Trading psychology is a vast field that explores how cognitive biases and emotional tendencies affect the way we make financial decisions. While most traders diligently study technical indicators, charts, and economic fundamentals, the role of behavioral biases often remains underemphasized. Yet, these psychological factors can have a significant impact on our trading performance.

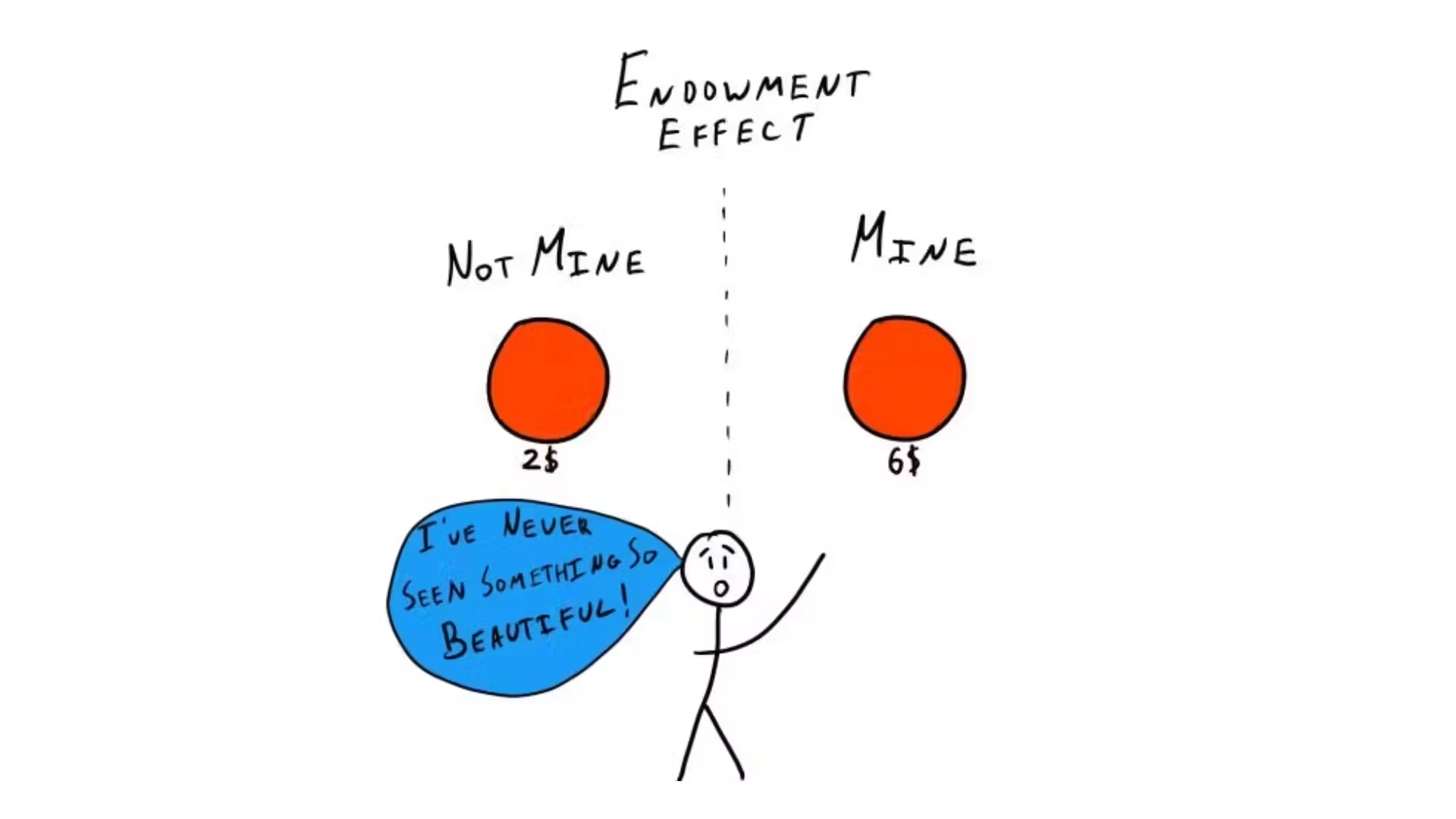

Among the myriad biases that can affect a trader’s decision-making, the Endowment Effect stands out as especially crucial. The Endowment Effect refers to our tendency to assign a higher value to things we own compared to items we do not. In a trading context, this phenomenon manifests when traders become overly attached to their current assets, resulting in suboptimal decisions like holding onto losing positions for too long or missing out on better investment opportunities. Understanding the Endowment Effect is thus essential for anyone who seeks to improve their trading outcomes and avoid preventable losses.

In this article, we will explain the Endowment Effect, its roots in behavioral finance, why it persists, and how it affects traders specifically. We will also explore research studies that validate its existence, highlight real-world examples, and offer strategies to help you mitigate or overcome its negative implications in trading. By the end, you will have a comprehensive view of this bias and be armed with practical techniques to enhance your trading psychology.

Table of Contents

What is Endowment Effect?

To fully grasp the implications of the Endowment Effect, it’s important to start with a clear definition. The Endowment Effect is a cognitive bias in which people assign greater value to items simply because they own them. In a classic experiment often used to demonstrate this bias, participants who received a coffee mug demanded a much higher price to sell it than the price they would have paid to acquire the same mug in the first place. This higher subjective valuation arises from an inherent emotional attachment and the aversion to losing something one already possesses.

In trading, the Endowment Effect typically manifests in overvaluing stocks, currencies, commodities, or other financial instruments that one already holds. This overvaluation can lead to irrational decision-making, such as refusing to sell an asset that no longer aligns with market data or fundamental indicators.

Key Characteristics of the Endowment Effect:

- Ownership-driven valuation: An item or asset is perceived to be more valuable merely because one owns it.

