Investing in individual stocks can be both exciting and overwhelming. While some investors turn modest sums into impressive portfolios, others fall victim to risky bets and market volatility. With countless stock-picking services available, choosing the right source for reliable investment advice is no small task. One name that consistently stands out in this space is The Motley Fool, a renowned financial and investing advisory company founded by brothers David and Tom Gardner. Among its many services, Motley Fool Stock Advisor has gained widespread attention from both beginners and experienced investors seeking expert stock recommendations.

In this Motley Fool Stock Advisor review, we take an in-depth look at whether this service lives up to its reputation. Does it truly offer some of the best stock picks in the market, or is its success more hit-and-miss? We’ll break down everything you need to know—how it works, its historical performance, key benefits, potential drawbacks, and how it compares to competing stock recommendation services. Along the way, we’ll provide real-world examples and actionable insights to help you determine if Motley Fool Stock Advisor is the right fit for your investment strategy.

This review is designed to be a comprehensive resource, covering all aspects of the service—from pricing and investment philosophy to stock performance and portfolio management tips. By the end, you’ll have a clear understanding of Motley Fool Stock Advisor and whether it aligns with your financial goals and risk tolerance.

Table of Contents

A Brief History of The Motley Fool

Before diving into the specifics of the Stock Advisor program, it helps to know who is behind the curtain. The Motley Fool was founded in 1993 by brothers David and Tom Gardner, along with Erik Rydholm. The company’s quirky name is inspired by William Shakespeare’s plays, specifically the court jester or “fool,” who could tell the truth to the king without repercussion. The ethos behind the name suggests that everyday people can benefit from savvy, transparent financial guidance that’s lighthearted yet actionable.

Initially, The Motley Fool gained traction with a presence on online forums and message boards—places like AOL in the early days—where it posted stock picks and educational articles. The founders believed (and still believe) strongly in long-term investing—buying and holding stocks of quality companies rather than frequently speculating. Over time, the company expanded its offerings significantly. Today, it produces articles, podcasts, and newsletters that reach millions of readers and listeners worldwide. Their free content is supplemented by premium subscription services, one of which is Motley Fool Stock Advisor.

Core Philosophy

The Motley Fool emphasizes a few core investing tenets:

- Long-Term Focus: Instead of making short-term trades based on market fluctuations, the company strongly encourages holding quality stocks for a minimum of three to five years—often longer.

- Fundamental Analysis: Their recommendations are largely based on a thorough analysis of a company’s financials, market position, growth prospects, and competitive advantages (often referred to as “moats”).

- Investor Education: Empowering individual investors by increasing financial literacy has been a cornerstone of The Motley Fool’s mission from the outset.

In many ways, the Stock Advisor program is the flagship embodiment of these principles, offering a regular stream of stock recommendations curated by professional analysts and shaped by the experience of its founders.

What Is Motley Fool Stock Advisor?

Motley Fool Stock Advisor is a subscription-based service designed to provide individual investors with curated stock recommendations. Every month, subscribers receive two “official” stock picks, each accompanied by an in-depth research report explaining the rationale behind the recommendation. These picks come from either David Gardner, Tom Gardner, or members of their team of analysts. The stocks selected are typically companies that Motley Fool believes have a strong potential for long-term growth and market outperformance.

However, Motley Fool Stock Advisor is more than just monthly picks. Subscribers also gain access to:

- A curated list of “Starter Stocks” intended to form a robust foundation for a portfolio.

- Regular updates on all the stocks that have ever been recommended in the service, including buy/hold commentary and news.

- Educational resources, such as how-to guides, articles, and videos on building a portfolio and understanding market dynamics.

- Community forums, where members discuss various investment ideas, market news, and questions related to the service’s recommendations.

The Goal

The main goal of Motley Fool Stock Advisor is relatively straightforward: to help subscribers identify stocks with high potential for long-term appreciation. According to the Motley Fool, their Stock Advisor picks have historically outperformed the S&P 500 significantly, although it’s crucial to note that past performance does not guarantee future results. Still, the track record—discussed in more depth later in this article—has been a key selling point for the service.

How New Recommendations Are Delivered

Every month, you can expect:

- Two new stock recommendations: Usually spaced out, often released on separate days. Each recommendation comes with an in-depth explanation, from the basic investment thesis to a summary of key risks and competitive landscape analysis.

