Options trading offers a dynamic way to hedge investments, speculate on price movements, or enhance portfolio income. To master this complex financial instrument, understanding the Options Greeks—Delta, Gamma, Theta, and Vega—is crucial. These metrics provide traders with insights into how different factors affect the price of options.

In this article, we will break down each Greek, explain how they work, and explore their significance in options trading. Whether you’re a beginner or an experienced trader, this comprehensive guide will deepen your understanding of these essential tools.

What Are the Options Greeks?

The Options Greeks are mathematical measures that quantify the sensitivity of an option’s price to various factors, such as changes in the underlying asset’s price, time decay, and market volatility. The Greeks help traders make informed decisions by predicting how an option’s value will change under different scenarios.

The primary Greeks are:

- Delta: Measures sensitivity to price changes in the underlying asset.

- Gamma: Measures the rate of change of Delta.

- Theta: Measures the impact of time decay.

- Vega: Measures sensitivity to changes in volatility.

Each Greek provides unique insights into an option’s behavior. Let’s explore them in detail.

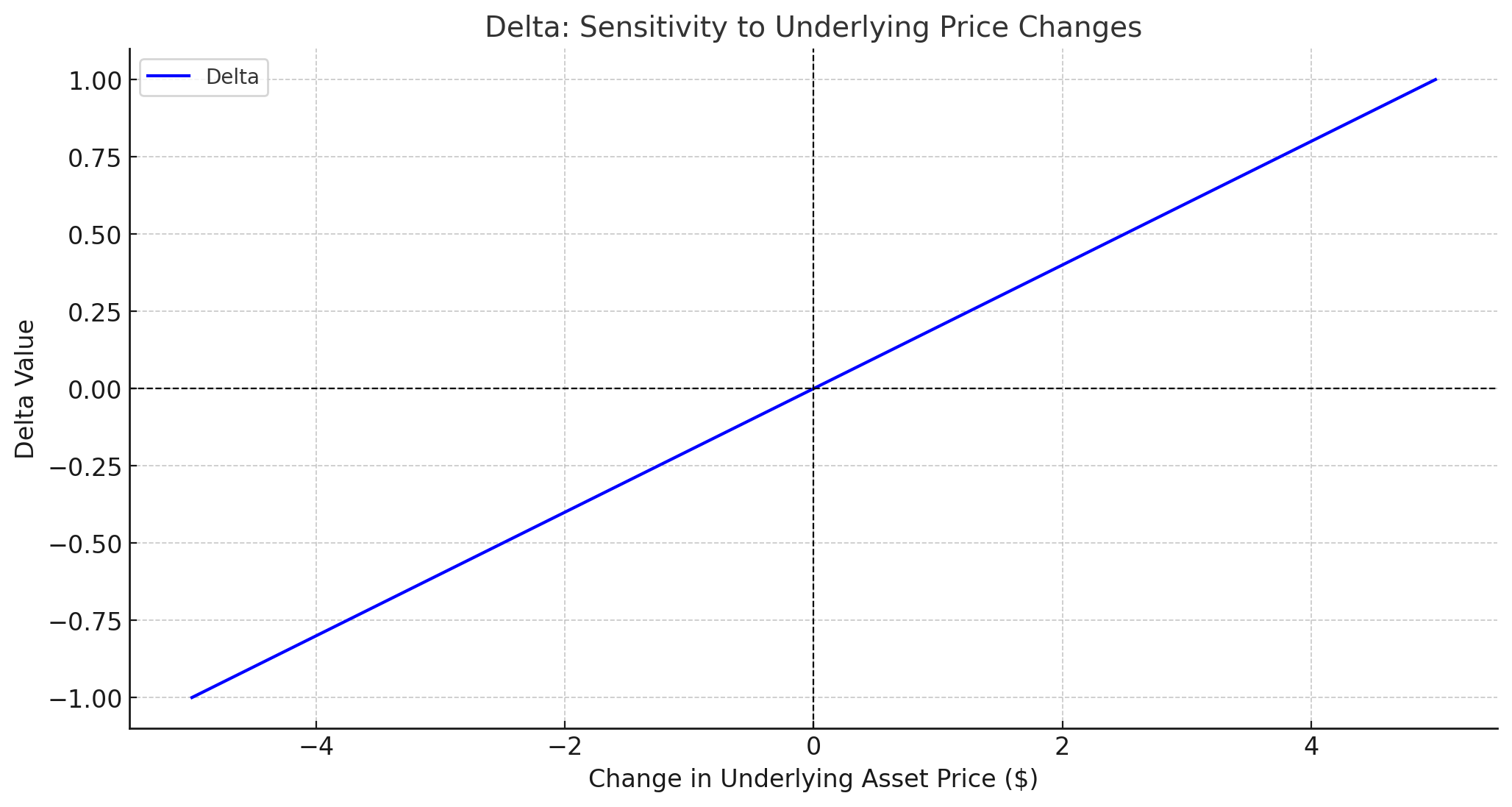

1. Delta: Sensitivity to Price Changes

What Is Delta?

Delta represents the rate of change in the price of an option relative to a $1 change in the underlying asset’s price. It ranges from -1 to 1 for options.

- Call Options: Delta ranges from 0 to 1.

- Put Options: Delta ranges from -1 to 0.

How to Interpret Delta

- Delta of 0.5: The option’s price is expected to change by $0.50 for every $1 change in the underlying asset.

- Delta of 1: Indicates a deep-in-the-money call option that moves nearly dollar-for-dollar with the underlying asset.

- Delta of -0.5: A put option’s price decreases by $0.50 for every $1 increase in the underlying asset.

Key Uses of Delta

- Directional Trading: Delta shows the probability of an option expiring in the money.

- Hedging: Delta helps traders hedge their positions. For example, if a portfolio has a Delta of 100, it behaves like owning 100 shares of the underlying asset.

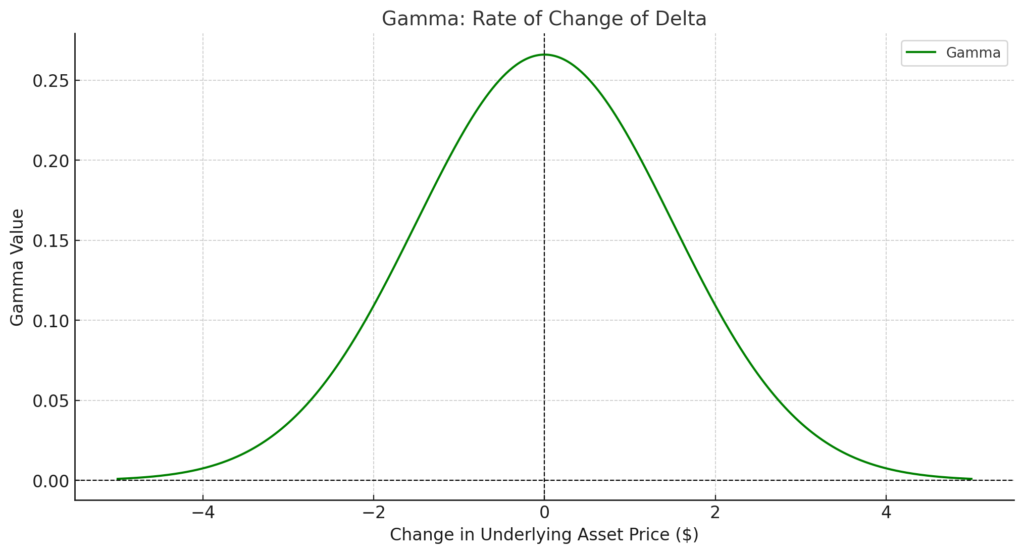

2. Gamma: The Rate of Delta’s Change

What Is Gamma?

Gamma measures the rate of change of Delta as the underlying asset’s price changes. It indicates how stable Delta is for an option.