- Loss aversion: People tend to focus on the potential losses from selling the asset, rather than the potential gains from switching to a more profitable opportunity.

- Emotional attachment: Ownership creates a sense of connection, leading to reluctance to part with the asset.

Historical Context and Foundational Research

The Endowment Effect is closely tied to the work of economist Richard Thaler and psychologists Daniel Kahneman and Amos Tversky, who are widely credited with founding the field of behavioral economics. Their studies offered deep insights into why people deviate from pure rationality.

- Richard Thaler: In his work on behavioral economics, Thaler introduced the concept of mental accounting and other biases that lead to irrational decisions. He helped popularize the idea that ownership changes the perception of value.

- Daniel Kahneman and Amos Tversky: Known for their Prospect Theory, which highlights loss aversion and how people value gains and losses differently, Kahneman and Tversky’s research also laid the groundwork for understanding why the Endowment Effect arises. Their early experiments demonstrated that participants demanded higher compensation to give up a good than they were willing to pay to acquire it.

One of the most cited experiments that highlight the Endowment Effect is the “mug experiment” introduced by Kahneman, Knetsch, and Thaler in 1990. Half the participants were randomly given coffee mugs, while the other half received no mugs. When owners were asked how much they would be willing to sell their mugs for, the price was almost twice as high as what non-owners were willing to pay. This discrepancy firmly established the Endowment Effect as a robust phenomenon.

Why the Endowment Effect Occurs

At the heart of the Endowment Effect is a psychological aversion to losing something that is already in one’s possession. When we own an item, part of our self-concept may become intertwined with that item. Consequently, the idea of losing it feels like a genuine loss and triggers a disproportionate emotional response.

Below are some of the most commonly cited psychological mechanisms behind the Endowment Effect:

- Loss Aversion: People generally fear losses more than they value equivalent gains. When deciding whether to sell an asset they already own, the pain of losing that asset (loss) overshadows the potential benefits of selling it.

- Status Quo Bias: We often prefer to keep things the same rather than change them. Selling an owned asset is a form of change, which can be uncomfortable for many.

- Psychological Ownership: Once individuals feel an item belongs to them, they often perceive it through a rose-tinted lens. The sense of “mine” imparts a sense of attachment and perceived value.

