Liquidity is one of the most critical yet often misunderstood concepts in the world of trading and investing. When traders talk about “liquid markets,” they typically refer to markets where large orders can be placed and filled quickly with minimal price impact. Liquidity influences the ease with which you can open or close positions, the size of your transaction costs, and even your overall risk exposure.

In this comprehensive guide, we will delve deep into the concept of liquidity in trading—covering its definition, why it matters, and how you can use it to your advantage. We’ll examine the factors that affect market liquidity, explore real-world examples, and consider best practices that can help traders maximize their returns while minimizing risk. By the end of this article, you should have a thorough understanding of liquidity’s importance, the tools to measure it, and the strategies to leverage it effectively in your trading journey.

Table of Contents

Defining Liquidity in Trading

Liquidity in financial markets generally refers to how easily and quickly a security (such as a stock, currency pair, commodity, or cryptocurrency) can be bought or sold in the market without significantly affecting its price. A more technical definition states that a market is liquid if market participants can trade rapidly and in large quantities at prices that reflect fundamental supply and demand.

Depth, Breadth, and Resiliency

Liquidity has multiple dimensions, often summarized as:

- Depth: The existence of abundant buy and sell orders at various price levels close to the current market price.

- Breadth: The number of participants actively placing those orders. A market with many participants—both institutional and retail—tends to be more liquid.

- Resiliency: How quickly a market can “bounce back” or stabilize after large trades or unexpected events.

When a market has high depth, breadth, and resiliency, it is considered highly liquid. Conversely, an illiquid market has fewer participants, wider bid-ask spreads, and slower recovery times after price shocks.

Why a Solid Definition Matters

Understanding the precise meaning of liquidity is foundational for any trader. By recognizing how quickly and easily your orders can be filled, you can make more informed decisions about timing, risk management, and trade execution. Failing to consider liquidity can lead to unexpected costs (like slippage) and heightened risk exposure.

Why Liquidity Matters

Liquidity is a linchpin for the smooth operation of financial markets. When liquidity is high, transactions happen quickly, spreads tighten, and price discovery is efficient. When liquidity is low, traders may face significant hurdles, including difficulty entering or exiting positions.

1. Ease of Entry and Exit

If you’re trading in a liquid market, it’s typically straightforward to open or close a position at or near the price you see on your screen. In highly liquid markets, large orders can be executed with less slippage, meaning you’re more likely to get your desired price. This is especially important for active traders or large institutional players who move substantial volumes.

2. Transaction Costs

Transaction costs encompass more than just commission fees. They also include the bid-ask spread, which is the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). In a liquid market, these spreads tend to be smaller. Over multiple trades, narrower spreads can mean the difference between consistent profits and marginal returns.

3. Market Efficiency and Fair Pricing

Liquid markets often display more accurate and efficient price discovery. With a higher number of participants and transactions, the market’s collective judgment tends to converge around a fair price. If a stock is suddenly deemed undervalued, participants quickly step in to buy, pushing the price up to what the market views as “fair.” Conversely, overvalued securities tend to be sold off until prices align more closely with market sentiment.

4. Reduced Slippage

Slippage occurs when a trader receives a different price than expected between the time an order is placed and the time it is executed. This can happen due to rapid market movements, low volume, or wide bid-ask spreads. In a liquid market, slippage is generally reduced because there’s a larger volume of pending orders at various price points, making it easier to fill trades at or near the quoted price.

5. Hedging and Risk Management

Institutions, corporations, and sophisticated traders often rely on derivatives and other instruments for hedging purposes. To effectively hedge, these traders need to open or close substantial positions without significantly moving the market. High liquidity allows for such large trades to be executed smoothly, thereby reducing overall systemic risk and making the entire market more stable.

Key Components of Market Liquidity

The Order Book

The order book is a real-time list of buy and sell orders for a particular asset organized by price levels. These orders reveal the depth of the market: the volume of trades waiting to be executed at specific prices.

- Buy Orders (Bids): Display how much of the asset buyers want to purchase and at what price.

- Sell Orders (Asks): Show how much of the asset sellers want to sell and at what price.