- Ongoing coverage: Alerts on previously recommended stocks, especially if a significant event or earnings report could alter the investment thesis.

- Portfolio guidance: Suggestions on how to integrate the new recommendations into an existing portfolio structure.

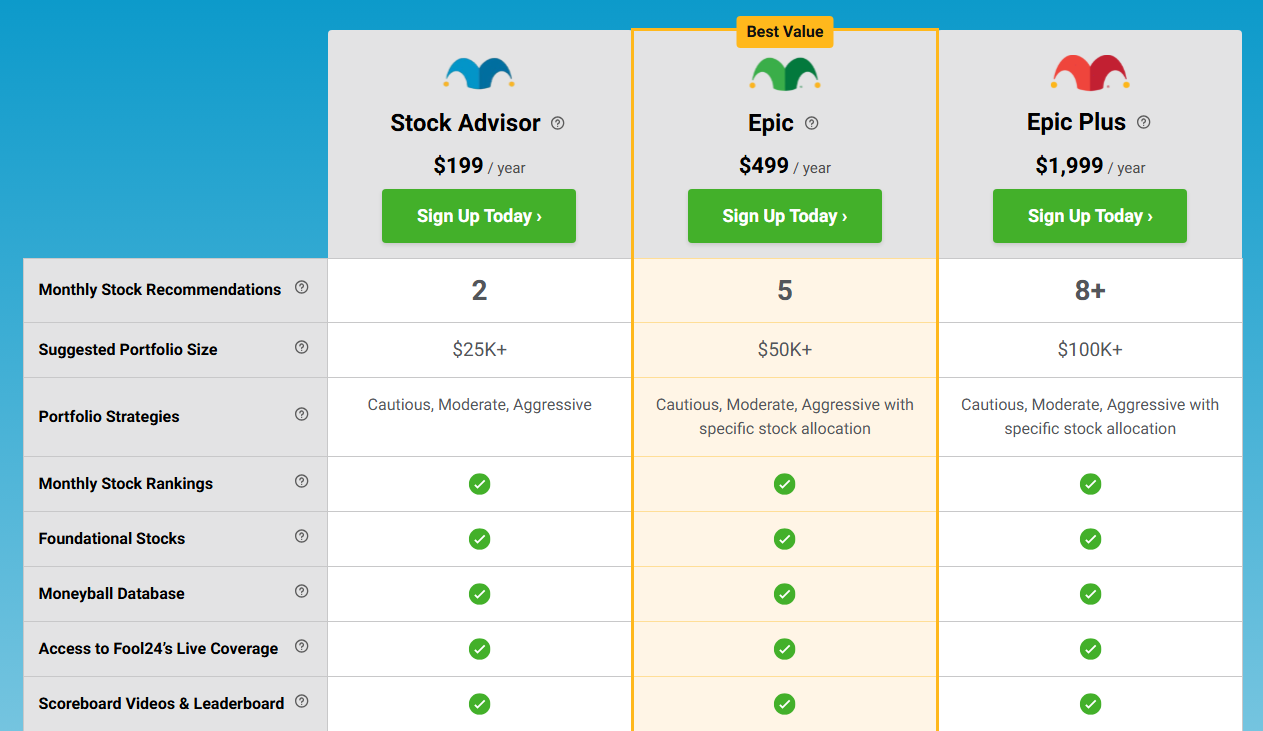

Subscription Structure

Motley Fool Stock Advisor is typically offered with annual and monthly billing options. Over the years, the service has frequently promoted discounts for the first year, often dropping the annual subscription price to around $99 for new members. After the promotional period ends, pricing tends to revert to the standard rate (which has been around $199 per year, though this can change).

How Motley Fool Stock Advisor Works

Understanding exactly how the service functions is pivotal to deciding if it’s the right fit for you. Below is a step-by-step look at the subscriber journey, from sign-up to making actual trades (should you choose to follow the recommendations).

Sign-Up and Getting Started

- Create an Account: Once you visit The Motley Fool’s website and choose the Stock Advisor subscription, you’ll set up your login credentials. This grants you access to the Stock Advisor dashboard.

