Trading the financial markets—whether it’s stocks, forex, cryptocurrencies, or commodities—is a multi-faceted endeavor. At first glance, the pursuit may appear to revolve around charts, indicators, and market analysis. While these components are undeniably important, a deeper layer exists that significantly influences success or failure: trading psychology.

For manual traders, the emphasis on trading psychology is even more pronounced than for algorithmic or automated traders. As a manual trader, you’re the one making the final call to enter or exit a position. You’re also the one experiencing the emotional roller coaster that comes with real-time price fluctuations, sudden news events, and the stress of live decision-making.

In this article, we’ll dive deeply into the concept of trading psychology. We’ll explore how emotions, cognitive biases, and mental frameworks converge to influence your trading decisions—often more than any technical or fundamental analysis might. With insights, examples, and actionable strategies, this guide is designed to be your definitive resource for harnessing the power of mindset and emotional control in trading.

Table of Contents

What Is Trading Psychology?

Trading psychology refers to the emotional and mental aspects of a trader’s decision-making process. This includes not only high-level attributes like discipline, patience, and resilience but also moment-to-moment emotional states like fear, greed, and excitement. The distinctiveness of trading psychology lies in how raw market feedback—profits, losses, volatility—can amplify these emotions, thereby shaping actions and outcomes in ways that might otherwise seem irrational.

Key Components of Trading Psychology

- Mindset: A set of beliefs and attitudes influencing how you approach each trade. A trader with a growth mindset will treat losses as opportunities to learn, whereas a trader with a fixed mindset may feel demoralized by setbacks.

- Emotional Regulation: The capacity to identify your emotional states and manage them effectively. Emotional regulation prevents knee-jerk reactions when trades go against you or when the market becomes extremely volatile.

- Cognitive Biases: Systematic patterns of deviation from logical thinking. These biases can distort market perception, leading to poor decision-making.

- Risk Perception: How you perceive and react to risk is intimately tied to your psychological makeup. A trader who underestimates risk may over-leverage, while someone overly fearful might stay out of valid opportunities.

When you, as a manual trader, place a trade, you subject yourself to a real-time emotional feedback loop—your emotional state changes as soon as price ticks in or out of your favor. This constant interplay between market signals and internal emotions underscores the importance of mastering trading psychology.

Why Trading Psychology Matters for Manual Traders

For manual traders, every decision is a personal judgment call. Automated systems remove many emotional variables by following predefined logic and risk parameters. Manual traders, on the other hand, must stay mentally agile, consistently self-aware, and disciplined under ever-changing market conditions.

Impacts on Performance

- Decision-Making Under Pressure: Markets can move swiftly. When confronted with rapid price swings, traders can easily succumb to panic or euphoria, clouding otherwise rational analysis.

- Consistency: Emotions can cause a trader to deviate from a winning strategy. You may exit too early, hold on too long, or skip valid signals entirely if fear or greed takes over.

- Opportunity Costs: Emotional hesitation can make you miss out on profitable trades, while impulsive decisions can lead you into high-risk setups you wouldn’t normally consider.

Long-Term Consequences

- Psychological Burnout: The stress of consecutive losses or rapid wins can lead to a chronic state of anxiety or euphoria, diminishing objectivity over time.

- Eroded Confidence: Even a few emotionally-driven mistakes can create a feedback loop of self-doubt, further hampering your ability to execute trades effectively.

By prioritizing trading psychology, you’re not merely adding a secondary skillset; you’re elevating the core foundation upon which all other trading knowledge rests. Technical and fundamental analyses are indeed valuable, but without the psychological resilience and mental clarity to apply them effectively, even the best strategies can fail.

Understanding Core Emotions in Trading

Emotions are the driving force behind most human behavior, and trading is no exception. Understanding how specific emotions manifest in trading can help you anticipate pitfalls and exploit strengths. Below are four primary emotions that frequently arise in the trading environment.

1. Fear

Fear generally manifests in two forms within trading:

- Fear of Loss: Traders may exit trades prematurely or avoid valid setups altogether to avoid potential losses. This behavior leads to a failure in capitalizing on winning opportunities.

- Fear of Missing Out (FOMO): When markets move quickly—especially in parabolic uptrends—traders may jump in late at inflated prices due to the fear of missing profit opportunities.