A robust order book with numerous orders clustered tightly around the current market price indicates good liquidity. Traders should regularly monitor the order book to gauge the market’s strength, anticipate potential support or resistance levels, and plan trade entries or exits accordingly.

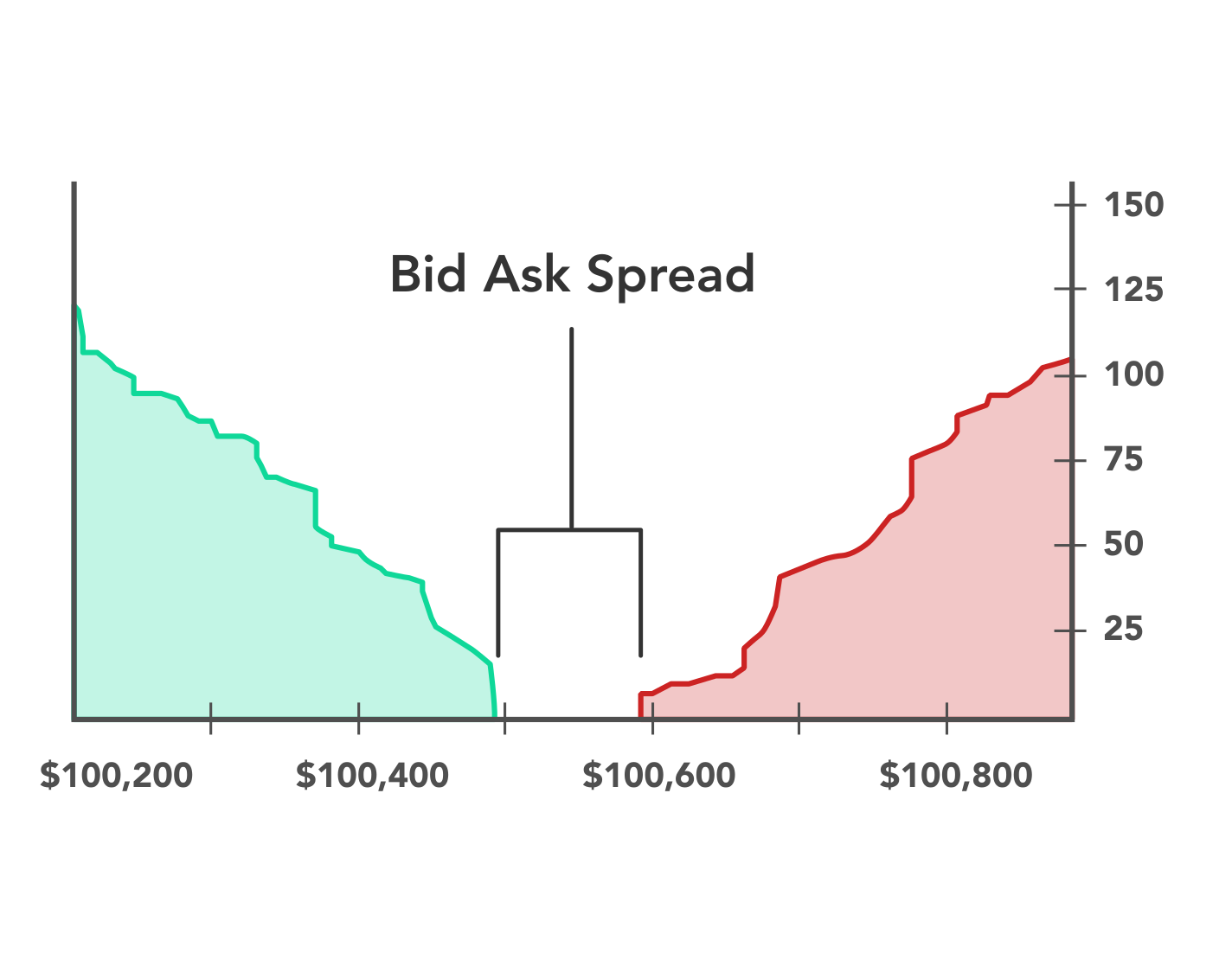

Bid-Ask Spread

The bid-ask spread is one of the most straightforward measures of liquidity. A narrow spread typically signals higher liquidity because there is less discrepancy between what buyers are willing to pay and what sellers are willing to accept. Conversely, a wide spread suggests a less liquid market, where fewer buyers and sellers are agreeing on a fair price.

