In the fast-paced world of trading whether in stocks, forex, futures, or cryptocurrencies software for tracking trading metrics is essential for gaining a competitive edge. Success isn’t just about analyzing market news and price charts; it’s also about measuring your own trading performance through concrete data. By tracking key metrics, you gain valuable insights into your strengths, weaknesses, and areas for improvement.

A structured approach to performance analysis can mean the difference between consistent profitability and ongoing struggles. Metrics like win rate, drawdown, and Sharpe ratio provide a clear picture of your success rate, risk exposure, and risk-adjusted returns. With these insights, you can refine your strategies, enhance risk management, and optimize your overall trading efficiency.

This article explores the importance of trading metrics, highlights the most critical ones to monitor, and reviews the top software for tracking trading metrics effectively. By the end, you’ll know exactly what to measure, why it matters, and which tools can help you analyze and improve your trading performance seamlessly.

Table of Contents

What Are Trading Metrics?

Before we explore the top tools and software, let’s clarify what we mean by “trading metrics” In essence, trading metrics are quantitative measurements that reflect various aspects of your trading activity and performance. They can shed light on:

- Profitability: How well are you doing overall in terms of gains versus losses?

- Risk Management: How much capital are you putting at risk, and how effectively do you manage drawdowns?

- Trade Execution Quality: Are your entries and exits aligned with your strategy?

- Consistency: How steady are your returns and how much volatility do you experience?

By consistently monitoring these indicators, traders can eliminate guesswork from their strategies. Instead of relying purely on intuition, you can use hard data to guide your decision-making. This data-driven approach often yields better long-term results and a more stable growth curve for your trading account.

Key Trading Metrics You Should Track

Although there are dozens of metrics available to traders, a handful stand out as universally beneficial. These metrics track your profitability, consistency, and risk exposure. Below is an in-depth overview of the metrics that are most critical to your success.

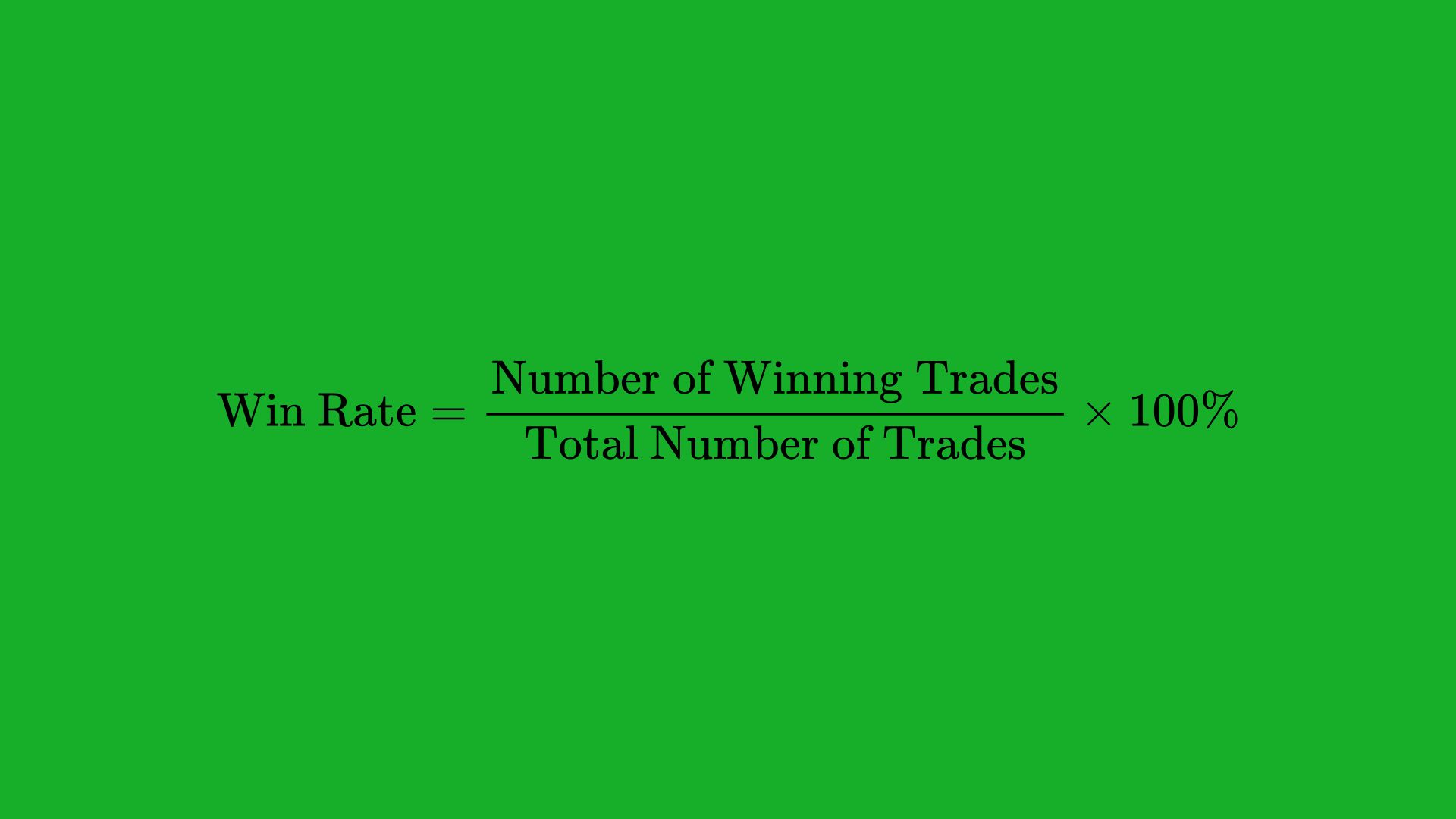

1. Win Rate (Winning Percentage)

The win rate (or winning percentage) measures how many of your trades are profitable compared to total trades executed.

Why It Matters:

- Confidence in Strategy: A high win rate can improve your psychological outlook, but it might also come with a lower average reward per trade.

- Early Warning Sign: A downward trend in win rate can signal that market conditions have changed or that your strategy needs revisiting.

Example:

- If you made 100 trades in a month and 55 were profitable, your win rate would be 55%.

2. Risk-Reward Ratio

The risk-reward ratio indicates how much you stand to gain for every dollar you risk on a trade. If you typically risk 1 point (or dollar) to gain 2 points, your risk-reward ratio is 1:2.

Why It Matters:

- Profit Expectancy: Even if your win rate is relatively low, a favorable risk-reward ratio (like 1:2 or 1:3) can still make you profitable.

- Position Sizing: Helps you determine the proper stop-loss and take-profit levels for each trade.

Example:

- If your typical stop-loss is 10 pips and your target is 30 pips in the forex market, your risk-reward ratio is 1:3.

