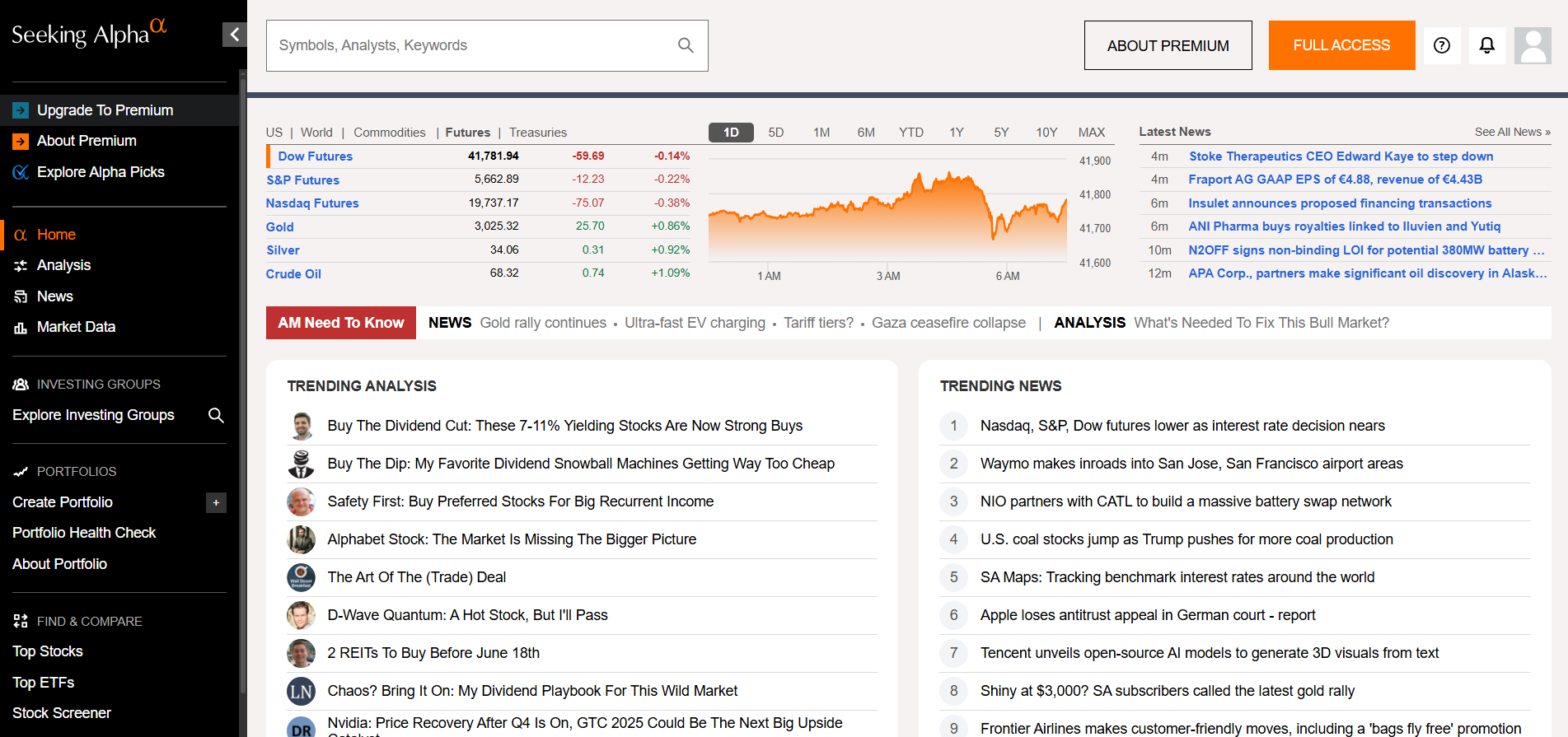

Navigating the stock market can feel like searching for hidden treasure without a map—you know there’s potential, but figuring out where to look and how to get there can be overwhelming. This is where investment research platforms come in, offering the insights and data needed to make informed decisions. Among the many options available, Seeking Alpha Premium stands out as a leading resource, combining a vast community of investors, expert-driven crowd-sourced analysis, and a unique Quant Ratings system that ranks stocks based on key financial metrics.

Over the years, Seeking Alpha has grown from a community-driven blog where investors shared insights into a full-fledged research powerhouse with multiple subscription tiers, including its Premium plan. But is Seeking Alpha Premium truly worth the investment? How reliable are its Quant Ratings? Does crowd-sourced analysis provide a meaningful edge, or does it introduce more noise than value?

