In an increasingly volatile financial environment, savvy investors are constantly seeking ways to protect their hard-earned capital. While traditional strategies like diversification or holding cash reserves have their merits, many experienced traders and portfolio managers turn to options for a more nuanced and targeted approach to risk management. Hedging with options is a technique that can provide a crucial safety net for your investments. By understanding how to effectively employ puts, calls, and strategic combinations of both, you can maintain greater control over potential losses and enhance your portfolio’s resilience during market downturns.

In this comprehensive guide, we will delve into the key concepts behind hedging with options. From understanding the basics of options contracts to exploring advanced strategies like protective puts, covered calls, and collars, we’ll cover it all. By the end, you’ll be equipped to protect your portfolio like a pro.

What is Hedging?

Hedging is a risk management strategy aimed at reducing or limiting potential losses. At its core, it involves taking an offsetting position in a related asset or financial instrument so that gains in one position counterbalance losses in another. In essence, when you hedge, you’re buying “insurance” for your portfolio. You accept a small, known cost (like an insurance premium) in exchange for mitigating much larger, uncertain losses down the line.

Why Hedge?

- Mitigate Downside Risk: If the market suddenly turns against you, a well-planned hedge can soften the blow and prevent catastrophic drawdowns.

- Improve Consistency of Returns: Hedging can smooth out your investment returns over time, reducing volatility and making it easier to stick to a long-term strategy.

- Psychological Comfort: Knowing you have a safety net in place can help you stay calm and rational, rather than making panic-driven decisions.

Understanding Options: The Building Blocks of Your Hedge

What Are Options?

Options are derivative contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset (such as a stock, ETF, or index) at a predetermined price (strike price) by a specific expiration date. There are two main types of options:

- Call Options: Provide the right to buy the underlying asset at the strike price.

- Put Options: Provide the right to sell the underlying asset at the strike price.

Key Terms to Know

- Strike Price: The predetermined price at which you can buy (call) or sell (put) the underlying asset.

- Expiration Date: The date on which the option contract becomes invalid. After this date, the contract can no longer be exercised.

- Premium: The price you pay upfront to purchase an option contract. This is similar to paying an insurance premium—if the hedge isn’t needed, you lose this premium, but if you do need it, it can pay off handsomely.

- In-the-Money (ITM), At-the-Money (ATM), Out-of-the-Money (OTM): These terms describe an option’s relationship to the current underlying price. For example, a put option with a strike price above the current market price of the underlying is considered in-the-money, as it has intrinsic value.

Why Use Options for Hedging?

Options can be powerful hedging tools because they offer a high degree of flexibility and can be structured to provide protection without having to sell your core holdings. This allows you to maintain exposure to assets you believe in long-term, while reducing the impact of short-term market volatility.

Common Option-Based Hedging Strategies

1. The Protective Put

What is a Protective Put?

A protective put is a strategy where you already own the underlying asset—say, 100 shares of a particular stock—and you buy a put option on that same stock. This hedge acts much like an insurance policy: if the stock’s price falls below the put’s strike price, the put option gains value and helps offset losses on the underlying shares.

How It Works:

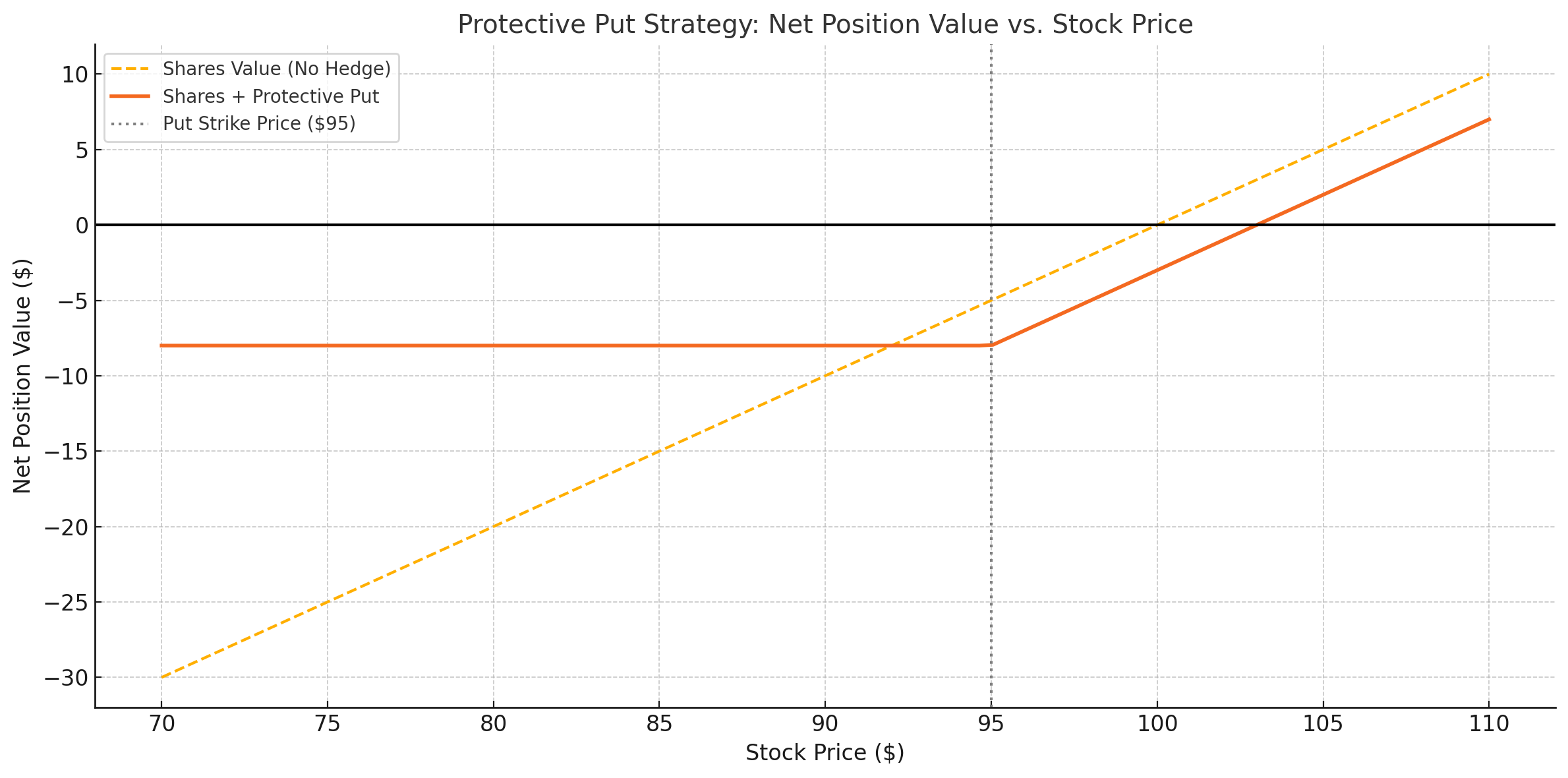

- Example: Suppose you own 100 shares of Company X, trading at $100 per share. You’re worried about a short-term dip but believe in the company’s long-term prospects. You buy a put option with a strike price of $95, expiring in three months, for a premium of $3 per share.

- Scenario 1 (Stock Falls): If the stock falls to $80 by expiration, your shares lose $20 per share in value. However, your put option, which can be exercised at $95, is now worth $15 (since you can sell at $95 instead of the market price of $80). Thus, your net loss is reduced to $8 per share instead of $20.

- Scenario 2 (Stock Rises): If the stock rises to $110, the put expires worthless, and you “lose” the $3 premium. But you keep all the gains on your stock. Overall, you’ve paid a small “insurance premium” for peace of mind.

When to Use Protective Puts:

- You have a large exposure to a particular stock or sector and want downside protection.

- You are uncertain about short-term market conditions but remain optimistic about long-term prospects.

2. The Covered Call

What is a Covered Call?

A covered call involves owning an underlying asset while simultaneously selling (writing) a call option on that asset. This strategy can provide partial downside protection through the premium received from selling the call, though it limits your upside potential if the stock’s price soars.

