Trading psychology encompasses the mental and emotional factors that influence how traders behave. While technical and fundamental analyses, along with a solid grasp of market conditions, are crucial components for success, many traders often neglect the critical role their mindset and emotions play. This oversight can be costly, as powerful emotions like fear and greed can heavily sway decision-making in volatile, high-stakes environments.

Understanding the psychology behind trading is essential because market dynamics frequently hinge on collective human behavior. When large groups of traders succumb to the same emotional triggers or cognitive distortions, price movements can become amplified, causing rational thinking to take a back seat. In these moments, unchecked emotions can spur impulsive trades, leading to poorly timed entries and exits.

Out of all the biases that shape trading outcomes, loss aversion bias in trading stands out as one of the most influential and financially harmful. It highlights how the pain of losing often outweighs the pleasure of an equivalent gain. This heightened fear of loss can lead to irrational moves—such as clinging to losing positions for too long or closing profitable ones too early. In this article, we’ll delve deeply into the definition of loss aversion bias, explore its causes, examine its damaging effects on trading results, and offer practical strategies to overcome it for greater consistency and success.

Table of Contents

What is Loss Aversion Bias?

Loss aversion bias refers to the tendency for individuals to experience the pain of losses more strongly than the pleasure of equivalent gains. In other words, the negative utility or impact felt from losing a certain amount of money is generally perceived to be greater than the positive utility or impact felt from gaining the same amount of money. This phenomenon is not limited to trading and can be observed in everyday decision-making scenarios such as consumer choices, negotiation strategies, and even personal relationships.

From a trading standpoint, loss aversion manifests as the preference to avoid losses rather than to acquire gains. This disproportionate emphasis on losses can push traders toward irrational behaviors. They might, for instance, hold onto losing trades for far too long in hopes that the price recovers, rather than cutting their losses quickly and freeing up capital to invest in better opportunities. Conversely, loss-averse traders sometimes rush to close profitable trades prematurely out of fear that the small gain might evaporate.

In a balanced, rational world, a trader should view a $100 gain and a $100 loss with equal magnitude but opposite sign. However, due to loss aversion bias, the perceived “emotional weight” of the $100 loss is often significantly heavier than the pleasure derived from a $100 gain. This asymmetry leads to emotional decision-making, which in a high-stakes environment like trading, can be especially costly over time.