In this Seeking Alpha Premium review, we’ll take an in-depth look at everything the subscription offers, from unlimited article access and detailed stock ratings to advanced screening tools and earnings call transcripts. We’ll also examine how the platform compares to competitors, highlight real-world use cases, and break down whether the features align with different investing styles.

Table of Contents

Understanding Seeking Alpha

What is Seeking Alpha?

Seeking Alpha is a financial website that was originally built around contributions from a wide variety of authors—ranging from hobbyist traders to professional analysts—aimed at providing stock market insights, investment ideas, and analyses. The platform started around 2004 with a simple objective: offer a community-driven space where investors could share detailed opinions, research, and commentary on publicly traded companies, macroeconomic trends, and investment strategies.

Over the years, Seeking Alpha has expanded in both scope and credibility. Its content is often referenced by market participants for timely analysis, contrarian viewpoints, and deep dives into companies that may be ignored by larger Wall Street research firms. Articles on Seeking Alpha can cover:

- Individual Stock Coverage – Detailed breakdowns of a single company’s financials, future prospects, management commentary, growth potential, and risks.

- Sector or Industry Overviews – Articles that look at broader trends and emerging themes within sectors like technology, healthcare, energy, and financials.

- Macroeconomic Insights – Content focusing on Federal Reserve decisions, fiscal policy, economic releases, and how they might impact the markets.

- Investment Strategy Guides – Explorations of different investing approaches (e.g., dividend growth, value investing, growth stocks, etc.).

- Market Sentiment and Behavioral Factors – Crowd psychology, investor sentiment, market cycles, and how they influence stock valuations.

Community-Driven Content

What makes Seeking Alpha unique is its strong emphasis on community-generated content. Some articles are authored by professionals working in hedge funds or private equity, but others come from independent bloggers or individual investors who have a passion for research. This crowd-sourced model provides a diversity of views and insights that you might not get in more mainstream or “traditional” analyst reports.

On any given stock ticker page within Seeking Alpha, you’ll often find a variety of articles that present bullish and bearish cases. This is extremely helpful if you’re trying to get a 360-degree view of an investment. While mainstream research might give you one or two opinions on the stock, Seeking Alpha might have dozens—allowing you to form your own well-rounded perspective.

Evolution Into a Research Platform

Beyond its article repository, Seeking Alpha has expanded into an all-in-one research platform. This includes:

- Interactive discussion forums on specific companies and sectors.

- Earnings call transcripts that are quickly posted for reference.

- Financial data on stock performance, valuation metrics, and key ratios.

- Tools such as watchlists and automated stock screeners.

Seeking Alpha also offers three primary tiers: a free version, a Premium subscription, and a higher-end plan known as “Pro.” We’ll dive into exactly what Premium offers in a later section, but keep in mind that the platform’s value stems from both the breadth of content and the unique perspectives contributed by a global community of analysts, investors, and finance enthusiasts.

The Value of Crowd-Sourced Analysis

What is Crowd-Sourced Analysis?

Crowd-sourced analysis is an approach where a large, diverse group of people collectively generate insights, opinions, or research. In the financial world, it can be immensely powerful because it breaks away from the “ivory tower” of professional analyst reports and broadens the perspective to many individuals—each bringing unique experiences, viewpoints, or specialized knowledge.

The idea is that, by gathering contributions from a large pool of minds, you can surface opportunities and risks that a single research team might miss. This is often referred to as the “wisdom of the crowd,” a concept suggesting that decentralized groups are typically better at problem-solving, innovation, and forecasting than even the most skilled individual expert—although there can be exceptions.

How Seeking Alpha Harnesses Crowd-Sourced Analysis

Seeking Alpha’s content pipeline is largely driven by tens of thousands of contributors over the years. Here’s how it typically works:

- Authors Submit Articles – Anyone meeting Seeking Alpha’s contributor guidelines can submit an article for publication. These articles can be short analyses, in-depth theses on individual stocks, or broader market commentaries.

- Editorial Review – Articles go through an editorial process to ensure they meet basic standards. That said, the editorial standards aren’t necessarily as stringent as those of an institutional research house, so quality can vary.

- User Interaction – Once published, articles are open for comments. Readers often scrutinize the analysis, ask questions, or provide opposing views and supplemental data. This leads to lively discussions, sometimes unearthing additional insight or highlighting flaws in the original thesis.

- Rating System & Author Reputation – Seeking Alpha allows readers to “follow” authors and also can show how an author’s past calls have performed over time. This tends to naturally filter out lower-quality contributions and amplify top-notch analysts or authors with strong track records.

