPO for advanced market profile analysis.

- Plan: You might rely on second-based alerts to jump in and out of trades quickly.

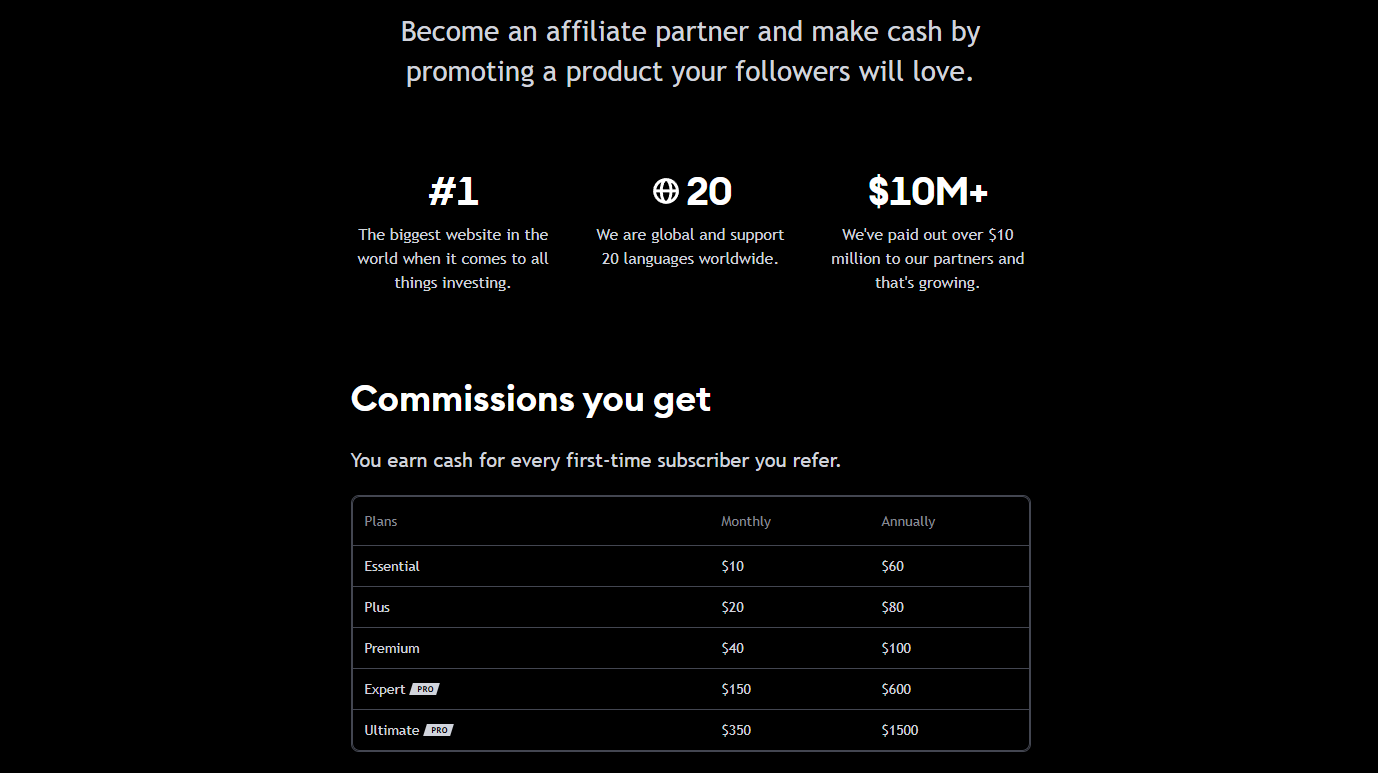

Adding Affiliate Links and Earning Through TradingView

TradingView offers affiliate programs that let you earn commissions when you refer new customers. If you run a blog, a YouTube channel, or an active social media profile, you can share your unique affiliate link. When someone subscribes to a paid plan through your referral link, you earn a percentage of their subscription fee.

Steps to Add Your Affiliate Links

- Sign Up for TradingView’s Affiliate Program: Look for the “Affiliates” or “Partner Program” link on TradingView’s website.

- Obtain Your Unique Referral Link: Once approved, you’ll receive a URL that tracks sign-ups originating from your promotions.

- Embed Links in Your Content:

- Blog posts, YouTube descriptions, social media bios, and email newsletters are all great places to include your referral links.

- Disclose Affiliate Partnerships: As we did at the start of this article, always be transparent about affiliate relationships.

Pro Tip: Combine your affiliate links with valuable content like tutorials, strategy guides, or plan comparisons to genuinely help new users understand why a paid TradingView plan might be beneficial.

Conclusion

TradingView remains a powerhouse for traders, analysts, and financial enthusiasts across the globe. With its recent 2025 plan updates, the platform has refined its offerings to meet the evolving demands of a diverse user base from hobbyist traders to institutional power-users.

- Basic Plan suits absolute beginners or anyone who wants a no-cost introduction.

- Essential Plan helps intermediate traders eliminate ads and unlock key features like volume profile, custom time frames, and more alert capacity.

- Plus Plan offers even more advanced features like multiple charts per tab and extended trading hours data, ideal for serious swing traders and day traders.

- Premium Plan is a top-tier solution for professional retail traders who need advanced charting capabilities, second-based alerts, and unlimited layouts.

- Expert and Ultimate Plans cater to the needs of institutional or enterprise-level users, providing the most extensive chart, alert, and indicator allowances.

When choosing your ideal plan, consider your trading style, budget, and the scale of your market engagements. With robust features like Pine Script, advanced alerts, multi-chart layouts, and a vibrant community to draw insights from, TradingView can significantly enhance your trading experience—whether you’re analyzing equities, forex, crypto, or beyond.