Just a few years ago, Decentralized Apps were little more than buzzwords on ICO pitch decks. Today, in 2025, over 24 million wallets interact with dApps daily—powering real estate tokenization, player-owned gaming assets, and fully on-chain social platforms on Layer-2 blockchains. Despite this rapid growth, most resources still feel scattered, overly technical, or too focused on specific ecosystems.

This guide simplifies everything. You’ll get a clear, step-by-step understanding of how Decentralized Apps work, where they’re headed, and exactly how to build your first one with confidence.

Table of Contents

What exactly is a dApp?

A decentralized application is software whose critical state and logic are enforced by a permissionless blockchain rather than by a company‑controlled server. Three pillars separate a true dApp from “crypto‑flavored SaaS”:

| Pillar | Why it matters | Example |

|---|---|---|

| Decentralized execution | No single entity can change rules or censor transactions. | Uniswap smart contracts live entirely on Ethereum; once deployed, even the founders can’t halt trading. |

| Open, verifiable state | Anyone can audit past events or fork the project. | Blur’s NFT order book is transparent, enabling third‑party analytics dashboards. |

| Token‑aligned incentives | Economic rewards/punishments keep actors honest. | Aave stakers earn protocol fees and underwrite liquidations, aligning security with usage. |

Everything else—mobile app, caching layer, analytics dashboard—can be centralized or hybrid. That flexibility is why many 2025 dApps use “Web2.5” architectures: decentralized core, user‑friendly edges.

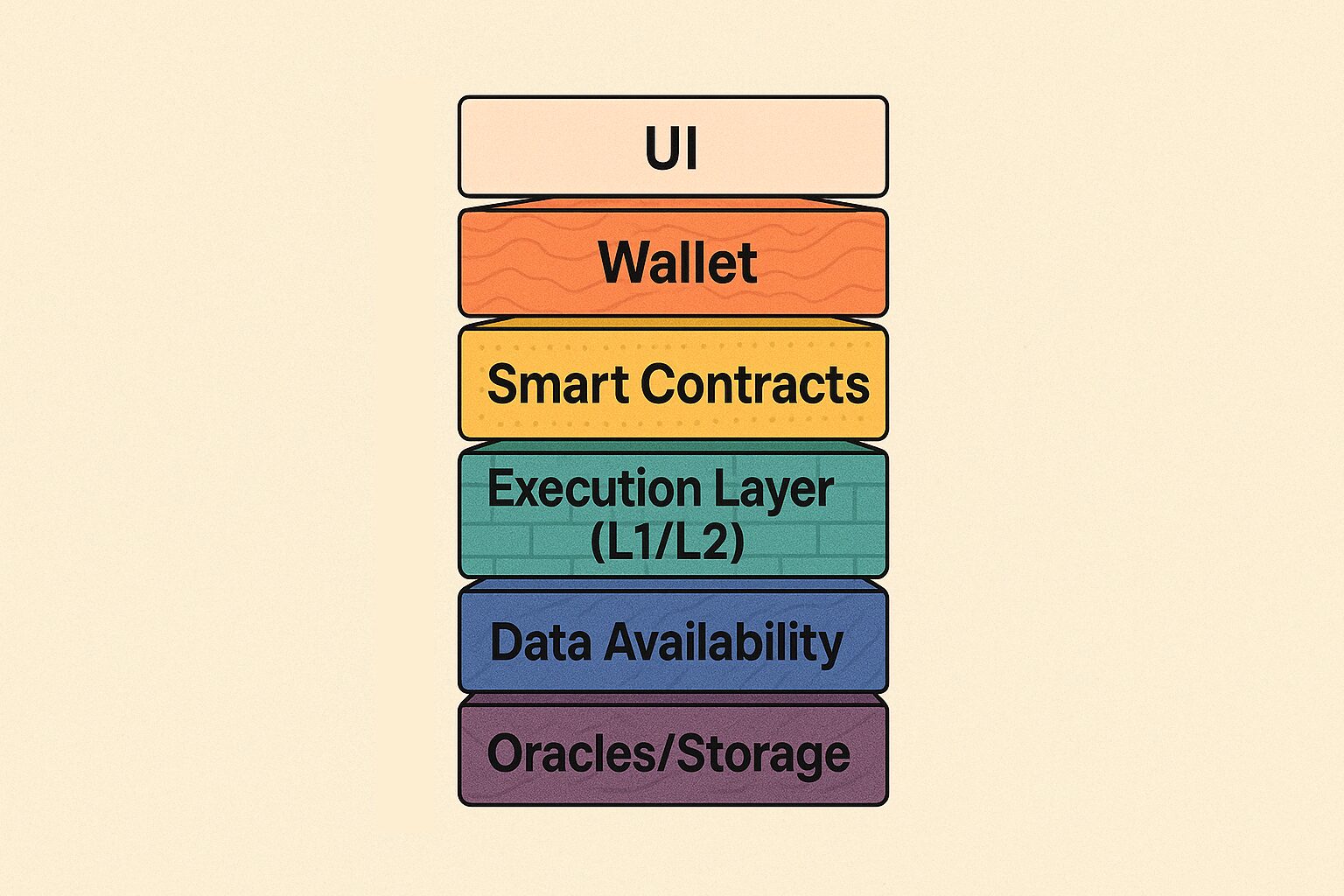

The full tech stack, layer by layer

Smart‑contract layer

- Languages: Solidity (EVM), Vyper (EVM alt), Rust (Solana, Near), Move (Aptos/Sui), Cairo (Starknet).

