Portfolio diversification is a strategic approach to investing that involves spreading investments across various financial instruments, industries, and other categories to minimize risk and maximize returns. By holding a mix of assets, investors can protect themselves against significant losses from any single investment. In this article, we will explore what is portfolio diversification, its key concepts, benefits, and challenges.

What is Portfolio Diversification?

Portfolio diversification is a risk management strategy that mixes a wide variety of investments within a portfolio. The rationale behind this technique is that a diversified portfolio will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio.

Diversification aims to smooth out unsystematic risk events in a portfolio, so the positive performance of some investments neutralizes the negative performance of others.

Key Ideas in Portfolio Diversification

Risk Reduction: One of the primary goals of diversification is to reduce the overall risk of the portfolio. By investing in a variety of assets, an investor can protect their portfolio from significant losses. For example, if one sector or asset class underperforms, the gains from other investments can help offset those losses.

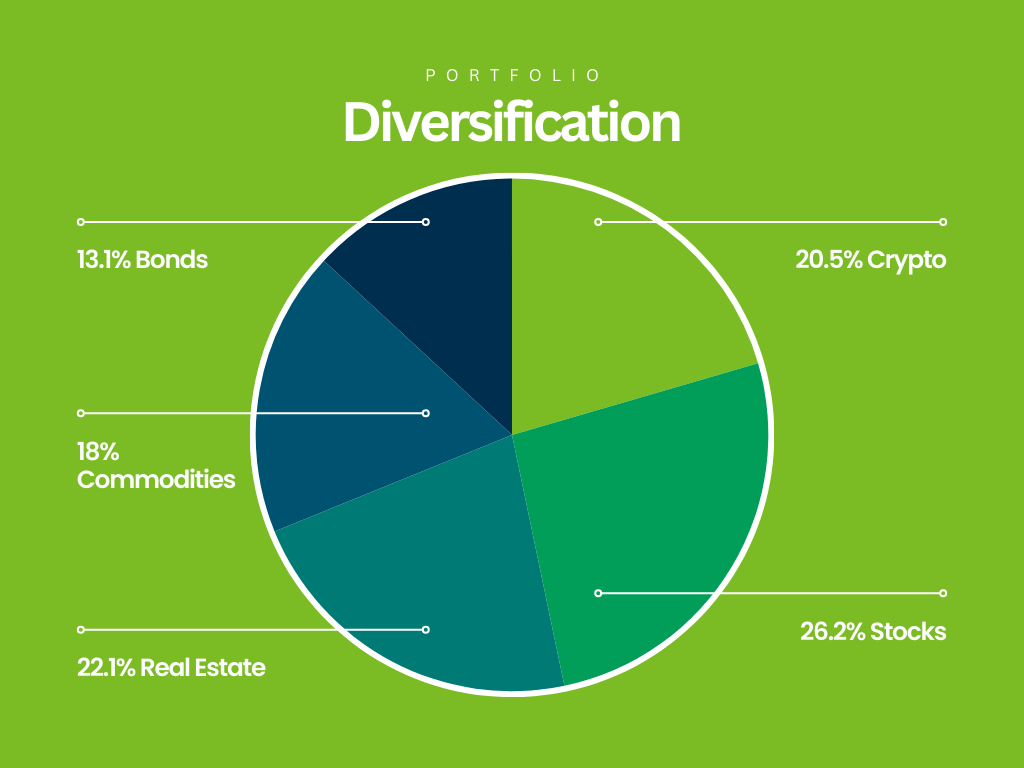

Asset Allocation: This involves spreading investments across various asset classes such as stocks, bonds, real estate, commodities, and cash. Each asset class has different levels of risk and return, and they often perform differently under various market conditions. Proper asset allocation ensures that the portfolio is not overly exposed to any single asset class.

Sector and Industry Diversification: Within the stock portion of a portfolio, it’s important to invest in different sectors and industries. For example, technology, healthcare, finance, consumer goods, and energy sectors all react differently to economic changes. By holding stocks from various sectors, an investor can reduce the impact of sector-specific risks.

Geographic Diversification: This strategy involves investing in international markets in addition to domestic ones. Different countries’ economies do not move in tandem, so geographic diversification can protect against regional economic downturns.

