In the realm of financial trading, few topics generate as much interest—and confusion—as the win rate. Traders everywhere talk about it, brag about it, or obsess over it. Yet, a win rate on its own can be misleading, and even a high win rate does not necessarily translate into profitability. Understanding the nuances of this crucial metric is the foundation on which profitable trading strategies are built. In this comprehensive guide, we will delve deeper into the meaning of win rate, explore why it matters, discuss how to calculate it properly, and examine practical ways to improve it—without overwhelming you with unnecessary complexity.

Table of Contents

Understanding Win Rate in Trading

At its simplest, the win rate is the percentage of trades that close in profit out of your total trades. For instance, if you execute 100 trades and 60 are winners, then your win rate stands at 60%. However, while the formula is straightforward, the story behind the metric is more layered.

- Context Matters: Different strategies and market conditions can produce drastically different win rates. A scalping strategy might have a high win rate but small gains per trade, while a trend-following strategy might have a lower win rate but larger gains when it wins.

- Strategy Type: Traders who rely on quick profits and shorter holding periods often aim for a higher win rate. Longer-term traders may prioritize a higher risk-reward ratio over a higher win rate.

- Market Conditions: A strategy that works well in a bull market (leading to a high win rate) might flounder in a choppy or bear market. As conditions change, so can your win rate.

Ultimately, viewing win rate as part of a broader trading equation allows you to see how often you’re right but also how much you profit when you’re right—versus how much you stand to lose when you’re wrong.

Why Win Rate Matters

The prominence of win rate in trading discussions is no accident. Here are some core reasons why it’s often held in high regard:

- Immediate Feedback: A clear, simple metric that reflects how many times your strategy “worked.” This immediate feedback can help you stay engaged and measure progress without too many calculations.

- Psychological Comfort: Everyone prefers seeing more winning trades than losing ones. A higher win rate can ease the emotional toll of trading, helping you stay disciplined.

- Indicator of Edge: Over a large enough sample size, a consistently strong win rate suggests that you have developed (or discovered) a genuine market edge—some systematic advantage that tilts the probability in your favor.

- Investors and Stakeholders: If you are managing money for others, a robust, stable win rate can be appealing to potential investors. Many investors prefer seeing frequent smaller gains than infrequent large ones, even if the net profit is the same.

Key Insight: While the win rate is important, other metrics—like the size of your winners vs. losers—are equally pivotal. As you progress in trading, you’ll realize that large losing trades can quickly offset frequent small gains, which is why a broad perspective is necessary.