Pros & Cons of Crowd-Sourced Analysis

While the crowd-sourced nature of Seeking Alpha can be incredibly beneficial, it also comes with some caveats:

Pros

- Broad Perspectives: Multiple angles on the same stock, often uncovering lesser-known details.

- Timeliness: Articles can be published quickly, reacting to breaking news and events faster than some institutional reports.

- Community Engagement: The comment sections can refine or challenge the original analysis, offering ongoing peer review.

Cons

- Varied Quality: Not all authors have the same expertise, and some articles may be biased, incorrect, or overly promotional.

- Potential Hype or Herd Mentality: Crowd-sourced platforms sometimes fall victim to hype cycles, where consensus forms around a narrative without strong fundamental support.

- Limited Accountability: While Seeking Alpha does track performance, and authors build reputations, there is no strict regulatory oversight or uniform standard, so readers must do their own due diligence.

In essence, crowd-sourced analysis can be a powerful arrow in your quiver of investment research—provided you remain critical, do your own fact-checking, and use the analysis as a starting point rather than an absolute conclusion.

Introduction to Quant Ratings

Defining Quant Ratings

“Quant Ratings” refer to algorithmically generated scores that aim to summarize a stock’s investment potential based on quantitative factors. These can include financial metrics like revenue growth, profit margins, valuations, analyst estimates, earnings momentum, and more.

Rather than read through reams of data manually, the quant model automates the process of evaluating key metrics. For example, if a stock has steadily rising revenues, strong profitability, an attractive valuation relative to its peers, and upward-trending earnings revisions, the quant model might rate it favorably. On the other hand, a stock with inconsistent earnings, high valuation multiples, or negative analyst revisions could be rated poorly.

Why Quant Ratings Matter

- Efficiency: They save time by consolidating a variety of metrics into a single, easy-to-understand score or rating.

- Objectivity: Human biases can cloud judgment. An algorithmic approach helps remove emotional decision-making (e.g., fear, greed, or recency bias).

- Comparability: Because the scoring is systematic, it’s easier to compare ratings across multiple stocks or even entire sectors.

Potential Limitations of Quant Ratings

While Quant Ratings can be a valuable tool, they are not infallible. They rely heavily on historical and real-time data that might not account for “black swan” events, unexpected corporate governance issues, or brand-new product innovations that aren’t yet reflected in the data. Moreover, quant models often struggle with forward-looking qualitative factors like a visionary CEO, patent pipelines, or disruptive business strategies.

Therefore, most savvy investors use Quant Ratings as a starting point or an additional data point in their analysis, rather than a final verdict on whether to buy or sell.

Detailed Look at Seeking Alpha Premium Features

Now that we have an understanding of how Seeking Alpha operates and the fundamentals of crowd-sourced analysis and Quant Ratings, let’s focus on Seeking Alpha Premium itself. The Premium tier is designed to transform the platform from a free content aggregator into a more robust, feature-rich research environment.

Premium vs. Free vs. Pro

- Free: Allows you to read a limited number of articles each month, access basic stock quotes, and browse some financial data. However, deeper content (like older articles, certain tools, and in-depth analyses) is restricted or hidden behind paywalls.

- Premium: Unlocks unlimited article access, deeper data and analysis tools, advanced screening capabilities, Quant Ratings, author performance metrics, and more.

- Pro: The highest subscription level is intended for professionals or advanced traders who need real-time alerts on top investment ideas, exclusive content, and specialized tools. This plan is significantly more expensive and includes features not typically necessary for most individual retail investors.

Key Features of Seeking Alpha Premium

1. Unlimited Access to Articles

One of the biggest draws of Premium is the unlimited access to Seeking Alpha’s massive archive of articles. As a free user, you may quickly hit a monthly limit on how many pieces you can read, which can be frustrating if you’re trying to research multiple companies or read older articles for historical context. With Premium:

- You can read as many articles as you want without worrying about paywalls.

- You gain access to older articles that can provide insights into an author’s track record or a company’s historical performance.

- You no longer have to ration your clicks or constantly clear browser cookies just to access more free articles.

2. Earnings Call Transcripts & Presentations

Seeking Alpha is known for its extensive, timely library of earnings call transcripts. With Premium, you gain:

- Ad-free and quick access to transcripts without being locked out after a certain number of views.

- Ability to read older transcripts for historical comparisons to see if management’s words match actual performance.

- Accompanying presentations from the company’s investor relations section (if available), often in a more convenient format than rummaging through the SEC website.

Being able to read multiple quarters’ worth of earnings transcripts in one sitting can give you deep insight into how management’s tone, guidance, and strategy have evolved over time.

