The year 2025 has brought a whirlwind of developments in the world of cryptocurrency. Rapid price movements, surprising new token launches, and increasing global interest have all collided to produce one of the most dynamic periods in crypto history. Political figures, celebrities, and mainstream corporations have entered the blockchain space in ever-greater numbers, signaling that digital assets are undeniably part of the modern financial ecosystem.

Among the most noteworthy developments this year is the launch of the $TRUMP meme coin, a cryptocurrency associated with President-elect Donald Trump. Though initially met with skepticism in some quarters of the industry, this token has captured a substantial share of the market’s attention due to its political connections, social media-driven marketing, and remarkable performance since its unveiling. In this news article, we will delve deeply into the essential details about $TRUMP, including its tokenomics, market performance, blockchain infrastructure, community debates, and future prospects. We will also explore other major cryptocurrencies—such as Bitcoin, Ethereum, Solana, Cardano, BNB, XRP, Dogecoin, and HBAR—to provide an updated snapshot of 2025’s crypto market.

By the end of this article, you will have a thorough understanding of the $TRUMP coin, the broader crypto landscape, and the emerging trends shaping investor sentiment. Whether you’re a newcomer to the blockchain realm or a seasoned market participant, these insights will help you stay informed and make sense of the latest headlines in the digital asset world.

TRUMP Coin Overview and Analysis

My NEW Official Trump Meme is HERE! It’s time to celebrate everything we stand for: WINNING! Join my very special Trump Community. GET YOUR $TRUMP NOW. Go to https://t.co/GX3ZxT5xyq — Have Fun! pic.twitter.com/flIKYyfBrC

— Donald J. Trump (@realDonaldTrump) January 18, 2025

1. What is the $TRUMP Meme Coin?

On January 17, 2025, President-elect Donald Trump used his social media platforms—most notably Truth Social and X—to introduce a new cryptocurrency known as the $TRUMP meme coin. At its core, the coin is designed to function as a digital asset that embodies Trump’s ideals, promotes community engagement, and creates an ecosystem rallying his supporters worldwide. While the concept of meme coins is not new—tokens like Dogecoin and Shiba Inu have exemplified this category—$TRUMP stands out due to its affiliation with a prominent political figure and the aura of controversy that surrounds both meme tokens and political fundraising.

Meme coins often rely heavily on community support, social media hype, and the cultural resonance of their branding to gain momentum. $TRUMP embraces this approach by leveraging Trump’s already vast and highly vocal political base. The coin’s value proposition is inseparable from Trump’s celebrity and political influence, and this unique positioning has helped it garner quick adoption and buzz within the crypto community.

2. Built on the Solana Blockchain

Unlike many meme coins that have historically been launched on Ethereum due to its robust smart contract ecosystem, $TRUMP is built on the Solana blockchain. Launched in 2020, Solana boasts high transaction throughput, minimal fees, and efficient network scalability. Its Proof of History (PoH) consensus mechanism—coupled with features like Tower BFT—enables Solana to process thousands of transactions per second at a fraction of the cost typically experienced on other networks.

This technology backbone has crucial implications for $TRUMP. By using Solana, transactions involving $TRUMP are not only rapid but also cost-effective. This can encourage more frequent trading, micropayments, and everyday usage scenarios—qualities that help meme coins create and sustain momentum. Early adopters and supporters can buy, sell, or transfer $TRUMP with minimal friction, making it more appealing to a broad audience.

