As Bitcoin edges closer to its all-time high, the crypto market is abuzz with anticipation. In this week’s crypto analysis for October 26, 2024, we examine the latest price movements, market catalysts, and factors fueling Bitcoin’s rise. Explore what’s driving this momentum and what it could mean for the broader crypto landscape.

Upcoming Economic Events

These are the key events to watch, but you can find a full list on the Crypto Craft calendar.

2024.10.31

- 8:30 ET: US Core PCE Price Index (m/m) Release — The upcoming release of the Core PCE Price Index, with a prior reading of 0.1% and a forecast of 0.3%, provides critical insights into consumer inflation by tracking changes in prices for goods and services, excluding food and energy. As the Federal Reserve’s primary inflation gauge, this data is closely watched, as inflation influences currency values and central bank policy. Rising inflation typically prompts the Fed to increase interest rates in alignment with its inflation control mandate. Recently, the Fed reduced rates by 0.5%, making this release pivotal in gauging inflation’s response. If actual data surpasses the 0.3% forecast and inflation rises, the Fed may consider pausing further rate cuts or limiting reductions to 0.25% rather than 0.5%. This report could have substantial implications for USD value and, by extension, the cryptocurrency market, especially Bitcoin, as it reacts to macroeconomic trends.

2024.11.01

- 8:30 ET: US Unemployment Rate Release — The upcoming US Unemployment Rate report, with previous and forecast figures at 4.1%, tracks the percentage of the workforce that is unemployed and actively seeking jobs. As a primary gauge of economic health and inflation, higher employment typically signals economic strength, leading to increased consumer spending and potentially driving inflation upward. If inflation rises, the Federal Reserve may consider pausing further rate hikes or implementing smaller increases, similar to the approach discussed above. Like the PCE Price Index, this report could significantly impact USD value and may influence the cryptocurrency market, especially Bitcoin, as it responds to macroeconomic conditions.

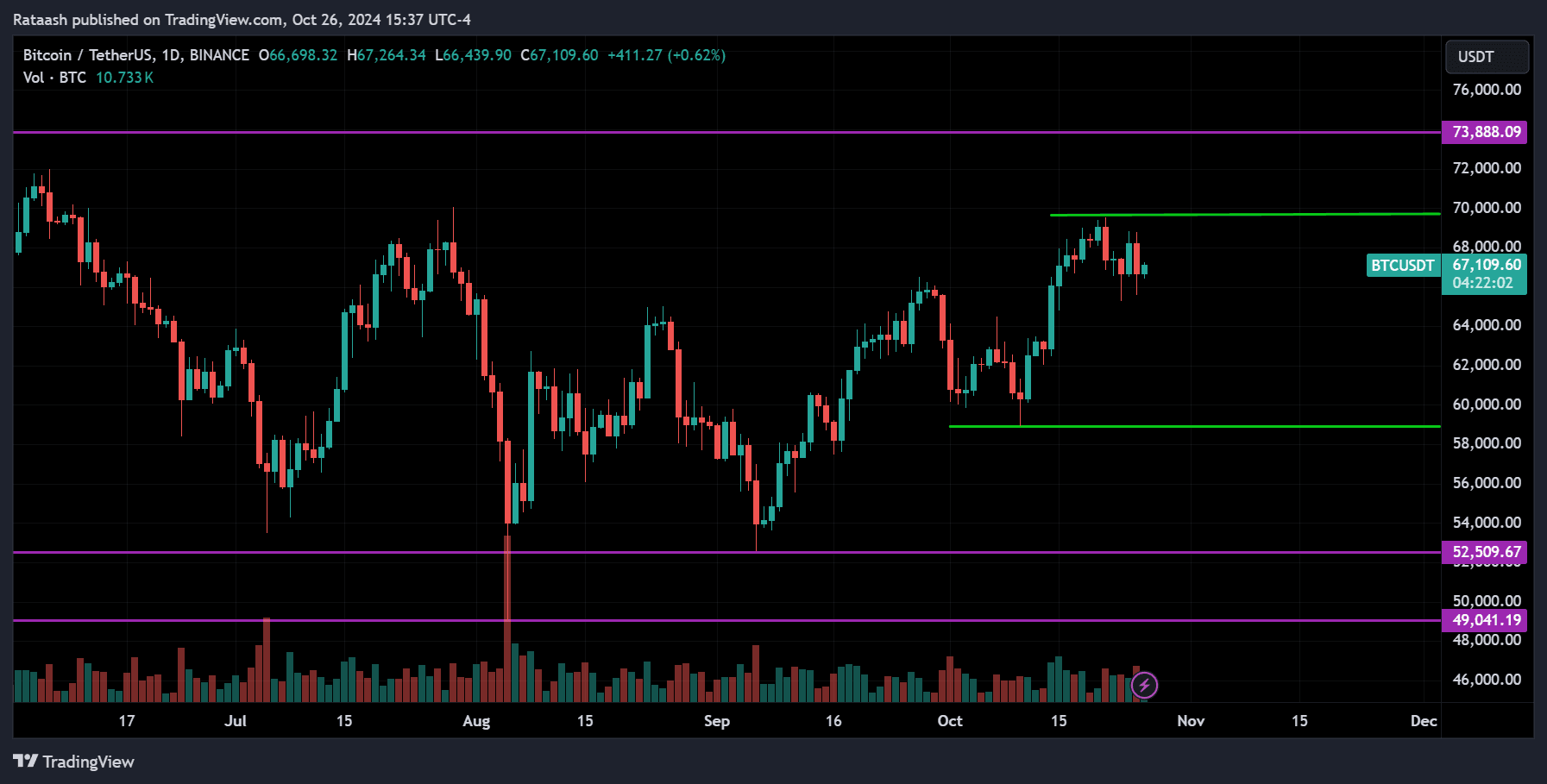

Bitcoin(BTC):

