Wondering how to trade options for the first time? Trading options can seem intimidating at first glance, especially if you’ve never ventured beyond buying and selling stocks. Terms like “calls,” “puts,” “strike price,” and “expiration date” may appear overwhelming. However, with the right understanding and a systematic approach, options trading can become a valuable part of your overall investment strategy. This comprehensive guide will walk you through every step of the process—covering basic definitions, strategies, risk management, broker selection, and more. By the end of this article, you’ll have a clear picture of what it means to trade options for the first time and how to set yourself up for long-term success.

Table of Contents

What Are Options? An Introduction

Definition of an Option

An option is a contractual agreement that gives the buyer the right, but not the obligation, to buy or sell an underlying asset—such as a stock—at a specified price (called the strike price) on or before a certain date (the expiration date). Options are part of the derivatives market, meaning their value is derived from the performance of an underlying instrument (like a stock, ETF, index, commodity, or even cryptocurrency in some markets).

Calls and Puts

There are two main types of options: calls and puts. A call option gives you the right to buy the underlying asset at the strike price. A put option gives you the right to sell the underlying asset at the strike price. We’ll discuss these in greater detail in a later section, but understanding these concepts is crucial for any beginner.

Obligation vs Right

- The buyer of an option has a right (not an obligation) to buy or sell the underlying asset.

- The seller (or writer) of an option has an obligation to fulfill the contract if the buyer chooses to exercise the option.

Why Options Exist

Options started as a way for producers and buyers of commodities to hedge against price fluctuations. For instance, a farmer might buy put options on the grain market to secure a minimum selling price for their crops, while a bread manufacturer might buy call options to ensure they don’t exceed a certain buying price. Over time, this concept expanded into financial markets for stocks, bonds, and indexes, allowing investors to manage risk and speculate on price movements.

Modern Usage

Today, individual investors and institutional traders use options for a variety of purposes. Some common uses include:

- Hedging existing stock positions to minimize risk.

- Generating income by selling options (collecting premiums).

- Speculating on short-term price movements with less capital compared to buying shares outright.

Key Terms You Need to Know

A strong understanding of terminology is essential for successful options trading. Below are some of the most important terms:

- Premium

The price you pay or receive for an option contract. Premiums are quoted on a per-share basis. Since most options contracts in the U.S. cover 100 shares, you multiply the quoted price by 100 to determine the total amount you pay or receive. - Strike Price

The predetermined price at which the buyer of the option can exercise the right to buy (call) or sell (put) the underlying security. - Expiration Date

The date by which the option must be exercised if the buyer wants to exercise it. After this date, an unexercised option expires worthless. - Exercise

The act of invoking the right to buy or sell the underlying asset at the strike price. - Assignment

When the option buyer exercises the option, the seller of the option is “assigned” the obligation to deliver (for calls) or buy (for puts) the underlying asset at the strike price. - Underlying Asset

The financial instrument on which the option is based (e.g., a stock like Apple, an ETF like SPY, or an index like the S&P 500). - Intrinsic Value

The real value of an option if it were exercised immediately. For a call option, intrinsic value is calculated as max(0,Current Stock Price−Strike Price); for a put, it’s max(0,Strike Price−Current Stock Price). - Extrinsic Value (Time Value)

The part of an option’s price that exceeds its intrinsic value. It includes factors such as time until expiration, implied volatility, and market demand. - In the Money (ITM)

- Call Option: Current stock price is above the strike price.

- Put Option: Current stock price is below the strike price.

- At the Money (ATM)

The strike price is very close or equal to the current market price of the underlying asset. - Out of the Money (OTM)

- Call Option: Current stock price is below the strike price.

- Put Option: Current stock price is above the strike price.

Understanding these key terms will make the rest of your options trading journey more manageable. Whenever you encounter a new concept, refer back to these definitions to keep things clear.

Calls vs Puts: The Fundamentals

Call Options

- Definition: A call option gives the buyer the right to buy an underlying asset at the strike price before the contract expires.

