Thanksgiving week and Black Friday have always been pivotal moments for the U.S. stock market. In 2024, these events are more critical than ever, as they intersect with economic uncertainty, inflationary trends, and evolving consumer behaviors. Here’s a detailed analysis of what Thanksgiving week and Black Friday mean for the U.S. stock market, incorporating historical insights, current economic conditions, and market expectations for this year.

Historical Stock Market Trends During Thanksgiving Week

Thanksgiving week often sets a bullish tone for the markets. Historically, the shortened trading week is characterized by:

Positive Performance:

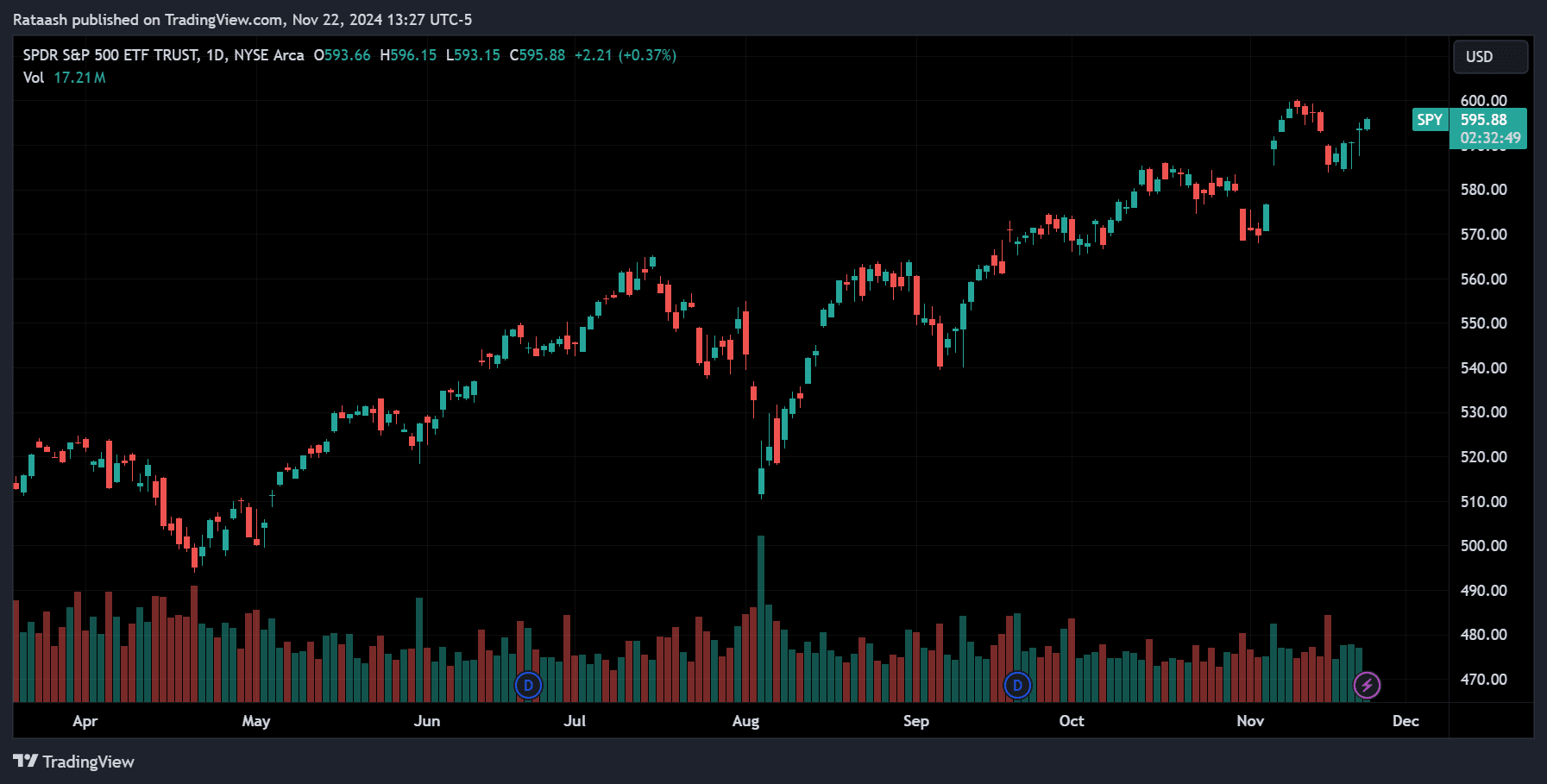

The S&P 500 has posted gains in 68% of Thanksgiving weeks over the past 50 years, averaging a 0.5% increase.

The Dow Jones Industrial Average and Nasdaq also typically exhibit strong performances, driven by lighter trading volumes and investor optimism.

Low Volatility:

With major institutional players often on holiday, trading volumes tend to be lower, resulting in less market noise and reduced volatility.

