In the world of trading—be it stocks, forex, commodities, or cryptocurrencies—metrics and analytical tools are vital for understanding performance and making informed decisions. Among these metrics, the Profit Factor (PF) often stands out as an indispensable measure of a trading strategy’s efficiency. But what exactly is Profit Factor, and why should you, as a beginner or even a seasoned trader, pay close attention to it?

In this comprehensive guide, we’ll dive deep into everything you need to know about Profit Factor in trading. From the basic definition to practical usage, interpretation, and comparison with other essential trading metrics, this article aims to provide a one-stop knowledge hub. By the end, you’ll have a strong understanding of Profit Factor, how to calculate it, and ways to use it effectively in your trading journey.

Table of Contents

Introduction to Profit Factor

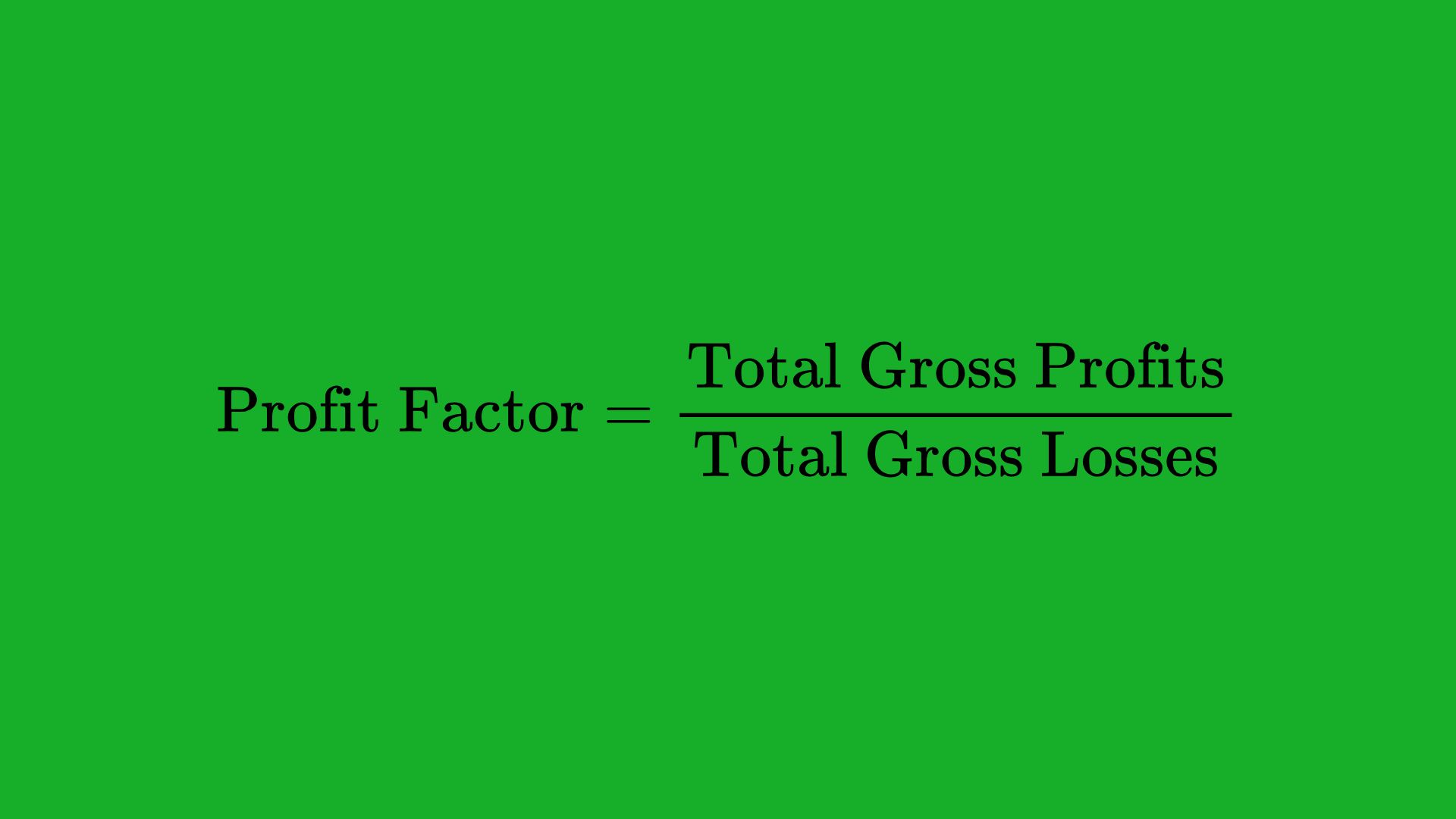

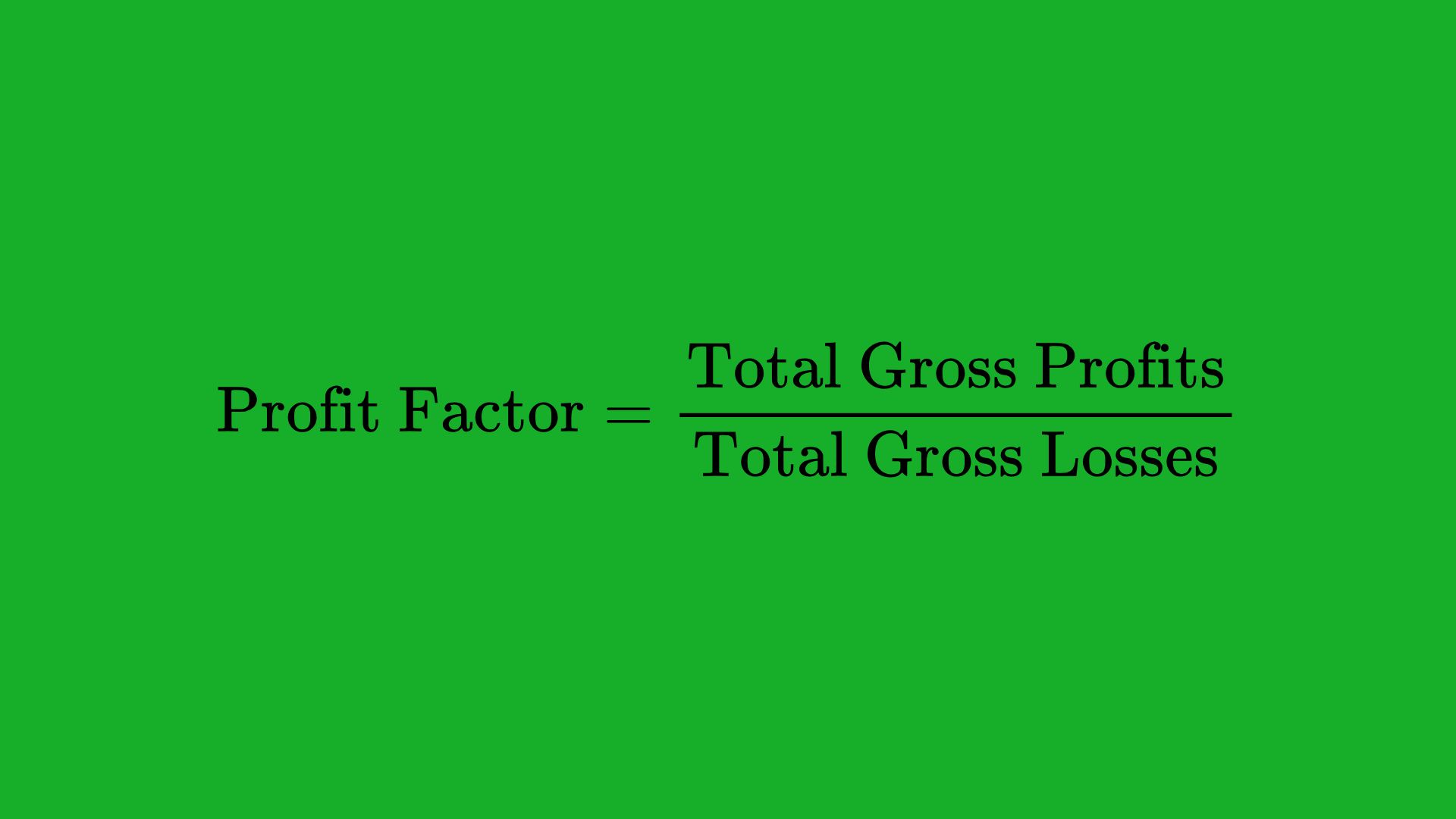

Profit Factor (PF), at its most basic level, is the ratio between your total gains and your total losses. Specifically:

If your overall profits consistently surpass your overall losses, your Profit Factor will be greater than 1.0, signifying a profitable strategy. If it falls below 1.0, your strategy is net unprofitable.

The Origins and Relevance of Profit Factor

The concept of Profit Factor has been around for decades, initially popularized by systematic traders and mechanical system developers who needed an easy, quantitative metric. Over time, PF has become a core figure in both retail and institutional trading circles:

- Mechanical System Developers: Early quant traders needed a clear barometer to judge whether their algorithms generated net profits.

- Manual Traders and Retail Investors: Over the past 20 years, the widespread availability of online trading platforms brought PF to a larger audience.

Its continued use in all levels of trading—from small retail accounts to large hedge funds—underscores its universality as a measure of net profitability.

The Role of Profit Factor in Modern Trading

In modern trading, we often use advanced tools like machine learning algorithms and big data analytics to evaluate performance. Still, Profit Factor remains one of the most accessible and intuitive metrics. It directly tells you how many dollars you gain per dollar lost:

- In Algorithmic Trading: PF serves as a top-line metric to gauge whether a backtested strategy is worth investigating further.

- In Discretionary Trading: PF provides a quick read on the balance between your winners and losers.

- In Risk Management: PF helps frame discussions about the quality of a trading desk’s execution or system performance.

Why Is Profit Factor Important in Trading?

To succeed in trading, you need to identify approaches that yield positive returns over the long term. However, performance analysis can become complicated. Metrics like win rate, Sharpe ratio, and maximum drawdown each tell part of the story. Profit Factor is unique in that it brings together the total sum of wins and losses in a single ratio, making it an invaluable yardstick for:

- Identifying Efficiency: You immediately see if a strategy is returning more than it’s losing.

- Comparative Analysis: PF makes it easier to compare different strategies on an apples-to-apples basis.

- Risk-to-Reward Awareness: While not a pure risk metric, PF implicitly captures how effectively you balance risk and reward by looking at total profits relative to total losses.

- Long-Term Perspective: A consistent PF above 1.0 over a meaningful sample can suggest ongoing viability.

A Quick Overview of Trading Metrics

Before focusing on PF alone, consider the landscape of trading metrics you might encounter:

- Win Rate: Percentage of winning trades.

- Average Win vs Average Loss: On average, how big are your winners and losers?

- Max Drawdown: The worst peak-to-trough decline in account equity.

- Sharpe Ratio: Risk-adjusted metric based on volatility.

- Sortino Ratio: A variation of Sharpe that focuses on downside risk only.

Profit Factor complements these metrics by zeroing in on your total gains versus total losses, providing a concise financial snapshot that can stand on its own or be used alongside other indicators.

Profit Factor as a Core Performance Indicator

PF’s simplicity is what makes it a favorite for quick assessments and ongoing monitoring. It’s a solid “first checkpoint” when you evaluate or develop a new strategy:

- Quick Elimination: If PF < 1.0, the strategy might be a non-starter unless you see a compelling reason to believe it can improve.

- Benchmarking: Over time, you’ll build mental reference points for what PF values are typical for your style (e.g., scalp, swing, or position trading).

How to Calculate Profit Factor

Calculating Profit Factor isn’t complicated, but the details matter, especially around expenses like commissions, spreads, or slippage that may affect real-world results.

Basic Formula

That’s the entire equation. The complexity lies in accurately summing your gains and losses.

Step-by-Step Calculation with Examples

- Identify All Winning Trades: Sum up every profitable trade’s net profit, ensuring you subtract any commissions or fees if you’re aiming for real-world accuracy.

