When it comes to investing, information is power. Whether you’re a beginner looking to buy your first mutual fund or a seasoned investor refining a sophisticated portfolio, reliable research and objective analysis can be the difference between mediocre returns and long-term success. This is where Morningstar Premium steps in. Renowned for its detailed fund reports, star-rating system, and comprehensive portfolio tools, Morningstar Premium has established itself as a go-to resource for smart U.S. investors seeking data-driven, informed decision-making.

In this Morningstar Premium Review, we’ll take an in-depth look at its key features, the types of assets it covers, the benefits of using its services, and how its research tools and ratings work. We’ll also compare it to other popular investing platforms to help you determine if it’s the right fit for your investment strategy. By the end of this guide, you’ll have a clearer understanding of how Morningstar Premium can help you make smarter investment decisions and effectively strengthen your portfolio.

Table of Contents

What Is Morningstar Premium?

Morningstar is a Chicago-based global financial services firm founded in 1984 by Joe Mansueto. It has grown into one of the most influential investment research companies, commonly known for its star ratings on mutual funds, which are used by both professional financial advisors and retail investors alike.

Morningstar Premium is the company’s paid subscription service. It provides subscribers with:

- Enhanced Research Reports – Detailed analyses that dive deeper than what free users see.

- Proprietary Ratings – Access to forward-looking Analyst Ratings and other proprietary metrics.

- Exclusive Screeners – Advanced search features for funds, stocks, and ETFs based on specific metrics.

- Portfolio Management Tools – Tools like the Portfolio X-Ray that allow you to see a 360° view of your holdings.

- Planning and Education – Comprehensive investment guides and newsletters aimed at helping investors of all stripes.

For many, the hallmark of Morningstar Premium is the rigorous fund analysis. While the platform also covers stocks, ETFs, and bonds, its mutual fund and ETF data are arguably among the most exhaustive and trusted in the U.S. market.

Who Uses Morningstar Premium?

Investors with varying levels of experience subscribe to Morningstar Premium. While novice investors might enjoy the structured tools, basic data, and clear star ratings, more advanced investors appreciate the Analyst Reports, forward-looking Ratings, and deeper insights into fund strategy, expenses, management, and risk.

Key Features of Morningstar Premium

Morningstar Premium is more than just a rating system. Its ecosystem consists of multiple tools and resources that help both novice and professional investors make more informed decisions. Below are some of the core features you can access with a Morningstar Premium subscription:

Morningstar Analyst Reports

One of the prime draws of Morningstar Premium is the Morningstar Analyst Reports. These are in-depth, forward-looking research analyses written by qualified professionals employed by Morningstar. Here’s what these reports often include:

- Thesis: An overview of the investment’s strategic direction, including its main objectives and strengths.

- Performance: A look at recent and historical performance relative to benchmarks or peers.

- Management: Information about the managers or key executives, their track records, and investment philosophies.

- Risk Assessment: Analysis of volatility, sector concentration, and other risk factors.

- Valuation: For stocks, an estimate of fair value; for funds, an explanation of cost efficiency and potential growth.

- Actionable Takeaways: Prospective calls to action, such as whether a fund is undervalued, fairly valued, or overvalued.

Morningstar’s analyst team is known for applying a consistent methodology to these reports, which helps compare different funds or stocks on similar criteria. These analyses often come with a Morningstar Analyst Rating, which is a reflection of the analyst’s expectation of how the investment will perform relative to other comparable funds or stocks.