3. Tokenomics and Distribution

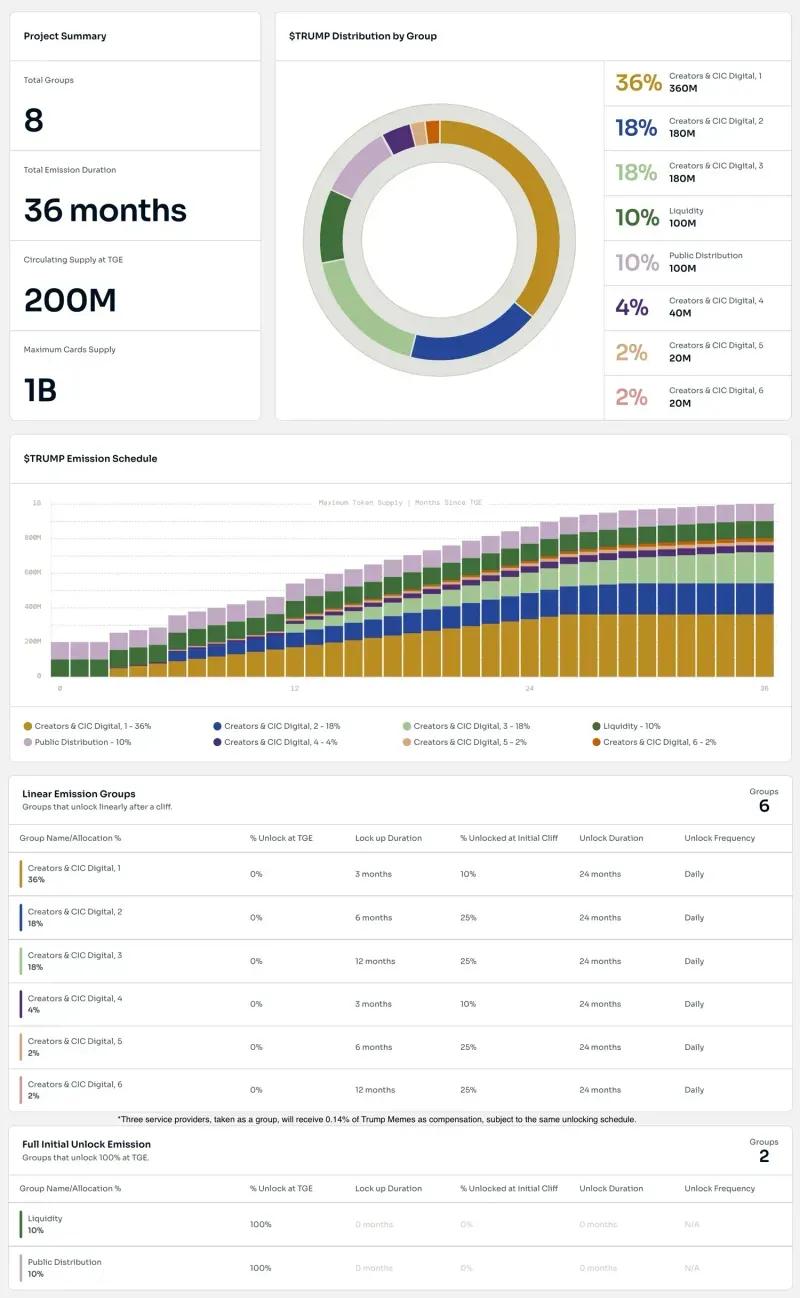

A cryptocurrency’s tokenomics and distribution structure can reveal a lot about its potential for value appreciation, as well as the intentions of its creators. Below is a breakdown of the $TRUMP coin’s essential tokenomics:

- Total Supply:

The $TRUMP meme coin has a capped total supply of 999,999,993 tokens. This finite cap can serve as a key differentiator from inflationary cryptocurrencies, as investors often place more trust in assets with limited supply. - Circulating Supply:

As of the latest update, 200,000,000 tokens are in circulation. The remaining tokens are locked or set aside according to various unlocking schedules. This structure creates a scarcity dynamic that could impact the token’s price over time. - Ownership Structure:

- 80% of the token supply is controlled by CIC Digital LLC (an affiliate of The Trump Organization) and Fight Fight Fight LLC.

- These holdings are locked and follow a three-year unlocking schedule, which means they are gradually released over time rather than being available in full at launch.

- The presence of large controlling entities can raise concerns about centralization. However, proponents argue that it offers a stable backing and ensures the coin remains aligned with Trump’s official brand.

- Initial Distribution:

- 20% of the total tokens were released at the project’s inception.

- This portion included liquidity and a public distribution to early investors and supporters.

- The rest is subject to vesting schedules for the controlling entities and possibly for marketing, development, or other strategic efforts.