Example of Fear in Action

Imagine a trader who has studied a particular currency pair extensively, identifying a reliable breakout pattern. The breakout occurs, but the trader hesitates to enter out of fear. By the time they decide to jump in, the price has already moved substantially, increasing their risk and reducing the potential reward.

2. Greed

Greed is an overzealous desire for more profit, which can result in taking on excessive risk or refusing to exit profitable trades at predefined targets.

- Excessive Profit Targets: Holding onto a winning trade well beyond logical profit levels, hoping for an even bigger move, can backfire if the market reverses.

- Overleveraging: In pursuit of large gains, traders might use position sizes disproportionate to their account balance, magnifying losses if the trade goes against them.

Example of Greed in Action

A day trader sees a stock skyrocket on news of a potential merger. Instead of booking a reasonable profit, they keep moving their profit target higher, eventually watching the stock tumble back down, turning a winning trade into a breakeven or losing one.

3. Hope

Hope can be both a motivator and a detriment. It becomes dangerous when it morphs into wishful thinking, preventing traders from cutting losses or adapting to new market information.

- Refusal to Accept Losses: Holding a losing position out of hope that the market will “surely” reverse can balloon small losses into catastrophic drawdowns.

- Blind Optimism: Believing a failing strategy will eventually work without objective reevaluation can erode capital and undermine confidence.

Example of Hope in Action

A swing trader invests in a stock expecting a positive earnings report. When the report misses expectations and the stock begins to slide, they refuse to exit, hoping for a quick recovery. The stock continues to drop for days, leading to a much larger loss.

4. Frustration

Frustration often stems from unmet expectations or consecutive losing trades. When frustration dictates trading behavior, it can lead to revenge trading—attempting to recover losses hastily without proper analysis.

- Revenge Trading: Doubling the next trade size to “win back” losses can expose you to even more significant risk.

- Emotional Outbursts: Slamming your desk, yelling at the screen—these reactions might offer brief emotional relief but do nothing to improve trading outcomes.

Example of Frustration in Action

After losing three trades in a row, a trader impulsively enters a fourth trade out of anger, ignoring risk management rules. This trade also goes against them, magnifying the initial drawdown.

