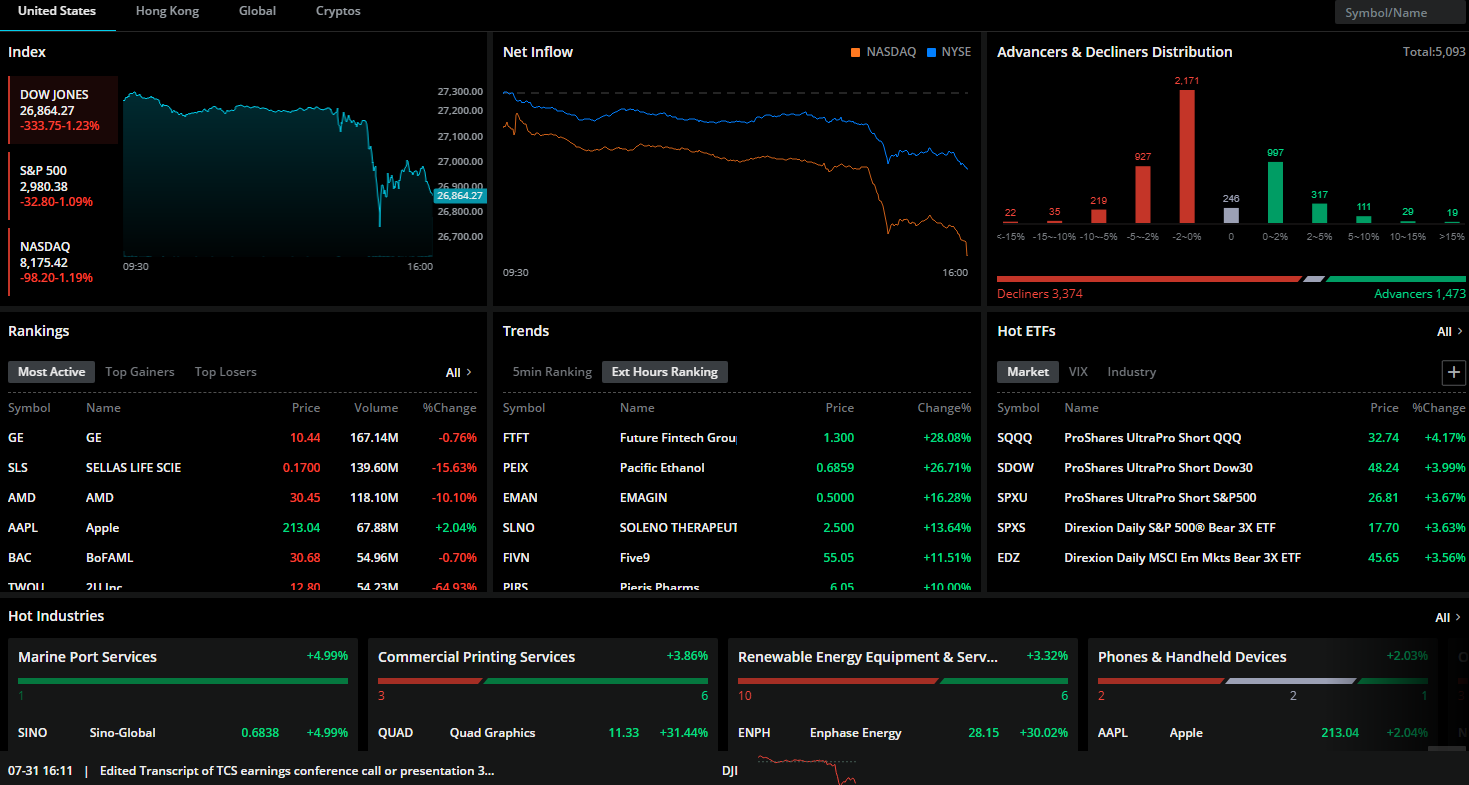

In today’s fast-paced financial markets, options trading has become a go-to strategy for both new and seasoned traders, offering powerful leverage, versatile strategies, and the potential for significant returns—even in uncertain market conditions. To fully capitalize on these opportunities, selecting the best options trading platforms is critical. The right platform can simplify complex strategies, optimize your trades, and provide the tools needed to succeed.