Investment Styles: Including different investment styles such as growth, value, large-cap, small-cap, and mid-cap stocks within a portfolio can enhance diversification. Each style has unique risk and return characteristics, and their performance can vary based on market conditions.

Fixed Income Investments: Bonds and other fixed income securities can provide stability and income to a portfolio. They typically have lower risk compared to stocks and can act as a buffer during market volatility.

Benefits of Portfolio Diversification

Enhanced Stability: A diversified portfolio is generally more stable than a non-diversified one. By spreading investments across various assets, sectors, and regions, the portfolio can better withstand market fluctuations.

Optimized Returns: While diversification does not guarantee against losses, it can help achieve a more consistent return on investment. The positive performance of some investments can help balance out the negative performance of others, leading to a smoother overall return.

Protection Against Uncertainty: Markets are unpredictable, and diversification provides a safety net against unforeseen events that could impact specific assets or sectors.

Psychological Comfort: Knowing that a portfolio is diversified can provide peace of mind to investors. It can reduce the stress and emotional reaction to market volatility, allowing for more rational decision-making.

Challenges of Portfolio Diversification

Over-Diversification: While diversification is beneficial, over-diversification can dilute returns. Too many investments can lead to higher transaction costs and management complexities without significantly reducing risk.

Correlation Misjudgment: Sometimes, investments that appear uncorrelated may move together in certain market conditions. It’s crucial to understand the true correlation between assets.

Market Timing: Diversification does not protect against broader market downturns. Timing the market correctly is challenging, and diversified portfolios can still experience significant short-term losses during major market corrections.

Importance of Portfolio Diversification

The main idea behind diversification is that by holding a mix of different types of investments, you can potentially lower the overall risk in your portfolio because different assets may respond differently to various economic and market conditions.

Diversification aims to achieve a balance between risk and return.

The easiest way to show why diversification matters is through an example. So, let’s get started.

Imagine you believe that a single stock, AAPL, represents a fantastic company and you anticipate that it will thrive in the future. You decide to invest all of your funds into this particular company.

However, it’s important to acknowledge the inherent risk in this strategy. What if AAPL faces challenges such as producing subpar products, encountering new competitors, or dealing with changes in taxation laws, among other potential issues? In such cases, if the company does not perform well, you stand to lose your entire investment.

This is why it is crucial to adopt a diversified approach, where you don’t concentrate all your resources in one investment. The underlying principle of diversification is that by spreading your investments across different assets or securities, you mitigate the risk associated with the failure of any one investment.

Diversification can take various forms. You can diversify within a specific asset class, such as stocks, by holding multiple stocks simultaneously. Additionally, you can expand your diversification beyond stocks by incorporating various investment assets into your portfolio. This includes bonds, gold, real estate, and crypto, providing you with multiple avenues for diversifying your investments.

There are individuals who prefer not to embrace diversification. For them, the rationale is as follows: they might have a strong belief in the potential of a particular company, and they anticipate it will yield the highest returns. Consequently, they question the need to divide their funds among multiple companies and instead propose concentrating all their capital in the one company they believe will perform the best.

Once again, it ultimately comes down to an individual’s risk tolerance. Consider someone who, back in the early 2000s, exclusively invested in AAPL stock. They would likely have accumulated substantial wealth by now. If you genuinely believe that a particular company will prosper in the future and are willing to take on the risk of losing your entire investment if it fails, then it’s your choice to proceed. If your assessment turns out to be accurate, you will undoubtedly be grateful to yourself for making that decision.

What is Correlation?

Correlation in stocks refers to the statistical relationship or degree of association between the price movements of two or more stocks in a portfolio. It measures how closely the prices of these stocks move together over a certain period of time, and it is an essential concept in the field of portfolio management and risk assessment.