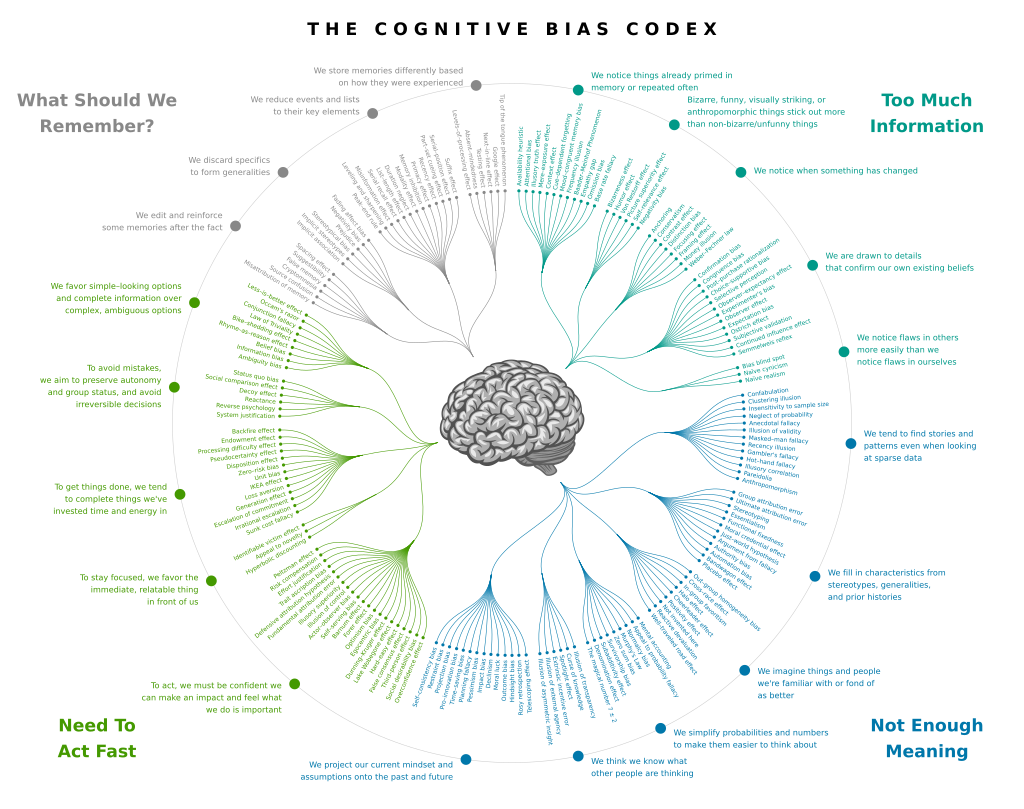

Common Cognitive Biases and How They Affect Your Trades

Cognitive biases are subconscious tendencies or shortcuts that our brains use to process information. While these shortcuts can be helpful in everyday life, they often hinder objective decision-making in trading, where data-driven analysis is paramount.

1. Confirmation Bias

- Definition: The tendency to search for or interpret information in a way that confirms one’s preconceived notions.

- Trading Effect: A trader who believes a particular stock is undervalued may only focus on bullish news and ignore bearish indicators.

Mitigation

Actively seek out contrary evidence. If you’re bullish on a currency pair, read bearish analyst reports and factor them into your analysis. This ensures a more balanced view and reduces the risk of tunnel vision.

2. Anchoring Bias

- Definition: Relying too heavily on the first piece of information encountered (the “anchor”) when making decisions.

- Trading Effect: You might anchor on a stock’s all-time high and assume it will return to that level, ignoring changes in the company’s fundamentals or market sentiment.

Mitigation

Reevaluate your assumptions regularly. Market conditions evolve, so an anchor established weeks or months ago may no longer be relevant. Use technical and fundamental metrics that reflect the current environment rather than past highs or lows as your reference point.

3. Overconfidence Bias

- Definition: Overestimating your skills, knowledge, or the accuracy of your forecasts.

- Trading Effect: After a series of profitable trades, you may begin to believe you are “unstoppable,” leading to risky decisions like increasing leverage or neglecting stop-loss orders.

Mitigation

Maintain a trading journal and review it impartially. Recognize that some wins are due to market conditions rather than pure skill. Enforce strict risk management rules—such as limiting the percentage of capital at risk per trade—regardless of recent gains.

4. Loss Aversion Bias

- Definition: The psychological preference to avoid losses more strongly than seeking equivalent gains.

- Trading Effect: Traders may hold onto a losing trade far too long, hoping to “get back to breakeven,” while they prematurely close winning trades to “lock in gains.”

Mitigation

Predefine your stop-loss and take-profit levels for every trade. By deciding on these levels before emotions take control, you ensure a more rational approach to trade exit points.

5. Recency Bias

- Definition: Placing undue emphasis on recent events while ignoring broader historical or long-term data.

- Trading Effect: After witnessing a week of bullish momentum, a trader might assume the trend will continue indefinitely, missing signs of an impending reversal.

Mitigation

Regularly consult longer timeframes, such as weekly or monthly charts, and track broader fundamental factors. This practice helps place short-term data in a larger context, reducing impulsive decisions based solely on recent price action.

6. Availability Bias

- Definition: Overvaluing information that is easily accessible—like flashy headlines or hot tips—while discounting more thorough research that requires effort.

- Trading Effect: You might place undue weight on social media chatter or trending news without verifying facts or analyzing the fundamental and technical indicators.

Mitigation

Cross-verify information from multiple, reputable sources and perform your own technical/fundamental checks. Don’t rely solely on viral tweets or sensational headlines.

7. Herd Mentality

- Definition: Following the crowd’s actions or sentiments, often due to social influence or fear of missing out.

- Trading Effect: Large-scale mania or panic can drive asset prices to irrational extremes, leading individual traders to buy at tops or sell at bottoms.

Mitigation

Strengthen your independent analysis. Develop a trading plan and stick to it, regardless of market hype. If you do follow a crowd-based move, ensure your decision is grounded in solid research rather than impulsive imitation.

Building a Strong Trading Mindset

Cultivating a robust trading mindset involves systematic, deliberate practice. It’s not an overnight transformation but rather a long-term commitment to psychological self-improvement.

1. Developing Mental Resilience

Mental resilience is the capacity to recover quickly from setbacks and maintain a steady emotional baseline.

- Expect Losses: Losses are inevitable. By accepting that you can’t win every trade, you reduce the emotional shock when losses occur.

