Electronic Communication Networks (ECNs) have revolutionized how modern traders and investors interact with the stock market. Their primary purpose is to directly connect buyers and sellers of financial instruments—particularly stocks—without the need for a traditional centralized exchange. By bypassing some of the conventional intermediaries, ECNs can deliver faster execution times, improved liquidity, greater market transparency, and often tighter bid-ask spreads.

In the early days of stock trading, most orders were funneled through large exchanges like the New York Stock Exchange (NYSE) or NASDAQ, where specialists or market makers facilitated trades. Over time, the demand grew for more direct, automated, and transparent systems—ones that could accommodate rapid order matching and 24/7 trading capabilities. ECNs emerged from this demand, providing an electronic order-matching mechanism that aggregates bids and offers from various market participants.

With traders increasingly focused on speed, cost-efficiency, and anonymity, ECNs have found their way into the mainstream. Both institutional and retail traders recognize the value that ECNs bring—particularly in maximizing liquidity, market access, and execution speed. This in-depth article explores every aspect of ECNs, from their history and regulatory landscape to practical strategies for integrating them into your trading workflow. By the end, you will have a comprehensive understanding of how ECNs operate, their pros and cons, and why they play a pivotal role in the modern trading environment.

Table of Contents

What Are Electronic Communication Networks (ECNs)?

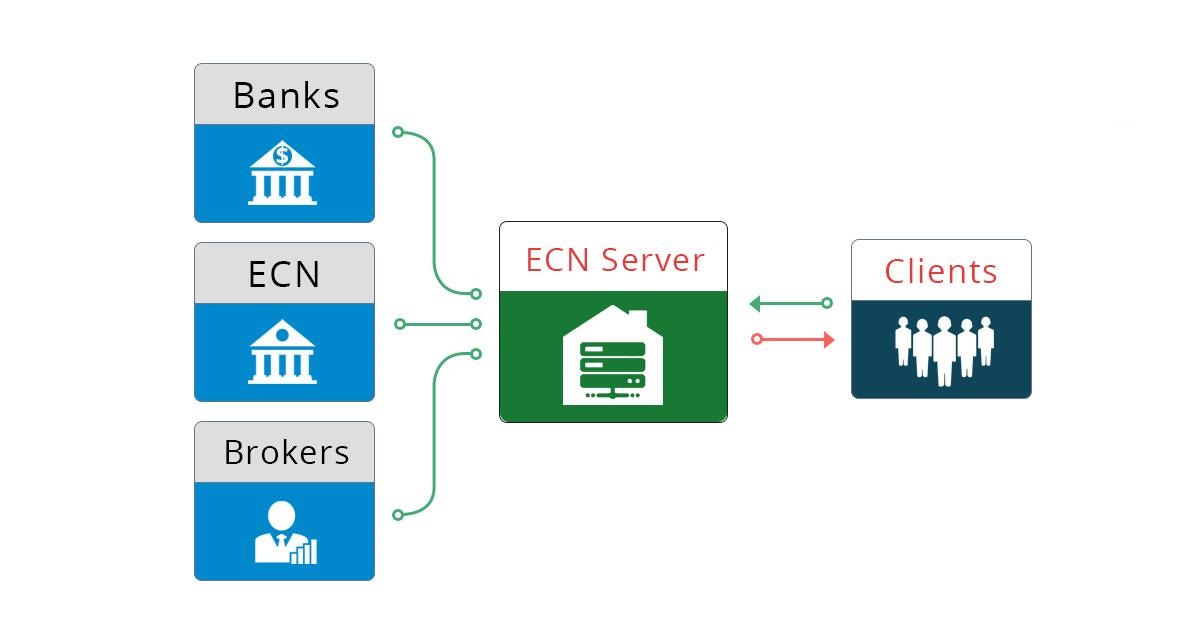

An Electronic Communication Network (ECN) is a computerized system that matches buy and sell orders for stocks, currencies, and other financial instruments directly between market participants. Unlike traditional exchanges that often rely on designated market makers or specialists, ECNs function as automated platforms. They bring together orders from multiple sources—such as broker-dealers, institutional investors, and retail traders—and match these orders based on price and availability.