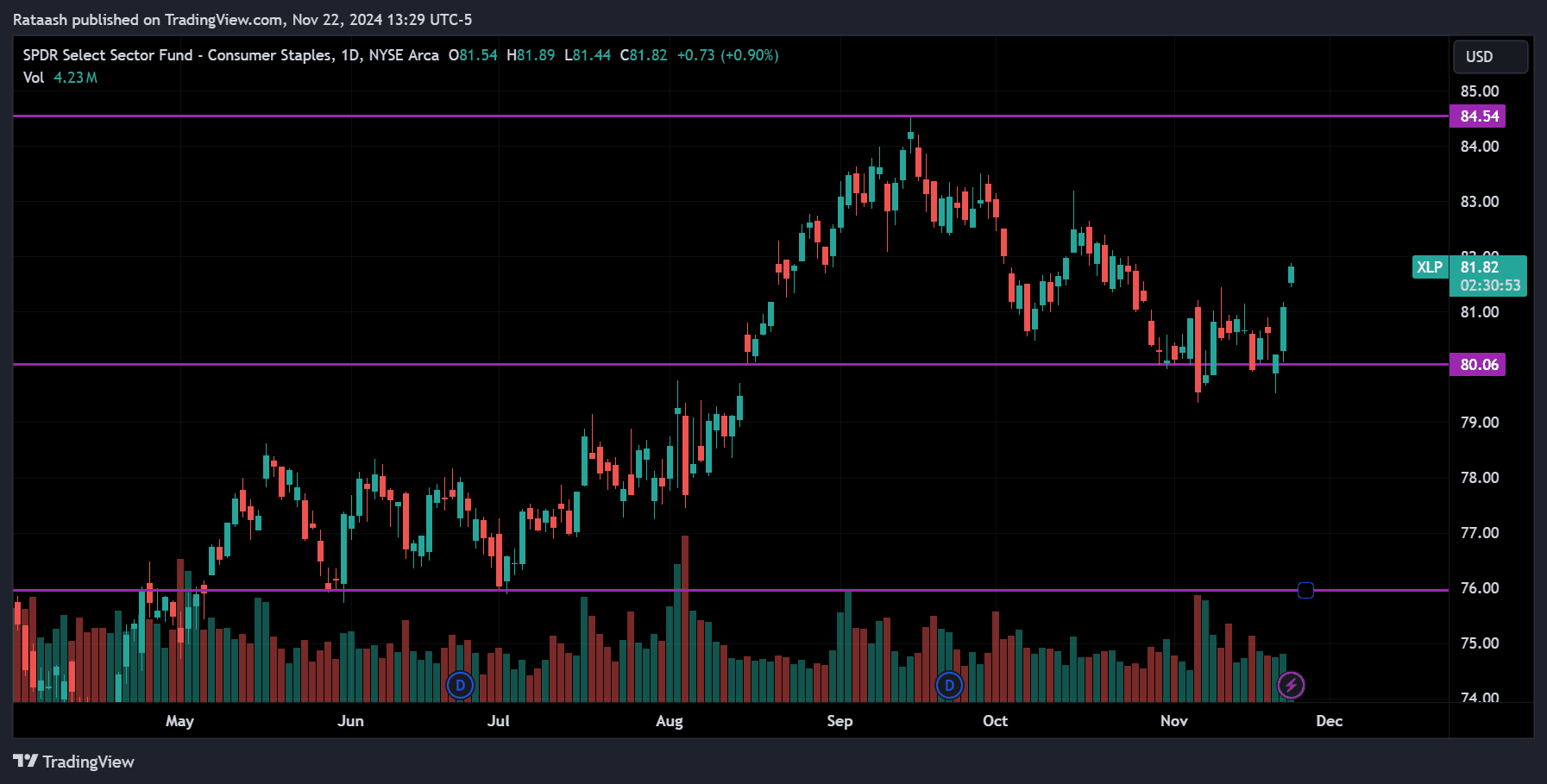

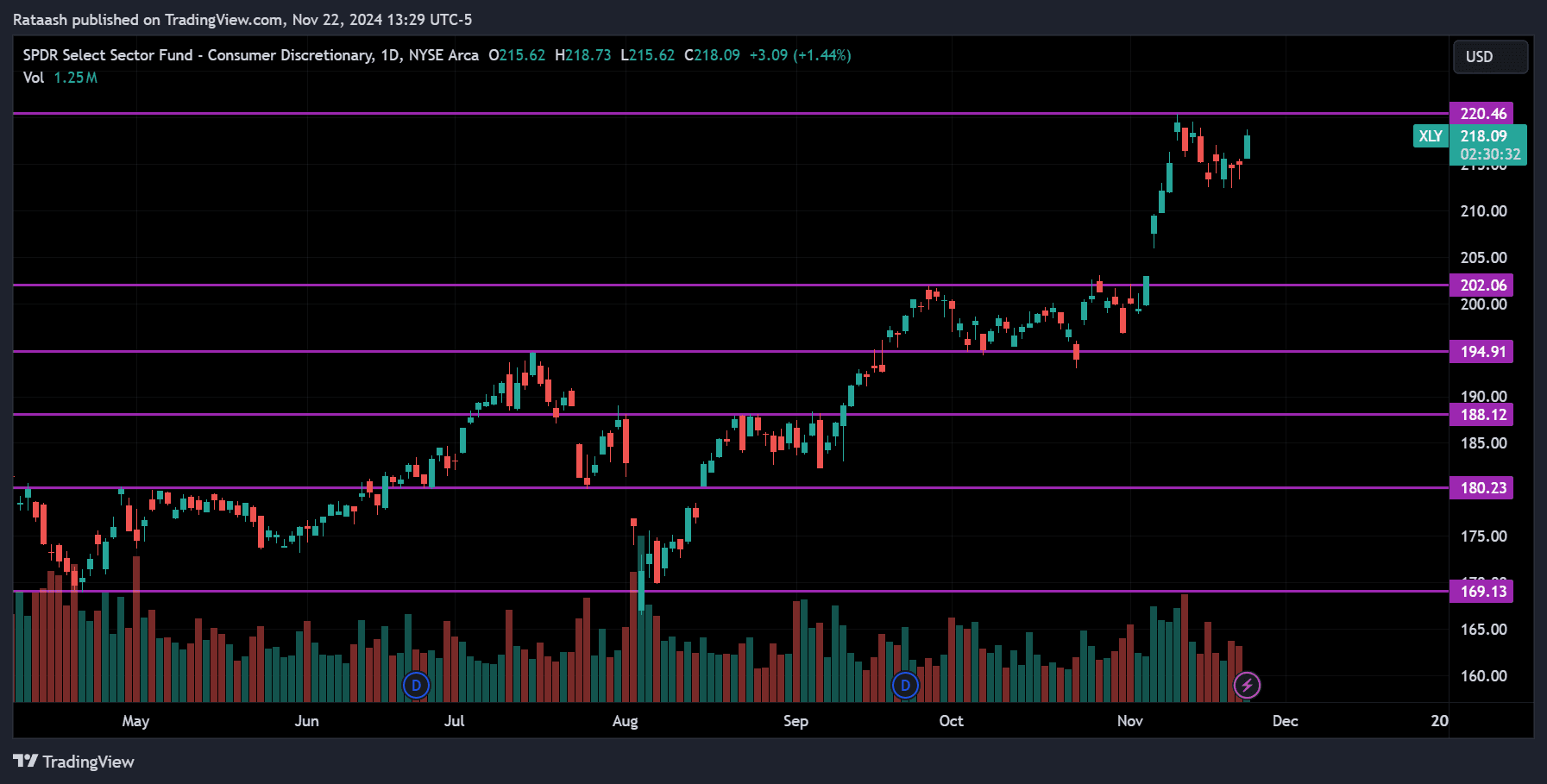

Sector-Specific Gains:

Retail and consumer discretionary sectors usually benefit the most during Thanksgiving week, as the holiday shopping season kicks off.