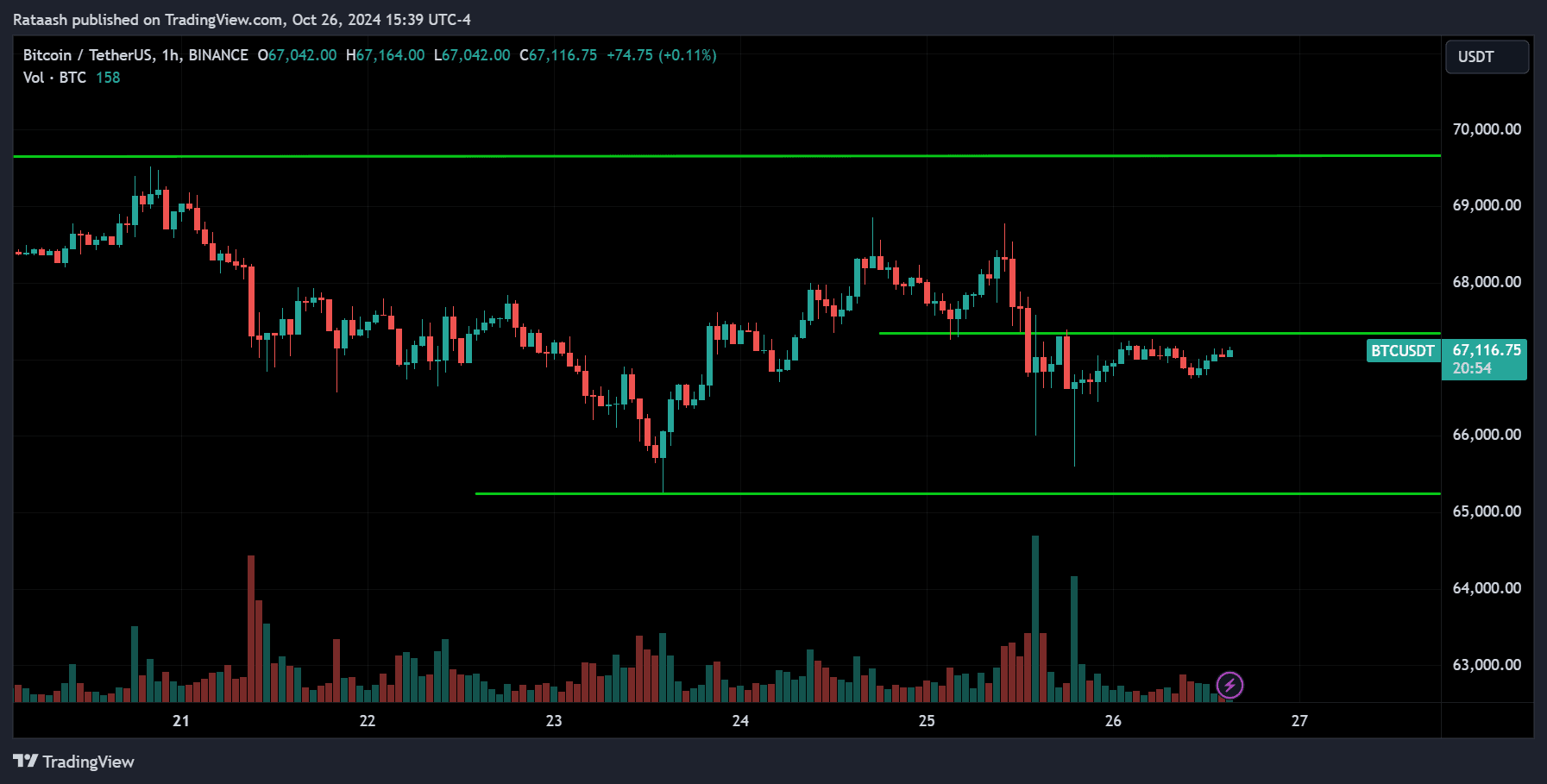

Bitcoin has been in a sideways trend for some time, with its recent all-time high reaching around $73,084. Currently trading near $67,116, the potential impact of rate cuts could fuel increased spending, drawing more investors toward assets like Bitcoin, known as one of the top-performing assets. Continued rate cuts may support Bitcoin’s upward movement, but any pause or slowdown could see it consolidate or enter a corrective phase.

Analyzing Bitcoin’s price action, we see it recently pulled back from a major resistance level around $70,000, finding support near $65,000. Currently trading above this level, a breakout above the $67,100 resistance zone could push Bitcoin back toward $70,000, where it may either consolidate or potentially move past this level toward a new ATH. However, a drop below $65,000 could signal a deeper correction.