- Identify All Losing Trades: Sum up every unprofitable trade’s net loss.

- Compute Profit Factor: Divide gross profit by gross loss.

Example:

- Winning trades: $60, $120, $40, $100, $80 (gross profit = $400)

- Losing trades: -$50, -$70, -$30 (gross loss = $150)

- PF = 400 / 150 = 2.67

Adjusting for Fees, Slippage, and Other Costs

- Broker Commissions: If you pay $4.95 per stock trade, or a 0.1% commission per forex trade, ensure you deduct these from your net profit.

- Spreads: Particularly for forex or crypto pairs, wide spreads effectively reduce your net wins and increase net losses.

- Slippage: The difference between your expected entry/exit and the actual fill can be significant in fast-moving markets. Over many trades, this can shift your real PF.

By accounting for every cent of trading costs, you avoid an inflated PF that won’t hold up in live conditions.

Interpretation and Benchmarks of Profit Factor

Once you’ve calculated PF, the real question becomes: What does this number mean, and is it good or bad?

What Different PF Ranges Indicate

- PF < 1.0: Losing strategy overall, since total losses exceed total gains.

- PF = 1.0: Exactly break-even—often still a losing proposition when you factor in fees.

- 1.0 < PF < 1.5: Modest profitability. Some see it as not enough cushion to account for real-world inefficiencies.

- 1.5 ≤ PF < 2.0: Generally considered a decent, workable system.

- PF ≥ 2.0: Strong or high-performing strategy, often indicative of either tight risk controls or large average wins.

Profit Factor in Various Market Conditions

- Trending Markets: A trend-following system may have fewer losing trades, but the losing trades could be smaller, raising PF.

- Range-Bound Markets: Mean reversion strategies might see moderate PF values but frequent trades.

- Volatile Markets: Profits (and losses) can be larger. A big, single trade can heavily skew PF.

Understanding Sample Size and Statistical Validity

- Minimum Trades: Many traders feel you need at least 30 trades to glean preliminary insights. More data is always better for reliability.

- Rolling Windows: Watch your PF evolve over the last 20, 30, or 50 trades to spot shifts in performance.

- Market Regime Analysis: If you test your strategy in just one market phase (e.g., a strong bull run), your PF might not translate to other conditions.

Benefits of Using Profit Factor

PF is often the first ratio that traders look at when evaluating a strategy’s performance because it’s intuitive and streamlined:

- Simplicity and Accessibility

- You can calculate PF within seconds. There’s no advanced math or programming required.

- Universal Applicability Across Markets

- Whether you trade forex, stocks, options, futures, or crypto, PF remains the same.

- Quick Snapshot of Strategy Efficiency

- A PF above 1.0 immediately signals that you’re profitable in net terms—useful for prompt decision-making.

- Compatibility with Other Measures

- PF can be paired with win rate and drawdown to form a powerful trifecta of performance evaluation.

Limitations and Caveats of Profit Factor

No single metric can capture every nuance of trading. Understanding PF’s blind spots is critical:

- Absence of Time and Volatility Measures

- PF does not account for how long trades are open, nor does it reflect the ride (volatility) along the way.

- Insensitivity to Drawdowns and Psychological Stresses

- A strategy with a high PF could still experience large drawdowns that make it psychologically or financially unviable.

- Susceptibility to Outliers and Cherry-Picking

- A single large win (or loss) can dramatically alter the ratio, especially with small sample sizes.

- Not a Standalone Risk Metric

- PF doesn’t show how consistently you reach your profits or how severe your worst losing streak might be.

- Not Always Directly Scalable

- A strategy with a PF of 3.0 might not maintain that ratio under larger position sizes or in different market conditions.

Strategies for Improving Profit Factor

If your PF is lower than you’d like, or if you’re striving to maintain a high PF in fluctuating markets, here are ways to refine your approach.

Refining Entry and Exit Signals

- Enhanced Timing: Instead of entering trades purely on “gut feeling,” use data-backed signals, like moving average crossovers, RSI divergences, or volume spikes.

