Money management stands as one of the most critical yet overlooked aspects of trading. Many beginner traders focus primarily on finding the “perfect” trading strategy or the most profitable system, often neglecting the importance of properly managing their capital. However, effective money management can be the decisive factor that determines whether you achieve consistent trading success or encounter a string of devastating losses. This comprehensive guide aims to equip beginners with the knowledge and strategies necessary to manage their money effectively, minimize losses, and maximize the probability of long-term success in the financial markets.

In this article, we will explore essential money management concepts and techniques that encompass risk control, position sizing, trading psychology, and performance measurement. We will also highlight the importance of discipline and provide practical examples that illustrate how to implement these principles in your daily trading routine. By the end of this guide, you will have a much clearer understanding of how to manage your capital responsibly, no matter which market you trade—stocks, forex, cryptocurrencies, commodities, or any other asset class.

Table of Contents

Understanding the Importance of Money Management

Money management is the glue that holds your trading framework together. Even the most outstanding technical or fundamental strategies can fail if they are coupled with poor risk management. In trading, success is not just about making the biggest gains; it’s more importantly about protecting your capital. If you can preserve your trading capital during losing streaks, you are able to continue trading and capitalize on the inevitable winning streaks.

Key benefits of sound money management include:

- Capital Preservation: The primary goal of trading is to stay in the game. By managing risk, you ensure that no single trade or series of trades can wipe you out.

- Consistent Growth: Proper allocation of risk per trade promotes a more stable growth of your account, helping you avoid extreme drawdowns.

- Stress Reduction: Having clear-cut rules for position sizing and stop-loss placement removes guesswork, which leads to better emotional control.

- Enhanced Discipline: Money management principles, once followed strictly, enhance overall discipline and trading consistency.

Regardless of your style—day trader, swing trader, or long-term investor—money management remains the cornerstone for long-term success.

Fundamental Concepts in Trading Risk Management

Defining Risk and Reward

In trading, risk typically refers to the financial exposure you face if the market moves against your position. It’s essentially what you stand to lose in a trade. Reward, on the other hand, is the profit potential if the trade goes in your favor.

- If you buy 100 shares of a stock at $50 each, your total position is $5,000. If you place a stop-loss at $48, you risk $2 per share. Thus, you are risking $200 in total on this trade.

- If your profit target is $55, your potential reward is $5 per share, or $500 for the position.

Understanding the difference between risk and reward sets the foundation for most of the strategies we will discuss throughout this guide. Every trade involves weighing the potential reward against the possible loss.