- Adaptability: Stay open to adjusting your trading approach. Market conditions change, and rigidity can result in missed opportunities or sustained drawdowns.

- Practice Self-Compassion: Instead of berating yourself for mistakes, focus on the lessons learned. This mindset encourages continuous improvement rather than destructive self-criticism.

Real-World Application

A trader suffering a series of stop-outs might take a day off to review each losing trade, identifying common threads—whether it’s using too tight stops or trading during low-liquidity times. Instead of despairing, they refine their strategy to avoid repeating these mistakes.

2. Cultivating Discipline

Discipline is the glue that keeps your strategy intact when emotions tempt you to deviate.

- Systematic Rules: Create detailed guidelines for entries, exits, and risk management. Write them down and follow them to the letter.

- Routine: Establish trading routines, such as checking the economic calendar each morning or journaling your trades at the end of the day.

- Delayed Gratification: Recognize that not every moment in the market is a trading opportunity. Sometimes the best trade is no trade.

Real-World Application

A disciplined trader sets an alarm every four hours to check charts and conduct analysis. They only trade setups that meet strict criteria—for example, a confluence of a particular support level, a bullish candlestick pattern, and a favorable RSI reading.

3. Setting Realistic Expectations

Unrealistic expectations are a direct pathway to frustration and large losses.

- Incremental Gains: Aim for a consistent growth of capital rather than “home run” trades.

- Accept the Learning Curve: Mastery in trading can take years. Rushing for fast profits can lead to poor decisions.

- Patience: Give your trades room to breathe, and give yourself time to grow as a trader.

Real-World Application

A trader with a $5,000 account might target a consistent 2–3% monthly return. This approach is far more sustainable than trying to double or triple the account within weeks by using excessive leverage.

4. Embracing a Growth Mindset

A growth mindset fosters continuous learning and adaptability, whereas a fixed mindset might shatter when faced with adversity.

- Never Stop Learning: Attend webinars, read reputable trading books, and network with fellow traders.

- Valuing Feedback: Review your trades—both winners and losers—to identify what went right and wrong.

- Experiment: Don’t be afraid to tweak your trading system, add new indicators, or explore different market sectors. Treat each attempt as a learning experience.

Real-World Application

A growth-minded trader might invest in courses focusing on trading psychology, actively engage in trading communities, and attend virtual conferences. Each encounter with new information is an opportunity to refine their strategies.

The Role of Emotional Intelligence in Trading

Emotional Intelligence (EQ) is the skill of recognizing and managing your emotions while also being aware of others’ emotional states. In trading, higher EQ translates into greater self-awareness, better impulse control, and more nuanced market insights.

1. Self-Awareness

Self-awareness is the foundation of emotional intelligence.

- Identify Emotional States: Practice labeling your emotions—are you anxious, excited, fearful, or overconfident? A simple check-in before you place a trade can reveal a lot.

- Spotting Triggers: Market volatility, recent profits, or news headlines might trigger emotional reactions. Knowing your triggers helps you prepare.

- Tracking Over Time: Keep a trading diary that logs not just trade details but also your emotional state at the time.

Example

A trader notices that after two consecutive winning trades, they often feel euphoria and become overly confident. Recognizing this pattern, they impose stricter risk controls on the next trade to prevent a reckless bet fueled by overconfidence.

2. Self-Regulation

Self-regulation refers to controlling impulsive actions and managing emotional reactions effectively.

- Pause Before Action: When you feel a strong urge—like revenge trading or doubling down—count to ten or walk away from your computer for a few minutes.

- Structured Reactions: Employ checklists. Before entering a trade, confirm you’ve met your criteria, considered risk, and noted your emotional state.

- Reset Mechanisms: If you’re overwhelmed, step back. Emotional resets are crucial during highly volatile market events or after significant wins/losses.

Example

After a losing streak, a self-regulating trader opts to take the next day off rather than rush back into the market. This deliberate cooldown often prevents larger cascading losses and helps the trader return with a clearer mind.

3. Empathy (and Why It Matters Even for Traders)

Though trading is often viewed as an isolated activity, empathy can offer advantages in reading market sentiment and interacting with other market participants.

- Market Sentiment Analysis: Understanding collective fear or greed can offer clues about potential bubbles or panic sell-offs.

- Building Peer Relationships: Traders who exhibit empathy can better network in trading communities and learn from others’ perspectives and experiences.