The Origins of Loss Aversion: Research and Background

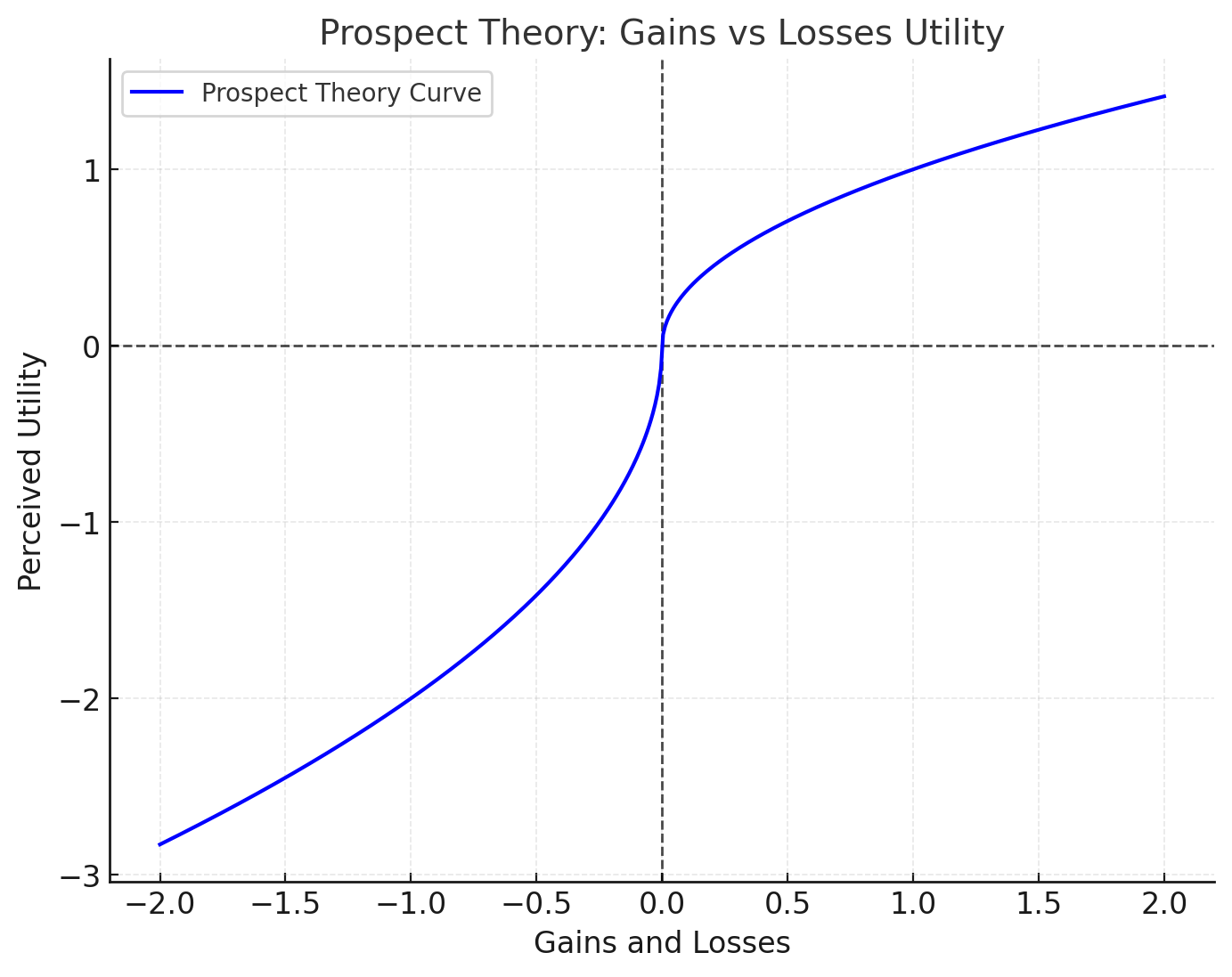

The concept of loss aversion was popularized by Nobel Prize-winning psychologists Daniel Kahneman and Amos Tversky through their groundbreaking work on Prospect Theory in the late 1970s. Their research sought to understand how people make decisions under uncertainty, focusing on why they deviate from what is predicted by classic economic theories that assume human beings behave rationally.

Prospect Theory

According to Prospect Theory, people do not evaluate outcomes using final absolute wealth levels. Instead, they gauge gains and losses relative to a reference point (often the status quo or initial price level). Kahneman and Tversky found that individuals display what they called a “reflection effect” and are generally risk-averse in gains but risk-seeking in losses:

- Risk-Averse in Gains: People prefer sure smaller gains over a risky prospect with a potentially larger gain.

- Risk-Seeking in Losses: When faced with a sure loss, individuals prefer to gamble in the hope of avoiding that loss altogether, even if the probability is low.

Importance of Reference Points

A critical part of loss aversion involves the concept of reference points. If you buy a stock at $100, that purchase price becomes your reference point. A drop to $90 feels like a real, painful loss, even if from a purely objective standpoint (for example, if market analysis suggests the current fair value is actually $90), it might simply be part of normal market fluctuations.

Emotional and Evolutionary Underpinnings

Some evolutionary psychologists propose that loss aversion has roots in survival instincts. For our ancestors, failing to escape a threat (like a predator) was often costlier than missing a potential reward (like finding extra food). In modern financial markets, this can translate to an overemphasis on avoiding losses rather than maximizing gains. As such, it’s deeply ingrained and not something we can simply “turn off.” Only through awareness and active countermeasures can traders begin to mitigate its effects.