- Main jobs: encode business rules, mint/burn tokens, store critical data, manage access control, and—if you choose—enable upgrades via proxy or diamond patterns.

Consensus / settlement layer

- Monolithic L1s: Ethereum, Solana, Sui — handle execution and data availability in one chain.

- Layer‑2 rollups: Optimism, Base, zkSync, Starknet — batch many transactions and submit proofs to Ethereum, giving users 10–100× cheaper fees.

- Permissioned chains: Onyx (by JPMorgan) and Canton (by Digital Asset) let regulated institutions transact privately while retaining some blockchain guarantees.

Data‑availability (DA) & modular stacks

Celestia, Avail, and EigenDA separate data publishing from execution, letting any team launch a custom rollup that rents shared DA security instead of building it from scratch. Celestia’s roadmap targets >1 GB/s throughput—orders of magnitude beyond Ethereum’s current capacity.

Off‑chain helpers

| Service | Typical provider | Why it matters |

|---|---|---|

| Decentralized storage | IPFS, Arweave, Filecoin | Keeps large files (NFT art, game assets) retrievable without centralized servers. |

| Oracles | Chainlink, Pyth, RedStone | Bring off‑chain facts—prices, weather, sports scores—into the blockchain. |

| Compute / AI | Akash, Bittensor, Gensyn | Rent GPU cycles or ML model outputs in a trust‑minimized way. |

Front‑end & wallet

Most dApps ship a React/Next.js site that talks to wallets via ethers.js or viem. Browser wallets (MetaMask, Phantom), mobile smart wallets (Rainbow, Zerion), and embedded wallets (Privy, Web3Auth) sign transactions. Smart‑account standards (ERC‑4337) remove seed‑phrase headaches—more on that in § 10.

Smart‑contract platforms & languages

| Ecosystem | Language | Strengths | Caveats |

|---|---|---|---|

| EVM / Solidity | Solidity, Vyper | Largest dev tooling, audits, liquidity, and libraries. | Gas‑price sensitivity; single‑threaded VM. |

| Solana | Rust, C, Move (via Seahorse) | 400 ms blocks, parallel runtime, cheap fees. | Steeper learning curve, “state‑rent” model requires periodic rent payments. |

| Aptos / Sui | Move | First‑class “object” model: assets behave like structs, preventing many double‑spend bugs. | Smaller library ecosystem; fewer auditors. |

| Starknet | Cairo | Built‑in zero‑knowledge proofs, enabling provable computation. | Novel language; ecosystem still maturing. |

| Cosmos SDK | Rust, Go | Build your own application‑specific chain; communicate with others via IBC. | You (or a hosting partner) must run validators—extra operational complexity. |

Tip: For your very first project, choose Solidity on an EVM chain. Tutorials, Stack Overflow answers, and auditors are abundant.

