Swing trading is a popular trading style that aims to capture short- to medium-term moves in a stock’s price. Traders who adopt this strategy typically hold positions for a few days to a few weeks, seeking to profit from market “swings” or fluctuations that occur in a relatively brief timeframe. Unlike day traders, who might close all positions by the end of the trading day, swing traders are comfortable holding a trade overnight or even for several weeks, depending on market conditions and the stock’s performance.

The fundamental idea behind swing trading is to capitalize on momentum shifts in the market—whether they are driven by technical patterns, fundamental news, or broader market sentiment. Because these trades usually require less day-to-day vigilance compared to day trading, many investors find swing trading attractive as it can be compatible with a regular job or other personal obligations, while still offering more frequent opportunities than long-term investing.

In this article, we will explore the ins and outs of swing trading stock strategy, covering everything from the basics of market swings and technical indicators to the psychology of trading and risk management best practices. By the end, you will have a comprehensive understanding of how to formulate your own swing trading approach and improve your chances of success in the stock market.

Table of Contents

Why Swing Trading?

Before delving into the specifics, it’s worth understanding why swing trading has gained so much popularity among active traders. Below are some of the top reasons:

- Balance of Time Commitment

- Swing trading is less time-intensive than day trading. You’re not necessarily glued to the screen all day. Instead, you can often review charts in the morning or evening, place orders, and monitor positions with less minute-by-minute pressure.

- Greater Flexibility

- Swing traders can adapt to a range of market environments. Whether the market is trending up, trending down, or moving sideways, there are often swing-trading opportunities by focusing on stocks that are experiencing momentum in one direction or showing signs of a potential reversal.

- Higher Reward Potential per Trade

- Because swing trades can be held for multiple days, there’s the possibility of capturing more significant price moves compared to day trading, where intraday fluctuations might be limited.

- Reduced Transaction Costs

- Fewer trades on average can mean lower brokerage fees and reduced slippage (the difference between the expected fill price and the actual fill price), helping you keep more of your profits.

- Compatibility with Other Commitments

- Many swing traders have full-time jobs or other responsibilities. Swing trading can be done part-time, so long as you have a disciplined approach to market analysis and risk management.

Ultimately, swing trading can bridge the gap between aggressive day trading and passive buy-and-hold investing. This style appeals to those who want quicker results than long-term investing but who lack the time or desire for the constant intensity of day trading.

Key Principles of Swing Trading

- Focus on Short-Term Price Movements

- Swing trading revolves around identifying and profiting from movements that span from a few days up to a few weeks. The key is catching those “mini-trends” inside bigger market waves.

- Technical and Fundamental Blend

- While technical analysis often drives swing trading decisions, fundamental factors like earnings reports, news catalysts, and overall market sentiment can also have a significant effect. Many swing traders use a blend of both approaches.

- Risk Management Is Paramount

- Because swing traders typically hold positions overnight and sometimes for weeks, risk management methods like setting stop-losses or employing a proper position sizing strategy are crucial to protect capital in the event of adverse moves.

- Plan Each Trade Thoroughly

- Swing traders define entry points, stop-loss levels, profit targets, and exit conditions in advance. This helps remove emotional biases when the trade is live.

- Patience and Discipline

- Although swing trades can be relatively short-term, traders should practice patience—waiting for the right setups to develop and discipline in adhering to their trading rules.

Understanding these core principles helps form a strong foundation for your swing trading journey. With these guiding concepts in mind, let’s explore how different market conditions can affect swing trading opportunities.

Market Conditions and Their Impact on Swing Trading

Swing trading opportunities are not uniform across all market environments. Different conditions can either provide a fertile ground for quick profits or present traps that lead to losses.

- Bullish Markets

- In rising markets, swing traders often look for stocks that pull back slightly from a sustained uptrend. These are often called “buy the dip” trades. The idea is to ride the ongoing momentum as the stock reverts to its primary uptrend after a short-term retracement.

