Options trading offers a flexible and strategic approach to the financial markets. Among advanced strategies, Iron Condors and Butterfly Spreads stand out as popular choices for traders aiming to profit from market conditions with controlled risk. These strategies can seem complex at first but are straightforward once broken down. This article provides an in-depth explanation of Iron Condors and Butterflies, covering their mechanics, potential risks, rewards, and the ideal market conditions for their application.

What Are Advanced Options Strategies?

Advanced options strategies involve combining multiple option positions to create specific risk/reward profiles. Unlike basic strategies like buying calls or puts, these advanced techniques use a mix of options to:

- Limit potential losses.

- Capitalize on specific market conditions.

- Create complex payoff structures.

Two such strategies—Iron Condors and Butterflies—are widely used by seasoned traders to profit from periods of low volatility or to position for specific price ranges.

Iron Condor Strategy

What Is an Iron Condor?

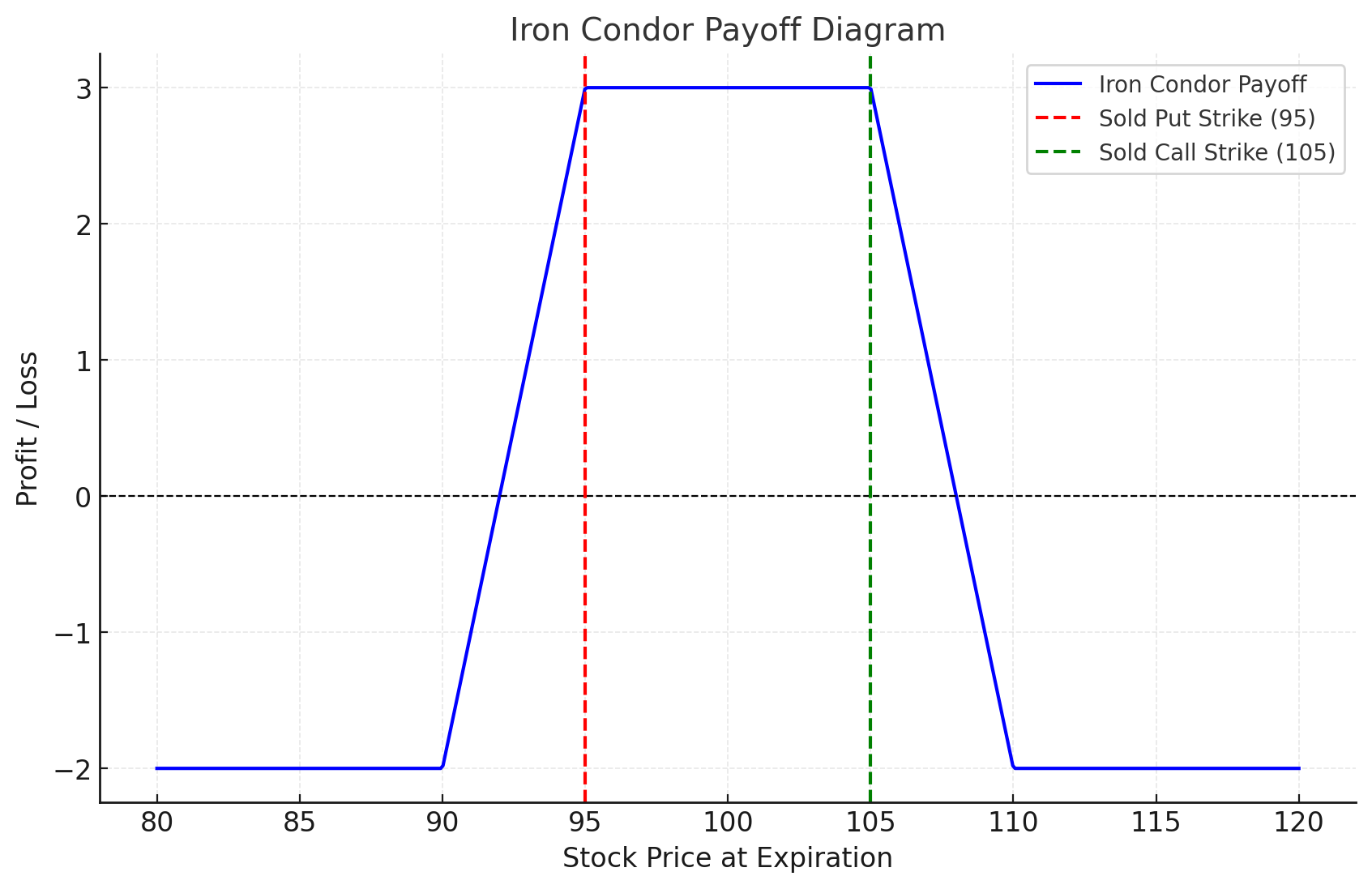

The Iron Condor is a neutral options strategy that profits when the underlying asset remains within a specific price range. It involves creating two credit spreads: a bull put spread and a bear call spread.