Black Friday’s Influence on Retail Stocks

Black Friday, the day after Thanksgiving, is a barometer for the retail sector. It sets the stage for the holiday shopping season and provides insight into consumer sentiment.

2024 Retail Expectations:

According to the National Retail Federation, holiday sales in 2024 are expected to grow by 4-6%, despite inflationary pressures.

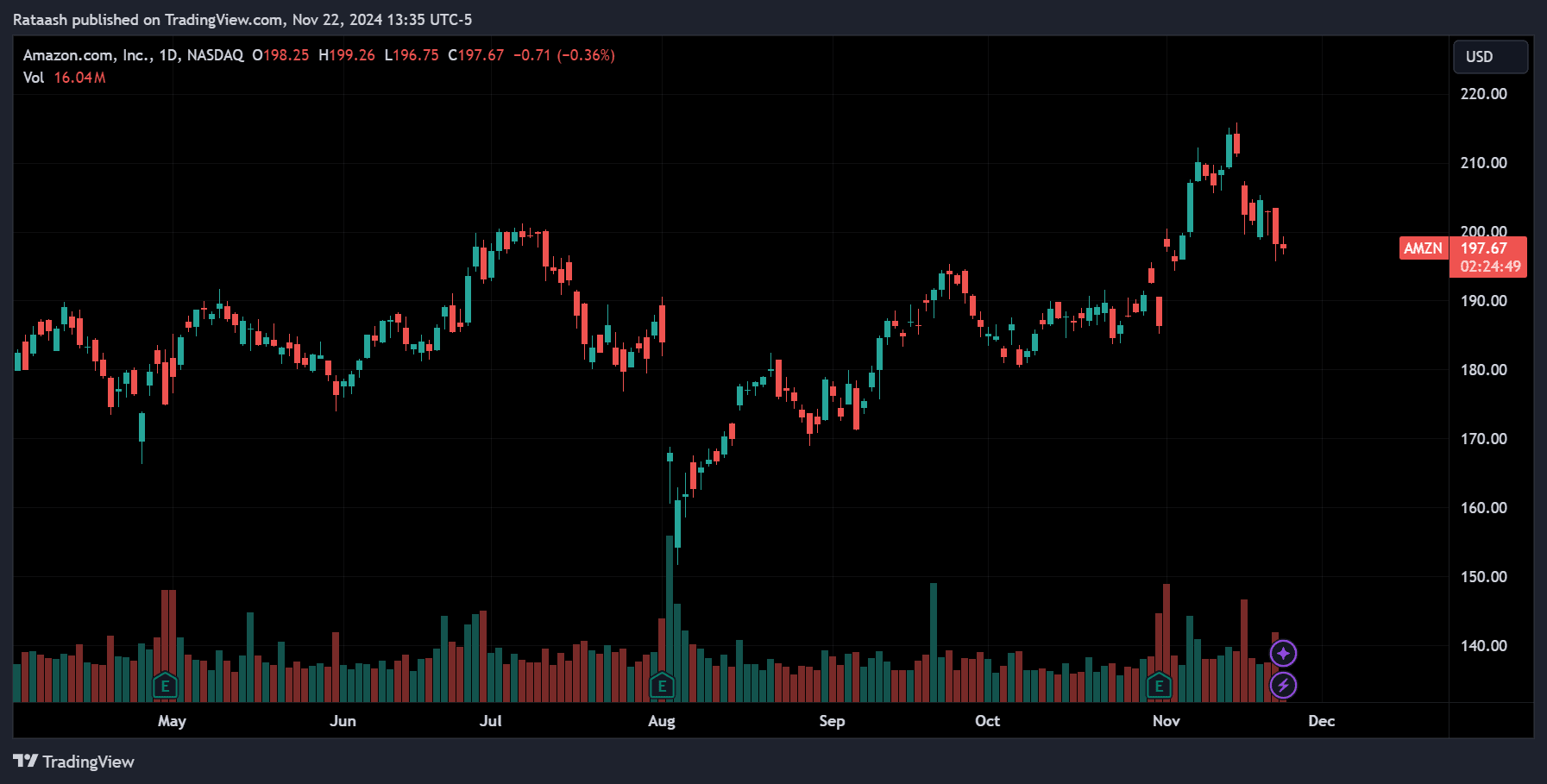

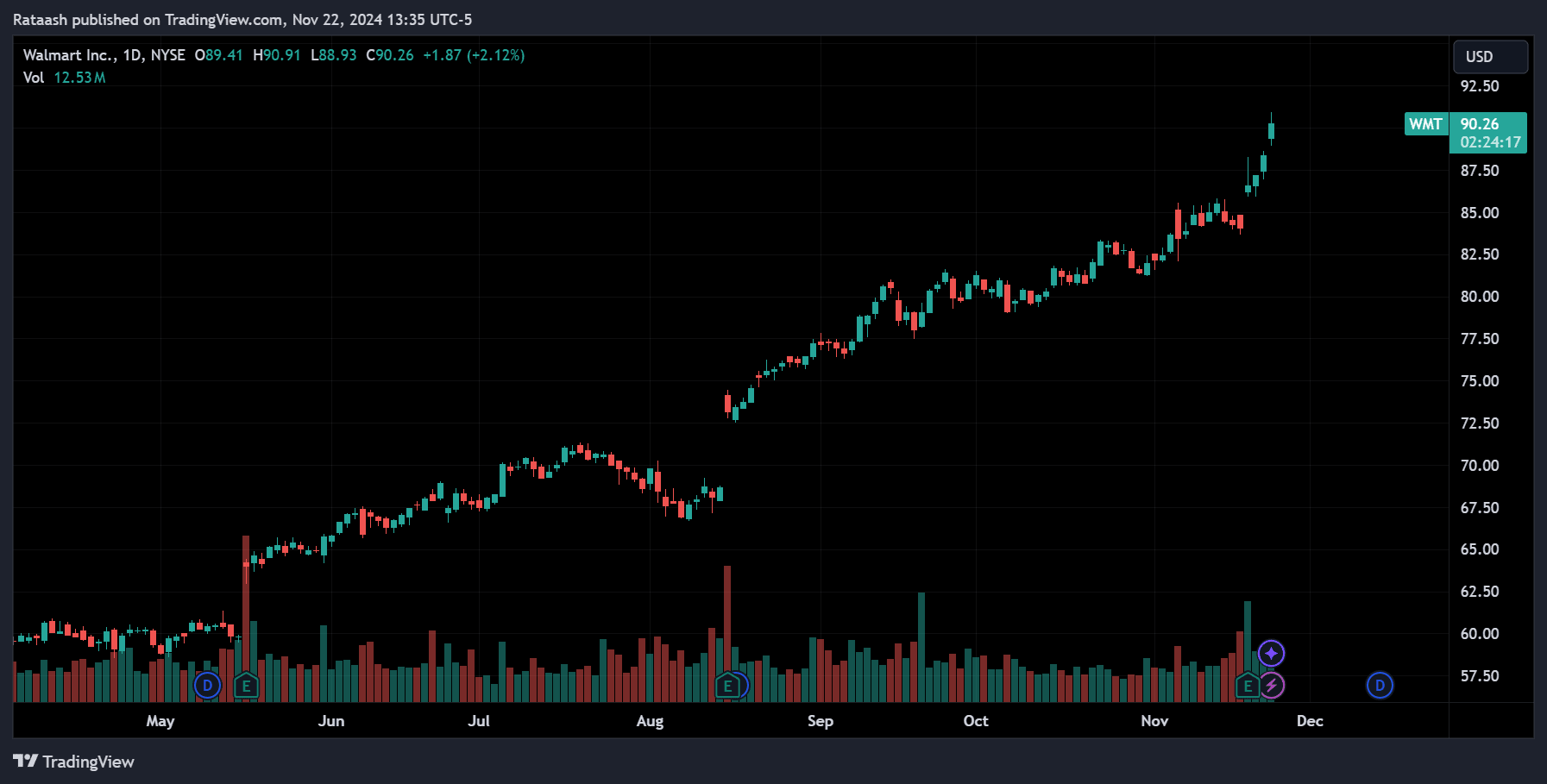