- Bearish Markets

- In falling markets, swing traders may look to short stocks that experience small relief rallies or “dead cat bounces.” Once momentum resumes to the downside, the trader hopes to capitalize on a further decline.

- Sideways (Range-Bound) Markets

- Some stocks or even entire markets can trade within a relatively tight range for weeks. Swing traders in this environment often utilize oscillators (like RSI or Stochastics) to spot overbought or oversold conditions and aim to trade reversals near the boundaries of the established range.

- Volatile vs. Stable Conditions

- Volatility can be a double-edged sword. High volatility can amplify profits if you catch the right side of the swing, but it can also magnify losses when moves go against you. Low volatility might result in fewer trading setups or smaller profit targets.

- Sector Rotation and Market Themes

- Market conditions can shift based on economic data, interest rates, or hot sectors. Swing traders should be aware of which sectors are leading or lagging at any given time. Chasing momentum in a leading sector can sometimes yield better opportunities for short-term price swings.

Understanding how market conditions influence price action is an essential step. Combine this knowledge with strong research both fundamental and technical to refine your strategy and increase the odds of success.

Fundamental Analysis in Swing Trading

While swing trading often relies heavily on technical chart patterns, fundamental analysis still plays a critical role for many traders. If you choose to blend fundamentals with your technical setups, you might enjoy a more robust trading edge and improved confidence in each trade.

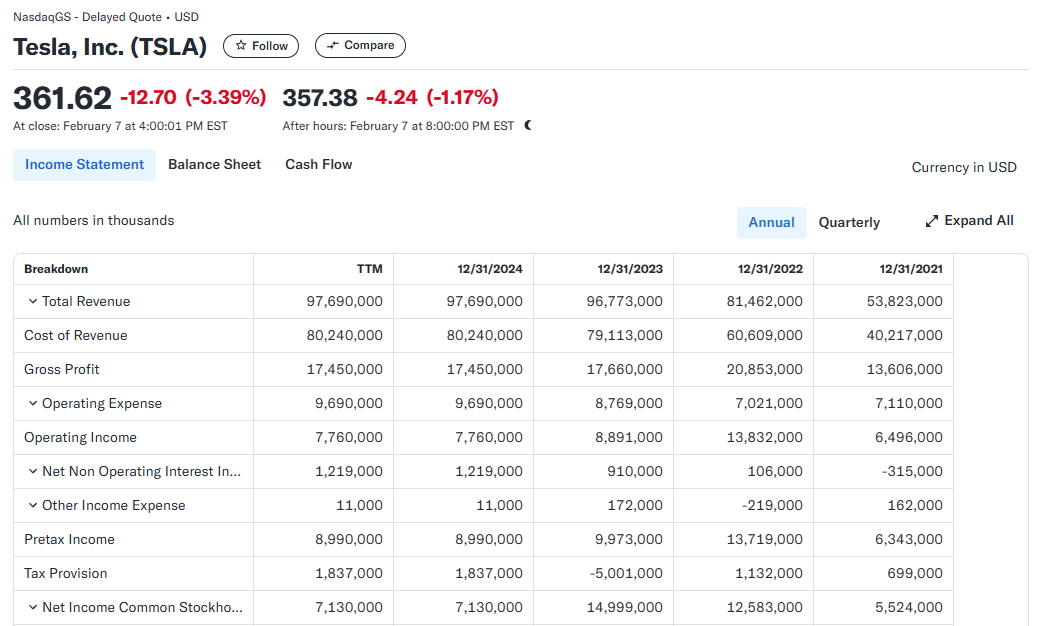

Key Fundamental Factors

- Earnings Reports

- A company’s quarterly earnings can significantly move the stock price, often setting the trend for weeks or months. Positive earnings surprises may catalyze a bullish swing, while disappointing results could spark a sell-off.

- Revenue and Growth Trends

- Consistent revenue growth can signal a healthy company. Even if you only plan to hold the stock for a few weeks, a positive fundamental backdrop can mean more reliable follow-through on bullish technical patterns.

