Pairs trading is a popular trading strategy employed by traders in the financial markets. It involves the simultaneous buying and selling of two related instruments, typically stocks, that have historically demonstrated a strong correlation in price movements. The strategy aims to profit from the relative price changes between the two instruments, regardless of the overall direction of the market.

Pairs trading, a time-tested strategy in the world of finance, owes its origins to the pioneering work of Wall Street quantitatively inclined minds. Among the earliest proponents of this strategy were the renowned statisticians and traders, Nunzio Tartaglia and Edward Thorp, who laid the groundwork for pairs trading in the 1980s.

It’s a well-liked strategy for many reasons, one being its potential for high returns compared to the risks involved. Another reason is its exceptionally low risk. Most importantly, it’s favored for being market-neutral. we’ll get into these more later.

What is Pairs Trading Strategy?

Imagine you’re comparing two stocks that behave similarly. Let’s say you’re looking at two banks, Bank A and Bank B, both located in the same state. They have similar structures and functions. So, when one is doing well, the other tends to do well too. And when one is struggling, the other usually faces challenges too.

You notice that these two banks are so alike that their stocks should always move together. If one of them has really good earnings this quarter, well, probably the other one does too because of their strong similarities.

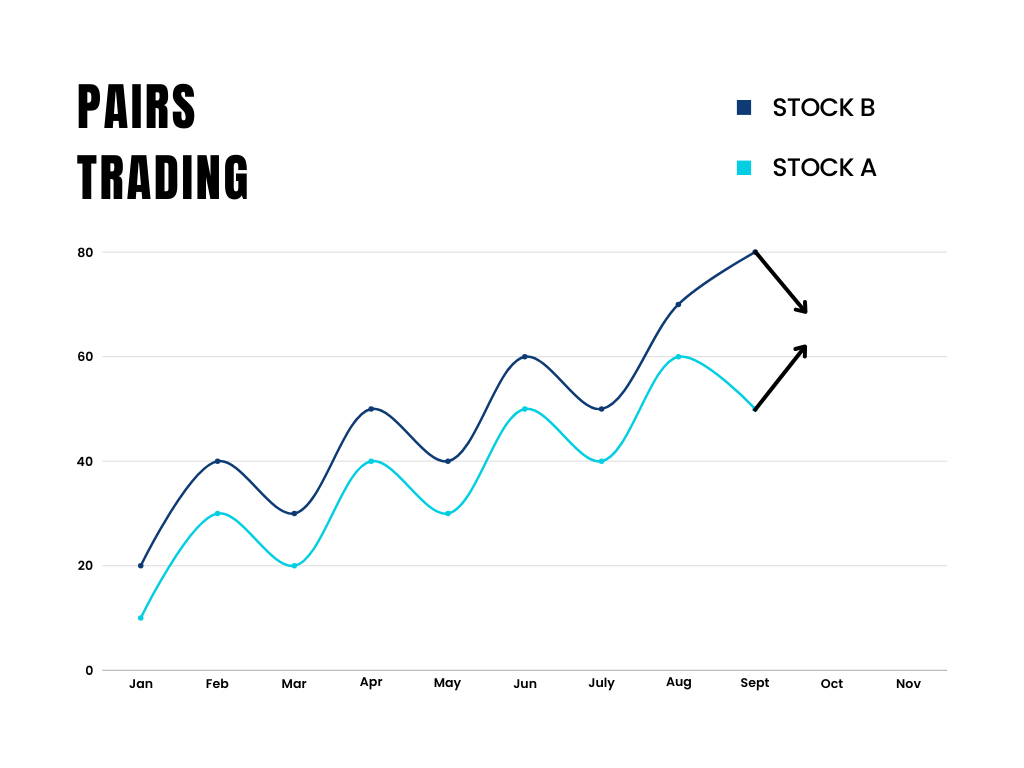

So, what you’re doing is comparing two stocks that are very similar to each other and moving in the same way. As they’re moving, if at one point they start to go in different directions, what you’d expect to happen is either the one that falls behind should go up and catch up with the other, or the one that went up should fall and catch up with the other.

So, in pair trading, we anticipate that even though both stocks are very alike, they might diverge due to factors like supply and demand. Because of this divergence, there are opportunities where we can capitalize and profit from the eventual convergence back together.

Now, the issue with that is we can’t predict which one will bounce back. We’re uncertain whether stock A will rise and converge, or if stock B will drop and converge, or maybe both will move.

Because of this uncertainty, our strategy is to buy stock A and short stock B. This way, if stock A moves up, we’ll profit from it. Stock B might move a bit, resulting in a small gain or loss, but the profit from stock A will outweigh it. Conversely, if stock B moves, being short will make us money on stock B, and any gain or loss on stock A will be minimal. This approach ensures that we can make money regardless of which direction the stocks move.

And this strategy is really great because it doesn’t matter if the market is going up. As we know, when the market goes up, all stocks tend to rise. So, if the market goes up, the one you’ve shorted will probably go up a bit, but not by much because it’s already up – that’s why we shorted it in the first place. You might lose a bit there, but the one you’ve bought, since it’s undervalued, will likely go up by a lot, so you’ll make much more money on that.

Now, if the market were to go down – and we can’t predict if it will go up or down, right? – if it goes down, the one you’ve bought might lose a bit, but the one you’ve shorted will make a lot of money. It’s already highly valued, and when the market goes down, everything tends to go down.

Because when the market goes up, everything goes up, and when it goes down, everything goes down. But if you have both long and short positions, you don’t care if the market goes up or down. If it goes up, you’ll make more on your long position than you’ll lose on your short. And if it goes down, you’ll lose less on your long position than you’ll gain on your short. So, you’ll always be making more money on one side than you’re losing on the other.

And if the market is just neutral, you might make money on both positions. And this is why it’s such a popular strategy in the industry. In the industry, we’re not trying to bet or make money based on whether the market goes up or down; we’re just trying to make money regardless of what happens. And this is what we call market neutrality.

A market-neutral strategy is one that stays neutral regardless of what the market is doing.

Conclusion

This is the basic concept of pairs trading. However, the process of implementation and creating these pairs can be a bit complex. That’s why I want to keep this article focused on understanding what pairs trading is. In future articles, we’ll explore these concepts in a more accessible way. For now, pairs trading simply involves selecting two similar stocks that move together and trading based on their divergence.