- When to Use: Calls are typically purchased when a trader expects the underlying asset’s price to rise. By purchasing a call, you’re essentially betting that the stock’s price will be higher than the strike price by the time the option is exercised or expires.

- Profit Potential: Theoretically, there is unlimited upside. If the stock keeps rising, the value of your call increases.

- Example: If you buy one call option contract on Company XYZ with a strike price of $50, and the stock is trading at $60 at expiration, you can exercise the option to buy 100 shares at $50 each (for a total of $5,000). In reality, you could then sell those shares at $60 each (for a total of $6,000), netting a profit (minus the initial premium).

Put Options

- Definition: A put option gives the buyer the right to sell an underlying asset at the strike price before the contract expires.

- When to Use: Puts are typically purchased when a trader expects the underlying asset’s price to fall. By purchasing a put, you’re betting that the stock’s price will be lower than the strike price by the time the option is exercised or expires.

- Profit Potential: In theory, the maximum gain for a put option buyer is when the stock goes to zero.

- Example: If you buy one put option on Company ABC with a strike price of $50, and the stock is trading at $40 at expiration, you can exercise the option to sell 100 shares at $50 each (for a total of $5,000). If you buy those shares at the market price of $40 each (for $4,000), your profit (minus the premium) is $1,000.

American vs European Options

One subtle but important distinction in options trading is whether the contract is American-style or European-style. The difference hinges on when the buyer can exercise the option.

- American Options: Can be exercised anytime between the purchase date and the expiration date. Most equity options (options on individual stocks) traded on U.S. exchanges are American-style.

- European Options: Can only be exercised at the expiration date. Many index options (like those on the S&P 500) are European-style.

For most beginner retail traders, you’ll be dealing with American-style options, particularly if you’re trading single stocks. However, it’s always good to double-check, especially if you move into trading options on indexes or international stocks.

Why Trade Options? Advantages and Disadvantages

Before diving into the mechanics of placing your first trade, it’s wise to evaluate whether options trading makes sense for your investment objectives and risk profile. Here are some of the main advantages and disadvantages.

Advantages

- Leverage

Options allow you to control 100 shares of stock with a relatively small amount of capital. For instance, buying one call option at a premium of $2.00 per share costs $200 total (ignoring transaction fees), whereas buying 100 shares of that same stock at $50 would cost $5,000. This leverage can amplify gains if the underlying stock moves in your favor. - Flexibility

Options offer a range of strategies—from bullish and bearish to neutral plays. You can adjust your approach to match your market outlook and risk tolerance, employing basic or advanced methods like spreads, straddles, and iron condors. - Risk Management (Hedging)

If you own 100 shares of a stock, you can buy a put option to protect against downside risk. This is often referred to as a “protective put,” acting like an insurance policy on your shares. - Income Generation

Selling options (e.g., covered calls) can generate income on stocks you already own. You earn a premium upfront, which can boost returns or offset potential losses.

Disadvantages

- Complexity

Options are more complex than stocks. Beginners must invest time in understanding terminology, pricing, volatility, and the Greeks. - Time Decay

Options lose value as they approach expiration (for buyers). If the underlying asset doesn’t move in the expected direction quickly enough, the option can lose a significant portion of its value. - Potential for Significant Losses

While buying options limits your maximum loss to the premium paid, selling options (especially naked puts or calls) can expose you to large or even unlimited losses. You need to understand the risks thoroughly. - Less Liquidity for Some Contracts

Not all options are highly traded. Low liquidity means wider bid-ask spreads, increasing trading costs and making it more difficult to enter or exit positions at favorable prices.

