Position sizing stands at the very heart of successful stock trading. Regardless of how accurate your technical analysis or fundamental research may be, failing to manage position sizes properly can unravel even the most brilliant strategy. In this comprehensive guide, we’ll take an in-depth look at every aspect of calculating position size in stock trading—from basic definitions and key concepts to practical examples, advanced techniques, and common pitfalls. By the end, you’ll have the knowledge and tools to manage your trades with greater consistency, confidence, and risk control.

Understanding Position Sizing

Position sizing refers to the process of determining how many shares (or lots, contracts, units, etc.) of a particular stock (or other financial instrument) you should buy or sell in each trade. Rather than arbitrarily deciding the number of shares based on gut feeling or the capital you have “lying around,” position sizing uses a structured approach. It involves:

- Assessing your total available trading capital (your account size).

- Determining how much of that capital you are willing to risk on any single trade.

- Factoring in the stock’s volatility, the position’s stop-loss level, and your market outlook.

The primary goal is to protect your trading account from substantial losses, maintaining consistent risk levels across all trades. This ensures that no single losing trade can wipe out a large portion of your capital.

Why Position Size Matters

Risk Management Benefits

- Capital Preservation

One of the golden rules of trading is: Don’t lose big. By controlling position size, you keep losses manageable so you can survive inevitable drawdowns. - Avoiding Catastrophic Drawdowns

A series of losing trades can occur even to the best traders. Proper position sizing ensures that each loss remains small enough not to blow up your account. - Consistency in Trading

Maintaining a consistent risk profile for each trade allows you to evaluate your trading strategy more effectively. If each trade risks a similar percentage of your account, you can better track performance metrics such as expected value, win rate, and drawdown.

Psychological Advantages

- Reduced Emotional Stress

When you know you’re only risking a small, consistent percentage of your account, you trade with greater peace of mind. You’re less likely to panic if the trade goes against you. - Better Decision-Making

Traders who risk too much often exit trades prematurely or hold losing positions in the hope that they’ll break even. Small, manageable position sizes help you stick to your trading plan. - Long-Term Outlook

Position sizing aligns you with a strategic, methodical mindset. You move away from trying to “hit home runs” on every trade, focusing instead on consistent, long-term growth.

Key Components of Position Sizing

Before you can determine the optimal number of shares to trade, you need to understand the essential components that feed into the position-sizing formula.

Account Size

- Definition: Your account size is the total amount of capital you have allocated to trade stocks. This can be the total balance in your brokerage account or the portion designated for active trading.

- Importance: Everything in position sizing starts from your account size. If you have a $100,000 account, risking 1% per trade equates to $1,000 risk per trade. Conversely, if you have a $5,000 account, 1% risk per trade is only $50.

Risk Tolerance and Risk per Trade

- Risk Tolerance: Refers to how much financial risk you can stomach—both psychologically and financially.

- Risk per Trade: A commonly cited rule of thumb is to risk 1-2% of your account on any single trade. This is not set in stone; some traders risk as low as 0.5% per trade, especially when volatility is high or if they are new to trading.

- Why It Matters: Choosing a risk per trade is a personal decision that affects how quickly you can grow your account and how well you can weather losing streaks.

Stop-Loss Placement

- Definition: A stop-loss is a predetermined price point at which you will exit a trade if it moves against you, to cap potential losses.

- Relation to Position Size: The difference between your entry price and your stop-loss price is crucial in calculating how many shares you can hold. A wider stop-loss (e.g., $5 away from entry) means you can hold fewer shares to maintain the same risk. A tighter stop-loss (e.g., $1 away from entry) allows more shares.

- Strategic Placement: Stop-losses should typically be placed at technical or logical levels—perhaps below a key support level—to avoid being easily triggered by normal price fluctuations.

Stock Price and Volatility

- Price: If a stock is trading at $20 and your stop-loss is at $18, the per-share risk is $2. If a stock is trading at $100 and your stop-loss is $95, the per-share risk is $5.

- Volatility: Stocks with higher volatility can have larger swings. Trading these stocks might require smaller position sizes to keep the total risk in check.

