In today’s fast-paced financial markets, technology has become the backbone of almost every trade. What once took minutes—or even hours—now happens in microseconds. This acceleration in trade execution isn’t just about speed for speed’s sake; it’s also about maximizing efficiency and profitability. Two key concepts have emerged in this high-speed, highly competitive environment:

- Smart Order Routing (SOR): The process by which brokerage firms direct your trade orders to different exchanges or Electronic Communication Networks (ECNs).

- High-Frequency Trading (HFT): Specialized trading strategies executed by sophisticated algorithms that exploit market inefficiencies at lightning-fast speeds.

Why do these concepts matter to you as a trader or investor? Because they can directly affect the quality of your trade execution—from the price you get to how quickly your trade is filled. When you click “Buy” or “Sell,” a lot of complex processes happen behind the scenes. Knowing how these processes work can help you make more informed decisions and potentially save you money.

In this comprehensive guide, we’ll unravel the intricacies of Smart Order Routing and High-Frequency Trading, exploring how these components fit into modern stock market infrastructure. By the end, you’ll understand how brokers choose where to send your orders, how HFT firms capitalize on market inefficiencies, and what you can do to optimize your own trading experience.

Table of Contents

Understanding Stock Market Infrastructure

Traditional Exchanges and Market Centers

Historically, trading took place on centralized exchanges like the New York Stock Exchange (NYSE). Traders and brokers congregated on the physical exchange floor, conducting trades via open outcry or telephone calls. Over time, electronic systems began to supplement and eventually replace these manual methods.

Decentralized and Fragmented Markets

Today, trading is far more fragmented. Besides traditional exchanges (NYSE, NASDAQ), we have multiple venues like ECNs and Alternative Trading Systems (ATS). Each venue can display different liquidity, attract different types of traders, and charge different fees or offer different rebates. Fragmentation makes it both challenging and advantageous for large or sophisticated players:

- Challenging because liquidity is scattered and determining the best venue can be complex.

- Advantageous because more competition among venues can reduce trading costs (e.g., narrower spreads, potential for rebates) and provide more choices.

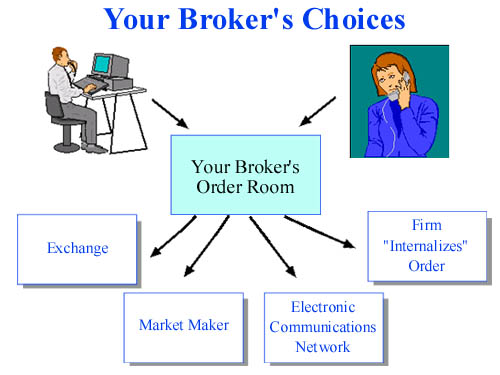

The Role of Brokers in Market Infrastructure

When you place a trade—whether you’re a retail investor on a popular trading app or a professional trader at a hedge fund—it usually goes through a broker. The broker serves as the intermediary between you and the markets. They decide how and where to execute your order, unless you specifically instruct them otherwise (e.g., using direct routing to a preferred ECN).

Brokers have their own incentives, which may include:

- Earning commissions or fees from clients.

- Receiving rebates or payments from specific exchanges or ECNs.

- Internalizing order flow, matching your trade against another client’s order in-house.

Understanding these incentives is crucial if you want the best execution possible, which is why Smart Order Routing (SOR) comes into play.

Electronic Communication Networks (ECNs) Explained

What Are ECNs?