Structure of an Iron Condor:

- Sell one out-of-the-money (OTM) put.

- Buy one further out-of-the-money put.

- Sell one out-of-the-money call.

- Buy one further out-of-the-money call.

This setup creates a range-bound strategy with defined maximum risk and reward.

How It Works:

- The trader collects a net credit (premium) when setting up the Iron Condor.

- The profit comes if the underlying asset’s price stays within the range defined by the strikes of the sold options.

- Losses occur if the price moves significantly above or below the strike prices of the bought options.

When to Use an Iron Condor:

- Market Conditions: Ideal for markets with low volatility.

- Expected Movement: The underlying asset is expected to stay within a specific range during the option’s lifespan.

Example:

Suppose the stock is trading at $100. You could construct an Iron Condor as follows:

- Sell a 95 Put and Buy a 90 Put (bull put spread).

- Sell a 105 Call and Buy a 110 Call (bear call spread).

If the stock remains between $95 and $105, the strategy yields a profit equal to the net premium received.

Pros and Cons of Iron Condors:

Pros:

- Limited risk and reward.

- Suitable for range-bound markets.

- Generates income through premiums.

Cons:

- Requires precise market predictions.

- High risk of loss if the market moves significantly.

Butterfly Spread Strategy

What Is a Butterfly Spread?