- Example: Suppose a stock’s bid price is 100 USD and the ask price is 100.05 USD. This 0.05 USD difference represents the spread. The narrower this difference, the easier it is for traders to buy and sell at close to the prevailing market price.

Market Makers

Market makers are entities (often large financial institutions) responsible for providing liquidity to the market by continuously placing buy and sell orders. They stand ready to buy securities from sellers and sell securities to buyers, thus narrowing the bid-ask spread and facilitating more efficient price discovery.

- How They Profit: Market makers profit from the spread between the bid and ask prices. Over many transactions, these small margins can add up to substantial profits.

- Role in Volatile Markets: During periods of high volatility, market makers help stabilize markets by maintaining bid and ask orders, although they may widen spreads to account for higher risk.

Having robust market makers is especially important in smaller or emerging markets, where fewer participants naturally exist to maintain liquidity.

Factors Affecting Liquidity

Trading Volume

The primary factor influencing liquidity in any market is trading volume, or the number of shares, contracts, or lots traded over a specific period. High volume typically correlates with high liquidity, making it easier to enter or exit positions. When volume is low, price movements can become erratic, and spreads may widen due to a scarcity of buyers and sellers.

- Volume Spikes: Sudden increases in volume can either indicate heightened interest in an asset (positive or negative) or result from significant market news. Volume spikes often come with improved liquidity—at least temporarily—because more participants enter the market.

- Sustained High Volume: Assets with consistently high trading volumes (like major currency pairs in forex or blue-chip stocks) tend to maintain tighter spreads and more stable prices.

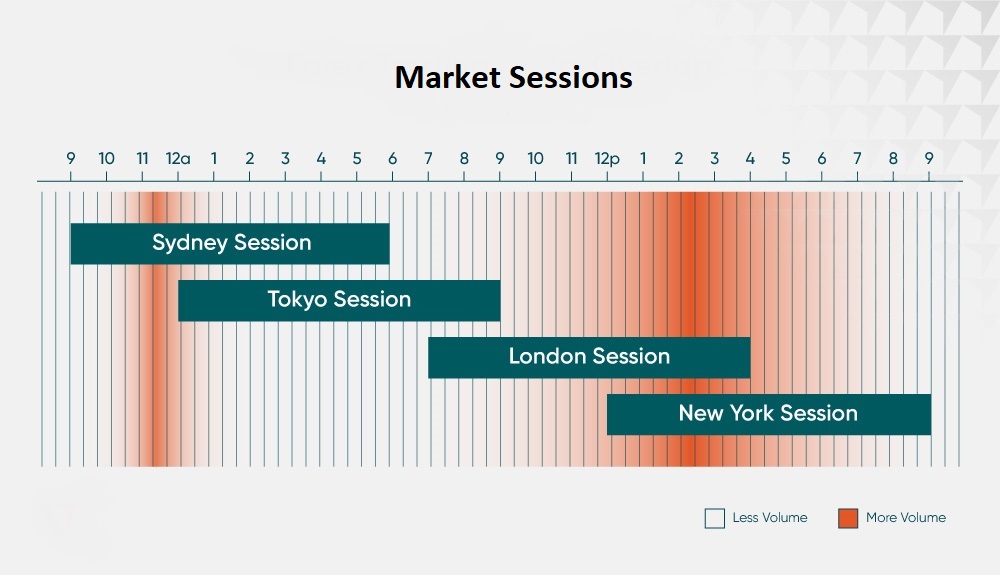

Time of Day & Market Sessions

Liquidity also varies throughout the trading day. In markets like forex, liquidity is often highest when major financial centers overlap (e.g., London and New York). In stock markets, liquidity tends to be highest near the open and close of trading sessions.

- Overlap of Key Sessions: In forex, for instance, the busiest hours often see the most liquidity. When the London and New York sessions overlap, more trades are executed, and spreads tighten.

- Market Close: The closing hour can see increased volume as traders finalize positions, but it can also feature more volatility as large orders are placed before the bell.