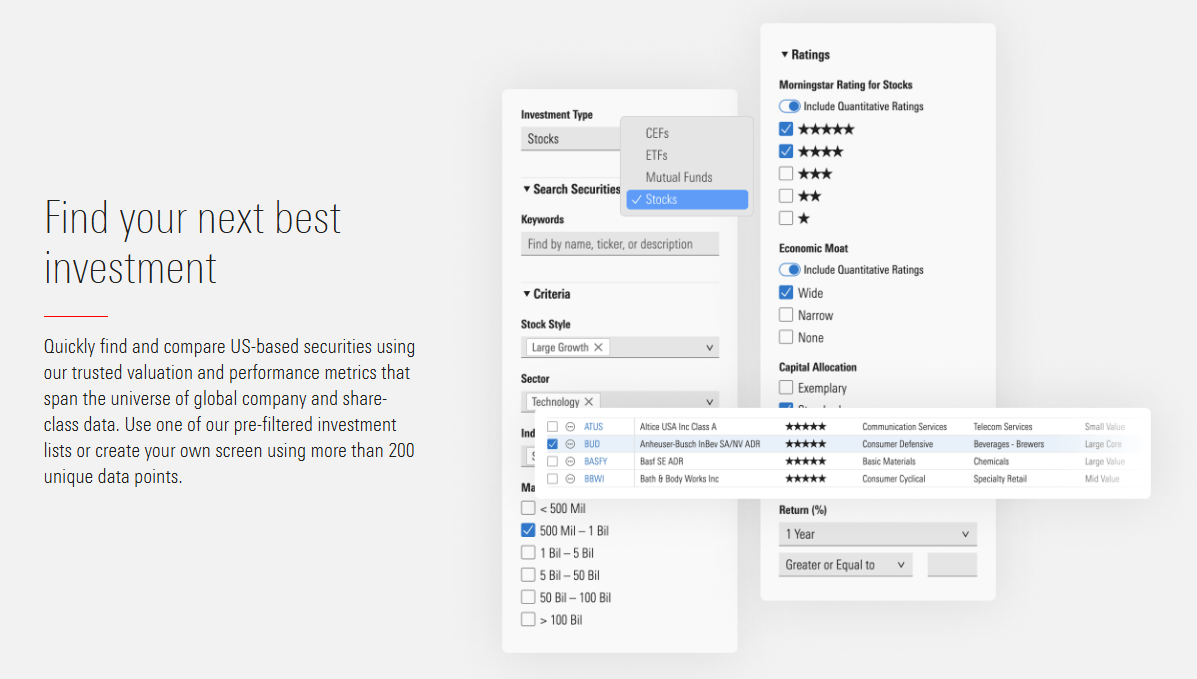

Fund Screener and Fund Compare

Morningstar provides robust screeners that let you filter through thousands of investment options. The Fund Screener is especially prized by users who want to:

- Search for funds by category (e.g., U.S. Equity, Bond, Sector Funds, International).

- Filter by performance metrics (e.g., 1-year, 3-year, 5-year returns).

- Sort by Morningstar Rating, expense ratios, manager tenure, etc.

- Customize screens with advanced metrics like alpha, beta, Sharpe ratio, and standard deviation.

Once you’ve shortlisted a few funds, you can use the Fund Compare tool to view them side-by-side. This direct comparison includes total returns, fees, asset allocation, sector breakdown, and more. This feature is crucial for those looking to pinpoint which fund can best fit specific portfolio needs.