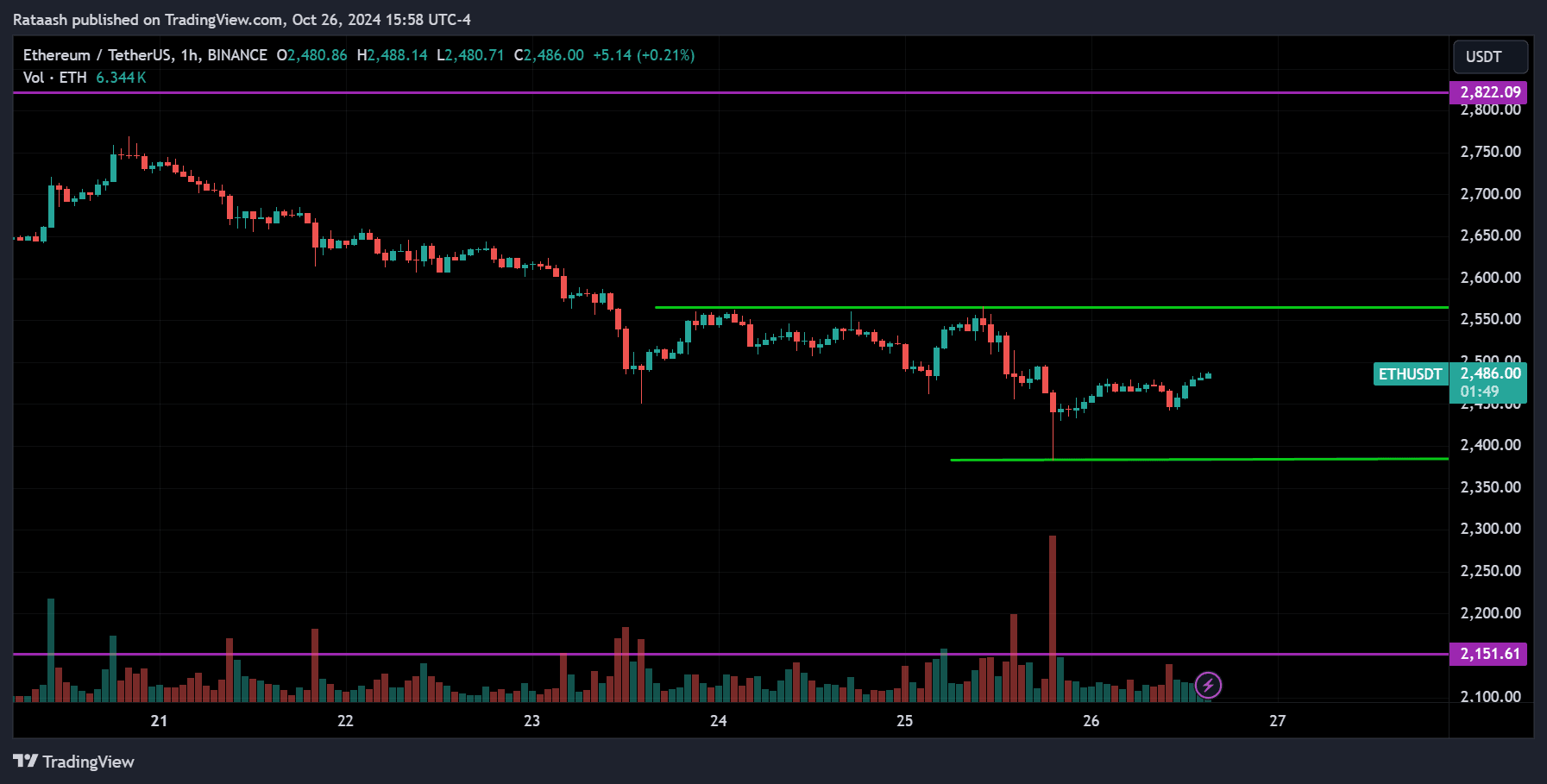

Ethereum(ETH):

