Confirmation bias is one of the most pervasive cognitive biases in human psychology. Traders, regardless of experience level, are not immune to it. When left unchecked, confirmation bias can cause you to overlook critical market information, ignore warning signs, and cling to incorrect assumptions about price movements. The result: costly trading mistakes and unnecessary risk. In the world of trading psychology, understanding and overcoming confirmation bias is an essential step toward consistent, profitable decision-making.

In this in-depth article, we will explore everything you need to know about confirmation bias in trading. We’ll begin with a basic definition and then unpack how and why it arises in traders’ minds. From there, we’ll move into the real implications of confirmation bias, illustrating with examples from both technical and fundamental trading. We’ll also examine the psychological and behavioral factors contributing to this bias, provide actionable strategies for overcoming it, and discuss how to integrate these strategies into your everyday trading routine. By the end of this article, you’ll have a clear understanding of what confirmation bias is, why it’s so dangerous for traders, and how you can protect your trading strategy from its insidious effects.

Table of Contents

Throughout these sections, you’ll find comprehensive, in-depth explanations, real-life examples, and practical steps to manage and overcome confirmation bias. Feel free to navigate to the sections most relevant to you, or read through from start to finish for the complete picture.

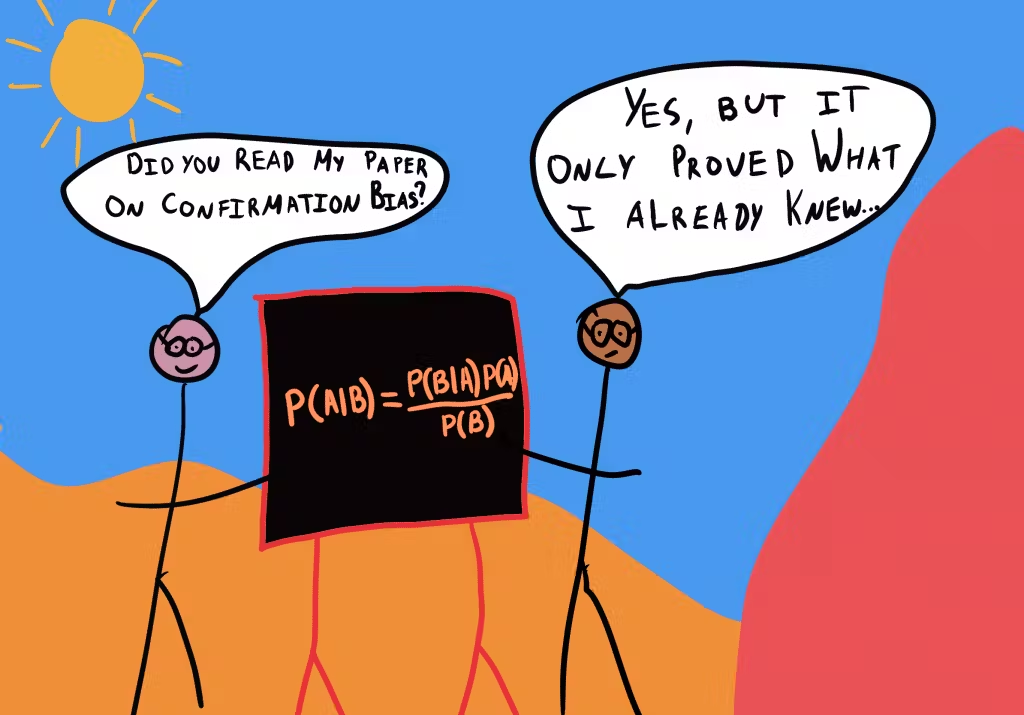

What Is Confirmation Bias?

Confirmation bias is a cognitive phenomenon where individuals tend to seek out, interpret, and remember information in a way that confirms their existing beliefs or hypotheses. Rather than remaining objective, the mind naturally leans toward reinforcing what it already thinks it knows, while dismissing or minimizing evidence that challenges these beliefs.

Key Characteristics of Confirmation Bias

- Selective Attention: People actively look for or give more weight to evidence that supports their preconceived notions.

- Selective Interpretation: Even neutral or ambiguous information may be interpreted in a way that supports the existing viewpoint.

- Selective Memory: Evidence contradicting the belief can be forgotten or overlooked, while confirmatory evidence is remembered vividly.