- Welcome Materials: You’ll receive a welcome email or series of emails outlining how the service works, what to expect each month, and tips on building a strong foundation for your portfolio.

- Starter Stocks: One of the first things new subscribers see is a curated list of “Starter Stocks”—often well-known, stable companies that the Motley Fool analysts believe are strong buys even for those just starting out. These are designed to help build a solid foundation for long-term growth.

Monthly Stock Picks

- Frequency: You typically receive two new recommendations each month. One is usually from Tom Gardner, the other from David Gardner (or lead analysts carrying on their specific style).

- Recommendation Format: Each pick comes in the form of a detailed write-up, highlighting:

- The company’s business model

- Key financial metrics

- Competitive advantages and potential market opportunities

- Risks or challenges the company might face

- The recommended time horizon

Some subscribers appreciate these explanations because they offer insight into how professional analysts evaluate companies. This is often more useful than simply getting a ticker symbol.

Updates and Alerts

- Daily News and Commentary: Motley Fool analysts sometimes share commentary or “alerts” on big market news stories that affect recommended companies. This can keep you abreast of critical events, such as earnings announcements or major product launches.

- Performance Tracking: The service’s website includes a dashboard that shows performance metrics for all recommended stocks. You can easily see how much each recommendation is up or down since it was first suggested, along with relevant articles or updates.

Engaging with the Community

Motley Fool has dedicated forums and discussion boards where paying members can talk directly to each other and sometimes interact with Motley Fool analysts. People often discuss:

- Clarifications on recommended stocks

- Additional research on upcoming picks

- Investing strategies and personal finance tips

The sense of community can be a valuable aspect, especially for those new to stock investing who want to learn from peers.

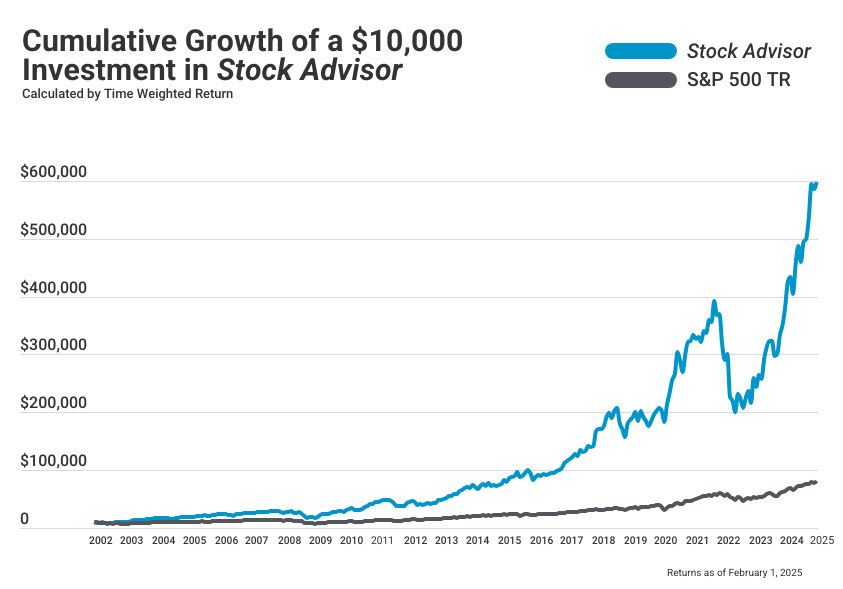

Stock Advisor’s Performance and Track Record

One of the biggest selling points for Motley Fool Stock Advisor has always been its purported outperformance of major market benchmarks like the S&P 500. According to Motley Fool’s data—which they display prominently in their marketing materials—Stock Advisor’s average pick has historically beaten the S&P 500 by a notable margin since the service’s inception in 2002. However, it is important to dissect how they arrive at these numbers.

Evaluating Claims of Outperformance

- Cumulative vs. Annualized Returns: Always check if the returns quoted are cumulative or annualized. The Motley Fool often references cumulative returns over the lifetime of the service. For instance, a certain recommendation might be up 300% over 10 years, which is compelling but different from saying it has a 300% annualized return.