This comprehensive guide dives deep into the world of options trading platforms. We’ll break down what options trading is, highlight the must-have features of an effective platform, and showcase the best options trading platforms—from beginner-friendly interfaces to advanced tools designed for professionals. By the end, you’ll have the insights to confidently choose a platform that suits your trading style, expertise, and long-term goals.

Understanding Options Trading

What Are Options?

Options are financial derivatives that give you the right—but not the obligation—to buy or sell an underlying asset (such as a stock or an ETF) at a predetermined price, known as the strike price, within a specified period. The two primary types of options are:

- Call Options: These give the holder the right to buy the underlying asset at the strike price before the option expires.

- Put Options: These give the holder the right to sell the underlying asset at the strike price before the option expires.

Options can be used to hedge existing positions, speculate on market movements, or generate income through certain strategies (like selling covered calls). The flexibility and complexity of options make them appealing, but they also mean that understanding them thoroughly is crucial before diving in.

Why Trade Options?

- Leverage and Cost-Efficiency: Buying options generally requires less capital than buying the underlying asset outright. This leverage can magnify gains but can also increase potential losses.

- Risk Management: Options can serve as insurance for your portfolio. For example, buying put options can protect your stocks from large downward moves.

- Versatility in Strategies: From basic bullish or bearish strategies to more complex neutral trades (such as iron condors or butterflies), options enable traders to express market views with precision.

- Potential Income Generation: Strategies like writing covered calls allow traders to generate income from existing stock holdings.

Key Features to Consider When Choosing an Options Trading Platform

Selecting the right options trading platform is not a one-size-fits-all process. Different platforms cater to different skill levels, trading styles, and budgets. Here are some critical factors to consider:

1. User Interface and Ease of Use

- Beginners Need Intuitive Interfaces: If you’re new to options, a platform that simplifies contract selection, strategy building, and trade execution is essential. Look for a clean interface, helpful tooltips, and educational resources integrated into the platform.

- Advanced Tools for Professionals: Experienced traders might prefer more complex order entry options, hotkeys, and advanced charting tools. The user interface should facilitate quick decision-making and efficient execution.

2. Commission Structures and Fees

- Low Costs Matter: Options commissions can vary widely. Some platforms charge per-contract fees, while others offer flat rates or even commission-free options on certain products.

- Hidden Fees: Look beyond the headline commission rates. Check for assignment fees, exercise fees, and any platform or data charges.

3. Quality of Educational Materials

- Learning Curve Support: Beginners benefit significantly from platforms that offer robust educational content, including tutorials, webinars, options trading courses, and interactive tools that explain complex concepts.

- Ongoing Skill Development: Even experienced traders can gain from up-to-date market research, trade ideas, and advanced strategy insights.

4. Research and Analysis Tools

- Charting Capabilities: Look for platforms with integrated charting tools that offer a wide range of technical indicators, real-time data, and customization options.

- Options Chains and Greeks: A good options platform provides comprehensive options chains with key metrics like delta, gamma, theta, and implied volatility. This data helps traders make informed decisions.

- Screeners and Strategy Builders: Advanced scanning tools can help traders quickly find opportunities that match their criteria, such as high implied volatility stocks or strategies that aim for a particular risk/reward profile.

5. Execution Speed and Reliability

- Stability Under Pressure: During high market volatility or news events, platforms can slow down or experience outages. Ensure the platform has a strong reputation for uptime, fast execution, and stable servers.

- Mobile App Performance: In today’s mobile-first world, the quality of a broker’s mobile app can be a game-changer. Check that the app provides the necessary features for when you’re trading on-the-go.

6. Customer Support

- Availability and Responsiveness: It’s crucial to have reliable customer support via phone, chat, or email, especially for beginners who may need help placing trades or troubleshooting platform issues.

- Community and Forums: Some platforms encourage community discussions and Q&A forums where traders can learn from each other’s experiences.