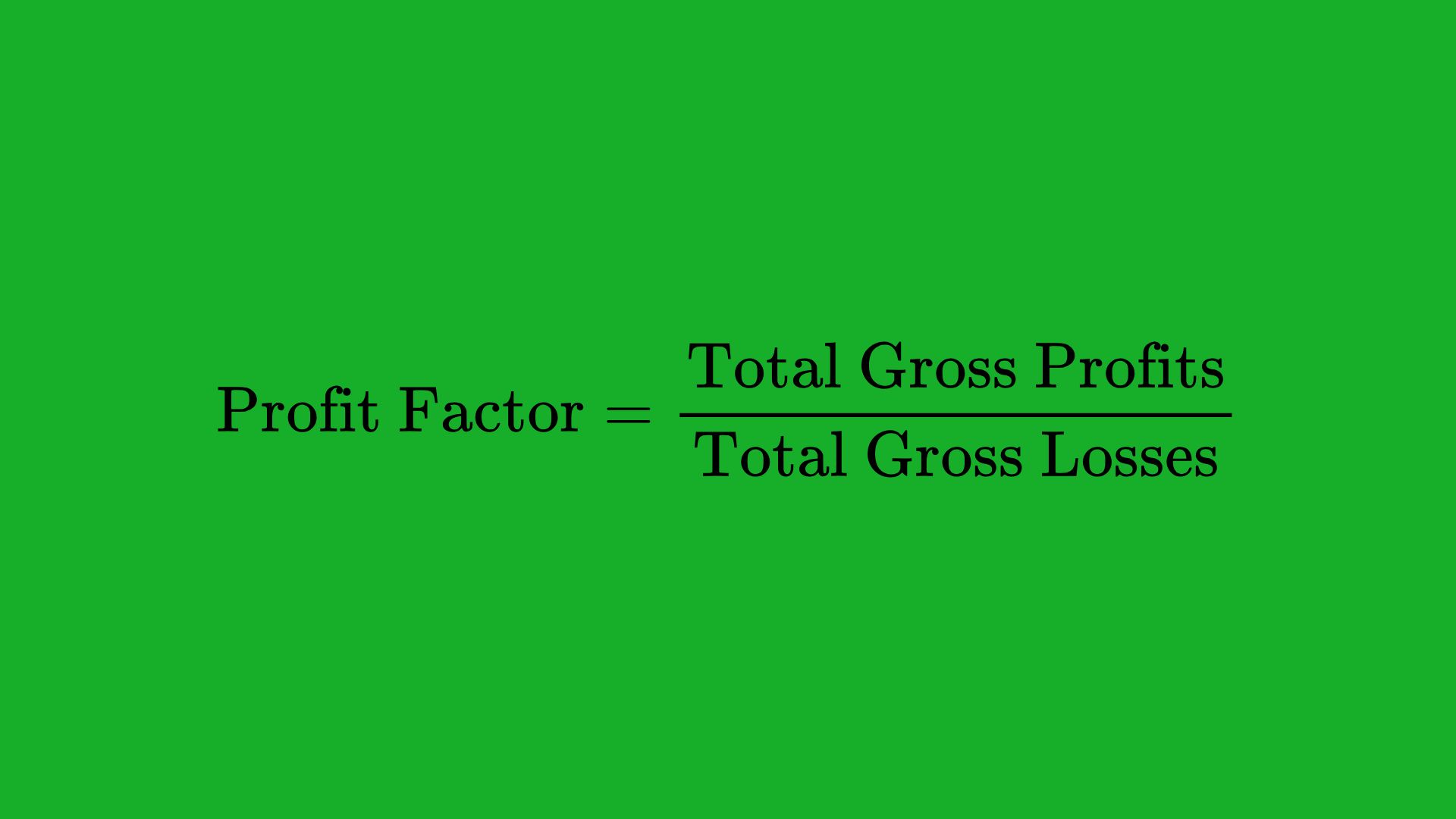

3. Profit Factor

Profit factor is calculated as gross profits divided by gross losses. It gives a ratio of how many dollars you earn per dollar lost.

Why It Matters:

- Profitability Snapshot: A profit factor of 2 means you earn $2 for every $1 you lose, indicating a robust trading strategy.

- Risk Tolerance: If the profit factor is close to 1, it may indicate that the strategy yields minimal net gains after losses.

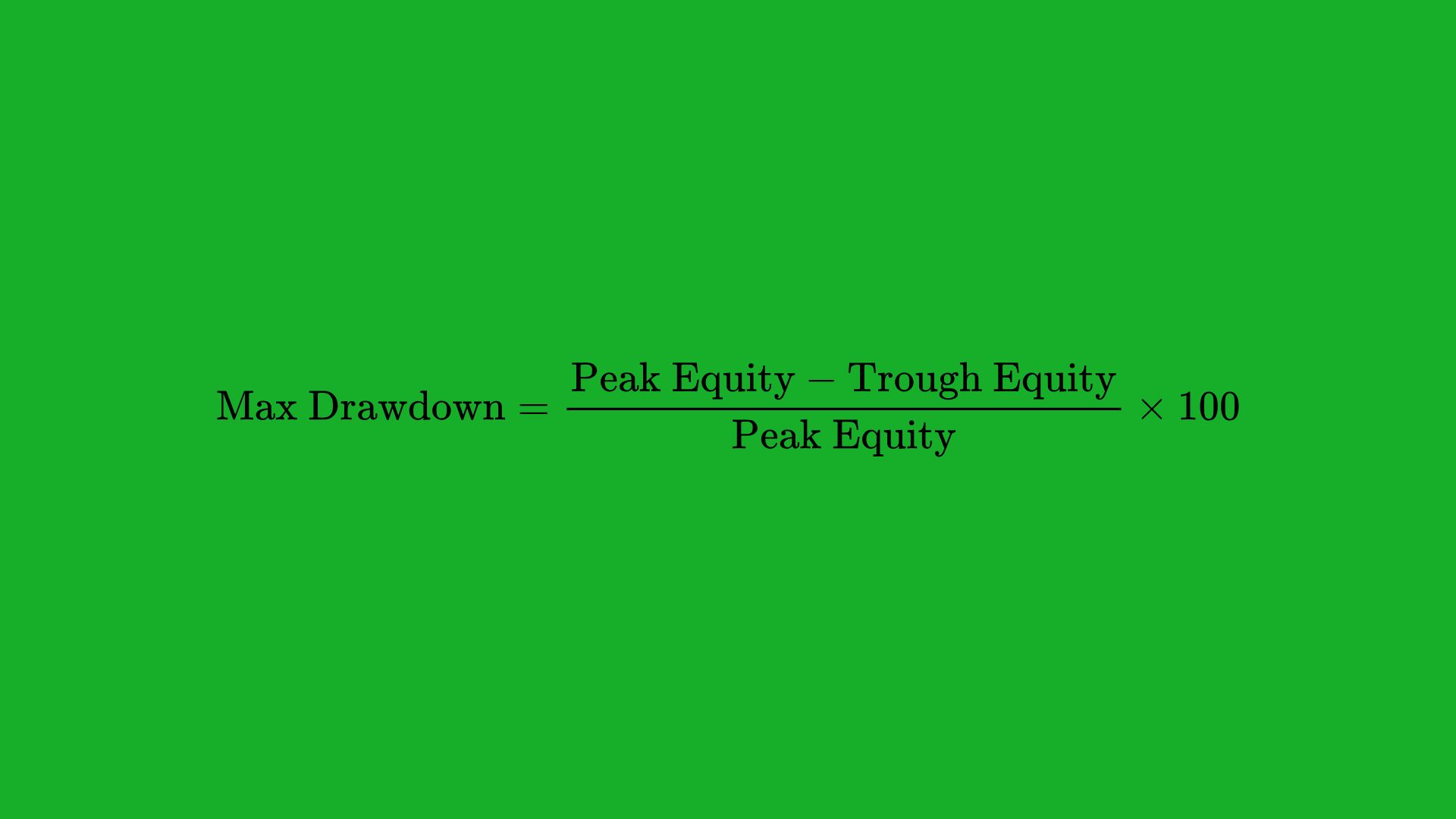

4. Drawdown (Max Drawdown)

Drawdown refers to the decline in your trading account from its peak to its lowest point over a specific period. Maximum drawdown is the largest drop during that period.

Why It Matters:

- Capital Preservation: A large drawdown indicates high risk and can lead to account blow-ups if not managed properly.