- Performance Since Inception: Stock Advisor often touts the percentage outperformance of the entire portfolio (i.e., if you had bought every recommendation and held them to the present day). Not every subscriber invests in every pick, though, and real-world results can vary based on timing and individual allocation strategies.

Examples of Successful Picks

The Stock Advisor track record includes some noteworthy winners. Although individual results vary, a few famous wins come up frequently in discussions:

- Netflix (NFLX): Recommended multiple times in its earlier stages, Netflix has grown into one of the top-performing stocks of the last decade. Early investors saw massive returns.

- Amazon (AMZN): The Gardner brothers identified Amazon as a potentially disruptive company early on, recommending it well before it became the e-commerce and cloud computing juggernaut it is today.

- Shopify (SHOP): Another e-commerce-related pick that soared in value, reflecting the rise of digital retail solutions.

Occasional Misses

Not every pick is a winner. Stock Advisor has had its fair share of misses, which is natural for any stock-picking service. Some examples include companies that failed to maintain momentum or faced competitive pressures. Even so, The Motley Fool staff generally keeps these stocks in their recommendation lists, but they may update subscribers on changing theses, advising caution or occasionally suggesting it might be time to exit. However, it’s relatively rare for The Motley Fool to give an outright “sell” rating; they usually adopt a long-term perspective.

Volatility and Holding Periods

Many of the recommended companies are growth-oriented, which can mean volatile stock price movements. While the overall trend might be upward for successful picks, monthly or even yearly downturns are not uncommon. The Motley Fool approach encourages riding out these short-term fluctuations in the pursuit of long-term gains.

Pricing, Value, and Cost

Motley Fool Stock Advisor is positioned as an affordable entry point into premium investing research. The service frequently offers promotional pricing—often around $99 for the first year—to encourage new sign-ups. After the initial discount period, the cost generally resets to around $199 per year. Additionally, some users opt for monthly billing, which may be around $39/month, but the annual subscription is usually more cost-effective.

What You Get for the Price

- Monthly Stock Picks: Two new ideas each month, with complete write-ups.

- Starter Stocks: Ideal for those just getting started or looking to anchor their portfolios in stable investments.

- Supportive Community and Resources: Access to analysts’ insights, discussion boards, and educational materials.

- Tools: Portfolio trackers, watchlist features, and performance dashboards.

Is It Worth It?

Whether it’s “worth it” depends on individual investing goals and how much you utilize the service’s resources:

- Active Readers who follow the research, read market updates, and thoroughly study each recommendation may find great value in Stock Advisor.

- Passive Investors who want a set-it-and-forget-it approach might find it less beneficial, especially if they have low interest in analyzing or at least understanding the picks.

- Budget: Paying $99 or $199 per year might be negligible if your portfolio is large enough and you’re able to capitalize on the service’s stock picks. Conversely, for someone investing very small amounts, you’ll want to ensure the subscription fee doesn’t significantly eat into your potential returns.

Refund and Cancellation Policy

Motley Fool occasionally offers a 30-day or 60-day money-back guarantee, though policies can change. Subscribers can usually cancel at any time, but you may only be eligible for a refund within specific timeframes. Reading the terms and conditions thoroughly before purchasing is always recommended.

Key Features and Tools

Motley Fool Stock Advisor delivers more than just a list of stock tips. Here are some standout features that subscribers often cite as reasons to stick with the service:

1. Starter Stocks

For new subscribers—or those looking to revamp their portfolios—Stock Advisor provides a list of companies deemed foundational. These are often large-cap, relatively stable businesses that the Motley Fool expects to remain robust over the long haul. It’s a quick way to start building a diversified portfolio without needing to sift through every historical recommendation.

2. Performance Tracking and Scorecard

The Motley Fool platform has a user-friendly dashboard where you can track:

- Each official stock recommendation since the service’s inception

- The date of the recommendation

- The initial price at recommendation

- The current price (updated regularly)

- Percentage gains or losses

- Any relevant notes or updates from the analysts

Having this data in one place can be immensely helpful for seeing the bigger picture and evaluating how an individual pick aligns with your personal performance goals.

3. In-Depth Research Reports

Each monthly recommendation comes with a thorough research article outlining:

- Company Overview: A clear explanation of what the company does and how it generates revenue.

- Financials: Key metrics such as revenue growth, debt levels, margins, and valuation multiples.