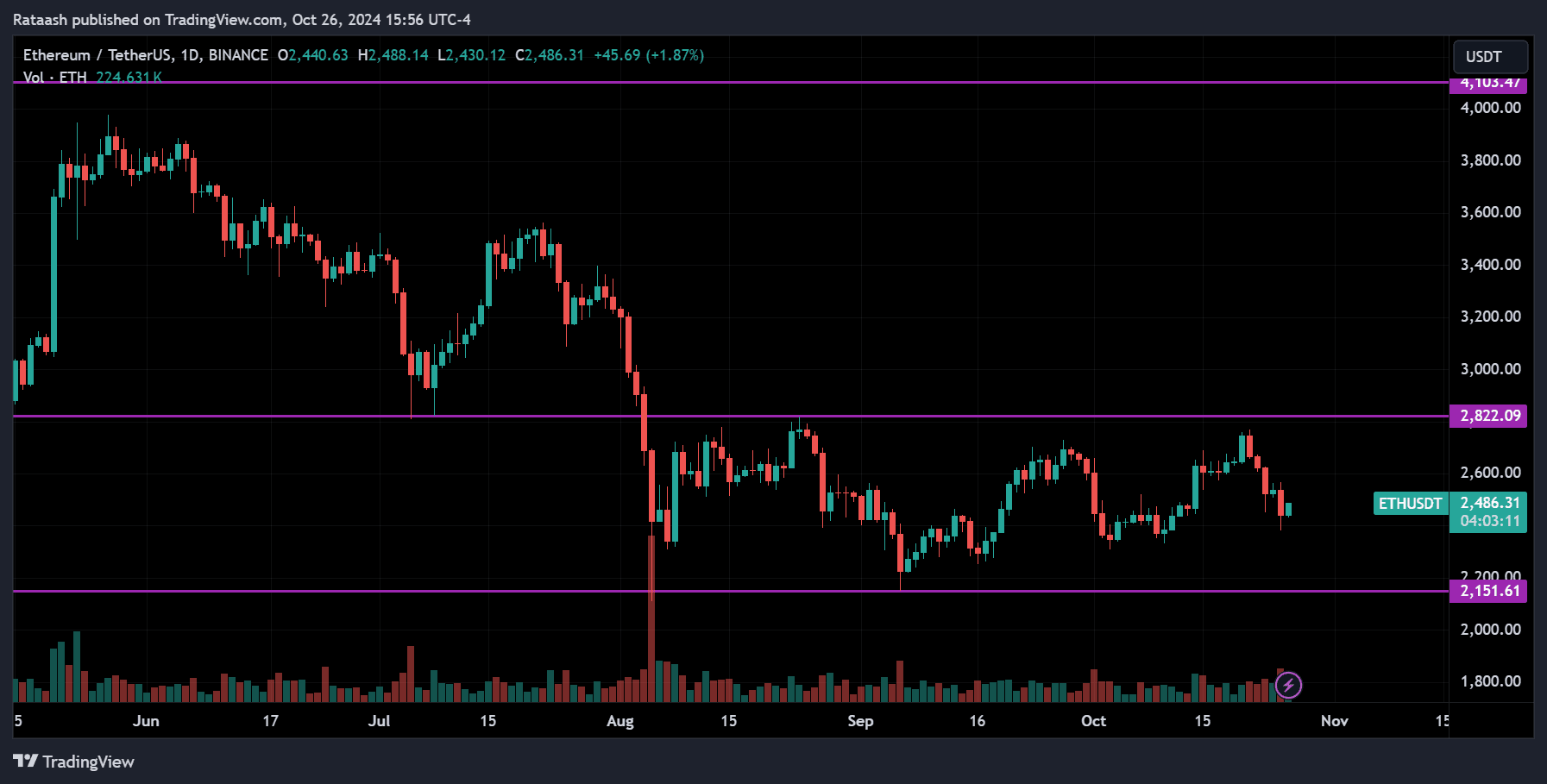

Ethereum has been trending down over the past few months and is currently consolidating around a key support level of $2,150. Like Bitcoin, Ethereum’s price is sensitive to Federal Reserve decisions, which impact major cryptocurrencies. While it’s consolidating now, upcoming economic updates could influence its price direction.

As a groundbreaking technology in blockchain and decentralized applications, Ethereum plays a vital role as the host platform for well-known tokens like Shiba Inu, Uniswap, Chainlink, and USD Coin, supporting the stability and operation of these assets. This makes Ethereum a significant foundation in the cryptocurrency and blockchain industry.

Analyzing Ethereum’s price action, we see support around $2,150, with recent pullbacks from the $2,800 resistance. On the 1-hour chart, a minor support level has formed around $2,400, while resistance is near $2,550. Given the downtrend, a break below $2,400 could push Ethereum toward the major $2,150 support zone. Conversely, a breakout above $2,550 might lead the price back toward $2,800.