- Psychological Burden: Suffering a significant drawdown can psychologically impact your trading decisions, causing overcaution or revenge trading.

5. Sharpe Ratio

The Sharpe ratio measures risk-adjusted returns by comparing your average returns above a risk-free rate to the volatility of those returns.

Why It Matters:

- Risk-Adjusted Performance: A higher Sharpe ratio indicates you’re earning more returns per unit of risk taken.

- Benchmarking: Helps compare different strategies or portfolios on a level playing field.

6. Sortino Ratio

Similar to the Sharpe ratio, the Sortino ratio also measures risk-adjusted performance, but it focuses only on downside volatility rather than total volatility.

Why It Matters:

- Penalizes Downside Risk: More accurate representation for traders who are more concerned about negative swings.

- Helps Assess Asymmetrical Strategies: Particularly relevant for strategies that have skewed distributions of returns.

7. Average Trade Gain/Loss

This metric shows the average profit or loss you make per trade over a specific time.

Why It Matters:

- Scalability Insight: If your average trade gain is too low, increasing position size might help—but only if your drawdown and risk metrics are comfortable.

- Strategy Suitability: Some strategies are built around taking smaller, more frequent gains. Others rely on less frequent but larger gains.

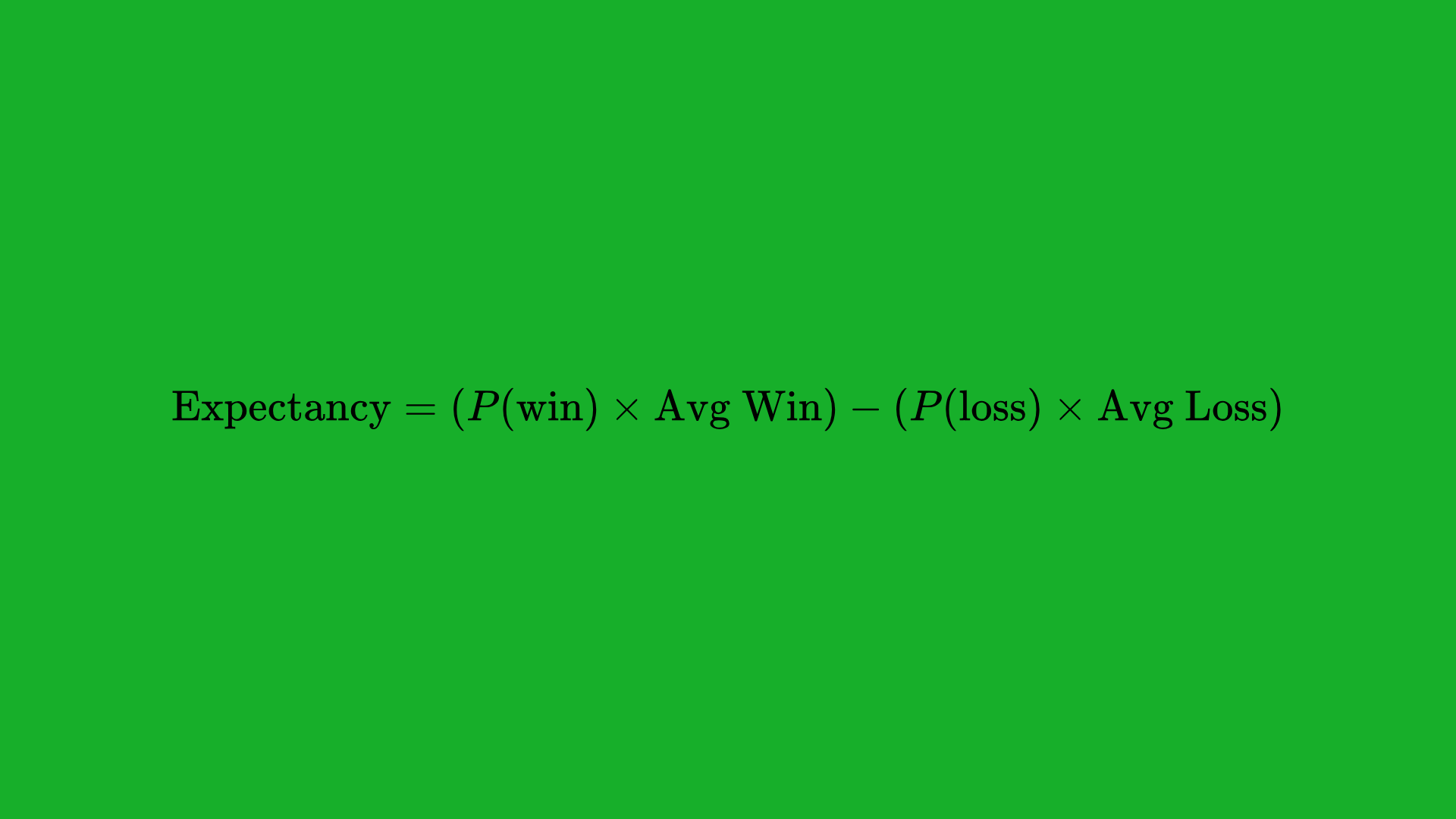

8. Expectancy

Expectancy is a projection of what you can expect to earn or lose on average per trade over the long run. It factors in both your win rate and risk-reward ratio.

Where:

- P(win) = Probability of a winning trade (win rate)

- P(loss) = Probability of a losing trade (1 – win rate)

Why It Matters:

- Long-Term Viability: If your expectancy is positive, you have a strategy that could be profitable in the long term.

- Risk Management Tool: Knowing your expectancy can help you refine position sizes and manage downside risk effectively.

9. Consistency and Volatility Measures

Consistency and volatility measures might include standard deviation of returns, daily/weekly volatility, or variability in profit/loss.

Why It Matters:

- Predictability of Returns: Lower volatility suggests steadier returns, making it easier to predict outcomes and manage risk.

- Benchmark Comparisons: Compare your strategy’s volatility with market indices or other strategies.

10. Trade Duration Metrics

These metrics capture how long you hold trades on average and whether certain time frames yield better results.

Why It Matters:

- Timing Strategy Refinement: Helps you understand if you do better with short-term intraday trades or longer multi-day trades.

- Efficiency of Capital Usage: If you hold losing trades longer than winning trades, you might need to revisit your exit criteria.

Essential Features to Look For in Trading Metrics Tools

When evaluating tools for tracking trading metrics, consider the following features to ensure that the software aligns with your needs:

- Automated Data Import: Saves you from manual data entry, reducing human error.

- Comprehensive Reporting: Look for platforms that offer a wide array of metrics—win rate, drawdown, Sharpe ratio, and more.

- Ease of Use: Intuitive interfaces and simple navigation can help you spend more time analyzing and less time trying to learn the software.

- Customization: The ability to create custom metrics or personalized dashboards can be a game-changer for sophisticated traders.

- Integration with Brokers: Seamless integration ensures real-time data collection and quick analysis.

- Security and Reliability: Your trading data is sensitive; opt for platforms with robust security protocols.

- Scalability: If you plan to grow your trading operation, ensure the tool can handle more data, strategies, and trading accounts.

Top Desktop-Based Tools for Tracking Trading Metrics

1. MetaTrader (MT4/MT5)

Overview:

- Platforms: Windows, Mac (with additional software), and Linux (via emulators).

- Market: Primarily Forex, but also supports CFDs, commodities, and cryptocurrencies through certain brokers.

- Cost: Free to use through a broker account.

Key Features for Metrics Tracking:

- Built-In Trade Reports: MetaTrader provides a straightforward interface for analyzing trades, detailing profit, loss, drawdown, and average trade duration.