- Market Opportunity: The total addressable market and how much the company can grow within that market.

- Competitive Landscape: Insights into other key players in the industry, the company’s competitive advantages or moats, and any looming threats.

- Risks and Challenges: Highlighting any red flags or areas where investors should pay close attention.

These reports are great learning tools. Even if you choose not to invest in a particular stock, reading the analysis can sharpen your ability to evaluate companies independently.

4. Investing Education

Beyond the stock recommendations themselves, Stock Advisor offers robust educational materials:

- “How to Invest” Guides: Covering everything from basic terminology (e.g., P/E ratio, market cap) to advanced valuation techniques.

- Videos and Webinars: Occasionally, the service hosts live or recorded sessions where analysts break down new investment ideas, macroeconomic conditions, or trends in specific sectors.

- Articles and Newsletters: Regularly updated content about market happenings, earnings results, and sector deep-dives.

5. Community and Discussion Boards

Few services have as active a community as The Motley Fool. While not every subscriber uses the discussion boards, they can be a treasure trove of additional insights and second opinions. Investors share their own research and experiences, debate the merits of recommended stocks, and discuss broader financial strategies.

6. Mobile App and Notifications

Some individuals prefer to manage their subscriptions via smartphone. The Motley Fool offers an app for accessing articles, stock picks, and updates on the go. While not as feature-rich as the desktop experience, it’s convenient for quick checks or to read new recommendations.

Pros and Cons of Motley Fool Stock Advisor

No investing service is without trade-offs, and Motley Fool Stock Advisor is no exception. Here’s a balanced look at the major upsides and downsides.

Pros

- Proven Track Record: Many of the service’s stock picks have significantly outperformed the market over the long haul. While past performance isn’t everything, it’s still a compelling reason to pay attention.

- Long-Term Focus: If your investment philosophy aligns with “buy-and-hold,” you’ll likely appreciate the guidance and mindset shared by the analysts. This can help reduce the harmful instincts of panic selling during market downturns.

- User-Friendly and Educational: The platform offers in-depth analyses that teach you how to interpret company data and market trends. This can be invaluable for less experienced investors eager to learn and grow.

- Community Access: Whether through discussion boards or Q&A sections, having access to a community of like-minded investors can provide emotional support and additional insights.

- Relatively Affordable: Compared to some premium newsletters and advisory services that can cost hundreds or even thousands of dollars per year, Stock Advisor is comparatively budget-friendly.

Cons

- Growth Stock Tilt: Many of the picks lean toward growth companies, which can be more volatile. Investors looking for dividend payers or stable, high-yield companies might find fewer relevant picks.

- Rare Sell Recommendations: The service rarely issues explicit “sell” signals. Some critics argue that this can leave investors holding onto laggards longer than they should, although Motley Fool’s philosophy is that time in the market beats timing the market.

- Performance Variability: Not every recommendation is a winner. While the broader portfolio may outperform, some investors might be disappointed if they selectively invest in the picks that underperform.

- Risk of Over-Diversification: If you try to buy every single monthly recommendation, you could end up with a very large portfolio, some of which may not align well with your personal risk profile or sector preferences.

- Market Timing Still Matters: Recommendations come out monthly, but you may invest at a time that coincides with a short-term stock peak. The long-term thesis might still hold, but you could face near-term losses.

Who Should Consider Motley Fool Stock Advisor?

Given the pros and cons, who stands to benefit the most from Motley Fool Stock Advisor?

- Beginners in Investing: Newcomers can gain significant educational value and a roadmap for building an initial portfolio. The Starter Stocks and monthly picks provide structure, while the community offers additional support.

- Long-Term Oriented Investors: Individuals who resonate with the buy-and-hold mentality are likely to appreciate the Stock Advisor approach. The service encourages patience and advocates looking past short-term market swings.

- DIY Investors Seeking Guidance: If you manage your own portfolio and want a second opinion—or a primary research source—Stock Advisor can supplement your due diligence. The monthly picks can expose you to companies you might not have discovered on your own.

- Growth-Focused Investors: Many of Motley Fool’s recommendations concentrate on companies with high growth potential. If that aligns with your risk tolerance, you could see above-average returns over time.