In a trading context, confirmation bias often manifests when a trader holds a firm view about a stock, currency pair, or other asset. They might spend more time focusing on news articles, analyst reports, and technical indicators that validate their outlook—while ignoring any negative news or contradictory chart signals that suggest an impending reversal.

Why Understanding Confirmation Bias Is Crucial for Traders

Trading Is About Probability, Not Certainty

Successful trading is largely about evaluating probabilities, managing risk, and adapting to ever-changing market conditions. By definition, there are no certainties; every trade carries risk. When a trader succumbs to confirmation bias, they can become convinced of the “certainty” of a particular outcome. This mindset blinds them to market signals that might indicate a need to exit a position or hedge against potential losses.

The Market Doesn’t Care About Your Beliefs

No matter how strongly you believe in a trade, the market’s price action is ultimately determined by collective human behavior, macroeconomic conditions, liquidity, and a myriad of other factors. Confirmation bias can trick a trader into conflating strong conviction with market reality. Ignoring opposing evidence or signals can be disastrous, especially in volatile markets.

Risk Management and Emotional Capital

Emotions like fear and greed often exacerbate confirmation bias. When faced with challenging market conditions, traders may cling more tightly to original biases as a way to avoid cognitive dissonance. This behavior can amplify risk and emotional stress. Understanding and actively addressing confirmation bias is therefore a key aspect of not only financial capital preservation but also emotional capital protection—both of which are essential for long-term trading success.

Psychological Underpinnings of Confirmation Bias

Confirmation bias is not just a trading phenomenon—it’s a universal aspect of human psychology. We’re wired to interpret new information in a way that reduces cognitive discomfort. This is closely tied to concepts in behavioral finance and psychology like cognitive dissonance, anchoring bias, and overconfidence bias.

- Cognitive Dissonance: When new information conflicts with existing beliefs, the discomfort encourages people to find ways to reinforce their preconceived notions rather than changing them.

- Anchoring Bias: The tendency to rely heavily on the first piece of information (anchor) when making decisions. If your first analysis of a market is bullish, you might anchor to that viewpoint even as new data suggests a shift.

- Overconfidence: Overestimating one’s analytical abilities can lead to ignoring contradictory evidence. An overconfident trader might assume their initial analysis is superior, thus disregarding anything that suggests a need for re-evaluation.

These psychological tendencies create a fertile ground for confirmation bias to flourish. Since trading is a domain where uncertainty is the norm and stakes can be high, the emotional and cognitive pressure often magnifies these biases.

Common Triggers of Confirmation Bias in Trading

While confirmation bias can arise in almost any decision-making scenario, certain trading conditions and habits tend to trigger or exacerbate this bias:

- High-Conviction Ideas

- When traders have done extensive research or have strong personal beliefs about a trade, they become more invested in proving themselves right. The psychological attachment to being correct can overshadow logical thinking.

- Echo Chambers and Social Media

- Online communities, trading forums, and social media groups can become echo chambers, where individuals share similar views. Traders might follow or engage only with those who support their bias, reinforcing one-sided perspectives.

- Large Unrealized Gains or Losses

- When a position is already showing significant unrealized gains, traders may seek information that validates holding the position further. Conversely, when facing large unrealized losses, traders might look for evidence that suggests a turnaround is imminent, rather than facing the reality that the trade might need to be closed.

- Market Hype and FOMO

- In highly volatile or “hot” markets (e.g., IPOs, meme stocks, cryptocurrencies during a bull run), fear of missing out (FOMO) combines with confirmation bias. Traders will look for any positive sign to jump in or stay in the trade, ignoring red flags.

- Recent Wins or Losses (Recency Effect)

- Success can breed complacency, leading traders to trust their initial analysis without question. Conversely, recent failures can push traders to double down on “safe” biases or overly rely on negative information to confirm a bearish stance.

Understanding these triggers can help you spot when you might be most vulnerable to confirmation bias. Awareness is the first step toward prevention.

Real-World Examples of Confirmation Bias in Trading

Example 1: The Stock Market Bull

Imagine a trader named Sarah who is convinced that a specific technology stock is poised for explosive growth. She bases her belief on the company’s innovative product line and some strong quarterly earnings reports. Over the following weeks, she:

- Reads predominantly bullish articles and tweets about the company.

- Ignores or dismisses any news that might indicate rising competition or potential regulatory hurdles.