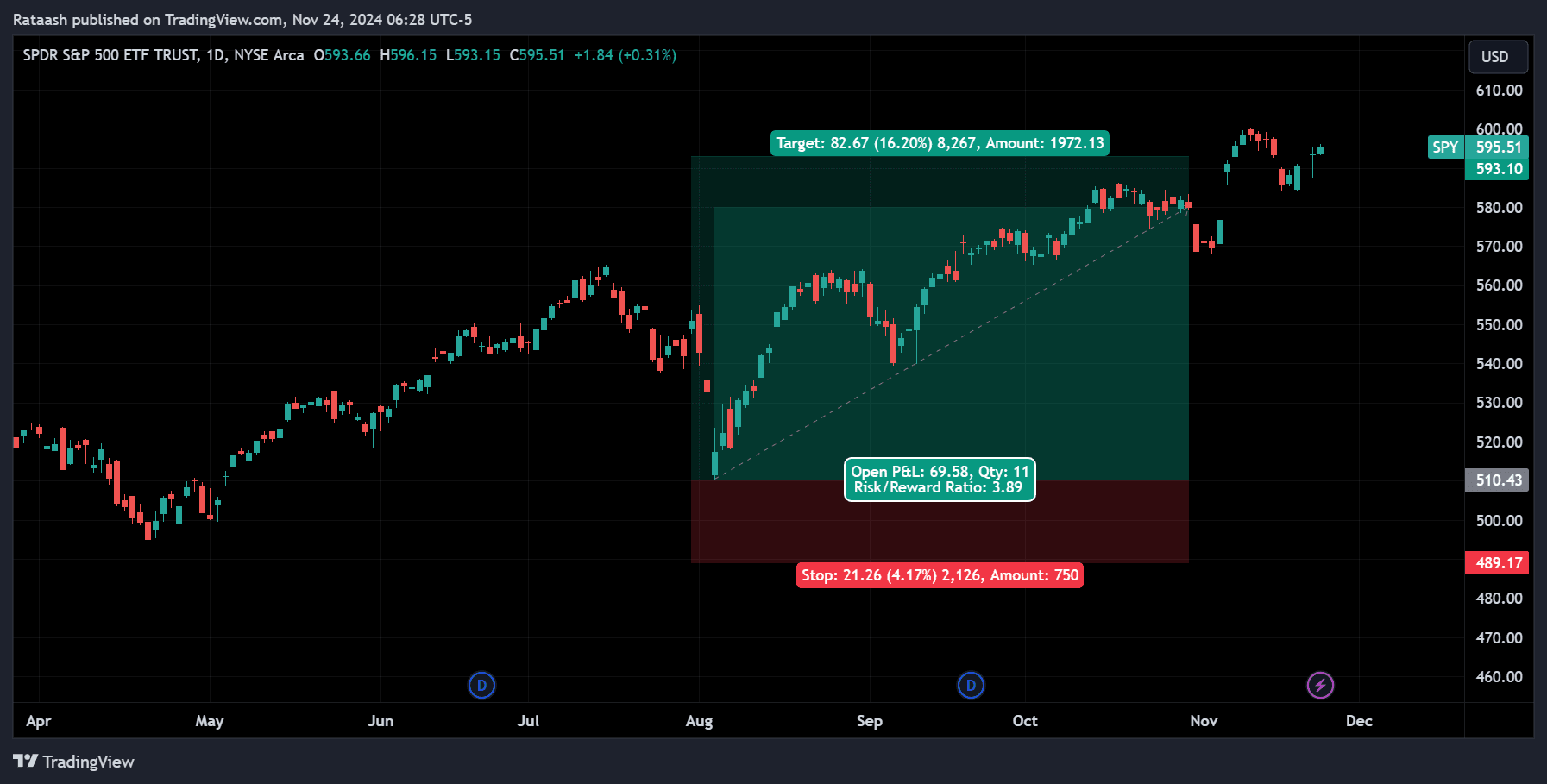

Risk-Reward Ratio

A common mistake beginners make is focusing exclusively on how much they could earn from a winning trade. A more balanced approach involves looking at the risk-reward ratio (RRR). The risk-reward ratio is calculated by dividing the potential profit by the potential loss.

- For instance, if you risk $2 per share and stand to make $6 per share, your RRR is $6 / $2 = 3:1.

A higher ratio, such as 2:1 or 3:1, is generally more attractive. However, a good ratio does not guarantee profitability; it simply means you stand to gain more on each winning trade compared to what you would lose on each losing trade.

Why RRR is Important:

- It helps you choose trades more carefully.

- It sets realistic expectations for potential profit.

- It aligns your strategy with acceptable risk levels.

Drawdowns and Recovery

| Balance | Loss in Percentage | Required Earnings % |

|---|---|---|

| $10000 | 0% | 0% |

| $8000 | -20% | 25% |

| $7000 | -30% | 43% |

| $5000 | -50% | 100% |

| $4000 | -60% | 150% |

Drawdown refers to the percentage or amount lost from the peak of your trading account balance. It is essentially the distance between your highest equity point and the subsequent lowest equity point over a certain timeframe.

For example, if you start with $10,000, grow to $12,000, but then drop to $9,000, your drawdown from the peak ($12,000) is $3,000 (a 25% drawdown from $12,000).

The bigger the drawdown, the harder it is to recover. For instance, a 50% drawdown requires a 100% return to break even. This underscores the need to keep drawdowns as small as possible via proper money management. By limiting the amount you risk on each trade, you reduce the likelihood of experiencing debilitating losses that can be extremely challenging to overcome.

Position Sizing Strategies

Position sizing is the process of determining how many shares, contracts, or lots you purchase or sell in a trade. It is one of the most crucial, yet frequently neglected, facets of trading. By sizing positions methodically, you ensure that no single trade can significantly harm your account. Below are several popular position sizing strategies.

Fixed Dollar Risk Model

In the fixed dollar risk model, you decide on a dollar amount you are comfortable losing on any single trade. This amount remains constant regardless of the size of your trading account or market conditions.