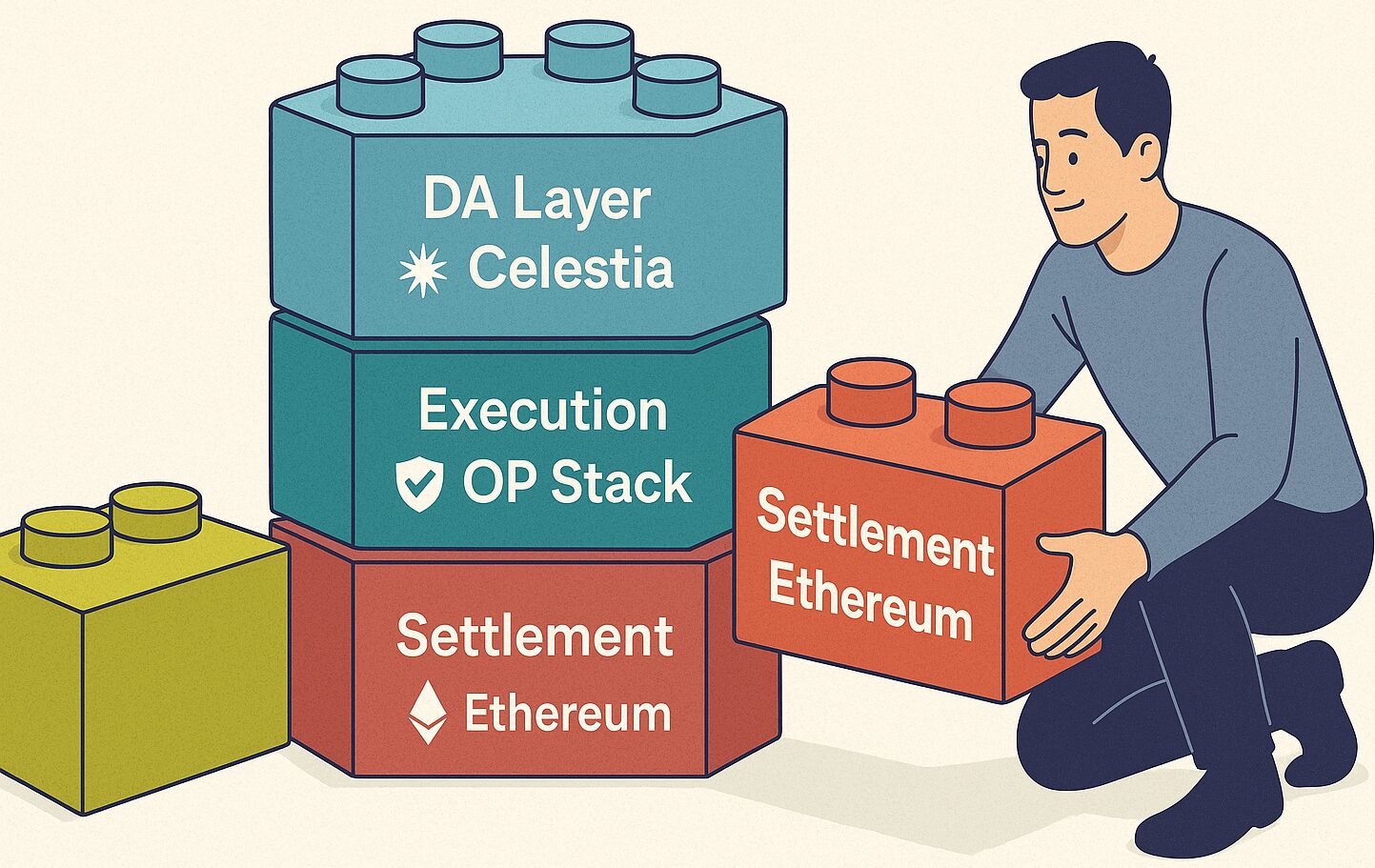

Networks, rollups & modular blockchains

Monolithic vs modular

A monolithic chain (e.g., Solana) bundles consensus, execution, and DA into one system for low latency. A modular design (e.g., Celestia + OP‑Stack rollups) lets teams pick and mix execution environments, DA layers, and settlement layers. Analysts call 2025 “the modular decade” because this separation drastically lowers the cost of launching specialized chains.

Rollup‑as‑a‑Service (RaaS)

Firms like Conduit, Caldera, AltLayer, Gelato, Dymension spin up custom rollups—complete with block explorers, sequencers, and bridges—in hours. Conduit alone launched more than three hundred production chains in 2024. RaaS removes DevOps headaches so projects can focus on product.

Bridging & interoperability

Protocols such as IBC, LayerZero, Wormhole, and Hyperlane move tokens or arbitrary messages across chains. While interoperability is the dream, “bridge risk” remains the single biggest cause of nine‑digit exploits (§ 11), so many teams now adopt native issuance on each chain or secure their bridges with light‑client proofs to reduce attack surface.

Where dApps are used today

| Vertical | What users actually do | Flagship projects |

|---|---|---|

| DeFi | Swap tokens, lend/borrow, trade perps, hedge yield. | Uniswap, GMX, Aave, Morpho. |

| NFTs & Media | Mint art, trade collectibles, license music, stream on‑chain video. | OpenSea, Magic Eden, Sound. |

| Gaming | Own in‑game items, earn tokens, govern game economies. | Illuvium, Axie, Parallel, Treasure. |

| SocialFi | Publish posts, follow accounts, monetize content. Lens Chain launched on 4 Apr 2025 with ~600 k pre‑migrated profiles. | Lenster, Orb, TeaParty. |

| AI & Compute | Rent GPU power or buy ML inference through tokens. | Bittensor, Gensyn, Ritual. |

| Real‑World Assets (RWA) | Tokenize US treasuries, money‑market funds, or real estate. The DAMAC‑MANTRA partnership brought $1 B of Dubai property on‑chain in 2025. JPMorgan’s Onyx division runs tokenized MMF pilots. |

The takeaway: dApps now touch real cashflow industries, not just speculative trading.