Portfolio X-Ray

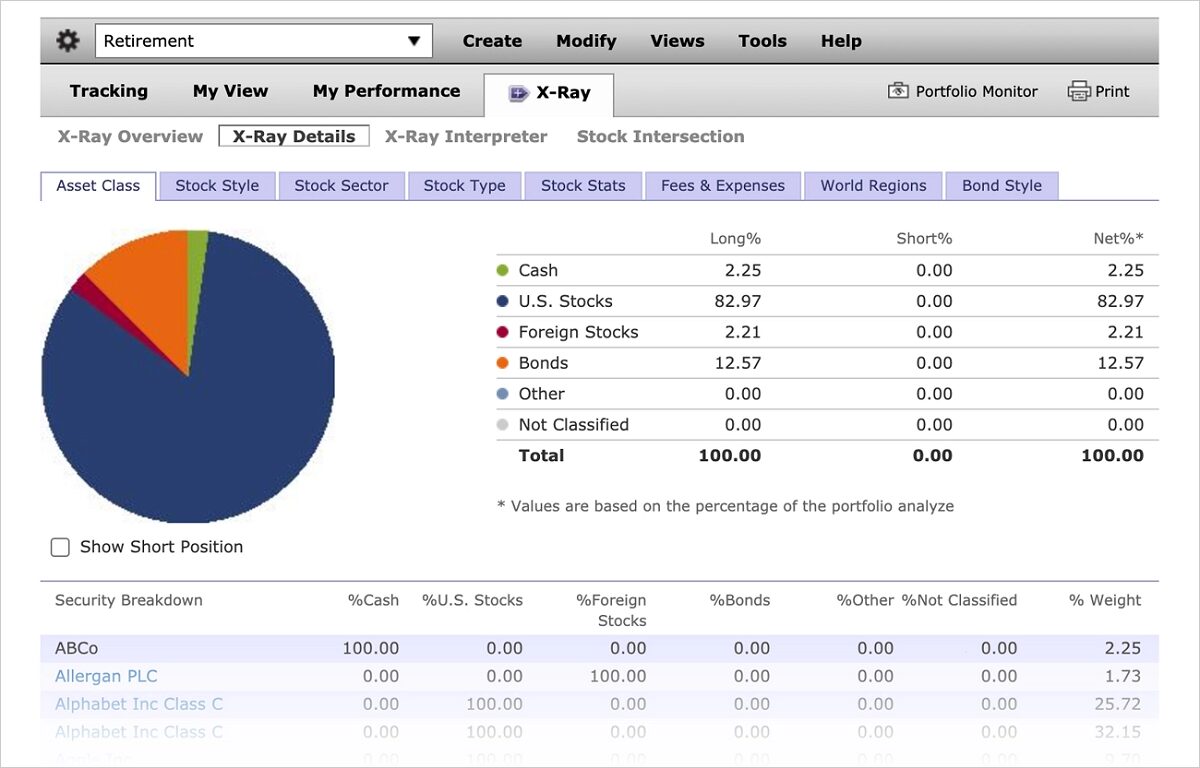

Arguably one of Morningstar Premium’s most popular features, Portfolio X-Ray allows you to:

- Aggregate Multiple Accounts: You can consolidate holdings from different brokerage accounts into one virtual portfolio.

- Analyze Asset Allocation: Identify how your portfolio is split among stocks, bonds, cash, and other asset classes.

- Sector & Region Exposure: Check if you are overexposed to certain sectors (e.g., technology) or geographic regions (e.g., North America vs. emerging markets).

- Performance Tracking: Monitor historical gains and losses, benchmark performance, and track portfolio volatility over time.

- Fee & Expense Insights: Find out how your collective expense ratios might impact returns.

This tool is especially beneficial for investors juggling multiple brokerage accounts or investments in different fund families. It brings an added layer of transparency that can help spot redundancies in your holdings or identify gaps in your asset allocation strategy.

Investment Planning Tools

Morningstar Premium offers a host of planning tools, resources, and calculators, such as:

- Retirement Calculators – Estimate how much you need to save based on your current income, expected retirement age, and lifestyle goals.

- College Savings – Helps you plan for education expenses, often factoring in inflation and historical returns.

- Asset Allocation Guidance – Offers model portfolios and historical data to guide you toward balanced, growth-oriented, or conservative allocations.

- Goal Planning – Tools that let you map your investments to life goals, ensuring your financial strategy aligns with your personal aspirations.

Stock Analysis

While Morningstar is best known for funds, it also provides deep stock research, including:

- Equity Screener – Filter stocks by market cap, sector, valuation metrics (P/E ratio, P/B ratio, PEG), dividend yield, analyst rating, and more.

- Detailed Stock Reports – Similar to the fund reports, these come with an Analyst Rating, a fair value estimate, competitive advantages (“moats”), and risk factors.

- Morningstar Fair Value – A proprietary estimate of how much a stock should be worth based on the company’s fundamentals and future growth prospects.

For investors with a more stock-centric strategy, these tools can be incredibly useful for identifying undervalued companies or for confirming a stock’s potential before adding it to a portfolio.

Bond Analysis

Morningstar Premium also offers comprehensive data on:

- Bond Funds – Access to performance, risk metrics, and manager strategies for bond mutual funds and ETFs.