- Valuation Metrics

- Ratios like Price-to-Earnings (P/E), Price-to-Sales (P/S), and Price-to-Book (P/B) can indicate if a stock is undervalued or overvalued relative to its industry peers. Swing traders often use valuation filters to avoid overpriced stocks.

- Sector and Industry Factors

- External events can drive an entire sector (e.g., technology, energy, healthcare). Monitoring sector-wide fundamentals can help you pick stocks that align with current market themes.

- News Catalysts

- Analyst upgrades, product launches, mergers, and other news items can shift investor sentiment dramatically. Keeping an eye on a stock’s news flow can help validate a technical setup or warn you about potential volatility.

Balancing Fundamentals and Technicals

For many swing traders, combining the “what” (fundamental backdrop) with the “when” (technical timing) provides a more comprehensive approach. While the fundamental story indicates potential direction and overall sentiment, technical analysis helps pinpoint precise entry and exit points. Traders who utilize both can:

- Filter out weaker trade setups by dismissing companies with deteriorating fundamentals.

- Identify catalysts to trade around (e.g., entering ahead of earnings if the technicals and fundamentals are both strong).

- Gain confidence in holding a position overnight or for multiple days, knowing that the company is not purely a speculative play.

That being said, pure technical swing traders might rely little on fundamentals, particularly if they are seeking very short-term moves (e.g., 2–5 days). The choice to incorporate or ignore fundamentals ultimately depends on your personal trading style, time horizon, and comfort level with researching company-specific information.

Technical Analysis in Swing Trading

Technical analysis is crucial for swing traders, as it helps in pinpointing where to enter and when to exit a position. While the number of available technical indicators is vast, certain classics have proven especially helpful for spotting short-term swings.

Moving Averages

Moving averages are among the most widely used indicators in swing trading. They smooth out price data, making it easier to identify the overarching trend and potential support or resistance levels.

- Simple Moving Average (SMA): A straightforward average of closing prices over a specific period (e.g., 20-day SMA, 50-day SMA).

- Exponential Moving Average (EMA): Similar to SMA but gives more weight to recent price data, making it more responsive to short-term price changes.

Using Moving Averages in Swing Trading

- Trend Confirmation: If the current stock price is above a rising 50-day SMA, it often signals a bullish trend. Swing traders might look to buy on short-term dips to the moving average.

- Crossovers: A common bullish signal is when a shorter-term moving average (e.g., 20-day EMA) crosses above a longer-term moving average (e.g., 50-day SMA). Conversely, a bearish crossover might indicate a shift to negative momentum.

Relative Strength Index (RSI)

The Relative Strength Index measures the speed and change of price movements, oscillating between 0 and 100. Traditionally, an RSI above 70 indicates overbought conditions, while an RSI below 30 indicates oversold conditions.

Using RSI in Swing Trading

- Overbought/Oversold Signals: A swing trader might consider shorting a stock when the RSI nears or crosses above 70 and confirm it with other signals. Conversely, a reading below 30 might prompt a long position if it aligns with other bullish indicators.

- Divergence: When the RSI diverges from the stock price meaning the stock makes a new high, but the RSI does not—it can signal a potential trend reversal.

Moving Average Convergence Divergence (MACD)

MACD is another powerful momentum indicator, derived from the difference between two EMAs (typically the 26-day EMA and the 12-day EMA). A signal line (9-day EMA) is then plotted on top to generate bullish or bearish signals.

Using MACD in Swing Trading

- Crossover Signals: A bullish signal is generated when the MACD line crosses above the signal line, while a bearish signal occurs when it crosses below.

- Histogram: The MACD histogram reflects the difference between MACD and the signal line. Growing histogram bars can indicate strengthening momentum.

Bollinger Bands

Bollinger Bands consist of a middle band (usually a 20-day SMA) and two outer bands set typically two standard deviations above and below the middle band. They expand and contract based on market volatility.

Using Bollinger Bands in Swing Trading

- Mean Reversion Plays: Stocks often move from the upper band to the lower band within an established trend. If a stock touches the upper band and the RSI or other indicators suggest overbought conditions, a short trade might be considered, and vice versa.