Example

A trader active in social media forums senses widespread pessimism about a particular stock, noticing a near-unanimous cry of “dump it.” This uniform negativity could signal the stock is oversold and near a potential rebound.

4. Social Skills in Trading Communities

Communicating effectively within trading communities can expedite your learning process and provide emotional support.

- Constructive Critique: Offer well-structured feedback to others and seek the same from experienced traders.

- Networking: Join meetups, webinars, and online groups. Exchanging strategies, discussing market conditions, and sharing emotional hurdles can be immensely beneficial.

Example

A trader joins a local trading club that meets every week. They share screenshots of their trades, seeking feedback from more seasoned members who highlight overlooked biases and provide nuanced tips.

Risk Management and Psychology

Risk management is not just about placing stop-loss orders or setting appropriate position sizes—it’s also about safeguarding your mental capital. When your risk is under control, you can trade with less emotional turbulence.

1. Position Sizing and Risk Tolerance

Balancing position sizes with personal risk tolerance is a cornerstone of healthy trading psychology.

- Percentage Risk per Trade: Common guidelines suggest risking 1–2% of your total trading account per position.

- Factors Influencing Risk Tolerance: Experience level, overall financial stability, and personal stress thresholds should dictate how much you’re willing to risk.

Example

A trader with a $10,000 account decides on risking 1% per trade ($100). This approach ensures that even a string of losing trades is unlikely to devastate the account or cause emotional breakdown.

2. Using Stop-Loss Orders Strategically

Stop-loss orders are your emotional and financial safety net.

- Volatility-Based Stops: Adjust stop-loss levels according to the asset’s volatility. A highly volatile instrument might require a wider stop to avoid being whipsawed out.

- Trailing Stops: These can lock in gains while allowing a trade to continue running if the market moves in your favor.

Example

A trader calculates the Average True Range (ATR) of a currency pair and places the stop-loss at 1.5 times the ATR below the entry point. This ensures enough “breathing room” to accommodate normal price fluctuations.

3. Avoiding Overtrading

Overtrading is often a manifestation of boredom, impatience, or greed.

- Quality vs. Quantity: Focus on high-probability setups aligned with your strategy rather than feeling compelled to trade all the time.

- Set a Daily/Weekly Limit: Restrict the maximum number of trades you’ll take, forcing yourself to be selective.

Example

A swing trader limits themselves to five trades per month, each thoroughly vetted against a multi-criteria checklist. This reduces impulsive entries and fosters patience.

Creating a Well-Defined Trading Plan

A meticulously crafted trading plan offers clarity and structure, helping you remain emotionally grounded. By committing your trading approach to a written document, you reduce the likelihood of emotionally-driven decisions.

1. Defining Your Trading Style

Choose a trading style that aligns with your lifestyle, temperament, and time availability.

- Scalping: Involves very short-term trades, sometimes lasting mere seconds or minutes. Scalpers thrive on quick decisions but must manage stress well.

- Day Trading: Positions are opened and closed within the same day. Requires moderate time commitment and rapid decision-making.

- Swing Trading: Trades are held for days or weeks, suitable for those who prefer less frequent monitoring.

- Position Trading: Involves long-term holdings, often weeks to months, relying more heavily on fundamental analysis.

Example

A busy professional might opt for swing trading, as it doesn’t require constantly monitoring the markets. This style also reduces the emotional intensity of minute-to-minute price changes.

2. Outlining Entry and Exit Criteria

Clarity on how you’ll enter and exit trades helps reduce emotional second-guessing.

- Technical Indicators: Moving Averages, RSI, MACD, Fib retracements, etc. Combine multiple indicators for confluence.

- Fundamental Triggers: Earnings announcements, economic data releases, and news can validate or invalidate a trade setup.

- Exit Strategies: Define your stop-loss and take-profit levels before entering a trade. Consider partial exits if the market moves favorably.

Example

A day trader might wait for the 50- and 200- moving average crossover on a 15-minute chart, combined with a bullish candlestick pattern, before entering a long position. The stop-loss is placed below a key support level, and the take-profit aligns with the next resistance zone.

3. Setting Up a Trade Journal

A trade journal is your best friend for self-evaluation and emotional tracking.

- What to Record: Entry/exit prices, trade rationale, market conditions, emotional state, and outcome.