- Individual Bonds – While individual bond coverage may not be as extensive as the coverage for equities, you can still find basic data, yield-to-maturity, and credit ratings.

- Bond Screener – Filter bond funds by type (corporate, government, high-yield, municipal) and by metrics like duration, yield, expense ratio, and more.

Given that many investors look to bond funds to stabilize portfolios, Morningstar’s insights can be a big help in understanding potential risks and returns in fixed-income investments.

ETF Research Tools

Exchange-Traded Funds (ETFs) continue to gain popularity for their cost efficiency and tradability. Morningstar Premium covers ETFs extensively, providing:

- ETF Ratings – A star rating system for ETFs based on risk-adjusted returns, plus forward-looking qualitative ratings for select ETFs.

- ETF Screener – Filter by expense ratio, holdings overlap, performance, and more.

- ETF Compare – A side-by-side comparison of multiple ETFs, including sector breakdown and underlying holdings.

This can be especially helpful if you are deciding between two similarly themed ETFs but want deeper insight into their respective portfolios and fees.

Morningstar Newsletters & Additional Resources

Morningstar Premium subscribers gain access to newsletters such as:

- Morningstar FundInvestor – Focuses on mutual fund picks and analysis.

- Morningstar StockInvestor – Offers equity-focused insights, featuring stock recommendations and market commentary.

- Morningstar ETFInvestor – Dives deeper into ETF strategies, recommended picks, and industry trends.

Additionally, Morningstar regularly publishes white papers, commentary, and articles covering market trends, sector analysis, and “top picks” from its analysts. These resources can be a goldmine for anyone wanting to keep a pulse on market movements and expert perspectives.

Morningstar’s Rating System

Much of the brand’s popularity comes from its iconic star rating for funds. However, there’s more to the system than a simple 1- to 5-star scale. Morningstar has developed a suite of rating methodologies, each with a specific purpose and perspective.

The Star Rating: A Backward-Looking Tool

The classic star rating is perhaps the best-known Morningstar product. Funds (and sometimes stocks and ETFs) receive between 1 and 5 stars based on their historical risk-adjusted returns.

- 1 Star = Poor risk-adjusted performance relative to category peers

- 3 Stars = Average risk-adjusted performance

- 5 Stars = Excellent risk-adjusted performance relative to category

Key points to remember:

- Category-specific: A small-cap growth fund is only compared with other small-cap growth funds, for instance.

- Historical: The rating is based on past returns and does not necessarily predict future performance.

- Risk-adjusted: Funds that take on more risk may be penalized unless their returns justify that additional risk.

Because the star rating is purely based on quantitative historical data, it has limitations. A 5-star fund does not guarantee future outperformance, and a 1-star fund might still have good prospects under new management or a changing strategy.

The Analyst Rating: A Forward-Looking Assessment

To address the shortfalls of backward-looking data, Morningstar introduced the Analyst Rating. This rating relies on the expertise of Morningstar’s analysts and serves as a forward-looking metric.

Analyst Rating Tiers:

- Gold: The analyst believes the fund is among the best in its category and is highly likely to outperform on a risk-adjusted basis over a full market cycle.

- Silver: The fund is deemed to have solid advantages and is likely to outperform, though perhaps not as strongly as a Gold-rated fund.

- Bronze: The fund has certain strengths that likely outweigh its weaknesses and is expected to outperform peers, at least moderately.

- Neutral: The fund neither stands out as particularly strong nor particularly weak.

- Negative: The analyst believes the fund is unlikely to perform well relative to similar products.

Analysts consider many factors, such as the fund manager’s track record, expense ratio, fund strategy, and stewardship. While not a crystal ball, these insights add an additional layer of scrutiny that historical data alone cannot provide.

Quantitative Ratings: Bridging the Gaps

Given the sheer volume of funds and stocks, Morningstar’s analysts cannot provide a forward-looking Analyst Rating for every single security. That’s where the Quantitative Rating (Q Rating) comes into play. This rating uses algorithms and statistical models to approximate the methodology that analysts use, producing a forward-looking perspective for funds and stocks that lack direct analyst coverage.