Adoption in numbers

- 24.6 million daily unique active wallets (dUAW) by Q4 2024 — up 485 % year‑over‑year.

- 32 % of total on‑chain activity is DeFi.

- AI/“Other” dApps grew 2,269 % in 2024.

- ~24 000 full‑time blockchain developers tracked in Electric Capital’s 2024 report.

- $227 B total value locked in DeFi at end‑2024 — within 20 % of the 2021 bull‑market peak.

- Over $100 M in bug‑bounty payouts to white‑hats on Immunefi since 2021.

More users, more professional devs, and rising TVL indicate a maturing ecosystem where shipping polished products is finally practical.

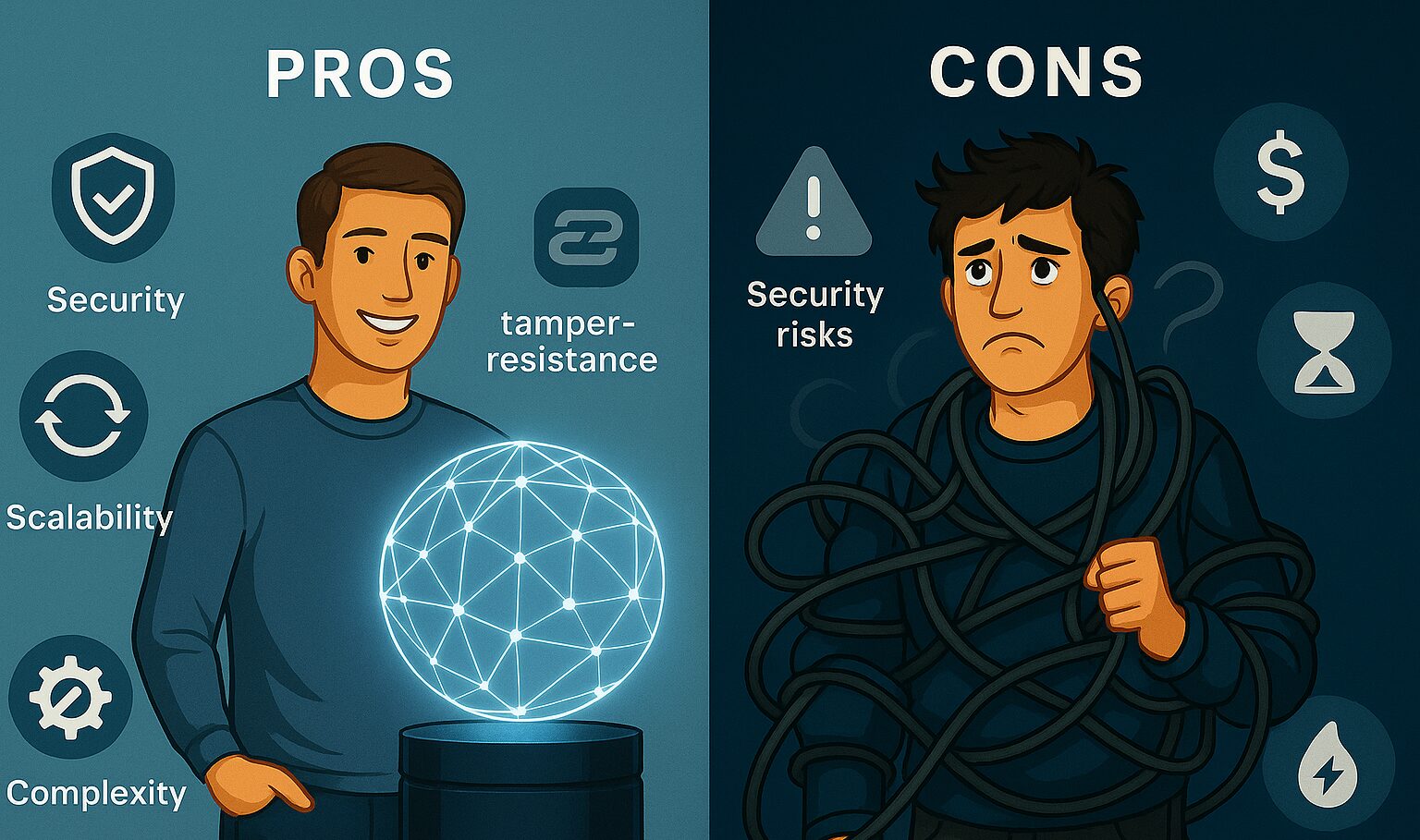

Should you build a dApp?

Advantages

- Global reach: Launch day one to anyone with an internet connection.

- Composability: Other developers can integrate or extend your contracts without permission, creating network effects.

- Transparent revenue: On‑chain fees split automatically—no accountants or lawyers for every micro‑payment.

- Resilience: Removing a single corporate server is good for censorship resistance and disaster recovery.