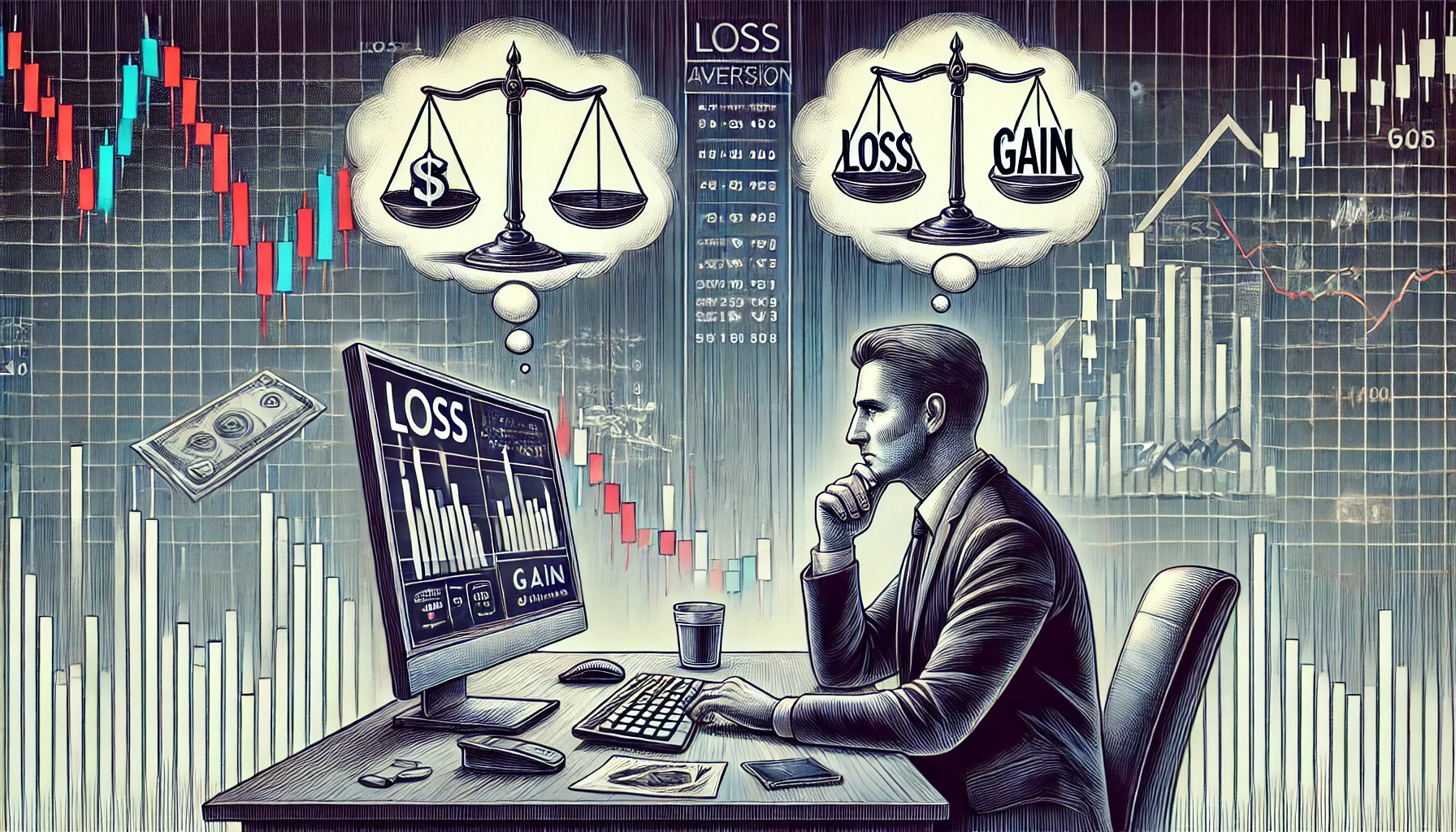

Why Loss Aversion Matters in Trading

Loss aversion matters in trading because of its direct impact on performance and profitability. While some biases can be relatively minor or situational, loss aversion is pervasive and can influence almost every decision a trader makes. If left unchecked, loss aversion can lead to systematic trading errors such as:

- Failure to Cut Losses: Traders who are loss-averse may hold onto losing trades for far too long, hoping that the market will reverse and “save” their position.