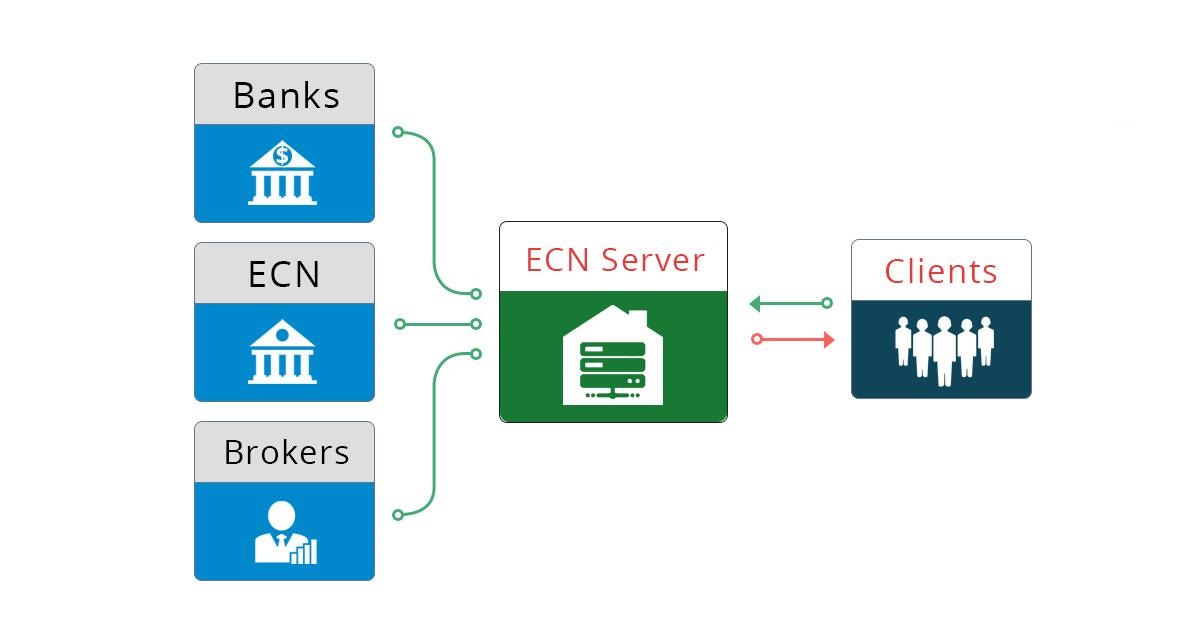

Electronic Communication Networks (ECNs) are automated systems that match buy and sell orders for securities. They are often considered an alternative to traditional stock exchanges. ECNs facilitate trading by connecting major brokerages and individual traders electronically, bypassing the need for a middleman on a physical exchange floor.

How ECNs Differ from Traditional Exchanges

- Speed: ECNs generally offer faster trade execution times.

- Accessibility: Some ECNs allow direct access for day traders and retail investors, while others cater primarily to broker-dealers.

- Fee Structures: ECNs often operate on a “maker-taker” model, where they pay a small rebate for orders that add liquidity and charge a fee for orders that remove liquidity.

Popular ECNs

Some well-known ECNs include:

- BATS (now part of Cboe Global Markets)

- ARCA (owned by NYSE)

- INET (associated with NASDAQ)

- BYX (another Cboe ECN)

- EDGX/EDGEA (Cboe)

Each ECN can have slightly different fee structures, latency profiles, and liquidity pools, making them more or less attractive to different types of traders. For instance, one ECN might charge higher fees for removing liquidity but give substantial rebates for adding it, while another might do the opposite.

What Is Smart Order Routing (SOR)?