Volatility

While volatility and liquidity are different concepts, they influence each other. In times of extreme volatility (e.g., during economic crises or significant news releases), some traders exit the market, fearing large price swings. This can reduce liquidity. However, other players—like high-frequency traders—may increase their activity, potentially providing short-term liquidity. The net effect on liquidity during volatile periods can be mixed, but volatility generally makes liquidity less predictable.

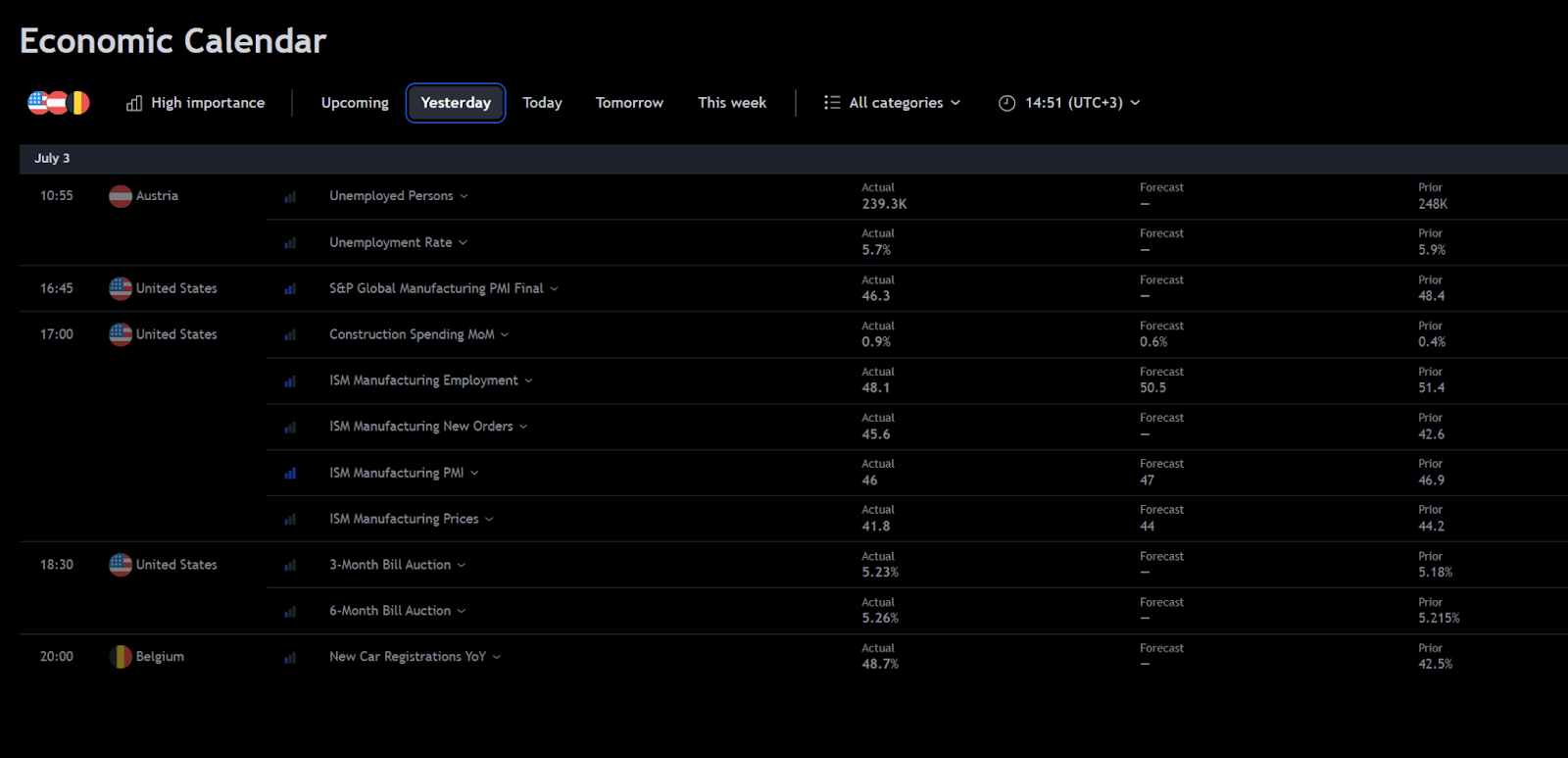

Economic and News Events

Major economic announcements (such as central bank decisions, GDP reports, or employment data) can temporarily disrupt liquidity. When markets anticipate significant news, spreads can widen just before and after the announcement due to uncertainty. Large orders can move the market more than they would under normal conditions, leading to price gaps and slippage.

