Are you looking for a reliable, user-friendly scalping strategy that can help you capitalize on the forex market’s short-term movements? Whether you’re new to currency trading or an experienced trader seeking to refine your approach, the Forex Impulse Scalping Strategy might be exactly what you need. In this in-depth review—we will explore every aspect of this strategy: its concepts, key indicators, trend-focused approach, risk management insights, and more.

By the end of this article, you’ll have a comprehensive understanding of how the Forex Impulse Scalping Strategy works, how to integrate it into your daily trading routine, and how to take advantage of its unique features. You’ll also discover how to leverage additional resources (like the Candle Closing Time Indicator, Double Pipe Pattern Trading Strategy, and an eBook on Japanese Candlestick Patterns) that come bundled with the system. Finally, if you’re convinced it’s right for you, we will guide you on how to purchase the strategy through Digistore24 so you can start your scalping journey with a high-probability system. Let’s dive right in!

Table of Contents

What Is Forex Scalping and Why Does It Matter?

The Concept of Scalping

Scalping in the forex market is a short-term trading approach that capitalizes on small price movements. Scalpers aim to enter and exit trades quickly—often within seconds to minutes—seeking to make frequent gains throughout a trading session.

- High-Frequency Trades: A single trading day could include multiple scalping trades, each designed to capture a small profit.

- Targeting Minimal Pip Gains: Scalpers might aim for anywhere from 2-10 pips per trade, depending on their strategy and market conditions.

- Fast Decision-Making: Because price action in lower timeframes (like the 1-minute or 5-minute charts) can change rapidly, scalpers rely on quick analysis, often supported by indicators.

Advantages of a Scalping Approach

- Lower Exposure to Market Fluctuations: Since trades are held for shorter durations, you’re less affected by major news events or long-term sentiment shifts.

- Potential for Multiple Entry Opportunities: Scalpers may accumulate small profits throughout the day, leading to potentially higher overall gains if consistent.

- Immediate Feedback Loop: You quickly see whether a trade is working, aiding in faster skill development and strategy refinement.

Common Risks and Drawbacks of Scalping

- Stressful Environment: Monitoring the markets closely can be intense and mentally exhausting.

- Higher Transaction Costs: Spreads and commissions can add up when placing multiple trades, making broker choice critical.

- Requires Quick Execution: Slippage and requotes can significantly impact profits if your brokerage or internet connection is suboptimal.

Because of these pros and cons, a robust strategy—especially one that clearly defines entry, exit, and risk management parameters—becomes crucial. This is exactly where the Forex Impulse Scalping Strategy excels by providing an easy-to-follow framework tailored to short-term trading.

An Overview of the Forex Impulse Scalping Strategy

The Philosophy Behind the Strategy

The Forex Impulse Scalping Strategy was developed by a private, seasoned forex trader passionate about currency markets. The primary goal is to simplify trading decisions for scalpers by focusing on trend alignment, momentum, and clear-cut signals. Unlike more complex strategies requiring intricate technical analysis, the Forex Impulse Scalping Strategy strives to make key information highly visual and intuitive.

Unique Selling Points

- User-Friendly Interface: The strategy integrates color-coded indicators and straightforward signals, reducing guesswork for both beginners and advanced traders.

- Trend-Focused: Emphasizes trading in line with the dominant trend, which significantly enhances the probability of success.

- Clear Entry and Exit Signals: The system uses two custom indicators that must converge to signify a high-probability trade.

- Comprehensive Manuals in German: If you read German, the included manuals walk you through every step with detailed explanations and chart illustrations.

Compatibility and Ease of Use

- Platform: Primarily designed for MT4 (MetaTrader 4), the most popular forex trading platform among retail traders.

- Account Types: Compatible with all major broker account types—both real and demo—allowing you to backtest and forward-test comfortably.

- Quick Setup: Most traders can get up and running “within minutes,” as installing the indicators and templates does not demand advanced technical knowledge.

Key Components of the Forex Impulse Scalping Strategy

Proprietary Custom Indicators

The strategy revolves around two proprietary custom indicators. These indicators analyze price action and momentum, offering traders a clear picture of when a market is primed for a potential breakout or when momentum is strong enough to warrant an entry.

- Indicator 1 (Momentum Filter): A specialized momentum-based filter that evaluates volume, volatility, and recent price action to decide if the market has sufficient “push” for a trade.