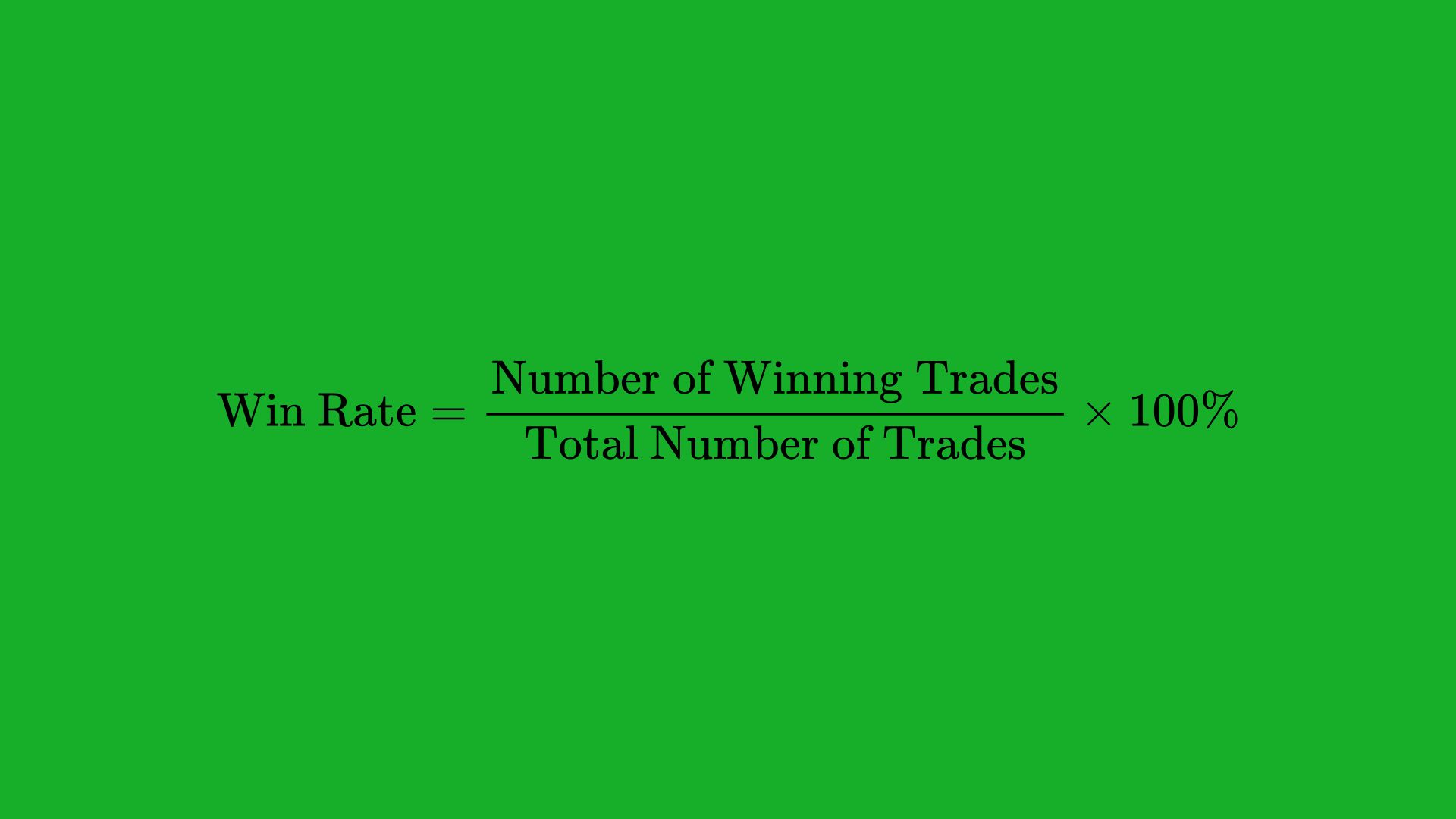

How to Calculate Win Rate

Calculating your win rate is not complicated, but it does require disciplined trade recording and a consistent method:

- Accurate Record-Keeping

- Log every trade: Include entry and exit prices, position size, date and time of trade, and any reasons for entering.

- Mark each trade as a win (profitable) or a loss (unprofitable).

- Basic Formula Win Rate = (Number of Winning Trades/Total Number of Trades) × 100% For example, if you made 50 trades this month and 30 were winners, your win rate is (30/50)×100% = 60%

- Frequent vs. Periodic Calculation

- Short-Term: Calculating daily or weekly can help you spot shifts in market conditions.

- Long-Term: Monthly or quarterly evaluations provide a broader perspective, smoothing out short-term luck or anomalies.

- Trading Journal

- Alongside the win/loss outcome, note each trade’s profit or loss amount, the market condition, and your emotional state if relevant.

- Over time, you can see if certain patterns—like trading on Mondays or trading during specific news events—affect your win rate.

The Importance of Sample Size

It’s tempting to take 5 or 10 trades, see a promising win rate, and assume your strategy is a winner. Unfortunately, small sample sizes often mislead traders:

- Statistical Reliability: In statistics, the law of large numbers states that results become more reliable as sample size increases. Similarly, in trading, you need a substantial number of trades—often in the hundreds—to trust your win rate’s stability.

- Market Variability: Market conditions can be unusually favorable or unfavorable in certain periods. For example, a simple “buy the dip” strategy might show a high win rate in a long-running bull market but fails in sideways or declining markets.

- Probability of Random Chance: Over a small sample, a string of wins (or losses) could simply be luck. As you accumulate more trades, the impact of randomness diminishes, revealing the true performance of your strategy.

Practical Tip: If you are a day trader making many trades per week, you can more quickly reach that large sample size. However, a position trader or swing trader might take months or even years to build a meaningful data set. Stay patient and focus on collecting quality data over time.