- Premature Profit-Taking: Traders may exit winning positions too early to lock in small gains, leading to missed opportunities and reduced profit potential.

- Overtrading: Fear of realizing a loss can drive some traders to adjust positions frequently, trying to avoid any short-term negative moves, resulting in excessive transaction costs.

- Emotional Distress: The constant fear of losing increases psychological stress, which can cloud judgment and lead to impulsive decisions.

Being aware of loss aversion is the first step in mitigating its detrimental effects. When a trader recognizes they have a tendency to weigh losses too heavily, they can take deliberate actions—like setting firm stop-losses or practicing mindfulness—to ensure they adhere to a more rational approach.

Key Components of Loss Aversion in Trading Decisions

Loss aversion is influenced by various psychological and behavioral factors. Below are some of the key components that shape how traders experience and act on this bias:

- Fear of Regret

- Many traders fear the regret that comes with acknowledging a losing trade. Realizing a loss feels like admitting a mistake, which can be psychologically taxing. This fear is a powerful deterrent to closing losing positions.

- Overvaluation of the Current Position

- People tend to overvalue what they already own. In trading, once you hold a position, you may become emotionally attached to it, which can lead to reluctance to sell it at a loss.

- Anchoring to the Purchase Price

- The purchase price often becomes an emotional anchor. Traders fixate on this anchor point and see any price below it as unacceptable. As a result, they may wait indefinitely for the price to “come back.”

- Risk-Seeking Behavior in Losses

- When faced with guaranteed losses, traders may take risky gambles, such as adding to a losing position, to avoid realizing a loss. This can exacerbate the problem if the market continues to move against them.

- Short-Term Focus

- Loss aversion can drive a short-term mindset. Traders might close out trades with small gains too quickly because they are overly concerned about losing what they’ve gained.

- Inadequate Risk Management

- Some traders fail to set or adhere to stop-loss levels. They find it hard to accept a “forced” loss, which leads to letting losses run out of control.

Understanding these components can help traders spot where loss aversion might be creeping into their trading plan and day-to-day decisions.

Loss Aversion vs Risk Aversion: Understanding the Difference

Although the terms “loss aversion” and “risk aversion” may sound similar, they are conceptually distinct.

- Risk Aversion: A general preference for certainty over uncertainty. A risk-averse person might prefer a guaranteed $50 to a 50% chance of winning $100, because they would rather not risk ending up with nothing.

- Loss Aversion: A specific bias where the emotional weight of a loss is disproportionately heavier than the emotional weight of an equivalent gain. A loss-averse individual feels the pain of losing $50 more intensely than the pleasure of gaining $50.

Put simply, risk aversion addresses how a person deals with uncertainty in general. Loss aversion focuses particularly on how people handle outcomes that are framed as losses versus gains. A risk-averse trader might want more conservative trades overall, but a loss-averse trader may act irrationally to avoid locking in a loss—even if that means potentially incurring bigger losses down the road.

Common Examples of Loss Aversion in Trading

It’s not hard to spot loss aversion in everyday trading scenarios once you know what to look for. Below are some common examples:

- Refusal to Sell a Losing Stock

- A trader buys a stock at $100, which then drops to $80. Despite mounting evidence that the company’s fundamentals have deteriorated or that a broader market downtrend persists, the trader refuses to sell because that would “lock in” the loss. They hold, hoping for a rebound, rather than reallocating the capital to a more promising trade.

- Prematurely Closing Profitable Positions

- A stock surges from $100 to $110, and the trader immediately sells to “secure” the $10 gain. This might be a valid decision in some contexts, but if they sell purely out of fear of losing that $10 if the price dips again (rather than based on an analysis of the stock’s valuation or technical indicators), it can be a sign of loss aversion.

- Overtrading to Avoid Small Losses

- In this scenario, a trader sets tight stop-losses or frequently moves their stops closer to the price out of fear. Each small downturn triggers a stop, incurring repeated small losses, rather than allowing the position time to mature. While controlling risk is important, doing it out of fear of seeing any red in your account can lead to a series of small but cumulative losses.