- Indicator 2 (Trend Filter): This indicator confirms the direction of the trend and fine-tunes entry timing. When combined with Indicator 1’s signals, it offers a double-confirmation mechanism.

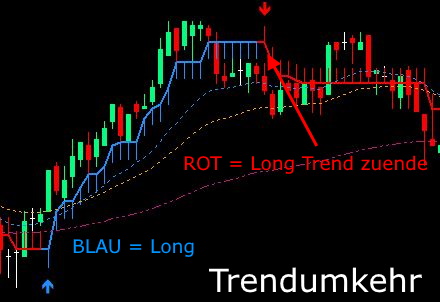

Color-Coded Trend Identification (Blue vs. Red Lines)

One of the major highlights is the color-coded line that identifies bullish and bearish market conditions:

- Blue Line: Indicates a bullish trend (prices are generally rising).

- Red Line: Indicates a bearish trend (prices are generally falling).

These lines simplify a trader’s understanding of the prevailing trend and serve as a visual cue for potential trend reversals. Once the color switches—say, from blue to red—it hints at a shift in market momentum. Traders can respond quickly by either exiting long positions, entering short positions, or waiting for a solid confirmation before acting.

Confluence and Momentum for Trade Entry

“Confluence” refers to having multiple trading signals align simultaneously, boosting the probability of a trade’s success. In the Forex Impulse Scalping Strategy, you look for:

- Trend alignment (blue for bullish, red for bearish)

- Indicator 1 signifying sufficient market momentum

- Indicator 2 confirming the trend direction and entry timing

These three components together increase the win rate because you only enter trades when multiple signals point in the same direction.

The Role of Timeframes

Scalpers often use shorter timeframes like 1-minute, 5-minute, or 15-minute charts to identify quick opportunities. The strategy is adaptable:

- 1-Minute and 5-Minute: For very quick scalping, especially during high-liquidity market sessions (London or New York open).

- 15-Minute: Offers a slightly more extended perspective, which can be beneficial if you want fewer but more robust signals.

Regardless of the chosen timeframe, the important aspect is to follow the trend and use the indicators for confluence. Many users find that the 5-minute chart strikes a good balance between frequent trading opportunities and manageable noise levels.

Trading With the Trend: A Core Principle

How to Identify the Long-Term Trend

Even though the strategy focuses on short-term scalps, it places a significant emphasis on the long-term trend. Here’s how to identify it:

- Check Higher Timeframes: For instance, if you’re trading on the 5-minute chart, glance at the 1-hour or 4-hour chart to see the broader price direction.

- Look for Consistent Higher Highs and Higher Lows: In an uptrend, price action often forms new peaks (higher highs) and higher troughs (higher lows).

- Moving Averages or Color-Coded Lines: The built-in color-coded line effectively replaces standard moving averages, giving you a quick read on trend direction.

Why Trading Against the Trend Is Risky

“The trend is your friend” might be one of the oldest trading adages, and for good reason:

- Momentum Favors the Dominant Trend: Markets tend to continue moving in the existing direction unless disrupted by major news or events.

- Higher Win Probability: Trading with the trend generally increases your chance of success, as you’re aligning yourself with market sentiment rather than attempting to predict reversals.

- Reduced Drawdowns: Even minor pullbacks in a strong trend can quickly recover, meaning your potential losses are often smaller or your trades revert to profit faster than if you were fighting the trend.

Incorporating Multi-Timeframe Analysis

While the Forex Impulse Scalping Strategy can be used on a single timeframe, multi-timeframe analysis is often recommended:

- Long-Term Trend Confirmation: Use a higher timeframe (1-hour or 4-hour) to ensure you’re trading in the direction of the dominant trend.

- Execution on a Lower Timeframe: Switch to the 5-minute or 15-minute chart to pinpoint scalping entries that align with the larger direction.