- Studies only the bullish chart patterns while overlooking neutral or bearish signals.

Eventually, negative regulatory news hits the market, causing a sudden downturn in the stock. Because Sarah was so focused on confirmation, she either fails to see the warning signs or explains them away. By the time she acknowledges the new information, her position has suffered considerable losses.

Example 2: The Forex Trader’s Tunnel Vision

Consider John, a Forex trader who strongly believes the EUR/USD pair is undervalued and will rally based on his macroeconomic analysis. When a reputable economist publishes a research paper suggesting the Eurozone might be headed for slower growth, John discounts the credibility of the research because it doesn’t align with his view. Even technical indicators like a strong downtrend are brushed off as short-term anomalies. John remains in his long position far too long, culminating in a major drawdown.

Example 3: Cryptocurrency Mania

During a crypto bull run, many traders form communities around specific altcoins, sharing memes, success stories, and price predictions. These groups create a fervent environment of confirmation bias:

- Negative news about blockchain security breaches, low user adoption rates, or regulatory crackdowns is quickly dismissed.

- Positive tweets, endorsements, and influencers promoting the altcoin are amplified and revered.

- Traders within this echo chamber assure each other that any downturns are “buy the dip” opportunities, ignoring broader macro market concerns.

When a major correction hits, this group is caught off guard, as their shared confirmation bias prevented them from considering the possibility of a significant market downturn.

These examples highlight the importance of balanced, evidence-based analysis. Whether you’re trading stocks, Forex, cryptocurrencies, or other assets, ignoring contradictory signs can lead to unexpectedly large losses and missed exit opportunities.

Consequences of Confirmation Bias on Trading Performance

1. Missed Warning Signs

By focusing only on evidence that supports a trade idea, you risk missing critical warning signs. These could be macroeconomic shifts, technical chart patterns indicating a reversal, or even fundamental changes in a company’s outlook.

2. Amplified Losses

Confirmation bias can lead traders to hold onto losing positions longer than they should. The longer you wait to exit a trade going against you, the larger your losses can become. This often triggers a cycle of loss aversion, where you continue to seek confirmation that the price will rebound, rather than cut the loss.

3. Overconfidence and Poor Risk Management

When you consistently reinforce your own belief, you might develop an inflated sense of your market intuition. Overconfidence can cause you to take on larger position sizes, use less protective measures like stop-loss orders, or ignore diversification principles.

4. Stagnant Growth as a Trader

If you never challenge your beliefs, you limit opportunities to learn and grow. Constructive feedback and even failure can be valuable teachers, but confirmation bias often shuts these lessons out. Traders who fail to challenge their assumptions remain stuck in limiting patterns.

5. Psychological Strain

Emotional stress is an often-overlooked consequence. The internal conflict between recognizing contradictory evidence and refusing to accept it can create anxiety. Over time, this emotional burden can lead to burnout or impulsive trading decisions.

Overall, confirmation bias erodes profitability, increases psychological strain, and inhibits growth. Recognizing these potential consequences underscores the importance of proactively identifying and mitigating this bias.

How to Identify Confirmation Bias in Real-Time

Catching confirmation bias as it happens can be challenging. However, developing a heightened sense of self-awareness and establishing systematic checks can help you spot the warning signs.

Self-Observation Techniques

- Frequent Reflection: Take brief pauses during your trading sessions to ask yourself, “Am I ignoring any information?” This simple question can jolt you into a more balanced perspective.

- Trading Journal: Maintain a detailed trading journal documenting your trade rationale, the sources you consulted, and your emotional state. Review these entries regularly to identify patterns of selective information gathering.

- Ask Why vs. Why Not: For every bullish reason you find, ask yourself, “Why might this trade idea fail?” For every bearish conviction, ask, “What if the trend reverses?” This habit forces a more complete analysis.

Red Flags to Watch Out For

- Ignoring Contradictory News: If you find yourself quickly clicking away or scrolling past headlines that challenge your viewpoint, you might be under confirmation bias.

- Negative Emotional Reaction to Opposing Views: Feeling irritated, anxious, or dismissive when you hear an opposing argument is often a sign of internal bias.

- Selective Communication: If you only follow or engage with analysts, traders, or community members who share your perspective, you may be filtering out essential counterpoints.

Spotting these red flags in real-time can significantly reduce the duration and impact of confirmation bias on your trades. The key is to be honest with yourself and practice consistent self-awareness.