Setting Up an Options Trading Account

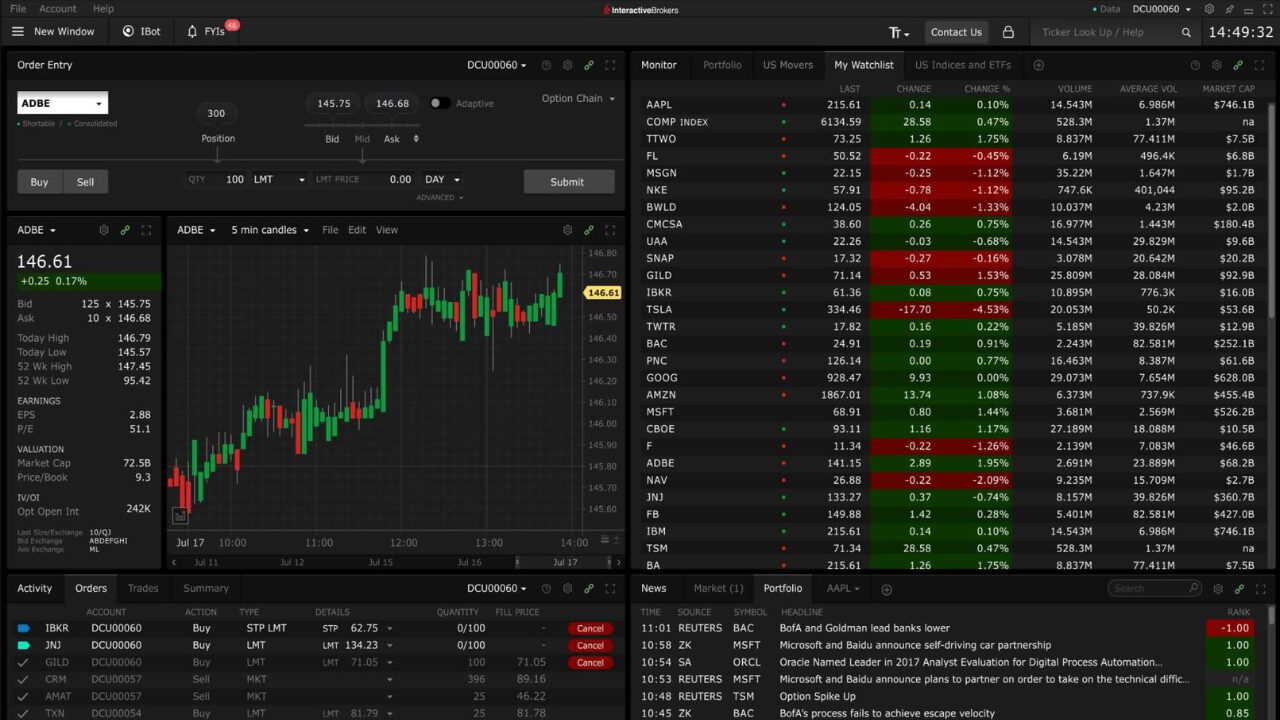

Choosing a Brokerage

Not all brokerages are created equal when it comes to options trading. You’ll want to choose a broker that:

- Offers an intuitive trading platform with real-time data, charting tools, and an easy-to-use options chain interface.

- Has reasonable commission and fee structures for options trades. Some brokers offer commission-free stock and ETF trades but may charge per-contract fees for options.

- Provides educational resources like tutorials, webinars, and demo accounts (paper trading) to help you learn.

Some popular brokers for options trading in the United States include E*TRADE, Fidelity, Charles Schwab, Webull, Interactive Brokers, and Robinhood (for beginner-friendly mobile trading). Compare their offerings, fees, and user reviews before making a decision.

Completing the Options Approval Process

When you open a brokerage account, you must request “options trading approval.” Brokerages categorize traders into different tiers or levels based on their experience and financial situation. Typically:

- Level 1: Allows you to buy calls and puts (long options) and engage in covered calls.

- Level 2 and beyond: Grants higher-level strategies (like spreads or naked options), but requires more experience and net worth or capital in your account.

Be truthful about your trading experience and financial situation when applying. The broker wants to ensure you understand the risks involved.

Funding Your Account

Fund your brokerage account with the amount of capital you’re comfortable risking. Options can be volatile, so many beginners start with a modest amount to test strategies before committing larger sums.