How It Works:

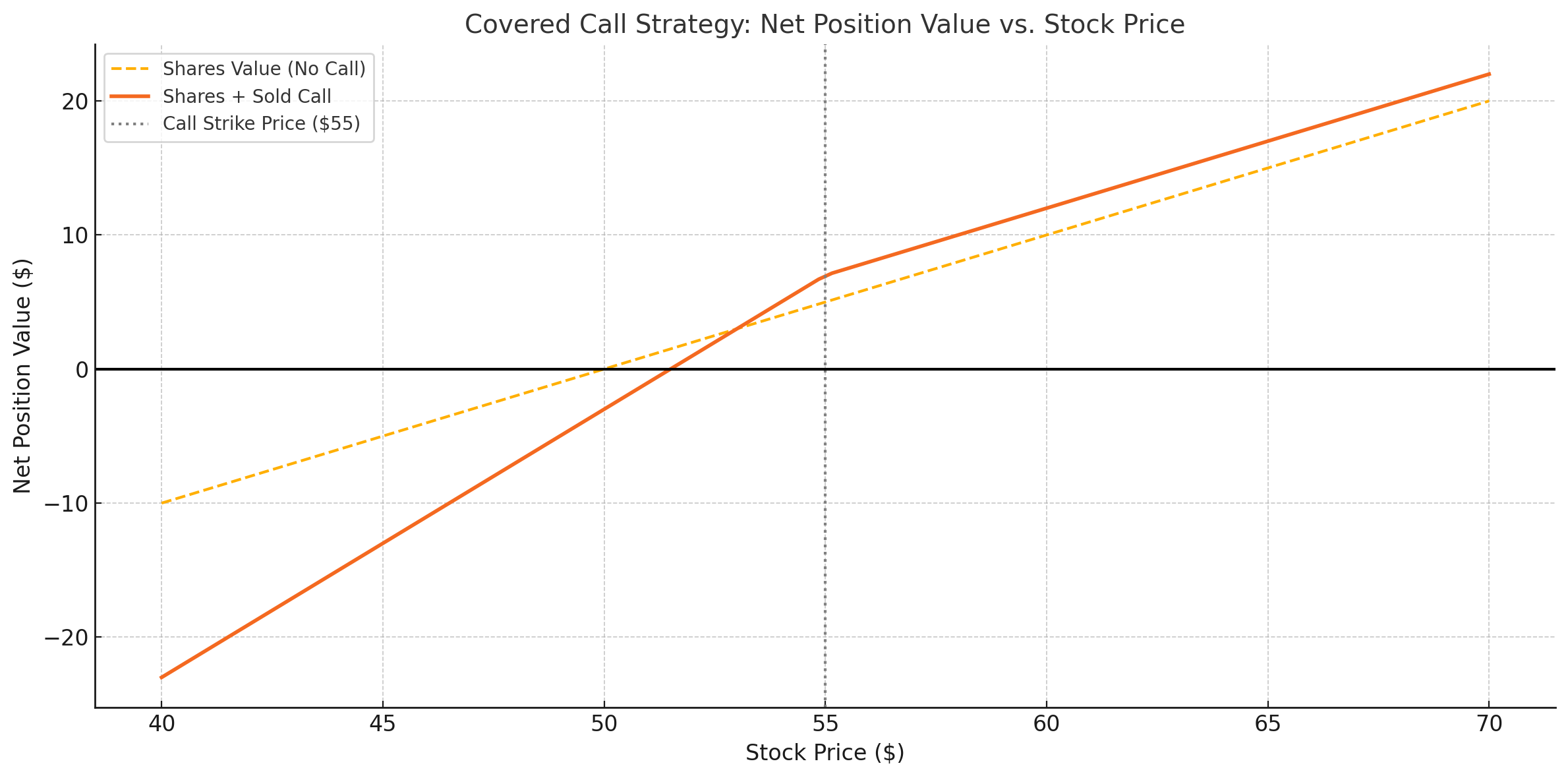

- Example: You own 100 shares of Company Y, trading at $50 per share. You sell a call option with a $55 strike for a $2 premium.

- Scenario 1 (Stock Stays Flat or Declines): If the stock remains at $50 or falls, the call option will likely expire worthless. You keep the $2 premium, effectively reducing your cost basis to $48 per share, offering a small cushion against losses.

- Scenario 2 (Stock Rises Above $55): If the stock ends up at $60, your call option is exercised, and you must sell your shares at $55. You’ve gained $5 per share plus the $2 premium, total $7 profit per share. However, you miss out on the extra $5 gain you would have had if you simply held the stock until $60. The premium received, however, served as a “mini hedge” when the stock wasn’t performing well.

When to Use Covered Calls:

- You own a stable, dividend-paying stock and want to generate extra income while having mild downside protection.

- You’re comfortable limiting your upside in exchange for some immediate income from the option premium.