- For example, suppose you decide you are willing to risk $100 per trade. If your stop-loss size for a particular setup is $2 per share, you can purchase up to 50 shares (because $100 / $2 = 50 shares).

Pros:

- Simplicity: Easy to understand and implement.

- Consistency: Helps maintain discipline because you know exactly how much capital you’ll lose if your trade goes wrong.

Cons:

- Doesn’t scale with account growth: If your account grows significantly, risking only a fixed $100 might become too conservative.

- May result in smaller positions in higher-volatility assets.

Fixed Fraction Model (Percentage Risk Model)

Under the fixed fraction model, you risk a consistent percentage of your overall account equity on each trade. Common percentages range from 1% to 3%, but this can vary based on personal risk tolerance.

Example:

- You have a $10,000 account.

- You decide to risk 2% per trade.

- 2% of $10,000 is $200.

- If your stop-loss size is $1 per share, you can buy up to 200 shares.

Pros:

- Scales with account size: As your account grows, the amount you risk grows proportionally.

- Limits risk during drawdowns: If you lose money, the amount you risk is reduced in proportion to your account balance.

Cons:

- May lead to smaller positions initially if your account balance is small.

- Requires frequent recalculation as your account balance changes.

Kelly Criterion

The Kelly Criterion is a more mathematically driven approach that suggests an optimal fraction of your capital to risk on each trade based on historical win/loss probabilities and average win/loss sizes. The formula for the Kelly fraction (K%) is:

K% = W – (1 – W) / R

Where:

- W is the probability of winning (win rate).

- R is the ratio of the average win to the average loss.

For instance, if you have a 50% win rate and your average win is twice your average loss (R = 2), then:

K% = 0.5 – (0.5 / 2)

K% = 0.5 – 0.25

K% = 0.25 (or 25%)

This means that for optimal growth, you would theoretically risk 25% of your capital per trade. However, this can be extremely aggressive. Most traders use a fraction of the Kelly result (e.g., half-Kelly) to reduce risk and volatility in their equity curve.

Pros:

- Maximal long-term growth in theory.

- Based on mathematical expectation and historical data.

Cons:

- Can be dangerously aggressive if taken literally.

- Requires accurate tracking of win rate and average wins/losses.

Using Leverage Safely

Leverage allows traders to control larger positions with a smaller amount of capital, but it can also magnify losses. While leverage offers a pathway to greater returns, it equally exposes you to amplified risks. Understanding how to use leverage safely is essential for anyone who wants to preserve capital and trade consistently.

Pros and Cons of Leverage

- Pros:

- Increases potential returns: You can make a higher profit on a smaller amount of invested capital.

- Allows for greater diversity: You can open multiple positions simultaneously with the same capital base.

- Cons:

- Amplifies losses: A small adverse move can result in significant losses.

- Emotional stress: Large swings in account value can lead to emotional decision-making and panic.

Margin Calls and Over-Leveraging Risks

When trading with margin or leverage, your broker may issue a margin call if your account equity falls below a certain threshold. This usually results in positions being liquidated automatically to bring your account back to acceptable margin levels. Over-leveraging is a common pitfall for beginners, causing large drawdowns or even complete account blowouts.

How to avoid over-leveraging:

- Use a smaller portion of your margin capability than what’s offered.

- Always place stop-loss orders to limit downside.

- Monitor positions closely, especially in volatile market conditions.

Stop-Loss Orders and Effective Risk Control

A stop-loss order is an instruction to your broker to close a position once the price reaches a specific level, thereby limiting potential losses. It’s one of the most straightforward yet powerful tools for controlling risk.

Types of Stop-Loss Orders

- Static/Fixed Stop-Loss: Placed at a fixed price below (for long positions) or above (for short positions) your entry.

- Trailing Stop-Loss: Moves in lockstep with favorable market movements, locking in profits as the price rises (or falls, if short).

- Volatility-Based Stop: Adjusts to changing market volatility, often using metrics like the Average True Range (ATR).

Trailing Stops

Trailing stops are particularly beneficial for capturing the bulk of trending moves while safeguarding accumulated gains. For instance, you might place a trailing stop 10% below your stock’s current price. As the stock moves up, the stop-loss adjusts, maintaining that 10% gap from the new peak. Should the price reverse by 10% or more, your position closes, and you keep any profit made above your entry price.