Key Points:

- Direct Access Trading: ECNs grant traders direct access to the order book. This is distinct from the experience you might have with a broker who internally routes your orders.

- Lower Latency: Because orders are matched electronically, latency—the delay in order execution—tends to be lower compared to conventional exchanges.

- Market Transparency: ECNs often provide more transparent quotes, since they aggregate multiple liquidity sources.

- Extended Trading Hours: Most ECNs operate outside regular market hours, allowing for pre-market and after-hours trading.

In short, ECNs are designed to streamline and automate the trading process, often at lower cost and with higher speed than traditional broker-mediated methods.

Historical Evolution of ECNs

ECNs date back to the late 1960s and early 1970s, even before the widespread adoption of personal computers and the internet. Here’s a brief timeline highlighting significant milestones:

- Instinet (1969): Often cited as the first ECN, Instinet was established to provide institutions with electronic channels to execute trades anonymously.

- Late 1980s to Early 1990s: The Securities and Exchange Commission (SEC) fostered an environment for alternative trading systems, which spurred the growth of new ECN platforms.

- Growth in the 1990s: The proliferation of the internet and online trading technologies allowed more ECNs to emerge, each offering unique features like improved speed or lower fees.

- Regulation ATS (1998): The SEC enacted Regulation ATS (Alternative Trading Systems), defining the rules under which ECNs could operate. This provided a more structured regulatory framework, ensuring that these systems adhered to specific standards to protect investors.

- Consolidation and Integration (2000s): Many ECNs merged with or were acquired by major exchanges. For example, Archipelago merged with NYSE, while INET (formed from the mergers of Instinet ECN and Island ECN) joined forces with NASDAQ.

- Current Landscape: ECNs are now integral to modern trading, offering sophisticated order-routing algorithms and deep pools of liquidity. The lines between ECNs, dark pools, and traditional exchanges have blurred, as many of these platforms share overlapping features.

This rich history of innovation has shaped the modern trading ecosystem. Today, ECNs support everything from high-frequency trading (HFT) strategies to retail trading through direct market access (DMA) platforms.

How ECNs Work

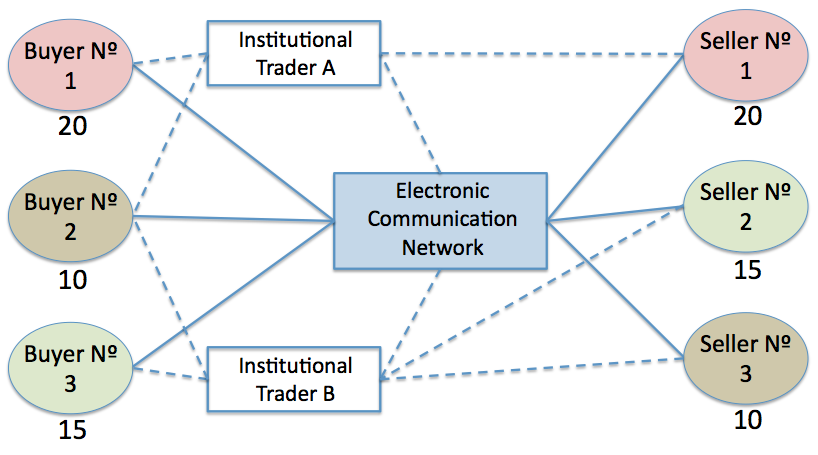

At the core, an ECN is an order-matching engine. When you place an order via an ECN-enabled broker or platform, your order is routed to the ECN’s electronic order book. The ECN then attempts to match your order with an opposing order (a buy order matches a sell order and vice versa) based on best available prices.

Step-by-Step Process:

- Order Entry: A trader inputs a buy or sell order for a specific stock. This order includes parameters such as quantity, price type (market or limit), and possibly timing conditions.

- ECN Routing: The broker routes the order to the ECN’s electronic order book.

- Matching Engine: The ECN’s system looks for a matching order. If the trader’s order is a buy limit order of USD 100 per share, the system searches for any sell orders priced at USD 100 or better.

- Order Execution: If a match is found, the trade is executed automatically. If no match is immediately found, the order remains in the ECN’s order book until it is matched, canceled, or expires (depending on the type of order).