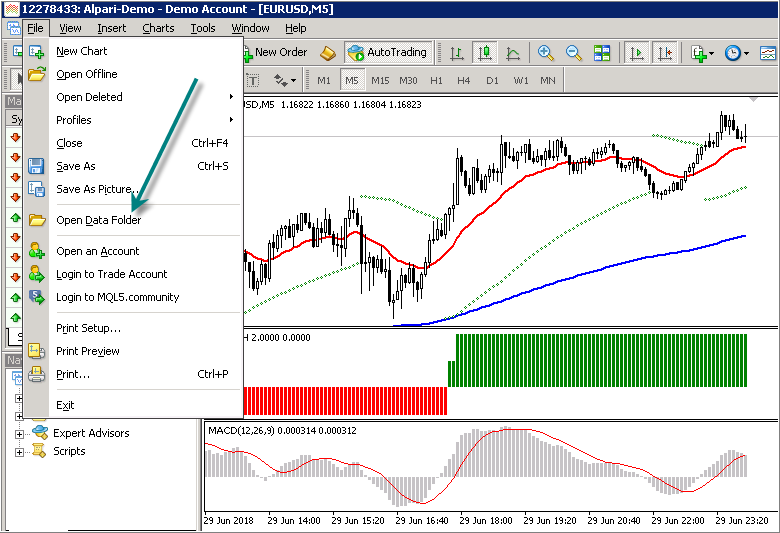

Setting Up the Forex Impulse Scalping Strategy in MT4

Step-by-Step Indicator Installation

- Download the Custom Indicators and Template: Once you’ve purchased the system, you’ll receive files for the two custom indicators and an MT4 template.

- Open Your Data Folder in MT4: Go to

File -> Open Data Folder. - Locate MQL4 Folder: Open the

MQL4folder, then find theIndicatorsfolder. - Paste the Indicators: Copy your downloaded indicators into the

Indicatorsfolder. - Restart or Refresh MT4: Close and reopen MT4, or refresh the Navigator window to see the new indicators.

- Apply the Template: Right-click on your chart, choose “Template,” then load the provided Forex Impulse Scalping Strategy template.

- Confirm Visual Display: You should now see color-coded lines and any additional signals the indicators generate.

Recommended Currency Pairs and Market Sessions

- Major Pairs (EUR/USD, GBP/USD, USD/JPY) are typically the best starting point due to their high liquidity and lower spreads.

- Market Sessions:

- London Session: Known for high volatility and volume, an excellent time for scalping.

- New York Session: Also offers robust volume, with overlapping market hours ideal for quick trades.

Chart Setup and Customization

- Timeframe: While many scalpers use 1-minute or 5-minute charts, the 15-minute can be equally profitable if you prefer slightly fewer trades and more stability.

- Additional Indicators: Avoid clutter. The strategy’s custom indicators are designed to be enough, though some traders add standard indicators (like RSI or stochastic) for personal confirmation.

Tips for Quick Implementation

- Practice in a Demo Account: Familiarize yourself with the signals and price patterns before committing real capital.

- Set Up Notifications: If your broker and trading platform support alerts, configure them so you’re notified when the indicators converge for a potential trade.

Detailed Trade Examples and Walkthrough

Bullish Trend Example (Blue Line)

Let’s say you’re on the EUR/USD 5-minute chart during the London session. The Forex Impulse Scalping Strategy displays a blue line, indicating a bullish trend. Here’s the step-by-step process:

- Indicator 1 Confirmation: The momentum filter shows that the market is gaining bullish strength (e.g., a bar on the histogram or a green arrow for momentum).

- Indicator 2 Confirmation: The second indicator might show a bullish arrow or a color-coded bar.

- Entry Trigger: Both indicators align, and the price is above the blue line, confirming an uptrend. You place a buy order.

- Stop-Loss Placement: Set it below the most recent swing low or just beneath a significant support level.

- Take-Profit: Aim for a small pip target, such as 5-10 pips, based on your comfort level and the pair’s volatility. Some traders use a 1:1 or 1:2 risk-to-reward ratio for scalping.

Bearish Trend Example (Red Line)

Now consider you’re on the GBP/USD 15-minute chart. The system’s line turns red, indicating a bearish trend. Here’s how to proceed:

- Indicator 1 Confirmation: The momentum filter shows an increase in bearish pressure (maybe a red histogram bar or downward arrow).

- Indicator 2 Confirmation: The trend filter further confirms that price action is accelerating downward.

- Entry Trigger: The price is below the red line, and both indicators indicate strong selling momentum. You place a sell order.

- Stop-Loss Placement: Set your stop just above the most recent swing high or a nearby resistance level to protect against sudden reversals.

- Take-Profit: Scalpers might target 5-15 pips or use a support area to gauge a potential exit.

When to Stay Out of the Market

Not every signal is a guaranteed win. Here are times you might avoid trading:

- Indicator Mismatch: If one indicator shows bullishness while the other remains bearish, it’s safer to wait for alignment.

