When it comes to the world of financial markets, few instruments capture both the allure of high profit potential and the risk of rapid losses quite like options. Options have grown increasingly popular among traders and investors for their unique characteristics—particularly their ability to provide leverage, hedging capabilities, and highly flexible trade structures. Yet, not all options strategies are created equal. Many market participants use options for conservative purposes, such as hedging a portfolio. In contrast, some traders actively seek out the high-octane potential of speculative options strategies. These high-risk, high-reward approaches can generate massive gains, but they can also wipe out capital faster than many other forms of trading if not properly managed.

This article delves deep into the world of speculative options trading. We will explore what options are, the mechanics behind them, key concepts to understand before diving in, the types of strategies that can skyrocket your returns or vanish your principal, risk management considerations, and examples illustrating how these strategies play out in the real world. By the end, you should have a comprehensive understanding of the potential rewards—and pitfalls—of speculating with options.

What Are Options?

Options are derivatives—financial instruments whose value is tied to the price of an underlying asset, such as stocks, ETFs, indexes, or commodities. Each option contract grants the holder the right (but not the obligation) to buy or sell the underlying asset at a specified strike price before a set expiration date.

There are two primary types of options:

- Call Options: A call option gives the buyer the right to purchase the underlying asset at the strike price. Traders often buy call options when they believe the underlying asset will increase in value.

- Put Options: A put option grants the buyer the right to sell the underlying asset at the strike price. Traders typically buy put options when they believe the underlying asset will decrease in value.

By themselves, options can provide asymmetric returns. This means that the buyer of an option can profit dramatically if the underlying asset moves favorably, but the loss is capped at the premium paid for the option. However, when you engage in more complex, speculative strategies—like selling options without coverage, employing spreads, or combining options with other derivatives—the risk/reward profile shifts dramatically.

Understanding Speculation vs Investing

Before diving deeper, it’s crucial to distinguish between speculation and investing. While both concepts aim to profit from financial markets, their fundamental philosophies differ:

- Investing: Investors usually seek steady, long-term growth, focusing on the fundamentals of companies, stable income streams, or broad market appreciation. They tend to use options for reducing risk—such as buying protective puts to hedge portfolio downside risk.

- Speculation: Speculators, on the other hand, aim to profit from price movements that may occur in the short term. They often rely on technical analysis, market sentiment, volatility bets, and event-driven catalysts. Speculating with options can mean taking on positions that have limited probability of profit but offer incredibly high payouts if those low-probability scenarios occur.

Understanding the difference helps clarify that speculative option strategies typically come with higher risk, require more active management, and often are not suitable for long-term wealth preservation. They are best reserved for traders who can afford the potential loss of all capital allocated to these bets.

Key Concepts to Understand Before Speculating

1. Leverage

Options provide leverage, allowing traders to control a large amount of the underlying asset with a relatively small amount of capital. For example, one standard options contract typically represents 100 shares of the underlying stock. If a stock trades at $100, buying 100 shares outright would cost $10,000. But buying a single call option might only cost a few hundred dollars depending on the option’s strike price and expiration date. This leverage can magnify gains, but it also magnifies losses. If the trade goes against you, you can lose your entire investment quickly.

2. Time Decay (Theta)

Options are wasting assets. As time passes, the value of an out-of-the-money option erodes. Time decay (theta) means the option buyer is fighting the clock. Even if the underlying stock price remains unchanged, the value of a bought option may decrease daily. Speculators must have a solid grasp of how time decay works to time their entries and exits effectively.

3. Volatility (Vega)

Volatility heavily influences option prices. High volatility often increases option premiums, as the probability of large price moves grows. Conversely, low volatility usually depresses option premiums. Volatility can be implied or historical, and speculators often thrive on predicting volatility changes. Understanding volatility’s impact on option pricing is essential, as a correct view on volatility can make or break a speculative option trade.

4. Delta and Directional Bias

Delta measures how much an option’s price changes with a $1 move in the underlying asset. A deep-in-the-money call might have a delta close to 1, meaning it behaves almost like the underlying stock. An out-of-the-money call might have a delta of 0.2, meaning it will gain or lose much less per $1 move in the stock. For speculators, selecting options with the right delta profile is key, as it dictates how sensitive their position is to the underlying’s price movements.