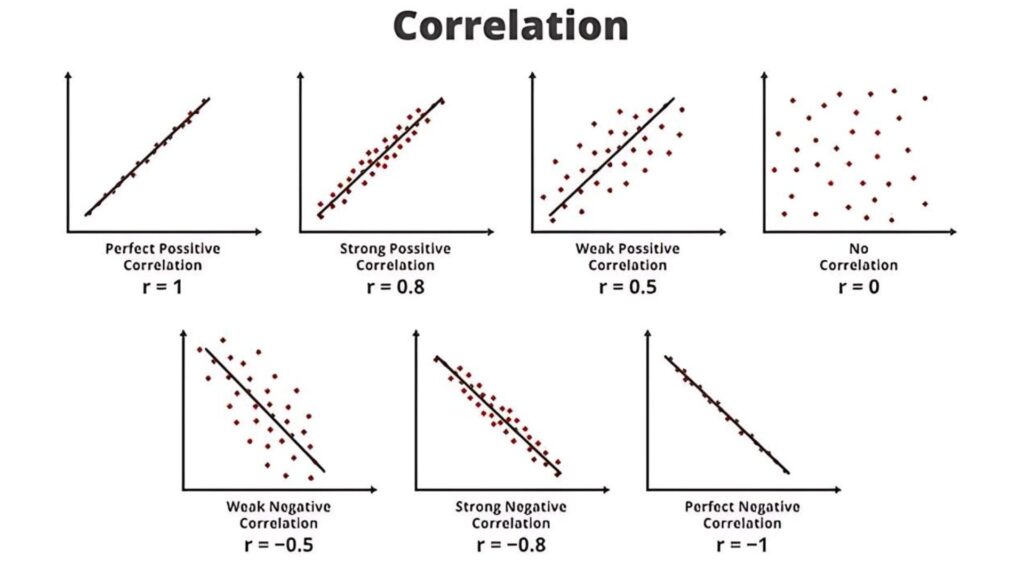

Correlation is typically measured using statistical methods, and the result is expressed as a correlation coefficient, which can range from -1 (perfect negative correlation) to 1 (perfect positive correlation).

Positive Correlation: When two stocks have a positive correlation, it means that their prices tend to move in the same direction. If one stock goes up, the other is likely to go up as well, and if one stock goes down, the other is likely to go down too. A correlation coefficient for positively correlated stocks will be greater than 0 but less than 1. This suggests that they are moving somewhat in sync but not perfectly.

Negative Correlation: Conversely, when two stocks have a negative correlation, their price movements move in opposite directions. If one stock goes up, the other is likely to go down, and vice versa. A correlation coefficient for negatively correlated stocks will be less than 0. This suggests that they tend to move in opposite directions.

No Correlation: When the correlation coefficient is close to 0 or very low, it indicates that there is little to no linear relationship between the price movements of the two stocks. In other words, the movements of one stock do not provide any meaningful information about the movements of the other.

You can use TradingView to visually analyze correlations among your stocks, or you can calculate them using their price data.

It’s important to note that correlation does not imply causation. Just because two stocks are correlated does not mean that one stock’s performance directly influences the other. Other factors may be at play, and correlation should be used in conjunction with other tools and analyses when making investment decisions.

The significance of understanding correlation in stocks lies in portfolio diversification and risk management. By including stocks with different correlation patterns in a portfolio, investors can reduce overall risk. This is because if one stock in a diversified portfolio performs poorly, the impact on the entire portfolio is mitigated by the performance of other stocks with different correlation characteristics. Diversification seeks to balance the risk-reward trade-off and potentially enhance portfolio stability.

Stocks within the same sector tend to exhibit some level of correlation, while stocks within the same industry often have a strong correlation. Therefore, if you’re selecting stocks within the same asset category, such as sectors or industries, you may not achieve effective diversification.

This is because if the specific sector encounters a downturn, all the stocks within that sector are likely to decline, resulting in a decrease in your portfolio’s value. This occurs because you’ve chosen stocks that are closely correlated. To mitigate this risk, it’s advisable to opt for assets that exhibit minimal correlation with each other.

The lower the correlation between your assets, the more secure your portfolio becomes.

Conclusion

Portfolio diversification is a cornerstone of prudent investing. It involves spreading investments across various asset classes, sectors, regions, and styles to reduce risk and enhance stability. While diversification cannot eliminate all risks, it can help investors achieve more consistent returns and protect against significant losses. By understanding and implementing effective diversification strategies, investors can build resilient portfolios capable of weathering market volatility and achieving long-term financial goals.