- Scheduled Events: Traders know in advance about many economic releases, so they often adjust their positions beforehand. This can lead to brief spikes or drops in liquidity.

- Unscheduled Events: Surprising events (e.g., natural disasters, sudden geopolitical tensions, or unexpected corporate announcements) can have a more pronounced impact on liquidity because the market has less time to prepare.

Liquidity vs Volatility

Liquidity and volatility are two critical but distinct concepts:

- Liquidity measures how easily you can execute trades without affecting price.

- Volatility refers to how rapidly and unpredictably prices change over time.

Interplay Between Liquidity and Volatility

- In highly liquid markets, large trades can typically be absorbed without drastic price shifts, which can moderate volatility.

- In illiquid markets, even relatively small trades can cause significant price movements, leading to higher volatility.

A market can be both liquid and volatile if many trades occur in rapid succession, driving swift price changes without large spreads. However, it’s more common to see low liquidity coincide with high volatility because the lack of buyers or sellers magnifies each trade’s impact on the price.

Why This Matters for Traders

Understanding whether your target market is liquid or volatile—and the relationship between the two—helps you plan trade entries, exits, and position sizes. For instance, if you anticipate a period of high volatility in a less liquid market, you might adjust your position size to mitigate the risk of large price swings or significant slippage.

Indicators and Tools for Measuring Liquidity

Trading platforms and analytical tools provide various metrics to help traders gauge liquidity. By combining these indicators with personal observations of market behavior, you can better understand the current liquidity environment and adapt your strategies accordingly.

Volume Indicators

Volume is one of the most commonly tracked metrics. It can be displayed on most charting platforms, often as vertical bars at the bottom of a candlestick or bar chart. These bars represent how many shares, contracts, or lots traded during a specific period (e.g., a 5-minute, 1-hour, or 1-day interval).

- On-Balance Volume (OBV): A cumulative indicator that adds volume on up days and subtracts volume on down days. It helps traders see if volume is confirming price trends.

- Volume-Weighted Average Price (VWAP): This indicator calculates the average price weighted by volume, providing insight into the “true” price level around which most trading has occurred.

Market Depth

Market depth provides a snapshot of the order book, showing how many buy and sell orders exist at various price points. This is often displayed in a Level II or Depth of Market (DOM) window.

- Level II Quotes: Offer more detail than a basic quote by revealing the best bid and ask, as well as additional pending orders at multiple price levels.

- Usage: By analyzing the depth of buy and sell orders, traders can identify possible support and resistance areas. For example, a massive block of sell orders at a certain price could indicate a potential ceiling.

Spread Monitoring

Pay close attention to bid-ask spreads as you trade. Even a quick glance at the spread provides valuable information about instantaneous liquidity conditions.

- Tight Spreads: Suggest that supply and demand are well-balanced.

- Wide Spreads: May indicate lower liquidity or heightened uncertainty.

Spreads can fluctuate throughout the trading session and become more pronounced during major news events or off-peak trading hours.

Liquidity Ratios

Some traders and analysts calculate liquidity ratios—like the ratio of average daily volume to shares outstanding—to gauge how easily a stock might be traded. These ratios can be applied similarly in other markets, adjusting for the specific metrics relevant to each asset class.

- Example: In the stock market, a high turnover ratio (daily trading volume / number of shares outstanding) often implies robust liquidity. Conversely, a low turnover ratio can be a red flag for liquidity problems.

Liquidity in Different Markets

Liquidity levels differ markedly across various financial markets. By understanding these nuances, you can tailor your trading strategies to the specific liquidity profile of each market.

Stocks

The stock market’s liquidity can vary widely. Blue-chip stocks (large, well-known companies with high market capitalization) generally have strong liquidity, tight spreads, and large order books. Small-cap or penny stocks, on the other hand, can be highly illiquid, leading to wide spreads and potential difficulties in trade execution.