- Confirmation: Both parties receive trade confirmations, and the trade settles in a similar fashion to any exchange-based transaction.

- Price Discovery: The ECN publishes the current bid and ask prices, often contributing to broader market price discovery, which can be accessed by other market participants in real-time.

Because the entire process is electronic, this matching can occur within milliseconds, providing near-instantaneous execution speeds for high-volume trading. Another key benefit is anonymity. Unlike traditional exchange floors where trade participants might be identifiable, ECNs shield participant identities, publishing only the volume, price, and sometimes the size of the order.

Key Characteristics of ECNs

Order Matching and Anonymity

ECNs automatically match orders based on price and volume, which ensures fairness and transparency in executing trades. The matching process is anonymous, meaning traders only see the size and price of incoming orders, not the identity of the counterparty. This anonymity benefits both retail and institutional traders who may want to keep their trading strategies private.

Continuous Market Access and Extended Trading Hours

Another hallmark of ECNs is the ability to facilitate after-hours trading, allowing participants to place orders outside the traditional 9:30 a.m. to 4:00 p.m. Eastern Time window in the U.S. This extended access can be crucial when important earnings announcements or global economic events occur before or after the traditional trading session.

- Pre-Market Trading: Often starts as early as 4:00 a.m. EST.

- After-Hours Trading: Can extend up to 8:00 p.m. EST.

Extended trading hours can be advantageous but also come with lower liquidity and higher volatility, which traders must carefully navigate.

Transparency in Order Books

ECNs typically display real-time market data, including the best bid and ask prices as well as market depth (Level II quotes). This transparency allows traders to see how many shares are being bid or offered at various price points, which provides greater insight into market sentiment and liquidity. However, note that not all ECNs disclose the full depth of their order books; some choose to only show aggregated data or partial depth.

Why Liquidity, Market Access, and Execution Speed Matter

Liquidity

Liquidity refers to how easily an asset can be bought or sold without significantly affecting its price. High liquidity in a trading environment means there are plenty of buyers and sellers, thereby improving the odds of executing large orders at stable prices. ECNs aggregate orders from multiple participants, including large institutions and individual traders, thus creating a deeper pool of liquidity.

- Tighter Spreads: In highly liquid markets, the difference between the bid (the highest price a buyer is willing to pay) and the ask (the lowest price a seller is willing to accept) tends to be smaller.

- Efficient Price Discovery: More participants and orders lead to more accurate price discovery, as prices continuously adjust to reflect current demand and supply.

Market Access

ECNs provide direct market access (DMA), allowing traders to interact directly with the order book. This can result in better control over order execution, faster trade settlement, and improved transparency. Moreover, ECNs often link multiple global markets, letting traders access international equities or markets that would be otherwise difficult to reach through a single centralized exchange.

Execution Speed

Speed is paramount in modern stock trading. Even a slight delay can result in missing profitable opportunities or incurring larger losses. ECNs minimize such delays by automating the entire trade process—from order entry to execution—within milliseconds. This speed advantage is crucial for day traders, high-frequency traders, and any trader employing algorithmic strategies that rely on rapid market movements.

ECNs vs Traditional Stock Exchanges

Understanding the difference between ECNs and traditional stock exchanges can clarify why many traders prefer using ECNs for certain strategies:

| Aspect | ECNs | Traditional Exchanges |

|---|---|---|

| Order Matching | Automatic, electronic matching of orders with minimal human input | Often rely on market makers/specialists to fill orders |

| Execution Speed | Extremely fast; millisecond-level response times | Generally slower than ECNs, although modern exchanges have improved speeds |

| Transparency | Real-time display of orders, but sometimes partial or aggregated | Typically displays best bid and ask, with more limited depth data (Level I) |

| Costs/Fees | Typically charge variable fees depending on volume, liquidity, etc. | May involve exchange fees, brokerage fees, and sometimes specialist fees |

| Anonymity | High anonymity; participants’ identities are usually shielded | Less anonymity; floor-based systems historically allowed participants to be seen |

| Market Hours | Often offers extended trading hours | Generally limited to standard market hours (with some after-hours sessions) |

In many respects, the lines between ECNs and modern exchanges have blurred, as both are fully electronic. However, ECNs still tend to focus more on transparency in order books, direct user participation, and faster turnaround times.