Trade‑offs

- UX friction: New users still struggle with wallets, seed phrases, and gas estimates.

- Irreversible bugs: If you ship a vulnerable contract, hackers can siphon funds instantly. There is no “undo.”

- Regulatory uncertainty: Securities law differs across countries; tokens that share revenue might be classified as securities.

- Speculative distraction: Token incentives can attract mercenary farmers who chase rewards but ditch the project when yields drop.

Rule of thumb: If provable trust is your competitive edge—custody of funds, deterministic rules, censorship resistance—consider a dApp. Otherwise, a traditional cloud backend might be simpler.

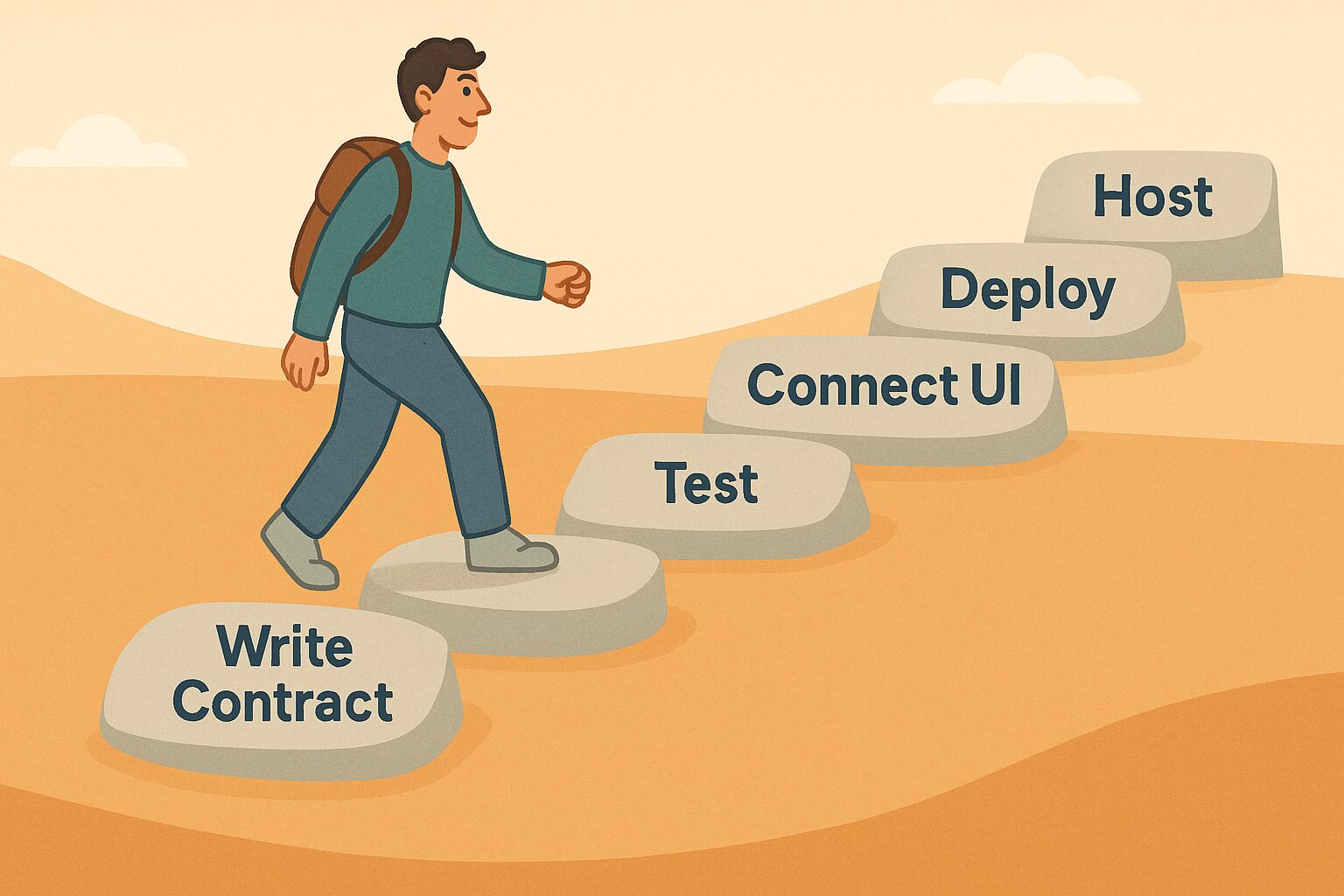

Hands‑on tutorial: shipping your first dApp

Goal: Deploy a minimal “on‑chain todo list” on the Base rollup and connect it to a Next .js UI.