- Impact: The more volatile the stock, the greater the potential for large price moves, and hence the greater the potential loss if you don’t size appropriately.

Common Methods of Calculating Position Size

There isn’t a one-size-fits-all approach to position sizing. Different methods suit different trading styles, risk appetites, and market conditions. Here are some widely used models:

Fixed-Dollar Risk Model

- Overview: You decide on a fixed dollar amount of your account to risk per trade. For instance, if you have $50,000 and decide you only want to risk $500 per trade, that’s your fixed dollar risk.

- Pros: Simple to understand and implement.

- Cons: Does not adapt automatically to changing account sizes. If your account grows or shrinks, you have to adjust manually or risk an inconsistent percentage of your account.

Percentage Risk Model

- Overview: You risk a fixed percentage of your account per trade—commonly between 1% and 2%. As your account changes, the absolute dollar risk changes proportionally.

- Pros: More dynamic approach; risk scales automatically with account size.

- Cons: During large drawdowns, your absolute risk per trade shrinks, which can slow recovery if your account suffers a significant loss.

Volatility-Based Position Sizing

- Overview: Incorporates the stock’s volatility into position size calculations. You might measure volatility through the Average True Range (ATR) or standard deviation.

- Why It’s Useful: High-volatility stocks can be riskier, so you might want smaller positions in those. Conversely, low-volatility stocks might allow slightly bigger positions.

- Implementation: Multiply a volatility measure (e.g., ATR) by a factor (e.g., 2) to determine a stop-loss distance, or adjust the number of shares inversely proportional to volatility.

The Kelly Criterion

- Overview: A formula created to determine the optimal bet size based on your win probability and the payoff ratio.

Formula: f∗ = ((p−q) / r ) / average payoff

Where p is the probability of winning, q = 1 − p, and r is the odds ratio (payoff ratio).

- Pros: Maximizes the growth rate of capital mathematically if you have accurate estimates of probabilities and payoffs.

- Cons: Highly aggressive and sensitive to inaccuracies in your probability estimates. Often traders use a fraction of the Kelly Criterion (e.g., half-Kelly) for risk management.

Using R-Multiples in Position Sizing

- Definition: R-multiple is the ratio of your potential reward to your risk. For instance, if you risk $1 and expect to make $3, that’s a 3R trade.

- Application: Position sizing can factor in the R-multiple to consistently risk the same amount of capital (or same “R”) on each trade. If each trade has a risk of 1R, position sizing ensures that 1R remains a consistent fraction of your total capital.

ATR (Average True Range) Approach

- Overview: The ATR indicator measures the average volatility of a stock (or other instrument) over a specified period (commonly 14 days).

- How It Helps: Traders set their stop-loss based on a multiple of the ATR (e.g., 2 × ATR) away from the entry. If ATR is $1, a 2 × ATR stop-loss is $2 away from entry. You then adjust your position size so that the total dollar risk matches your desired risk.

Step-by-Step Guide to Calculating Position Size

Below is a cohesive step-by-step approach to calculating position size using a percentage risk model as an example. This process can be adapted to other methods simply by changing how you define risk.

1. Determine Your Total Account Size

- Action: Check your brokerage account balance or the capital you have set aside for trading.

- Tip: If part of your account is locked up in other trades, only consider your liquid or available capital for new trades.

2. Set Your Maximum Risk per Trade

- Action: Decide on a percentage of your account you are willing to risk on each trade. For example, if your account is $50,000 and you choose 1% risk, your maximum risk per trade is $500.

- Reasoning: 1% is a commonly cited figure. However, the “right” number could be anywhere from 0.5% to 2% depending on your risk tolerance, strategy, and market conditions.

3. Identify Your Stop-Loss Level

- Action: Analyze your charts, fundamentals, or whichever method you use to determine the logical stop-loss placement.

- Example: Suppose you decide to enter at $30 for a stock, and you determine that a sensible stop-loss (below a support level) is at $28.

- Note: The difference between entry price ($30) and stop-loss ($28) is $2 per share.

4. Calculate the Risk per Share

- Formula: Risk per share = Entry Price − Stop-Loss Price

- Example: If the entry price is $30 and stop-loss is $28, the risk per share is $2.