Major ECNs and Their Platforms

NASDAQ and Its ECNs

NASDAQ started as an electronic quotation system in 1971 and evolved into the first electronic stock market. Over the years, it absorbed several ECN platforms to become the powerhouse it is today.

- INET: Formed from the mergers of Instinet ECN and Island ECN, later integrated into NASDAQ’s infrastructure.

- NASDAQ Market Center: Now serves as a central point for matching orders, providing significant liquidity.

NYSE Arca (Formerly Archipelago)

Archipelago was a pioneering ECN that merged with the New York Stock Exchange (NYSE). It evolved into NYSE Arca, focusing on equities and exchange-traded funds (ETFs). NYSE Arca operates a fully electronic trading platform that offers:

- Fast Execution: Designed to compete with other ECNs and high-speed trading venues.

- Extensive Market Listings: Supports trading in thousands of securities, including ETFs and equities.

BATS (Now Cboe)

BATS Global Markets was an ECN founded in 2005 that quickly gained market share through competitive fees and cutting-edge technology. It later became a fully registered exchange. BATS merged with Cboe in 2017, but the core technology and many features from BATS remain:

- Cost-Efficient Model: Known for lower fees and rebates to liquidity providers.

- High-Speed Matching: Emphasizes ultra-low latency and advanced matching algorithms.

Other Regional and Niche ECNs

Beyond the big names, there are regional ECNs and smaller alternative trading systems that cater to specific niches or less-liquid markets. Some specialize in small-cap stocks, while others focus on foreign stocks. These niche ECNs can offer unique opportunities for traders looking to diversify or find overlooked market segments.

Regulatory Landscape

ECNs fall under the broader category of Alternative Trading Systems (ATS) and operate under the guidelines set forth by the U.S. Securities and Exchange Commission (SEC). Notable regulatory frameworks include:

- Regulation ATS (1998): This SEC rule standardized the operation of ATS, including ECNs, requiring them to register as broker-dealers and comply with periodic reporting requirements.

- Regulation NMS (2005): The National Market System regulation aims to foster competition among markets and ensure investors receive the best possible price by linking multiple trading venues, including ECNs.

- FINRA Oversight: Most ECNs are also subject to the rules and examinations of the Financial Industry Regulatory Authority (FINRA).

Outside the United States, other regions have their own regulatory bodies (e.g., Europe has the European Securities and Markets Authority, ESMA) that impose similar requirements on electronic trading platforms. Regulatory compliance ensures that ECNs maintain fair, orderly, and transparent markets.

Advantages of Trading Through ECNs

Tighter Spreads

Because ECNs consolidate orders from a wide range of participants, they tend to offer tighter bid-ask spreads. This is particularly beneficial for active traders who need to open and close positions multiple times a day. Lower spreads reduce slippage (the difference between expected and executed prices), which can significantly impact trading performance over time.

Potential for Lower Transaction Costs

Although ECNs typically charge transaction fees (sometimes on a per-share basis), the overall cost can be lower compared to traditional brokerages that might mark up spreads. Additionally, some ECNs offer rebate pricing to liquidity providers, effectively rewarding traders who place limit orders that improve the market’s depth.

Fair and Equal Access

Unlike traditional exchange floors, which historically favored large institutions or members with physical seats, ECNs level the playing field. Anyone with an ECN-enabled broker can enter orders at any time, and the orders are matched purely on a first-come, first-served basis at the best available price.

Speed and Efficiency

Speed is at the heart of ECN trading. Automated matching engines are designed to handle high volumes of trades with minimal latency, making ECNs particularly attractive for traders who rely on split-second timing.

Anonymity in Trading

ECNs maintain anonymity, which is crucial for large institutional traders who might not want to disclose the size of their trades. Even for retail traders, anonymity can help avoid “front-running” or price manipulation by other market participants.

Drawbacks and Considerations

Connectivity and Technology Costs

To fully leverage ECNs, traders often need high-speed internet, advanced trading software, and possibly co-location services (placing servers physically close to ECN data centers). These infrastructure costs can be prohibitive for smaller retail traders.