Strategies to Overcome Confirmation Bias

Overcoming confirmation bias is not a one-time effort—it requires ongoing discipline and structured practices. Below are some strategies, each explained in detail, to help you systematically counteract confirmation bias in your trading.

1. Embrace a Hypothesis-Testing Mindset

Rather than seeing your analysis as truth, treat it as a hypothesis that must be tested against market data and diverse opinions. This scientific approach encourages you to search for potential disconfirming evidence rather than solely seeking to validate your initial thesis.

- Write Down Your Hypothesis: For example, “I believe XYZ stock is undervalued and will rise due to strong fundamentals and an upcoming product launch.”

- Identify Disconfirmation Criteria: State clearly under what conditions you would abandon or revise this hypothesis (e.g., a break below a key support level, negative earnings surprise, etc.).

- Test and Reassess: Monitor the market and check if these disconfirmation criteria are triggered. If they are, it’s time to reevaluate or exit the trade.

2. Seek Out Contrarian Views

Deliberately expose yourself to contrarian or opposing viewpoints. This can be done by following analysts, traders, or news sources that often present the opposite side of the argument.

- Contrarian Analysis: For every bullish trade idea, look for the top reasons why someone might be bearish. Even if you don’t agree, understanding their arguments can broaden your perspective.

- Discussion Groups: Join forums or discussion groups where traders share diverse opinions. Engage in debates that force you to justify your stance logically rather than emotionally.

3. Employ Structured Decision-Making Frameworks

One effective way to counter confirmation bias is to adopt structured decision-making processes like checklists or quantitative models.

- Checklists: Create a pre-trade checklist that includes reviewing contradictory signals, setting a maximum risk threshold, and verifying any fundamental catalysts.

- Data-Driven Models: Rely on quantitative indicators or algorithmic models to remove some of the emotional and cognitive biases. While these models are not foolproof, they help bring objectivity to your decision-making.

4. Validate Trades with Multiple Analysis Methods

Use both technical and fundamental analysis, and consider sentiment data as well. When your conclusion is supported by multiple independent methods, you can have more confidence in your trade, and you’re less likely to zero in on selective data.

- Technical Analysis: Look at price action, volume, chart patterns, and indicators like moving averages or the Relative Strength Index (RSI).

- Fundamental Analysis: Examine earnings reports, revenue growth, macroeconomic indicators, and industry trends.

- Sentiment Analysis: Evaluate whether market sentiment is extremely bullish or bearish, as extremes in sentiment often precede reversals.

5. Use Objective Risk Management Tools

Implementing mechanical exit rules (e.g., stop-loss orders, trailing stops, risk-reward ratios) can help you disengage from bias-driven decisions. When the market hits a predefined stop-loss, you close the position—no second-guessing involved.

- Stop-Loss Orders: Set stop-loss levels at points that invalidate your original trade thesis.

- Trailing Stops: As the trade moves in your favor, a trailing stop ensures you lock in profits while mitigating the risk of a reversal.

- Trade Sizing: Adjust position size based on volatility and market conditions. Smaller positions can reduce emotional attachment.

6. Maintain a Trading Journal for Post-Trade Analysis

After each trade, record the following in a journal or spreadsheet:

- Your initial analysis and reasons for entering the trade.

- Any alternative views you might have considered.

- The outcome of the trade (win or loss, size of profit or loss, etc.).

- An honest assessment of any cognitive biases that arose during the trade.

Over time, patterns become evident. You might notice that you consistently ignore certain types of news or that you only partially complete your checklist when you’re overconfident. Having these observations laid out can help you correct your course.

7. Regularly Review and Update Your Trading Plan

Markets change, and so do your trading strategies and risk tolerance. Schedule regular reviews—monthly, quarterly, or whatever frequency aligns with your trading style—to update and refine your trading plan. During these reviews, specifically look for areas where confirmation bias may have crept in.

The Importance of a Well-Defined Trading Plan

A trading plan is more than just a set of rules; it’s your roadmap for navigating the psychological and emotional challenges inherent in trading. A well-defined plan should:

- Outline Entry and Exit Criteria

- Specify not only your ideal entry signals but also the conditions that will tell you to get out or avoid a trade altogether.

- Incorporate Risk Management

- Detail how much of your capital you’ll risk per trade, where your stop-loss levels will be set, and how you’ll handle drawdowns.