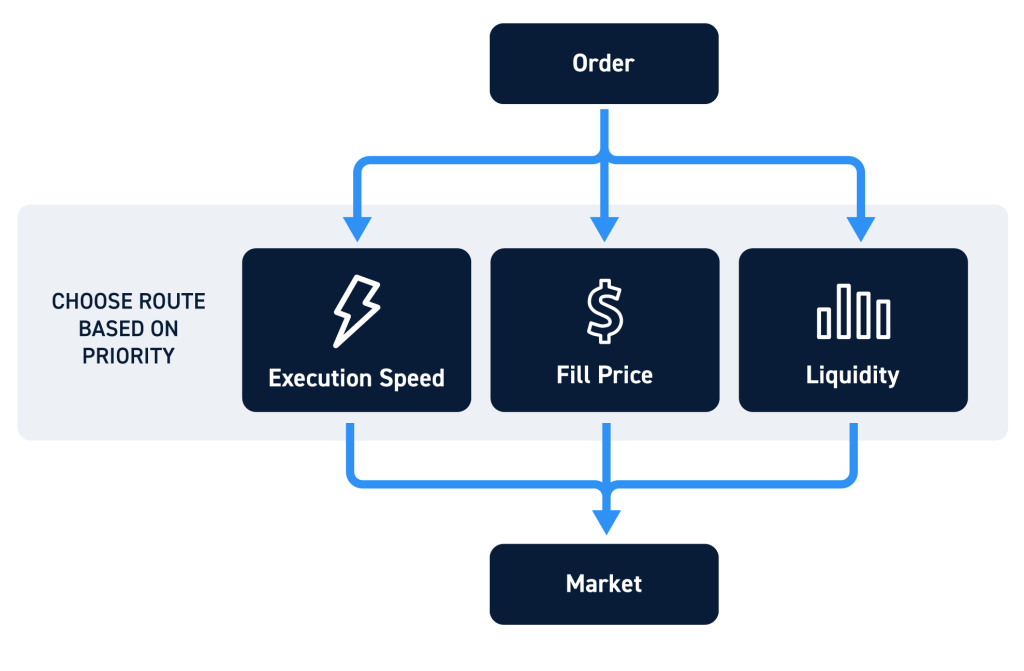

Smart Order Routing (SOR) is the algorithmic process your broker uses to determine where to send your order when you decide to buy or sell a stock. Since there are multiple market venues—exchanges, ECNs, and ATSs—an SOR system tries to achieve the best possible execution by factoring in:

- Price

- Speed

- Liquidity availability

- Order size

- Fee or rebate structures

Why SOR Exists

The market’s fragmentation and the complexity of fee structures make it nearly impossible for a human trader to manually pick the best venue for every order. SOR algorithms were developed to automate this choice, optimizing for certain objectives, often best price or best net execution cost (price plus or minus fees/rebates).

How SOR Algorithms Work

Although specifics vary by broker, a typical SOR algorithm:

- Scans the market for the best available prices (NBBO—National Best Bid and Offer in the U.S.).

- Evaluates the liquidity at each price level across multiple ECNs and exchanges.

- Considers the fees and rebates associated with each venue.

- Splits or routes your order in a way that it believes will yield the best overall execution outcome, factoring in speed, price, and net transaction cost.

How Brokers Choose Where to Route Your Orders

Broker Incentives

Brokers are not purely altruistic actors aiming only for your best execution. They have economic incentives, including:

- Payment for Order Flow (PFOF): Some brokerages receive payments from market makers or ECNs for directing trade flow.

- Internalization: Large retail brokers may fill orders in-house if they can match them against other clients’ orders.

As a result, a broker’s Smart Order Router might be biased toward sending your order to the venue that benefits the broker the most, not necessarily you.