- Q Gold, Q Silver, Q Bronze, Q Neutral, Q Negative – These mirror the Analyst Rating tiers. The difference is that a machine-driven model is making the judgments based on historical data, fees, performance patterns, and other quantitative factors.

For many investors, the Q Rating helps fill coverage gaps and offers a preliminary read on funds or stocks that might otherwise lack in-depth analysis.

Morningstar Premium’s Role in U.S. Investing

Morningstar Premium is particularly influential in the United States, where mutual funds, ETFs, and retirement accounts like 401(k)s and IRAs form the backbone of individual investing. Let’s look at how Morningstar Premium aids U.S. investors across various asset types.

Relevance to Mutual Funds

Mutual funds remain one of the largest categories of investment for U.S. retail investors, especially in retirement accounts. Morningstar Premium provides:

- Deep Analysis: Detailed looks at strategy, cost, and management for thousands of funds.

- Peer Comparison: Tools that highlight where a mutual fund stands relative to its category peers in terms of expenses, returns, and risk profile.

- Forward-Looking Opinions: Analyst Ratings that can help you decide if a fund aligns with your investment outlook.

Relevance to ETFs

ETFs are an increasingly popular alternative to mutual funds due to lower fees and intraday tradability. Morningstar Premium:

- Rates and reviews ETFs using a similar star-rating system and forward-looking assessments (where available).

- Provides ETF screeners to discover niche or specialized ETFs for specific strategies like sector investing or factor-based investing.

- Helps you compare the total cost of ownership and underlying assets of different ETFs.

Relevance to Stocks

Morningstar is well-known for its fair value estimates and moat ratings for stocks. Subscribers can:

- Identify undervalued stocks that Morningstar analysts believe have a competitive advantage.

- Set price alerts or watchlists to act on market dips or breaks above certain thresholds.

- Access advanced metrics and research that detail a company’s fundamentals, industry outlook, and potential catalysts.

Relevance to Bonds

Fixed-income investments are essential for many portfolios looking to balance volatility from equity investments. Morningstar Premium:

- Offers a well-rounded approach to bond fund analysis, focusing on duration, yield, credit quality, and fees.

- Allows side-by-side comparisons of different bond funds or ETFs.

- Provides fundamental data and yields for various bond categories, helping you gauge risk-return trade-offs.

Portfolio Building and Asset Allocation

A crucial aspect of successful investing lies in selecting the right mix of asset classes—equities, fixed income, real estate, cash, and other investments—that align with your risk tolerance and financial goals. Morningstar Premium’s suite of tools aids in both the selection and evaluation stages, ensuring that you not only pick strong investments but also assemble them cohesively.

Using Morningstar’s Tools to Diversify

Diversification is about reducing risk by investing across various sectors, regions, and asset classes. With Morningstar Premium, you can:

- Research Overlaps: Use Portfolio X-Ray to see if multiple holdings invest heavily in the same stocks or sectors.

- Set Allocation Targets: Morningstar’s calculators and model portfolios can guide you toward an ideal equity-to-bond ratio based on your time horizon and risk tolerance.

- Track Sector Shifts: Keep tabs on sector weightings (e.g., technology, healthcare, consumer staples) to ensure balance and respond to market changes.

Example of Building a Balanced Portfolio

Let’s say you want a moderately aggressive portfolio (around 70% stocks, 30% bonds). Using Morningstar Premium:

- Start with a Core Equity Fund: Screen for a large-cap blend mutual fund or ETF that has at least a Bronze rating or better, low expense ratio, and strong manager tenure.

- Add Mid/Small-Cap Exposure: Find a small or mid-cap fund with a proven track record or a favorable Analyst Rating to capture growth potential outside large-caps.

- Include International Equity: Look for an international fund to spread risk geographically. Target countries in both developed and emerging markets.

- Incorporate Bond Holdings: For the 30% bond allocation, you could opt for a core bond fund or a total bond market ETF with a good Morningstar Rating.

- Review with Portfolio X-Ray: Evaluate your sector and geographic exposure, ensuring you’re not over-concentrated. Check overall fees, top holdings, and performance metrics.