3. Quant Ratings & Factor Grades

Premium subscribers get full access to Seeking Alpha’s Quant Ratings, which evaluate stocks on multiple factors such as:

- Value: Is the stock priced attractively compared to its fundamentals?

- Growth: Are revenues, earnings, and cash flows trending up?

- Profitability: Do the company’s margins and returns compare favorably to its peers?

- Momentum: Has recent stock price performance outpaced that of similar companies?

- Revisions: Are analysts raising or lowering earnings estimates?

Each factor is given a letter grade (A+ down to F), and the overall Quant Rating combines them into a single metric. This grading system is a simple and quick way to screen for high-quality or problematic stocks without manually combing through dozens of financial statements.

4. Author & Article Performance Analysis

A major part of the Premium experience is the ability to see an author’s track record:

- Performance metrics show how an author’s past stock picks have fared relative to sector benchmarks or the S&P 500.

- You can sort articles by performance, allowing you to find authors who consistently outperformed.

- This functionality also allows you to read older articles from top-performing authors, gleaning insights from their past analyses.

This feature is invaluable if you are looking to identify reliable voices on the platform. In the free version, you might read an article without knowing whether the author has a history of strong calls or if they have repeatedly been off the mark.

5. Advanced Screening & Data Visualizations

Premium subscribers also gain access to more advanced tools for screening and analyzing stocks:

- Stock Screeners: You can filter companies based on market cap, valuation metrics, dividend yield, Quant Ratings, and more.

- Comparative Metrics: Compare stocks side by side across various financial ratios, growth metrics, and analyst estimates.

- Charting Tools: While not as robust as specialized charting platforms, Seeking Alpha’s integrated charts allow you to view price performance against specific events or compare multiple tickers on the same graph.

These features can save you time. Rather than going to multiple websites for data, charting, transcripts, and community discussions, you can handle a lot of your research workflow on Seeking Alpha’s single, integrated platform.

6. Top Ideas & Editorial Picks

While the free version of Seeking Alpha can show you trending articles, Premium will often highlight Top Ideas or Editor’s Picks, which are curated analyses deemed especially insightful or timely. This can help you cut through the noise and focus on high-value content, especially if you’re short on research time.

Also, some authors might keep certain in-depth or time-sensitive analyses exclusively behind the Premium paywall. If you’re tracking a particular author or sector, having Premium ensures you don’t miss those exclusive pieces.

7. Ad-Free Experience

Let’s be honest—most of us find ads a little distracting. One added bonus of a Premium subscription is an ad-free reading experience, making the interface cleaner and more streamlined. While not a core functional feature, it can reduce distractions and help you focus purely on research.

User Interface & Experience

Overall, Seeking Alpha’s user interface is relatively straightforward:

- Navigation Bar: Provides easy access to Markets, Ideas, Portfolio, and Quant Ratings.

- Ticker Pages: Searching for a ticker (e.g., AAPL) brings you to a dedicated page with price charts, ratings, articles, transcripts, and key financials.

- Watchlists: You can create watchlists to monitor the stocks you care about, along with relevant articles.

For Premium subscribers, the interface is expanded with additional data panels, performance metrics, and fewer locked sections. The site’s layout is designed to guide you to top news, trending tickers, or newly published articles without feeling overwhelming. However, like any tool, it takes a bit of time to learn where everything is and how best to tailor it to your workflow.