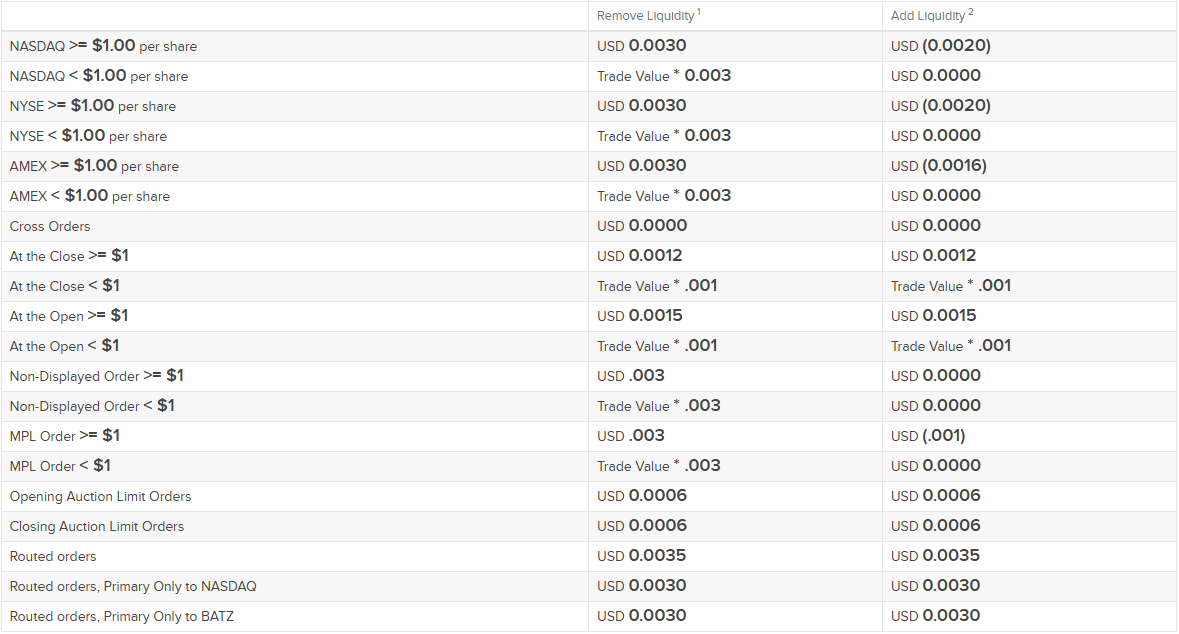

Example: Adding vs. Removing Liquidity

Consider a situation where you want to buy 1,000 shares of a stock at $10. Different ECNs have different fee structures:

- ECN A: +$0.002/share for adding liquidity, -$0.003/share for removing liquidity.

- ECN B: +$0.001/share for adding liquidity, -$0.002/share for removing liquidity.

If your broker’s SOR primarily cares about rebates, it might route your order to ECN A where it would earn more for you adding liquidity, even if that means your order might take longer to fill. Conversely, if the market is moving fast, you might prefer the immediate fill on ECN B, even if it pays a smaller rebate or charges a lower removal fee.

When It Matters

For long-term investors, a few cents difference in execution cost might not be critical. However, for active traders, especially day traders trading frequently or in large volumes, execution quality can significantly impact overall profitability. Slippage (price movement between order placement and execution) and missed fills can erode your trading edge.

Fee Structures and Payment for Order Flow

Maker-Taker Models

Many ECNs and exchanges operate under a maker-taker fee model:

- Maker: If you place a limit order at or outside the current best bid or offer, you add liquidity to the market. The ECN may pay you a small rebate for this.

- Taker: If you place a market order or a limit order that crosses the spread and is immediately executed, you remove liquidity. The ECN charges a fee in this scenario.

Payment for Order Flow (PFOF)

Payment for Order Flow is a contentious practice where market makers or high-frequency trading firms pay brokers for the right to execute retail orders. Proponents argue it offers reduced or zero-commission trading for retail investors, while critics maintain it introduces a conflict of interest—brokers might route orders to the highest-paying market maker rather than the venue offering the best price or fastest execution.

Impact on Execution Quality

Even if you don’t see a direct fee or commission, you might lose in the form of:

- Wider spreads

- Longer fill times

- Price improvement that fails to beat the market

It’s important to note that regulators like the SEC require brokers to provide best execution, but the exact definition of “best” can be open to interpretation and influenced by these fee and rebate structures.

Latency in Trading: A Critical Factor

Definition of Latency

In trading, latency is the time delay between when you initiate an order and when it is executed in the market. This delay includes:

- The speed of your internet connection.

- The broker’s internal processing time.

- The data transmission time from the broker to the exchange or ECN.

Historical Decline in Latency

- Pre-1980s: Latencies could be in the order of minutes, especially if trades were done by phone.

- 1980s: NYSE introduced quicker quote systems, bringing latency down to around 20 seconds.

- 2000s: By 2007, latencies of 100 milliseconds became common; by 2009, they dropped to around 1 millisecond.

- Today: Latencies can be as low as nanoseconds or microseconds, thanks to co-location services and advanced fiber-optic and laser data transmission technologies.

Why Low Latency Matters

- Fast Reactions: In fast-moving markets, even a delay of a few milliseconds can mean missing out on an optimal price.

- Front-Running Risks: If your order travels slowly, high-frequency traders can detect the order flow and race ahead.

- Volatile Markets: Rapid price changes amplify the effect of latency, making timely execution crucial.