- Volatility Breakouts: When Bollinger Bands squeeze together (low volatility), it often precedes a bigger breakout. Swing traders might anticipate a sharp move and position themselves accordingly.

Stochastics Oscillator

The Stochastics oscillator compares a stock’s closing price to its price range over a specific period (commonly 14 days). It is measured on a scale of 0 to 100, with readings above 80 considered overbought and below 20 considered oversold.

Using Stochastics in Swing Trading

- Overbought/Oversold Conditions: Similar to RSI, extreme readings can indicate potential short-term tops or bottoms.

- Crossovers: The %K and %D lines crossing can be a strong signal. For instance, if %K crosses above %D in oversold territory, that could be a bullish reversal signal.

Support and Resistance Levels

These are price levels where buying or selling pressure has historically been strong enough to halt or reverse a trend.

- Support: A price level where demand is strong enough to stop a price decline.

- Resistance: A price level where supply is strong enough to stop a price advance.

Using Support and Resistance

- Swing traders often initiate trades near support levels in uptrends and set stop-loss orders just below these levels. Conversely, they might look to short near resistance in downtrends, placing stop-losses just above resistance.

Candlestick Patterns

Candlestick charts provide detailed insights into price action. Certain candlestick patterns can be especially helpful for swing traders:

- Hammer and Inverted Hammer

- These often form near the end of a downtrend and signal a potential reversal.

- Shooting Star

- A bearish reversal pattern that appears after a bullish price move.

- Engulfing Patterns (Bullish or Bearish)

- When a candle fully engulfs the previous day’s candle, it can indicate a strong shift in sentiment.

By combining multiple technical indicators with support and resistance analysis, you can create high-confidence setups that offer a good risk-to-reward ratio.

Selecting the Right Stocks for Swing Trading

Not all stocks are equally suited for swing trading. Some may lack liquidity, have low volatility, or trade erratically. Here are key factors to consider when choosing stocks:

- Liquidity

- Ensure the stock has high enough daily trading volume to allow for easy entry and exit. Illiquid stocks can result in large bid-ask spreads, making it costlier to trade.

- Volatility

- Swing trading thrives on price movement. Too little volatility, and price swings might not be substantial enough to yield meaningful profits. On the other hand, extremely volatile stocks can move unpredictably, increasing risk.

- Price Range

- Some swing traders focus on mid- to higher-priced stocks (e.g., $20–$100), as these can offer more significant price swings in dollar terms. Others might specialize in lower-priced stocks but should be mindful of added volatility and potential liquidity issues.

- Trendiness

- Look for stocks that have a well-defined trend (either upward or downward) or are forming reliable chart patterns. Identifying a clear trend simplifies the process of spotting pullbacks and bounces.

- Sector Strength

- Even the best technical setup can fail if the overall sector is weak. If you’re trading a tech stock, check how the tech sector index is performing. Alignment with the broader sector often increases the probability of success.

- Earnings Calendar

- Be aware of upcoming earnings announcements. Swing trading through earnings can be risky due to large gaps, so know the dates and decide if you want to hold through these events or exit beforehand.

By scanning for stocks that meet these criteria, you can narrow down a large universe of possibilities into a more manageable watchlist one tailored for swing trading opportunities.

Developing Entry and Exit Strategies

A structured entry and exit plan is a cornerstone of successful swing trading. Haphazardly jumping into a trade without defining how you’ll manage it typically leads to inconsistent results.

Entry Strategies

- Breakout Entries

- Entering when the price breaks above a key resistance level or a bullish chart pattern (like a flag or ascending triangle).

- Pros: Can capture explosive moves.

- Cons: Prone to false breakouts (price may break resistance and then reverse).

- Pullback Entries

- Buying a stock in an uptrend on a pullback to a key support level or a moving average.

- Pros: Often provides a better risk-to-reward ratio.