- Those Willing to Pay for Convenience: The curated approach can save time compared to researching every stock independently. If you prefer having a team of analysts narrow down the choices for you, the cost might be well worth it.

Potential Drawbacks and Criticisms

While the service has many satisfied subscribers, it has also faced critiques:

- Hype and Momentum: Because recommendations can move markets—especially smaller cap stocks—some argue that the initial surge after a recommendation might inflate the entry price, reducing potential gains for subscribers who buy late.

- Heavy Marketing: The Motley Fool does extensive marketing. Some people find the promotional emails, upsells to more expensive services, and frequent advertisements off-putting.

- Not Personalized: The service provides broad stock picks for the general audience. It doesn’t factor in individual circumstances, such as age, income level, or other specific portfolio goals like retirement timelines or the need for stable, consistent dividends.

- Bull Market Bias: Much of the massive outperformance occurred during significant bull market runs, especially in technology and consumer sectors. Skeptics question whether the same level of outperformance will continue in choppier or bearish market conditions.

Real-World Examples of Motley Fool Picks

Concrete examples can lend credibility to any stock-picking service. Below, we’ll look at a few real-world picks and how they performed. Keep in mind that these examples are for illustrative purposes only and do not guarantee future results.

1. Netflix (NFLX)

- Initial Recommendation: Netflix was first recommended when it was transitioning from a DVD-by-mail service to a streaming pioneer.

- Rationale: Motley Fool analysts believed the shift to streaming would transform home entertainment and disrupt traditional cable.

- Outcome: Over a 10+ year holding period, Netflix stock rose dramatically, making early investors who followed the recommendation quite happy.

2. Amazon (AMZN)

- Initial Recommendation: Made decades ago, well before Amazon dominated e-commerce and cloud computing.

- Rationale: The Gardner brothers saw Jeff Bezos’s focus on customer experience as a strong competitive advantage, with the potential to expand beyond books and into numerous online retail categories.

- Outcome: Amazon’s stock performance has been legendary, with shares skyrocketing over the years. Early investors witnessed one of the most spectacular growth stories in modern market history.

3. Shopify (SHOP)

- Initial Recommendation: Recommended when Shopify was primarily serving small online businesses.

- Rationale: Analysts believed in the surging trend toward independent e-commerce, identifying Shopify as a platform with minimal competition in a rapidly expanding market.

- Outcome: The stock soared for several years, significantly outpacing the broader market before experiencing the typical growth-stock volatility.

4. The Other Side: Misses

There are also picks that did not pan out as hoped. For instance, certain smaller tech or biotech companies recommended early in their lifecycle may have floundered due to competitive pressures or an inability to turn nascent technology into profitable ventures. The Motley Fool’s general stance is to hold onto these positions for the long term unless a key aspect of the thesis changes drastically.

Comparison with Other Stock-Picking Services

The investing landscape is crowded, featuring established names like Morningstar, Zacks Investment Research, and up-and-coming platforms like Seeking Alpha’s premium services. So how does Motley Fool Stock Advisor stack up?

Morningstar Premium

- Focus: Morningstar focuses heavily on mutual funds, ETFs, and long-term portfolio strategies, though it also offers stock research.

- Approach: They often emphasize metrics like star ratings and analyst fair value estimates, typically catering to more traditional or conservative investors.

- Cost: Pricing for Morningstar Premium can vary but is generally comparable to or slightly higher than Stock Advisor.

Comparison: Motley Fool Stock Advisor is more about single-stock recommendations and less about comprehensive fund analysis. If you’re an ETF or mutual fund-oriented investor, Morningstar might be a better fit. If you want targeted stock picks with a growth lens, Stock Advisor edges ahead.

Zacks Investment Research

- Focus: Zacks is well-known for its quantitative model that ranks stocks based on earnings estimate revisions and surprises.

- Approach: Primarily short-term oriented, focusing on near-term earnings momentum. The platform can feel more technical or trading-oriented.

- Cost: Zacks offers multiple tiers, with varying features, often costing more than Stock Advisor for its premium or ultimate packages.

Comparison: Zacks’s short-term, momentum-driven methodology contrasts sharply with Motley Fool’s emphasis on long-term holdings. If you’re more comfortable with active trading, Zacks might appeal to you. If you prefer buy-and-hold growth investing, Motley Fool is likely a better match.