- Monitor Periodically: Revisit your portfolio monthly or quarterly to see if any fund is lagging severely, incurring higher fees, or changing strategy.

By combining thorough research (Analyst Reports, Ratings, Screener) with the Portfolio X-Ray tool, you create a more disciplined framework for portfolio construction and maintenance.

Morningstar Premium vs Competitors

Morningstar Premium does not operate in a vacuum. Several other platforms provide investment research, ratings, and portfolio tools. Here’s how Morningstar Premium compares to some of its direct competitors.

Seeking Alpha

- Focus: Primarily stock market commentary and crowd-sourced articles.

- Strength: Real-time market news, in-depth articles from an active community of analysts and contributors, and premium services for stock picking.

- Comparison: While Seeking Alpha is strong for stock-focused discussion, it lacks the robust mutual fund and ETF coverage that Morningstar offers. Morningstar’s professional Analyst Reports are more standardized and consistent than user-generated content.

The Motley Fool

- Focus: Premium subscription services offering stock picks (e.g., Stock Advisor, Rule Breakers).

- Strength: Easy-to-digest newsletters, recommended picks often focused on growth stocks, and a strong community.

- Comparison: The Motley Fool leans heavily toward active stock picking and providing trade ideas, while Morningstar is more comprehensive across funds, stocks, and ETFs with methodical data. If you are specifically looking for funds and portfolio analysis, Morningstar is often superior.

Zacks Investment Research

- Focus: Quantitative models that rank stocks and funds based on momentum, earnings estimate revisions, etc.

- Strength: Proven track record for short-term stock selection, daily newsletters, and stock screeners.

- Comparison: Zacks is more of a momentum- and earnings-driven approach, focusing on short- to medium-term performance. Morningstar tends to evaluate long-term fundamentals and risk-adjusted measures, making it more suitable for longer-term or buy-and-hold investors.

Yahoo Finance Premium

- Focus: Enhanced stock research, charting tools, and curated investment ideas.

- Strength: Integration with a leading financial news platform, user-friendly interface, real-time market data.

- Comparison: Yahoo Finance Premium does not offer the same depth in mutual fund and ETF analysis as Morningstar. However, its real-time data and easy interface can be appealing. Morningstar’s advantage remains its comprehensive, high-caliber fund reports and portfolio analytics.

Pricing and Subscription Model

Before signing up for Morningstar Premium, it’s essential to understand the cost structure and what you get for your money.

Free Trial

Morningstar often offers a 14-day free trial for those wanting to test its Premium features. During this trial, you can explore:

- Analyst Reports

- Portfolio X-Ray

- Advanced screeners

- Morningstar newsletters

You do have to provide credit card information upfront, and if you don’t cancel before the trial ends, your subscription will automatically renew into a paid plan.

Annual vs. Monthly Subscriptions

Morningstar Premium typically comes in two billing options:

- Monthly Plan: A higher per-month cost but offers the flexibility to cancel anytime.

- Annual Plan: A lower monthly average cost if you commit for an entire year.

Though exact prices can vary, expect to pay somewhere around $199 to $249 per year if you opt for an annual subscription. Monthly can range around $30–$35 if you choose that route.

Refunds and Cancellation Policy

Morningstar has had varying policies over time regarding refunds. Typically:

- Cancellation: You can cancel anytime, but refunds for partial months or partial years may not be available.

- 30-Day Money-Back Guarantee: In some promotional periods, Morningstar may offer a 30-day money-back guarantee, so read the terms before finalizing your subscription.

Who Should Use Morningstar Premium?

Morningstar Premium suits a wide range of investors, but particularly those who:

- Value In-Depth Fund Analysis: If mutual funds or ETFs form a large part of your portfolio, Morningstar’s research is some of the best in the industry.

- Use a Data-Driven Approach: The combination of star ratings, Analyst Ratings, and quantitative data appeals to investors who want thorough, analytical input.

- Manage Multiple Accounts: With Portfolio X-Ray, you can get a full picture even if your assets are scattered across IRAs, 401(k)s, and brokerage accounts.