3. The Collar Strategy

What is a Collar?

A collar strategy combines a protective put and a covered call. You own the stock, buy a put option for downside protection, and simultaneously sell a call option to offset the cost of the put. This can create a nearly cost-free hedge if structured properly.

How It Works:

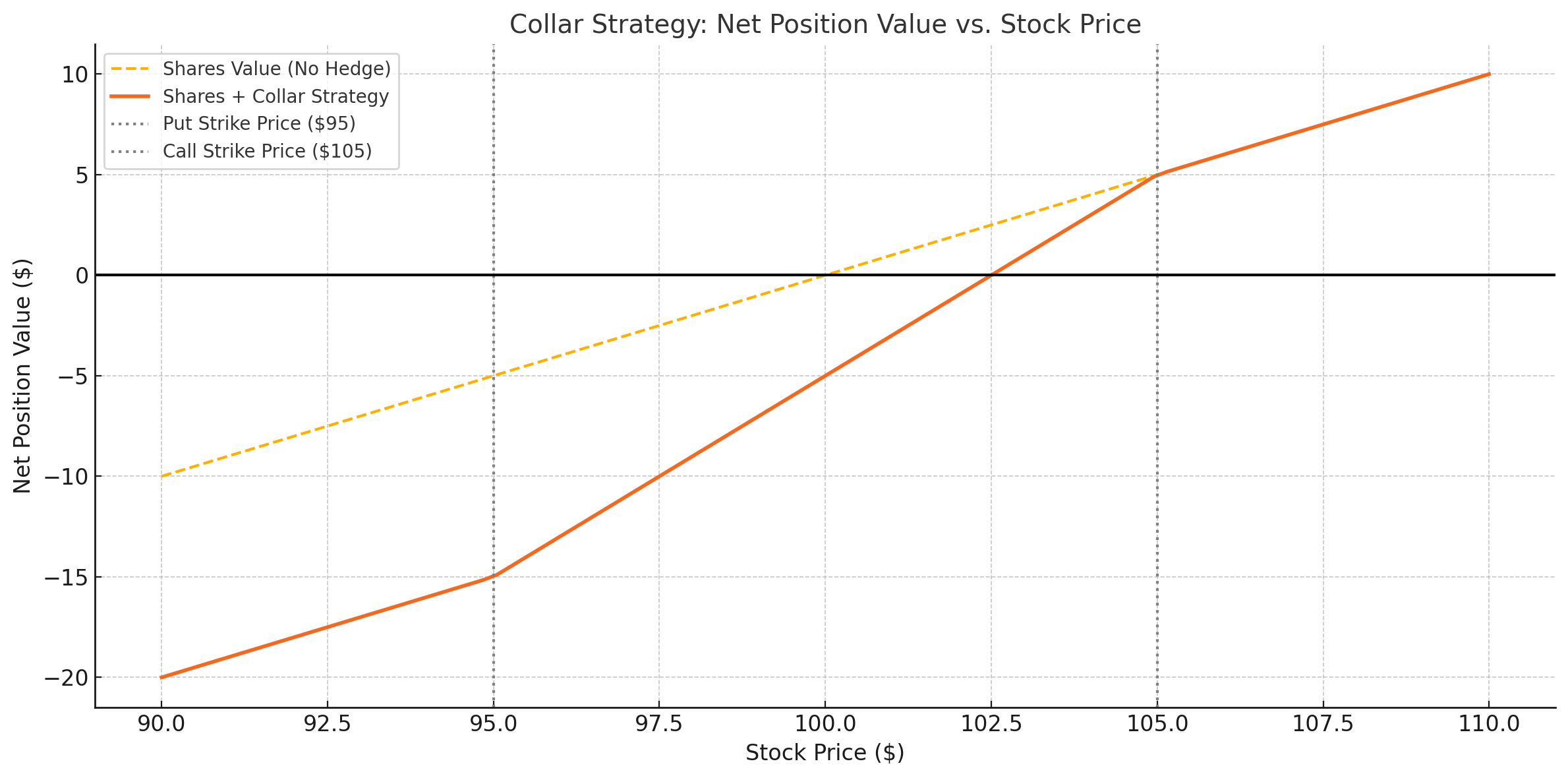

- Example: You own 100 shares of Company Z at $100 per share. You buy a put with a strike price of $95 for $3 and sell a call with a $105 strike for $3.