These mechanisms are rooted in evolutionary psychology, suggesting that preserving resources once they are in our possession may have provided a survival advantage to our ancestors. While these tendencies can be beneficial in certain life scenarios, they can distort decision-making in financial markets, where rapid and rational decisions are sometimes necessary.

The Endowment Effect in Trading

In the context of trading and investment, the Endowment Effect can become particularly dangerous because financial assets fluctuate in value. The longer a trader holds an asset, the stronger the sense of ownership, and the higher the possibility of emotional attachment. If the price begins to drop, some traders may cling to the asset longer than warranted, hoping for a rebound, partly because of the Endowment Effect combined with loss aversion.

Below are some scenarios in which the Endowment Effect surfaces:

- Holding Losers Too Long: Many traders struggle to exit positions that are losing money. Their Endowment Effect leads them to see their current holdings as more valuable than market reality, making them wait for an unlikely turnaround.

- Missing Out on Better Opportunities: By focusing on assets they already own, traders may overlook fresh opportunities in other markets or securities that could offer a better risk-reward ratio.

- Anchoring Bias and Endowment Effect Overlap: Traders might anchor on the original purchase price (or any price at which they owned the asset) and be unwilling to sell below that level, reinforcing the sense that the asset is “worth” at least that amount.

- Overconfidence in Owned Assets: Familiarity with an owned asset can create a false sense of security. Traders may rationalize negative news or fundamentals about the asset in a way that justifies maintaining their position, even when selling might be the more rational choice.

Real-World Research and Examples

1. Research Involving Traders

Several studies have focused on professional traders and how the Endowment Effect influences their decisions. Interestingly, while professional traders are often perceived as more “rational” and less susceptible to psychological biases, research has shown that the Endowment Effect can still have a measurable impact on their decisions.

- Example: Huber, Kirchler, and Stöckl (2010)

Their study examined professional traders and found that even individuals with years of market experience displayed reluctance to part with assets they already owned, selling them only at higher prices than they would have bought them for. - Example: Odean’s Research on Overconfidence

While not focusing exclusively on the Endowment Effect, Brad Barber and Terrance Odean’s research highlights how overconfidence and other biases can lead investors to hold onto their own picks longer than advisable. This holding pattern can be partially attributed to the Endowment Effect because investors overvalue their personal stock picks due to emotional attachment.

2. Examples from Historical Market Events

- Dot-Com Bubble (Late 1990s to Early 2000s): Many investors watched technology stocks soar to unprecedented heights. Those who bought early developed a strong attachment to their holdings. When the market turned, they found it difficult to sell because they felt these stocks were “worth so much more,” reflecting the Endowment Effect.

- Housing Market Crisis (2007-2008): Although not strictly a stock trading scenario, the concept of overvaluing owned assets was evident as homeowners and real estate investors clung to inflated property values during the subprime mortgage crisis. Even in the face of falling prices and dire economic indicators, many refused to sell or refinance.

These real-world instances confirm that the Endowment Effect can influence behavior on a large scale, affecting not only individual portfolios but also broader market dynamics.

How the Endowment Effect Distorts Trading Decisions

It’s worth emphasizing that the Endowment Effect doesn’t merely “nudge” traders. In many scenarios, it can severely distort the decision-making process, resulting in a meaningful drag on profitability and risk management. Below is a more in-depth look at how this bias can sabotage trading:

1. Emotional vs Rational Decision Making

Traders who fall prey to the Endowment Effect are more prone to making emotional decisions. Since they place excessive emotional weight on their assets, they are less likely to respond optimally to clear signals—like a deteriorating chart pattern or a downgrading of the stock by analysts.

- Emotional Decision Example: A trader holds a stock that has lost 20% in the past month due to poor earnings. Rational analysis suggests the stock has more downside risk, but the trader refuses to sell because they believe “it was once worth more” and that “it will return to its original value,” all the while ignoring current fundamentals.