Understanding Options Pricing and the Greeks

Options pricing can seem like an enigma to those unfamiliar with its underlying components. The most commonly used model to value options is the Black-Scholes model, which takes into account multiple factors. Key among these are implied volatility and the Greeks—Delta, Gamma, Theta, Vega, and Rho.

Implied Volatility (IV)

- Definition: Implied volatility is the market’s forecast of a stock’s potential movement over a specific period.

- Impact: Higher IV = higher option premiums (all else being equal). If you buy options during periods of high implied volatility, you’ll pay more for the premium. Conversely, if you sell options during high IV, you collect more premium.

The Greeks

- Delta (Δ)

- Measures how much an option’s price is expected to change for a $1 change in the underlying stock.

- For calls, Delta ranges from 0 to +1; for puts, from 0 to -1.

- A call option with a Delta of +0.50 should theoretically gain $0.50 for every $1 increase in the stock price.

- Gamma (Γ)

- Measures the rate of change of Delta as the stock price moves.

- A higher Gamma means Delta can shift more rapidly, making the option’s value more sensitive to underlying price changes.

- Theta (Θ)

- Represents time decay, the amount an option loses in value each day as it approaches expiration.

- A Theta of -0.05 means the option will lose $0.05 in value each day, assuming all other factors remain constant.

- Vega (ν)

- Measures the sensitivity of the option’s price to changes in implied volatility.

- A Vega of 0.10 means the option price is expected to change by $0.10 if implied volatility changes by 1%.

- Rho (ρ)

- Measures the impact of interest rate changes on the option’s price.

- Rho is generally less significant for short-term equity options, but it can matter for longer-dated options or in environments with rapidly changing interest rates.

Why the Greeks Matter

Understanding the Greeks helps you anticipate how an option’s price might change due to movements in the stock, changes in implied volatility, or simply the passage of time. While memorizing complex formulas isn’t mandatory, a foundational awareness will improve your decision-making, enabling more precise risk management.

Key Options Strategies for Beginners

When you’re just getting started, it’s best to focus on a few straightforward strategies that won’t overwhelm you. Here are three beginner-friendly approaches.

1. Long Call (Buying a Call)

- Objective: Profit from an expected increase in the stock price.

- Scenario: You’re bullish on a stock but want to risk less capital than buying shares outright.

- Risk: Limited to the premium paid. If the stock price fails to rise above the strike by expiration, you lose your premium.

- Reward: Potentially unlimited since the stock price can theoretically rise indefinitely.

2. Long Put (Buying a Put)

- Objective: Profit from an expected decrease in the stock price or hedge a long stock position.

- Scenario: You’re bearish on a stock or want to protect the value of shares you own.

- Risk: Limited to the premium paid. If the stock doesn’t fall below the strike by expiration, you lose your premium.

- Reward: Potentially significant if the stock price falls sharply (theoretically down to 0).

3. Covered Call

- Objective: Generate extra income on a stock you already own by collecting a premium.

- Scenario: You hold 100 shares of a stock you’re willing to sell. You write (sell) a call option on those shares to earn the premium.

- Risk: If the stock price rises significantly above the strike, you miss out on those additional gains because you are obligated to sell at the strike price.

- Reward: The premium collected upfront. Plus, you keep any gains in the stock price up to the strike price.

By focusing on these strategies, you will become comfortable with the dynamics of both call and put contracts as well as the process of writing (selling) an option. Once you master the basics, you can explore more advanced strategies like vertical spreads, iron condors, and butterfly spreads.

Step-by-Step Guide: Placing Your First Options Trade

This section will walk you through a simplified, hypothetical example of buying a call option. The steps are broadly applicable to puts and other strategies, too. Always perform your own due diligence before executing any trade.

Step 1: Analyze the Underlying Stock

- Select a Stock: Choose a company you’ve researched and believe is likely to rise in value over a specific timeframe. Let’s say you pick Company XYZ, currently trading at $48.

- Market Outlook: Check recent news, technical indicators, and fundamental metrics (earnings, P/E ratio, etc.). If you’re bullish, continue to the next step.