Pricing and Plans

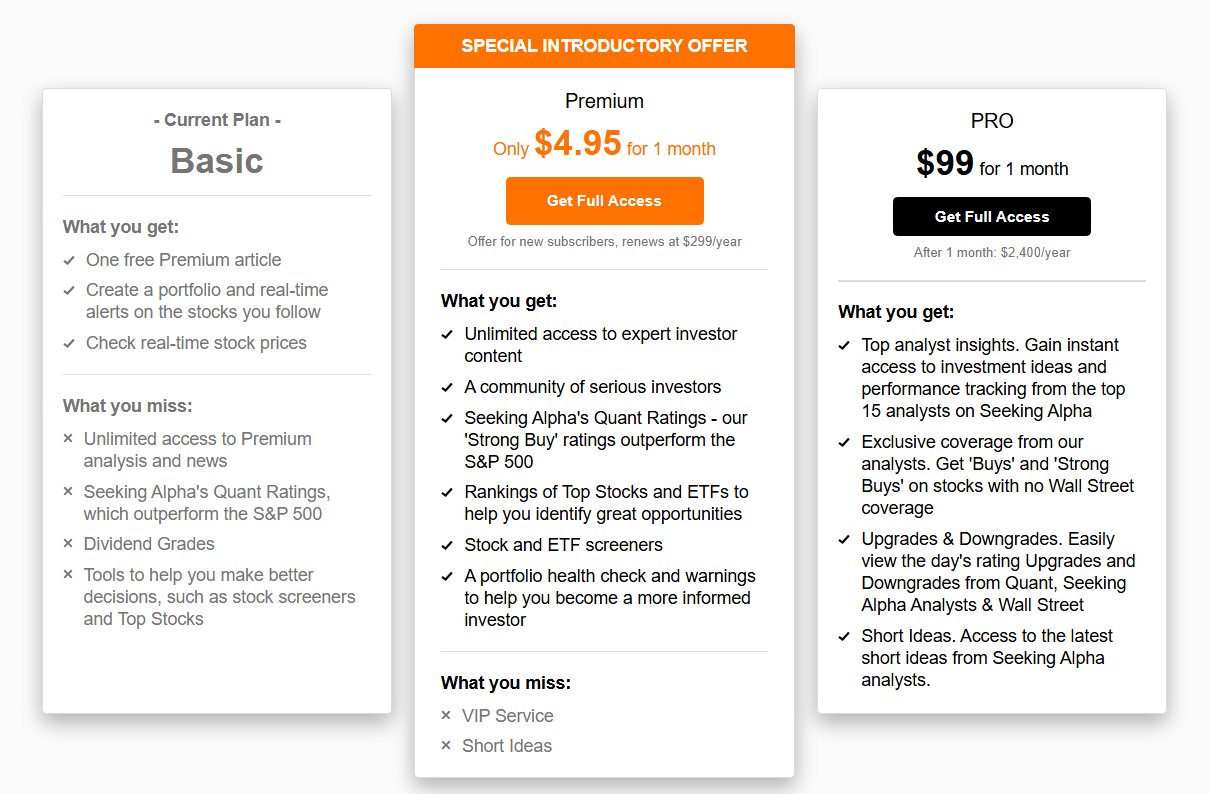

Seeking Alpha currently offers three membership tiers: Basic, Premium, and Pro, each catering to different levels of investor needs.

Basic Plan:

Free to use, but comes with significant limitations. You’ll get access to one free Premium article, the ability to create a portfolio with real-time stock alerts, and real-time stock prices. However, you’ll miss out on unlimited Premium articles, Quant Ratings, dividend grades, and advanced research tools like stock screeners and top stock rankings.