- Cons: Prices might keep falling if support doesn’t hold.

- Reversal Entries

- Looking for oversold conditions in a downtrend or overbought conditions in an uptrend, expecting a trend reversal.

- Pros: Potential for early entry into a new trend.

- Cons: Reversals can be risky if the stock’s downtrend or uptrend is still strong.

Exit Strategies

- Stop-Loss Placement

- Always determine a stop-loss level before entering a trade—usually placed below significant support for a long position, or above resistance for a short. This ensures that a single trade does not damage your account significantly if it moves against you.

- Profit Target

- Define a realistic target price based on technical resistance levels, Fibonacci extensions, or a measured move of a chart pattern.

- This helps you stay disciplined and lock in profits if the market behaves as anticipated.

- Trailing Stop

- As a trade moves in your favor, you can move your stop-loss to break-even or above it. This method locks in profits and rides the trend until the stock stops you out.

- Time-Based Exits

- Some swing traders exit their positions by a specific date if the trade hasn’t reached the target or stop-loss, especially if the original premise no longer holds.

- Indicator-Based Exits

- You might exit when an indicator like MACD or RSI signals a reversal, or when the price closes below a short-term moving average.

A well-defined entry and exit strategy removes much of the emotional guesswork. Once you have a plan, the key is sticking to it consistently.

Risk Management and Position Sizing

One of the most significant reasons traders fail whether in swing trading or other styles is insufficient attention to risk management. Even the most promising strategies can fail over the long run without proper measures to control losses.

Position Sizing

- Fixed Risk Percent Model

- Risk a fixed percentage of your trading capital per trade (e.g., 1–2%). For instance, if you have a $50,000 account and risk 1%, your maximum loss per trade is $500.

- Calculation: Distance to stop-loss in dollars × number of shares = $500.

- This prevents a single loss from causing catastrophic damage to your account.

- Volatility-Based Sizing

- Adjust position size based on a stock’s volatility. More volatile stocks might warrant smaller positions to keep risk constant, while lower-volatility stocks might permit bigger positions.

Setting Appropriate Stop-Loss Orders

- Below Support or Above Resistance

- If you’re going long at $100 and strong support is at $95, you might set your stop around $94–95, allowing for some noise without risking too much.

- ATR (Average True Range) Method

- A more sophisticated approach uses the ATR indicator to gauge how much a stock moves on average each day. For instance, you might place a stop-loss 2× ATR below your entry for a long position.

- Capital Preservation

- Always ask, “If this trade hits my stop-loss, will I still be in a strong position to continue trading?” If the answer is no, consider taking a smaller position or skipping the trade entirely.

Diversification

- Spread Out Risk

- Try not to put all your trading capital in a single stock or a single sector. Diversify across different sectors or asset classes if possible.

- Correlation Matters

- Holding multiple stocks in the same sector can be risky if sector-specific news causes all of them to move in tandem.

Risk-to-Reward Ratios

Always aim for trades where the potential upside is at least twice the downside risk (e.g., a 1:2 risk-to-reward ratio). This ensures that even if you only win half of your trades, you could still come out ahead over the long run.

Psychology of Swing Trading

Trading psychology is often the difference maker in whether a trader’s strategy is successful. Emotions like fear, greed, and impatience can sabotage even the best trading plans.

- Discipline

- Stick to your predetermined entries, exits, and stop-loss levels. Avoid the temptation to move your stop-loss farther away to “give the trade more room.”

- Patience

- Wait for setups that match your criteria perfectly. Overtrading can lead to forced trades in suboptimal conditions.

- Emotional Control

- Losses are part of trading. Accept them, analyze them, and move on. Do not let a losing trade prompt you to over-risk on the next trade in an attempt to “win it all back.”

- Confidence vs. Arrogance

- Confidence comes from backtesting your strategy, knowing your edge, and executing consistently. Arrogance leads to ignoring risk and eventually large drawdowns.

- Setting Realistic Expectations

- Understand that consistent, moderate gains compounded over time often beat a “get rich quick” mentality. Avoid chasing extreme returns or comparing your performance to social media hype.