- Set Clear Goals

- Whether you aim for a specific monthly return or focus on consistent execution of your strategy, clarity in your objectives helps you measure progress effectively.

- Account for Market Conditions

- Your plan should be adaptable to different market conditions—bearish, bullish, range-bound, or highly volatile.

By adhering to a trading plan, you reduce the likelihood of making impulsive decisions based on emotional bias. The plan serves as a neutral reference point, guiding you back to a systematic approach whenever confirmation bias threatens to take hold.

Using Risk Management to Mitigate Cognitive Bias

Risk management is the backbone of successful trading. Proper risk management doesn’t just protect your capital—it also protects you from making psychologically driven errors.

Position Sizing and Confirmation Bias

One of the most effective ways to mitigate confirmation bias is to limit how much capital you allocate to a single trade. If you only risk 1–2% of your trading account per position, you’re less emotionally attached to any single outcome. This lower emotional stake makes it easier to accept contradictory evidence and exit a failing trade.

Stop-Loss Placement

Strategically placed stop-losses are critical. Rather than setting arbitrary levels, place your stop where your trading thesis becomes invalid. If the market hits that level, it’s an objective sign that your analysis needs to be revisited. This mechanical process prevents you from continually shifting your perspective to keep the trade alive.

Diversification Across Uncorrelated Markets

Diversifying your positions among different asset classes or uncorrelated markets can limit the impact of a single bias-driven mistake. If your biases lead you astray in one market, losses can be offset by correct decisions in another. This approach doesn’t eliminate confirmation bias, but it can mitigate its financial impact.

Developing Self-Awareness and Emotional Discipline

All the strategies and tools in the world won’t help if you lack self-awareness. Emotional discipline is cultivated over time through introspection, practice, and sometimes hard lessons. Here are key techniques to strengthen your mental resilience:

Mindfulness Practices

- Meditation: Even five minutes of mindfulness or breathing exercises before you start trading can help clear mental clutter and ground you in the present moment.

- Journaling: Write down your emotional state and thoughts at the start of each trading day. Recognizing recurring emotional themes can help you manage them more effectively.

Realistic Expectations

Unrealistic expectations, such as believing you can double your account in a month, amplify emotional responses and confirmation bias. Grounding your expectations in historical performance and realistic growth rates fosters a healthier trading mindset.

Accountability Partners or Mentors

A trading mentor or accountability partner can provide a second opinion on your trades. When you share your trade ideas, they can offer alternative perspectives or ask critical questions that challenge your biases. Mentorship can be formal (paid coaching) or informal (a colleague or friend who is also involved in trading).

Tools and Techniques for Minimizing Confirmation Bias

1. Trading Journals and Tracking Software

Digital Tools: Software such as Evernote, OneNote, or specialized trading journals let you tag entries with emotions, triggers, and specific market conditions. Over time, you can run queries or use built-in analytics to see how often you engaged in confirmation bias.

Spreadsheet Analysis: A simple Google Sheets or Excel file can track your entry and exit points, reasons for the trade, and final outcomes. Create columns specifically for noting conflicting evidence you observed but chose to ignore.

2. Automated Alerts

Set price alerts at critical technical levels. If you believe a stock is in an uptrend, place alerts below certain support zones. If these alerts are triggered, it forces you to re-evaluate your bullish stance. Similarly, you can set alerts for relevant news or economic calendar events that might challenge your trade thesis.

3. Scenario Planning and Probability Weighting

Utilize scenario analysis to break down possible market outcomes:

- Base Case: The market performs as per your initial analysis.

- Bull Case: The market exceeds your expectations to the upside (if you’re bullish) or has a stronger rally.

- Bear Case: The market declines or moves against your position more quickly than anticipated.

Assign probabilities to each scenario. Even if these probabilities are rough estimates, the exercise forces you to acknowledge multiple outcomes and re-check your biases.

4. Backtesting Historical Data

For systematic or quantitative traders, backtesting can be a powerful way to reduce confirmation bias. A robust backtest shows how a strategy would have performed historically under various conditions.

- Red-Flag Backtesting: Specifically look for the strategy’s worst-performing months or drawdown periods. Analyze what caused the strategy to fail during those times, and see if those same conditions exist today.

- Sensitivity Analysis: Vary the parameters (e.g., stop-loss levels, indicator periods) to see how sensitive the strategy is to small changes. A strategy overly sensitive to parameter tweaks might be more prone to confirmation bias in live trading.