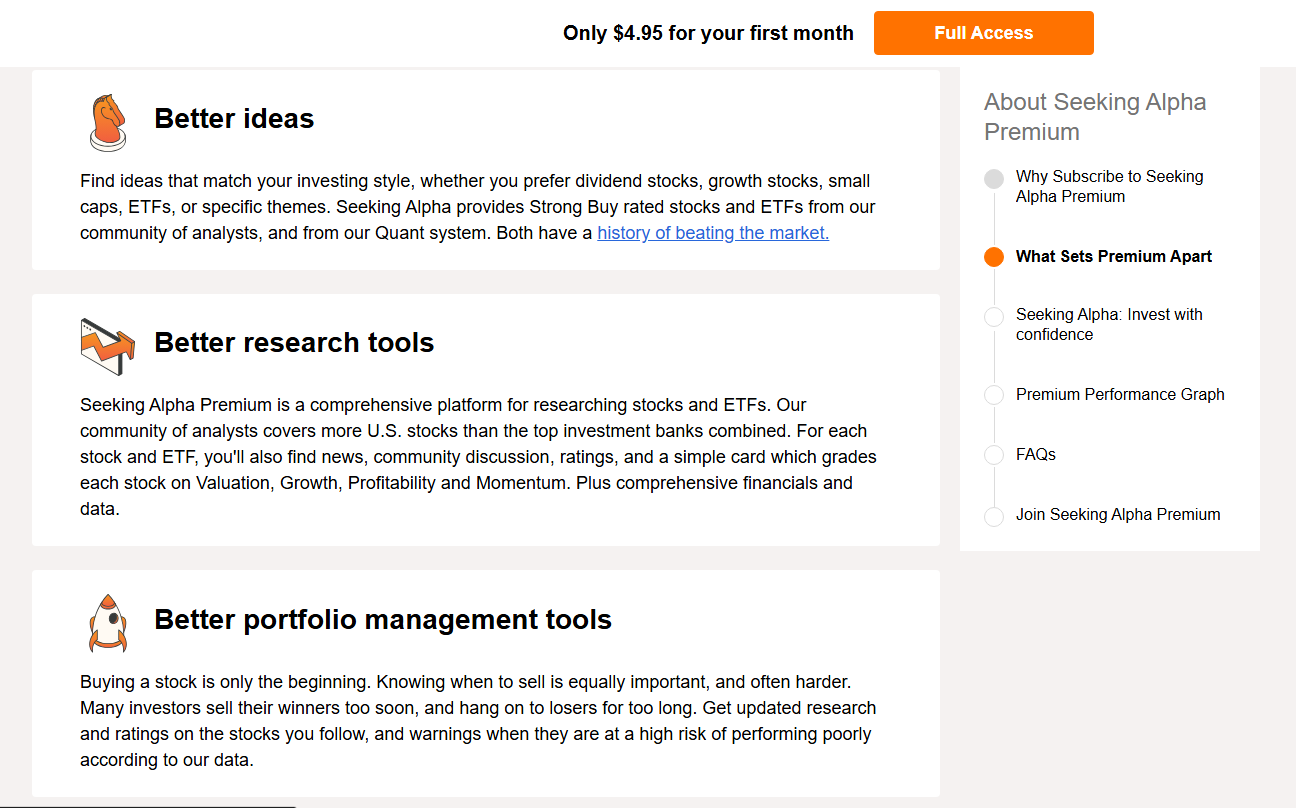

Premium Plan:

Available at a special introductory price of $4.95 for the first month. After the trial, it renews at $299 per year (approximately $24.92/month, billed annually). Premium gives you:

- Unlimited access to expert investor content

- Membership in a community of serious investors

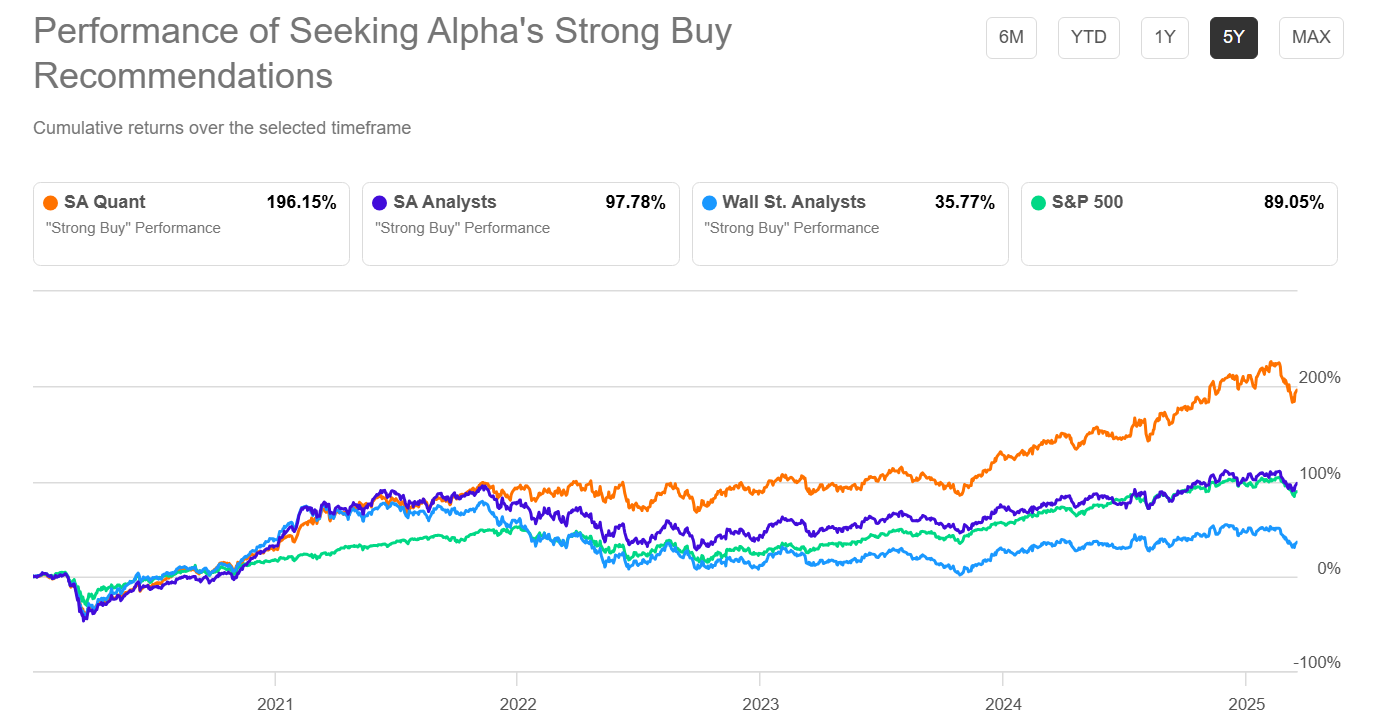

- Access to Seeking Alpha’s proprietary Quant Ratings (noted for outperforming the S&P 500)

- Rankings of top stocks and ETFs

- Stock and ETF screeners

- Portfolio health checks and warnings

Note: VIP service and “Short Ideas” content are exclusive to the Pro tier and are not included in Premium.