Significance of the Distribution Model

Meme coins often thrive on decentralization and grassroots enthusiasm, so questions naturally arise when a large portion of the supply remains in the hands of a small group. Supporters maintain that controlled distribution can prevent rampant market manipulation and instill confidence, as major stakeholders have a vested interest in the project’s long-term success. Critics, however, worry that such concentration of ownership could lead to price manipulation or conflict of interest, especially when politics is woven into the narrative.

Nonetheless, $TRUMP’s tokenomics strategy—finite supply, partial decentralization, and structured unlocking—has thus far attracted substantial interest. Investors intrigued by high-risk, high-reward propositions have begun accumulating tokens, betting on the possibility that the coin’s political underpinnings will drive demand beyond typical meme coin life cycles.

4. Market Performance

The performance of $TRUMP has been nothing short of astonishing since its debut. According to the most recent data:

- Current Price: The live price of $TRUMP is $44.27 USD.

- 24-Hour Performance: The token has surged by 288.48% in the last 24 hours, marking a significant bullish trend.

- Trading Volume: The 24-hour trading volume stands at a massive $11,066,052,717 USD, reflecting high liquidity and robust market participation.

- Market Capitalization: Thanks to its explosive price rise, the live market cap of $TRUMP is $8,854,001,857 USD, earning it the #22 spot in CoinMarketCap’s rankings.

These metrics paint a picture of an asset that has defied expectations in both price and trading interest. Some reasons for this performance include:

- Strong Community Hype: Trump’s loyal base and fervent supporters have added a layer of enthusiasm rarely seen in typical meme coin communities.

- High-Profile Endorsements: With Trump’s personal brand behind the coin, significant media coverage and influencer endorsements followed, driving up demand.

- Strategic Exchange Listings: Early listings on major cryptocurrency exchanges provided easy access for investors and improved the token’s market visibility.

- Speculative Trading: Some traders see $TRUMP as a pure speculative play, capitalizing on hype cycles to reap short-term gains.

While these factors have contributed to the rapid uptick, critics caution that meme coins are notoriously volatile. A sharp rise in value can be followed by significant corrections, especially if trading volume dries up or if major holders decide to cash out. Nonetheless, $TRUMP’s journey thus far has been impressive, capturing the attention of seasoned traders and novices alike.

5. Performance and Blockchain Infrastructure

One of the critical decisions shaping $TRUMP’s adoption curve is its foundation on Solana. The coin’s rapid transaction speed and low fees have resonated with retail traders, who often find high Ethereum gas costs prohibitive. Moreover, these features allow for micro-transactions and frequent in-app purchases—potentially important for marketing campaigns, merchandise, or exclusive content tied to Trump’s brand.

Comparative Performance: Solana vs Ethereum

The broader cryptocurrency market conditions influence every token, including $TRUMP:

- Solana: Up 18.77% in the last 24 hours. This bullish performance indicates that the underlying network hosting $TRUMP is also experiencing positive market sentiment. High throughput and strong developer activity on Solana are some of the main drivers.

- Ethereum: Down 1.19% in the last 24 hours. Ethereum remains a leading blockchain platform, powering thousands of tokens and decentralized applications. However, its slower transaction speeds and higher fees can sometimes make alternative networks—like Solana—attractive for new project launches.

Since its inception, $TRUMP has shown remarkable resilience and growth:

- Initial Surge: The token briefly shot up to $30 in value after launch, pegging its fully diluted valuation at $30 billion.

- Sustained Demand: The coin did not fade away, as many meme coins do once the initial excitement subsides. Instead, it has maintained a strong community following, visible in both on-chain activity and social media discussions.

- Renewed Bullish Momentum: The recent gains to a price of $44.27 reflect an ongoing belief in the token’s future, possibly linked to Trump’s upcoming inauguration and the attention this event is drawing to the coin.

6. Community and Ethical Considerations

Community Aspects

- Grassroots vs. Top-Down: Unlike certain meme coins that start as grassroots projects, $TRUMP was introduced with a highly orchestrated launch, leveraging Trump’s media empire and brand. This blend of top-down and bottom-up marketing has created a unique atmosphere.

- Social Media Engagement: Discussions about $TRUMP dominate sections of crypto Twitter, Truth Social, and Telegram channels, showcasing a fervent community that eagerly shares memes, price updates, and speculation about the coin’s future.