1. Bootstrap the project

npx create-hardhat@latest my-dapp

cd my-dapp && npm install2. Write the contract (Todo.sol)

pragma solidity ^0.8.24;

contract Todo {

struct Item { string text; bool done; }

Item[] public items;

function add(string calldata _text) external {

items.push(Item(_text, false));

}

function toggle(uint id) external {

items[id].done = !items[id].done;

}

}3. Test

npx hardhat test4. Deploy

npx hardhat run scripts/deploy.js --network base5. Connect front‑end (using wagmi + RainbowKit)

import { useWriteContract } from 'wagmi';

const { writeAsync: add } = useWriteContract({

address: '0xYourContract',

abi: TodoABI,

functionName: 'add'

});6. Host UI on IPFS (via Fleek, Pinata, or Cloudflare) and map an ENS domain for a fully decentralized experience.

7. Upgrade path: For production, wrap business logic in a transparent proxy so you can patch bugs under a 48‑hour timelock.

Account abstraction & the wallet UX revolution

ERC‑4337 defines “smart accounts” that live entirely as contracts—no externally owned account (EOA) or seed phrase needed.

How it works

- Users sign a UserOperation (a structured JSON object) off‑chain.

- A Bundler picks up many UserOps and submits them in one transaction, saving gas.

- A Paymaster can optionally pay the gas, enabling gasless UX or credit‑card on‑ramps.

- The EntryPoint contract verifies and executes each smart‑account call.

Why it matters

- Seed‑phrase free: Users recover via email, social guardian set, or biometrics.

- Sponsored gas: Apps can pay fees for onboarding or promotions.

- Batched actions: Approve → swap → stake happens in one UX step; no more “click approve then click swap” friction.

Analysts forecast over 200 million smart‑account deployments by late 2025. Many new dApps, especially consumer‑facing ones, now treat smart accounts as their default.

Security best‑practices (and horror stories)

Common vulnerabilities

| Bug class | Exploit scenario | Mitigation |

|---|---|---|

| Re‑entrancy | Attacker loops withdraw calls before balance updates. | Checks‑effects‑interactions pattern or reentrancy guard. |

| Integer overflow/underflow | Funds locked or minted unexpectedly. | Solidity ≥ 0.8 auto‑checks; SafeMath for older code. |

| Oracle manipulation | Thin liquidity pairs skew on‑chain price, triggering bad loans. | Use TWAP oracles, Chainlink feeds, and circuit breakers. |

| Access‑control misconfig | Admin keys seize or freeze funds. | Multisig, timelock, DAO governance, hardware storage of keys. |

Audit & bounty checklist

- Static analysis (Slither, MythX).

- Property‑based fuzzing (Echidna, Foundry).

- Formal verification for complex math (Certora, Certik).

- Independent audit—budget at least one month for fixes.

- Public bug bounty—white‑hats on Immunefi have earned over $100 M so far.

Incident statistics

Total crypto losses in 2024 were ≈ $1.3 B, the lowest since 2020, but bridges still accounted for more than half of that number. Treat bridge contracts as critical infrastructure: audit them twice, or avoid them.

Sustainable tokenomics 101

- Clearly define utility: voting, fee discounts, staking access, governance, or revenue share.

- Cap inflation: publish an emission schedule; consider halving events (Bitcoin style) or capped supply (Celestia).

- Guard against reflexive loops: avoid printing tokens just to farm other tokens (the 2022‑23 “Ponzinomics” era).

- Plan treasury runway: audits, liquidity mining, developer grants, and legal costs.

- Legal alignment: tokens that share revenue may be securities in some jurisdictions (§ 13).