Maintaining a healthy mindset and emotional balance can help you stay focused on your strategy, avoid costly mistakes, and build sustainable profitability in swing trading.

Constructing a Swing Trading Plan Step-by-Step

A structured plan is vital for any swing trader. Below is a concise blueprint to guide you:

- Define Your Goals

- Are you aiming for short-term income, portfolio growth, or skill-building? Clarity on your end goal helps tailor your risk levels and strategy focus.

- Determine Your Market Focus

- Which sectors or types of stocks do you intend to trade? Are you including ETFs or just individual stocks? Being specific narrows your research and scanning efforts.

- Develop Your Watchlist

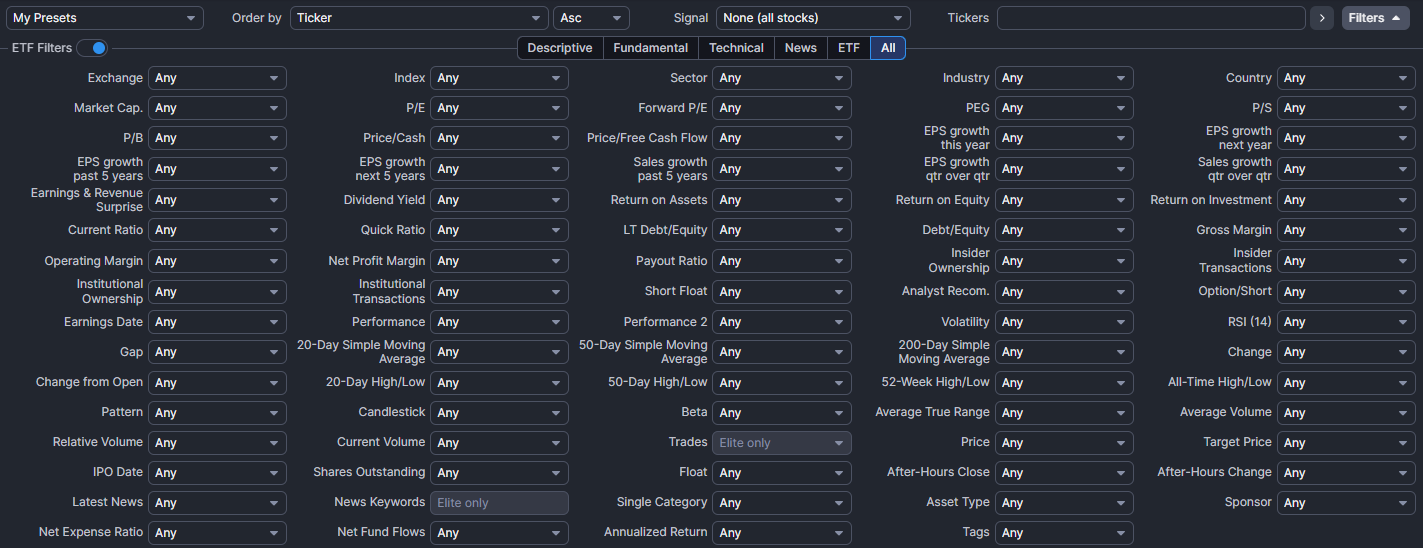

- Use fundamental filters (e.g., minimum daily volume, market cap, etc.) and technical filters (e.g., stocks trading above their 50-day SMA) to find candidates.

- Set Entry Criteria

- Decide on your triggers: Are they breakouts above resistance, pullbacks to a moving average, or oversold RSI readings?

- Establish Exit Criteria

- Define how you’ll exit a profitable trade (target price, trailing stop) and how you’ll exit a losing trade (stop-loss at a specific level, time-based exit, etc.).

- Position Sizing Rules

- Clearly state how you’ll size each trade. This may include a fixed risk percent rule.

- Risk Management Protocol

- Determine your maximum acceptable daily, weekly, or monthly loss. If you hit these thresholds, scale back or pause trading and reassess.