Best Options Trading Platforms for Beginners and Experienced Traders

Below are some of the leading options trading platforms, each with its own set of strengths. As you review this list, consider which platform best aligns with your specific needs and trading ambitions.

1. TD Ameritrade’s thinkorswim

Thinkorswim, offered by TD Ameritrade (now part of Charles Schwab), stands out as one of the most comprehensive and powerful options trading platforms on the market. It caters to both beginners and professionals, offering a wide range of tools, research features, and educational resources.

Key Features:

- Advanced Charting Tools: Access to dynamic charting with hundreds of technical indicators, custom studies, and one-click trade functionality.

- Integrated Option Analytics: Built-in tools like Option Hacker and Spread Hacker help you find opportunities based on volatility, delta, and other options “Greeks.”

- Paper Trading Account: New traders can use the paperMoney® simulation account to practice risk-free and familiarize themselves with the platform.

- Robust Educational Resources: thinkorswim’s learning center provides tutorials, live webcasts, courses, and an extensive video library.

Who It’s For:

From novices to seasoned pros, thinkorswim can serve everyone. Beginners enjoy the educational support and paper trading features, while veteran traders appreciate the platform’s powerful analytical tools.

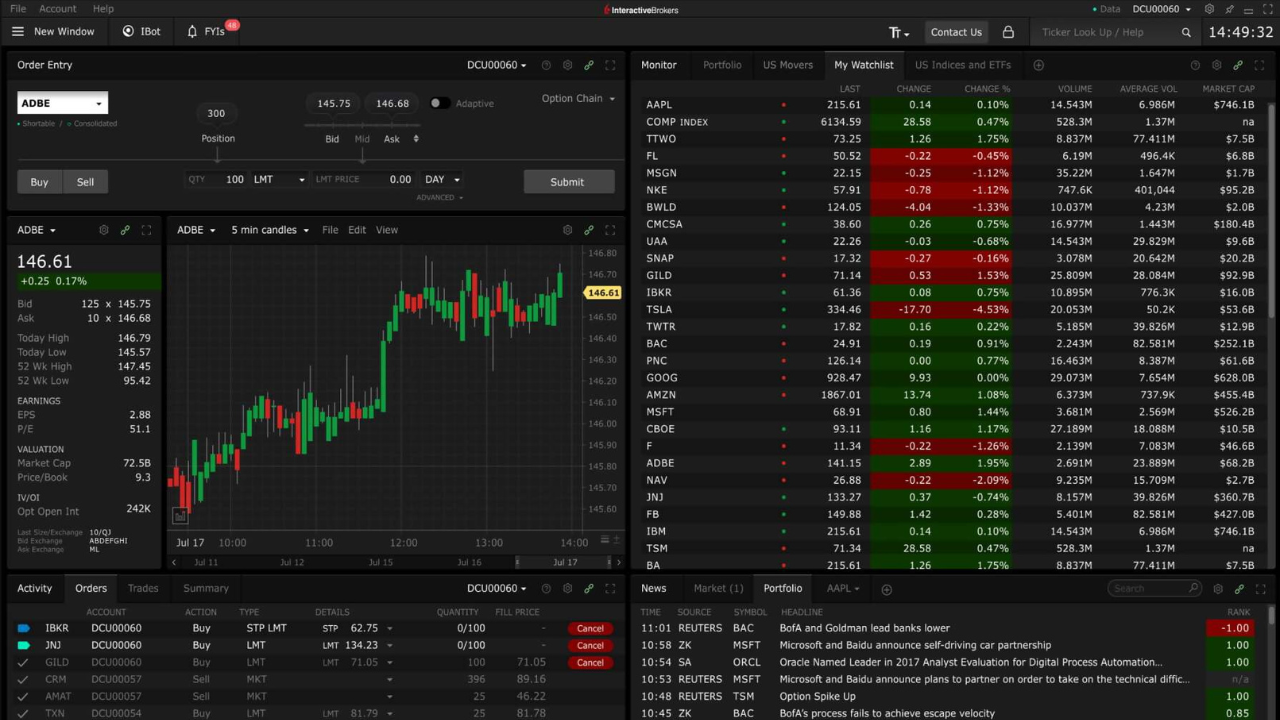

2. Interactive Brokers (IBKR)

Interactive Brokers has long been known for its low-cost structure, wide range of tradable products, and advanced trading tools. Its Trader Workstation (TWS) is geared towards experienced traders, though the IBKR Lite service makes it more accessible to beginners.