- Flat Market or Sideways Consolidation: The Forex Impulse Scalping Strategy shines in trending conditions. If the market is choppy and the color-coded line frequently switches between blue and red, stand aside until a clear direction emerges.

- High-Impact News Events: Major economic releases (like Non-Farm Payrolls, central bank announcements) can cause unpredictable volatility. Unless you’re an advanced scalper, it’s wise to let the market settle first.

Entry and Exit Tactics

- Entry Confirmation: Always wait for both custom indicators to confirm a move, not just one.

- Scaling Out: Some scalpers will exit part of their position after reaching half of their profit target, then move their stop-loss to break even.

- Time-Based Exits: If a trade isn’t moving in your favor within a certain number of candles (e.g., 3-5 bars on a 5-minute chart), consider exiting to free up capital for better setups.

Risk Management Essentials

Setting Stop-Loss and Take-Profit Levels

Stop-losses (SL) and take-profits (TP) are non-negotiable in responsible scalping:

- Stop-Loss: Should be close enough to protect your equity but not so tight that you get stopped out by normal market fluctuations.

- Take-Profit: Must reflect the realistic pip movement you expect within your trading session. For scalping, TPs can be as low as 5-10 pips, depending on volatility.

Position Sizing and Risk-to-Reward Ratios

A common approach for scalpers is to risk 1-2% of their trading account on any given trade:

- Position Sizing Formula: \text{Position Size (lots)} = \frac{\text{Account Risk ($)}}{\text{Stop-Loss (pips) } \times \text{Pip Value}}

- Risk-to-Reward Ratio: While some scalpers aim for a 1:1 ratio, others seek 1:2 or higher to account for losses.

Avoiding Overtrading in Scalping

Overtrading is a common pitfall for scalpers excited by rapid market movements. To avoid it:

- Set a Daily Trade Limit: For example, cap yourself at 5-7 trades per session.

- Take Breaks: Step away from the screen if you find yourself forcing trades or chasing the market.

Emergency Exits and Worst-Case Scenarios

Forex markets can be unpredictable, and even the best strategy can falter during extreme conditions:

- Use Hard Stop-Losses: Rely on your broker’s platform to close your trade if price hits your SL, preventing catastrophic losses.

- Monitor Major News: If a surprise news event hits the market, consider manually closing positions to avoid slippage.

Embracing Trading Psychology

Managing Emotions During Quick Trades

Scalping can be psychologically intense:

- Adrenaline Rush: Rapid market changes can cause anxiety or excitement.

- Mindful Breathing: Practicing short mindfulness exercises between trades helps maintain clarity.

Maintaining Discipline and Following the System

Consistently following the Forex Impulse Scalping Strategy’s signals is crucial. Emotional trades—like “revenge trading” to recover losses—often lead to bigger losses. A few practical tips:

- Trading Plan: Write down your rules for entry, exit, SL, and TP.

- Trade Journal: Keep a record of every trade, noting why you entered and how you felt during the trade.

Developing a Growth Mindset for Scalping

Traders who adapt, learn from mistakes, and refine their strategy over time tend to be the most successful:

- Backtest and Forward-Test: Use historical data to see how the strategy would have performed, then demo trade in live market conditions.

- Continuous Improvement: Review your journal weekly or monthly to identify recurring mistakes or missed opportunities.

Bonus Tools and Resources

Beyond the core system, the Forex Impulse Scalping Strategy package includes several bonus materials designed to enhance your trading experience.

1. Candle Closing Time Indicator for MT4

- Purpose: Displays how much time remains before the current candle closes.

- Benefit: Helps you gauge momentum; if a candle is close to closing and about to form a strong bullish or bearish signal, you can time your entry more effectively.

2. Double Pipe Pattern Trading Strategy

- Focus: Identifies false breakouts around significant pivot points.

- Advantage: Useful for spotting reversals or trapped traders who entered on a false breakout.

- How to Use: Look for the formation of two consecutive spikes (pipes) near a pivot zone, then trade in the opposite direction of the breakout once confirmed.

3. eBook on Japanese Candlestick Patterns

Candlestick patterns are a cornerstone of technical analysis. This eBook covers:

- Doji, Hammer, Shooting Star, and More: Each pattern’s psychology and how to incorporate it into your scalping.

- Historical Significance: How Japanese rice traders pioneered candlestick charting to predict price movements.

