In the world of trading and investing, call options are a popular financial instrument that can offer substantial returns if used correctly. They provide investors with flexibility, leverage, and opportunities to manage risk. This article will walk you through the essentials of call options, their mechanics, and when to use them effectively.

What Are Call Options?

A call option is a type of financial derivative that gives the buyer the right, but not the obligation, to purchase an underlying asset (like stocks, ETFs, or indexes) at a specified price, called the strike price, within a defined time frame.

Key Terms in Call Options:

- Strike Price: The predetermined price at which the option buyer can purchase the underlying asset.

- Premium: The cost of the option, paid by the buyer to the seller.

- Expiration Date: The date by which the option must be exercised or allowed to expire.

- In-the-Money (ITM): When the underlying asset’s price is above the strike price.

- Out-of-the-Money (OTM): When the underlying asset’s price is below the strike price.

- At-the-Money (ATM): When the underlying asset’s price is equal to the strike price.

How Call Options Work

Buying Call Options

When you buy a call option, you pay a premium to gain the right to buy the underlying asset at the strike price before the expiration date. You would do this if you believe the asset’s price will rise above the strike price plus the premium you paid.

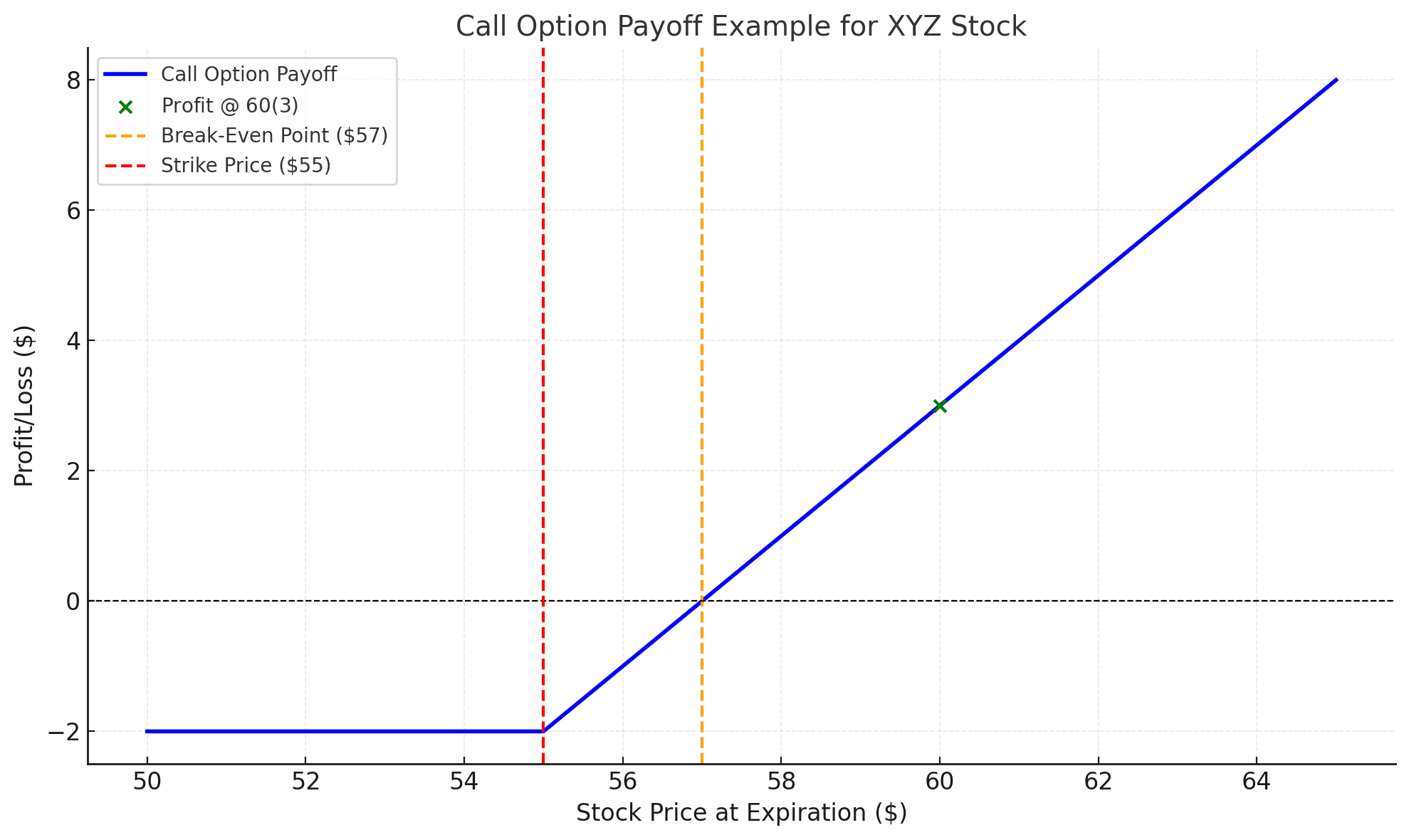

Example:

- Underlying Asset: XYZ Stock

- Current Price: $50

- Strike Price: $55

- Premium: $2

If the stock price rises to $60, you can exercise your option to buy the stock at $55, profiting $5 per share minus the $2 premium.

Selling Call Options (Covered Calls)

When you sell a call option, you receive a premium but are obligated to sell the underlying asset at the strike price if the buyer exercises the option. This strategy, known as covered calls, is often used to generate income from assets you already own.

Call Option Payoff Diagram

A call option buyer’s payoff is unlimited on the upside but limited to the premium paid on the downside. For the seller, the payoff is the opposite: limited profit (the premium received) but potentially unlimited risk if the underlying asset’s price rises significantly.

Advantages of Call Options

- Leverage: You control a large position with a small upfront investment (premium).

- Risk Limitation: The maximum loss for buyers is limited to the premium paid.

- Flexibility: Call options allow you to profit from upward price movements without owning the underlying asset.

- Income Generation: Selling call options (covered calls) can generate income for asset holders.

Disadvantages of Call Options

- Time Decay: As the expiration date approaches, the option’s value may decrease even if the underlying asset price rises.

- Complexity: Options trading requires understanding multiple factors like volatility, strike price, and time decay.

- Potential Loss: While losses for buyers are limited to the premium, sellers can face unlimited losses if the underlying asset’s price skyrockets.

When to Use Call Options

1. Bullish Outlook on an Asset

- If you believe an asset’s price will rise, buying call options allows you to capitalize on the upward movement.

2. Hedging a Short Position

- Call options can serve as a hedge against short positions, protecting you if the price rises.

3. Income Generation (Covered Calls)

- If you own stocks and expect limited price movement, selling call options provides income through premiums.

4. Leveraging Small Capital

- Investors with limited capital can use call options to take positions on high-value assets without buying them outright.

Practical Example: Using Call Options

Let’s say you anticipate that a tech stock currently trading at $100 will rise due to strong earnings.

- Option Strike Price: $105

- Option Premium: $3

- Expiration Date: 30 Days

If the stock rises to $115:

- You exercise your option to buy at $105 and sell at $115.

- Profit: $10 (Stock Price Gain) – $3 (Premium) = $7 per share.

If the stock stays below $105:

- You don’t exercise the option.

- Loss: Limited to the $3 premium.

How to Trade Call Options

Step 1: Choose an Underlying Asset

Research stocks or assets with expected price movements.

Step 2: Decide on the Strike Price

Select a strike price based on your risk tolerance and market outlook.

Step 3: Monitor the Market

Keep track of the asset’s price, volatility, and time decay.

Step 4: Close or Exercise the Option

Decide whether to exercise the option, sell it in the market, or let it expire.

Common Strategies with Call Options

1. Long Call

- Buying a call option to profit from a price increase.

- Best for: Bullish investors.

2. Covered Call

- Selling call options on assets you own to generate income.

- Best for: Income-focused investors.

3. Bull Call Spread

- Buying a call option and selling another at a higher strike price to reduce costs.

- Best for: Cost-conscious traders.

Frequently Asked Questions (FAQs)

1. What is the difference between a call and a put option?

- A call option gives the right to buy, while a put option gives the right to sell the underlying asset.

2. Can I lose money with call options?

- As a buyer, your loss is limited to the premium. As a seller, losses can be unlimited if the asset price rises significantly.

3. Are call options suitable for beginners?

- Yes, but only after understanding the risks and mechanics. Start with small trades and practice using a demo account.

4. What happens if I don’t exercise my call option?

- It expires worthless, and you lose the premium paid.

Conclusion

Call options are powerful tools for traders and investors looking to benefit from upward price movements, generate income, or hedge positions. However, they require a thorough understanding of their mechanics, risks, and appropriate strategies. By learning when and how to use call options effectively, you can unlock significant opportunities in the financial markets.

Take Action:

If you’re new to options, start with a paper trading account to test your strategies without risk. Once confident, you can incorporate call options into your portfolio to enhance returns and manage risks.