- Custom Indicators & Expert Advisors (EAs): You can program or download scripts that calculate advanced trading metrics like Sharpe ratio and Sortino ratio.

- Automated Trading: If you’re using Expert Advisors, the software can automatically compile performance analytics.

Pros & Cons:

- Pros: Wide user base, extensive online community, access to thousands of indicators, robust charting.

- Cons: Focus is more on trade execution than deep analytics; out-of-the-box analytics are somewhat limited.

Ideal For:

- Forex traders who want a simple, broker-supported platform with basic to moderate analytics.

- Traders who don’t mind using custom plugins or external websites to expand analytics.

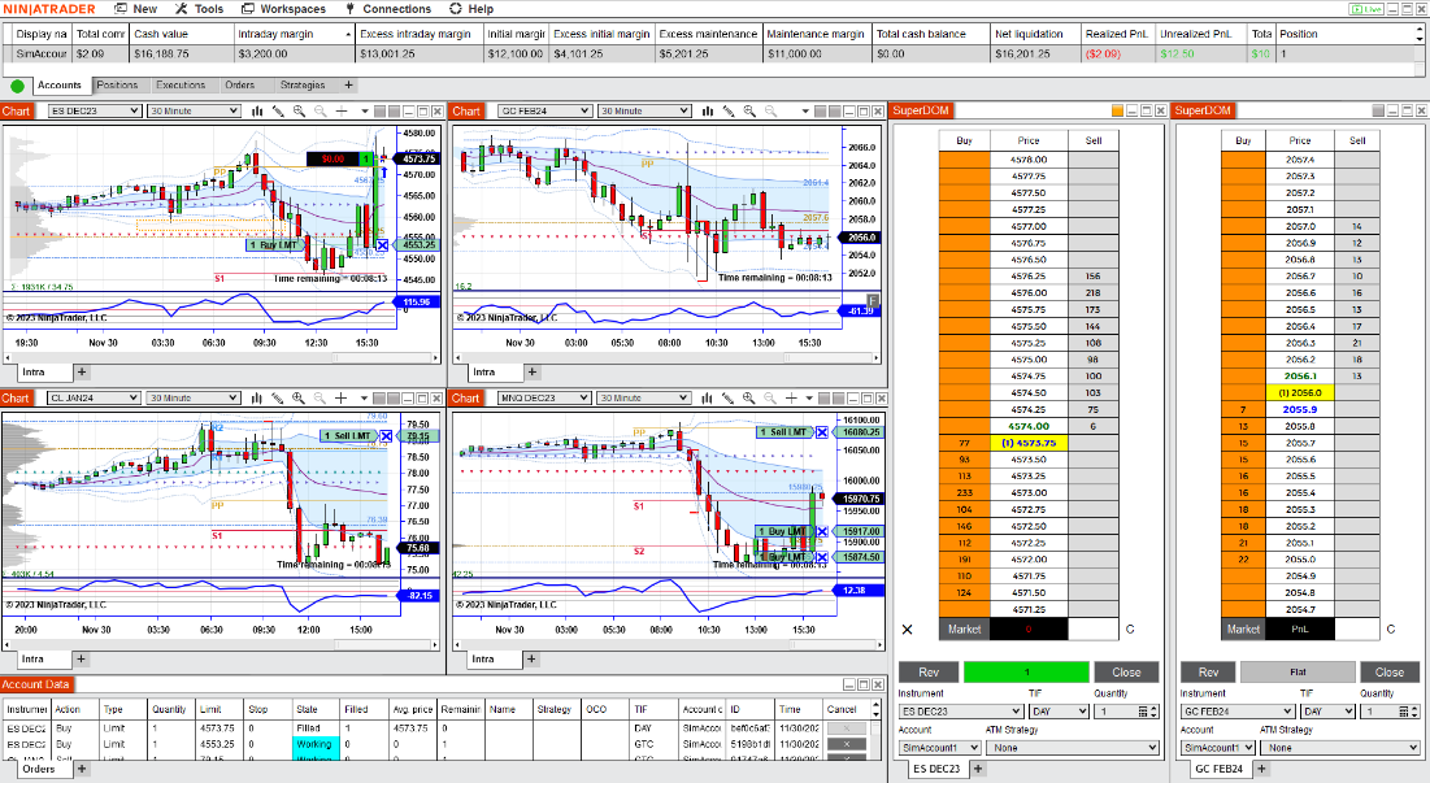

2. NinjaTrader

Overview:

- Platforms: Primarily Windows-based.

- Market: Futures, forex, and equities (through integrated broker).

- Cost: Free for charting and strategy backtesting, but paid for live trading.

Key Features for Metrics Tracking:

- Strategy Analyzer: Offers robust backtesting and optimization with performance metrics like net profit, drawdown, win rate, and Sharpe ratio.

- Chart Trader & Real-Time Analysis: Track performance metrics in real-time as you execute trades.

- Add-On Ecosystem: NinjaTrader has a marketplace for third-party indicators and analytics tools.

Pros & Cons:

- Pros: Advanced backtesting engine, comprehensive analytics, user-friendly interface for systematic traders.

- Cons: Windows-only can be limiting for Mac or Linux users.

Ideal For:

- Active futures traders or those who want detailed backtesting, automated trading, and advanced analytics.

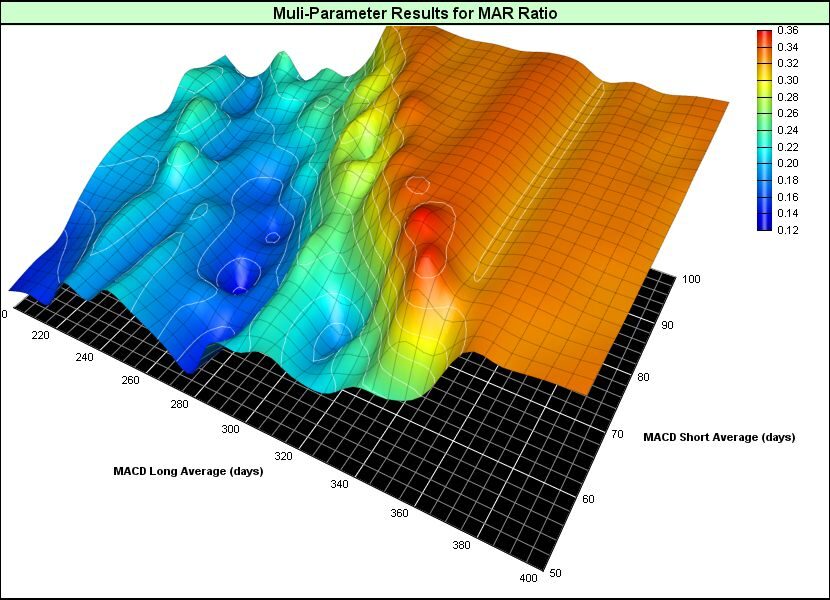

3. Trading Blox

Overview:

- Platforms: Desktop-based (Windows).

- Market: Stocks, futures, forex, and more.

- Cost: Paid software with various license levels.

Key Features for Metrics Tracking:

- System Development & Testing: Trading Blox allows you to develop and test systematic trading strategies across multiple markets.

- Detailed Performance Reports: Metrics include Sharpe ratio, Sortino ratio, MAR ratio (CAGR/Max Drawdown), correlation analysis, and more.

- Complex Portfolio Simulations: Evaluate portfolio-level metrics and correlations between different instruments.

Pros & Cons:

- Pros: Extremely comprehensive analytics for systematic and algorithmic traders.