5. Risk Tolerance and Position Sizing

Speculative option traders must have a clear understanding of their risk tolerance. They should never risk more capital than they can afford to lose. Position sizing—allocating the right amount of money to each trade—is critical. A single trade should not be so large that a loss could significantly damage the trader’s overall portfolio.

High-Risk, High-Reward Options Strategies

When traders think about “high-risk, high-reward” in options, they often envision strategies that capitalize on big market swings or specific events. These strategies come with the possibility of fast and substantial gains, but can also result in swift losses.

1. Long Out-of-the-Money Calls or Puts

One of the simplest high-risk strategies is buying out-of-the-money (OTM) calls or puts. Because OTM options have no intrinsic value, they are cheaper than at-the-money or in-the-money options. This low cost means small changes in the underlying stock price can generate substantial percentage returns if the option moves into the money.

Why High-Risk/High-Reward?

- Reward: If a stock currently trading at $100 surges to $120, an OTM call option with a strike of $110 purchased for $2 could become worth more than $10, a 400% gain or more.

- Risk: If the stock doesn’t move as anticipated or lingers sideways, the option can expire worthless, resulting in a 100% loss on the premium paid.

When to Consider:

- When anticipating a major catalyst, such as earnings announcements, product launches, FDA approvals for biotech companies, or macroeconomic reports that might cause big price swings.

- As a lottery-ticket type trade with a small portion of risk capital.

Example:

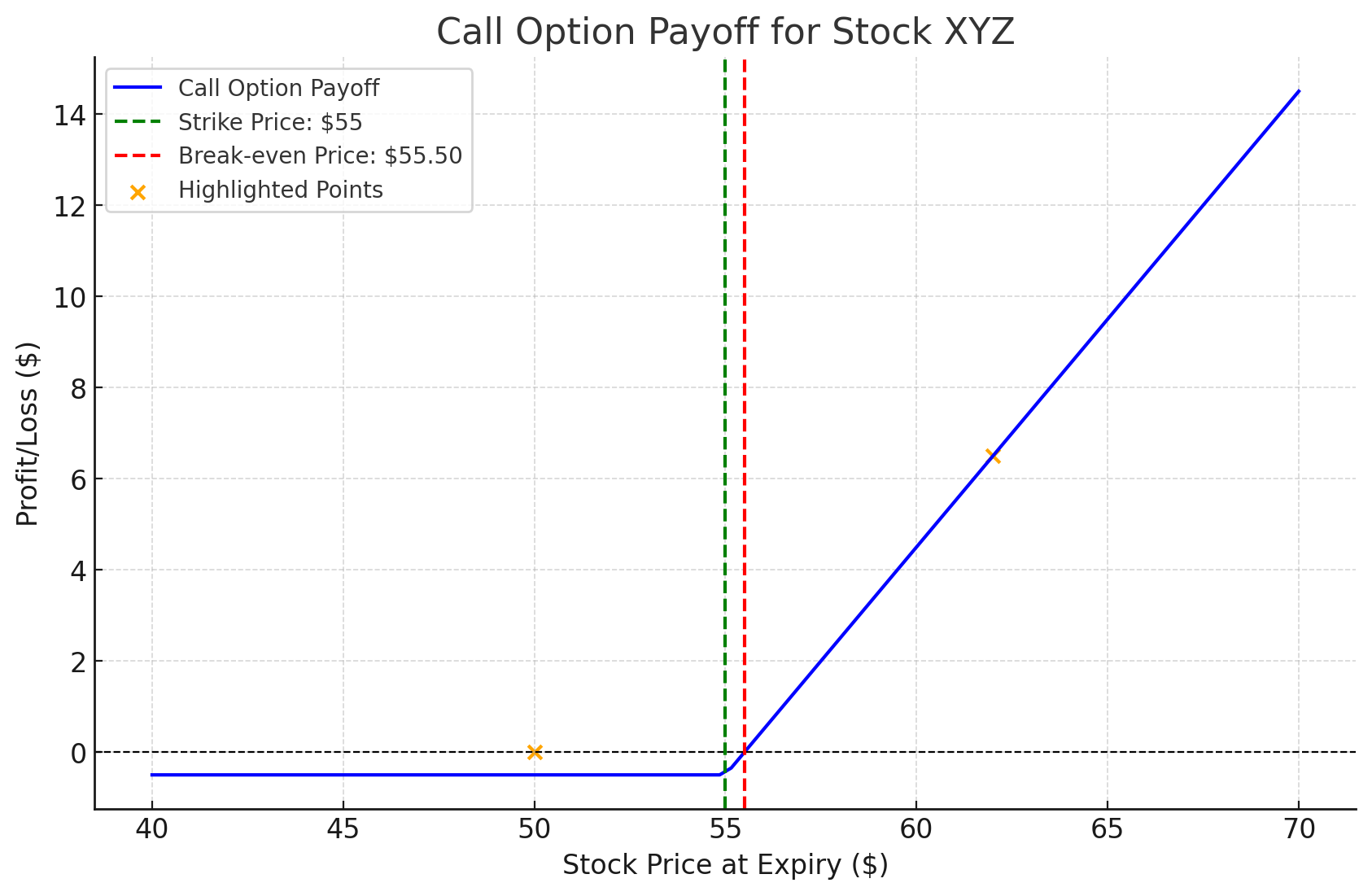

Imagine stock XYZ is at $50. A speculative trader thinks XYZ will jump to at least $60 within a month due to a new product release. The trader buys a 1-month $55 strike call for $0.50 per contract. If XYZ moves to $62 before expiration, the call might be worth $7 (since it’s now $7 in-the-money), generating a massive return on the initial $0.50. Conversely, if XYZ stagnates around $50, the option expires worthless.

2. Naked Option Selling (Short Calls or Puts)

Selling options without owning the underlying asset is known as writing “naked” options. Naked call selling involves selling a call option without owning the underlying stock. Naked put selling involves selling a put without having cash earmarked to buy the stock. These strategies are considered extremely risky because losses can be theoretically unlimited (in the case of naked calls) or very large (for naked puts).

Why High-Risk/High-Reward?

- Reward: The option seller collects a premium upfront, and if the option expires worthless, that premium is pure profit. With high volatility or distant expiration dates, premiums can be sizable.

- Risk: A short naked call can produce unlimited losses if the underlying stock skyrockets, as the seller might have to buy shares at a much higher price to fulfill the contract. A short naked put can result in large losses if the underlying stock plummets, forcing the seller to buy shares at a significantly above-market strike price.

When to Consider:

- Generally not recommended for inexperienced traders.

- Suitable only if a trader has a very strong directional bias and can closely monitor the position.

- Typically used by sophisticated speculators who can quickly adjust their positions or have deep pockets to handle margin calls.

Example:

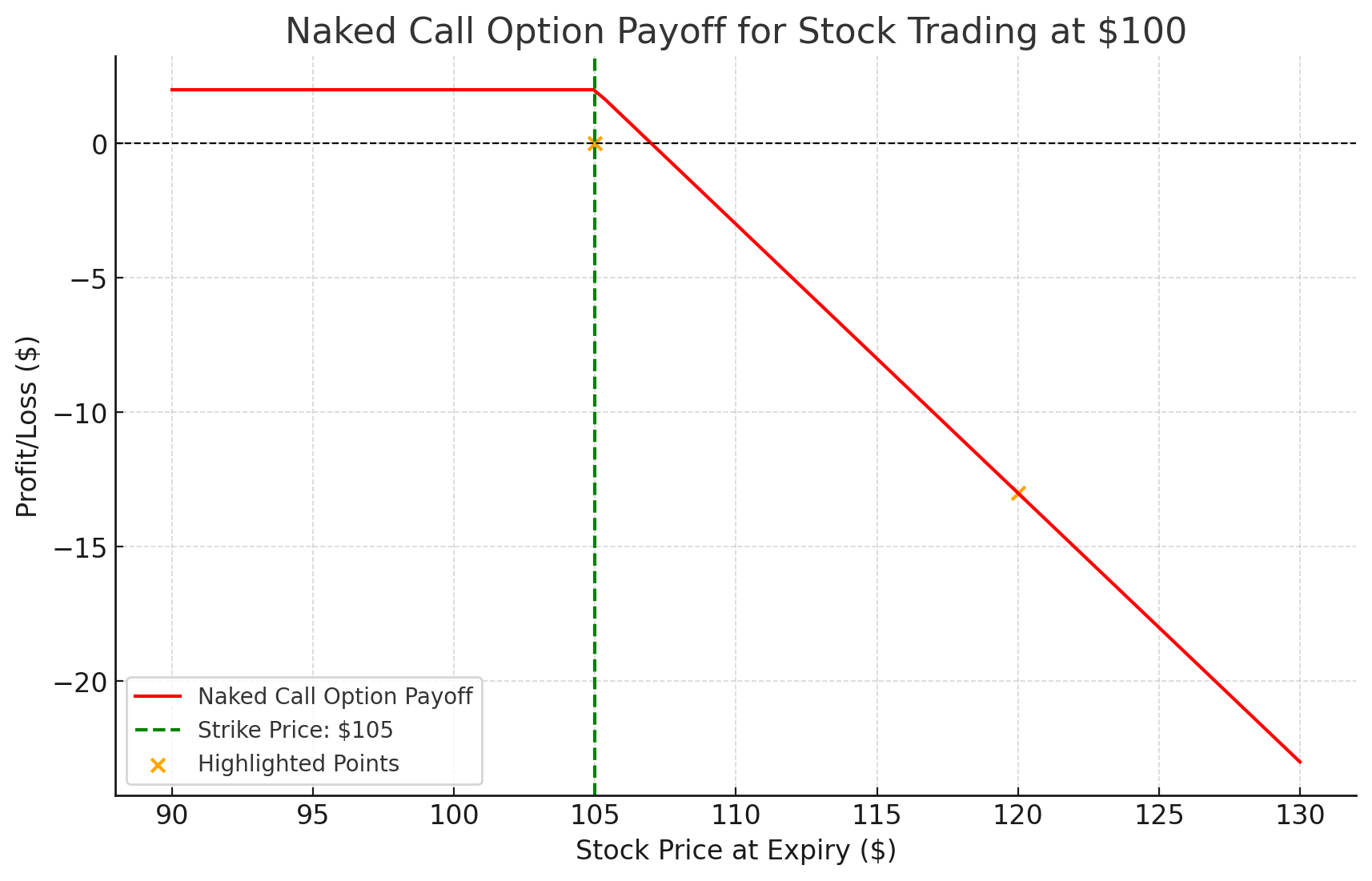

A trader believes a stock currently trading at $100 will stay below $105 for the next month. The trader sells a $105 call option naked for a $2 premium. If the stock stays at or below $105 by expiration, the trader keeps the $2 premium per contract. If the stock soars to $120, the trader faces a substantial loss, potentially having to buy at $120 and sell at $105, a $15 loss per share minus the $2 initial premium.

3. Long Straddles and Strangles (Volatility Plays)

A long straddle involves buying both a call and a put at the same strike price and expiration date. A long strangle is similar, but the call and put options have different strike prices. Both strategies aim to profit from a large movement in either direction. They are volatility plays—the trader doesn’t care which way the market moves, only that it moves far enough.

Why High-Risk/High-Reward?

- Reward: If the underlying asset makes a significant price move—either up or down—the combined position can yield substantial profits.

- Risk: If the underlying asset remains range-bound and fails to move, both options can lose value simultaneously, resulting in a double loss scenario.

When to Consider:

- Before earnings reports, economic announcements, or events likely to increase volatility.

- When expecting a market shock or large unpredictable moves.

Example:

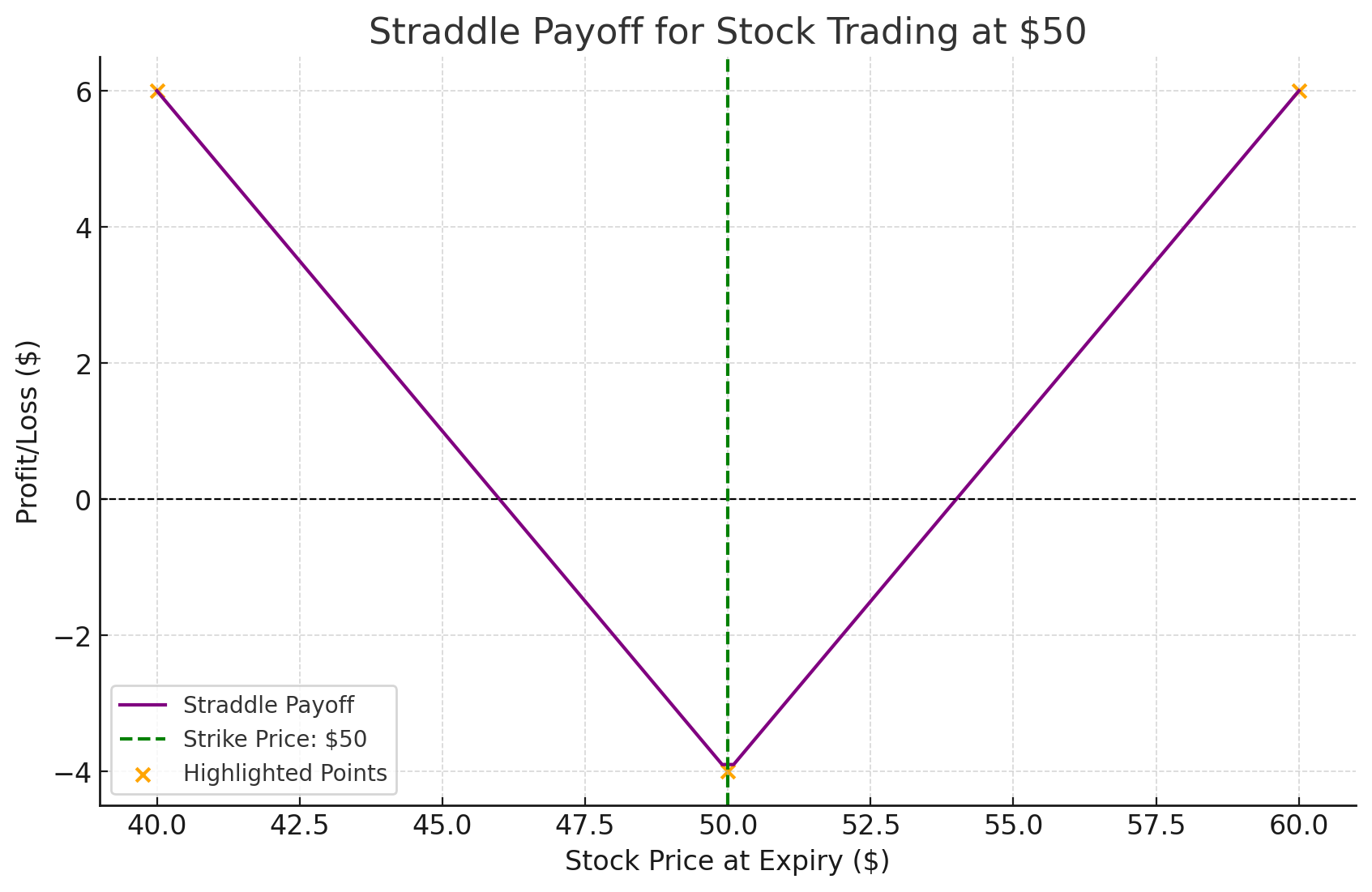

A stock trades at $50. You buy a $50 call for $2 and a $50 put for $2, spending a total of $4. If the stock jumps to $60, the call might rise to $10, while the put becomes almost worthless. You net $6 profit ($10 from the call minus $4 initial cost). If the stock falls to $40, the put might jump to $10, delivering a similar profit. If the stock stays near $50, both options decay, and the $4 initial outlay likely goes to zero.

4. Ratio Spreads and Backspreads

Ratio spreads involve selling multiple options at one strike for every single option purchased at another strike. A backspread is a type of ratio spread that gives a net long or short position in volatility. These are more complex strategies that can produce asymmetrical payoff profiles, allowing for unlimited profit potential on one side and controlled risk on the other—if structured properly.

Why High-Risk/High-Reward?

- Reward: Certain ratio spreads and backspreads can be set up for a small credit or debit, offering a chance at large gains if the underlying makes a significant move.