Seeking Alpha Premium

- Focus: User-generated content from professional and semi-professional analysts, offering a wide array of viewpoints and stock discussions.

- Approach: Offers multiple opinions for each stock, leaving the investor to sort through potentially conflicting analyses.

- Cost: Similar or more expensive than Motley Fool, depending on promotions and add-on features.

Comparison: Seeking Alpha’s greatest strength is also its greatest weakness—multiple viewpoints mean you have to spend time deciding which contributor is most credible. Motley Fool Stock Advisor, in contrast, consolidates the viewpoints of its in-house experts into cohesive picks.

Market Volatility and Risk Management

Investing is inherently risky, and growth stocks, which Motley Fool often favors, can be particularly volatile. It’s essential to have strategies for managing risk. Here are a few points to consider if you subscribe to Stock Advisor:

- Diversification: Holding multiple stocks across various sectors can mitigate the impact of a single underperformer. Motley Fool often recommends diversification, although they also champion concentrating on your highest-conviction ideas.

- Position Sizing: Even if you believe strongly in a recommendation, avoid putting an uncomfortably large portion of your portfolio into a single stock. This helps protect you if the stock experiences a sharp decline.

- Dollar-Cost Averaging (DCA): Rather than investing a lump sum, consider gradually buying shares over time to average out price fluctuations.

- Personal Risk Tolerance: Growth stocks can see severe drops during market downturns. If you’re close to retirement or otherwise risk-averse, consider balancing your portfolio with more stable, dividend-paying companies or bonds.

The Long-Term Investment Approach

One of the core reasons Motley Fool Stock Advisor resonates with so many investors is its dedicated commitment to long-term investing. This concept cannot be emphasized enough, especially in an era where daily headlines and social media can trigger impulsive trading.

Buy-and-Hold Mindset

The Motley Fool often points to historical data showing that the longer you remain invested in the stock market, the greater your chances of seeing positive returns. While not every pick is guaranteed to be a winner, the philosophy of “letting your winners run” and giving innovative companies enough time to realize their growth potential has, in many cases, produced solid results for Stock Advisor subscribers.

Emotional Discipline

One of the biggest challenges is resisting emotional urges—such as panic-selling during a market correction. Motley Fool’s emphasis on thorough research and conviction in a company’s fundamentals can help you maintain discipline and potentially capitalize on market volatility by buying on dips, as opposed to panic-selling.

Reinvesting Gains

Many Stock Advisor subscribers who experience gains will reinvest those gains back into either new recommendations or additional shares of existing winners. This snowball effect can help accelerate portfolio growth over years or decades, provided you have the patience and the stomach to tolerate the inevitable market ups and downs.

How to Get the Most Out of Motley Fool Stock Advisor

Simply reading the monthly picks and investing blindly in every recommendation is not necessarily the best strategy. Here are a few tips to optimize your experience and potential returns:

- Engage with the Research: Read each recommendation carefully. Understand the reasons Motley Fool analysts are bullish on a stock, including the potential risks. This will help you evaluate if it aligns with your personal investment style.

- Leverage Starter Stocks: For new subscribers, consider the Starter Stocks to anchor your portfolio. They’re typically chosen for stability and potential long-term growth.

- Use the Community: The discussion boards can be incredibly insightful. If you have questions about a company’s latest earnings report or concerns about a sector’s outlook, you can often find in-depth conversations among subscribers and sometimes analysts.

- Stay Educated: Make use of the educational resources available within the platform. These can help you understand market metrics, read financial statements, and refine your investment strategies.

- Tailor to Your Situation: Remember, the Stock Advisor recommendations do not account for your personal situation. Integrate them into a broader financial plan that considers your age, goals, risk tolerance, and other assets.

- Review Your Portfolio Periodically: While the Motley Fool preaches a buy-and-hold philosophy, periodically reviewing your holdings ensures you remain comfortable with each position. Major red flags or changes in fundamentals might justify trimming or exiting a position.