- Want to Refine Asset Allocation: The platform’s diversification analysis and model portfolios offer clarity in constructing balanced portfolios.

- Seek a One-Stop-Shop: From stocks to bonds to ETFs, Morningstar Premium covers a broad spectrum of investments, reducing the need to subscribe to multiple services.

On the other hand, if you’re solely focused on short-term trades, day trading, or crypto assets, Morningstar Premium might not be the best fit. Its strength is in long-term, fundamental, and risk-adjusted analysis, not in short-term market speculation.

Pros and Cons

Below is a quick snapshot to help you weigh whether Morningstar Premium is worth the investment:

Pros

- Comprehensive Coverage: Stocks, mutual funds, ETFs, and bond funds all in one place.

- Reputable Ratings: The star rating and Analyst Rating systems are considered industry standards.

- Portfolio X-Ray Tool: Offers a 360° view of asset allocation, fees, and sector/region exposures.

- In-Depth Analyst Reports: Forward-looking and thoughtful analyses help investors understand not just performance, but why a fund or stock is a good (or poor) investment.

- Educational Resources: Newsletters, tutorials, and articles for all levels of investor experience.

Cons

- Cost: The annual fee can be steep for some, especially if you’re a new investor or on a tight budget.

- Limited Coverage for Very Niche Investments: If you’re interested in highly speculative securities, private placements, or certain alternative assets, Morningstar might not cover them extensively.

- Overwhelming for Beginners: The sheer volume of data and tools can be intimidating if you’re brand-new to investing.

- Focus on U.S. Markets: While Morningstar is global, the most comprehensive coverage and analysis are on U.S.-listed funds and stocks.

Expert Tips for Maximizing Morningstar Premium

Even seasoned investors can overlook some valuable features. Here are a few tips:

- Start with a Clear Goal: Are you building a retirement portfolio, saving for a down payment, or simply testing strategies? Customize Morningstar’s tools accordingly.

- Experiment with Screeners: Don’t just use default settings—play with advanced filters like Sharpe ratio, Standard Deviation, or Alpha to uncover lesser-known but solid funds or stocks.

- Check Fees Carefully: Use the Portfolio X-Ray to calculate your overall expense ratio if you hold multiple mutual funds or ETFs. High fees can erode returns over time.

- Read Analyst Reports Thoroughly: Don’t just look at the Rating or the summary. Delve into the rationale behind the rating. If an analyst highlights potential red flags, pay attention.

- Utilize Model Portfolios: Morningstar often provides sample portfolios that can serve as a reference. You can tweak these models to fit your risk tolerance or investment timeline.

- Monitor Performance Regularly: Set a schedule—monthly, quarterly, or semi-annually—to review how your portfolio is tracking against benchmarks. Morningstar’s performance charts and metrics can highlight when rebalancing is needed.

- Learn the Lingo: Terms like “moat,” “Style Box,” “R-squared,” and “Sortino ratio” are frequently mentioned. Understanding these concepts will make your time on the platform far more productive.

Real-Life Example and Walkthrough

Sometimes the best way to see the value of a tool is to walk through an example. Below is a hypothetical scenario showcasing how an investor might use Morningstar Premium.

Analyzing a Hypothetical Mutual Fund

Fund: ABC Growth Fund (a fictional fund)

- Search and Initial Glance

- You type “ABC Growth Fund” into Morningstar’s search bar.

- Right away, you see it has a 4-star rating and a Silver Analyst Rating. The expense ratio is 0.75%, which is slightly higher than average for its category but not excessive.

- Morningstar Analyst Report

- The analyst’s summary points out that the fund’s manager has 15 years of experience.

- The strategy focuses on large-cap growth stocks, primarily in the technology sector.

- Over the past 5 years, it has outperformed its benchmark (the S&P 500 Growth Index) by ~1.5% annually.

- Risk and Performance Metrics

- Standard Deviation is slightly higher than the category average, indicating more volatility.

- Sharpe Ratio is above 1, suggesting good risk-adjusted returns.