- Cons: Higher cost compared to free platforms; a learning curve for advanced features.

Ideal For:

- Systematic traders, hedge funds, or advanced retail traders seeking a robust testing environment and in-depth performance reporting.

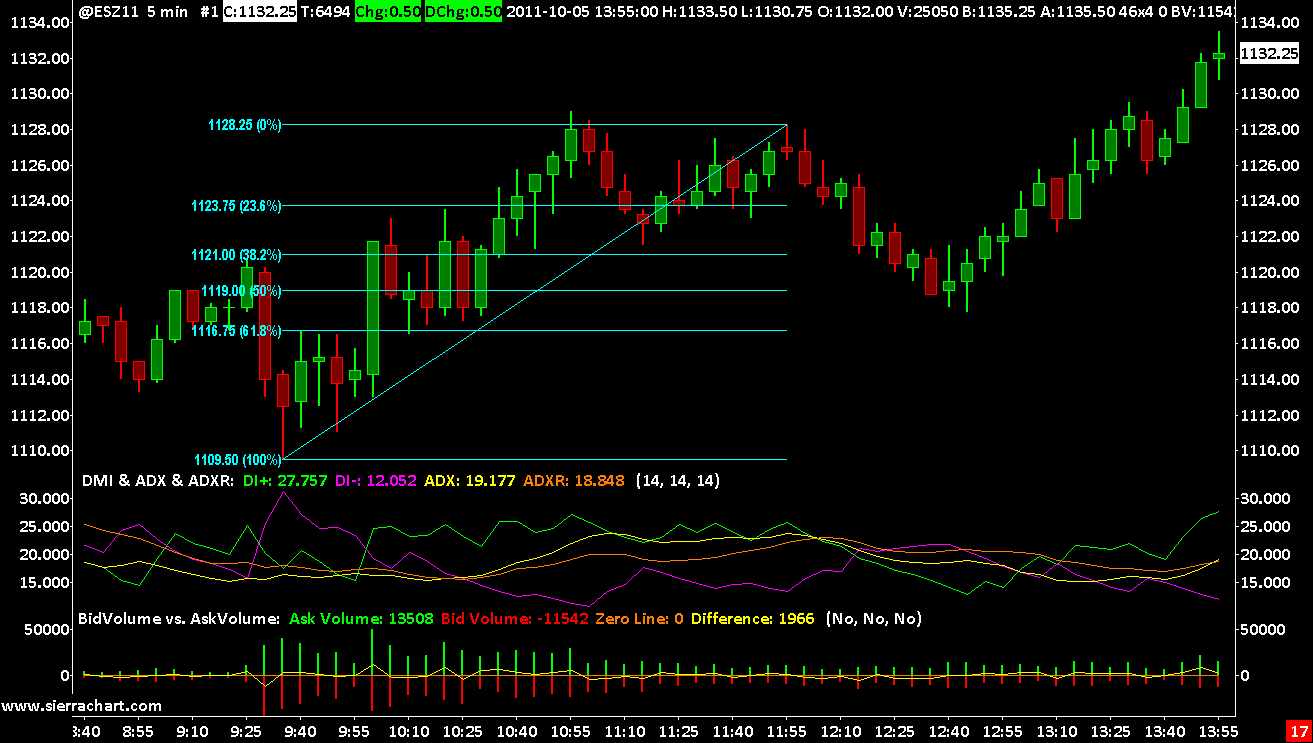

4. Sierra Chart

Overview:

- Platforms: Desktop (Windows), can be run on Mac with certain workarounds.

- Market: Primarily futures and forex, with some support for stocks depending on the data feed.

- Cost: Monthly subscription with different package levels.

Key Features for Metrics Tracking:

- Advanced Charting Tools: Sierra Chart is known for its professional-grade charting, enabling detailed technical analysis.

- Trade Activity Log: Includes performance summaries, trade-by-trade breakdowns, and customizable metrics.

- Analytics Studies: Ability to add or code custom studies that track specialized metrics.

Pros & Cons:

- Pros: Highly customizable, professional-level data feeds, robust platform stability.

- Cons: Steep learning curve for beginners, interface can feel less intuitive compared to others.

Ideal For:

- Traders who want professional-level charting and integrated analytics, especially in the futures market.

Leading Web-Based Platforms for Trading Metrics Analysis

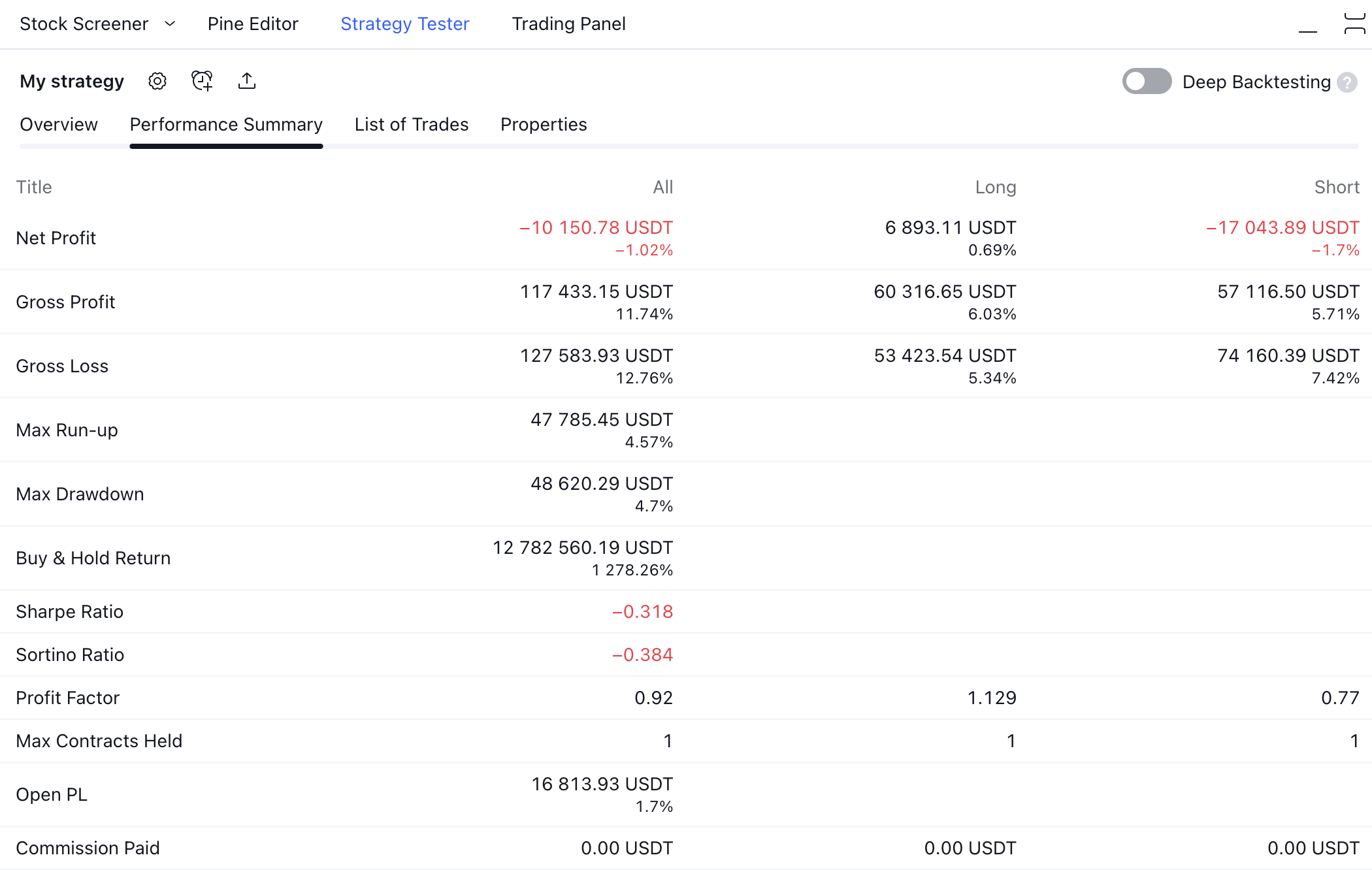

1. TradingView

Overview:

- Platforms: Web-based and mobile apps.