- Exchange vs. OTC: Most stocks are listed on major exchanges like the NYSE or NASDAQ, providing transparency and typically higher liquidity. Some stocks trade over-the-counter (OTC), where liquidity and regulatory oversight may be lower.

Forex

The foreign exchange (forex) market is the largest financial market globally, with an average daily turnover of over $6 trillion. Major currency pairs (e.g., EUR/USD, USD/JPY, GBP/USD) are extremely liquid. Spreads are typically very tight, especially during overlapping trading sessions (e.g., London-New York).

- Exotic Pairs: Less traded currency pairs, like USD/THB or EUR/RUB, can have wider spreads and lower liquidity, making them riskier to trade, especially for large orders.

- 24-Hour Market: Forex operates 24 hours a day during the workweek, but liquidity can still drop outside major market session overlaps.

Futures

Futures are standardized contracts to buy or sell assets—like commodities, currencies, or indices—at a predetermined price and date. Liquidity depends on the specific contract:

- Index Futures (e.g., S&P 500): Often highly liquid, especially near major market openings and closings.

- Commodity Futures (e.g., wheat, corn): Liquidity can vary significantly. Popular commodities (crude oil, gold) generally have better liquidity compared to niche or seasonal contracts.

Cryptocurrencies

The cryptocurrency market has grown rapidly, but liquidity varies enormously among different coins and exchanges.

- Major Coins (Bitcoin, Ethereum): Typically offer better liquidity, with high daily trading volumes on established exchanges.

- Altcoins: Can be extremely illiquid, resulting in large price swings even for relatively small trades.

- Decentralized Exchanges (DEXs): May have lower liquidity compared to centralized counterparts, although protocols like Automated Market Makers (AMMs) have improved liquidity for many tokens.

Options

Options (calls and puts) can be liquid for well-known stocks and indices, but liquidity is often segmented by specific strike prices and expiration dates. Some strikes and expirations may trade frequently, while others have few open contracts, leading to wider spreads and higher slippage.

- Liquidity Premium: In options, an illiquid contract can be extremely challenging to exit without taking a significant loss on the spread. Always check open interest and volume before trading.

Liquidity Risk and Management

Liquidity risk refers to the possibility that a trader cannot exit or enter a position quickly without experiencing substantial price changes or high transaction costs. This can lead to:

- Forced Liquidations: You might have to exit a position at unfavorable prices due to margin calls or other obligations.

- Opportunity Costs: Missing an advantageous trade because you’re stuck in an illiquid position elsewhere.

- Excessive Slippage: Encountering large price deviations when trying to trade in an illiquid environment.

Strategies to Manage Liquidity Risk

- Diversify Across Liquid Markets: Spreading your capital across multiple, more liquid assets can reduce concentration risk.

- Use Limit Orders: Instead of placing market orders, use limit orders to control the maximum or minimum price at which you’re willing to execute a trade. This can help mitigate slippage but may result in missed opportunities if the market never reaches your limit price.

- Monitor News and Events: Stay updated on economic calendars and news announcements that might trigger liquidity drops or spikes. Avoid placing large trades right before or after significant news releases to reduce slippage risk.

- Assess Market Depth: Regularly review Level II quotes or DOM windows to ensure there’s sufficient depth in the market before placing big orders.

- Position Sizing: Larger trades can have a greater market impact, especially in low-liquidity environments. Adjust your position size accordingly, or break large orders into smaller chunks to minimize price impact.

Limit Orders vs Market Orders

- Market Orders: Execute immediately at the best available price. While you’re guaranteed an execution, you aren’t guaranteed a specific price. In illiquid markets, this can lead to significant slippage.

- Limit Orders: Instruct your broker to buy or sell only at a specified price or better. While you gain more control over the price, you risk partial or no execution if the market doesn’t hit your limit.

Striking a balance between these two order types is key to effective liquidity risk management.

Trading Strategies Around Liquidity

Scalping

Scalping is a short-term strategy where traders aim to profit from small price movements over brief timeframes (seconds to minutes). High liquidity is crucial for scalpers, as they need to open and close positions rapidly without incurring large spreads or slippage.

- Liquidity Considerations: Scalpers gravitate toward highly liquid markets (e.g., major forex pairs, popular stocks).