- Analyzing Patterns: Reviewing your journal can reveal if you often break rules after a series of wins or if fear stops you from capitalizing on volatile opportunities.

Example

A trader logs every detail, including a screenshot of the chart, a short paragraph on why they took the trade, and a few sentences describing how they felt at entry and exit. Over time, they notice a pattern of closing profitable trades too early out of fear.

4. Reviewing and Adapting the Plan

A trading plan should be a living document, updated as you grow and as market conditions evolve.

- Periodic Audits: Weekly or monthly reviews can help you pinpoint inefficiencies or outdated assumptions.

- Flexibility and Innovation: As you gain new insights or market conditions shift, adjust your plan accordingly.

Example

During a period of heightened volatility (e.g., major political or economic upheaval), a trader temporarily widens their stop-loss and reduces position size to protect against abrupt swings.

Techniques to Strengthen Your Trading Psychology

Improving your mental performance in trading requires both time and consistent effort. Below are proven strategies you can incorporate into your daily or weekly routine.

1. Meditation and Mindfulness

Mindfulness trains you to be fully present, reducing the tendency for anxious speculation or regret over past trades.

- Daily Practice: Even 10 minutes of guided meditation can help clear mental clutter.

- Concentration Enhancement: By focusing on your breath or a calming phrase, you develop mental fortitude against impulsive actions.

- Stress Reduction: Meditation lowers cortisol levels, contributing to a more stable emotional baseline.

Practical Tip

A trader might meditate before the market opens, visualizing themselves calmly handling various scenarios (winning trades, losing trades, volatility spikes) to prepare psychologically.

2. Visualization and Positive Affirmations

Visualization involves mentally rehearsing scenarios, while positive affirmations reinforce beneficial beliefs and self-confidence.

- Mental Scenarios: Envision placing a trade, it going against you, yet you calmly follow your stop-loss plan—this primes your mind to handle stress in reality.

- Affirmations: Repeated statements like “I am disciplined and follow my plan” can shift internal dialogue from doubt to confidence.

Practical Tip

Before trading, a trader closes their eyes for a minute and mentally simulates pressing the “buy” button, seeing the price move in unfavorable ways, and calmly sticking to the plan. They end with verbal affirmations such as “I trade with discipline” or “Losses are part of the game.”

3. Physical Exercise and Healthy Lifestyle

Your mind and body are deeply connected. A healthy lifestyle can sharply enhance your focus, decision-making, and emotional control.

- Regular Exercise: Activities like jogging, weightlifting, or yoga help burn off excess stress hormones.

- Balanced Diet: Maintaining stable blood sugar levels can prevent mood swings that might influence trading decisions.

- Adequate Sleep: Sleep deprivation can impair judgment, reduce reaction times, and amplify negative emotions.

Practical Tip

A trader commits to a 30-minute walk or run each morning and avoids caffeine after mid-afternoon. They also prioritize 7–8 hours of sleep, ensuring they’re mentally sharp for the trading day.

4. Mentorship and Community

Isolation can exacerbate emotional stress in trading. Connecting with mentors or a community provides both accountability and moral support.

- Experienced Mentors: An experienced trader can offer tailored guidance, share pitfalls to avoid, and help refine your psychological approach.

- Peer Support: Engaging with fellow traders in online forums or local meetups can normalize the emotional ups and downs you experience, offering reassurance that you’re not alone.

Practical Tip

A trader might enroll in a small group mentorship program where participants discuss their weekly trades, emotional hurdles, and strategies to stay disciplined. Over time, this collaborative environment fosters accelerated learning and emotional resilience.

Overcoming Trading Slumps and Drawdowns

Every trader eventually experiences a slump—a series of losses or poor decisions that shake confidence. The key is to recognize and manage the slump effectively before it snowballs.

1. Recognizing the Emotional Spiral

- Early Indicators: Irritability, anxiety, or a sense of desperation often precede revenge trading or other self-sabotaging behaviors.

- Negative Feedback Loop: A few losses can lead to emotional trades, which lead to more losses, further amplifying emotional distress.

Example

A trader notices they’re checking their phone constantly, even during off hours, feeling unable to relax. This heightened state of anxiety might be an early sign they’re falling into a slump.

2. Taking a Step Back

- Cooldown Period: Closing all positions temporarily and refraining from new trades can offer space for reflection.