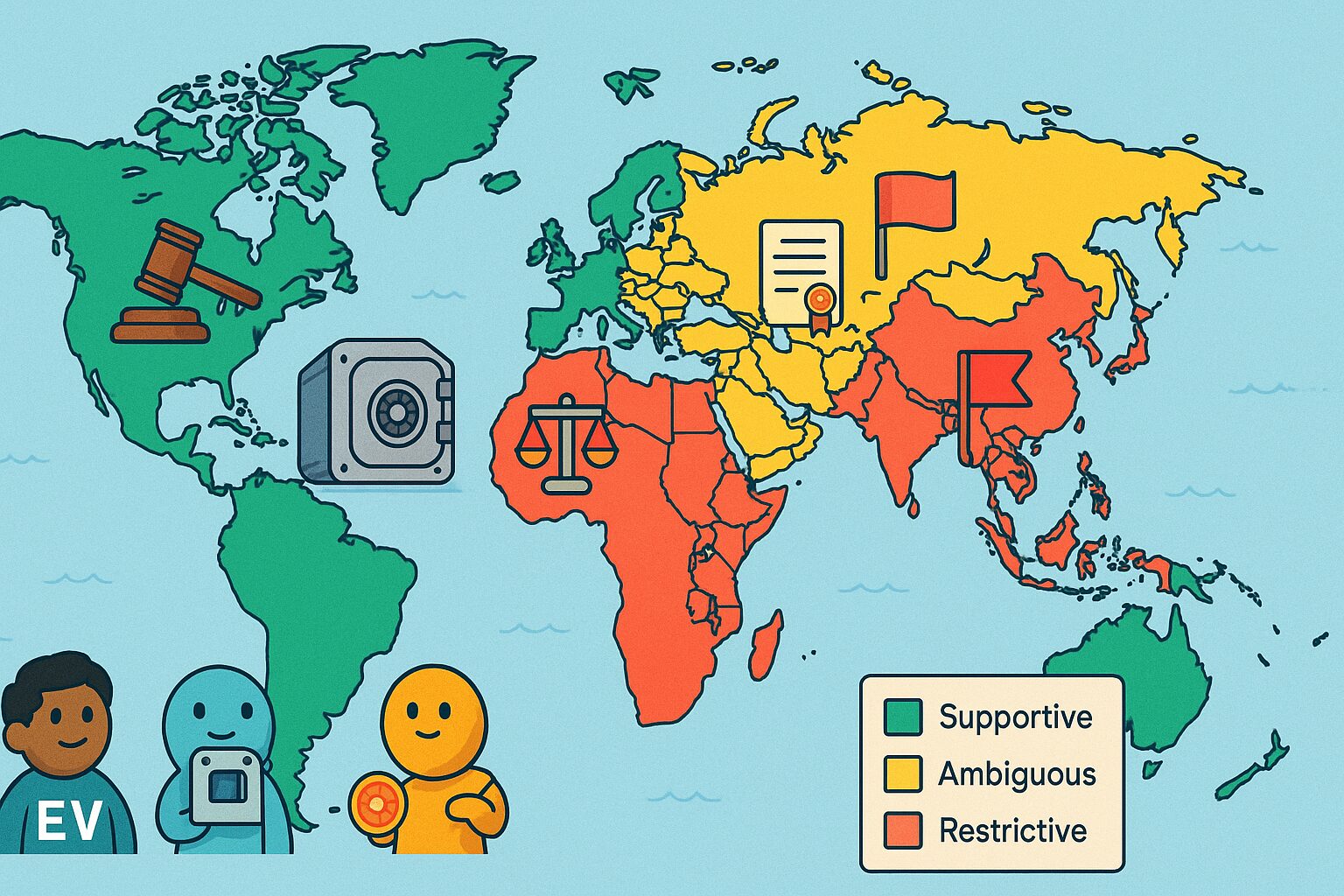

Regulation & compliance snapshot (Apr 2025)

| Region | 2025 status | Key points |

|---|---|---|

| United States | Stablecoin and RWA bills in committee; SEC vs CFTC turf war continues. | Use Reg CF/D or treat tokens as pure utility until the network is sufficiently decentralized. |

| European Union | MiCA fully in force: licensing for crypto‑asset service providers, strict stablecoin reserve rules. | DeFi and NFT annex drafts expected Q4 2025. |

| UAE / Dubai | VARA issues licenses; recognizes tokenized real‑estate offerings (DAMAC‑MANTRA, 2025). | Friendly regulatory sandbox for RWA pilots. |

| Singapore / Hong Kong | Sandbox regimes, clear guidance on stablecoins and AML. | Popular HQ for exchanges, custody firms, and RWA issuers. |

Practical tip: integrate privacy‑preserving on‑chain KYC credentials (Polygon ID, zkPass) so only verified users can access sensitive features while you stay AML‑compliant.