- Tools: Depth of market tools, one-click trading, and fast execution platforms are essential for this approach.

Day Trading

Day traders open and close multiple positions within the same trading day, avoiding overnight risk. Day trading strategies can range from momentum trading to range-trading, but all rely on sufficient liquidity to ensure quick entries and exits.

- Liquidity Benefits: Tight spreads and high trading volumes can help day traders reduce transaction costs and slippage.

- Volatility Factor: Day traders also look for reasonable volatility to generate tradable intraday price moves, ideally in a liquid market so they can exit quickly if conditions sour.

Swing Trading

Swing trading involves holding positions for several days to weeks, aiming to capture medium-term price moves. Liquidity remains important, but the strategy can be more flexible about slight fluctuations in spreads since trades are not executed as frequently.

- Market Selection: Swing traders can benefit from moderately liquid markets as long as the asset’s price movements align with the anticipated swing.

- Risk Management: Using limit orders can still be crucial to avoid excessive slippage on entry or exit, especially if the market experiences sudden low-liquidity moments.

High-Frequency Trading (HFT)

High-Frequency Trading (HFT) firms use sophisticated algorithms and ultra-fast execution speeds to capitalize on micro-opportunities that can last for seconds or even milliseconds. These firms add liquidity by constantly placing and canceling orders, profiting from very tight spreads.

- Infrastructure: HFT firms invest in advanced hardware, co-location (physical proximity to exchange servers), and custom software to achieve minimal latency.

- Market Impact: While HFT can improve liquidity in normal conditions by narrowing spreads, it can also contribute to sudden liquidity withdrawal in chaotic market scenarios (e.g., flash crashes).

Real-World Liquidity Events

Flash Crashes

A flash crash is a rapid, deep plunge in the price of one or more assets, followed by a swift recovery. These events are often triggered by:

- Erroneous Trades or Algorithms: Faulty algorithms might issue large market orders that consume available liquidity and drastically move prices.

- Herding Effects: Once prices start to drop rapidly, other algorithms or traders may join the sell-off, further exacerbating the crash.

In these moments, liquidity can evaporate almost instantly, causing extreme volatility and major slippage for anyone attempting to trade through it.

Example: The 2010 Flash Crash

On May 6, 2010, the Dow Jones Industrial Average plunged about 1,000 points (nearly 9%) in minutes before rebounding just as quickly. Regulatory analysis pointed to a large automated sell program and liquidity withdrawal by high-frequency traders as contributing factors.

Black Swan Events

Black Swan events are rare, unpredictable occurrences with severe consequences—think of major geopolitical turmoil, pandemics, or catastrophic natural disasters. These events can trigger widespread panic, causing liquidity in even the most liquid markets to dry up rapidly.

- Market-Wide Implications: During the early stages of a black swan event, many participants freeze, unsure how to price assets. This leads to wide spreads and extreme volatility.

- Risk Management: Traders often resort to safe-haven assets (like gold or government bonds), although even these can temporarily suffer from liquidity crunches in the face of panic selling or buying.

The Role of Regulators in Maintaining Liquidity

Regulatory bodies such as the U.S. Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and similar organizations in other countries play a vital role in ensuring markets remain fair and liquid.

- Circuit Breakers: Many stock exchanges use circuit breakers—pauses in trading once prices move beyond a certain threshold. This mechanism allows traders to regroup and prevents panic-selling from creating illiquid, spiraling price declines.

- Market Maker Incentives: Exchanges may provide rebates or fee reductions to market makers to encourage them to continue providing liquidity, even during volatile times.

- Transparency and Reporting: Regulators require certain disclosures (e.g., large shareholder positions, insider trading reports) to foster transparency and fairness, indirectly supporting liquidity by boosting market confidence.

When participants trust the market structure, they’re more likely to stay active, thus improving overall liquidity.

Best Practices for Traders

Whether you’re a beginner or an experienced market participant, following best practices around liquidity can significantly improve your trading performance and risk management.

- Choose Liquid Instruments

- Start with major currency pairs in forex, blue-chip stocks, or well-known ETFs.

- Liquidity generally leads to tighter spreads, lower slippage, and better execution.