Step 2: Access the Options Chain

- Locate the Options Tab: Most trading platforms have an “Options” tab for the selected stock.

- Expiration Dates: Decide how much time you expect the stock to need to make its move. You might pick an expiration date about 1–2 months out to give yourself a reasonable time horizon.

- Strike Prices: Look at the available strike prices (often spaced $1, $2.50, or $5 apart). For a bullish move, consider a strike near or slightly above the current market price.

Step 3: Compare Premiums

- Premium Costs: Note the ask price of the call options in the chain. For example, a $50 strike call might be trading at $1.20. Since one contract covers 100 shares, the total cost would be $120 (plus fees).

- Break-Even Point: Your break-even at expiration is typically the strike price plus the premium (i.e., $50 + $1.20 = $51.20). This means Company XYZ’s stock needs to exceed $51.20 by expiration for you to profit (not counting time decay and other factors during the holding period).

Step 4: Enter the Trade

- Order Type: You can place a limit order to specify the premium you want to pay or a market order to get filled at the prevailing market price.

- Confirm the Details: Double-check strike price, expiration date, number of contracts, and cost before submitting.

Step 5: Monitor the Position

- Track Stock Price: Keep an eye on Company XYZ’s price movements and any relevant news events.

- Watch Time Decay: As days pass, the extrinsic value of your option erodes.

- Greeks Analysis: Monitor Delta and Gamma to see how sensitive your position is to price changes. If implied volatility drops sharply, the premium can also decline, affecting the value of your call.

Step 6: Exit the Trade

You have a few options for exiting:

- Sell the Call Option at any time before expiration if you want to lock in gains or minimize losses.

- Exercise the Option if it’s in the money and you wish to own the underlying shares.

- Hold Until Expiration and let the option settle automatically. If it expires out of the money, it becomes worthless; if in the money, the broker will usually exercise it automatically (check with your broker).

Risk Management in Options Trading

Options can be highly rewarding but also come with unique risks. Proper risk management ensures you can stay in the game for the long haul.

Position Sizing

- Rule of Thumb: Never risk more than a small percentage (e.g., 1–3%) of your account on a single trade. This helps you survive losing streaks.

- Allocation: If you’re brand new, consider only allocating a small part of your overall portfolio to options trading.

Stop Losses

- Not as Straightforward: Because time decay and implied volatility affect option prices, using a traditional percentage stop loss can be tricky.

- Price Alerts: Set alerts for the underlying stock’s price moves. If the stock breaks a key support level, you may consider closing the option position.

Diversification

- Spread Your Bets: Avoid putting all your capital into one stock or sector. Diversifying helps reduce the impact of a single disappointing trade.

Implied Volatility Considerations

- IV Crush: After major events (e.g., earnings), implied volatility often collapses, causing option premiums to drop. Buying options right before earnings can be especially risky if you’re not careful about IV changes.

Common Mistakes to Avoid

- Overusing Leverage

It’s easy to get enticed by the potential for huge gains. Always remember that leverage is a double-edged sword. - Ignoring Time Decay

New traders often overlook how quickly an option’s value can diminish if the underlying stock doesn’t move favorably. - Trading Illiquid Options

Wide bid-ask spreads can make it difficult to exit without a loss due to poor liquidity. - Failing to Have a Plan

Know your profit targets and stop-loss levels before entering any trade. Emotional trading leads to poor decisions. - Not Understanding Assignment Risk

If you sell options, be aware that you could be assigned at any point (for American-style options) if the option goes in the money.

Paper Trading vs Live Trading

Before you put real money on the line, consider paper trading—using a simulator to practice buying and selling options without actual financial risk.

- Benefits:

- Allows you to familiarize yourself with the platform.

- Helps you test strategies in real market conditions (delayed or real-time data, depending on the broker).

- Builds confidence without risking capital.

- Drawbacks:

- No emotional component: It’s hard to replicate the stress or psychology of risking actual money.