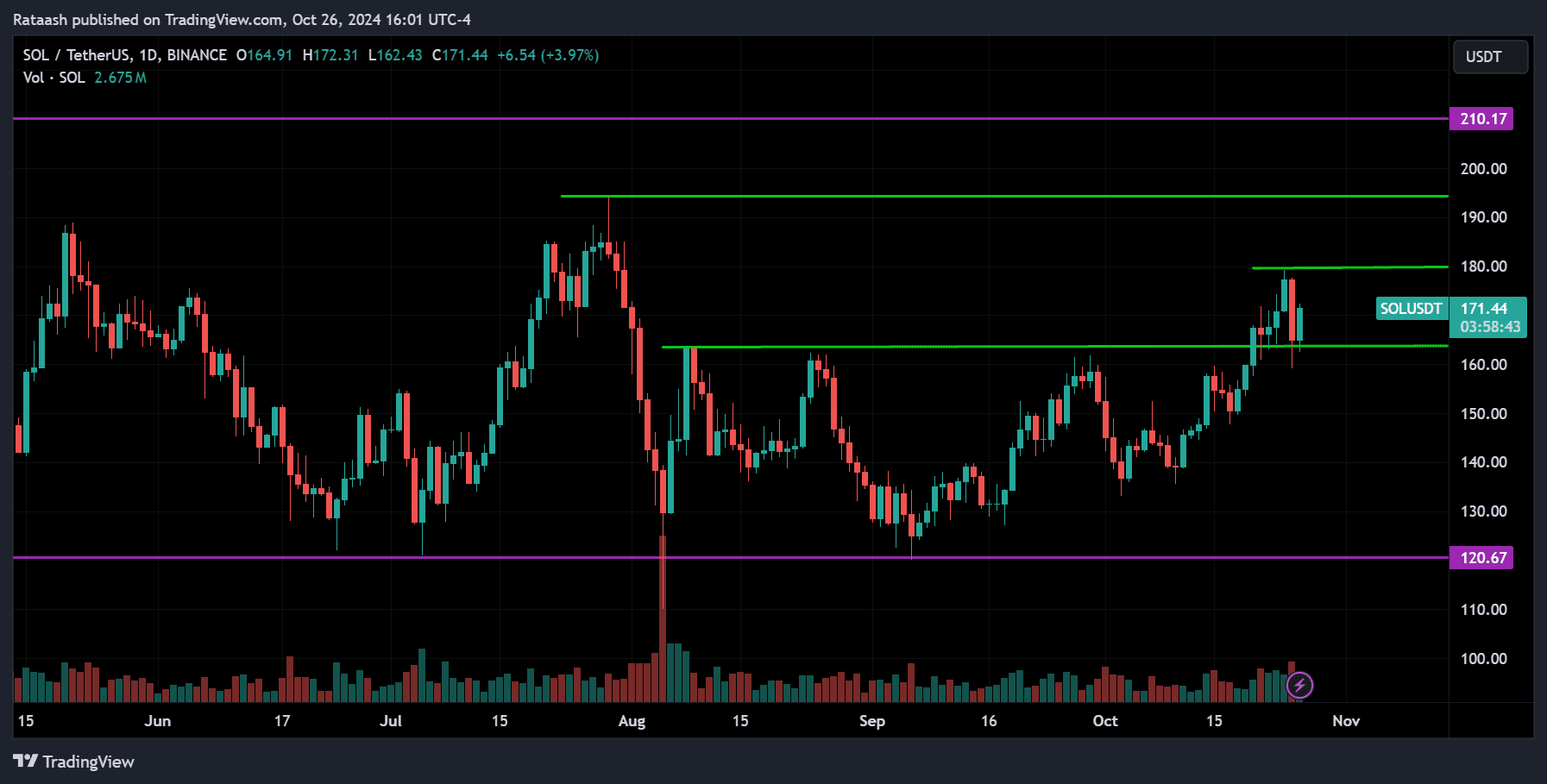

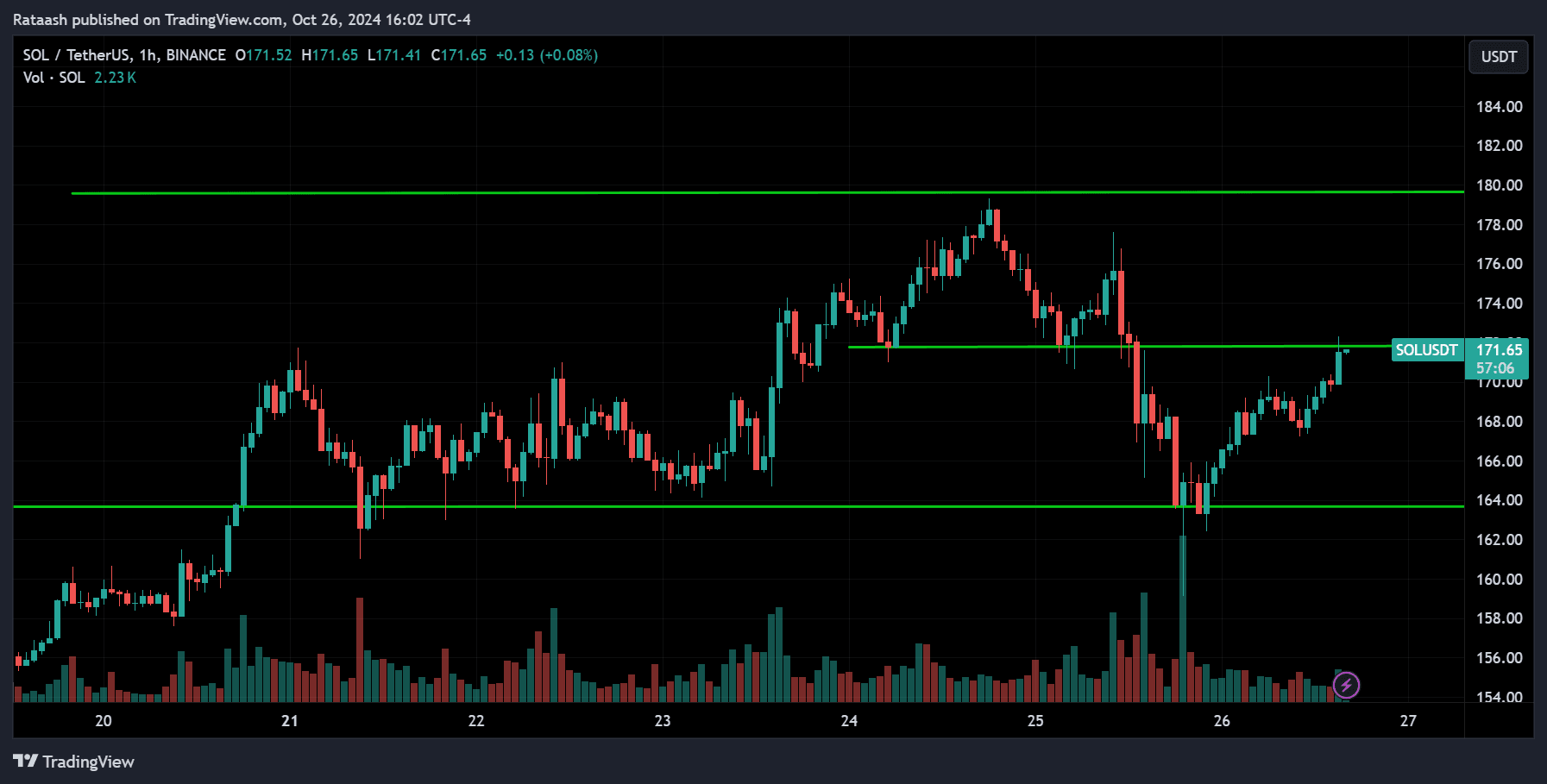

Solana(SOL):

Solana is a high-performance blockchain platform celebrated for its exceptional speed, scalability, and low transaction costs, making it ideal for decentralized applications (dApps) and cryptocurrencies. Launched in 2020 by Anatoly Yakovenko, Solana was designed to address the scalability challenges faced by many blockchain networks. As a result, it’s become a popular choice in the crypto community, especially for decentralized finance (DeFi), non-fungible tokens (NFTs), and other dApp ecosystems.

While Solana competes with Ethereum, it operates on different technology, focusing on enhanced scalability. This has drawn significant attention from developers and investors, making it a key asset to watch.

In terms of price action, Solana recently rose from support at $120, broke above resistance at $160, and is now trading near $180. On the 1-hour chart, after reaching $180, it briefly pulled back to $164 before climbing back to a key level at $170. If Solana breaks above $170, it may continue toward $180 and beyond. However, a dip below $164 could signal a potential correction.