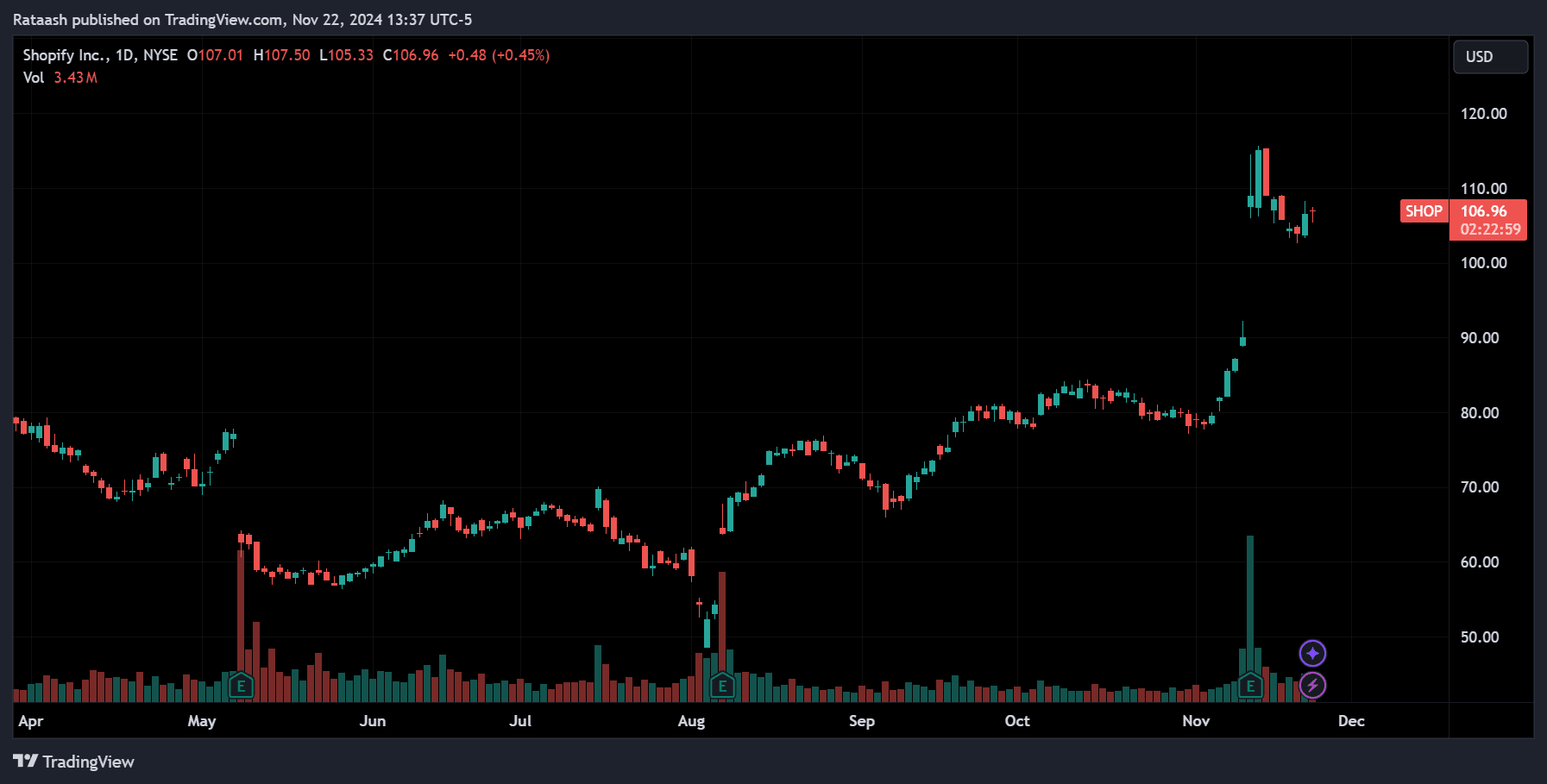

Strong online sales trends, with e-commerce expected to account for 20% of total holiday sales, could benefit companies like Amazon (AMZN), Walmart (WMT), and Shopify (SHOP).

Key Metrics to Watch:

Foot Traffic: Increased foot traffic in malls and stores during Black Friday can signal higher in-store sales.

Online Sales: Adobe Analytics predicts a 10% year-over-year growth in Black Friday online sales in 2024, benefiting tech-driven retail platforms.