Lower Liquidity in Certain Hours

Extended trading hours are a double-edged sword. While ECNs allow for trading before and after the regular market session, the liquidity in these periods can be significantly lower, leading to wider spreads and higher volatility. Traders should be cautious when placing large orders or tight-stop orders during these sessions.

Regulatory Overheads

Though ECNs are designed for efficiency, they still must comply with a range of regulations, which can result in additional fees or complexities. In some cases, these regulatory costs might be passed on to the end-user.

Complex Fee Structures

ECNs typically employ a maker-taker fee structure. A trader who adds liquidity (a maker) could receive a rebate, while one who removes liquidity (a taker) pays a fee. Understanding and optimizing these fee schedules is essential. Traders who blindly place market orders may end up paying more in fees than anticipated.

Types of Traders That Benefit from ECNs

Day Traders and High-Frequency Traders

- Speed: Ultra-fast executions are paramount for these traders, who might hold positions for minutes or even seconds.

- Scalping: By exploiting small price increments multiple times a day, day traders rely on low latency and tight spreads to stay profitable.

Swing Traders and Momentum Traders

- Market Depth: Visibility of the order book helps identify support and resistance levels based on real-time supply and demand.

- Flexibility: Extended trading hours allow swing traders to react to after-hours news or pre-market earnings releases.

Institutional Investors and Hedge Funds

- Large Order Execution: Anonymous and direct access to liquidity pools help institutions execute large orders without revealing their hand to the market.

- Algorithmic Trading: Advanced order-routing algorithms can tap into multiple ECNs simultaneously to find the best price.

Retail Traders with Direct Market Access

- Cost Savings: Some brokers offering ECN accounts provide competitive commission structures, which can be lower overall for active retail traders.

- Better Control: Retail traders can directly route their orders to the ECN’s order book, customizing how they enter or exit positions.

How to Choose an ECN Broker

Choosing the right broker is critical to fully leverage ECNs. Here are key considerations:

Regulation and Broker Reputation

- Regulatory Bodies: Ensure the broker is regulated by reputable agencies such as the SEC, FINRA, or the equivalent in your jurisdiction.

- History and Track Record: Research the broker’s customer reviews, years in operation, and any disciplinary actions against them.

Fee Structures and Commissions

- Maker-Taker Model: Understand whether you’ll be adding or taking liquidity and how the fees or rebates will impact your strategy.

- Commission Tiers: Some brokers offer lower fees for higher trading volumes, which might be beneficial if you’re an active trader.