Key Features:

- Low Commissions: IBKR often offers some of the lowest commissions and margin rates in the industry, which is ideal for frequent traders.

- Global Market Access: With Interactive Brokers, you can trade options on multiple international exchanges, broadening your opportunity set.

- Powerful Analytical Tools: The OptionTrader tool within TWS provides real-time quotes, integrated risk analytics, and sophisticated order types.

- Fractional Shares and Robo-Advisory: Beginners who are still building their equity portfolio can also benefit from IBKR’s other features, like fractional shares and the IBKR GlobalAnalyst tool.

Who It’s For:

Advanced traders who want robust global access and low trading costs will find IBKR highly suitable. Beginners can start with IBKR Lite and grow into the platform’s more advanced features over time.

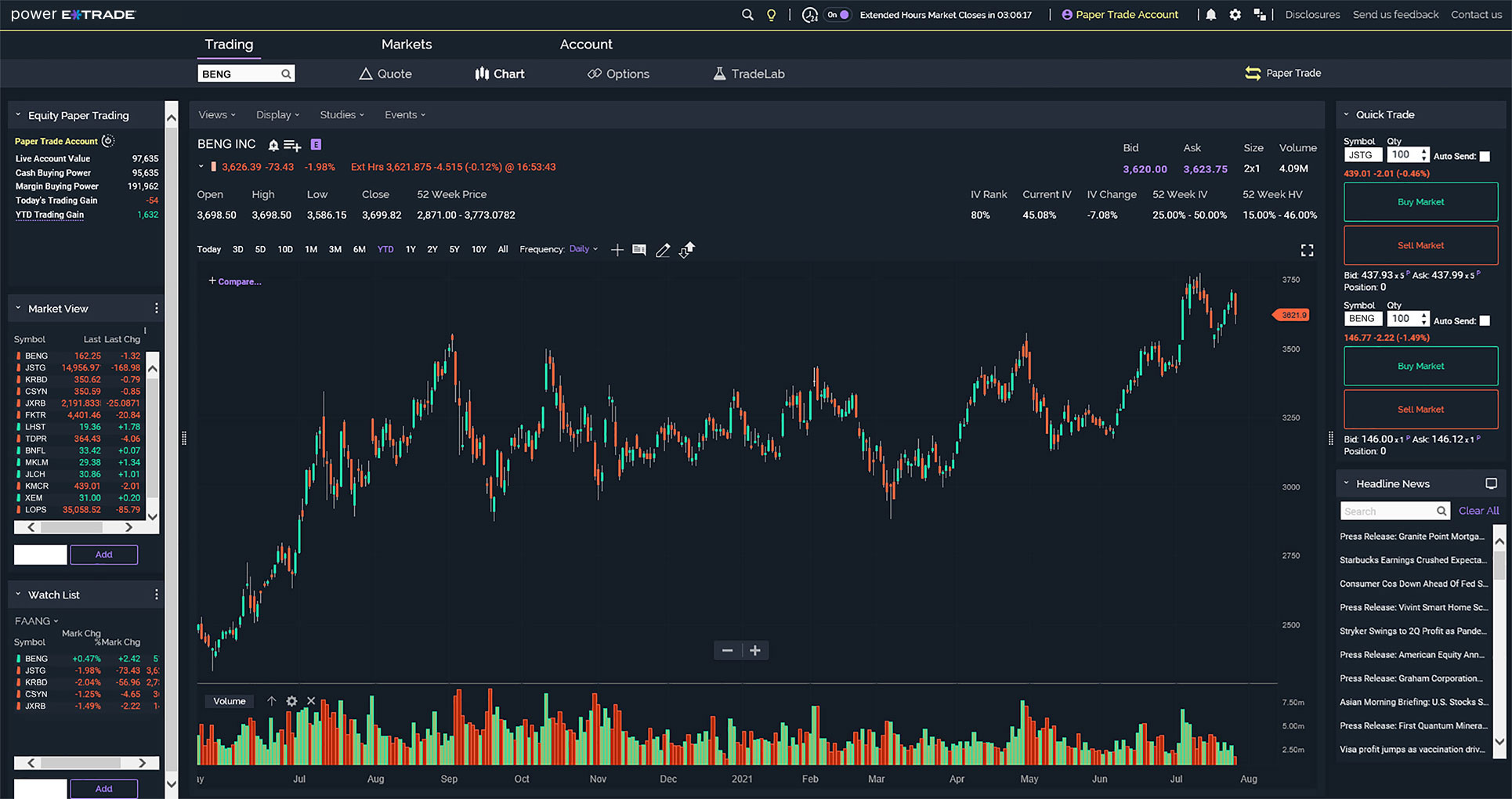

3. ETRADE (Power ETRADE)

Power E*TRADE, formerly OptionsHouse, is a feature-rich platform focused on simplicity and innovation. It’s known for its user-friendly approach to complex options strategies.

Key Features:

- StrategySEEK Tool: This intuitive tool suggests options strategies based on your market outlook and risk tolerance, making it easier for beginners to find suitable trades.

- Live Action Scans: Real-time scanning tools help identify volatility events, unusual options activity, and potential trading opportunities.

- Extensive Educational Library: E*TRADE provides a wide range of articles, videos, webinars, and in-person events to help traders learn at their own pace.

Who It’s For:

ETRADE is an excellent middle-ground platform. It’s approachable enough for beginners but still offers a host of advanced tools for experienced traders. Those who value a balance of user-friendliness and analytical depth will find Power ETRADE appealing.