- Review and Refine

- Maintain a trading journal to document the rationale for each trade, entry/exit points, and outcomes. Periodically review your trades to refine your strategy.

Having this plan in writing helps solidify your approach and reduces emotional deviations when the market is in motion.

Example of a Swing Trade

To illustrate how these concepts come together, let’s walk through a hypothetical swing trade scenario:

- Stock Selection

- You scan the market and find “XYZ Company,” which trades around $50 with a daily trading volume of 2 million shares. The stock has been in an uptrend for several months, with the 50-day SMA sloping upward.

- Fundamental Backdrop

- XYZ recently beat earnings expectations and guided higher for next quarter. The tech sector is also strong, adding a supportive fundamental tailwind.

- Technical Analysis

- The stock recently pulled back from $54 to $50, nearing its 20-day EMA around $49.50. The RSI dropped close to 40 (mildly oversold in the context of an ongoing uptrend), and a bullish candlestick pattern (a hammer) formed on the daily chart.

- Entry Strategy

- You decide to go long if the price trades above the previous day’s high of $50.20, which you believe indicates a resumption of the uptrend.

- Stop-Loss

- You set a stop-loss at $48.50, just below both the 20-day EMA and a recent support level, risking $1.70 per share. Since you’re comfortable risking $500 (1% of a $50,000 account), you purchase approximately 294 shares (500 ÷ 1.70 ≈ 294).

- Profit Target

- Based on a resistance level around $54 and a measured move from the recent pullback, you set your initial profit target at $54, aiming for a $3.80 gain per share.

- Trade Execution

- The next morning, XYZ opens at $50.10 and moves up to $50.30, triggering your buy order. Over the next few days, the stock climbs steadily toward $54.

- Trade Management

- As the price reaches $52.50, you move your stop-loss up to $50. This ensures that if the trade reverses unexpectedly, you can still walk away with minimal loss or break-even.

- Once it hits $54, you exit half your position, locking in profits. You place a trailing stop-loss on the remaining shares at $52. Over the next week, the stock moves to $56, at which point your trailing stop now sits at $54. Eventually, a minor pullback hits your trailing stop at $54, and you exit the remainder of the position.

- Result

- You lock in gains from both profit targets. You record the trade details in your journal to analyze any lessons learned.

This example demonstrates how a structured approach—rooted in both fundamental and technical analysis, clear entry/exit rules, and risk management—can help swing traders identify and profit from short-term market swings.

Common Mistakes to Avoid

- Overtrading

- Taking too many trades can lead to unnecessary fees, increased stress, and mistakes due to lack of focus. Only trade setups that meet your strict criteria.

- Ignoring Risk Management

- Trading without a stop-loss or risking too much on a single trade can wipe out weeks or months of gains in a single bad position.

- Failing to Adapt to Market Conditions

- A strategy that works in a trending market might fail in a range-bound market. Regularly review your approach and adjust if the market environment changes.

- Chasing Trades

- Jumping into a stock after a big move without waiting for a pullback or confirmation often leads to entering at peak prices. Wait for the trade to come to you.

- Letting Emotions Dictate Actions

- Overconfidence after winning trades or despair after losing trades can trigger irrational decisions. Maintain emotional balance and follow your plan.

- Lack of a Trading Journal

- Without documenting your trades, you miss out on valuable feedback. A trading journal allows you to identify recurring mistakes and refine your strategy.

Avoiding these pitfalls can enhance the consistency and longevity of your swing trading endeavors.

Advanced Techniques for Swing Traders

Once you’ve mastered the basics, you can explore advanced methods to amplify your swing trading performance:

- Options for Swing Trading

- Trading call or put options instead of shares can increase leverage and limit risk to the premium paid. However, be mindful of time decay and volatility crush.

- Scaling In and Out

- Rather than entering or exiting a full position all at once, you can add to your position incrementally if the trade moves in your favor. Similarly, exit portions of the trade as it hits various price targets.