- Market: Stocks, forex, cryptocurrencies, futures, and more.

- Cost: Free (Basic), Pro, Pro+, and Premium subscription tiers.

Key Features for Metrics Tracking:

- Portfolio Tracking: You can simulate trades using the paper trading feature or track actual trades for certain broker integrations.

- Social Community: Sharing and analyzing ideas can offer insights into your metrics compared to community benchmarks.

- Pine Script for Custom Metrics: You can script your own indicators or calculations to measure specific metrics in real-time.

Pros & Cons:

- Pros: Intuitive interface, wide market coverage, strong social and educational components.

- Cons: Some advanced metrics and features require scripting or a paid subscription.

Ideal For:

- Multi-market traders who value a simple, clean interface and a large community for idea exchange.

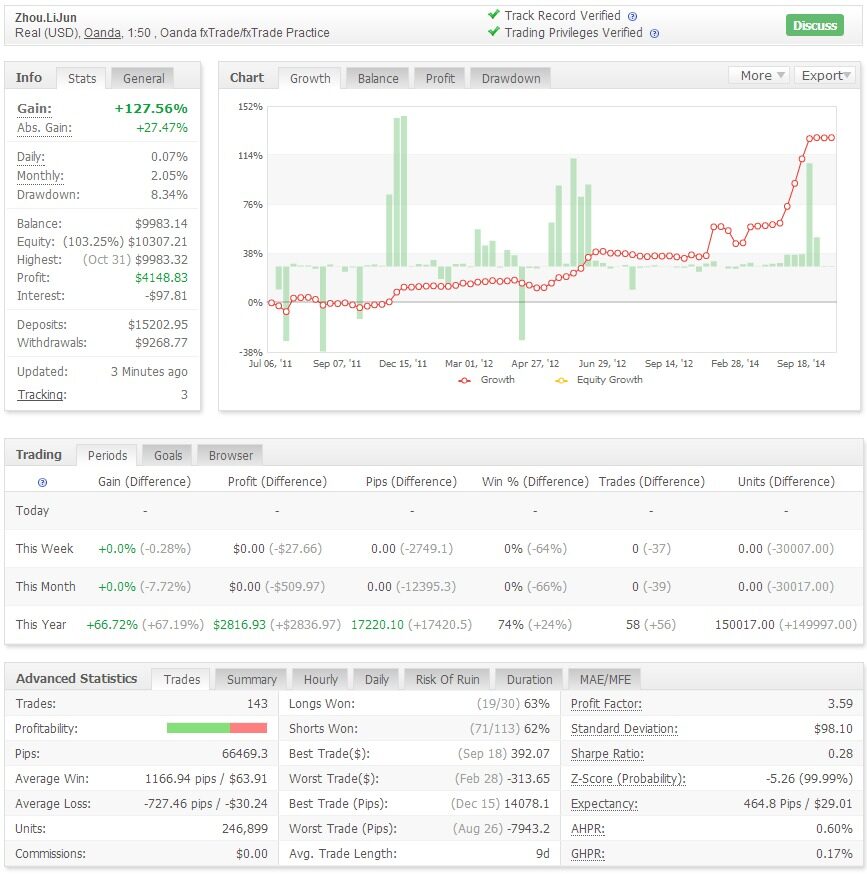

2. Myfxbook

Overview:

- Platforms: Web, primarily for forex tracking.

- Market: Forex (strong focus), also some support for other CFDs.

- Cost: Free (ad-supported).

Key Features for Metrics Tracking:

- Automated Account Sync: Connect your broker account, and Myfxbook automatically imports your trades.

- Detailed Analytics: Offers comprehensive stats including drawdown, win rate, monthly gains, and advanced ratios like Sharpe and Sortino.

- Community Benchmarks: Compare your performance with other traders in the Myfxbook community.

Pros & Cons:

- Pros: Very thorough analytics specifically tailored for forex, easy integration with MT4/MT5.

- Cons: Limited support outside forex, user interface can feel cluttered with ads.

Ideal For:

- Forex traders seeking a free, web-based solution for detailed performance analytics and community comparison.

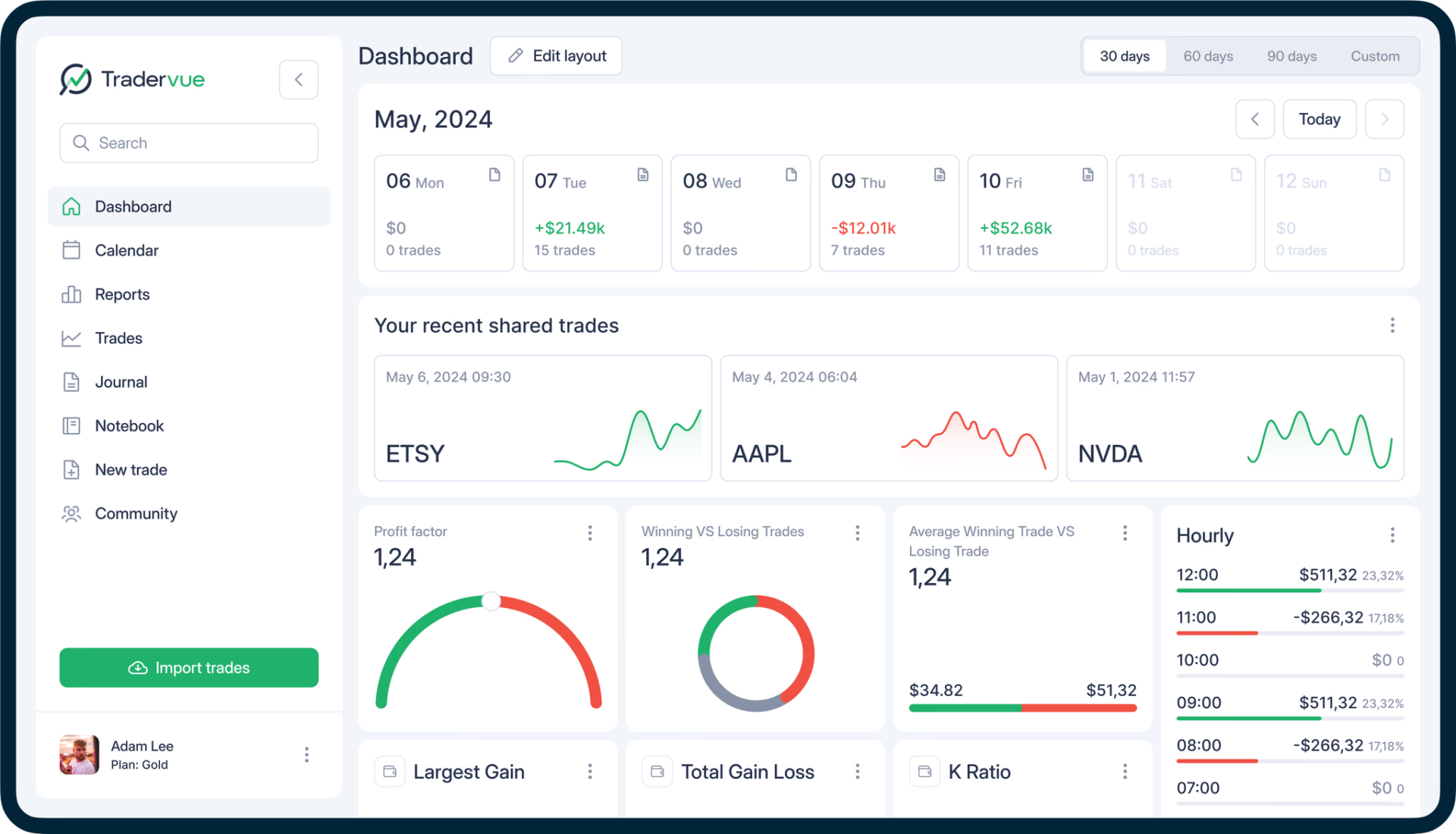

3. TraderVue

Overview:

- Platforms: Web-based.