- Optimized Stop Loss and Take Profit: Too tight a stop loss can lead to frequent small losses that add up. Too large a take profit target might reduce your win rate. Striking the right balance is crucial to elevating PF.

Upgrading Your Risk Management

- Position Sizing: If you risk too much on any one trade, a single large loss can sink your PF. Use techniques like fixed fractional position sizing.

- Risk-Reward Ratio: Seek trades with at least a 1:1 or 2:1 ratio so winning trades can outpace your losses.

Filtering Out Low-Probability Trades

- Market Volatility Filters: Only trade during times of day or week when liquidity is high and spreads are tight.

- News/Event Filters: If your strategy isn’t designed to handle event-driven volatility, avoid trading around major economic releases.

- Technical Filters: Utilize multiple technical confirmations (e.g., RSI, MACD, moving averages) to weed out low-quality setups.

Aligning with Market Conditions

- Trend vs. Range: Adjust your approach based on market environment. Trend-following indicators work well in trending markets, while oscillators can shine in choppy, sideways markets.

- Adaptive Systems: Some advanced strategies use machine learning or adaptive algorithms to shift in tandem with changing market regimes.

Ongoing Optimization and Strategy Review

- Regular Backtesting: Continually re-test your strategy on the latest data to spot any weakening in PF.

- Forward Testing: Once changes are made, confirm them in real or demo markets to ensure they hold up in live trading conditions.

- Elimination of Weak Segments: If a particular stock, currency pair, or timeframe consistently drags down your PF, consider removing or restructuring trades in that segment.

Practical Examples of Profit Factor Calculation

Example 1: High-Frequency, Low-Margin Forex Scalping

- Scenario: In a week, you execute 50 trades on EUR/USD.

- Winners: 30 trades, total gross profit = $3,000

- Losers: 20 trades, total gross loss = $2,000

- PF = 3,000 / 2,000 = 1.5

Interpretation: You earn $1.50 for every $1.00 lost. This can be profitable if maintained consistently, but high-frequency trading also incurs higher costs in spreads and commissions, so always factor those in.

Example 2: Low-Frequency, High Reward Swing Trading

- Scenario: You place 5 trades in a month on major stock indices.

- Winners: 3 trades, total gross profit = $10,000

- Losers: 2 trades, total gross loss = $3,000

- PF = 10,000 / 3,000 ≈ 3.33

Interpretation: You make $3.33 for each $1.00 lost. The relatively small number of trades means each trade matters more. A single large loss can quickly reduce PF.

Example 3: Multiple Months of Daily Equity Trades

- Scenario: Over six months, you make 200 trades in the stock market.

- Winners: Net $50,000

- Losers: Net $40,000

- PF = 50,000 / 40,000 = 1.25

Interpretation: A PF of 1.25 is profitable but not by a wide margin. At scale, small improvements in trade execution or risk management could significantly boost overall returns.

Comparing Profit Factor with Other Key Trading Metrics

Profit Factor is a cornerstone metric but should be viewed alongside other measurements to build a holistic picture of your trading performance.

Win Rate

- Definition: The percentage of trades that end in profit.

- Comparison: A high PF can come from relatively few, large winners outweighing many small losers (which might lead to a low win rate). Conversely, a high win rate may pair with a poor PF if winners are tiny and losses are big. Both metrics help clarify how your profits are generated.

Reward-to-Risk Ratio

- Definition: The ratio between the average size of winning trades and the average size of losing trades.

- Comparison: While reward-to-risk ratio focuses on a per-trade basis, PF aggregates all wins and all losses. Both are vital but operate at slightly different scales of analysis.

Sharpe Ratio and Sortino Ratio

- Sharpe Ratio: Measures excess return per unit of volatility.

- Sortino Ratio: Variation of Sharpe focusing only on downside volatility.

- Comparison: Profit Factor doesn’t account for volatility or the variability of returns. Sharpe and Sortino add context on risk-adjusted performance.

Maximum Drawdown

- Definition: The largest percentage drop from a peak to a trough in your equity.