- Practical Application: Combine these patterns with the Forex Impulse Scalping Strategy for an extra layer of confirmation.

How to Incorporate These Tools Effectively

- Combine Indicators Wisely: Use the Candle Closing Time Indicator for refined entries, and keep an eye out for Double Pipe Patterns at potential support or resistance zones.

- Strengthen Your Analysis: Candlestick patterns can confirm the signals from the two custom indicators. A doji near a color change (blue to red) might suggest an impending trend reversal.

Testimonials and Real-Life Feedback

1. Marco N.’s Experience

Marco was initially skeptical about trading systems, as he had encountered many overhyped products in the past. However, after rigorously testing the Forex Impulse Scalping Strategy, he reported surprisingly consistent results:

“I followed the rules exactly as described in the manuals and saw immediate improvements in my scalping. Staying disciplined was the key.”

2. Dieter K.’s Journey as a Beginner

Dieter, a complete newbie to forex trading, found the system intuitive. Although he initially struggled with emotional control, he steadily improved:

“Reading the manuals and practicing on a demo account helped me understand the indicators. I eventually opened a small live account, and I’m now seeing consistent progress.”

Importance of Following the Strategy’s Guidelines

Both testimonials underscore a critical point: The strategy works best when strictly followed. Skipping steps, ignoring signals, or deviating from the instructions typically leads to subpar results.

Pricing & Purchase

How to Buy via Digistore24

The Forex Impulse Scalping Strategy is priced at €45.90 and is available exclusively through Digistore24, a reputable payment processor that ensures secure transactions. To purchase:

- Click the Purchase Button: You’ll be redirected to Digistore24’s secure checkout page.

- Complete Payment: Choose your preferred payment method. (credit card, PayPal, etc.).

- Receive Confirmation: After successful payment, you’ll receive a confirmation email with download instructions.

Data Privacy and Security Assurances

Worried about your personal information? Rest assured, the developers have committed to respecting your privacy. Your data is not shared with third parties for advertising or spam.

Immediate Digital Download

Once payment is confirmed, you’ll have instant access to the entire package—no waiting days for shipping. Simply download the materials and begin setting up the indicators on your MT4 platform.

Frequently Asked Questions (FAQs)

1. Is the Forex Impulse Scalping Strategy Suitable for Beginners?

Absolutely. The system comes with detailed German-language manuals and is designed with user-friendliness in mind. Even if you’re just starting, the color-coded approach and clear signals minimize confusion.

2. Can I Use It on Multiple Real and Demo Accounts?

Yes. There is no limit to the number of accounts—both real and demo—that you can use with the Forex Impulse Scalping Strategy.

3. What Timeframes Work Best?

While many scalpers prefer the 1-minute or 5-minute charts, some traders find success using the 15-minute timeframe as well. It ultimately depends on your trading style and how frequently you want to trade.

4. Do I Need Additional Technical Analysis Skills?

The system is built to function primarily on its two custom indicators and color-coded trend lines. Having extra knowledge of support and resistance, candlestick patterns, or fundamental analysis can certainly help—but it’s not mandatory to start seeing results.

Conclusion

The Forex Impulse Scalping Strategy stands out in an often oversaturated market of “trading systems.” Its emphasis on trend alignment, momentum confirmation, and user-friendly interface make it a compelling choice for traders who want a scalping-focused approach without the steep learning curve of more complex methods.

Through its well-designed indicators, color-coded lines, and supporting bonus materials, the strategy ensures that both beginners and advanced traders can place trades with greater confidence and consistency. The included resources (such as the Candle Closing Time Indicator, Double Pipe Pattern Strategy, and eBook on Japanese Candlestick Patterns) further enhance your trading arsenal, offering deeper insights into the dynamics of price action.

Key Takeaways and Future Outlook

- Simplicity and Clarity: Color-coded lines and straightforward signals help you identify trade setups quickly.

- Trend-Focused: You’re always trading in the direction of the predominant trend, which inherently increases the probability of success.

- Strong Support: The accompanying manuals and bonus materials provide thorough explanations, minimizing the learning curve.

- Scalper’s Dream: If your preference is for short-term trades, this strategy caters to the rapid-in-and-out style with clear, rule-based entries and exits.

Given forex market volatility and 24-hour availability, scalping can be extremely lucrative if approached with discipline and a robust strategy. The Forex Impulse Scalping Strategy equips you with the tools and knowledge to navigate this fast-paced environment effectively.