- Risk: If the market doesn’t move as expected, the position might end up losing at expiration, and the complexity of these strategies can lead to unexpected outcomes if not managed properly.

When to Consider:

- By experienced options traders familiar with the Greeks and payoff diagrams.

- When looking for a trade that can handle different market conditions but still has strong upside potential if the move predicted occurs.

Example:

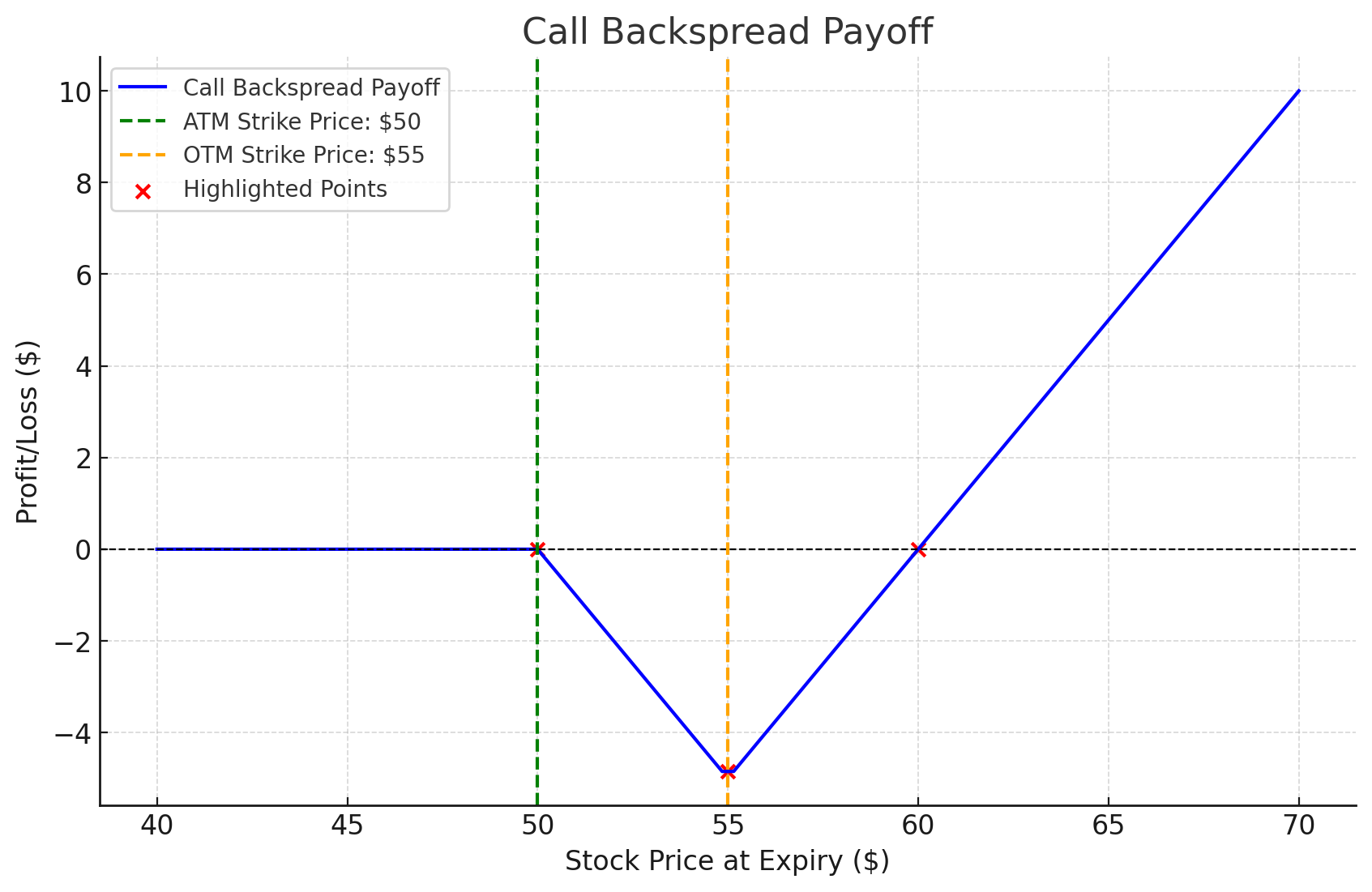

A call backspread involves selling one at-the-money call and buying two out-of-the-money calls. If the underlying surges, the two OTM calls can become very valuable, while the short call’s loss is offset by the long calls. If the stock languishes, you might lose the initial debit paid.