- Comparison: A system could have a high PF but undergo deep, prolonged drawdowns before recovering. Max drawdown reveals the worst-case scenarios that PF alone can mask.

Expectancy

- Definition: Average expected profit per trade ([(Win Rate x Average Win) – (Loss Rate x Average Loss)]).

- Comparison: Expectancy is closely aligned with PF but focuses on expected value per trade. PF is a ratio; expectancy is an absolute dollar or percentage measure. Both can reveal if your strategy is statistically favorable.

Common Pitfalls to Avoid When Using Profit Factor

1. Overemphasis on Short Samples

If you compute PF after just a few trades, it can spike or crash due to one or two outliers. Always gather enough data—30 trades minimum, ideally more—before drawing conclusions.

2. Ignoring Different Market Regimes

A PF of 2.0 in a trending market might drop to 1.0 or lower in sideways or bearish conditions if the system isn’t designed for those environments.

3. Not Accounting for Realistic Costs

Scalpers, in particular, must factor in spreads, commissions, and slippage; ignoring these can inflate PF beyond what’s realistically achievable.

4. Misinterpreting PF in Light of Large Outliers

A single giant win or loss can distort PF, especially with smaller trade counts. Always look at PF in conjunction with average trade size and consistency.

5. Failure to Track PF Over Time

Markets evolve, and so does your performance. Monitor PF on a rolling basis (e.g., the last 30 trades). A sudden drop can signal that the strategy needs adjustments.

Tools and Software for Calculating Profit Factor

Modern traders have a broad range of platforms and tools that automatically calculate Profit Factor, but you can also compute it manually in a spreadsheet.

Trading Platforms (MT4, MT5, NinjaTrader, etc.)

- MetaTrader (MT4/MT5): Common for forex, these platforms offer built-in reports that include PF. Some advanced EAs also display PF in real time.

- NinjaTrader: Popular among futures and forex traders. Its performance tab displays PF for historical and real-time trades.

Charting and Analysis Software

- TradingView: Primarily a charting tool, but you can code custom scripts in Pine to calculate PF over your strategy’s trades.

- MultiCharts: Known for robust backtesting features, MultiCharts helps system developers assess PF across various scenarios.

Spreadsheet Solutions (Excel, Google Sheets)

For manual or semi-automated approaches, you can maintain a trade log in Excel or Google Sheets. Simply sum up your wins and losses, then create a cell to calculate PF.

Algorithmic and Quantitative Platforms

- QuantConnect, Quantopian (now closed to the public), Amibroker: These platforms let algorithmic traders automate strategy testing. PF is often provided in the default performance reports.

Combining Profit Factor with Other Metrics in Your Trading Plan

No single metric, including PF, can give the full picture of a trading strategy’s viability or stability. Combining PF with other essential measurements ensures you see all angles.

1. Pairing PF with Win Rate and Drawdown

- Win Rate: Helps you understand the frequency of winning vs. losing trades.

- Drawdown: Shows the severity of losing streaks or capital erosion.

- Trifecta Analysis: High PF, high win rate, and low drawdown is the “holy grail” scenario, though rare.

2. Integrating PF into a Holistic Risk Management Framework

- Position Sizing: Let PF guide you in how aggressively you size trades. A high PF may allow for slightly larger positions, but only if drawdowns are manageable.

- Stop Loss Strategies: Combine PF with data on average adverse excursion (how far a trade goes against you) to refine stop placements.

3. Multi-Metric Dashboards for Strategy Evaluation

- Dashboard Example: PF, Win Rate, Average Trade Duration, Max Drawdown, Sharpe Ratio.

- Tracking Over Time: Gauge consistency by observing how each metric evolves as market conditions shift.

Advanced Insights: Psychology, Market Regimes, and Robustness

For a deeper exploration, it’s crucial to factor in the human and market elements that can influence PF.

Psychological Impact of Profit Factor on Trader Behavior

- Overconfidence: A high PF can lead traders to become complacent, risking overtrading or skipping due diligence.

- Fear and Hesitation: A dropping PF might cause traders to second-guess their system, leading to erratic changes or trade execution errors.

Maintaining emotional discipline and a consistent approach—even when PF fluctuates—is key to long-term success.