Placing Stop-Losses Strategically

Placing stop-losses merely based on how much money you want to risk can lead to poor outcomes. Instead, stops should align with logical support/resistance levels or volatility levels. Here are a few tips:

- Support and Resistance: Identify key support levels for long trades and set stop-losses just below them. For short trades, stop-losses should ideally be above resistance levels.

- Technical Indicators: Use moving averages, pivot points, or trendlines to help define logical stop-loss regions.

- Average True Range (ATR): This technical indicator measures market volatility, providing guidance for setting stops at a distance proportional to current volatility.

Diversification in Trading

Diversification is a technique that involves spreading out your risk across various instruments, markets, or strategies. The goal is to reduce the negative impact of any single trade or market event on your overall portfolio.

Asset Class Diversification

Trading in multiple asset classes—stocks, bonds, forex, cryptocurrencies, commodities—can help smooth out your equity curve if one market experiences a downturn. However, be mindful that certain asset classes might move in tandem (i.e., they could be correlated), so blindly spreading your capital across different instruments does not guarantee actual diversification.

Timeframes and Strategy Diversification

Another layer of diversification involves trading multiple strategies or timeframes:

- Timeframe Diversification: Holding long-term positions while occasionally day trading or swing trading can provide multiple streams of returns.

- Strategy Diversification: Combining momentum-based trades with mean-reversion trades, for example, can help you profit in various market conditions.

Diversification must be balanced with practical considerations like time commitment and transaction costs. You do not want to over-diversify and spread yourself too thin, which can dilute focus and reduce overall returns.

Trading Psychology and Emotional Control

Emotions like fear, greed, and overconfidence can sabotage even the most robust trading systems. Effective money management and a disciplined trading approach go a long way in minimizing the impact of these emotional biases.

Fear and Greed

- Fear: Fear often causes traders to exit winning trades too early or hold onto losing trades too long, hoping the market will turn around.

- Greed: Greed can push traders to risk more than they can afford, chasing higher returns without regard for the possibility of significant losses.

A well-defined plan detailing how much you risk per trade and where you set your stop-loss can mitigate both fear and greed. By having a predetermined blueprint, you reduce the likelihood of making impulsive, emotion-driven decisions.

Confidence vs Overconfidence

Having confidence in your trading strategy is essential, but overconfidence can lead to reckless behaviors such as trading without stop-losses or increasing position sizes arbitrarily. Stick to your money management rules, even during winning streaks. Overconfidence can blind you to changing market conditions and lead to excessive losses.

The Power of Discipline

A disciplined trader meticulously follows a proven strategy and money management rules. Developing discipline involves consistent execution, thorough preparation, and continuous reflection. While discipline is easier said than done, it is often the hallmark of successful traders.

Tips for cultivating discipline:

- Maintain a trading journal.

- Review your trades regularly.

- Have a daily routine or checklist before placing trades.

- Use rules-based systems where possible to reduce emotional interference.

Creating and Following a Trading Plan

A trading plan is a detailed document outlining your trading goals, strategies, risk tolerance, and money management rules. It acts as a roadmap, helping you make objective decisions in the heat of the moment.

Components of a Trading Plan

- Market Overview: The types of markets you focus on (stocks, forex, commodities, etc.).

- Trading Strategy: Criteria for entries and exits (e.g., moving average crossover, support/resistance, fundamental signals).

- Risk Management Rules: How much you risk per trade, your position sizing model, and stop-loss placement strategy.

- Time Commitment: Whether you’re a day trader, swing trader, or long-term investor, and how much time you can devote to market analysis.

- Emotional Control Measures: Steps to handle stress or excitement (e.g., walking away from the computer after a big trade to avoid revenge trading).

- Performance Metrics and Targets: How you measure success (e.g., monthly returns, drawdown limits, trade win rate).

Adapting Your Plan Over Time

Markets are dynamic, and no single plan remains perfect forever. Regularly review and update your trading plan to align with changing market conditions, evolving strategies, and your personal growth as a trader. Document any modifications you make and test them in a demo account or with smaller positions before fully integrating them into your standard practice.

Measuring Trading Performance and Progress

To improve your trading, you need to measure your results objectively. This means more than simply looking at how much money you made or lost; it involves analyzing a range of performance metrics that reflect both profitability and risk management.