Ethical Debates

- Intersection of Politics and Crypto: Critics argue that a cryptocurrency launched by a political figure could blur the lines between politics and personal gain. While political fundraising is not new, using a meme coin to attract investments raises questions about transparency, regulatory compliance, and potential conflicts of interest.

- Timing and Ethical Concerns: The coin’s launch occurred just days before Trump’s inauguration, prompting concerns about the potential monetization of a political event. Skeptics question whether the coin is more about capitalizing on hype than about providing genuine utility.

- Regulatory Scrutiny: Depending on how regulators interpret the token—security, utility, or otherwise—$TRUMP could face regulatory hurdles. The coin’s central association with a prominent political figure heightens the possibility of scrutiny from agencies like the SEC.

7. Current Sentiment and Future Prospects

Despite (or perhaps because of) the controversies, $TRUMP has quickly climbed into the top tier of cryptocurrencies by market capitalization. The token has tapped into an audience that is ready to engage financially in a political movement. In the near term, the price could see upward momentum continue if:

- Mainstream Adoption Grows: The introduction of additional utilities—such as voting on political polls, accessing exclusive events, or purchasing official merchandise with $TRUMP—could bolster the coin’s use cases.

- Media Spotlight Intensifies: Positive coverage by large news outlets and consistent mentions by Trump and his affiliates will maintain consumer curiosity.

- Broad Market Bull Run: A general crypto market uptrend can lift all boats, including meme coins. In 2025, if Bitcoin and other large-cap tokens resume their bull rallies, interest in speculative assets might surge again.

Conversely, potential risks include a sudden loss of interest if the political narrative wanes or if regulators crack down on the coin. Meme coins often rely on sentiment, making it imperative for $TRUMP to sustain its brand awareness and narrative relevance.

8. Key Highlights of $TRUMP (At a Glance)

- Blockchain: Solana – celebrated for its speed and efficient transactions.

- Price (Live): $44.27 USD

- Market Cap (Live): $8.85 billion USD

- 24-Hour Change: +288.48%

- Solana’s Performance: +18.77% in the last 24 hours

- Ethereum’s Performance: -1.19% in the last 24 hours

- CoinMarketCap Ranking: #22

The evolution of $TRUMP stands as a testament to the growing relevance of political figures in the crypto sphere. Whether you view it as a novelty, a political statement, or a serious investment, the coin represents a new dimension of how culture, finance, and technology intersect in the modern world.

Broader Crypto Market Context in 2025

Before diving into the price action of other major cryptocurrencies, it is essential to understand the overarching factors shaping the 2025 crypto landscape. The dynamics in this market go far beyond just one or two coins, especially when we consider how broader economic conditions, global adoption trends, and regulatory shifts play a major role in price movements.

2.1 The Global Economic Backdrop

After several years of global economic uncertainty, 2025 has brought signs of moderate recovery in many major economies. Central banks have adjusted monetary policies to control inflation and stimulate growth, leading more investors to explore alternative assets like cryptocurrencies as a hedge against fiat currency fluctuations.

- Institutional Adoption: Major financial institutions continue to integrate crypto trading desks and custodial services, offering clients an easier route to digital assets.

- Mainstream Acceptance: Several Fortune 500 companies now accept crypto payments for goods and services, normalizing digital currencies in daily commerce.

- Central Bank Digital Currencies (CBDCs): Governments worldwide are piloting or launching their own CBDCs, highlighting the growing recognition of blockchain’s potential in mainstream finance.

2.2 Regulatory Developments

The global regulatory climate for cryptocurrencies has become more defined yet remains patchy. Some countries have embraced digital assets with open arms, providing clear guidelines and tax incentives for crypto-based enterprises. Others maintain caution or outright bans. The interplay between these various stances influences capital flows into the crypto market.

- SEC Enforcement: In the United States, the Securities and Exchange Commission (SEC) has ramped up efforts to clarify securities laws as they pertain to crypto.

- International Coordination: Bodies like the Financial Action Task Force (FATF) and the International Monetary Fund (IMF) advocate for standardized international frameworks to address money laundering and regulatory arbitrage.