Risk Management in Speculative Options Trading

Speculative trading requires a rigorous approach to risk management. Without strict risk parameters, even the most promising trade can quickly turn catastrophic.

- Position Sizing:

Only allocate a small portion of your capital—perhaps 1-5% per trade—to high-risk options strategies. This ensures that a complete loss on one trade does not significantly damage your portfolio. - Use Stop-Loss Orders (Where Possible):

While not all options trades lend themselves to stop-loss orders due to liquidity and price gaps, having a mental or hard stop level is crucial. If the trade moves against you, it’s often better to accept a partial loss rather than hoping for a miracle comeback. - Time Horizons and Patience:

Speculative trades often require timing around a particular event. If the anticipated event (e.g., earnings, product launch) passes without the expected market reaction, consider exiting the position promptly to avoid further time decay and capital erosion. - Diversification of Strategies:

Don’t rely solely on a single type of speculation. Diversify your approaches. For example, combine long OTM calls on one stock with a long straddle on another. Not all trades will work, but diversification can help balance the overall risk. - Hedging and Adjustments:

Advanced traders can adjust positions to manage risk. For instance, if a long straddle is losing because the market isn’t moving enough, consider selling a vertical spread to collect premium and reduce the net cost. Proactive management can turn a losing trade into a breakeven or reduced-loss scenario.

Psychological Considerations of High-Risk Trading

Speculative trading isn’t just a numbers game—it’s also about mindset. Fear and greed dominate when big money can be made or lost in short order.

- Expect Volatility in Emotions: Prepare for stomach-churning swings in your account value. Emotional stability helps you make rational decisions instead of impulsive reactions.

- Accepting Total Losses: Speculative option trades can easily go to zero. Accept this possibility upfront. Knowing you can lose every penny you commit to the trade makes it easier to manage emotional stress.

- Focus on Process, Not Just Outcome: Even if a trade loses money, review the process. Did you follow your rules? Was your analysis solid, but the market unpredictable? Successful speculation involves continuous learning, not just short-term wins.

Real-World Example

Consider a high-profile technology company announcing earnings next week. The stock is at $200 and has a history of making large moves on earnings—sometimes up $20, sometimes down $20. A speculative trader believes volatility is underpriced by the market and sets up a long straddle by purchasing a $200 call for $5 and a $200 put for $5, a total cost of $10.

- Best-Case Scenario: The company announces blockbuster earnings, and the stock jumps to $220 overnight. The call might be worth $20 at expiration, while the put goes to zero. The total profit is $10 ($20 – $10 initial cost), a 100% gain.

- Alternate Scenario: The company’s earnings disappoint, and the stock falls to $180. The put becomes worth $20, and the call essentially expires worthless. The gain is still $10.

- Worst-Case Scenario: The stock barely moves, landing at $203 by expiration. The call might expire worth $3, and the put might expire worth $0. You get back $3 from your initial $10, losing $7. In this case, the expectation of a large move was not met, resulting in a significant loss.

This example shows how the high-risk strategy of a long straddle can deliver large gains if a significant move occurs, but also how it can fail if the event is a non-starter.

Final Thoughts

Speculating with options is akin to playing with fire: it can provide warmth and light, or it can burn you badly. The potential for astronomical returns exists, but so does the risk of total capital loss. High-risk, high-reward strategies like long OTM calls and puts, naked option selling, long straddles, and complex ratio spreads appeal to traders who have a clear market view, high risk tolerance, and a willingness to engage deeply with the mechanics of options pricing and volatility.

To become proficient in speculative options trading, start small and continuously educate yourself. Understand the Greeks, monitor volatility, and learn to manage time decay. Always keep risk management, position sizing, and emotional discipline at the forefront of your strategy. With careful planning and a realistic mindset, options speculation can be an exciting component of an active trading approach, potentially unlocking significant profits—if you are prepared to handle the inherent risks.