Trade Journals

A trade journal is a comprehensive record of each trade you take—entry/exit times, position sizes, stop-loss levels, profit or loss, and notes on why you took the trade. Journals help you:

- Identify Patterns: Spot recurring mistakes or confirm which setups yield the best results.

- Enhance Discipline: Knowing you must document each trade encourages more mindful decision-making.

- Facilitate Reviews: Periodic reviews of your journal can reveal trends and areas for improvement.

Analyzing Risk-Adjusted Returns

Risk-adjusted returns measure profit in the context of the risk taken. Two traders might both earn $1,000, but if Trader A risked $10,000 while Trader B risked only $2,000, Trader B’s return is stronger on a risk-adjusted basis. Common metrics include:

- Sharpe Ratio: (Return – Risk-Free Rate) / Standard Deviation of Returns.

- Sortino Ratio: (Return – Risk-Free Rate) / Downside Deviation (focuses on downside risk).

Performance Metrics and Ratios

Other useful performance metrics include:

- Win Rate: Percentage of trades that are profitable.

- Average Win vs. Average Loss: Useful for calculating risk-reward dynamics.

- Profit Factor: Ratio of total profits to total losses.

- Maximum Drawdown: The largest peak-to-trough decline in your equity balance.

Monitoring these metrics will inform you whether your strategy is robust or needs revision. Importantly, these measures provide objective evidence of your strategy’s consistency and risk profile.

Tools and Resources for Money Management

In the modern digital era, numerous tools exist to help traders handle money management effectively. Some are free, while others are commercial offerings with advanced functionalities.

Software and Spreadsheets

- Microsoft Excel/Google Sheets: Spreadsheets allow for real-time updates of your account balance, risk per trade, and position sizing calculations.

- Trade Tracking Software: Platforms like Edgewonk and TraderSync help maintain journals and generate performance analytics.

Risk Management Calculators

A variety of online calculators and broker-integrated tools can compute your position size automatically based on your risk level, stop-loss, and current market price. This ensures you take a systematic approach without manually crunching numbers every time.

Backtesting and Simulation Tools

Before deploying a strategy with real money, consider using backtesting tools like MetaTrader’s Strategy Tester (for forex), TradingView (for multiple markets), or specialized software like Amibroker and NinjaTrader. Simulation or paper trading accounts provided by many brokers also allow you to practice risk management in a live environment, minus real monetary stakes.

Real-World Examples of Effective Money Management

Case Study I: Fixed Fraction Model in Forex Trading

Scenario: You have a $5,000 forex trading account, and you decide to risk 2% of your balance per trade ($100).

- Set Stop-Loss Distance: You identify a trading setup in the EUR/USD pair. Your analysis determines that a 50-pip stop-loss aligns with recent support/resistance levels.

- Pip Value Calculation: Assume 1 pip = $10 for a standard lot, so for a 50-pip risk, you’d lose $500 per standard lot if the stop is hit.

- Position Size: Since you only want to risk $100, you will trade 0.2 lots (because $500 * 0.2 = $100).

- Outcome: If your trade hits the stop-loss, you lose $100, which is 2% of your account. If you target a 2:1 risk-reward ratio, you stand to gain $200 if the trade moves in your favor.

This disciplined approach ensures that a single loss doesn’t exceed your comfort level and multiple losses in a row won’t devastate your account.

Case Study II: Trailing Stops in Stock Trading

Scenario: You’re bullish on a technology stock trading at $100 per share. You buy 50 shares for a total of $5,000.

- Initial Stop-Loss: You set a static stop-loss at $95, risking $5 per share or $250 total.

- Trailing Stop Mechanism: Once the stock climbs above $110, you switch to a 5% trailing stop. So, if the stock hits $120 at its peak, your trailing stop would stand at $114 (5% below $120).

- Outcome: If the stock retraces from $120 to $114, you exit with a profit. By using a trailing stop, you lock in gains while giving the trade room to run if it continues to move higher.

Trailing stops can substantially boost profits during trending markets and help preserve gains once momentum starts to fade.

Common Money Management Mistakes and How to Avoid Them

- Failing to Use Stop-Losses: Without a hard exit plan, a small loss can balloon into a catastrophic one. Always use stop-losses to protect capital.