High-Frequency Trading (HFT): Foundations and Methods

Defining High-Frequency Trading

High-Frequency Trading (HFT) involves using sophisticated algorithms, ultra-fast systems, and low-latency connections to place a large number of orders in fractions of a second. HFT firms often co-locate their servers near exchange data centers to reduce latency as much as possible.

Common HFT Strategies

- Market Making: HFT firms post both bid and offer prices for various stocks, earning the spread or a rebate.

- Statistical Arbitrage: Exploiting short-lived discrepancies in prices across different markets or correlated securities.

- Event Arbitrage: Capitalizing on corporate announcements, economic releases, or news events faster than other market participants.

- Latency Arbitrage: Using speed advantages to profit from stale quotes or slow market participants.

Pros and Cons of HFT

- Pros:

- Adds liquidity to the market.

- Tightens bid-ask spreads.

- Can reduce volatility under normal conditions.

- Cons:

- Potential for market manipulation or unethical practices (e.g., front-running).

- Can exacerbate volatility during market shocks (flash crashes).

- May disadvantage slower, retail participants.

Front-Running, Order Anticipation, and HFT Strategies

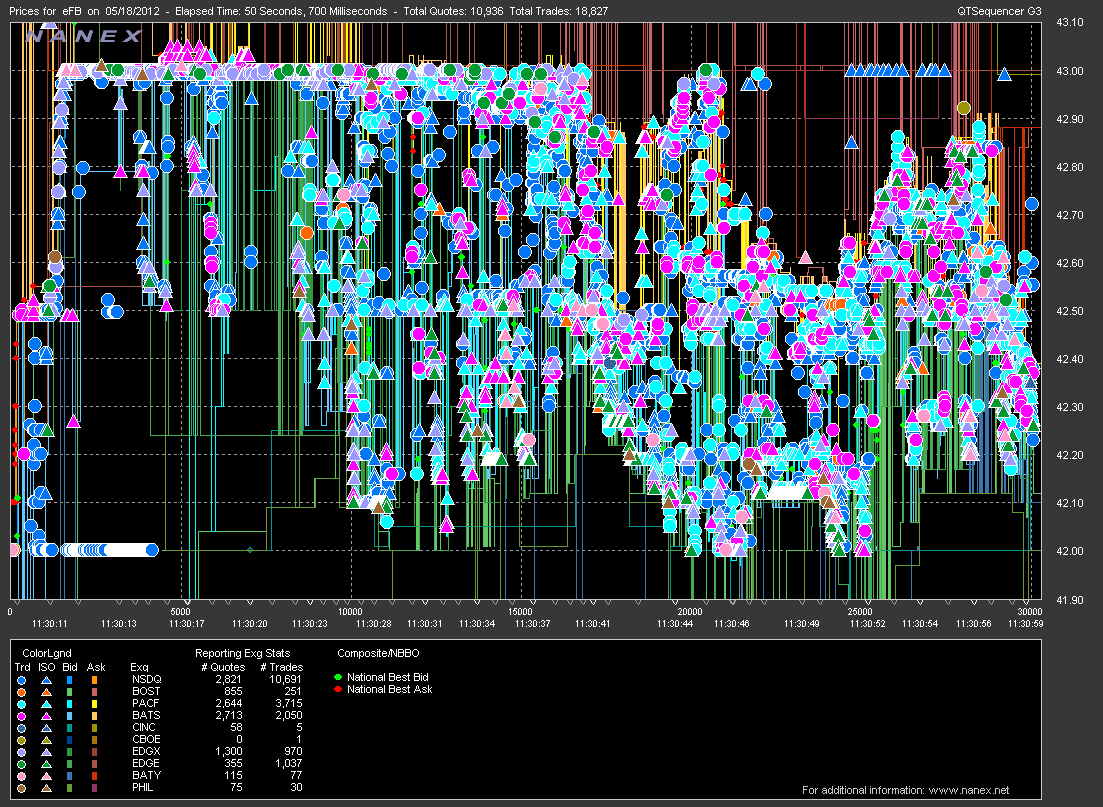

How HFT Firms Front-Run Orders

Front-running typically involves detecting large incoming orders and trading ahead of them to profit from the subsequent price move. In the context of Smart Order Routing, an HFT firm can:

- Identify your partial fill on one ECN.