- Trading Divergences

- Look for divergences between price and indicators like RSI or MACD. For example, if the price makes a higher high, but the RSI makes a lower high, it can signal weakening momentum and a potential reversal.

- Multiple Timeframe Analysis

- Confirm signals on higher timeframes (like weekly charts) for stronger confidence in your daily chart trades. This approach helps filter out noise from minor price fluctuations.

- Algorithmic Swing Trading

- Some experienced traders use algorithmic models or automated scanners to identify opportunities based on preset technical or fundamental criteria.

- Pair Trading or Hedging

- Hedge your positions by taking long and short trades in related stocks or by using derivatives. This reduces overall portfolio volatility.

Advanced techniques require thorough understanding and practice. Start small, backtest ideas whenever possible, and always consider the added complexity before integrating them into your real trading plan.

Swing Trading Tools and Resources

Leveraging the right tools can streamline your swing trading process and help you make informed decisions more efficiently.

- Charting Platforms

- TradingView, Thinkorswim (by TD Ameritrade), MetaTrader, and NinjaTrader are popular choices offering advanced charting features.

- Stock Screeners

- Finviz, Trade Ideas, and MarketSmith are well-known screeners that can help you filter stocks based on volume, price, technical indicators, and fundamental data.

- News Services

- Bloomberg, Reuters, Yahoo Finance, and CNBC can provide real-time updates on earnings, analyst ratings, and market-moving news. Timely access to news can be vital for understanding sudden price spikes or dips.

- Brokerage Platforms

- Interactive Brokers, Charles Schwab, Fidelity, and E*TRADE are among the brokers offering user-friendly interfaces, research tools, and relatively low commissions. Choose one that aligns with your trading style and jurisdiction.

- Mobile Apps

- Most modern brokers and charting tools have mobile apps, enabling you to monitor and manage your positions on the go. Handy for active swing traders who can’t always be at a computer.

- Trading Journals

- Educational Resources

- Websites like Investopedia, YouTube channels devoted to trading, and online courses from reputable traders can accelerate your learning curve. Also, consider joining trading communities or forums for peer support and idea sharing.

Regardless of which tools you use, the essential part is consistent usage in conjunction with your trading strategy. Don’t get bogged down by too many indicators or data sources—focus on the few that align best with your approach.

Conclusion

Swing trading offers a compelling balance between day trading’s immediacy and long-term investing’s leisurely pace. By capitalizing on short-term price swings, traders can harvest profits within days or weeks, all without the hyper-focus required of day trading. However, success in swing trading is neither automatic nor guaranteed. It requires:

- A solid understanding of technical and fundamental analysis to identify high-probability setups.

- Effective risk management and position sizing to protect your capital.

- A disciplined approach to entry and exit strategies that reduces emotional and impulsive decisions.

- A commitment to continuous learning and adaptation, as market conditions and individual stock behaviors evolve.

The beauty of swing trading is that it offers something for everyone: the potential for consistent gains without the need for constant market-watching. Whether you’re a part-time trader balancing a career or a more active participant exploring the markets daily, swing trading can fit seamlessly into your lifestyle. By applying the principles, strategies, and tools outlined in this article, you’ll be well on your way to profiting from short-term market swings in a systematic and sustainable manner.

Final Tips for Aspiring Swing Traders

- Start Small: Use smaller position sizes or a demo account if you’re new. Focus on learning and refining your strategy rather than chasing quick profits.

- Stay Informed: Keep up with market news, earnings calendars, and sector rotations. The market environment can shift quickly.

- Focus on Quality over Quantity: It’s better to take one high-quality trade than five mediocre ones.

- Maintain a Trading Journal: Record every trade and analyze performance. This alone can dramatically improve your results over time.

- Remain Flexible: Don’t become dogmatic about a single indicator or method. Markets are dynamic, and being open to adaptation is key.

By following these steps, you’ll enhance your odds of success, preserve capital through good times and bad, and ensure that swing trading remains a viable, rewarding pursuit. Good luck on your trading journey!