- Risking Too Much Capital: Over-leveraging or using an excessively large position size can lead to significant drawdowns. Stick to a predetermined percentage of your account per trade.

- Chasing Losses: Trying to recoup losses quickly by increasing your position size is a recipe for further drawdowns. Maintain discipline and follow your plan.

- Focusing Solely on Profit: Ignoring risk metrics and only looking at the potential upside can lead to neglectful risk management. Track both profit and drawdowns.

- Lack of Diversification: Concentrating all your capital in one stock or market exposes you to systematic risks that could devastate your account in a single downturn.

- Inconsistent Application of Rules: Changing your rules mid-trade or ignoring them during certain market conditions creates inconsistent performance. Consistency is key in long-term money management.

Advanced Topics in Money Management

Once you master the basics, several advanced concepts can further refine your money management practices and protect you from unexpected market conditions.

The Role of Correlation in Diversification

Many traders incorrectly assume that buying multiple assets automatically diversifies their portfolio. However, if those assets are highly correlated—such as two tech stocks that both respond to the same market sentiment—your effective diversification is minimal. Checking correlation coefficients between markets or individual assets helps ensure that you genuinely spread out risk.

- Example: Stocks and bonds often (but not always) have inverse correlations. During certain market conditions, when stocks drop, bonds may rise, helping offset losses.

Scaling In and Scaling Out of Positions

Scaling in involves gradually adding to a winning position as the market moves in your favor. This technique can maximize profits in trending markets but also amplifies risk if the market suddenly reverses.

Scaling out entails closing portions of your position incrementally to lock in gains while still leaving part of the trade open for potential further profit.

- Pros:

- Flexibility in risk management.

- Potential to capture extended moves while minimizing drawdowns.

- Cons:

- Complicates record-keeping and potential for confusion in position sizing.

- May reduce profits if you scale out too aggressively.

Conclusion

Effective money management is indispensable for consistent and successful trading. It protects your capital, sharpens your focus on risk versus reward, and promotes a disciplined trading mindset that endures over the long haul. Whether you’re day trading volatile stocks or swing trading forex pairs, the principles of proper position sizing, disciplined stop-loss usage, and psychological control form the bedrock of sustainable profitability.

Key Takeaways:

- Always Prioritize Capital Preservation: The single most important rule for long-term success is never to expose your account to a catastrophic loss.

- Use Proven Position Sizing Models: Whether you choose a fixed dollar risk, fixed fraction, or Kelly-based approach, consistency is paramount.

- Incorporate Stop-Losses and Other Risk-Control Methods: Prevent small losses from becoming debilitating.

- Diversify, but Do It Intelligently: Be mindful of correlation among different assets, markets, or timeframes.

- Master Your Emotions: Fear, greed, and overconfidence can quickly undo sound money management strategies.

- Maintain a Thorough Trading Plan and Journal: Ongoing documentation and performance reviews enable continual improvement.

- Adapt and Learn: Financial markets are dynamic, and your money management strategies should evolve as you gain experience and as market conditions change.

Ultimately, trading is not about one “holy grail” strategy; it’s about finding a consistent edge and protecting it with disciplined risk management. Traders who grasp this reality and diligently implement robust money management frameworks are far more likely to succeed in the long run. By adopting the insights and methods outlined in this guide, you will be on your way to a more stable, controlled, and profitable trading journey—one that’s anchored by effective money management principles.

By thoroughly understanding and applying these concepts—from basic risk-reward principles to advanced scaling-in strategies—you’ll be far better prepared to navigate the complexities of financial markets. Remember: The journey to consistent profitability is a marathon, not a sprint. Patience, persistence, and proper money management are your allies in achieving the consistent and successful trading outcomes you desire.

FAQ: Beginner’s Guide to Effective Money Management for Consistent and Successful Trading

Here is a comprehensive FAQ section that addresses common questions related to money management in trading:

1. What is money management in trading, and why is it important?

Money management in trading involves strategies and practices used to control risk, preserve capital, and maximize profitability. It includes determining position size, using stop-losses, managing leverage, and maintaining discipline. Without proper money management, even the best trading strategies can result in significant losses.

2. How much of my account should I risk on a single trade?

A common guideline is to risk no more than 1-3% of your total account balance on any single trade. This ensures that even a series of losing trades won’t significantly deplete your account and allows you to continue trading.