- DeFi and NFT Regulations: Decentralized finance (DeFi) and non-fungible tokens (NFTs) remain areas with less regulatory clarity, but ongoing discussions in 2025 suggest new guidelines may soon surface.

2.3 Emerging Trends and Technologies

- Layer-2 Scaling Solutions: Ethereum’s shift toward Proof of Stake has accelerated interest in Layer-2 solutions like Polygon, Optimism, and Arbitrum. Similarly, other ecosystems are expanding with sidechains and bridging solutions to reduce network congestion.

- Multichain Universe: The notion of a single “Ethereum Killer” has given way to a more multichain reality, where different blockchains coexist and cater to specific use cases. Assets often move seamlessly between networks via cross-chain bridges.

- Green Initiatives: Environmental concerns persist, pushing proof-of-stake and other energy-efficient consensus mechanisms to the forefront.

- Metaverse and Web3: Virtual worlds, digital ownership, and decentralized applications are deepening their roots in the mainstream consciousness, offering exciting new avenues for investment and innovation.

2.4 Market Sentiment: Cautious Optimism

Thanks to the combination of institutional support, moderate inflation, and technological progress, the crypto market in 2025 generally exhibits cautious optimism. While the memory of past bear markets still looms, many experts believe the industry has grown more resilient due to improved infrastructure and regulatory clarity. This environment favors both blue-chip cryptocurrencies like Bitcoin and Ethereum, as well as high-risk meme coins like $TRUMP, which can capture speculative interest.

Price Action Overview for Leading Cryptocurrencies

In the following subsections, we provide an overview of critical cryptocurrencies—beyond $TRUMP—and discuss their current trajectories in 2025.

Bitcoin (BTC)

Brief Analysis of Bitcoin in 2025

Bitcoin remains the leading cryptocurrency by market cap and continues to serve as a barometer for the broader crypto market. Institutional adoption through exchange-traded funds (ETFs), corporate treasuries, and digital gold narratives have fueled its growth, although it occasionally experiences volatility tied to macroeconomic developments.

- Store of Value: Bitcoin’s appeal as “digital gold” persists as many investors use it as a hedge against inflation.

- Layer-2 Expansions: The Bitcoin Lightning Network has matured considerably, offering faster and cheaper transactions, thus improving Bitcoin’s utility for day-to-day payments.

- Regulatory Landscape: Bitcoin usually garners less scrutiny than smaller altcoins due to its decentralized nature and more established market presence.

Ethereum (ETH)

Ethereum’s Position in 2025

Ethereum remains central to the development of decentralized applications (dApps) and smart contracts. Its shift to Proof of Stake (PoS) has drastically reduced energy consumption, although high gas fees remain an occasional issue when network usage spikes.

- Smart Contract Leader: Despite competition, Ethereum still boasts the largest developer community and the most robust ecosystem of decentralized finance (DeFi) and NFT projects.

- Layer-2 Dominance: Solutions such as Arbitrum, Optimism, and Polygon reduce transaction costs and times, driving more utility to the Ethereum network.

- Competition from Other Chains: Rival blockchains, including Solana, Avalanche, and Binance Smart Chain, vie for market share, offering faster throughput and lower fees.

Solana (SOL)

The Solana Ecosystem in 2025

Solana has solidified its reputation as a high-performance blockchain. Its ability to process thousands of transactions per second positions it well for decentralized finance, gaming, and NFTs.

- High Throughput and Low Fees: Solana’s main advantages continue to attract developers looking for smooth user experiences.

- Diverse DApp Ecosystem: Numerous DeFi protocols, NFT marketplaces, and Web3 applications flourish on Solana, increasing network usage.

- Reliability Concerns: Despite major improvements, some critics remain concerned about the network’s past outages, which have occasionally impacted user trust.

Cardano (ADA)

Cardano’s Ongoing Developments

Cardano has slowly and methodically rolled out features and upgrades based on peer-reviewed academic research. Key milestones include:

- Smart Contract Maturity: The Alonzo hard fork and subsequent improvements have enabled more complex dApp functionalities on Cardano’s blockchain.