How to Interpret Gamma

- High Gamma: Indicates that Delta is more sensitive to price changes.

- Low Gamma: Delta changes slowly as the underlying price changes.

Key Uses of Gamma

- Risk Management: High Gamma options require careful monitoring as Delta can shift rapidly.

- Neutralizing Positions: Traders use Gamma to adjust their Delta-neutral positions to maintain balance as the underlying price moves.

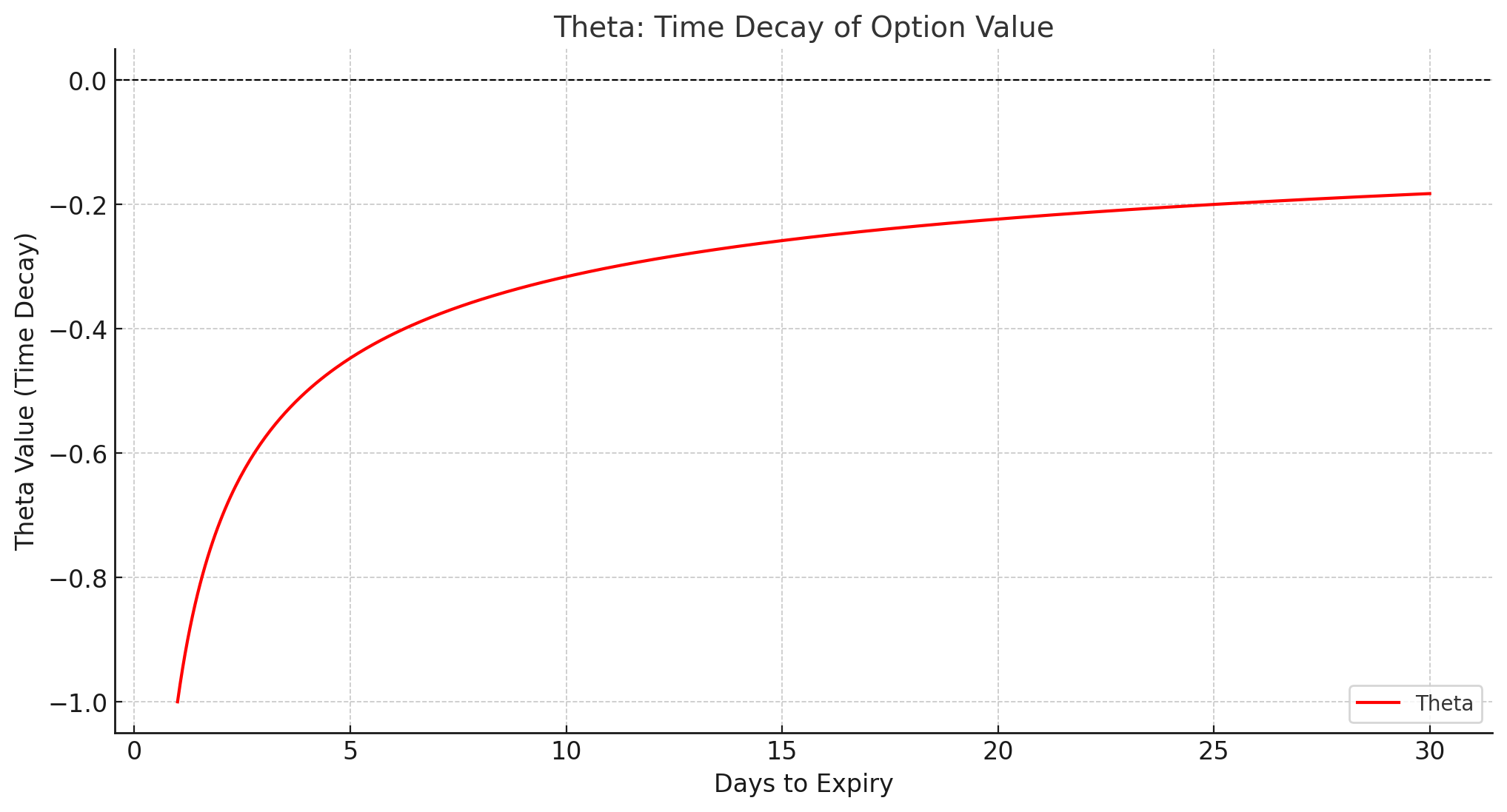

3. Theta: Time Decay

What Is Theta?