Conclusion and Final Thoughts

Motley Fool Stock Advisor has attracted a wide following for several compelling reasons: a long-term track record of beating the market, user-friendly research, and a community-driven environment. While it’s not free from drawbacks—such as occasional stock volatility and the rare issuance of “sell” recommendations—its general philosophy can align well with many investors who want credible guidance without shelling out thousands of dollars for high-end advisory services.

The real question is whether the service aligns with your specific goals and tolerance for risk. If you’re someone who appreciates a long-term approach and can stomach the highs and lows of growth-oriented stocks, you’ll likely find great value in Stock Advisor. If you prefer more immediate feedback, dividend-paying stocks, or day trading, you may need a different service or methodology altogether.

Ultimately, no stock-picking service can guarantee returns, and you’ll still need to exercise your own judgment. However, for those interested in building a portfolio of high-potential companies—and learning more about the “why” behind each pick—Motley Fool Stock Advisor remains a reputable and accessible option in the financial advisory landscape.

Frequently Asked Questions (FAQs)

Below are answers to common questions about Motley Fool Stock Advisor to help round out your understanding:

Q1: How often do they issue new stock recommendations?

They release two new picks per month. Additionally, they provide regular updates on previously recommended companies whenever there’s noteworthy news or an earnings report that might change the investment thesis.

Q2: What types of companies does Stock Advisor tend to favor?

While the service aims for a balanced approach, it has historically leaned toward growth-oriented companies, especially in technology, consumer goods, and innovative sectors. That said, they do occasionally recommend established blue-chip stocks if analysts see strong potential for growth or dividend appreciation.

Q3: Is there a money-back guarantee?

Motley Fool often offers a 30-day or 60-day money-back guarantee, but policies can vary. It’s best to check the terms on the sign-up page or contact their support team directly to confirm current offers.

Q4: Can I invest directly through Motley Fool Stock Advisor?

No, Motley Fool is not a brokerage. You would still need an external broker (e.g., TD Ameritrade, Fidelity, Schwab) to place trades. Stock Advisor is strictly a research and recommendations platform.

Q5: Do I need a large portfolio to benefit from the service?

Not necessarily. The subscription fee can be worthwhile if you’re serious about learning and gradually building a portfolio. However, if your investable capital is extremely limited, the subscription cost might be less justified unless you’re focused on education.

Q6: How long should I hold the recommended stocks?

Motley Fool typically advocates a holding period of 3–5 years or longer. They believe in giving companies time to realize their growth potential. Quick flips or short-term speculation are not central to this service’s philosophy.

Q7: Why do some people dislike the Motley Fool?

Common criticisms include heavy marketing tactics, upselling to more expensive services, and a bullish stance on growth companies that can be risky in volatile markets. Additionally, some investors who bought picks at inopportune times or neglected to diversify might have had bad experiences, which can shape negative opinions.

Q8: How does Stock Advisor handle changing market conditions?

While they continue to release monthly picks regardless of market highs or lows, they also issue special alerts and updates if a major macroeconomic shift or company-specific event warrants it. However, they seldom recommend selling unless a core component of the investment thesis is fundamentally broken.

Q9: Do they offer advice on portfolio allocation or diversification?

They provide general guidance and highlight the importance of diversification, but they do not offer individual portfolio allocation advice. Investors are encouraged to decide how each recommendation fits into their broader strategy.

Q10: Is Stock Advisor the only Motley Fool service?

No, The Motley Fool offers multiple premium services—like Rule Breakers, Everlasting Stocks, Motley Fool Options, and specialized sector-focused newsletters. Stock Advisor is often the entry-level or “flagship” service due to its accessibility and general focus.

Final Word

Motley Fool Stock Advisor can serve as a solid launching pad for investors looking to build a growth-oriented portfolio guided by professional research. Its track record of identifying high-flying companies—paired with a strong educational ethos and active community—has made it a trusted name over the years. Nevertheless, always remember that all investments carry risks, and no recommendation service can guarantee returns.

If you resonate with the long-term, buy-and-hold investment philosophy and have the discipline to stick through inevitable market swings, Motley Fool Stock Advisor might be one of the more worthwhile subscriptions in the crowded financial advisory space. With monthly picks that often highlight intriguing companies before they hit mainstream consciousness, it remains a popular choice for those seeking both guidance and an opportunity to learn the ropes of successful, long-term stock investing.