- Focus on Emerging Markets: Cardano’s partnerships in Africa and other developing regions highlight its aim to provide decentralized financial solutions globally.

- Community Governance: Cardano places strong emphasis on on-chain governance, letting ADA holders shape the network’s evolution via voting.

Binance Coin (BNB)

BNB’s Role in the Crypto Market

BNB continues to serve as the native token of the Binance ecosystem, encompassing:

- Binance Smart Chain (BSC): BNB is the fuel for transaction fees, DeFi protocols, and dApps running on the BSC network.

- Exchange Utility: Users trading on the Binance platform enjoy discounted fees when paying with BNB, supporting consistent demand.

- Regulatory Dynamics: Binance’s global presence has faced heightened regulatory checks in multiple jurisdictions, potentially influencing investor sentiment toward BNB.

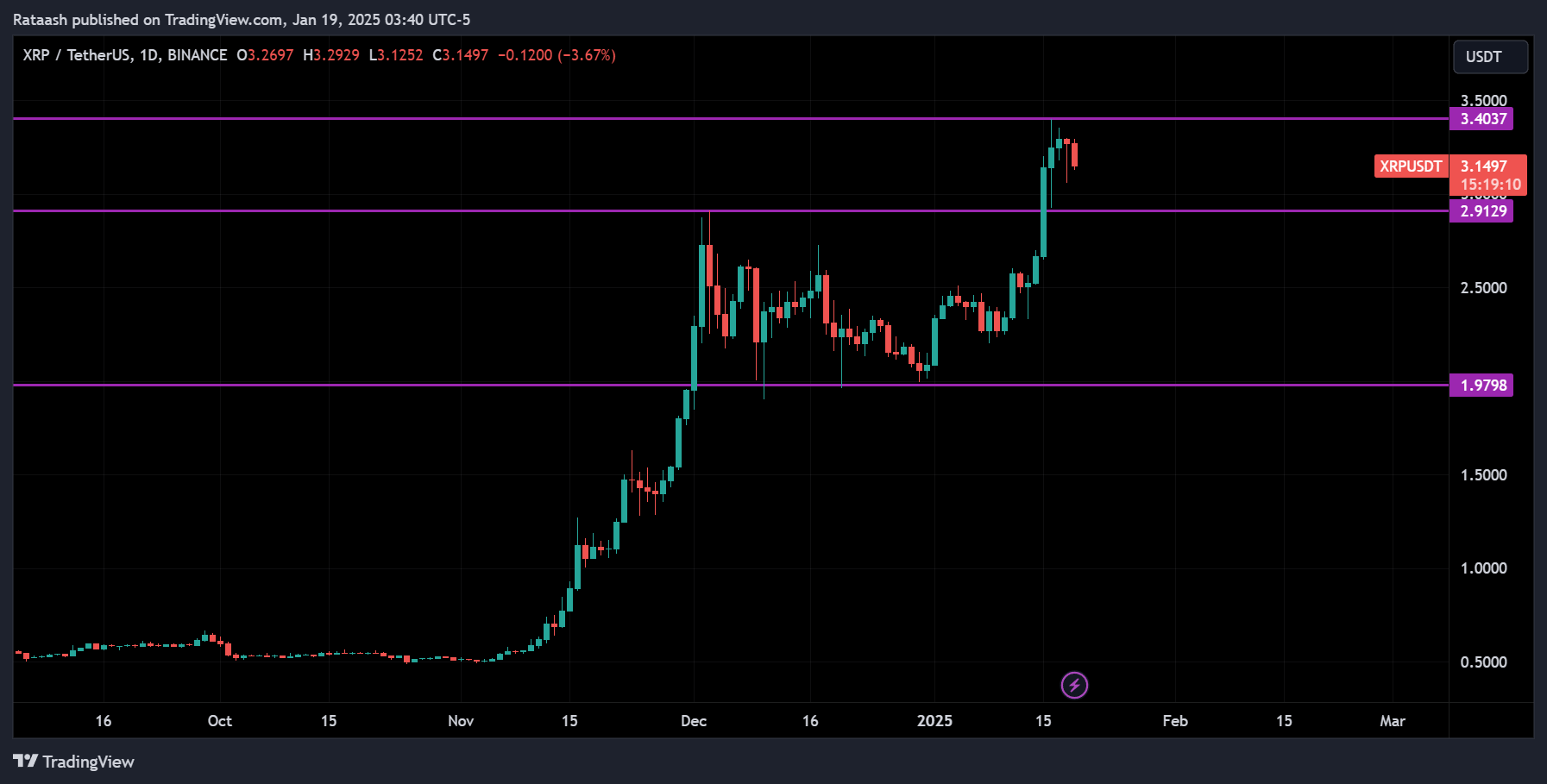

XRP (XRP)