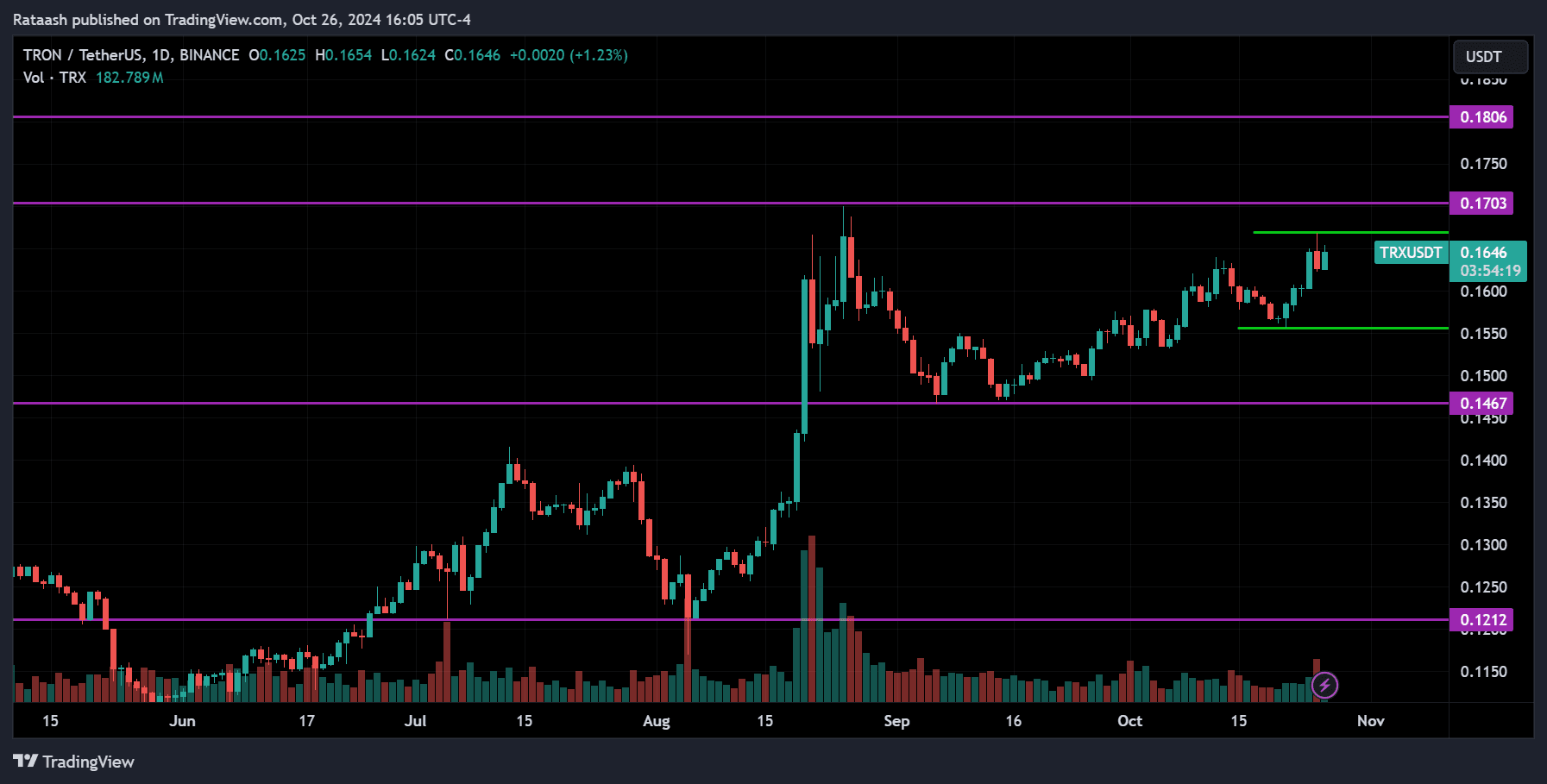

Tron(TRX):

Tron (TRX) is a blockchain-based, decentralized platform focused on building a decentralized internet, supporting smart contracts, and hosting decentralized applications (dApps). Founded by Justin Sun in 2017, Tron initially launched on Ethereum before migrating to its own blockchain. Its mission is to establish a global content and entertainment ecosystem, empowering creators to share their work directly with consumers, bypassing intermediaries.

Several prominent dApps run on Tron, including BitTorrent (BTT) for peer-to-peer file sharing, JUST (JST) for stablecoin lending and DeFi, and WINkLink (WIN) for blockchain gaming. Sun.io supports yield farming and staking, while APENFT (NFT) and Kraftly.io enable NFT creation and trading. JustSwap functions as Tron’s decentralized exchange for TRC20 tokens, and TronBank provides decentralized investment and staking services. Additionally, Tether (USDT) operates on Tron as a TRC20 token, allowing fast, low-cost stablecoin transactions across exchanges. These applications and tokens benefit from Tron’s high-speed, low-fee infrastructure, positioning Tron as a major player in DeFi, gaming, and NFTs.