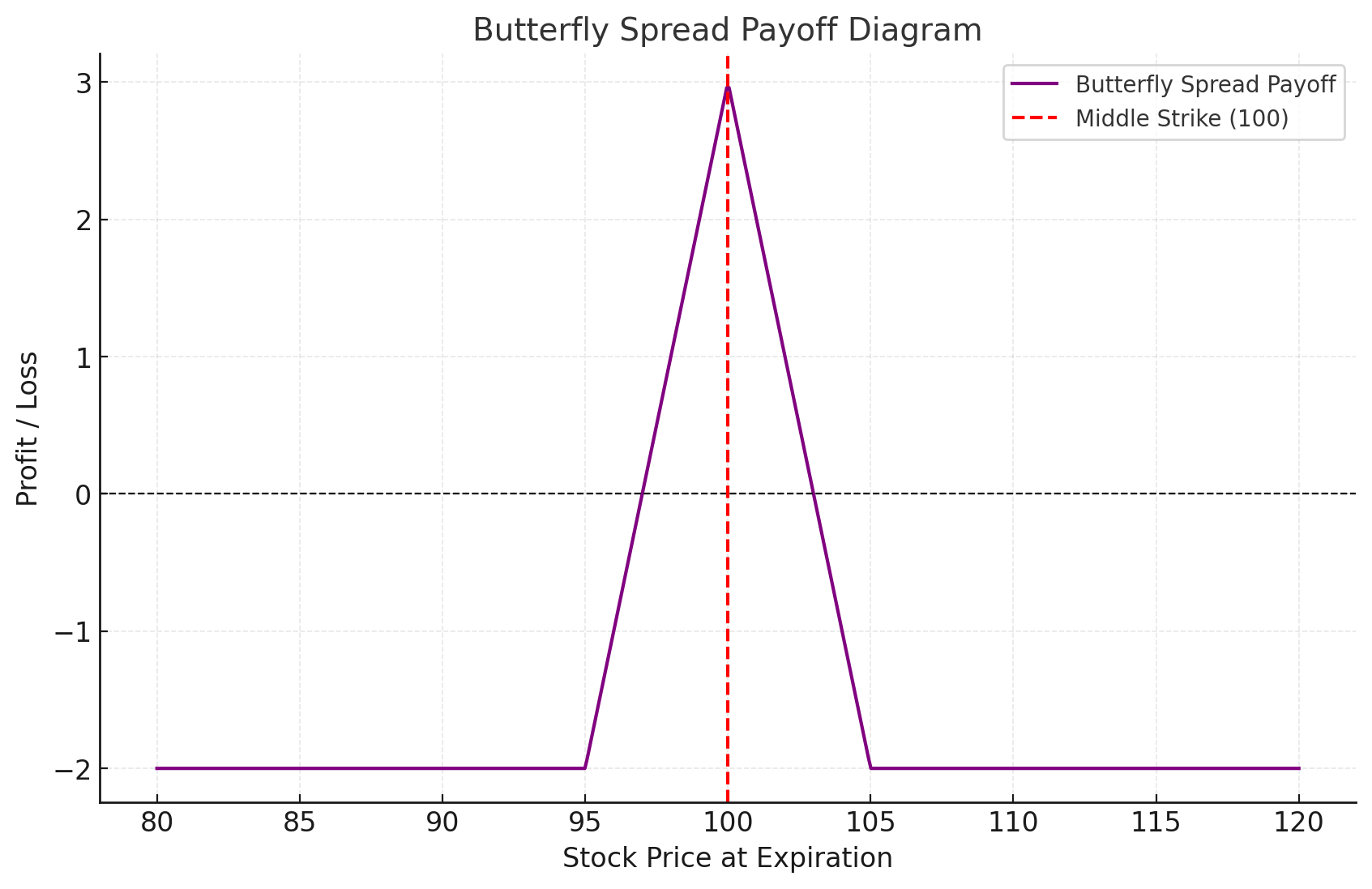

The Butterfly Spread is another advanced strategy, designed to profit from low volatility, with a focus on a narrow price range for the underlying asset.

Structure of a Butterfly Spread:

A long call butterfly spread involves:

- Buy one in-the-money (ITM) call.

- Sell two at-the-money (ATM) calls.

- Buy one out-of-the-money (OTM) call.

Alternatively, a long put butterfly spread can be used with similar mechanics, but with puts.

How It Works:

- The maximum profit occurs if the underlying asset’s price is at the ATM strike price at expiration.

- Losses occur if the price moves significantly away from the central strike price.

When to Use a Butterfly Spread:

- Market Conditions: Ideal for low-volatility environments.

- Expected Movement: The underlying asset is expected to stay close to the central strike price.

Example:

Suppose the stock is trading at $100. You could construct a Butterfly Spread as follows:

- Buy a 95 Call and Buy a 105 Call.

- Sell two 100 Calls.

If the stock closes at $100 at expiration, the strategy yields the maximum profit.

Variations of Butterfly Spreads:

- Iron Butterfly: Combines selling an ATM straddle with buying OTM options for protection.

- Broken-Wing Butterfly: Adjusts the distance between the strikes to reduce risk or cost.

Pros and Cons of Butterfly Spreads:

Pros:

- High reward-to-risk ratio.

- Low upfront cost.

- Suitable for precise price targets.

Cons:

- Limited profitability range.

- Requires accurate predictions of the underlying asset’s price.

Key Differences Between Iron Condors and Butterfly Spreads

| Feature | Iron Condor | Butterfly Spread |

|---|---|---|

| Structure | Combines two credit spreads | Combines a debit spread |

| Profitability Range | Broader | Narrower |

| Market View | Neutral/range-bound | Very low volatility |

| Risk/Reward Profile | Moderate reward, limited risk | High reward, limited risk |

Step-by-Step Guide to Setting Up These Strategies

Setting Up an Iron Condor:

- Analyze the asset’s volatility and price range.

- Choose strike prices for the OTM puts and calls.

- Sell the closer strike options and buy the farther strikes.

- Calculate the net credit and ensure the risk/reward ratio aligns with your trading plan.

Setting Up a Butterfly Spread:

- Identify a central strike price where the asset is expected to trade.

- Buy one ITM and one OTM option.

- Sell two ATM options at the central strike.

- Evaluate the net debit and potential profit.

Risk Management for Advanced Strategies

Both strategies involve controlled risk, but traders should:

- Monitor Position Delta: Ensure your portfolio is balanced.

- Set Stop-Loss Levels: Protect against unexpected market movements.

- Adjust as Needed: Consider rolling or closing positions if the market moves against you.

Tools and Resources for Traders

- Options Calculators: Use tools to calculate potential profits and losses.

- Implied Volatility Analysis: Helps identify low-volatility conditions.

- Trading Platforms: Advanced platforms like Thinkorswim or Tastyworks support multi-leg strategies.

Final Thoughts

Iron Condors and Butterfly Spreads are powerful tools in an options trader’s arsenal, offering opportunities to profit in low-volatility environments. However, success depends on careful planning, accurate market predictions, and diligent risk management. By mastering these strategies, traders can unlock new avenues for consistent profits with limited downside.