Retail Stock Movers:

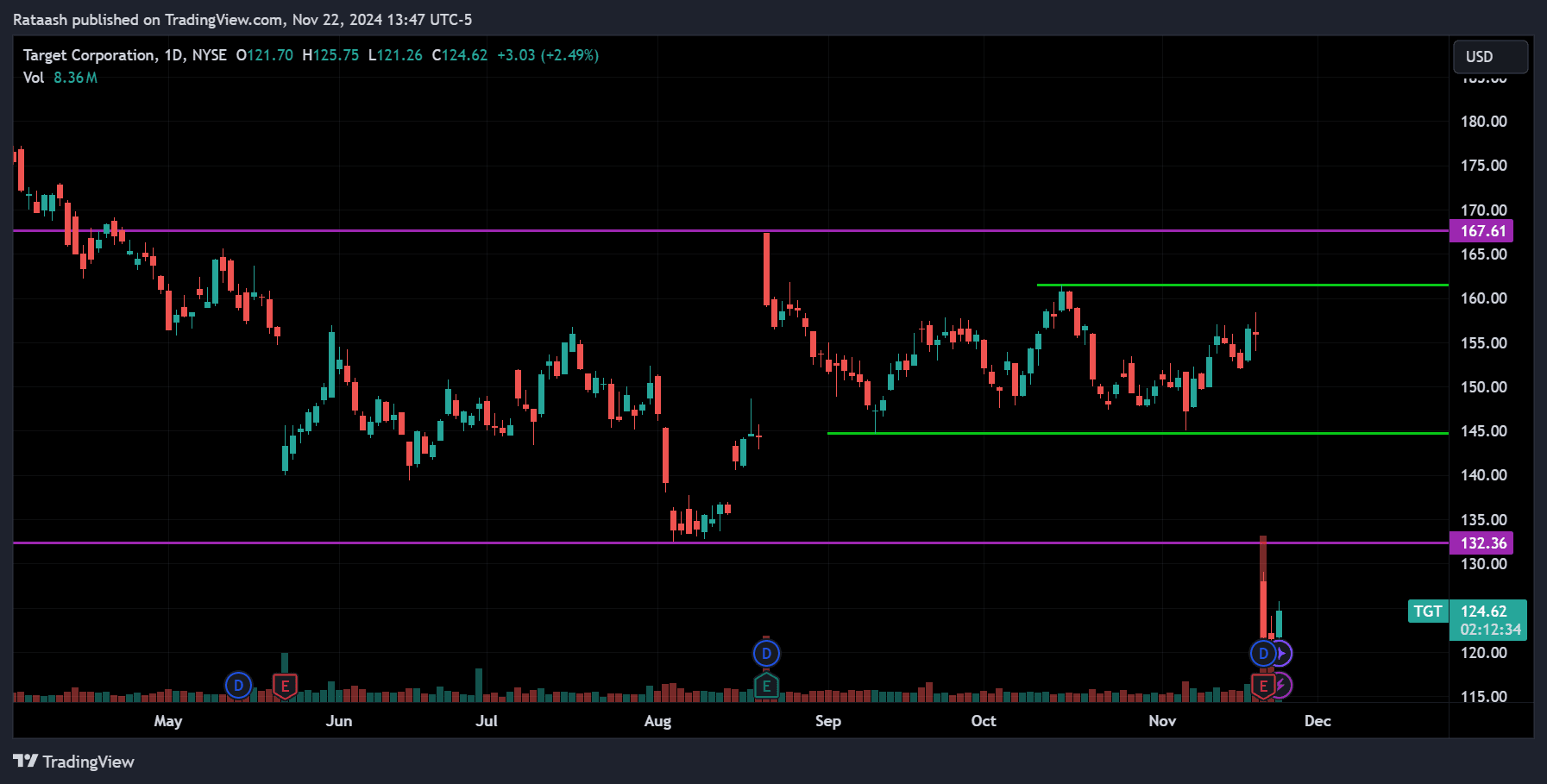

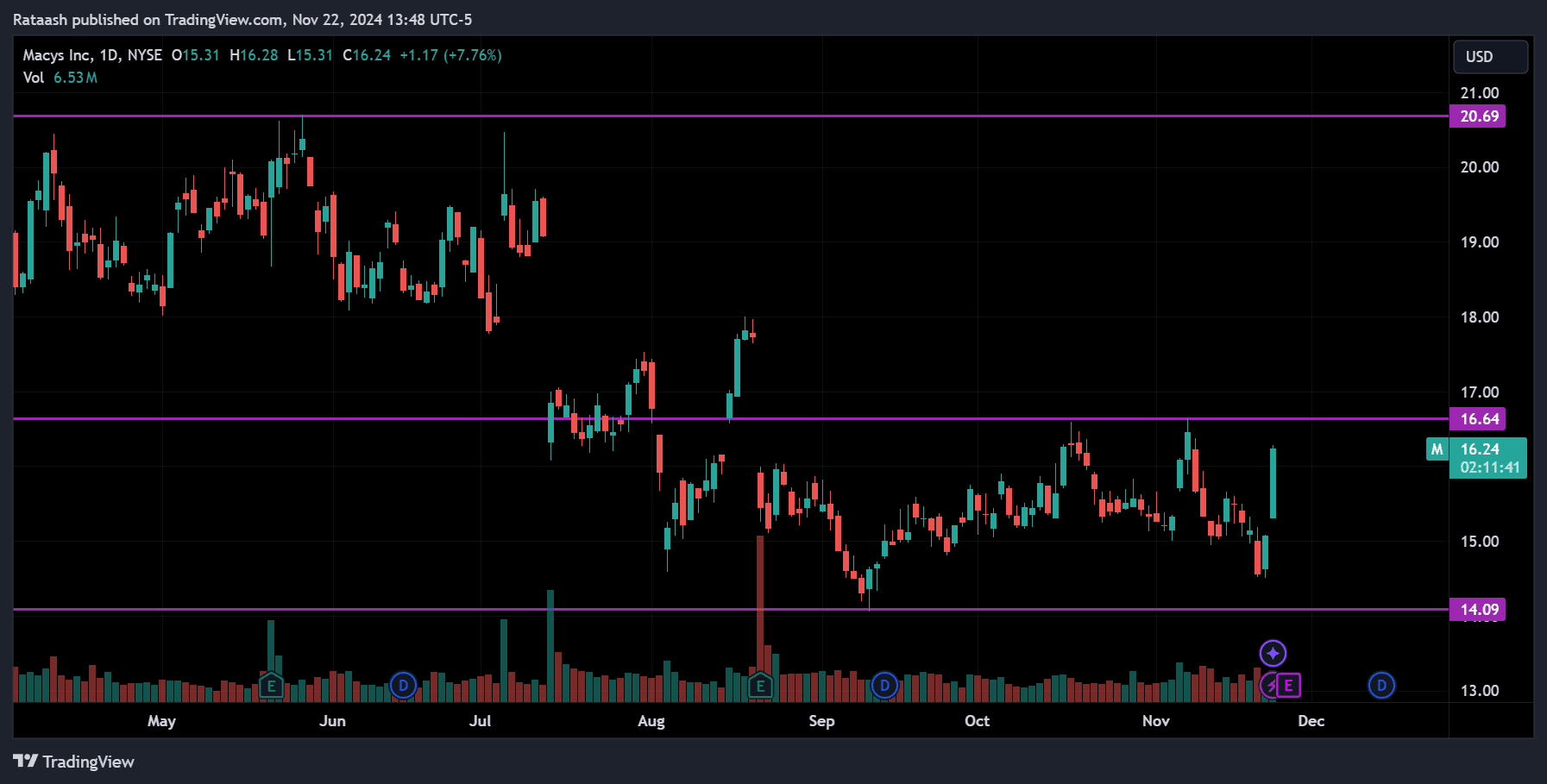

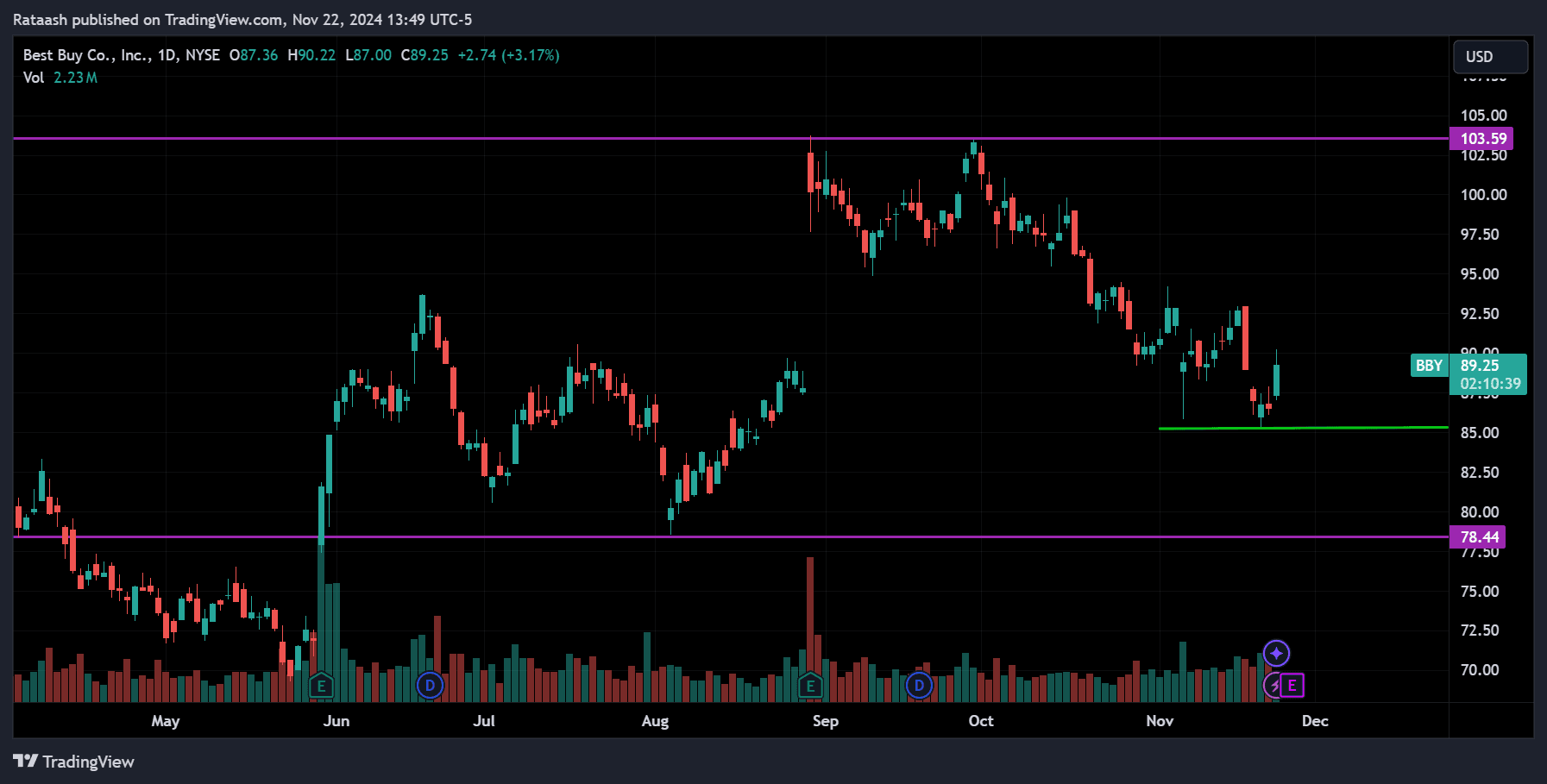

Watch stocks like Target (TGT), Macy’s (M), and Best Buy (BBY) for short-term price action.

Consumer sentiment reports post-Black Friday will be critical in gauging whether retailers met or missed expectations.

Macroeconomic Factors at Play in 2024

Thanksgiving week and Black Friday take place amidst a unique economic backdrop in 2024:

Inflationary Trends:

While inflation has cooled from 2023 highs, consumer prices remain elevated. This could impact discretionary spending, making Black Friday discounts a decisive factor in driving sales.

Interest Rates:

The Federal Reserve’s interest rate policies remain a focal point. If rates are expected to stabilize or decline, the markets could respond positively during the week.

Labor Market Data:

A robust labor market could signal higher consumer spending capacity, positively impacting retail and travel sectors.

Sector Analysis for Thanksgiving Week

Here’s a breakdown of key sectors to watch:

Retail & Consumer Discretionary:

Seasonal strength is expected. Companies offering deep discounts are likely to see higher sales volumes.

ETFs to monitor: SPDR S&P Retail ETF (XRT), Consumer Discretionary Select Sector SPDR Fund (XLY).