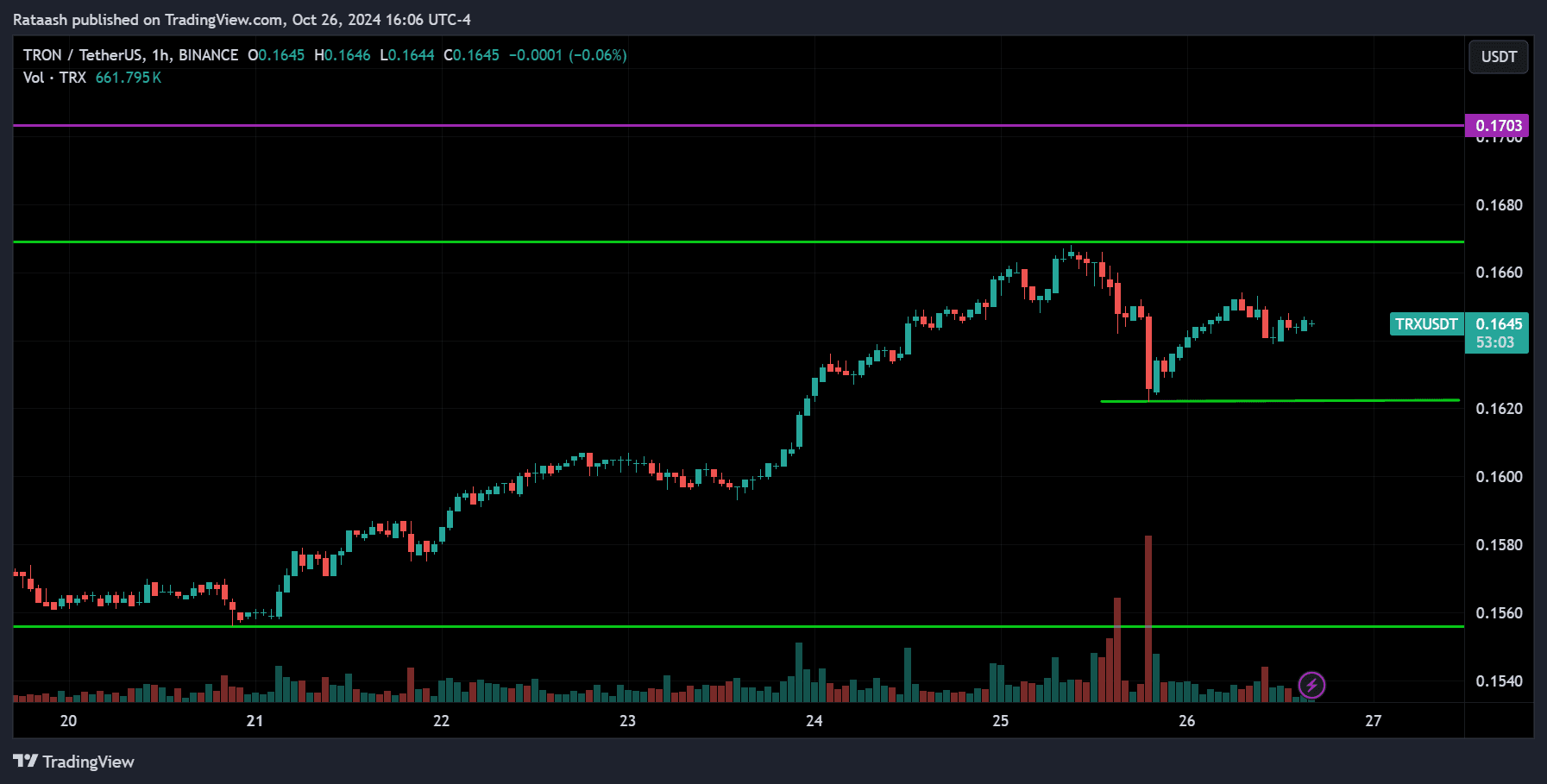

Currently, TRX is approaching a resistance level of $0.1700, with major support around $0.1450. On the 1-hour chart, TRX recently pulled back from $0.1680, found support around $0.1620, and has started to climb again. As always, the price’s direction will depend on the next breakout.

Helium(HNT):

Helium (HNT) is a blockchain-based decentralized network designed for the Internet of Things (IoT). Launched to create a wireless network infrastructure powered by blockchain, Helium allows devices to connect to the internet through decentralized hotspots. It leverages a unique Proof-of-Coverage consensus mechanism, which rewards users for contributing to network coverage with HNT tokens. The Helium network aims to revolutionize IoT connectivity by reducing dependency on traditional telecom providers.

Helium has become popular due to its practical use case, enabling low-cost, long-range wireless connections for IoT devices, such as smart sensors, GPS trackers, and environmental monitors. The HNT token, used for rewarding hotspot operators, is integral to this ecosystem.