- Doubling Down on a Losing Trade

- Some traders add to a losing position (“averaging down”) with the rationale that the stock is now cheaper. While this can be a strategic move if done with proper analysis and risk control, it can also be a way to postpone the emotional pain of accepting a loss. If the stock continues to drop, the trader’s losses can compound rapidly.

- Ignoring Stop-Losses

- Even if a stop-loss is set, a loss-averse trader might cancel or modify it once it’s about to be triggered. They might rationalize that the price will bounce back or that they want to give the market “one more day.” Consistently moving or ignoring stop-losses is a clear manifestation of loss aversion.

These examples highlight that loss aversion can shape trading behavior in multiple ways. Recognizing them is crucial for any trader who wants to preserve capital and perform consistently in the markets.

Real-World Research and Studies Illustrating Loss Aversion

Loss aversion is not just a theoretical construct; a variety of real-world studies have demonstrated its existence and implications. Below are a few influential pieces of research:

- Kahneman & Tversky’s Experiments on Prospect Theory (1979)

- They asked participants to choose between certain outcomes versus probabilistic ones. For example:

- Choice A: Guaranteed $50

- Choice B: 50% chance to win $100, 50% chance to win $0

- Most participants chose the guaranteed $50, revealing risk aversion in gains. When the choices were framed as potential losses, participants demonstrated risk-seeking behavior (they would rather gamble than accept a guaranteed loss). This experiment underscores that the pain of losing is felt more intensely than the satisfaction from winning.

- They asked participants to choose between certain outcomes versus probabilistic ones. For example:

- Thaler’s Endowment Effect Studies (1980s)

- Economist Richard Thaler demonstrated the Endowment Effect, which is closely related to loss aversion. In one famous study, participants who were given a mug assigned a much higher value to it when they were asked to sell it than participants who were asked to buy it. This supports the notion that “owning” an item (or a position in trading) increases its perceived value, making the potential loss of that item feel more significant.

- Studies on Trading Behaviors in Institutional Settings

- Various academic studies looking at institutional trading records found that professional portfolio managers often hold onto losing stocks longer than winning stocks. This phenomenon, known as the “disposition effect,” is a real-world manifestation of loss aversion. The managers were more willing to realize gains—thus selling winners—than to realize losses.

- Brain Imaging Studies

- Neurological research using fMRI scans has revealed that the areas of the brain associated with emotional responses (such as the amygdala) become highly active when individuals face potential losses. This suggests that loss aversion might be hardwired into our biology, making it a formidable bias to overcome by mere willpower alone.

These studies collectively confirm that loss aversion is a fundamental part of human cognition, influencing decisions across a broad spectrum of scenarios, including trading. Recognizing that even professional money managers and everyday investors are susceptible highlights the need for strategies to mitigate it.

How Loss Aversion Impacts Profitability

Loss aversion can significantly hamper profitability in several ways. Here’s how:

- Missed Opportunities

- If you’re too quick to sell winning trades, you limit your upside. Over time, these smaller-than-necessary gains might not offset the inevitable losses that come from being in the market.

- Large Drawdowns

- Holding onto losing trades for too long can lead to large drawdowns—significant reductions in trading capital. Recovering from a steep drawdown requires exponentially larger gains.

- Increased Transaction Costs

- Overtrading or rapidly shifting positions to avoid seeing losses can result in higher commissions, slippage, and other trading costs, which eat into your overall returns.

- Emotional Burnout

- Constantly fretting over avoiding losses can create mental fatigue, which in turn can lead to more mistakes or poor decision-making down the line.

- Capital Misallocation

- By not cutting losing positions, traders may end up tying their capital in unproductive trades rather than deploying it elsewhere. This opportunity cost can be significant if there are better opportunities in the market.

From a purely mathematical perspective, losing a chunk of your trading account requires a larger percentage gain to break even. For instance, if you lose 50% of your capital, you need a 100% return just to get back to square one. Loss aversion bias, therefore, can spiral into more significant losses and hamper growth if you let it dominate your trading approach.