5. Determine the Number of Shares

- Formula: Position Size (shares) = Dollars Risked per Trade / Risk per share

- Example: With $500 risk per trade and $2 risk per share, Position Size (shares) = 500/2 = 250 You would buy 250 shares of the stock.

6. Validate Against Overall Market Exposure

- Action: Check how many trades you already have open and whether adding this new position keeps your overall risk exposure in line.

- Why It Matters: If you hold multiple correlated positions (e.g., stocks all in the same sector), your risk is effectively higher than if you held positions in uncorrelated assets.

7. Place the Trade and Monitor Risk

- Action: Execute the trade. Immediately set your stop-loss order to ensure your maximum risk is capped.

- Monitoring: If market conditions change, you may adjust stop-losses or exit early. However, do so according to your plan rather than on emotional impulses.

Practical Examples

Example 1: Using a Percentage Risk Model

- Account Size: $100,000

- Risk per Trade: 1% → $1,000

- Stock to Trade: XYZ, current price $50

- Stop-Loss Level: $47 (based on support level and technical analysis)

- Risk per Share: $50 (entry) – $47 (stop-loss) = $3

- Position Size: $1,000 ÷ $3 = 333 shares (you could round down to 333 to keep risk consistent).

- Check: 333 shares × $50 = $16,650 capital allocated; total risk if stopped out is 333 × $3 = $999 (close to $1,000).

By following this method, you maintain exactly 1% risk of your total account. If the trade goes wrong, you lose only $1,000, keeping your losses manageable.

Example 2: Volatility-Based Model with ATR

- Account Size: $50,000

- Risk per Trade: 1% → $500

- Stock to Trade: ABC, current price $35

- ATR (14-day): $1.50

- Stop-Loss Placement: 2 × ATR = 2 × $1.50 = $3 from entry. So, stop-loss is placed at $32.

- Risk per Share: $35 (entry) – $32 (stop-loss) = $3

- Position Size: $500 ÷ $3 = 166 shares (approximately).

- Check: 166 shares × $35 = $5,810 capital allocation, potential loss if stopped out = 166 × $3 = $498.

This approach automatically adapts the position size to the stock’s volatility, meaning you will generally risk fewer shares in more volatile stocks and more shares in less volatile stocks.

Additional Factors to Consider

Correlation Between Positions

- Definition: Correlation measures how closely two assets move together. If you have multiple trades in highly correlated stocks, your portfolio is exposed to similar risks.

- Example: Holding shares in multiple tech companies can amplify losses if the entire tech sector experiences a downturn.

- Action: Diversify to reduce sector-specific risk. Keep track of your total risk exposure across correlated positions.

Leverage and Margin Requirements

- Definition: Leverage is when you borrow capital from your broker to take larger positions than your account balance alone could support.

- Risk Impact: Leverage can amplify gains, but it also magnifies losses. If you are using margin, you need to be extra cautious with position size, because even small price moves against you can cause margin calls.

- Best Practices: New traders should limit or avoid leverage until they have a solid track record. Even experienced traders must monitor margin requirements closely to avoid forced liquidation.

Time Horizon and Liquidity

- Time Horizon: Day traders generally use tighter stop-losses and smaller position sizes due to short holding periods and higher volatility within the day. Swing traders and position traders might hold positions for days or weeks, often using wider stop-losses.

- Liquidity: Heavily traded stocks (e.g., large-cap stocks with high daily volume) are easier to enter and exit without significant slippage. Thinly traded stocks can cause unexpected price movements, necessitating smaller position sizes to accommodate potential slippage.

Win Rate and Risk-Reward Ratio

- Win Rate: The percentage of trades that end profitably.

- Risk-Reward Ratio: How much you stand to gain for every dollar you risk. A standard guideline is to look for trades that offer at least a 2:1 reward-to-risk ratio.

- Influence on Position Size: If your strategy has a high win rate (70%+), you might afford slightly higher risk per trade. If your strategy has a lower win rate but large winners (e.g., 3:1 or 4:1 reward-to-risk), you can still be profitable with a conservative risk approach.