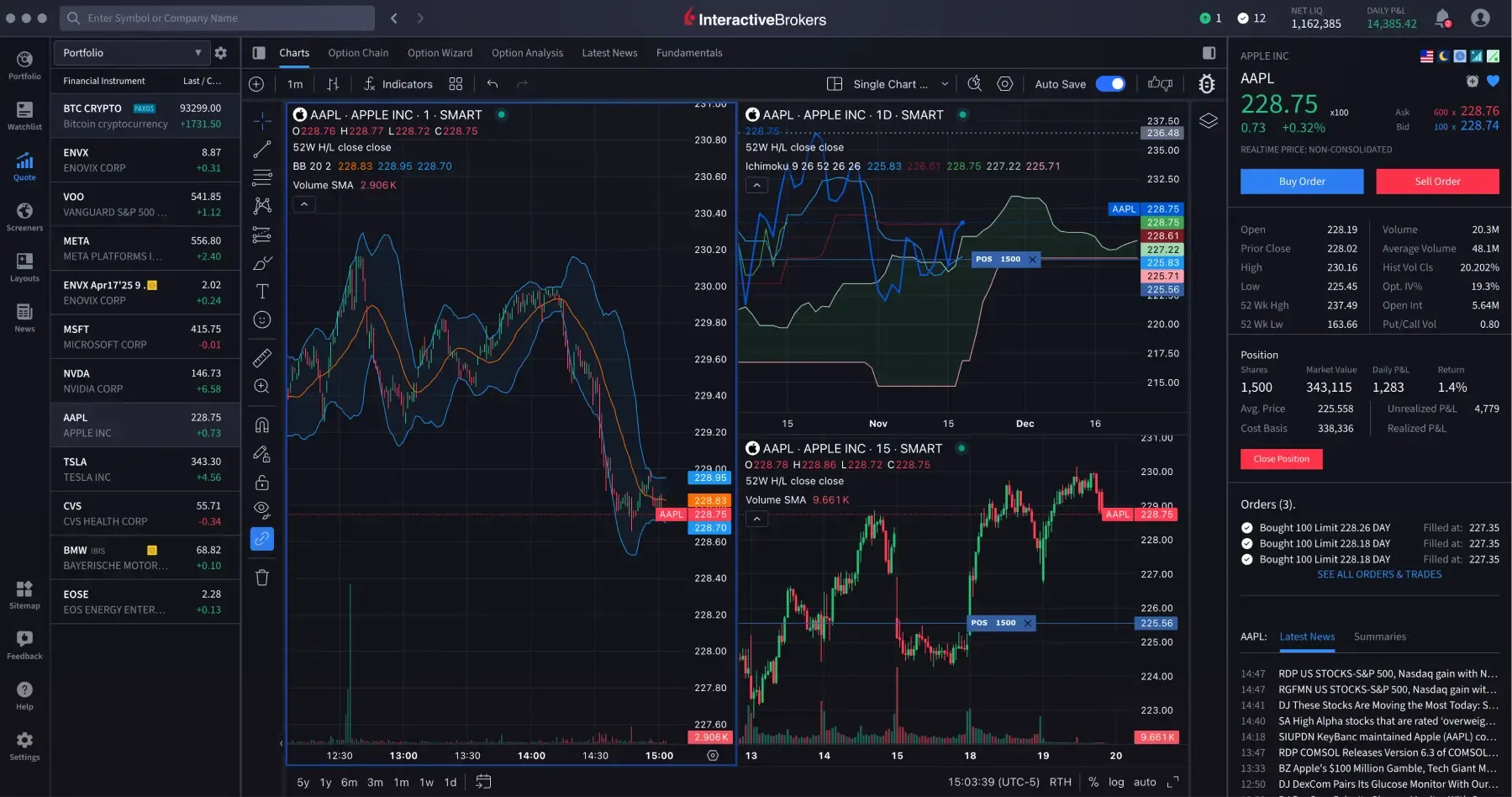

Trading Platform and Technology

- Direct Market Access (DMA): The broker’s platform should support direct routing to various ECNs.

- Real-Time Data: Look for a platform with robust charting tools, real-time Level II quotes, and fast execution speeds.

- Reliability: Platform uptime is critical; frequent outages or lags can be disastrous for active traders.

Customer Support and Resources

- Technical Support: Check the availability of live support, especially if you’re trading around the clock.

- Educational Material: Some brokers provide webinars, tutorials, and other resources to help you maximize your ECN trading strategies.

Tools and Technologies for ECN Trading

Direct Market Access (DMA) Platforms

DMA platforms allow traders to interact directly with the ECN’s order book. Advanced DMA platforms offer features like:

- Order Routing: Users can choose specific ECNs or set smart order routing to auto-select the best venue.

- Customization: Traders can automate certain functions, integrate third-party analytics, and set custom alerts.

Algorithmic and Automated Trading

Algorithmic trading strategies rely on pre-programmed instructions to place trades based on market conditions. ECNs are ideal for algo traders because of:

- Low Latency: Automated systems can exploit small price differentials in real-time.

- Data Feeds: ECNs offer continuous market data that algorithms can process instantaneously.

ECN Data Feeds and Analytics

Many ECN brokers provide Level II data feeds, which break down market depth at multiple price levels. Traders can subscribe to real-time analytics tools that interpret this data, highlighting emerging trends, price imbalances, or liquidity gaps.

Strategies for Successful ECN Trading

Scalping and Market Making

Scalping involves executing numerous short-duration trades to capture small profits repeatedly. Since ECNs offer tight spreads and quick fills, scalping can be highly effective. Market makers also use ECNs to post both bid and ask orders, profiting from the bid-ask spread.

Tips for Scalpers:

- Focus on High-Liquidity Stocks: Look for stocks with tight spreads and significant daily volume.

- Pay Attention to Fees: Ensure the ECN’s maker-taker fees don’t erode your small profits.

- Use Limit Orders: Limit orders let you control the price at which you enter or exit.