Overcoming Loss Aversion: Strategies and Techniques

Fortunately, while loss aversion might be deeply ingrained, it’s not insurmountable. Traders can use a variety of strategies and techniques to reduce its influence:

- Set and Respect Stop-Losses

- Establishing clear stop-loss orders is one of the most effective ways to manage risk. More importantly, honor these stop-losses. Write them down as part of your trading plan and avoid moving them unless there’s a justifiable reason based on your trading rules.

- Use a Predefined Trading Plan

- A detailed trading plan that includes entry criteria, exit criteria, and risk parameters can reduce on-the-spot emotional decision-making. When your rules dictate that you exit a trade, you follow them without second-guessing.

- Position Sizing

- Allocate only a small percentage of your capital to each trade. By risking less on each position, the emotional stakes are lowered. Traders who are overleveraged or place large bets on individual trades are far more susceptible to emotional swings.

- Focus on Process Over Outcomes

- Adopt the mindset that success in trading is about executing a robust process consistently. Losses will happen—it’s a normal part of trading. If you stick to your plan and manage your risk, you will eventually see the benefits in your bottom line.

- Practice Mindfulness and Emotional Regulation

- Techniques such as meditation, journaling, or breathing exercises can help in calming the mind, making it easier to adhere to logic rather than emotion. A calm trader is far more likely to make rational decisions.

- Use Probabilistic Thinking

- Remind yourself that no single trade defines your success. By viewing trading outcomes as a distribution of probabilities, each loss becomes just one random event in a larger sample size. This perspective can help reduce the emotional magnitude of a loss.

- Backtesting and Data-Driven Confidence

- By thoroughly testing your strategies using historical market data, you can gain confidence that your trading approach has a positive expectancy over time. This data-driven conviction can help you accept losses as part of the process without succumbing to fear.

- Reward Yourself for Following Rules

- Instead of focusing only on profits, reward yourself for successfully following your trading plan. For example, if you cut a losing trade quickly according to your rules, acknowledge that as a successful action. This shift in focus can help rewire your approach to losses.

Emotional Regulation and Mindset Shifts

Overcoming loss aversion also requires emotional regulation and a shift in mindset. Here are some key psychological adjustments you can make:

- Redefine “Losing”

- Instead of viewing a trade that hits its stop-loss as a “loss,” see it as a strategic decision that saved you from further downside. You’re paying a small price to preserve your capital for future opportunities.

- Accept Imperfection

- No trader is right 100% of the time. Even the best traders in the world maintain win rates of 50–60%. Accepting that losses are an inevitable part of the journey helps minimize their emotional sting.

- Visualize Different Scenarios

- Before entering a trade, visualize both winning and losing outcomes. If you can emotionally prepare for a worst-case scenario, actually encountering that scenario will be less jarring.

- Learn from Every Loss

- Treat every loss as an opportunity to refine your strategy. What went wrong? Was it market conditions, an error in analysis, or a lapse in discipline? By extracting lessons from each loss, you make it a valuable stepping stone toward greater expertise.

- Seek Social or Mentorship Support

- Engaging with a trading community or working with a mentor can provide emotional support and accountability. Sometimes, having a second pair of eyes to confirm your exit plan can help you pull the trigger on a losing trade more confidently.

- Keep a Trading Journal

- Recording your trades, along with your emotional state and rationale, can help you identify patterns of loss aversion. Over time, you’ll be able to correlate emotional states with outcomes and take corrective action.

Practical Exercises to Tackle Loss Aversion

Below are some practical exercises you can incorporate into your routine to manage and overcome loss aversion:

- Embrace “Small Loss Drills”

- Deliberately set up trades on demo accounts or with small real capital where you aim to close out positions at predetermined small losses. The point is to get comfortable with the act of accepting a loss and executing your plan. Over time, this desensitizes you to the fear of losing.

- Paper Trading with Strict Rules

- If you’re new or if you’ve noticed you have trouble following rules, use a paper trading account with strict guidelines for stops and take-profit levels. Practice enforcing them without exception, building the habit before risking real money.