Emotional Discipline and Adherence to Plan

- Common Pitfall: Traders often deviate from their trading rules mid-trade due to fear or greed.

- Solution: Set your position size, define your stop-loss, and stick to it. Only adjust if new market information genuinely invalidates the original trade premise.

Common Mistakes and How to Avoid Them

- Ignoring Position Sizing Altogether

- Mistake: Traders may just buy round lots (e.g., 100 shares) or an arbitrary number of shares without calculation.

- Solution: Always determine your risk first, then calculate position size.

- Using Too Large a Position

- Mistake: Overconfidence in a “sure thing” can lead to an oversized position and catastrophic losses if the trade fails.

- Solution: Stay within your pre-defined risk tolerance, typically 1-2% per trade.

- Not Adjusting to Volatility

- Mistake: Using the same stop-loss width for highly volatile and low-volatility stocks.

- Solution: Account for volatility through the ATR or another metric.

- Failing to Diversify

- Mistake: Taking multiple trades in the same sector or correlated assets without adjusting overall exposure.

- Solution: Track correlation and avoid exceeding your maximum risk when combined positions move in tandem.

- Setting Stop-Losses Randomly

- Mistake: Placing a stop-loss at arbitrary percentages (e.g., 5% below entry) instead of a logical technical level.

- Solution: Base stop-loss levels on support/resistance, ATR, or other strategic indicators.

- Neglecting Slippage and Commissions

- Mistake: Particularly in fast-moving markets or illiquid stocks, slippage can increase losses beyond the intended risk.

- Solution: Use limit orders where possible, trade liquid stocks, and factor in average slippage into your risk management plan.

- Incorrectly Averaging Down

- Mistake: Adding to a losing position in the hope of lowering the average cost. This often results in larger-than-intended risk.

- Solution: If you average down, do so with a structured plan that keeps your total risk within limits. Otherwise, consider not averaging down at all.

- Not Tracking Performance

- Mistake: Failing to analyze your trades to see if your position sizing rules are effective.

- Solution: Keep a trading journal detailing entries, exits, position sizes, and outcomes. Review periodically for improvements.