Pro Plan:

Geared toward professionals or advanced investors, Pro costs $99 for one month, renewing at $2,400 per year. It includes all Premium features, plus:

- Top analyst insights with access to ideas from Seeking Alpha’s top 15 analysts

- Exclusive analyst coverage, highlighting “Strong Buy” stocks not covered on Wall Street

- Daily ratings upgrades and downgrades from Quant, Seeking Alpha analysts, and Wall Street

- Full access to “Short Ideas” for advanced strategies

Promotions like the $4.95 first-month trial for Premium are regularly available, making it easier for new users to test the platform before committing.

Is Seeking Alpha Premium Worth It?

Whether Seeking Alpha Premium is the right fit depends entirely on your investing approach:

- For active investors who frequently research stocks, need access to advanced screeners, and appreciate crowd-sourced analysis paired with Quant Ratings, the annual Premium subscription offers excellent value.

- For casual or beginner investors, the free Basic plan may suffice initially, but limitations on article access and data tools might encourage upgrading as you get more involved.

Always check Seeking Alpha’s website for the latest deals and updated pricing, as promotions and rates may occasionally change.

Real-World Examples & Use Cases

Conducting Deep Stock Analysis

Suppose you’re researching a mid-cap technology company that doesn’t get a lot of mainstream coverage from major brokerages. With a Premium subscription, you can:

- Read multiple articles (bearish, bullish, or neutral) to understand the various viewpoints on the company.

- Check Quant Ratings to see if the stock’s metrics suggest overvaluation or undervaluation, strong growth prospects, or negative momentum.

- Review author track records of the bullish and bearish contributors, determining if they have a history of prescient calls or if they’ve been off track in the past.

- Dive into earnings call transcripts for the past several quarters, analyzing how management’s commentary and guidance have evolved.

- Screen for competitor companies in the same sector to compare valuation, profitability, and growth metrics side by side.

This approach offers a comprehensive view, not just a single dimension of fundamental or technical analysis.

Tracking Dividend Stocks

If you’re a dividend investor, Premium can help:

- Identify High-Yield Opportunities: Use the stock screener to filter for companies with a certain dividend yield, or that have consistently raised dividends for a specific number of years.

- Check Dividend History & Safety: Some authors focus specifically on dividend sustainability. Quant Ratings and factor grades can also clue you in to whether a company’s payout ratio or cash flow might be at risk.

- Evaluate Dividend Growth: Many articles discuss the growth potential of dividends, factoring in free cash flow trends and earnings stability.

Momentum & Growth Trading

For those leaning more toward growth investing or momentum trading, the platform’s quant system can pinpoint stocks with strong momentum or robust earnings growth. You could set up screens to look for stocks with:

- High Momentum Grades: Where the recent price action is strong relative to the overall market.

- Positive Earnings Revisions: If analysts are continually revising earnings estimates upward, the quant model catches that.

- Solid Profitability: Growth and momentum can be even more compelling when the company also has favorable profit margins.

You can then read analysis from authors who specialize in high-growth tech or biotech plays to see if the fundamentals back up the quant-driven momentum signals.

Sector & Macro Insights

Beyond individual stocks, Seeking Alpha often features macro or sector-focused analyses that can give you a strategic overview of:

- Energy Sector Trends: Commodity price outlook, OPEC decisions, or pipeline developments.

- Tech Innovations: Emerging technologies such as AI, quantum computing, or 5G, and which companies are best positioned.

- Financial Services: Insights into changes in interest rates, banking regulations, or credit card trends.

- Healthcare: Pipeline updates for pharma, regulatory shifts in healthcare law, or biotech approvals.

With Premium, you can read unlimited articles on these macro topics and reference older posts to see how analysts’ predictions held up over time.

Pros & Cons of Seeking Alpha Premium

Pros

- Unlimited Article Access: Arguably the biggest perk for those who love to read widely and deeply.

- Quant Ratings: A handy, data-driven system to quickly size up stocks across multiple factors.

- Robust Community & Commentary: Access to crowd-sourced insights and the ability to participate in discussions for further clarification.

- Earnings Call Transcripts & Historical Records: Excellent resource for deep research on a company’s management guidance and performance over time.