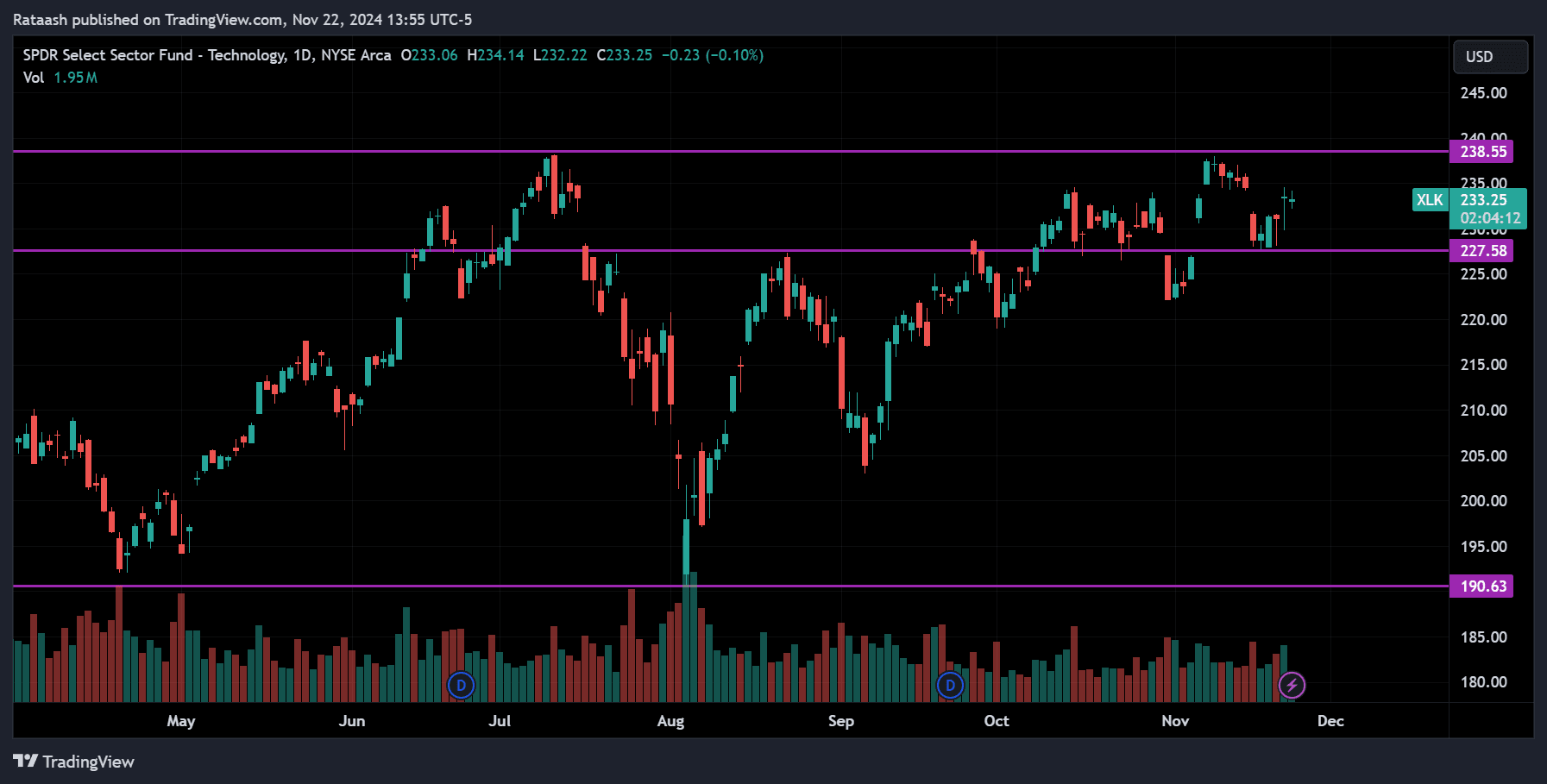

Technology:

E-commerce platforms will play a critical role. Tech-heavy indices like the Nasdaq could see gains if consumer tech products dominate Black Friday sales.