- Differences in fills and slippage: Paper trading fills might not perfectly match real-world scenarios.

Despite these drawbacks, paper trading remains a valuable stepping stone. Many brokers offer built-in demo accounts or a separate platform for simulated trading.

Tips for Long-Term Success

- Constant Learning

- Stay updated with market trends, watch tutorials, and read reputable sources about options strategies.

- Expand your knowledge into advanced strategies once you’re comfortable with the basics.

- Track Your Trades

- Maintain a trading journal. Log your entry/exit points, rationale, and outcomes.

- Review your trades regularly to spot patterns and mistakes.

- Focus on Liquidity

- Choose options on heavily traded stocks or ETFs. Higher volume typically translates to narrower bid-ask spreads and easier trade execution.

- Control Emotions

- Avoid panic selling or revenge trading.

- Options can swing widely in value; keep a level head and stick to your trading plan.

- Use Technical and Fundamental Analysis

- Combine both for a well-rounded view.

- Watch key technical levels (support/resistance) and fundamental drivers (earnings, economic data).

- Plan for Worst-Case Scenarios

- Always assume what can go wrong will go wrong and prepare accordingly.

- Use defined-risk strategies like vertical spreads if you’re concerned about potential large losses.

Frequently Asked Questions

1. Do I need a large account to start trading options?

Not necessarily. Many brokers allow you to open accounts with minimal initial deposits. Buying a single options contract can cost far less than buying 100 shares of a stock. However, you do need enough capital to cover margin requirements if you plan to sell uncovered (naked) options, which is generally not recommended for beginners.

2. What happens if I hold an option through expiration?

- If the option is out of the money (OTM), it typically expires worthless.

- If the option is in the money (ITM), your brokerage will usually automatically exercise it. You’ll either end up buying (for calls) or selling (for puts) the underlying shares at the strike price, unless you close or offset the position beforehand. Always confirm your broker’s policy.

3. Are there tax implications for options trading?

Yes. Profits from options trading are typically treated as capital gains, while losses can offset gains (to a certain extent). The specifics vary by country and even by region. In the U.S., short-term capital gains tax rates usually apply if you held the position for less than a year. Consult a tax professional for personalized advice.

4. Is trading options riskier than trading stocks?

Options can be riskier if misused. However, when used responsibly, options can also reduce risk (e.g., protective puts). The key is understanding how they work and adhering to strict risk management.

5. Can I lose more money than I invest in buying options?

No, when buying calls or puts, your risk is limited to the premium paid. However, if you sell options without owning the underlying (naked selling), you could face unlimited or very large losses.

Final Thoughts and Next Steps

Options trading provides an exciting avenue for both speculation and risk management. By understanding the core concepts—calls, puts, strike prices, expiration dates, the Greeks, and implied volatility—you can develop strategies suited to your market outlook. It’s crucial to remember:

- Start Small: Test the waters with a small amount of capital and focus on beginner-friendly strategies like long calls, long puts, or covered calls.

- Stay Disciplined: Use risk management tools, position sizing, and trading plans to mitigate potential losses.

- Keep Learning: The more you immerse yourself in webinars, books, forums, and hands-on practice, the better you’ll become at identifying high-probability trades.

Every seasoned options trader once started where you are now—at the beginning, learning the fundamentals. With careful study, diligent practice (paper trading), and disciplined risk management, you can become proficient and confident in your options trading journey.

Next Steps

- Open a Brokerage Account (if you haven’t already) and apply for options trading approval.

- Try Paper Trading: Familiarize yourself with order placement, bid-ask spreads, and your broker’s trading platform.

- Execute Your First Real Trade: When ready, start with a single contract and a basic strategy. Learn from the experience—win or lose.

- Refine and Repeat: Maintain a trading journal, revisit your trades, and continuously refine your approach.

By following this roadmap, you’ll be on the right track to responsibly trade options for the first time and beyond. The world of options is vast and continually evolving, but with a solid foundation and proper mindset, you can harness its power to work toward your financial goals. Good luck on your options trading journey!