Common Misconceptions About Win Rate

1. High Win Rate = Guaranteed Profit

A sky-high win rate (say 90%) can still be unprofitable if the 10% of losing trades are huge. For instance, consistently taking $20 gains might seem nice until you hit a $500 loss on one trade, wiping out weeks of profits. Always balance win rate with average profit vs. average loss.

2. Win Rate Is All That Matters

Some traders zero in on winning often, ignoring the magnitude of each win or loss. This can lead to taking many small gains and carrying large drawdowns. Profitable trading is a multi-dimensional endeavor that includes position sizing, stop-loss placement, and risk management.

3. Chasing 100% Is Sustainable

No strategy can maintain a 100% win rate forever. Market dynamics shift, economic events arise unexpectedly, and even computers aren’t infallible. Chasing perfection may cause overtrading or ignoring clear exit signals just to preserve a streak.

4. A Low Win Rate Means a Bad Strategy

Strategies that rely on large price moves—like trend-following—can have a win rate below 50% but still be profitable, as the average winner far exceeds the average loser. This underscores the importance of combining your win rate with other metrics like risk-reward ratio.

Other Key Trading Metrics to Consider

Your win rate is just one piece of the puzzle. To gain a well-rounded understanding of your trading performance, it’s essential to track and analyze a variety of other key metrics, such as:

1. Risk-Reward Ratio

Definition: The amount of potential profit you aim for compared to how much you risk losing. For instance, a 1:2 risk-reward ratio means you risk $1 to potentially gain $2.

- Why It Matters: Even with a modest win rate, a favorable risk-reward ratio can lead to overall profitability.

- Example: If your stop-loss is set at $50 and your profit target is $100, your risk-reward ratio is 1:2.

2. Profit Factor

Definition: Calculated by dividing your total gains by your total losses. A profit factor of 2 means you are earning twice as much as you’re losing across all your trades.

- Interpretation:

- 1.0: You’re breaking even.

- Above 1.5–2.0: Often seen as a good strategy.

- Below 1.0: Generally unprofitable over time.

3. Drawdown

Definition: The maximum decline in your trading account balance from a peak to a subsequent trough.

- Why It’s Critical: Even a system with a high win rate can suffer devastating drawdowns if losses are large. Drawdown gives you a sense of how deep your account might dip before recovering.

- Example: If your account grows from $10,000 to $12,000 but then drops to $9,000 before climbing again, your drawdown is $3,000 from the highest point (i.e., 25% of $12,000).

4. Average Gain vs Average Loss

Definition: A straightforward measure of how much you typically make on winning trades versus how much you typically lose on losing trades.

- Key Insight: If your average gain is $100 per win and your average loss is $200 per loss, you’ll need a win rate of at least 67% to break even (because 2 losers wipe out 1 winner).

- Action Point: Aim to keep your average loss smaller or at least proportionate to your average gain, so you do not rely on an unrealistic win rate to stay profitable.

Strategies to Improve Your Win Rate

Improving your win rate involves more than simply “winning more trades.” It is about enhancing your entire trading framework, from entry to exit and from planning to psychology.

1. Refine Your Trading Plan

A detailed trading plan should outline:

- Market Focus: Identify which markets (stocks, forex, crypto, futures) and which timeframes (intraday, swing, long-term) fit best with your strategy and lifestyle.

- Entry Signals: Whether you use technical indicators (e.g., moving averages, RSI) or fundamental catalysts (e.g., earnings reports, economic data), define the exact conditions required before you enter a trade.

- Exit Rules: Specify profit targets and stop-loss levels. Consider trailing stop-losses to lock in gains as the market moves in your favor.

- Position Sizing: Determine how many shares, contracts, or lots to trade based on a percentage of your account balance. A common approach is risking 1–2% of total capital per trade.

Benefit: By following a consistently applied plan, you filter out impulsive trades. Higher-quality trades can raise your overall win rate because you’re more selective.

2. Utilize Backtesting and Forward Testing

Backtesting: Use historical data to see how your strategy would have performed in past market conditions. This helps you identify potential issues—such as unacceptably large drawdowns or low win rates—before risking real capital.