- Objective Analysis: Use this break to conduct a thorough review of recent trades. Identify if the losses were due to market conditions, poor strategy execution, or emotional overreactions.

Example

After losing 10% of their account in a week, a trader takes the next three days off from trading. They meticulously review every trade to pinpoint patterns, such as entering positions without a complete checklist or widening stop-losses irrationally.

3. Reframing Losses

- Learning Mindset: Each loss is a lesson. Viewing losses through this lens can diminish their emotional sting.

- Process Over Outcome: Focus on whether you adhered to your plan rather than whether the trade was profitable. Consistency in following your process typically leads to profitability over time.

Example

A trader reviews a loss and notices they ignored their entry criteria in a moment of impatience. Rather than dwelling on the lost money, they commit to stricter adherence to their plan going forward.

4. Seeking Professional Help If Needed

Sometimes, deeper emotional or psychological issues can manifest in trading.

- Therapy or Counseling: Chronic stress, anxiety, or depression can severely impede trading performance. Seeking a mental health professional’s guidance can be transformative.

- Performance Coaches: Specialists in performance psychology or sports psychology often help traders develop tailored coping mechanisms and mental routines.

Example

A trader overwhelmed by panic attacks during high-volatility sessions consults a sports psychologist who helps them develop breathing techniques and cognitive restructuring methods to regain composure under pressure.

Real-World Examples and Case Studies

Case Study 1: The Overconfident Day Trader

- Scenario: After capitalizing on a series of bullish moves in a booming market, the trader began to believe they had an infallible strategy.

- Psychological Pitfall: Overconfidence bias led to ignoring stop-losses and using larger lot sizes.

- Outcome: When the market reversed, the trader’s account suffered significant drawdowns, eroding a major portion of prior gains.

- Lesson: Markets are cyclical and no strategy works in all conditions. Maintaining humility and discipline is crucial to preserving capital.

Case Study 2: The Fearful Swing Trader

- Scenario: This trader consistently took trades aligned with a well-researched strategy but exited most winning trades prematurely due to fear.

- Psychological Pitfall: Loss aversion bias limited profits as positions were closed after a small gain. Ironically, they held onto losing trades too long, hoping for a turnaround.

- Outcome: A plateau in account growth and mounting frustration.

- Lesson: Balancing risk management with the discipline to let profits run is essential. Setting trailing stops rather than exiting immediately can mitigate fear while still protecting gains.

Case Study 3: The Revenge Trader

- Scenario: After a heavy loss on a misguided short position, the trader immediately entered a new trade at double the original size.

- Psychological Pitfall: Frustration and anger fueled revenge trading, bypassing the usual due diligence.

- Outcome: Another large loss that compounded the initial drawdown, shaking the trader’s confidence even more.

- Lesson: Emotional decisions tend to invite further losses. When frustration mounts, taking a trading break and revisiting your plan is far more effective than forcing a win.

Putting It All Together: A Step-by-Step Approach

Below is a concise roadmap for cultivating robust trading psychology:

- Self-Assess

- Identify your emotional triggers, typical biases, and current risk tolerance.

- Conduct a strengths/weaknesses analysis to see where you can improve.

- Build (or Refine) Your Trading Plan

- Define your style (scalp, day, swing, or position).

- Determine strict entry/exit rules and risk parameters (e.g., 1–2% risk per trade).

- Incorporate a journaling process to record both technical and emotional data.

- Implement Emotional Intelligence Techniques

- Practice mindfulness, visualization, and positive affirmations.

- Conduct regular emotional check-ins during the trading day.

- Manage Risk Proactively

- Employ logical position sizing.

- Use stop-loss orders aligned with market volatility.

- Steer clear of overleveraging or overtrading.

- Develop Resilience and Discipline

- Accept that losses are part of trading.

- Commit to following the plan, even if market conditions become erratic.

- Review your trading journal weekly or monthly to identify and correct recurring errors.

- Learn from Every Trade

- Wins and losses alike should be documented and analyzed.

- Focus on process metrics (Did you follow your plan?) as much as outcome metrics (Did you profit?).

- Seek Continuous Improvement

- Adapt to market changes, but do so methodically.

- If you feel isolated, join mentorship programs or trading communities.

- Keep educating yourself on new strategies, indicators, or market sectors.

By systematically following these steps, you’ll establish a psychologically resilient foundation for your trading activities—one that’s designed to handle both market turbulence and personal emotional fluctuations.