XRP and Cross-Border Payments

XRP, developed by Ripple Labs, has carved out a niche as a cross-border payments solution. By 2025, ongoing litigation and regulatory uncertainties from earlier years have gradually clarified:

- Enterprise Adoption: Major financial institutions continue to evaluate XRP for remittances and settlements, especially in corridors with high transfer fees.

- Regulatory Milestones: Resolution or progress in court cases regarding the classification of XRP has offered more clarity, though global regulation remains a patchwork.

- Market Competition: Stablecoins and CBDCs are emerging as competitors to XRP in the cross-border payments space.

Dogecoin (DOGE)

DOGE’s Enduring Community

Originally launched as a joke in 2013, Dogecoin remains a prominent meme coin, predating the likes of Shiba Inu and $TRUMP. Its community-driven nature and endorsements from high-profile figures continue to fuel interest:

- Celebrity Support: Occasional tweets and comments from influential personalities can dramatically affect DOGE’s price and adoption rate.

- Payments and Merch: Several major retailers have integrated Dogecoin as a payment option, leveraging its popularity and low transaction fees relative to older networks.

- Network Upgrades: Although not as frequent as those on more developer-driven platforms, Dogecoin’s network improvements aim to keep it viable for day-to-day use.

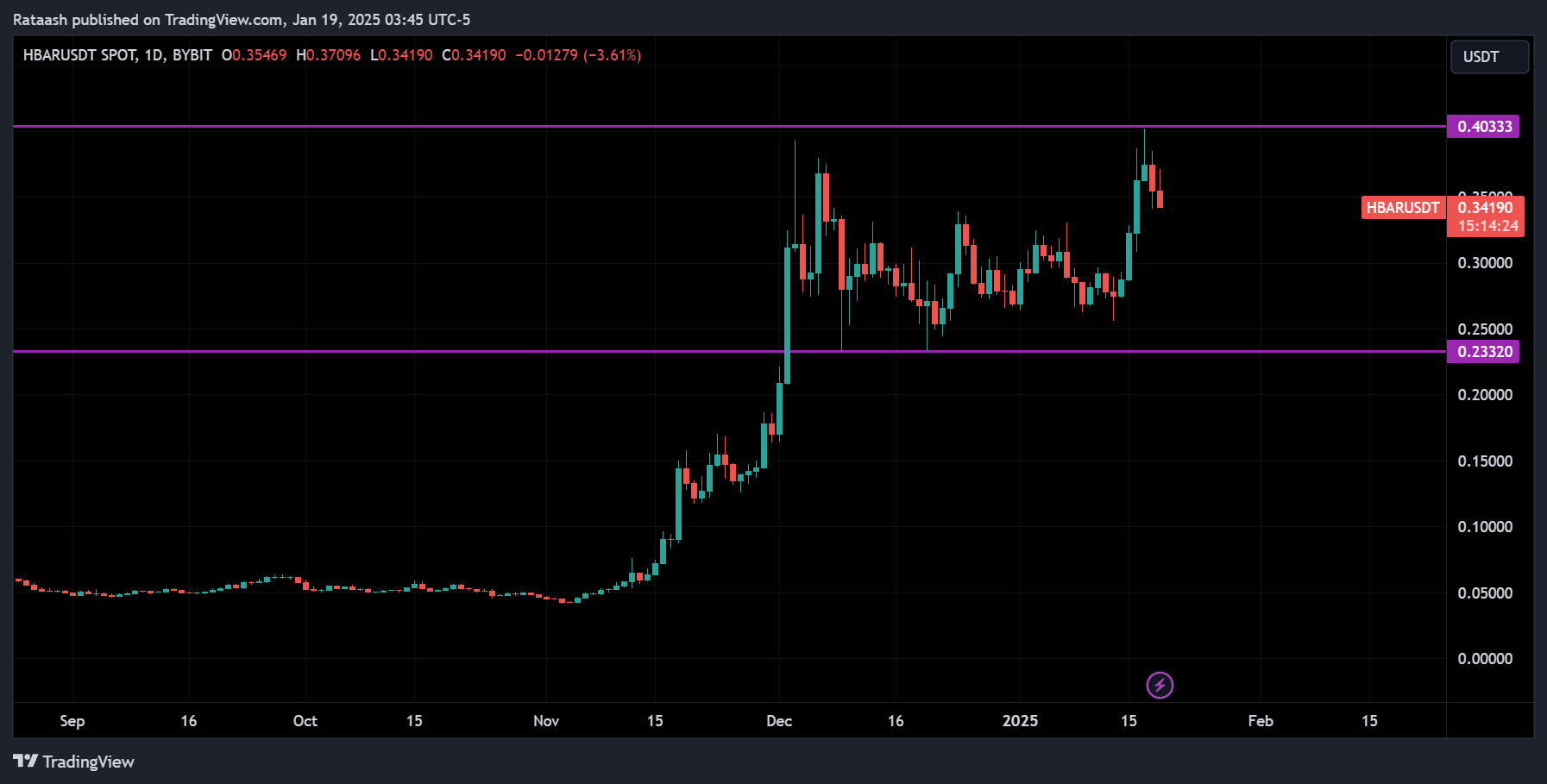

Hedera (HBAR)

Hedera’s Unique Value Proposition

Hedera Hashgraph offers a different consensus mechanism called Hashgraph, claiming faster transactions and enhanced security. By 2025:

- Enterprise Partnerships: Hedera’s governing council includes large corporations, leveraging the network for use cases such as supply chain, identity, and tokenization.

- Environmental Efficiency: Hedera’s design results in relatively low energy consumption, appealing to environmentally conscious developers and enterprises.

- Growing Ecosystem: While not as large as Ethereum or Solana, Hedera’s ecosystem steadily expands with tools for DeFi, NFTs, and real-world enterprise integrations.

Conclusion