Tools and Resources

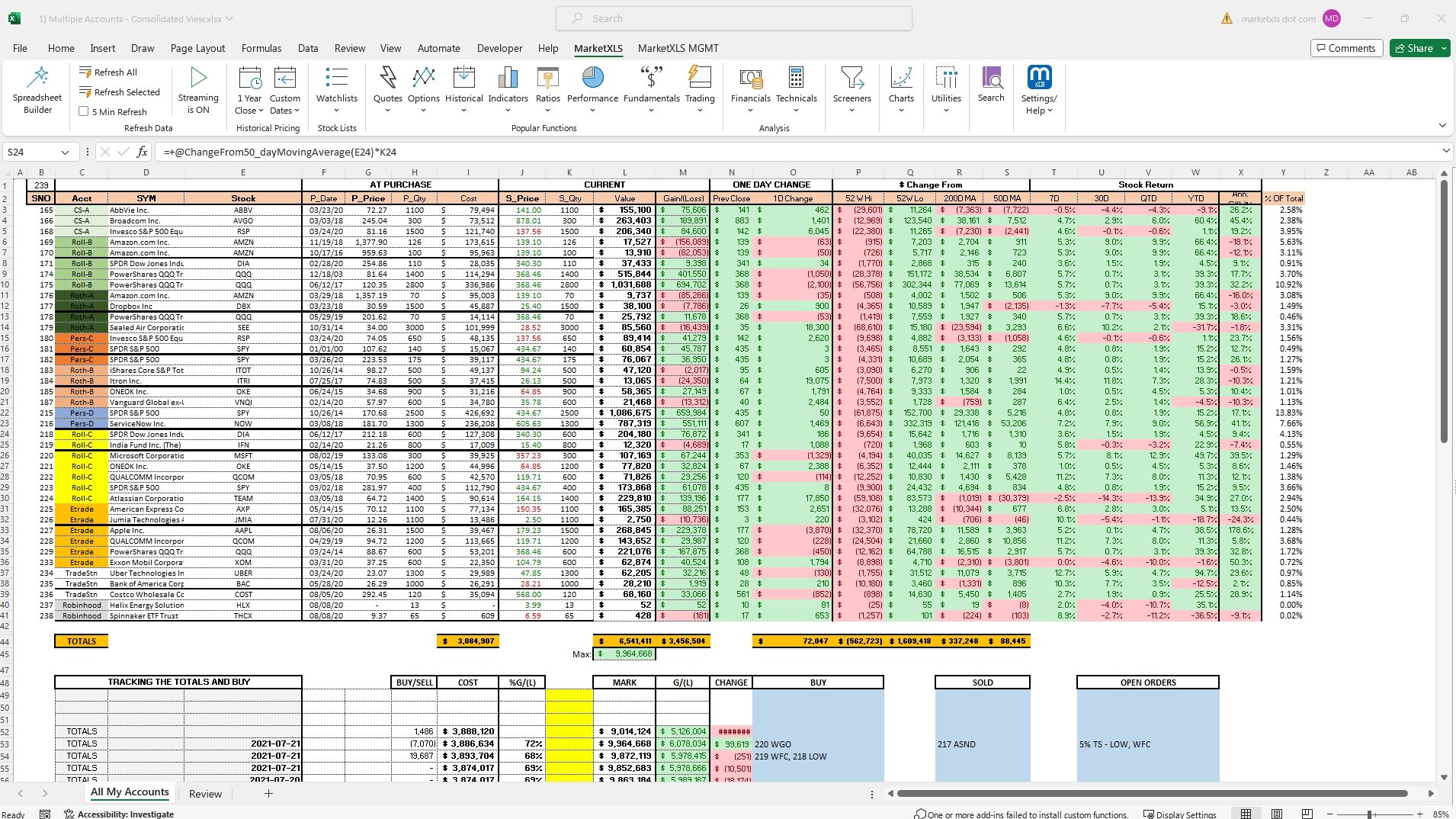

Excel/Google Sheets

- Usage:

- Create columns for Account Size, Risk per Trade, Entry Price, Stop-Loss Price, Risk per Share, and Position Size.

- Let the spreadsheet calculate the number of shares automatically whenever you input new data.

- Benefits: Allows easy tracking and quick recalculations if markets move or your strategy changes.

Online Calculators

- What They Offer:

- Automated fields for entry price, stop-loss, account size, and risk percentage.

- Instant calculation of position size.

- Considerations:

- Always double-check the logic behind any online tool to ensure alignment with your strategy.

- Use them for quick references but maintain your own systematic approach.

Trading Platforms and Advanced Software

- Brokerage Platforms: Many brokerages let you define a risk in dollars or percentages so you can see your position size in real-time.

- Advanced Software: Tools like TradingView, NinjaTrader often have built-in risk calculators or you can download community-created scripts.

- Advantages:

- Automated calculation reduces human error.

- Built-in functionality may place stop-loss orders simultaneously with position entries (bracket orders).

Final Thoughts on Position Sizing for Stock Trading

Position sizing is a crucial component of risk management and trading success. It helps ensure that no single trade wields outsized influence on your overall portfolio. Instead of throwing caution to the wind or basing trade sizes on feelings, having a systematic approach to risk control can significantly enhance your trading consistency and psychological well-being.

- Discipline Over Emotion: Calculating position size before entering a trade removes much of the guesswork and emotional baggage that can derail decision-making.

- Long-Term Profitability: Surviving losing streaks, preserving capital, and allowing profitable trades to flourish is how traders build sustainable returns.

- Continuous Improvement: Over time, refine your position sizing approach based on your performance data, evolving strategies, and changing market conditions.

By incorporating these robust methods—from percentage risk models to volatility-based calculations—into your trading routine, you’ll stand a better chance at steady, disciplined growth.

Remember, no single method is universally “best.” The optimal approach merges your personal risk tolerance, trading style, market knowledge, and the specifics of each trade. But the one constant thread is the necessity of having a plan and sticking to it. Whether you’re a day trader scalping quickly or a swing trader holding positions for weeks, the proper position size can make the difference between a manageable drawdown and a devastating blow to your account.