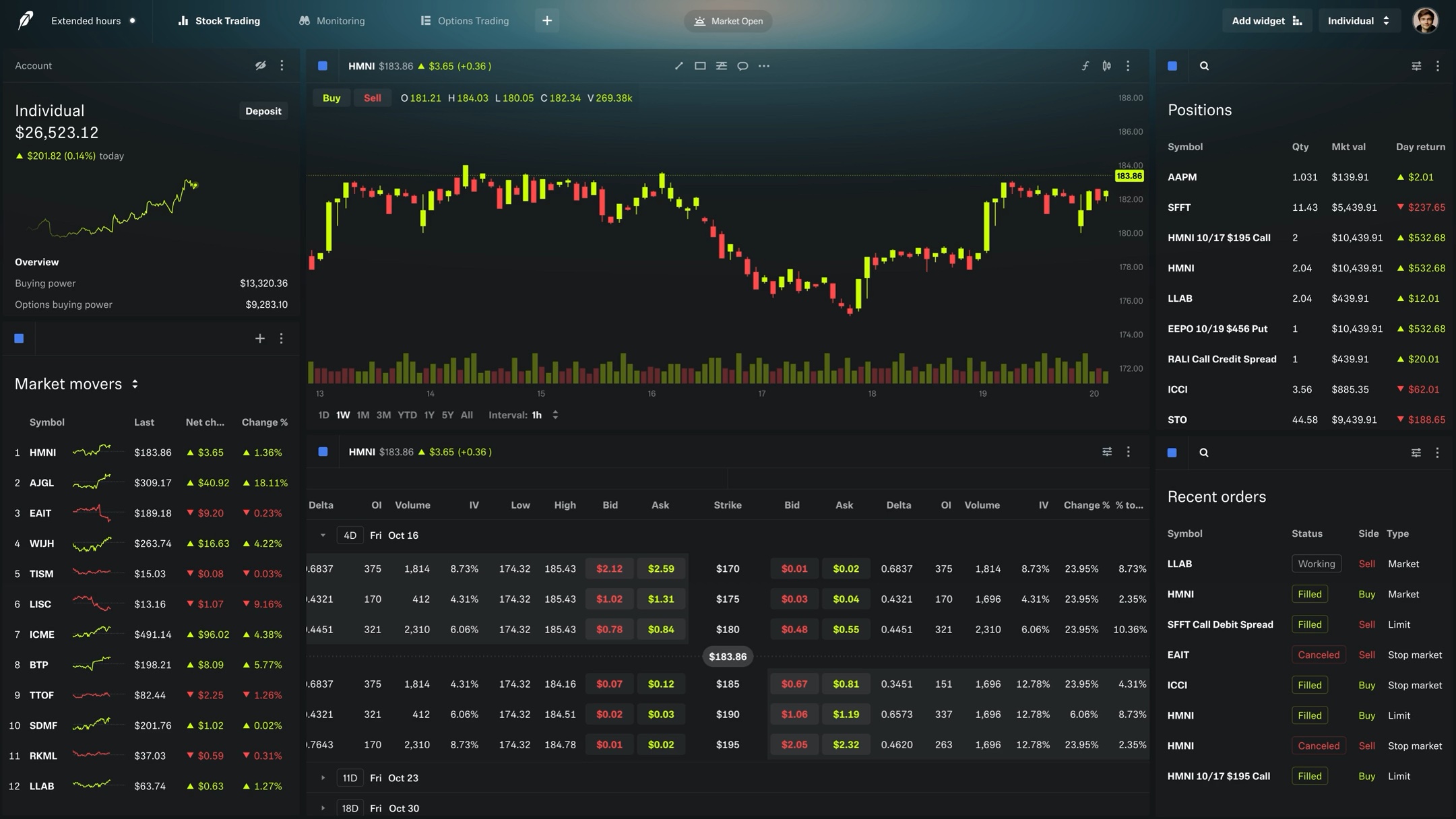

4. Tastytrade (formerly tastyworks)

Launched by the creators of thinkorswim, tastytrade focuses on empowering DIY traders with a streamlined platform and a strong emphasis on options strategies.

Key Features:

- Strategy-First Interface: The platform makes it easy to visualize and implement complex multi-leg options strategies.

- Low Commissions: Tastytrade’s cost structure is attractive, often featuring commission-free trading on opening and closing options trades (though this can vary by product).

- Educational Content: The brand offers daily web shows, educational videos, and research segments that dive into advanced options concepts.

- Fast Execution: Known for its efficient order routing and execution speed.

Who It’s For:

If you’re particularly focused on options and want a platform designed by options traders, for options traders, tastytrade is an excellent choice. It’s great for intermediate and experienced traders who already grasp the fundamentals and want to refine their edge.

5. Robinhood

Robinhood revolutionized the retail trading landscape by offering commission-free trades and a clean, mobile-first interface. While not the most robust for advanced strategy analysis, it’s appealing to beginners who want a simple entry into options trading.

Key Features:

- Commission-Free Options: Trade options without worrying about commissions, making it cost-effective for small trades.

- User-Friendly Mobile App: The mobile app is straightforward, ideal for novice traders who find more complex platforms intimidating.

- Basic Educational Material: Robinhood offers simple explanations of options concepts, though the depth of education lags behind some competitors.

Who It’s For:

Robinhood is best suited for absolute beginners who want to dip their toes into options trading with minimal cost and complexity. More advanced traders may find the platform lacking in analytical tools and strategy depth.

6. Webull

Webull is another commission-free platform that has grown rapidly in popularity. With more advanced charting and data features than Robinhood, it’s a step up in complexity while remaining user-friendly.

Key Features:

- Commission-Free Trading: Zero commissions on options contracts.

- Intuitive Interface with Strong Charting: Offers better charting tools and technical indicators compared to some other beginner-focused apps.

- Paper Trading: Practice trading strategies without risking real money.

- Enhanced Data and Analytics: Provides real-time market data, technical indicators, and community insights.