- Stay Informed About News and Events

- Economic calendars and market news feeds are invaluable tools.

- Anticipate when liquidity might drop (e.g., during off-market hours or major announcements).

- Use Appropriate Order Types

- Limit orders can protect you from unfavorable fills but can lead to missed trades if your price isn’t reached.

- Market orders offer guaranteed execution but at the risk of slippage.

- Monitor the Order Book (Level II Data)

- Keep an eye on supply/demand imbalances.

- If you see a thin order book, consider adjusting position sizes or waiting for better conditions.

- Manage Position Sizes

- Avoid placing orders that are too large for the market’s liquidity profile.

- For illiquid markets, break large trades into smaller blocks to minimize price impact.

- Set Realistic Profit Targets and Stop Losses

- Factor in spread costs and potential slippage when defining targets.

- Don’t place stop losses too tight in volatile, illiquid conditions; you risk being stopped out prematurely.

- Maintain Adequate Risk Capital

- Illiquid positions can tie up funds, so ensure you have enough capital for unexpected margin requirements or short-term opportunities.

- Over-leveraging in low-liquidity assets is a recipe for disaster.

- Diversify Strategies and Markets

- Liquidity can shift. Having multiple strategies across various liquid markets can reduce dependency on any single market condition.

- E.g., combine swing trades in equities with forex scalping during high-liquidity sessions.

By integrating these practices into your trading routine, you’ll not only navigate liquidity traps more effectively but also capitalize on liquid opportunities as they arise.

Future Trends in Liquidity

Financial markets are continuously evolving. Technological advances, regulatory changes, and shifting global economic conditions can all influence the future state of market liquidity.

- Algorithmic and High-Frequency Trading: As technology advances, more algorithmic traders might enter the market, providing additional liquidity under normal conditions but also creating complex dynamics during market stress.

- Decentralized Finance (DeFi): In the cryptocurrency realm, decentralized exchanges use automated market makers (AMMs) to supply liquidity. This model could expand into traditional finance, potentially revolutionizing how liquidity is provided.

- Electronification of Fixed Income Markets: Historically, bond markets were relatively opaque and illiquid compared to equities. The trend toward electronic trading platforms could enhance bond market liquidity.

- Globalization vs. Fragmentation: Political and economic policies can either encourage global market integration (boosting liquidity) or lead to market fragmentation (potentially reducing liquidity).

- Central Bank Policies: Low-interest-rate environments often push investors toward equities and risk assets, boosting liquidity. Rising rates or policy shifts might reverse this trend, impacting liquidity across asset classes.

Staying attuned to these trends can help traders anticipate changes in liquidity conditions and adjust their strategies accordingly.

Conclusion

Liquidity is more than just a buzzword in finance—it’s a fundamental aspect of how markets function. From the ability to quickly enter and exit positions to the tightness of bid-ask spreads and the reliability of order execution, liquidity shapes the trading environment in profound ways.

By understanding the mechanics of liquidity—from monitoring volume and market depth to recognizing the interplay between liquidity and volatility—you can make more informed decisions. Effective liquidity management involves selecting the right instruments, using the best order types, and adapting to market conditions that can shift rapidly, especially during major news events or unexpected crises.

Key Takeaways:

- Liquidity Underpins Market Efficiency: High liquidity facilitates fair pricing, tight spreads, and minimal slippage, which benefits all types of market participants.

- Multiple Factors Influence Liquidity: Trading volume, time of day, volatility, and news events can drastically alter liquidity conditions.

- Risk Management is Essential: Proper position sizing, the use of limit orders, and staying informed about potential market-moving events are crucial in avoiding liquidity pitfalls.

- Different Markets Have Different Profiles: From blue-chip stocks to exotic currency pairs and niche crypto tokens, liquidity varies widely. Select markets that align with your risk tolerance and strategy.

- Future Developments: Technological and regulatory changes will continue to shape liquidity. Traders who remain adaptable and informed will be best positioned to thrive.

Armed with this knowledge, you can approach the markets more confidently. Whether you’re scalping currencies, day trading stocks, or exploring cryptocurrency ventures, an in-depth grasp of liquidity—what it is, why it matters, and how to use it to your advantage—can significantly enhance your performance and overall market experience.