The launch of $TRUMP has injected new energy and controversy into an already vibrant cryptocurrency market in 2025. From its remarkable surge in price to its polarizing ethical debates, the token underscores how deeply crypto has permeated mainstream culture—extending even into the political realm. Built on Solana, $TRUMP capitalizes on the blockchain’s speed, scalability, and low fees, fueling an active and vocal community of supporters. At the same time, it raises questions about the future interplay between politics, regulation, and digital currencies.

Beyond $TRUMP, the crypto landscape this year is characterized by a blend of cautious optimism and robust innovation. Bitcoin continues to anchor the market, with institutional adoption serving as a key driver. Ethereum remains the hub for decentralized applications and smart contracts, even as its challengers—like Solana and Cardano—carve out their own niches. Binance Coin benefits from the extensive reach of the Binance ecosystem, while XRP contends with ongoing regulatory debates in its bid to revolutionize cross-border payments. Dogecoin persists as the leading meme coin with a powerful community, and Hedera (HBAR) is breaking ground with its unique Hashgraph consensus and enterprise use cases.

For investors and observers alike, 2025 is shaping up to be a pivotal year for cryptocurrencies. Mainstream integrations, evolving regulations, and new technologies are defining the space at a faster pace than ever. As you monitor market developments, remember that meme coins like $TRUMP can exhibit extreme volatility. Always conduct thorough research, understand the risks involved, and consider consulting financial or legal experts when venturing into this dynamic market.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency investments carry inherent risks, and past performance is not indicative of future results. Always perform due diligence before making any financial decisions.

In an era where politicians, celebrities, and large institutions are entering the crypto realm, $TRUMP exemplifies the new wave of digital assets that blend community engagement, technology, and cultural significance. Whether it proves to be a short-lived fad or a lasting legacy, its meteoric rise showcases the power of brand, community, and blockchain in shaping modern financial discourse.