Forward Testing (Paper Trading): Once your backtest looks promising, test your strategy in real-time using a demo account or minimal capital. This step can confirm whether your results hold up under live conditions, slippage, and psychological pressures.

Tip: Focus on how your strategy performs in different market environments (bullish, bearish, sideways). A strategy that only works in bullish conditions can show inflated performance in a backtest if you’re not careful.

3. Implement Strict Risk Management

Risk management is the backbone of long-term success:

- Stop-Loss Placement: Always know your exit plan in case the market moves against you. Setting an appropriate stop-loss can significantly reduce catastrophic losses.

- Position Sizing Rules: Over-leveraging even a high-probability trade can lead to devastating drawdowns if it goes wrong.

- Avoid Overtrading: Taking too many trades increases the chance of deviating from your strategy. Quality over quantity is key.

Impact on Win Rate: When you cut your losses early, you’re less likely to have massive losses that overshadow many small winners. Keeping your losing trades small can help maintain a healthier overall performance, which often reflects in a more stable or improved win rate.

4. Optimize Entry and Exit Points

Even minor tweaks can improve your win rate:

- Filter Signals: Wait for multiple confirmation signals (e.g., a moving average crossover plus a clear price-action pattern) before entering a trade.

- Patience in Entries: Sometimes waiting for the price to pull back to a better entry point can increase the probability of success.

- Scaling Methods: Some traders scale into a position (entering in partial increments) to get a better average price, while others scale out (exiting in increments) to lock in partial profits.

5. Adopt a Continuous Learning Mindset

Markets evolve, and so should your trading approach:

- Regular Reviews: Set aside time weekly or monthly to review your trades. Identify recurring mistakes or missed opportunities.

- Stay Informed: Keep up with economic announcements, changes in market structure (like new regulations), and evolving technology.

- Professional Communities: Join trading forums or communities where you can discuss ideas and get feedback on your trades.

By consistently iterating on your methods, you can catch minor flaws before they become major pitfalls—and discover small improvements that can meaningfully boost your win rate.

Psychological Factors Influencing Win Rate

Your mindset and emotional resilience can make or break your trading results, even if you have a well-researched strategy:

- Fear of Loss: Could lead you to close winning trades prematurely or avoid valid setups out of anxiety, potentially lowering both win rate and overall profit.

- Greed & Overconfidence: After a series of wins, you might increase your position size irresponsibly or deviate from your plan in the belief you “can’t lose.” This often ends in large, demoralizing losses.

- Revenge Trading: Trying to recoup losses quickly by placing impulsive trades typically amplifies losses. A few revenge trades can destroy weeks or months of gains.

- Impatience: Not waiting for ideal setups diminishes the probability of success. FOMO (fear of missing out) trades can be especially costly.

Actionable Tip: Incorporate “mindset checks” into your routine. For instance, before executing a trade, ask: “Am I calm and following my plan? Or am I reacting emotionally?” If the latter, it might be best to step away until you regain composure.

Real-World Examples of Win Rate in Action

Let’s see how the win rate concept plays out in two contrasting scenarios:

Example 1: Day Trading Scenario

- Strategy: A momentum scalp strategy that looks for small, quick gains.

- Risk-Reward Setup: Risking $50 per trade for a $100 target (1:2 ratio).

- Win Rate: 55%

Over 20 trades in a week:

- Winners: 11 trades (55%), each earning $100 → $1,100 total

- Losers: 9 trades (45%), each losing $50 → -$450 total

- Net Profit: $1,100 – $450 = $650

This trader’s win rate of 55%—combined with a solid risk-reward ratio—results in a respectable profit. The lesson: A win rate just over 50% can be lucrative if your winners outsize your losers.

Example 2: Swing Trading Scenario

- Strategy: Holding positions for several days based on technical breakouts in stocks.

- Risk-Reward Setup: Risking $200 with a target profit of $300 (1:1.5 ratio).

- Win Rate: 40%

Over 10 trades in a month:

- Winners: 4 trades (40%), each earning $300 → $1,200 total

- Losers: 6 trades (60%), each losing $200 → -$1,200 total

- Net Result: $1,200 – $1,200 = $0

While the trader doesn’t lose money overall, they also don’t profit. A small improvement in the win rate—say from 40% to 45%—or a modest increase in the risk-reward ratio could make the difference between breakeven and profitability.