2. Resistance to Loss Realization

Loss realization is one of the most challenging aspects of trading. No one likes to be “wrong” about a position. The Endowment Effect compounds this issue by making a trader feel that the asset is more valuable than what the market is currently indicating.

- Loss Aversion and Endowment Synergy: Loss aversion makes the potential pain of selling at a loss deeply uncomfortable, and the Endowment Effect further amplifies that pain. As a result, traders might hold onto losing positions far longer than they should.

3. Suboptimal Portfolio Allocation

Because of the overvaluation of current holdings, traders under the influence of the Endowment Effect might keep assets that don’t align with their risk tolerance or market outlook. The result is a suboptimal portfolio composition that fails to adapt to changing market conditions.

- Missed Rotation Example: If market conditions signal a rotation from growth stocks to value stocks, a trader under the Endowment Effect might continue holding growth stocks—even as they underperform—simply because the trader feels they’re “worth” more than the market price.

4. Perpetuation of Cognitive Dissonance

When faced with evidence that conflicts with their perception (e.g., the asset is declining in value despite their belief in its worth), traders experience cognitive dissonance. To resolve it, they may look for evidence that supports holding their position (confirmation bias), reinforcing the Endowment Effect.

- Selective Data Gathering: A trader might ignore negative market news, focusing instead on occasional minor upticks in the stock price as “proof” that the position is still sound.

Strategies to Overcome or Mitigate the Endowment Effect

The Endowment Effect is deeply rooted in human psychology and is further reinforced by other biases like loss aversion, confirmation bias, and the sunk cost fallacy. However, traders can employ practical strategies to mitigate its negative impacts.

1. Develop a Trading Plan and Stick to It

A well-structured trading plan can serve as a safeguard against impulsive decisions driven by cognitive biases.

- Entry and Exit Criteria: Clearly define the conditions under which you will enter a trade (e.g., chart patterns, fundamental triggers) and exit a trade (e.g., stop-loss, profit target, time-based exit).

- Risk-Reward Ratios: Decide your acceptable risk-to-reward ratio before entering a trade. If the market doesn’t align with your expectations, exit according to plan—no questions asked.

- Pre-Set Stop-Losses: Using automatic stop-loss orders can help you exit a position if it moves against you, effectively removing the emotional paralysis that the Endowment Effect can cause.

2. Reframe Your Perspective

Reframing involves looking at your assets (and the trading scenario) from a fresh angle to counteract emotional biases.

- Ask “Would I Buy This Now?”: Periodically ask yourself, “If I didn’t own this asset, would I buy it at this price?” If the answer is no, that’s a strong signal you might be holding it due to the Endowment Effect.

- Compare Assets: Compare your current holdings to other potential trades or alternative instruments. If you see that another opportunity has superior prospects, consider reallocating.

3. Regular Portfolio Reviews

Conducting routine portfolio reviews (weekly, monthly, or quarterly) helps maintain objectivity.

- Objective Analysis: Evaluate each position based on the original rationale for the trade and the current market conditions.

- Eliminate Underperformers: If the reasons you bought an asset are no longer valid, or if the market conditions have changed, consider closing the position—regardless of whether you’re in profit or loss.

4. Utilize Checklists

A pre-trade or post-trade checklist ensures that you adhere to a systematic approach rather than emotional impulses.

- Pre-Trade Checklist: Include items like “Is the risk-reward favorable?” “Am I ignoring any significant market news?” “Would I buy this even if I didn’t already own it?”

- Post-Trade Checklist: “Did I follow my trading plan?” “What did I do right?” “What can I improve next time?”

5. Seek External Input

Sometimes an external perspective—be it from a trading mentor, a community, or even a trading journal—can be invaluable.

- Mentoring Sessions: A mentor can spot biases and offer constructive feedback on your trading decisions.

- Trading Groups and Forums: Engaging with other traders can offer insights you may have missed due to cognitive blind spots. However, ensure you don’t blindly follow others’ decisions but use their input to challenge your own assumptions.