- Market: Stocks, options, futures, forex, and cryptocurrencies.

- Cost: Free (Basic), Silver, Gold, and other premium plans.

Key Features for Metrics Tracking:

- Trade Journal: A robust journaling feature to add notes, screenshots, and tags for each trade.

- Performance Reporting: Offers metrics like win rate, average gain/loss, risk analysis, and MFE/MAE (Maximum Favorable/Adverse Excursion).

- Analytics & Charts: Visual representations of your performance over time, trade distribution, and more.

Pros & Cons:

- Pros: Excellent journaling capabilities, user-friendly design, strong community following.

- Cons: Free version has limited features; advanced reporting requires paid plans.

Ideal For:

- Traders who value journaling and detailed post-trade analysis to refine their strategies.

4. StockCharts

Overview:

- Platforms: Web-based.

- Market: Stocks, ETFs, mutual funds, indexes, some forex coverage.

- Cost: Free with limited features; multiple paid tiers for advanced charting and scanning.

Key Features for Metrics Tracking:

- ChartSchool & Technical Tools: Educational resources to help you understand and customize technical indicators.

- SharpCharts & P&F Charts: Advanced charting styles for deeper technical analysis.

- Portfolio Tracker: Allows tracking of stocks/ETFs, but more limited in advanced trade metrics compared to some specialized tools.

Pros & Cons:

- Pros: Extensive educational material, robust charting.

- Cons: Primarily for chart-based analysis, limited direct trade-tracking features.

Ideal For:

- Long-term stock and ETF traders wanting a strong focus on charts and basic portfolio performance tracking.

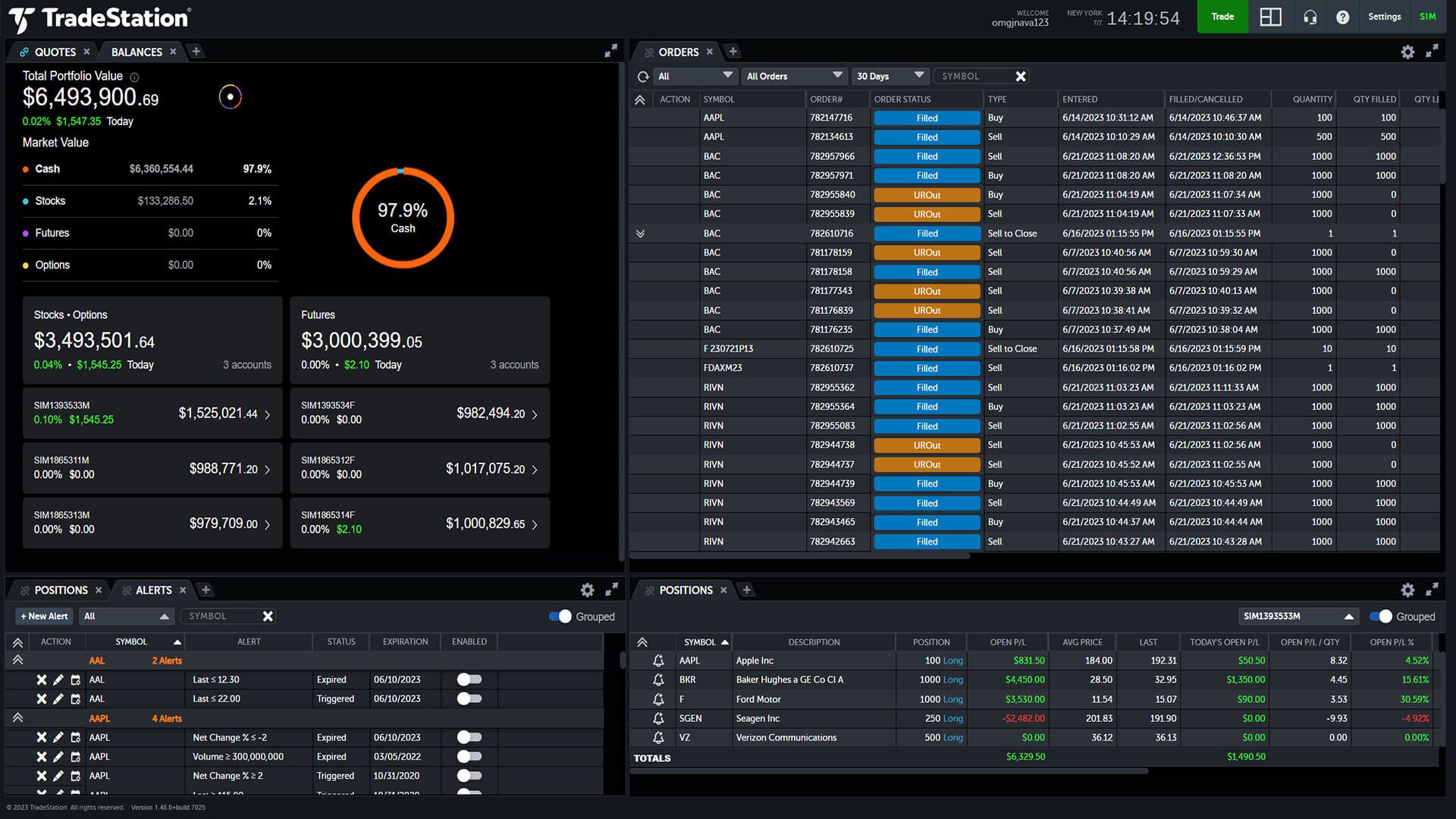

5. TradeStation Web Trading Analytics

Overview:

- Platforms: Web and desktop versions.

- Market: Equities, options, futures, forex, crypto (in certain regions).

- Cost: Free for TradeStation clients, plus various commissions.

Key Features for Metrics Tracking:

- Built-In Analytics: Real-time P/L, detailed order history, and advanced reporting in a unified interface.

- EasyStrategy Analysis: Advanced users can script custom performance reports.

- All-in-One Solution: Combines brokerage, charting, and analytics in a single ecosystem.

Pros & Cons:

- Pros: Integrated with a reputable broker, advanced analytics on both web and desktop.

- Cons: May require an account with TradeStation; somewhat complex for new traders.

Ideal For:

- U.S.-based traders seeking a unified solution for execution, portfolio management, and analytics.

Mobile Apps for On-the-Go Metrics Tracking

For active traders and those frequently away from their desks, mobile apps offer real-time tracking of performance, notifications, and quick trade execution. While many of the previously mentioned platforms (such as TradingView, MetaTrader, and Myfxbook) offer mobile versions, here are additional considerations:

- Broker-Provided Apps: Many brokers (e.g., Interactive Brokers, TD Ameritrade, E*TRADE) have robust mobile apps that include performance summaries, P/L breakdowns, and basic analytics.