Conclusion

Trading psychology is the invisible force that underpins every trade decision you’ll ever make as a manual trader. It governs how you handle the inevitable emotional swings—fear, greed, hope, and frustration—and how you navigate cognitive biases—confirmation bias, overconfidence, anchoring bias, and more. While market knowledge and technical/fundamental analysis are crucial, they are only as effective as the mindset that implements them.

By thoroughly understanding your emotional responses, strengthening self-awareness, and employing techniques like meditation, visualization, healthy living, and mentorship, you can continually refine your trading mindset. This refinement process is ongoing—there’s no permanent finish line in trading psychology. However, each incremental improvement in emotional discipline can yield disproportionately large returns in your consistency, confidence, and bottom-line results.

Above all, remember that capital preservation extends to your mental capital. A robust psychological framework frees you from panic or euphoria, allowing logical decision-making that honors your trading plan. Whether you’re new to the markets or have years of experience, prioritizing psychology can shift your trading trajectory from haphazard to disciplined, from emotionally fraught to controlled, and from stagnant to progressively successful.

In summary:

- Make self-awareness and emotional regulation core parts of your trading routine.

- Acknowledge and manage cognitive biases through structured plans and ongoing journal reviews.

- Implement risk management strategies that protect you both financially and psychologically.

- Embrace continuous learning, always refining your plan and your mindset.

Do this, and you’ll stand out as a manual trader capable of thriving in any market condition—not because you have a crystal ball, but because you’ve aligned mindset, method, and money management into a cohesive, disciplined system.

Final Words of Encouragement

Trading is a journey, and mastery is a marathon rather than a sprint. You’ll inevitably face setbacks, but each one is an opportunity to grow your emotional intelligence and fortify your strategy. Treat your psychological capital with the same (if not greater) care as your financial capital, and you’ll find that over time, it becomes the ultimate edge in a market filled with impulsive participants.

Stay disciplined, stay self-aware, and never stop refining your craft. By embracing the principles and practical tips outlined in this extensive guide, you position yourself to excel as a manual trader in a game where psychological strength often trumps technical or fundamental acumen.

FAQs: Trading Psychology

Q1: What is trading psychology?

Trading psychology refers to the mental and emotional factors that influence a trader’s decisions. It includes managing emotions like fear, greed, and frustration, as well as recognizing and overcoming cognitive biases that can hinder logical decision-making.

Q2: Why is trading psychology important for manual traders?

Manual traders rely on personal judgment rather than automated systems, making emotional control and mental clarity critical. Effective trading psychology ensures consistency, discipline, and the ability to handle market fluctuations without succumbing to impulsive decisions.

Q3: What are the most common emotional challenges in trading?

Key emotional challenges include:

- Fear (e.g., fear of loss or missing out)

- Greed (e.g., overleveraging or refusing to take profits)

- Hope (e.g., holding onto losing trades)

- Frustration (e.g., revenge trading after losses)

Q4: How can cognitive biases affect trading performance?

Cognitive biases, such as confirmation bias, anchoring bias, and overconfidence, distort logical thinking and lead to poor decisions. For example, confirmation bias may cause a trader to focus only on information that supports their trade idea, ignoring contradictory evidence.

Q5: What strategies can strengthen trading psychology?

Proven strategies include:

- Practicing mindfulness and meditation to enhance focus.

- Maintaining a detailed trading journal for self-awareness and learning.

- Using predefined trading plans with strict entry/exit criteria.

- Managing risk with position sizing and stop-loss orders.

Q6: How does emotional intelligence (EQ) benefit traders?

Emotional intelligence helps traders recognize and regulate their emotions, avoid impulsive actions, and interpret market sentiment effectively. High EQ also fosters better decision-making and builds resilience during challenging market conditions.

Q7: How can traders recover from a slump or losing streak?

To overcome a slump:

- Take a break from trading to reset emotionally.

- Review your trade journal to identify recurring mistakes.

- Focus on process-oriented goals rather than immediate profits.

- Seek mentorship or join trading communities for support and guidance.

Q8: Can trading psychology be improved over time?

Absolutely! Like any skill, trading psychology can be honed through consistent effort. Regular practice of emotional control techniques, ongoing self-assessment, and learning from both successes and failures will gradually strengthen your mental resilience.