Who It’s For:

Webull is ideal for beginner-to-intermediate traders who want more robust tools than Robinhood but still appreciate a user-friendly environment. It’s a good stepping stone before moving on to more complex platforms like thinkorswim or IBKR.

Additional Tips for Choosing the Best Options Trading Platform

1. Start with a Demo or Paper Trading Account

If you’re uncertain about which platform to commit to, consider those that offer paper trading or demo accounts. This feature allows you to practice risk-free, explore the platform’s tools, and determine if it suits your style. Beginners especially benefit from learning to navigate order types and test strategies before risking real money.

2. Evaluate Mobile and Desktop Compatibility

In today’s on-the-go world, having a responsive and fully functional mobile app can be a significant advantage. Check whether the platform’s mobile version syncs seamlessly with its desktop counterpart, providing access to watchlists, open positions, and research tools across devices.

3. Prioritize Customer Support and Community Engagement

Responsive customer support can be a lifesaver when facing technical issues or needing clarification on a trade. Platforms that offer 24/7 support, or at least extended hours, ensure help is available when you need it most. Additionally, some brokers foster a strong community through forums, chat rooms, and educational events—valuable resources for ongoing learning and networking.

4. Check for Regulatory Compliance and Security

Always ensure the platform you choose is regulated by recognized authorities like the SEC (U.S.) or FCA (U.K.). Strong encryption, secure data practices, and robust authentication measures are also critical factors, given the sensitive financial information involved.

5. Align the Platform with Your Trading Goals

If you’re primarily a buy-and-hold investor dabbling in covered calls for extra income, you may not need the complexity of advanced analytics. Conversely, if you’re a frequent options trader implementing complex strategies like calendar spreads or iron butterflies, investing in a platform with top-tier analytical tools may pay off in the long run.

Strategies for Success Once You’ve Chosen a Platform

Selecting the best platform is just the first step. How you use it makes all the difference. Here are some strategies to guide you toward success:

1. Start Small and Focus on the Basics

If you’re new to options, begin with simple strategies like buying calls or puts to gain familiarity with how options behave. Once you understand basic options concepts and order types, gradually progress to more complex strategies.

2. Leverage Educational Resources

Most platforms provide an array of educational content. Take full advantage of courses, webinars, and live events. Even as an experienced trader, staying updated on new features, market trends, and advanced strategies can keep you ahead of the curve.

3. Utilize Analytical Tools

For intermediate and advanced traders, learn to interpret the options “Greeks” (Delta, Gamma, Theta, Vega) and integrate them into your trading. Use scanning tools to find mispriced options, identify volatility skews, or locate underlyings with attractive implied volatilities. The more data-driven your approach, the better your long-term outcomes.

4. Practice Sound Risk Management

Options offer leverage, but they also come with risk. Always define your risk parameters, set appropriate stop-loss levels (if applicable), and consider position sizing carefully. Ensure you understand the worst-case scenario for each trade before you enter it.

5. Keep a Trading Journal

Documenting each trade, the strategy used, your reasoning, and the eventual outcome can help identify strengths, weaknesses, and patterns in your trading approach. Over time, this data can guide adjustments to improve your overall performance.

Conclusion

Finding the best options trading platform is a crucial decision for traders at all experience levels. Beginners need intuitive interfaces, comprehensive education, and supportive communities to ease them into the complex world of options. Experienced traders require advanced charting, sophisticated analysis tools, flexible order types, and global market access to execute more complex strategies efficiently.

By considering factors like user experience, fee structures, research capabilities, and platform stability, you can narrow down the brokers that best meet your needs. Whether it’s the robust analytics and educational resources of thinkorswim, the low-cost global access of Interactive Brokers, or the user-friendly simplicity of Robinhood and Webull, there’s a platform out there designed with you in mind.

Take the time to explore demos, read user reviews, and consider your long-term trading goals. With the right platform and a solid plan in place, you’ll be well-positioned to make the most of the dynamic world of options trading—regardless of whether you’re just getting started or refining an already seasoned trading strategy.