- Standalone Journal Apps: Some trading journal apps (like Edgewonk) are accessible on mobile browsers, but full-featured native apps might be limited.

Important Factors for Mobile Metrics Tracking:

- Real-Time Sync: Ensures the metrics you see are always updated.

- Push Notifications: Keeps you informed about trade status, margin changes, or performance milestones.

- Data Visualization: Good charts and straightforward metrics on mobile can significantly improve quick decision-making.

Automation and Customization: Advanced Tools for Data-Driven Traders

1. Python & R for Custom Analytics

Overview:

- Platforms: Cross-platform (Windows, Mac, Linux).

- Market: Any market data can be analyzed given you have the data feed.

- Cost: Free, open-source libraries.

Key Features for Metrics Tracking:

- Full Customization: You can build scripts that automatically calculate advanced metrics, generate custom performance reports, and even create dashboards.

- Data Science Libraries: Python’s

pandas,numpy, andmatplotlib(or R’squantmod,PerformanceAnalytics) enable robust data manipulation and visualization. - APIs for Data & Brokers: Many brokers offer APIs to pull trade history or place trades, allowing seamless end-to-end automation.

Pros & Cons:

- Pros: Infinite flexibility, no licensing costs, strong community support.

- Cons: Requires coding skills, a steeper learning curve for non-technical traders.

Ideal For:

- Algorithmic traders or those who want fully customized performance and risk metrics beyond what standard software provides.

2. MATLAB

Overview:

- Platforms: Cross-platform, commercial numerical computing environment.

- Market: Any market, provided you have the data feed.

- Cost: Paid license (with specialized toolboxes available).

Key Features for Metrics Tracking:

- Financial Toolbox: Advanced functions for calculating performance metrics, risk modeling, and portfolio optimization.

- Algorithmic Trading: Combine MATLAB’s robust computational capabilities with broker APIs for end-to-end algo trading.

- Visualization: MATLAB offers top-tier data visualization for complex performance models.

Pros & Cons:

- Pros: Industry-standard for quantitative research, extensive toolboxes for finance, signal processing, etc.

- Cons: Licensing costs can be prohibitive, especially for individual traders.

Ideal For:

- Quantitative analysts, professional trading firms, or academic researchers requiring advanced numerical methods.

3. Excel and Google Sheets

Overview:

- Platforms: Desktop (Excel) and web (Google Sheets).

- Market: Any market data can be imported manually or through add-ons.

- Cost: Excel is part of Microsoft Office (paid); Google Sheets is free.

Key Features for Metrics Tracking:

- Custom Formulas & Macros: Allows you to calculate your own metrics, keep track of daily P/L, etc.

- Integration with Plugins: Services like Excel’s Power Query or Google Finance can fetch real-time or delayed quotes.

- Simplicity & Familiarity: Many traders are already comfortable with spreadsheet software, making adoption easier.

Pros & Cons:

- Pros: Fully customizable, accessible, widely known.

- Cons: Manual data entry can be time-consuming and error-prone unless automated with APIs.

Ideal For:

- Traders who prefer a do-it-yourself approach and want full control but are okay with some manual processes.

Tips for Selecting the Right Tool

- Define Your Trading Style: Day traders might prioritize real-time analytics and quick order entry, while swing traders may favor more robust journaling tools for post-trade analysis.

- Check Broker Compatibility: Ensure the platform or software integrates seamlessly with your current broker for real-time or automated data updates.

- Assess Your Technical Comfort: If you’re not tech-savvy, consider user-friendly platforms with minimal setup. More advanced traders might prefer Python or MATLAB.

- Budget Considerations: Many free options exist, but premium features might be worth the investment if you need advanced metrics or backtesting capabilities.

- Look for Scalability: If you plan to grow your portfolio or trade multiple markets, opt for a platform that can handle larger data sets and multiple strategies.

How to Integrate Your Chosen Tools into a Trading Routine

- Daily or Weekly Reviews: Set aside time at the end of each trading session or week to analyze your performance metrics.

- Journaling: Use platforms like TraderVue or Myfxbook’s note feature to record why you took each trade, how you felt, and what you learned.

- Periodic Strategy Evaluation: Metrics like expectancy and drawdown can shift over time. Conduct monthly or quarterly reviews to update your strategy or risk parameters.

- Automation Setup: If using automated scripts (in Python or with EAs in MetaTrader), ensure they run reliably and cross-verify the data for accuracy.

- Risk Management Integration: Ensure that your metrics feed into your risk management protocols—like adjusting position sizes based on recent drawdowns or volatility spikes.

Common Mistakes to Avoid When Tracking Trading Metrics

- Focusing Solely on Win Rate: A high win rate doesn’t guarantee profitability; always consider risk-reward and profit factor.

- Ignoring Drawdowns: Profitable strategies can still experience large drawdowns that exceed your risk tolerance.

- Over-Reliance on a Single Metric: Metrics like Sharpe ratio are helpful, but they don’t tell the entire story. Use multiple metrics for a well-rounded view.

- Not Accounting for Fees and Slippage: Make sure to include transaction costs and slippage in your calculations. These can significantly affect net performance, especially for high-frequency traders.

- Infrequent Updates: Your metrics are only as useful as they are current. Failing to update your data regularly can lead to outdated conclusions.

- Poor Data Quality: If your data sources are inconsistent or have significant gaps, your metrics won’t reflect reality.

Conclusion: Maximizing Your Trading Potential Through Effective Metrics Tracking

In the fast-paced realm of trading, relying solely on intuition or unstructured observations can be a costly mistake. Tracking trading metrics from win rates and drawdowns to advanced ratios like the Sharpe and Sortino empowers you to identify what works and, crucially, what doesn’t. By leveraging the right tools and software, you can turn raw trade data into actionable insights.

From desktop-based powerhouses like MetaTrader, NinjaTrader, and Sierra Chart, to web-based favorites like TradingView and Myfxbook, and even advanced custom environments like Python or MATLAB, there’s a platform that matches every trading style and level of technical expertise. The key is to choose a solution that aligns with your markets, strategy, budget, and long-term goals.

Remember, metrics tracking isn’t just about numbers; it’s about guiding your decision-making process, refining risk management, and building consistency in your performance. Whether you’re a beginner, intermediate, or seasoned trader, investing time (and potentially money) into robust analytics tools can pay dividends down the line. In a market where countless variables are out of your control, it’s crucial to manage what you can control—and your trading metrics are at the top of that list.

Action Steps to Get Started:

- Identify Your Core Metrics: Start with win rate, average gain/loss, drawdown, and Sharpe ratio.

- Choose a Compatible Platform: Make sure it integrates with your current broker and offers any advanced features you might need.

- Set Up a Routine: Decide on daily, weekly, or monthly reviews and stick to them to build good trading habits.

- Review & Adapt: Metrics will fluctuate as markets evolve. Stay agile and adjust your strategies based on empirical data.

With a solid framework for metrics tracking, you’ll gain the confidence and clarity needed to reach new levels of trading success. Armed with the knowledge in this article, you’re well on your way to making data-driven decisions that can significantly improve your profitability and risk control.

Final Note: Achieving longevity in trading depends on understanding both your strengths and weaknesses. Properly tracked metrics illuminate the path forward by highlighting key areas for refinement. Whether you opt for user-friendly web platforms or sophisticated custom solutions, your focus should remain on consistency, disciplined evaluation, and continuous learning. Over time, this will give you the competitive edge required to thrive in today’s dynamic financial markets.