- Risk Reframing Exercise

- Write down the potential “painful” scenario of a losing trade (e.g., losing $500). Then write down potential upsides to managing that loss properly (e.g., preserving 95% of your capital for new trades). By cognitively reframing the scenario, you highlight the benefits of taking a controlled loss, reducing the emotional sting.

- Set Achievement Milestones

- For example, you might decide that your goal for the month is not to exceed your pre-set maximum drawdown limit. Tracking progress on this goal keeps you focused on risk management rather than just chasing profits.

- Review Past Trades Periodically

- Allocate time—perhaps weekly or monthly—to review both your winning and losing trades. Pay close attention to whether you held onto losing trades too long or sold winning trades too soon. Identify any consistent patterns that suggest loss aversion is at play.

- Self-Dialogue and Positive Affirmations

- Before or after market hours, spend a few minutes telling yourself that losses are normal and controlled losses are part of winning in the long term. Positive self-talk can effectively overwrite the fear-driven narratives in your mind.

- Gradual Increase in Position Size

- If the thought of losing money still paralyzes you, start with very small position sizes and gradually increase them as you gain confidence. Slowly building up tolerance is often more psychologically sustainable than a trial by fire.

Conclusion: Moving Beyond Loss Aversion for Better Trading Performance

Loss aversion bias is deeply rooted in human psychology, reinforced by centuries of evolutionary conditioning and further evidenced by modern neuroscience. Its effects on trading can be profound, often leading to suboptimal decisions such as holding onto losing positions, prematurely exiting winning trades, or overtrading in a frantic bid to avoid small losses. Left unmanaged, it can wreak havoc on profitability and create a cycle of fear and underperformance.

However, being aware of loss aversion is the first—and most critical—step toward neutralizing its negative impact. By combining robust risk management techniques (e.g., strict stop-loss rules, well-defined trading plans) with consistent emotional and psychological work (e.g., mindfulness, journaling, self-dialogue), traders can learn to manage and even harness loss aversion to their advantage. For instance, a healthy respect for losses can foster a disciplined approach to risk management, ensuring that no single setback decimates one’s capital.

Above all, remember that every trader, regardless of skill or experience, will face losses. The difference between profitable and unprofitable traders lies in how they handle these losses. A trader who can accept and manage a loss calmly is far more likely to succeed over the long term than one who is psychologically paralyzed by the mere thought of losing.

Loss aversion, therefore, need not be an insurmountable obstacle. With the right tools, mindset shifts, and consistent practice, you can reduce its hold on your trading decisions. Embrace the idea that losses are just part of the game. By focusing on process over immediate outcomes and by systematically implementing strategies to mitigate emotional decision-making, you put yourself in the best position to achieve steady, long-term profitability.

FAQ: Loss Aversion Bias in Trading

1. What is loss aversion bias in trading?

Loss aversion bias in trading refers to the tendency of traders to feel the pain of losses more intensely than the pleasure of equivalent gains. This bias can lead to irrational decisions, such as holding onto losing trades or closing profitable trades prematurely.

2. How does loss aversion bias affect trading decisions?

Loss aversion bias often causes traders to avoid realizing losses, leading them to hold onto losing positions in hopes of recovery. Conversely, it can make traders exit winning positions too early, fearing that gains might disappear, which limits overall profitability.

3. What are some common examples of loss aversion in trading?

Examples include:

- Refusing to sell a losing stock to avoid locking in a loss.

- Closing a winning trade too soon to “secure” a small profit.

- Ignoring stop-losses or moving them to avoid realizing a loss.

4. How can traders overcome loss aversion bias?

Traders can mitigate loss aversion bias by:

- Setting and adhering to stop-loss orders.

- Creating and following a structured trading plan.

- Practicing emotional regulation techniques like mindfulness.

- Viewing losses as a natural part of trading and focusing on long-term results.

5. Is loss aversion bias the same as risk aversion?

No, they are different. Loss aversion refers to the emotional weight of losses being greater than that of equivalent gains, while risk aversion is a general preference for certainty over uncertainty, regardless of the framing of outcomes.