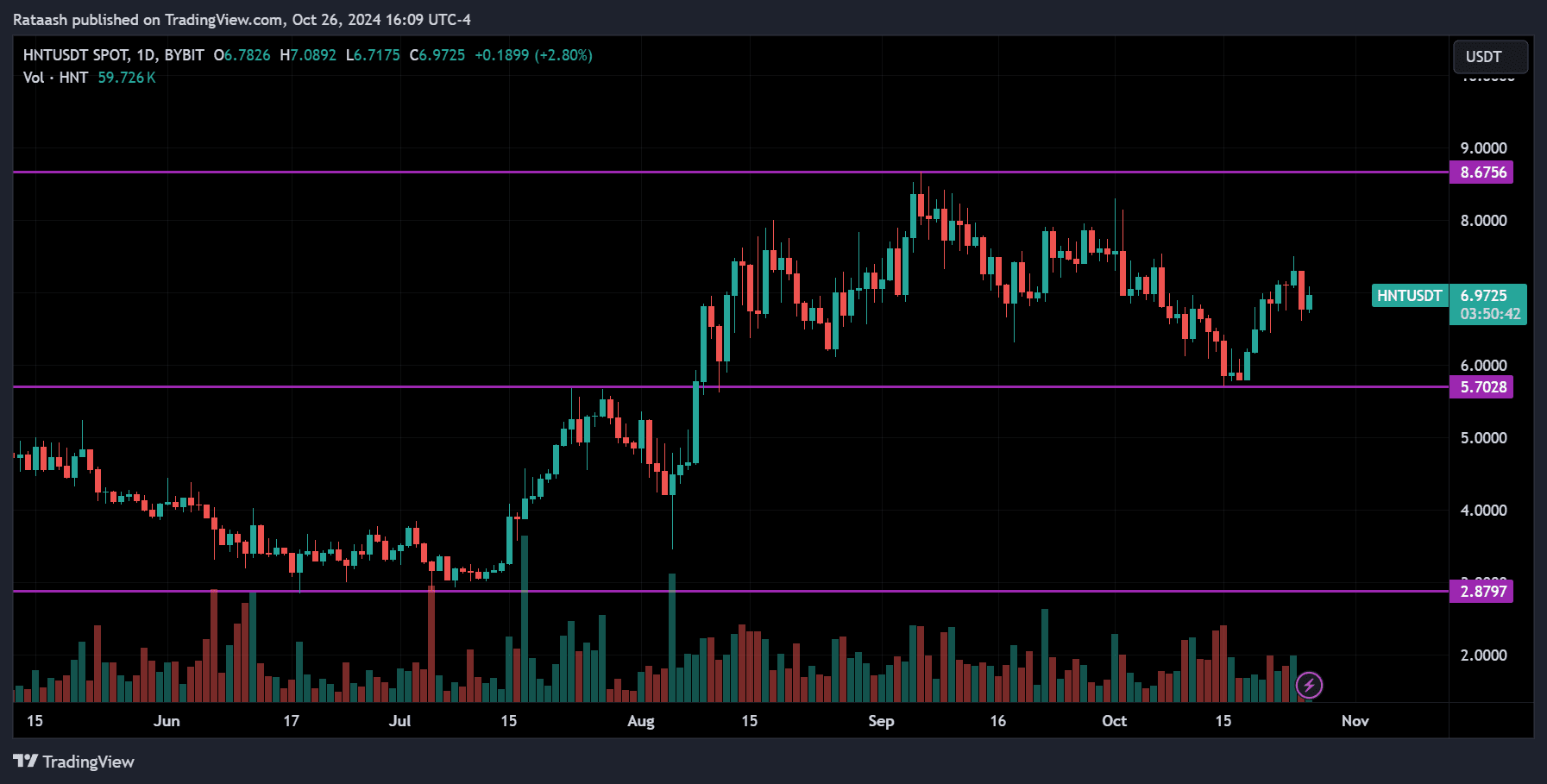

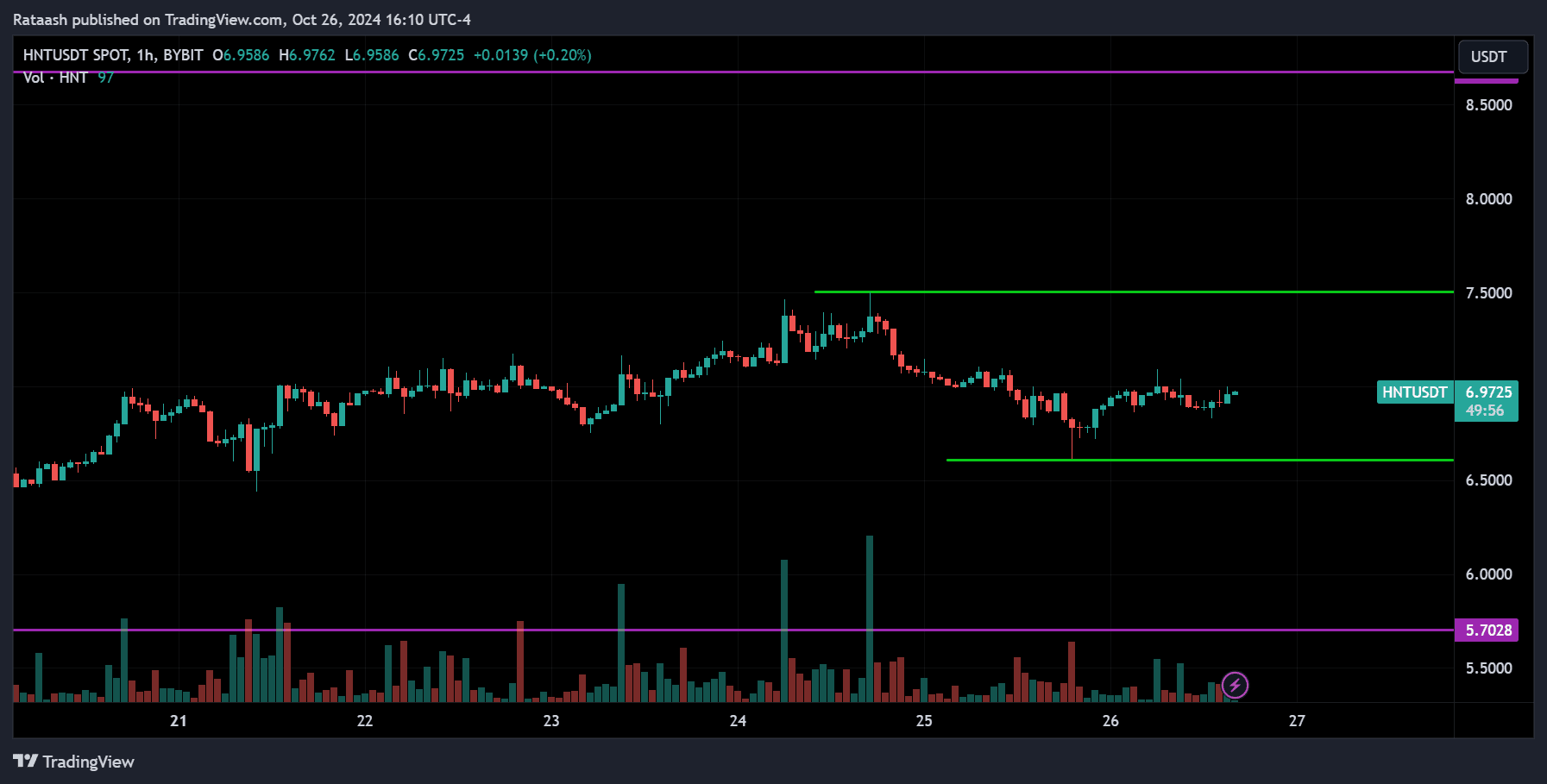

Currently, HNT is trading near a key level of $6.97. On the 1-hour chart, it recently pulled back from resistance around $7.50, finding support at approximately $6.50. If HNT breaks above the current resistance, we could see a push toward the next major resistance at $8.50. However, if the price dips below the $6.50 support, a further correction may be likely. As always, the direction will depend on the breakout.

Conclusion

In conclusion, the cryptocurrency market remains dynamic as we approach critical economic events that may impact key assets like Bitcoin, Ethereum, Solana, Tron, and Helium. Each of these assets is poised at significant technical levels, with potential breakouts or corrections hinging on broader economic indicators such as inflation and employment data. Bitcoin’s approach toward its all-time high has heightened market excitement, while Ethereum, Solana, Tron, and Helium each demonstrate unique strengths in DeFi, NFTs, and IoT.

Upcoming Federal Reserve decisions will likely play a pivotal role in shaping the trajectory of these cryptocurrencies, making it an essential time for investors to stay informed. As always, monitoring price movements in response to these catalysts will be crucial for navigating the next phase of the crypto market.