- Predict your broker’s next target venue.

- Jump ahead to fill or remove liquidity on that venue before your order arrives.

- Sell back to you or the market at a slightly worse price (for you).

Example of HFT Exploit

Assume:

- You want to sell 1,000 shares at the market price of $10.

- Your broker’s SOR sends 100 shares to an ECN that offers the highest rebate for removing liquidity.

- An HFT firm sees your 100-share fill, infers you still have 900 shares left to sell.

- The HFT algorithm quickly places orders on the next ECN in the “routing queue,” taking out available shares at $10, leaving fewer shares at $10 for you.

- Your next partial fill occurs at $10 but for fewer shares, and eventually, you’re forced to sell the remainder at $9.99 or even lower.

This might seem like a trivial difference ($0.01 per share), but HFT firms thrive on such fractions of a cent, executing thousands—if not millions—of transactions daily.

SOR vs HFT: How HFT Exploits Routing Inefficiencies

The Speed Advantage

Most Smart Order Routers are designed to scan multiple venues sequentially. While they are fast, they may not be optimized to outsmart or outrun HFT algorithms that specialize in speed and detection of market flow patterns.

The Problem of Simple SOR Algorithms

Many brokers’ SOR logic is relatively basic: they have a set priority based on fees, historical fill rates, and best price. HFT algorithms, on the other hand, might use real-time data analytics, advanced predictive models, and the fastest connections to detect—and act upon—your routing sequence.

Impact of Smart Order Routing on Retail Traders

Execution Quality

For retail traders, the biggest issue is execution quality. If your broker always routes your order to the ECN that pays the broker the highest rebate, you might:

- Experience partial fills.

- Suffer slippage (price moving against you before the order is fully executed).

- Miss out on the best possible price in a fast-moving market.

Commission-Free Trading and Hidden Costs

A broker that advertises “commission-free trading” might be making money via payment for order flow or by collecting liquidity rebates from certain ECNs. If that leads to poor fills, you could be paying a bigger “invisible commission” in the form of worse trade execution.

Day Traders vs. Long-Term Investors

- Day Traders: Every cent matters since they make frequent trades and rely on small price moves for profit.

- Long-Term Investors: Might be less affected by small differences in execution, focusing on multi-year investment horizons. Still, understanding SOR and fees can help them save on costs over time.

Choosing the Right Broker and Routing Options

Direct Routing

Some brokers, like Interactive Brokers, allow direct order routing. This means you can choose which ECN or exchange to send your order to. While it requires more knowledge and sometimes higher fees, it can offer the advantage of better control over your execution.

Factors to Consider

When selecting a broker, consider:

- Commission Structure: Is the broker truly commission-free, or do they rely on PFOF?

- Access to Direct Routing: Does the platform let you pick your preferred ECN, or must you rely on their SOR?

- Order Types Available: Can you place advanced limit orders or pegged orders that adjust automatically based on market conditions?

- Speed and Reliability: Does the broker offer co-located servers, or do they have known latency issues?

- Regulatory Oversight: Look for brokers in well-regulated jurisdictions with transparent best execution policies.

Costs vs Benefits

While advanced features like direct routing might increase complexity and cost per share, they can also reduce slippage for active traders. Always compare the net effect on your bottom line.

Regulatory Aspects of SOR and HFT

SEC and FINRA in the U.S.

In the United States, the Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA) oversee rules designed to ensure fairness and transparency:

- Best Execution: Brokers must strive for the best possible result for client orders, but the exact definition is multifaceted.

- Regulation NMS: Establishes rules for quoting, trading, and routing, including the Order Protection Rule to prevent trade-throughs at inferior prices.

European Market Regulators

In Europe, MiFID II (Markets in Financial Instruments Directive) sets similar standards for best execution, focusing on price, cost, speed, and likelihood of execution.