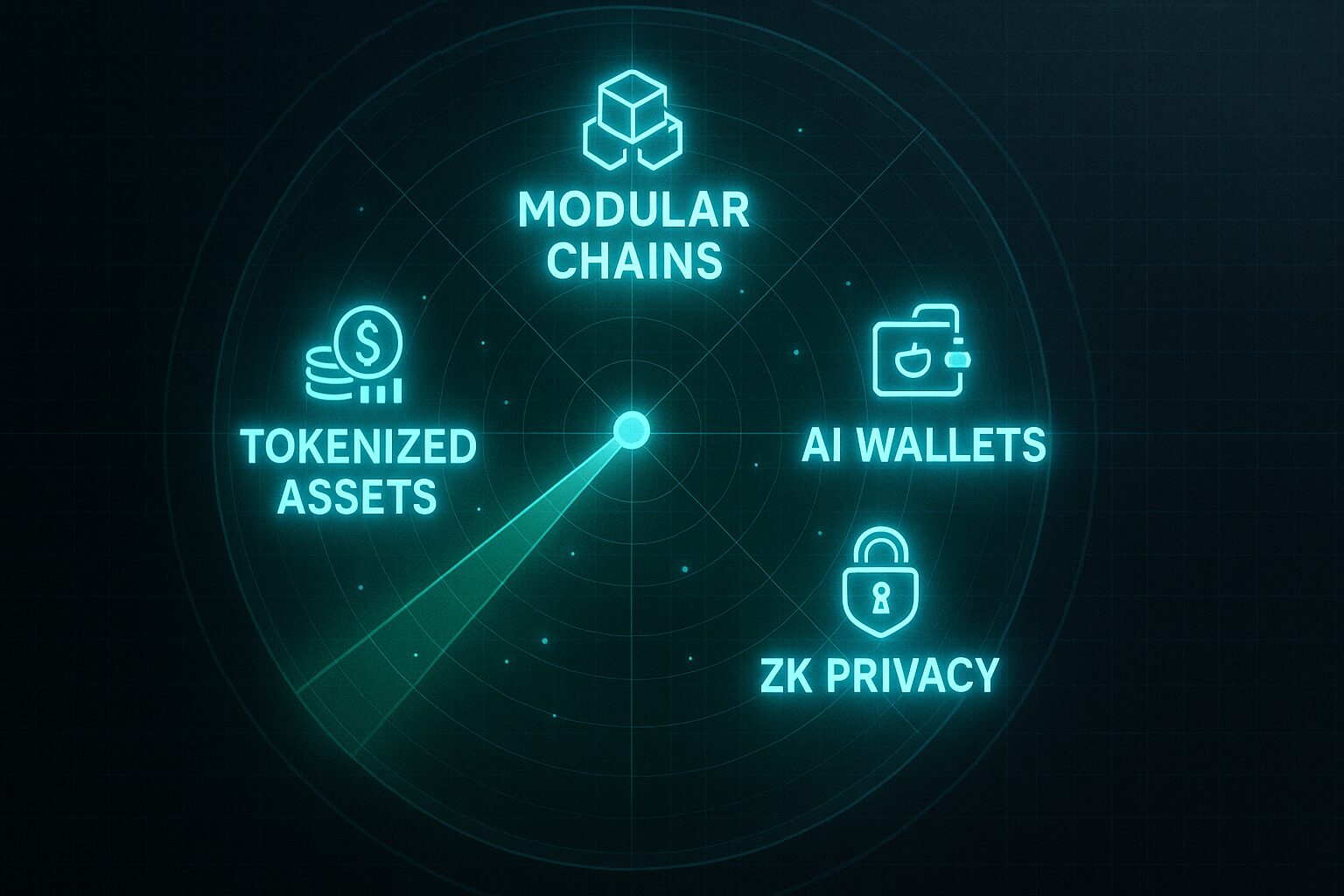

6 trends to watch through 2026

- Modular “app‑chains” delivering sub‑cent data blobs via Celestia, Avail, EigenDA.

- Rollup‑as‑a‑Service commoditizing chain deployment—Conduit’s 300+ rollups foreshadow thousands by 2026.

- AI‑powered smart‑account agents that auto‑rebalance portfolios, pay bills, bridge liquidity, and even vote in governance.

- Tokenized treasuries & MMFs expected to cross $10 B TVL as Onyx‑style rails mature.

- Privacy by default using ZK‑EVMs and fully homomorphic encryption (FHE) for compliant private DeFi.

- Social composability—Lens and Farcaster frames push decentralized identity and rich social widgets into mainstream apps.

Frequently‑asked questions

Q: Do I need blockchain knowledge to use a dApp?

A: Increasingly, no. Embedded smart‑wallets let you sign in with email or biometrics. The dApp covers keys and gas behind the scenes.

Q: How much does it cost to transact?

A: Ethereum mainnet ranges from $2–$10 per simple transaction. L2 rollups cost $0.02–$0.20. Solana and Near are fractions of a cent. Many consumer apps sponsor gas entirely.

Q: Can I migrate my existing Web2 userbase?

A: Yes. Start hybrid: keep your existing login, then let users “claim” on‑chain identities and port their data later. Reddit’s Collectible Avatars pioneered this flow.

Q: What if my contract needs an upgrade?

A: Use a proxy pattern with a timelock (e.g., 48 hours) so users can exit or protest before the change becomes active.

Wrap‑up & next steps

Decentralized applications have matured from speculative experiments into multi‑billion‑dollar infrastructure for finance, media, identity, and physical‑asset markets. Your success now depends less on cryptography wizardry and more on product: intuitive onboarding, bullet‑proof security, sustainable incentives, and a clear legal stance.

Whether you’re building a social‑token DAO, a tokenized real‑estate exchange, or an AI compute marketplace, the roadmap is similar:

- Define the trust problem you’re solving.

- Pick the right stack—L1, rollup, or app‑chain.

- Bake in security—audits, bounties, multi‑sigs.

- Focus on UX—smart accounts, sponsored gas, human‑readable names.

- Iterate in public—composability is free marketing.

Start tinkering today. When you push your contract to mainnet, share the address—I’d love to be your first user.