Liquidity-Based Trading Strategies

Liquidity-based strategies exploit shifts in supply and demand. For instance, a large institutional order might create significant buying or selling pressure, causing short-term price movements. Traders closely monitor the ECN order book for big blocks of shares that could signal pending price moves.

Execution Tactics:

- Iceberg Orders: Some ECNs allow iceberg orders, where large orders are partially hidden to avoid alarming other traders.

- Sweep Orders: Smart routing algorithms can “sweep” across multiple ECNs to fill large positions at the best prices.

High-Frequency Trading (HFT) Strategies

HFT strategies rely on ultra-low latency to exploit short-lived market inefficiencies. HFT firms often co-locate their servers near the ECN’s data center to shave off microseconds of communication time.

Common HFT Techniques:

- Statistical Arbitrage: Exploiting pricing inefficiencies between correlated stocks or ETFs.

- Market Microstructure Arbitrage: Identifying minute dislocations in the order book that can be exploited for quick profits.

Event-Driven and News-Based Trading

Traders can use ECNs to rapidly place orders when major market-moving events—such as earnings reports or economic data releases—occur outside regular market hours. Because ECNs support extended trading sessions, event-driven traders can position themselves ahead of the broader market’s reaction.

Best Practices:

- Set Alerts: Use news feeds or economic calendars to track upcoming events.

- Predefine Risk Parameters: Market conditions can be extremely volatile around major announcements.

- Use Limit Orders in Volatile Conditions: Protect yourself from extreme price slippage by specifying the maximum or minimum price you’re willing to accept.

Real-World Examples of ECN Usage

- Institutional Block Trades: A hedge fund wants to acquire 1 million shares of a mid-cap stock without revealing its full intention. By using an ECN with partial or hidden orders, the fund can gradually accumulate shares.

- Pre-Market Earnings Reaction: A day trader spots a positive earnings surprise from a well-known tech company at 7:00 a.m. EST. Using an ECN, the trader swiftly buys shares in pre-market trading, aiming to sell them when the regular session opens.

- Cross-Border Trading: An investor in Asia uses an ECN-linked broker to trade U.S.-listed stocks during extended hours, taking advantage of news in their time zone before the official U.S. market opens.

These real-world scenarios underscore how ECNs enhance flexibility, speed, and anonymity in various trading situations.

Future Outlook for ECNs

As markets become ever more fragmented and technology continues to evolve, ECNs are poised for further growth and innovation. Some trends to watch:

- Expansion into New Assets: Beyond stocks, ECNs could expand further into cryptocurrency, futures, and fixed-income markets.

- AI and Machine Learning: Advanced analytics and predictive algorithms might optimize order routing and trade execution even more efficiently.

- Regulatory Shifts: Heightened scrutiny of high-frequency trading and dark pools could lead to new regulations impacting ECN operations.

- Globalization of ECNs: More international tie-ups could create a 24-hour truly global ECN network for stocks and other instruments.

- Integration with Decentralized Finance (DeFi): As blockchain technology matures, there may be synergy between ECNs and decentralized trading protocols, merging traditional finance with decentralized platforms.

Conclusion

Electronic Communication Networks (ECNs) have become an indispensable component of the modern stock trading ecosystem, offering unparalleled speed, direct market access, and aggregated liquidity. They serve as a robust alternative—or complement—to traditional exchanges, especially for traders focused on efficiency, cost-effectiveness, and anonymity. Whether you’re a day trader executing rapid scalping strategies or an institutional investor discreetly handling large orders, ECNs provide a level playing field with transparent order books, tight spreads, and near-instant trade executions.

However, ECNs also come with their share of complexities, from navigating maker-taker fee models to managing the risks of after-hours liquidity. Selecting the right ECN broker—one that aligns with your trading style and strategic objectives—is pivotal. With continued innovations in technology, regulatory changes, and evolving market structures, ECNs are likely to remain at the forefront of trading innovations, continuously shaping how we buy and sell stocks in the global marketplace.

By thoroughly understanding the mechanics, benefits, and challenges of ECNs, traders at all levels can better position themselves to capitalize on the opportunities these networks offer—ultimately aiming to maximize liquidity, market access, and execution speed in their stock trading endeavors.