- The fund’s worst drawdown was -18% during a market downturn, but it recovered faster than peers.

- Analyst Opinion

- The forward-looking view is optimistic, citing strong management, a proven track record, and moderate fees.

- Potential concerns include a heavy technology tilt, which could underperform if tech stocks slump.

- Add to Portfolio X-Ray

- If you already hold tech-heavy funds like a NASDAQ index or a large holding in technology stocks, the X-Ray might show you have an overconcentration in tech.

- This insight might lead you to reduce or adjust your holdings to avoid unbalanced exposure.

- Actionable Decision

- Based on the analyst report and your portfolio review, you decide to invest in the ABC Growth Fund but in moderation—perhaps allocating 10% of your equity portion.

- You set up an alert to track changes in the Analyst Rating or any significant performance shifts.

Through this example, you can see how Morningstar Premium guides users from initial discovery to in-depth analysis and final decision-making.

Commonly Asked Questions

- Is Morningstar Premium worth it for beginner investors?

- If you are serious about understanding investments and want comprehensive tools, it can be very helpful. Beginners might feel some information overload, but Morningstar’s educational materials can ease the learning curve.

- How often are the Analyst Reports updated?

- Morningstar’s analysts update reports when material changes occur (e.g., a new fund manager, strategy shift) or during periodic reviews (often annually). You can see the last update date at the top of each report.

- Does Morningstar cover international funds?

- Yes, it does, although coverage is most extensive for U.S.-domiciled funds. International funds still receive star ratings and, in some cases, Analyst Ratings, but the depth can vary depending on the region.

- What is the difference between the Star Rating and the Analyst Rating?

- Star Rating is backward-looking, assessing historical performance on a risk-adjusted basis. Analyst Rating is forward-looking, where analysts evaluate factors like management, strategy, and fund stewardship to gauge future potential.

- Can I track multiple portfolios under one Premium subscription?

- Yes. You can create multiple virtual portfolios (e.g., “My IRA,” “My 401(k),” “My Brokerage Account”) and run them each through the Portfolio X-Ray tool to get a consolidated or separate view.

- What if I only invest in ETFs and no mutual funds?

- Morningstar Premium is still useful. It offers ETF screeners, Analyst Reports (for some ETFs), and star ratings. The Portfolio X-Ray tool also works just as effectively with ETFs.

- Does Morningstar Premium provide real-time market data?

- It provides delayed quotes for stocks and funds. If you need ultra-real-time data, you may need another brokerage platform. However, for long-term investors, delayed quotes are often sufficient.

- Is there an app for mobile devices?

- Morningstar does have apps, but most advanced features (like the Portfolio X-Ray) are best utilized via the desktop or browser interface. The mobile app can still offer quick checks and portfolio snapshots on the go.

Conclusion

Morningstar Premium stands as one of the most recognized research platforms for U.S. investors seeking in-depth fund, stock, and ETF analysis. Its backbone—the star rating system—remains an industry staple, but it’s the Analyst Reports, forward-looking Analyst Ratings, and the Portfolio X-Ray tool that truly elevate the subscription to a must-have for those deeply involved in self-directed investing.

From building a balanced portfolio to pinpointing funds that align with your risk tolerance and objectives, Morningstar Premium helps streamline complex decisions. While it comes with a cost that may deter casual investors, those who aim to manage a sizable or intricate portfolio can quickly see value in the depth and breadth of research. Moreover, the platform’s consistent methodology and transparent rating criteria bring an added layer of confidence to investment decisions—especially in a market filled with competing voices and opinions.

Ultimately, if you’re looking for robust, methodical, and well-respected tools for mutual fund, ETF, and stock analysis, Morningstar Premium remains a top-tier choice. Even though the service is particularly strong for mutual funds (given Morningstar’s long-standing reputation in the fund world), the additional coverage for ETFs, stocks, and bonds ensures a well-rounded investment research experience. Whether you’re starting a new 401(k) or refining a decades-old portfolio, Morningstar Premium can help guide your steps with data-backed insights and professional analysis.

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Always conduct your own due diligence or consult a qualified financial advisor before making investment decisions.