- Author Track Records: Helps you find analysts who align with your investing style and have demonstrated success.

- Ad-Free Experience: A more pleasant reading environment.

Cons

- Varied Quality of Analysis: Not all articles are equal, and some can be overly promotional or lacking depth.

- Cost: The monthly subscription can be a bit pricey if you’re not a frequent user, though the annual plan lowers the average monthly cost.

- Learning Curve: The array of features might be overwhelming at first, requiring time to fully utilize everything.

- Quant Model Limitations: Like any quantitative approach, it doesn’t capture all qualitative factors and can be skewed by short-term data anomalies.

Comparison With Other Platforms

To get a better sense of Seeking Alpha Premium’s value, it’s worth stacking it up against some other popular research tools.

Motley Fool

Motley Fool is famous for its stock-picking newsletters (e.g., Stock Advisor, Rule Breakers). While they provide in-depth analyses and investment theses, the content doesn’t typically feature crowd-sourced insights from thousands of authors. Motley Fool’s service is more about curated picks from the Fool’s own analysts, often focusing on growth stocks.

- Pros: Clear guidance, strong track record on some picks, actionable advice.

- Cons: Less community-driven, fewer immediate updates on breaking news, narrower focus (mostly on growth-oriented stocks).

Morningstar

Morningstar is known for its independent and data-centric approach. The platform offers detailed analyst reports (particularly on mutual funds and ETFs), star ratings, and an emphasis on fundamental valuations. However, the user community aspect is less pronounced than on Seeking Alpha.

- Pros: Trusted brand, comprehensive coverage of funds, robust analytics tools.

- Cons: Less interactive community content, can be more expensive for premium research, narrower coverage of real-time news.

Yahoo Finance Premium

Yahoo Finance is a go-to for quick checks on stock quotes, basic ratios, and news. Its Premium offering expands that with advanced charting, research reports (from partners like Argus), and portfolio insights. However, it lacks the extensive library of crowd-sourced articles and commentary that Seeking Alpha boasts.

- Pros: Easy-to-use interface, decent variety of data sources, good for quick scans.

- Cons: Limited in-depth articles, less emphasis on user discussions, may not offer the same depth of coverage.

In short, Seeking Alpha Premium distinguishes itself primarily by leveraging the power of a large, active community of contributors and the unique Quant Ratings feature. If you highly value diverse viewpoints and real-time discussions on virtually any ticker, Seeking Alpha’s advantage is tough to beat.

Who Should Consider Seeking Alpha Premium?

Seeking Alpha Premium might be a great fit for:

- Active Investors

- If you actively manage your portfolio, constantly researching new stocks, looking for contrarian takes, or scanning multiple sectors for opportunities, the unlimited article access and advanced tools can be a game-changer.

- DIY Retail Investors

- If you prefer doing your own research rather than relying on a broker or robo-advisor, having a vast library of analyses and data under one roof is convenient.

- Dividend Investors

- Dividend-focused content on Seeking Alpha is exceptionally robust, with many authors specializing in income investing strategies. Premium helps you read all these articles and track their performance.

- Long-Term Fundamental Analysts

- The ability to read historical articles and transcripts can be crucial for building a thorough fundamental thesis on a company and verifying if management’s past statements aligned with future results.

- Enthusiasts Who Love Investment Conversations

- If you enjoy reading and occasionally joining lively discussions, the Premium experience ensures you’re not locked out after a few reads, letting you keep the conversation flowing.

That said, if you trade infrequently, prefer short-term technical analysis, or rely mostly on a financial advisor to handle your portfolio, you may not get as much value out of a Premium subscription. In those scenarios, the free version (plus additional sources) might be sufficient.

Conclusion

In today’s fast-moving, information-packed investing world, having the right tools and insights at your fingertips can make all the difference. Seeking Alpha Premium offers a well-rounded blend of crowd-sourced analysis, quantitative ratings, and a wealth of historical data—all designed to give investors a deeper, more informed view of the market.

While not every article or rating is flawless, the platform’s advanced filters, author performance tracking, and Quant Ratings system allow you to cut through the noise and focus on credible, actionable information. Whether you’re searching for under-the-radar stock ideas, keeping up with earnings calls, or comparing financial metrics, Premium makes the process smoother and more structured.

Of course, no tool can replace thorough due diligence and a solid investment strategy. But if you’re someone who values diverse viewpoints, enjoys diving into detailed analysis, and wants a reliable research companion, Seeking Alpha Premium is well worth exploring—especially with its low-cost trial giving you a chance to test its full potential risk-free.