6. Practice Mindfulness and Emotional Regulation

Finally, understanding your emotional state while trading is key. Mindfulness and emotional regulation techniques can help you remain objective.

- Meditation and Breathing Exercises: Incorporate short mindfulness sessions to calm the mind before making trading decisions.

- Stress Management: High levels of stress amplify emotional biases. Techniques like journaling, exercise, or taking breaks from the screens can reduce stress and enhance decision-making clarity.

Additional Psychological Biases Related to the Endowment Effect

While the Endowment Effect can wield a powerful influence over trading decisions, it rarely operates in isolation. It often intertwines with other cognitive and emotional biases, creating a complex web that can drastically undermine a trader’s decision-making capabilities. Below are several biases closely related to, or that commonly co-occur with, the Endowment Effect.

1. Loss Aversion

- Definition: People generally prefer avoiding losses rather than acquiring equivalent gains.

- Connection to the Endowment Effect: The pain of loss aversion can reinforce the Endowment Effect, making traders reluctant to sell assets at a loss.

2. Confirmation Bias

- Definition: The tendency to search for, interpret, and recall information that confirms one’s preconceptions.

- Connection to the Endowment Effect: Traders often seek out information that justifies their continued ownership of an underperforming asset, reinforcing their attachment to it.

3. Sunk Cost Fallacy

- Definition: The mistaken belief that one should continue an endeavor because of the resources (money, time, effort) already invested in it.

- Connection to the Endowment Effect: When traders feel they’ve already “spent” a lot on a position—both financially and emotionally—they may overvalue that position, hesitating to cut losses.

4. Overconfidence Bias

- Definition: An inflated belief in one’s judgment, leading to overestimation of one’s knowledge or control over events.

- Connection to the Endowment Effect: Traders may believe they are immune to biases and overrate the worth of their positions, failing to adjust to new market data.

5. Anchoring Bias

- Definition: Relying heavily on the first piece of information encountered when making decisions.

- Connection to the Endowment Effect: Traders may anchor on the purchase price of an asset, refusing to sell below that price because they “believe” that is the asset’s real value.

Understanding these interrelated biases can aid in devising a more comprehensive strategy to combat the Endowment Effect. Recognizing one bias often leads to spotting others, making it easier to maintain objectivity and rationality in your trades.

Case Study: The Endowment Effect in Action

1. Background

Imagine a trader named Sarah who has been tracking a promising technology stock for months. She purchased 200 shares at $50 each, believing the company was about to unveil a game-changing product. Shortly after her purchase, the market turned volatile, and the stock price dropped to $40, mainly due to overall market sentiment and some disappointment about the product’s release date.

2. Endowment Effect Triggers

- Attachment to the Investment: Sarah feels a strong connection to the stock because she researched it extensively and believed in its potential. She perceives the stock to be “worth at least $50,” even though the market disagrees.

- Loss Aversion: Selling at $40 would lock in a $10 per share loss, which feels unbearable. Sarah decides to hold, hoping for a rebound.

3. Behavioral Bias Overlap

- Confirmation Bias: Sarah searches only for news that supports her view that the stock is undervalued. She finds a few optimistic blog posts and decides to disregard the overall bearish sentiment in the financial press.

- Sunk Cost Fallacy: She’s already invested $10,000 (200 shares * $50), so she feels that selling at a loss would “waste” this investment.

- Anchoring Bias: Her anchor point is the $50 purchase price. She refuses to consider that the market’s new valuation might be accurate.

4. Outcome

Over the next month, the broader market remains weak, and the company delays the product launch further. The stock slides to $35. Sarah continues to hold, convinced it’s “worth more.” By the time the stock hits $30, she finally sells, driven by sheer frustration and fear of losing even more. In total, she loses $4,000 (before commissions and fees). Had she been more objective and sold earlier (e.g., at $40), her loss would have been limited to $2,000.

5. Lessons Learned

- A strict stop-loss order at around $45 might have prevented Sarah from incurring deeper losses.

- Periodic reassessment of the stock’s fundamentals and ignoring her ownership bias might have prompted her to exit sooner.