Case Studies: Confirmation Bias in Action

Case Study 1: A Tech Stock’s Meteoric Rise and Fall

In early 2020, a hypothetical tech stock soared after releasing a groundbreaking product. Retail traders flooded in, convinced that the company’s potential was limitless. Confirmation bias was rampant:

- Analyst Upgrades: Traders latched onto every positive upgrade, ignoring the few cautious analysts warning about fierce competition.

- Selective Chart Analysis: Most focused on the exponential uptrend, discounting lower-volume spikes or divergences in momentum indicators.

- Groupthink on Social Media: Bullish traders overshadowed voices of caution in forums, belittling any contrarian arguments.

Eventually, a competitor launched a similar but more feature-rich product. The stock plummeted, catching bullish traders by surprise. Post-mortem analysis showed that multiple warning signs were available—such as slowing user adoption and patent disputes—but traders under confirmation bias had brushed these aside.

Case Study 2: The “Unbreakable” Support Level in Forex

A trader specialized in Forex believed a key support level on the USD/JPY was “unbreakable” due to historical price action. They opened large long positions whenever price neared that level. Though it bounced several times, a sudden change in U.S. interest rate policy caused a drastic shift in market sentiment.

- Ignoring Macro Fundamentals: The trader failed to integrate new data about Federal Reserve decisions and economic indicators, focusing instead on the past reliability of the support level.

- Overconfidence in Technical Patterns: Their entire trading logic revolved around the assumption that “history always repeats itself,” ignoring macro warnings.

- Lack of Stop-Loss: Because they were so confident in the support, they placed an extremely tight stop (or none at all), leading to a substantial loss when the level finally broke decisively.

The post-trade analysis revealed that they had disregarded multiple signals—rising treasury yields, shifting sentiment, and a divergence in the RSI—due to confirmation bias.

Key Takeaways

- Confirmation Bias Is Ubiquitous

- No trader is immune. Recognizing its presence is the first line of defense.

- It Stems from Human Psychology

- Our brains are wired to avoid cognitive dissonance, often reinforcing what we want to believe rather than what is.

- It Leads to Costly Mistakes

- Missed exit signals, amplified losses, and stagnation in skill development are direct results of unchecked confirmation bias.

- Awareness and Structured Methods Are Essential

- Hypothesis testing, contrarian analysis, and checklists can mitigate bias. Tracking your trades and reviewing them regularly can highlight where bias creeps in.

- Disciplined Risk Management Is Non-Negotiable

- Tools like stop-loss orders, position sizing, and diversification not only protect your capital but also protect your psychology from excessive attachment to any single trade.

- Self-Awareness Takes Practice

- Mindfulness, journaling, mentorship, and a willingness to challenge one’s own beliefs help cultivate the emotional discipline needed to overcome confirmation bias.

Conclusion

Confirmation bias is one of the most deceptive pitfalls in trading psychology. It can silently infiltrate your decision-making process, causing you to filter out critical information, hold losing positions for too long, and miss lucrative opportunities. Overcoming confirmation bias isn’t just about learning a few tricks; it’s about cultivating a robust trading mindset founded on objectivity, humility, and adaptability.

By embracing a hypothesis-testing framework, actively seeking out conflicting information, and rigorously applying risk management tools, you can systematically root out confirmation bias before it sabotages your trades. Building self-awareness and emotional discipline through mindfulness, journaling, and mentorship fortifies your trading approach even further. Ultimately, recognizing and mitigating confirmation bias will help you make more balanced decisions, preserve your capital, and sustain long-term growth as a trader.

As you move forward in refining your trading psychology, remember that confirmation bias will continually seek to influence you. Stay vigilant and keep a structured routine that forces you to engage with all available information. Over time, you’ll not only minimize costly mistakes but also gain deeper insights into market dynamics—turning you into a more resilient and successful trader.

Next Steps

- Review your recent trades for signs of confirmation bias.

- Implement at least one new strategy (e.g., contrarian analysis, new journaling practices, or mechanical stop-loss rules) this week.

- Continue expanding your knowledge of trading psychology by reading related articles on cognitive biases, emotional discipline, and risk management.

By actively working against confirmation bias, you open the door to more objective, data-driven decision-making. This shift in mindset can significantly boost both your trading performance and your confidence in navigating the ever-changing markets.