Putting It All Together: A Holistic Approach to Trading Success

Building a lasting, profitable trading career involves integrating multiple elements into a cohesive system. Here’s a quick roadmap:

- Comprehensive Trading Plan:

- Define your market, timeframe, and exact entry and exit conditions.

- Establish clear risk parameters, including maximum risk per trade.

- Robust Risk Management:

- Use consistent position sizing (e.g., 1–2% of account risk per trade).

- Never leave trades without a stop-loss or clear exit strategy.

- Win Rate + Other Metrics:

- Track win rate, but also monitor your risk-reward ratio, drawdowns, and profit factor.

- Identify where your strengths lie (high win rate, large winners, etc.) and where you need improvement.

- Continuous Review and Adaptation:

- Journal every trade and review the data. Look for patterns in your losses—did you deviate from your plan, or was it simply market behavior?

- Adapt your approach to new market conditions, whether that means adjusting your technical indicators or trying different timeframes.

- Mindset Management:

- Self-awareness is crucial. Recognize signs of emotional trading, such as chasing the market or revenge trading.

- Use relaxation techniques or short breaks to reset your emotional state if you find yourself feeling stressed or impulsive.

Why This Matters: A trader who only focuses on win rate might fall into the trap of ignoring big losses or exit strategies. By applying a balanced view—considering both frequency (how often you win) and magnitude (how much you win or lose)—you stand a better chance of building sustainable profitability.

FAQ: Mastering Win Rate in Trading

1. What is a good win rate for trading?

A “good” win rate depends on your trading strategy. Scalpers and day traders often aim for win rates above 50%, while swing traders or trend followers can be profitable with win rates as low as 40% if their risk-reward ratio is favorable.

2. Can I be profitable with a low win rate?

Yes, profitability depends on the balance between your win rate and risk-reward ratio. A trader with a 40% win rate can still make money if their average winning trades significantly outweigh their losses.

3. How do I calculate my win rate?

Divide the number of winning trades by the total number of trades, then multiply by 100. For example, if you have 25 winning trades out of 50 total trades, your win rate is (25/50)×100=50%(25/50) \times 100 = 50\%.

4. Does a high win rate guarantee success?

No, a high win rate does not guarantee profitability. If your losing trades are much larger than your winning trades, you could still lose money despite a high win rate.

5. How can I improve my win rate?

- Refine your trading plan with clear entry and exit criteria.

- Use backtesting to validate your strategy.

- Employ strict risk management, including proper stop-loss placement.

- Continuously review and adapt your approach based on market conditions.

6. Is it better to have a high win rate or a high risk-reward ratio?

Both are important and depend on your strategy. A high win rate provides psychological comfort, while a favorable risk-reward ratio ensures profitability even with a lower win rate. Ideally, aim to balance both.

7. How many trades should I analyze to determine my win rate?

Analyze at least 100–200 trades to get a statistically reliable win rate. Larger sample sizes provide more accurate insights into your strategy’s performance.

8. What tools can help track my win rate?

Trading journals, spreadsheet tools, and platforms like TradingView or MetaTrader allow you to log trades and calculate your win rate and other performance metrics.

Conclusion

Understanding and optimizing your win rate is a worthwhile pursuit, but it’s essential to realize that this metric is one piece of a greater trading mosaic. A high win rate can provide psychological comfort and impress stakeholders, but without careful attention to risk-reward ratios, drawdowns, position sizing, and trading psychology, that win rate may not translate into real profits.

To truly master your win rate and achieve a consistent edge:

- Develop a well-defined trading plan aligned with your goals and risk tolerance.

- Adopt strong risk management rules that keep losses under control.

- Continuously backtest, forward test, and refine your strategy to adapt to shifting markets.

- Maintain a healthy mindset to avoid emotional pitfalls that compromise even the best-laid plans.

By viewing the win rate in tandem with these other dimensions, you set the stage for robust, long-term success in the markets. Remember, consistency and risk control often trump flashy metrics. As your trading matures, your win rate will become a valuable gauge of progress rather than an end goal in itself, helping you build a sustainable and profitable trading journey for years to come.