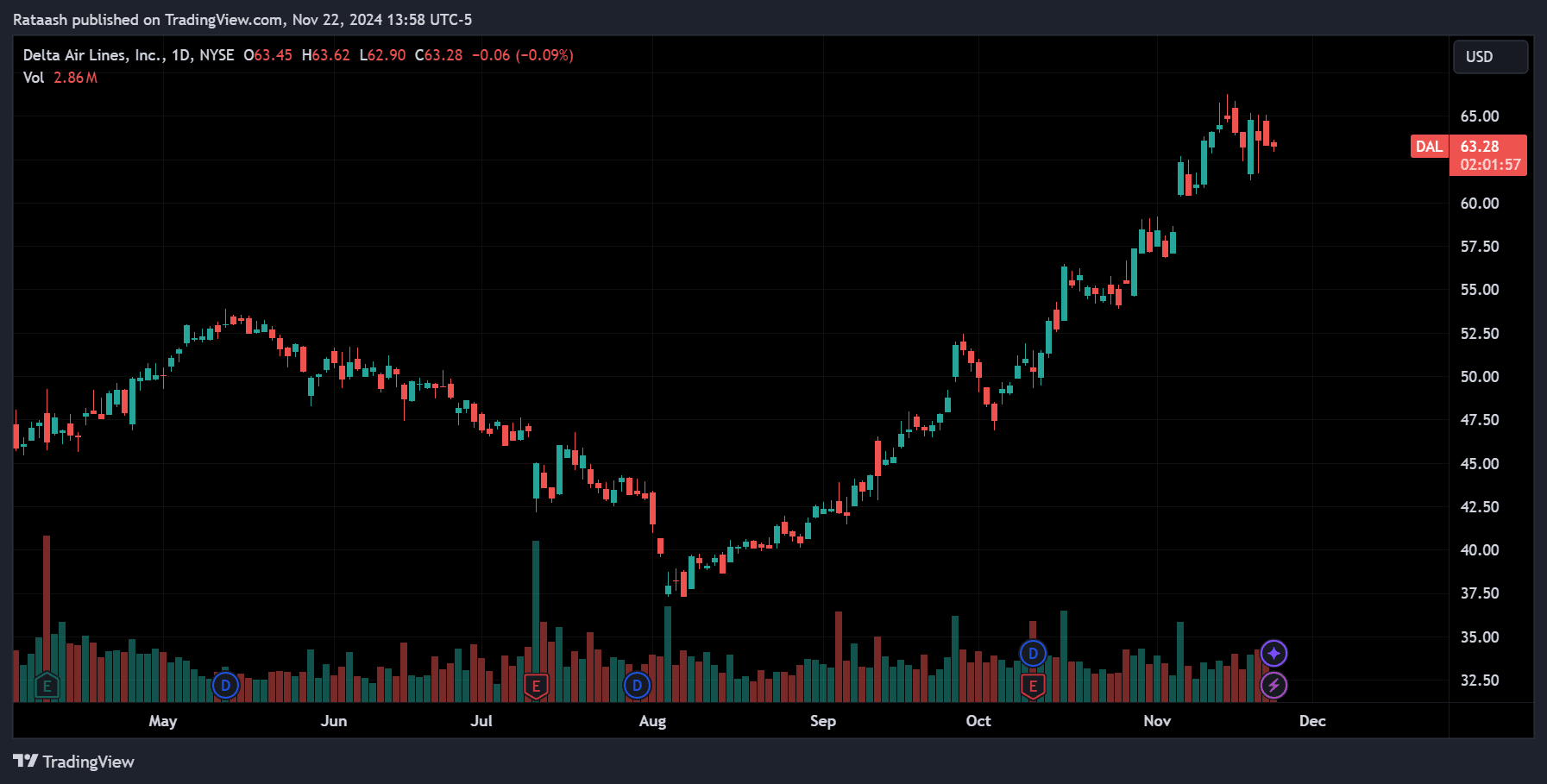

Travel and Hospitality:

Thanksgiving week is one of the busiest travel weeks in the U.S. Airlines (e.g., Delta Airlines, American Airlines) and hospitality companies (e.g., Marriott, Hilton) could benefit from increased bookings.

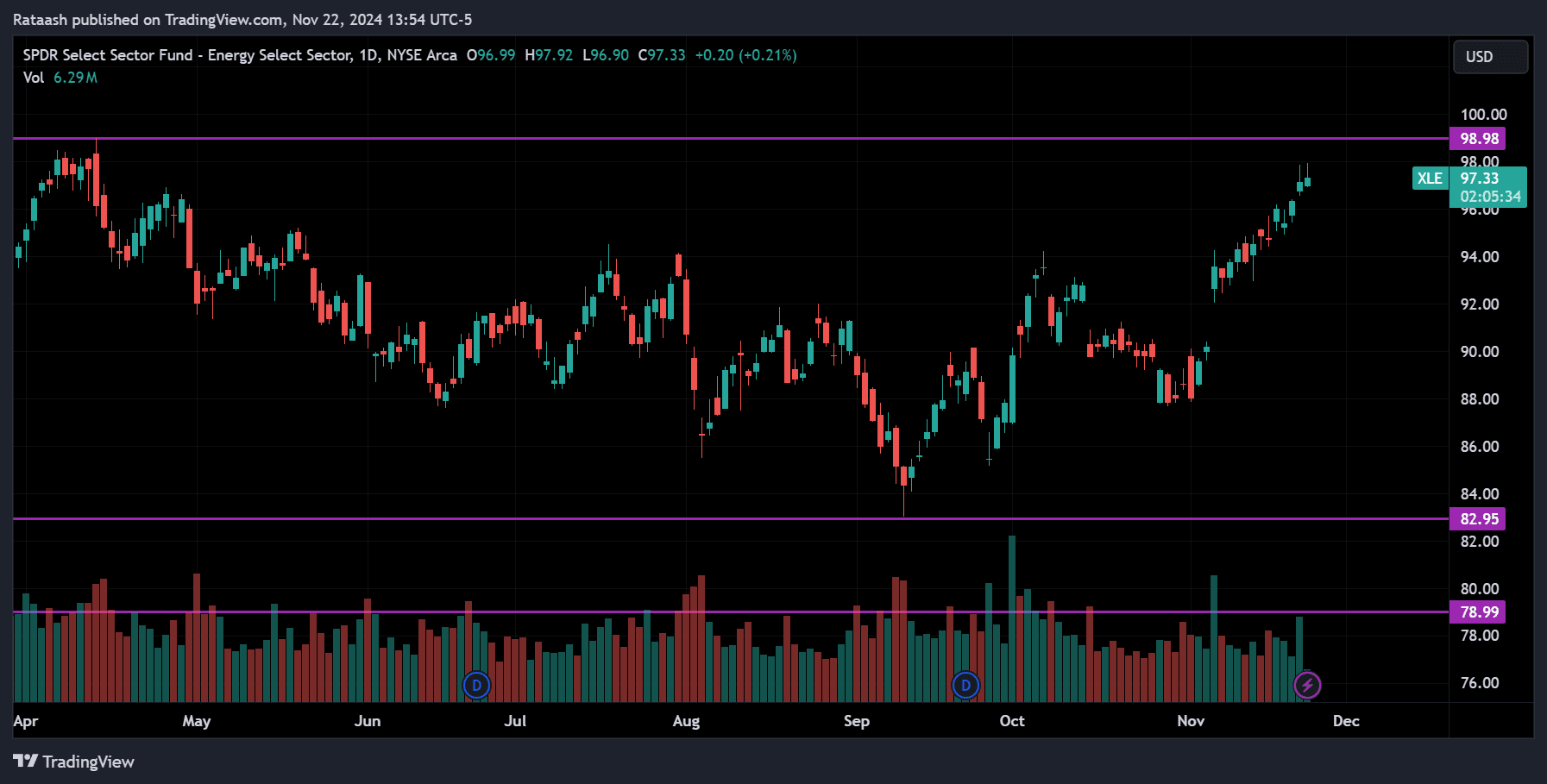

Energy:

As holiday travel spikes, crude oil prices could see upward pressure, benefiting energy companies.

Stock Market Trading Patterns

The trading schedule during Thanksgiving week can influence market behavior:

Shortened Week:

Markets close early on Black Friday (1:00 PM ET), leading to condensed trading opportunities. This often results in higher volatility in the days leading up to Thanksgiving.

“Santa Claus Rally” Setup:

Thanksgiving week is often seen as the precursor to the “Santa Claus Rally,” a period of bullish performance in late December.

How Investors Can Prepare

Focus on Earnings Reports:

Many retail giants report earnings in the weeks leading up to Thanksgiving, offering insights into their holiday season outlook.

Monitor Key Economic Data:

Reports such as consumer sentiment, personal spending, and retail sales will shape investor expectations for the quarter.

Short-Term Trading Opportunities:

With lower trading volumes, technical patterns like breakouts and retracements can offer profitable opportunities.

Conclusion

Thanksgiving week and Black Friday in 2024 offer a unique lens to understand consumer behaviors, economic trends, and stock market movements. As retailers brace for strong holiday sales and investors prepare for the year-end rally, this period remains a critical time for market participants to align their strategies with seasonal patterns.