PF Across Bull, Bear, and Ranging Markets

- Bull Markets: Long-biased strategies often post higher PF values due to fewer losing trades.

- Bear Markets: Short-focused strategies might see a spike in PF, while unhedged long strategies could collapse.

- Range-Bound Markets: Mean reversion or sideways strategies often produce moderate PF values but rely on frequent trades to generate returns.

Maintaining a Robust Strategy in Shifting Environments

- Regime Detection: Use moving averages or volatility-based measures (e.g., Bollinger Bands) to identify transitions from trending to ranging markets.

- Adaptive Strategies: Some advanced systems dynamically alter parameters (like stop loss distance) based on real-time market conditions to stabilize PF.

Best Practices and Tips for Beginners

1. Start Slow with Demo or Paper Trading

Before risking real capital, test your strategy’s PF in a demo environment. This helps you see how PF changes with real-time price movements and refine your approach with zero financial risk.

2. Keep Meticulous Records of Every Trade

An accurate PF calculation hinges on good record-keeping. Document:

- Entry and Exit Prices

- Position Size

- Commissions and Fees

- Stop Loss/Take Profit Levels

- Notes on Market Conditions

This trade history becomes your data source for calculating not just PF but also other performance metrics.

3. Use Rolling Windows for Ongoing PF Monitoring

A single PF figure can be misleading if it’s over a distant historical period. Calculate PF for the last 20–30 trades in a rolling fashion to detect trends in performance:

- Improving PF: Suggests your adjustments are effective.

- Declining PF: Warns you to re-evaluate the market conditions or your strategy execution.

4. Balance PF with Other Indicators

Use PF as part of a multi-faceted analysis. For instance, a PF of 2.5 might appear impressive, but a 50% drawdown or a 30% win rate might still make the strategy psychologically tough to endure.

5. Remain Adaptive in a Changing Market

Market conditions don’t stay static. Re-test and re-validate your approach periodically, especially if you notice a drastic shift in PF or other metrics.

Conclusion

Profit Factor (PF) remains one of the most straightforward yet powerful metrics to determine a trading strategy’s net profitability. It compresses the core essence of trading success—how much you win relative to how much you lose—into a single, easy-to-understand ratio. By looking at the ratio of total profits to total losses, PF offers an immediate glimpse into whether a system can stand the test of time or if it needs further refinements.

However, as valuable as PF is, it should never be viewed in isolation. Trading is multifaceted, influenced by factors like market volatility, trade frequency, drawdowns, and the trader’s own psychology. While PF can tell you if you make more money than you lose, it won’t reveal how turbulent the journey might be, how large your drawdowns could become, or whether your risk per trade is sustainable. That’s why combining PF with other metrics—such as win rate, reward-to-risk ratio, drawdown, Sharpe ratio, and expectancy—provides a well-rounded, realistic assessment of your trading strategy’s viability.

Key Takeaways:

- Calculation: PF = (Gross Profit) / (Gross Loss), factoring in all trading costs where possible.

- Interpretation: PF > 1.0 is generally profitable. Higher PF values suggest stronger performance, but context and sample size matter.

- Usage: PF is universal across asset classes (stocks, forex, crypto, futures), making it an excellent benchmark for strategy comparison.

- Limitations: It doesn’t measure drawdowns, volatility, or time in trades. Outliers can skew PF, especially with a small number of trades.

- Best Practices: Combine PF with other metrics, maintain diligent trade records, account for commissions and slippage, and revisit your strategies periodically.

By understanding both the power and the limitations of Profit Factor, you can harness it as part of a comprehensive trading plan. Whether you’re a beginner just learning the ropes or a seasoned trader optimizing multiple strategies, PF delivers a quick, indispensable snapshot of performance. Keep in mind that markets evolve, and so should your analysis. Track your PF over time, ensure your methodology is robust across different market conditions, and always couple PF with disciplined risk management. Ultimately, the best trading strategies—and the ones that produce a consistently favorable PF—are those that blend sound logic, statistical rigor, and adaptability in an ever-changing market landscape.