Criticisms and Loopholes

Despite regulations, critics argue that payment for order flow and dark pools can undermine market transparency. Regulators periodically review these structures, but lobbying and the inherent complexity of modern markets often delay significant reforms.

Practical Tips for Traders: Mitigating Risks in a High-Speed World

Use Limit Orders

Instead of market orders, consider using limit orders to control your execution price. This can help reduce the risk of massive slippage if the market moves rapidly or if an HFT algorithm anticipates your order.

Know Your Broker’s Policies

Ask questions like:

- Does the broker accept payment for order flow?

- Do they allow direct ECN routing?

- How does their SOR algorithm prioritize fees, speed, and liquidity?

Monitor Trade Execution Quality

Many broker platforms provide execution reports. Compare the filled price to the quoted National Best Bid and Offer (NBBO). If you consistently see subpar executions, it might be a red flag.

Consider Your Trading Frequency and Strategy

- Long-Term Investors: Might focus on lower commissions or zero-commission platforms, as the bid-ask spread on large-cap stocks is usually tight, and quick fills are less critical.

- Short-Term or High-Frequency Traders: Should prioritize direct access brokers with robust routing options and minimal latency.

Stay Informed About Technology Advances

As new technologies like laser data transmission or blockchain-based settlement emerge, trading speeds and methods will continue to evolve. Staying informed ensures you won’t be caught off-guard by new developments.

Future Trends: The Next Frontier in Trading Technology

Ultra-Low Latency Arms Race

We’re already at microseconds and even nanoseconds in some cases. Quantum computing and photonics could theoretically reduce latency even further, sparking an arms race for the fastest, most efficient trading technology.

Advanced SOR Algorithms

Future SOR systems may adopt machine learning to dynamically optimize routing based on real-time market conditions, trader behavior, and historical data. This could help reduce the advantage currently held by HFT firms, though the arms race could simply shift to AI-driven HFT.

Regulatory Developments

Calls for banning or limiting payment for order flow have resurfaced periodically. If regulators implement stricter rules, the industry might pivot away from PFOF-based business models. Additionally, more robust rules on order routing transparency may force brokers to disclose precisely how and why an order is routed.

Rise of Retail Trading Communities

The past few years saw a surge in retail participation, with traders sharing strategies on social media and forums. This collective intelligence might lead to greater scrutiny of brokers’ SOR practices, pressuring them to improve or clarify their execution processes.

Conclusion: Navigating Modern Markets Effectively

Smart Order Routing (SOR) and High-Frequency Trading (HFT) are integral pieces of the modern market structure. While they can enhance efficiency and liquidity, they also introduce complexity and opportunities for more sophisticated players to exploit latency and routing inefficiencies.

To safeguard yourself:

- Research your broker thoroughly: Understand whether they receive payment for order flow and how their SOR algorithm operates.

- Choose the right order types: Market orders are fastest but can leave you vulnerable to slippage and front-running. Limit orders may offer better control.

- Monitor and evaluate execution quality: Look at your trade confirmations and compare them to prevailing NBBO to ensure you’re not consistently getting worse fills.

- Stay informed: Technology evolves rapidly. Keeping abreast of the latest trends helps you make strategic decisions in your trading.

Ultimately, whether you’re a casual investor or a frequent trader, having a clear grasp of SOR and HFT is crucial for optimizing your trades and avoiding hidden pitfalls. While you may not out-speed the fastest algorithms, understanding how and why your orders move through the market can empower you to make better decisions about brokerage selection, order placement, and trade management.

Additional Reading

“Flash Boys: A Wall Street Revolt” by Michael Lewis – Provides an in-depth look at the world of high-frequency trading and its impact on market fairness.

- Regulatory Websites (e.g., SEC.gov, FINRA.org, ESMA.europa.eu) – For up-to-date rules and guidelines on best execution, HFT, and market structure.

- Brokerage Disclosures – Most brokers publicly file order routing reports (in the U.S., look for SEC Rule 606 disclosures) that detail how they route client orders.

By arming yourself with knowledge and continuously refining your trading approach, you can navigate a marketplace dominated by high-speed algorithms while still securing favorable executions for your stock trades.