Frequently Asked Questions (FAQ)

1. What is an options trading platform?

An options trading platform is a digital tool provided by brokers that allows traders to buy and sell options contracts. These platforms typically include features such as options chains, strategy builders, charting tools, educational resources, and analytics to help traders execute and manage their options trades effectively.

2. Which options trading platform is best for beginners?

Platforms like ETRADE and Robinhood are great for beginners due to their intuitive interfaces, educational content, and straightforward tools. These platforms simplify the trading process and help new traders build confidence without overwhelming them with advanced features.

3. Do I need to pay commissions for options trading?

Many platforms offer low or even commission-free trading for options. For example, Robinhood and Webull provide commission-free options trading, while platforms like Interactive Brokers and tastytrade offer competitive pricing. Be sure to review the broker’s fee structure for potential additional costs, such as assignment and exercise fees.

4. What are the most important features to look for in an options trading platform?

Key features to consider include:

- Ease of use: A beginner-friendly interface with intuitive navigation.

- Educational resources: Tutorials, webinars, and guides to help you learn options trading.

- Research tools: Advanced charting, options chains, and scanners for finding trading opportunities.

- Low fees: Competitive pricing structures to minimize trading costs.

- Mobile compatibility: A responsive mobile app for trading on the go.

5. Can I practice options trading without risking real money?

Yes! Many platforms, such as TD Ameritrade’s thinkorswim and Webull, offer paper trading accounts. These allow you to practice trading in a simulated environment, helping you understand the mechanics of options without risking real money.

6. What is the difference between options trading platforms for beginners and experienced traders?

Beginner platforms focus on simplicity, user-friendly design, and basic educational resources. Advanced platforms provide robust analytical tools, customizable interfaces, multi-leg strategy builders, and access to global markets, catering to the needs of experienced traders who require in-depth data and faster execution.

7. How much money do I need to start trading options?

The amount varies based on the broker’s requirements and the strategy you plan to use. Some platforms have no minimum deposit requirements (e.g., Robinhood), making it easier for beginners to start small. However, trading options often requires sufficient funds to cover margin requirements, especially for complex strategies.

8. Are options trading platforms safe?

Reputable platforms regulated by authorities like the SEC (U.S.) or FCA (U.K.) ensure the safety of your funds and data. Look for brokers with strong encryption, two-factor authentication, and a good track record of compliance.

9. Can I trade options on a mobile app?

Yes, most modern platforms, including thinkorswim, Webull, and Robinhood, offer mobile apps with nearly all the features available on their desktop counterparts. These apps are designed for on-the-go trading, making it convenient to monitor and execute trades from anywhere.

10. What are the risks of options trading?

Options trading comes with risks such as:

- Potential loss of premium: If the market doesn’t move as expected, you may lose the premium paid for the option.

- Complexity: Multi-leg strategies and the impact of factors like volatility and time decay can be challenging to understand.

- Leverage risks: While leverage can magnify gains, it can also lead to significant losses.

Always start with a solid understanding of the risks and practice proper risk management.

11. How do I get better at options trading?

To improve as an options trader:

- Educate yourself: Use the educational resources provided by platforms.

- Practice: Use paper trading to test strategies without financial risk.

- Analyze past trades: Keep a trading journal to review what works and what doesn’t.

- Stay updated: Follow market trends and learn new strategies over time.

- Start small: Begin with simple trades before moving to complex strategies.

12. Can I trade options internationally?

Yes, platforms like Interactive Brokers and thinkorswim provide access to international markets. Be aware that trading options on foreign exchanges may have additional regulations, fees, or margin requirements.

13. What is the “best” options strategy for beginners?

Simple strategies like buying call or put options are ideal for beginners as they have limited risk (the premium paid) and are easy to understand. Avoid complex multi-leg strategies until you’re comfortable with the basics of options trading.

14. How do I know if an options trading platform is right for me?

Evaluate your goals, skill level, and trading needs. Beginners should prioritize simplicity and education, while experienced traders may focus on analytics and advanced tools. Testing platforms with demo accounts can help you decide before committing real money.

If you have more questions about options trading platforms or strategies, leave a comment below or reach out for personalized guidance!