- Being mindful of her anchoring bias (the $50 price point) could have allowed her to evaluate the stock’s prospects more objectively.

This case study illustrates that a single bias—the Endowment Effect—can combine with other cognitive distortions, compounding the negative financial impact. Sarah’s story is not uncommon; many traders have lost substantial capital by clinging to assets they emotionally “value” more than the market does.

Frequently Asked Questions (FAQs)

Q1: Is the Endowment Effect always detrimental in trading?

Not necessarily. While the Endowment Effect can lead to irrational attachment and poor decision-making, a mild sense of ownership or pride in your assets can sometimes encourage thorough research and monitoring. The key is to remain vigilant so that this sense of ownership doesn’t turn into an unyielding emotional attachment that prevents you from making logical decisions.

Q2: Can long-term investors benefit from the Endowment Effect?

Long-term investors often hold onto assets for extended periods, riding out market fluctuations. In some cases, a temperate version of the Endowment Effect might discourage knee-jerk reactions to short-term volatility. However, it becomes problematic if it stops an investor from reassessing whether a company’s fundamentals have changed or prevents them from cutting inevitable losses.

Q3: How can I distinguish between genuine confidence in an asset and the Endowment Effect?

Ask objective questions such as “Would I buy this asset today at its current price if I didn’t already own it?” If your honest answer is no, you may be displaying the Endowment Effect rather than genuine confidence in the asset’s value.

Q4: Are professional traders and fund managers immune to the Endowment Effect?

No. Research has shown that professional traders, fund managers, and even institutional investors can fall victim to this bias. While experience and quantitative strategies might reduce its impact, it remains a persistent psychological tendency.

Q5: What’s the difference between the Endowment Effect and Sunk Cost Fallacy in trading?

Both biases can lead to holding onto losing positions for too long, but they arise from slightly different cognitive processes. The Endowment Effect is the heightened value assigned to owned assets, while the Sunk Cost Fallacy relates to the reluctance to abandon a project or asset because of resources already invested.

Conclusion

In the realm of trading, where the stakes are high and market conditions can shift suddenly, the Endowment Effect represents a potent psychological bias that can distort rational decision-making. Traders affected by this bias tend to overvalue their owned positions, holding onto them longer than justified and often ignoring new information that points to better opportunities elsewhere. This inclination is rooted in fundamental human tendencies like loss aversion and status quo bias, which once served as evolutionary advantages but now create pitfalls in modern financial markets.

Yet, awareness is the first step toward mitigation. By recognizing the Endowment Effect, understanding its origins in behavioral finance, and employing strategies such as defining clear trading plans, periodically reassessing positions, and employing objective risk management, traders can significantly reduce its detrimental impact. Moreover, acknowledging related biases—confirmation bias, sunk cost fallacy, overconfidence, and anchoring—further strengthens the trader’s psychological toolkit.

Ultimately, successful trading is not just about mastering technical or fundamental analysis; it’s about cultivating the self-awareness to recognize and counteract the cognitive biases that inherently influence human decision-making. The Endowment Effect serves as a vital reminder that trading psychology is as critical as any market signal or chart pattern. By integrating these insights into your daily trading routine—through checklists, external feedback loops, or mindfulness techniques—you can make more informed, rational, and ultimately more profitable decisions.

Key Takeaways:

- The Endowment Effect arises from emotional attachment to owned assets, making them seem more valuable than they might objectively be.

- Rooted in loss aversion and status quo bias, it can lead traders to hold losing positions for too long and ignore new opportunities.

- Strategies such as rigorous trading plans, reframing techniques, regular portfolio reviews, and external feedback can help mitigate its negative impact.

- Combining knowledge of the Endowment Effect with awareness of related biases creates a robust defense against suboptimal trading decisions.

By understanding and proactively managing the Endowment Effect, you put yourself in a stronger position to maintain clarity, adapt to changing market conditions, and ultimately enhance your trading performance. Embracing self-reflection and discipline in this area can make the difference between persistently subpar results and a consistently profitable trading career.