- Resulting Position: If the stock falls below $95, the put protects you. If the stock rises above $105, the call is exercised, and you sell the stock at $105, capping your gains. Meanwhile, the premium you received from the call offsets the cost of the put, making this a low or zero-cost hedge.

When to Use a Collar:

- You want stable, predictable outcomes.

- You expect moderate returns from the stock and are willing to cap your upside to pay less (or nothing) for downside protection.

Selecting the Right Strike Prices and Expiration Dates

Strike Price Considerations:

- At-the-Money (ATM): Offers the most immediate protection or income but comes at a higher cost (for puts) or more limited upside (for calls).

- Out-of-the-Money (OTM): Costs less for puts and limits your upside less for calls, but provides less direct protection.

- In-the-Money (ITM): More expensive and provides more immediate intrinsic value. Often used when you expect significant movement.

Expiration Date Considerations:

- Short-Term Options: Useful for earnings announcements or known market events. They are cheaper but require precise timing.

- Long-Term Options (LEAPS): Offers extended protection if you have a long investment horizon, though you’ll pay more in premiums.

Cost-Benefit Analysis of Hedging With Options

Pros:

- Risk Reduction: Options can limit losses during severe market downturns.

- Flexibility: A wide variety of strategies can be tailored to specific market views.

- Psychological Safety: With a hedge in place, you may invest more confidently and avoid panic selling.

Cons:

- Premium Costs: Option premiums aren’t free. The cost of “insurance” may eat into your returns over time.

- Limited Upside (in Some Strategies): Strategies like covered calls and collars can cap potential gains.

- Complexity: Understanding and properly implementing options strategies requires study and practice.

Practical Tips for Implementing an Options Hedge

- Start Small: Begin with a single stock or a small portion of your portfolio. Gain experience before scaling up.

- Use Liquid Underlyings: Choose stocks or ETFs with high trading volume and tight bid-ask spreads to minimize costs.

- Avoid Over-Hedging: Too much hedging can erode returns. Strive for balance: protect against large, catastrophic losses rather than every minor dip.

- Monitor Your Positions: Options have expiration dates and constantly changing market conditions. Keep a close eye on your hedges and adjust as needed.

- Consult a Professional if Needed: If you’re new to options, consider working with a financial advisor or taking a reputable options course.

Real-World Example: Hedging a Tech Portfolio

Scenario: You hold a diversified portfolio of tech stocks, including Apple, Microsoft, and Tesla. You’re concerned about a short-term downturn due to regulatory changes and rising interest rates affecting tech valuations.

Possible Hedge:

- Buy an ETF Put: Instead of buying puts for each stock, you could purchase a put option on a tech-focused index ETF (such as the Invesco QQQ, which tracks the Nasdaq-100). If tech stocks fall, the put option on QQQ will gain value, offsetting some of your portfolio’s losses.

- Implement a Collar on Your Largest Position: For the largest single stock holding, say Apple, consider setting up a collar. Buy a put below the current price and sell a call above it, aiming to neutralize your cost. This ensures some downside protection at a minimal net out-of-pocket expense.

This example demonstrates how hedging can be tailored to both broad market exposures (through ETF options) and individual stocks (through collars and protective puts).

When to Exit a Hedge

Hedging isn’t meant to be a permanent state. Review your hedges periodically and decide when to close them:

- Market Stabilization: If the market risk you were worried about dissipates, you might remove or adjust the hedge.

- Approaching Expiration: As expiration nears, decide whether to roll the hedge into a new option contract or let it expire.

- Shift in Market Outlook: If your outlook changes—from bearish to bullish or vice versa—reassess whether the hedge still aligns with your goals.

Final Thoughts: Becoming a Pro at Options Hedging

Hedging with options is like adding a layer of insulation to your investment house. It won’t eliminate all the cold drafts of market downturns, but it can keep your portfolio a lot more comfortable through the storms. By thoroughly understanding basic concepts, experimenting with common strategies like protective puts, covered calls, and collars, and carefully selecting strike prices and expiration dates, you can significantly enhance your risk management toolkit.

Remember that hedging comes at a cost—there is no free lunch in the markets. The key is to find the right balance and to use options hedges when they add value, not just because they are available. Over time, as you gain experience and fine-tune your approach, you’ll feel more confident navigating through both bull and bear markets, protecting your portfolio like a true professional.