Theta quantifies the rate of decline in an option’s price due to the passage of time, assuming other factors remain constant. It is also known as time decay.

How to Interpret Theta

- Negative Theta: For most options, Theta is negative because the value of options decreases as expiration approaches.

- Positive Theta: Rare for buyers but common for options sellers who benefit from time decay.

Key Uses of Theta

- Short-Term Trading: Options with high Theta lose value faster, making them suitable for sellers.

- Strategic Planning: Theta helps traders choose expiration dates based on their market outlook.

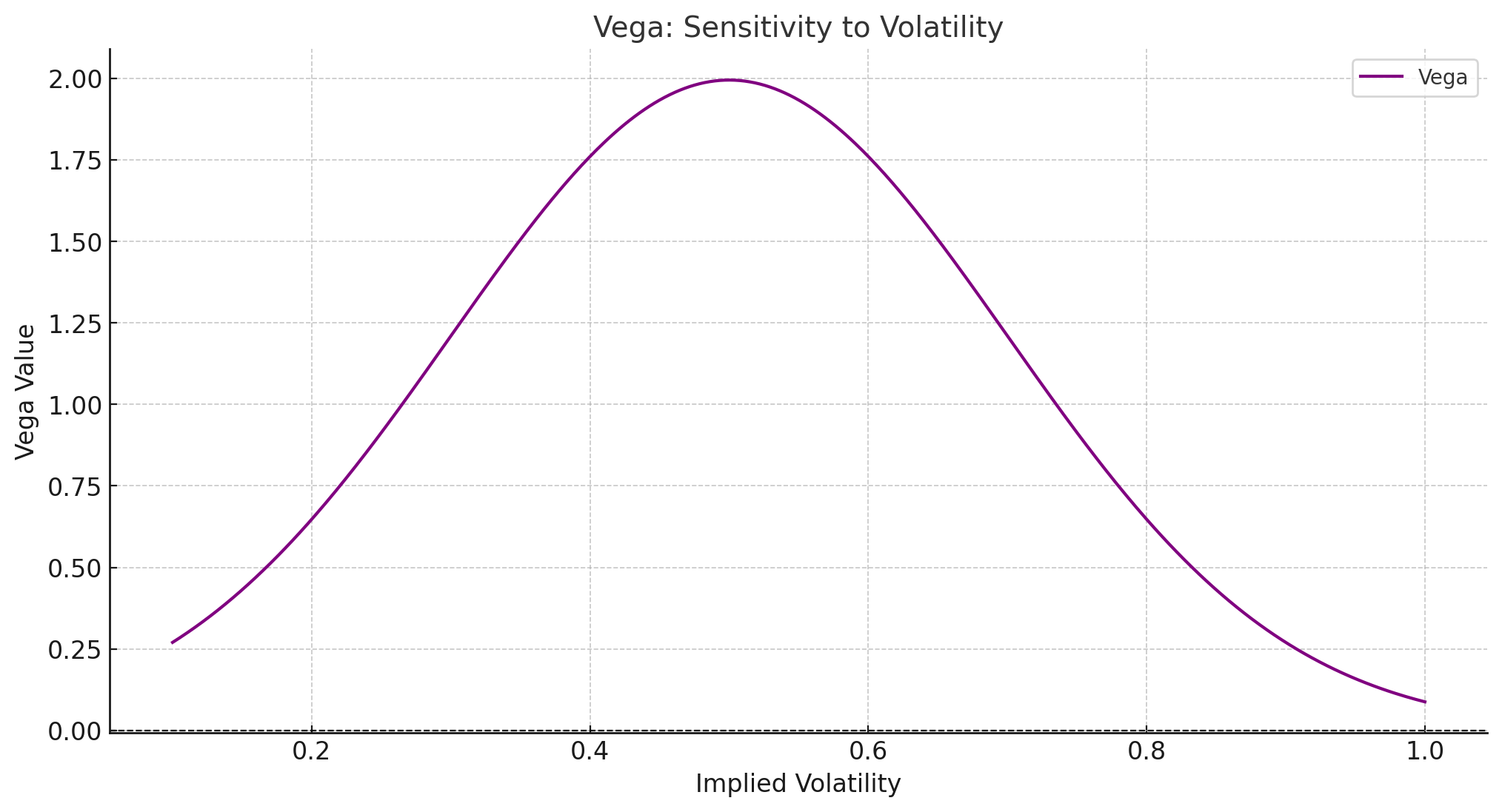

4. Vega: Sensitivity to Volatility

What Is Vega?

Vega measures an option’s sensitivity to changes in the implied volatility of the underlying asset. Higher volatility typically increases an option’s price.

How to Interpret Vega

- High Vega: Indicates that the option’s price is highly sensitive to volatility changes.

- Low Vega: The option is less affected by volatility.

Key Uses of Vega

- Volatility Trading: Traders use Vega to take advantage of changes in market volatility.

- Earnings Plays: High Vega is common before earnings announcements when implied volatility increases.

Practical Applications of the Greeks

Using Greeks Together

The Greeks don’t operate in isolation; traders often use them together to create well-rounded strategies. For example:

- Delta and Gamma: Used for managing directional risk.

- Theta and Vega: Help traders balance the effects of time decay and volatility.

Real-World Example

Imagine a trader buys a call option with a Delta of 0.5, Gamma of 0.02, Theta of -0.03, and Vega of 0.15:

- If the underlying asset’s price rises by $1, the option’s price increases by $0.50 (Delta).

- As the price rises, Delta increases, boosted by Gamma.

- Each passing day reduces the option’s value by $0.03 (Theta).

- If volatility rises by 1%, the option’s value increases by $0.15 (Vega).

Advanced Topics

Greek Neutral Strategies