3. What is the risk-reward ratio, and how does it affect trading success?

The risk-reward ratio (RRR) compares the potential profit of a trade to its potential loss. For example, a 3:1 RRR means you stand to gain three times more than you risk. Maintaining a favorable RRR ensures that even if you have a lower win rate, you can still be profitable over time.

4. How can I calculate the optimal position size for a trade?

Position size can be calculated using the formula:

Position Size = (Account Risk Amount) / (Stop-Loss Size)

For example, if you risk 2% of a $10,000 account ($200) and your stop-loss is $2 per share, you can purchase 100 shares ($200 / $2 = 100).

5. What is a stop-loss order, and how does it work?

A stop-loss order is an instruction to your broker to close a trade when the price reaches a specified level, limiting potential losses. For instance, if you buy a stock at $50 and set a stop-loss at $48, the trade will automatically close if the price falls to $48.

6. Should I always use a stop-loss?

Yes, using a stop-loss is highly recommended to protect your capital. It ensures that losses on a single trade are predefined and manageable, preventing emotional decisions during market volatility.

7. How does leverage impact money management?

Leverage allows you to control larger positions with smaller capital but amplifies both gains and losses. Effective money management involves using leverage conservatively and ensuring your position sizes align with your risk tolerance and stop-loss levels.

8. What is diversification, and how can it help in trading?

Diversification involves spreading risk across different assets, markets, or strategies to reduce exposure to any single trade or market condition. For example, trading in both stocks and forex can reduce the impact of market-specific risks.

9. What is the Kelly Criterion, and should I use it?

The Kelly Criterion is a formula that calculates the optimal fraction of your capital to risk based on historical win rates and risk-reward ratios. While it maximizes long-term growth, it can be aggressive. Many traders use a fraction of the Kelly result to balance risk and reward.

10. How do I handle a losing streak?

- Stick to your plan: Avoid deviating from your money management rules.

- Reduce position sizes: Consider lowering your risk per trade until your performance improves.

- Review your trades: Identify patterns or mistakes causing the losses.

- Take a break: Sometimes stepping back from the market can help reset your perspective.

11. Can I adjust my risk during a trade?

Yes, but it should be done cautiously. For example:

- Scaling Out: Reducing position size as the trade progresses to lock in profits.

- Trailing Stops: Adjusting stop-loss levels to follow favorable price movements while securing gains.

Avoid increasing risk mid-trade as this can lead to overexposure.

12. How do I track my trading performance?

Use a trade journal to record all trades, including entry/exit points, position sizes, stop-loss levels, and reasons for the trade. Regularly review your performance metrics such as win rate, risk-reward ratio, and maximum drawdown to identify strengths and weaknesses.

13. What are the most common money management mistakes?

- Risking too much on a single trade.

- Failing to use stop-losses.

- Over-leveraging positions.

- Ignoring diversification.

- Chasing losses to recover quickly.

- Lacking discipline and consistency in following a trading plan.

14. How does trading psychology affect money management?

Emotions like fear, greed, and overconfidence can lead to poor decision-making, such as abandoning stop-losses or over-leveraging. Developing discipline, maintaining a trading plan, and adhering to your money management rules help mitigate these emotional influences.

15. Are there tools or software to help with money management?

Yes, several tools can simplify money management:

- Trade Journals: Platforms like Edgewonk and TraderSync for record-keeping.

- Position Size Calculators: Online calculators for determining trade sizes.

- Backtesting Software: Tools like TradingView and MetaTrader for testing strategies.

- Risk Management Spreadsheets: Custom spreadsheets to track and analyze performance.

16. How often should I update my trading plan?

Your trading plan should be reviewed regularly—at least monthly or after significant market events. As you gain experience or as market conditions change, you may need to adapt your strategies, risk tolerance, or position-sizing models.

17. What’s the best way to balance profitability and safety?

- Use a favorable risk-reward ratio (e.g., 2:1 or higher).

- Limit your risk per trade to a small percentage of your account.

- Diversify your portfolio to reduce exposure to individual trades or markets.

- Practice disciplined use of stop-loss orders and trailing stops.

Balancing profitability and safety requires consistent application of money management principles and avoiding impulsive decisions.