- Delta-Neutral: Combines options and the underlying asset to neutralize directional risk.

- Gamma Scalping: Adjusting positions to profit from changes in Gamma.

- Vega Plays: Strategies focused on exploiting volatility changes.

Common Pitfalls

- Ignoring Gamma: Can lead to significant unexpected losses.

- Misusing Theta: Failing to account for time decay can erode profits.

- Overestimating Vega: Volatility changes can be unpredictable.

Conclusion

Mastering the Options Greeks—Delta, Gamma, Theta, and Vega—is essential for any serious options trader. These metrics provide a comprehensive framework for understanding how options prices react to various factors, enabling traders to optimize their strategies and manage risks effectively.

By incorporating the Greeks into your trading toolbox, you can make informed decisions, anticipate market movements, and build robust trading strategies.

If you’re new to options trading, start by understanding Delta and Theta, then gradually expand to Gamma and Vega as you gain experience. With consistent practice and analysis, you’ll be better equipped to navigate the complexities of the options market.

FAQs

1. Can the Greeks predict the exact movement of an option’s price?

No, the Greeks are estimates based on models like Black-Scholes and can change as market conditions evolve.

2. Why is Vega important for earnings trades?

Earnings announcements often lead to volatility spikes, significantly impacting options prices. Vega quantifies this sensitivity.

3. Are the Greeks applicable to all types of options?

Yes, the Greeks apply to all options, including equity, index, and futures options.

4. How do I minimize Theta decay?

Theta decay is unavoidable for buyers. To minimize its impact, choose longer expiration dates or consider selling options.

5. What tools can I use to calculate the Greeks?

Most brokerage platforms provide built-in tools to calculate Greeks. Additionally, you can use financial software like ThinkorSwim, MetaTrader, or Python libraries for more advanced calculations.