Trading is as much a psychological battle as it is a technical or fundamental one. While market analysis, chart patterns, and macroeconomic indicators play critical roles in trading success, the ability to manage your own emotions can often determine whether you profit or face repeated losses.

In this in-depth article, we will explore how to control emotions in trading so you can cultivate the discipline needed for consistent profitability. We will cover the science behind emotional triggers, discuss the most common trading emotions (like fear and greed), investigate key trading psychology concepts, and provide a wide range of practical strategies to help you stay composed under pressure. By the end of this guide, you’ll have a clear roadmap for mastering your emotions and improving your trading performance.

Table of Contents

The Importance of Emotional Control in Trading

Emotions, in many ways, define our humanity. They guide our decision-making, affect our interpersonal relationships, and can motivate us to achieve great things. In trading, however, emotions can become stumbling blocks if not properly harnessed. Sudden market shifts, unexpected losses, or euphoric wins can all trigger emotional responses that lead to irrational decision-making.

When you have a solid strategy, emotional control can mean the difference between diligently following your plan or deviating due to fear or greed. In other words, controlling emotions in trading is about safeguarding your strategy, capital, and mental health. This is not a skill that one acquires overnight—it takes continuous effort, self-reflection, and the right set of strategies.

Key Takeaways

- Emotional stability ensures consistency in executing trades.

- Emotional spikes can lead to irrational decisions and substantial losses.

- Discipline in trading aligns with your broader goal of sustained profitability.

Why Emotions Matter More Than You Think

Financial markets are dynamic and often volatile. Prices can swing wildly in minutes or even seconds, and while it might be tempting to rely solely on analytical tools or indicators, your mental state plays a crucial role in how you interpret these signals. Emotional control allows you to:

- Remain Objective: Detach from the noise and stick to facts and probabilities.

- Avoid Overreactions: Prevent panic selling or unplanned buying in a moment of market frenzy.

- Maintain Consistency: Execute trades systematically, adhering to a well-thought-out plan rather than succumbing to short-term impulses.

In Practice: A trader might face a sudden price drop in a stock they hold. Without emotional control, they might panic-sell in fear of further losses, even if the stock is fundamentally strong. If they stay calm, they can evaluate whether the drop is a normal fluctuation or a significant concern that genuinely warrants an exit.

Common Emotions in Trading

Understanding the variety of emotions you may encounter is the first step in learning how to control emotions in trading. Each emotion can affect trading decisions in subtle or overt ways.

1. Fear

- Definition: Fear in trading often manifests as the dread of losing money or missing out on gains.

- Impact: It can keep you out of profitable trades or cause you to close positions prematurely.

Example: You have identified a promising breakout pattern, but past losses make you hesitant to enter the trade. You watch from the sidelines as the asset surges, ultimately missing a profitable move.

Management Tip: Acknowledge the fear, and rely on data-driven analysis (risk-reward ratios, confirmation signals, etc.) to guide your decision.

2. Greed

- Definition: Greed is the overwhelming desire for bigger gains, leading traders to overstay in winning positions or over-leverage.

- Impact: Greed can prompt you to disregard your exit strategy, hoping for greater profits, only to see the market reverse.

Example: A trader who sees significant gains in a position avoids taking partial profits, convinced the price will climb indefinitely. The market takes a sudden downturn, wiping out much of the profit.

Management Tip: Stick to predefined profit targets and exit rules. If you want to let a trade run, consider a trailing stop to lock in gains.

3. Frustration and Anger

- Definition: These emotions typically surface after a series of losses or when the market moves against your analysis.

- Impact: Anger leads to revenge trading—an impulsive and often destructive attempt to “win back” losses.

Example: After three consecutive losing trades, a trader doubles their position size on the next trade out of frustration, ignoring their risk-management rules and often enlarging their losses.

Management Tip: Step away from the trading screen when you notice these emotions rising. Cool off, reassess your trading plan, or call it a day if you’re too emotional.

4. Overconfidence

- Definition: Occurs after a winning streak, where a trader believes they can do no wrong.

- Impact: May lead to taking on excessive risk, ignoring signals to exit, or trading without a solid plan.

Example: A day trader wins five trades in a row. Convinced of their skill, they place a high-leverage trade without thorough analysis. A small reversal triggers big losses.

Management Tip: Recognize that even a hot streak can be influenced by market conditions or luck. Stick to your trading journal and risk parameters.

5. Hope and Desperation

- Definition: Hoping a losing trade will turn around or clinging to a “lottery ticket” type trade.

- Impact: Leads to holding onto losing positions for too long, compounding losses.

Example: A trader’s position drops 15%, yet they refuse to exit, hoping for a miraculous recovery, only to see it drop another 10%.

Management Tip: Accept losses as part of the trading business. Use stop-loss orders to limit damage and look for new opportunities rather than pinning hopes on a reversal.

Psychological Biases That Affect Traders

Emotions aren’t the only mental hurdle. Cognitive biases systematic errors in thinking—can also influence trading outcomes. Awareness of these biases can help you avoid the pitfalls they create.

1. Confirmation Bias

- Definition: The tendency to seek or interpret information that aligns with one’s preconceived notions or analysis.

- Trading Relevance: Traders might ignore conflicting data that suggests their trade idea is flawed.

Example: You’re long on a particular tech stock. You focus on bullish news articles and analysis, dismissing any negative signals or bearish reports.

Solution: Actively look for contradictory evidence before committing to a trade, and remain open to adjusting your bias.

2. Anchoring Bias

- Definition: Relying too heavily on the first piece of information encountered (the “anchor”) when making decisions.

- Trading Relevance: A trader might fixate on a certain price as “cheap” or “expensive,” ignoring changing market conditions.

Example: You bought a stock at $50. Even after the price drops to $40 due to poor earnings and sector weakness, you keep believing $50 is its “true value,” refusing to exit.

Solution: Regularly re-evaluate your trades based on current data. Ask yourself if you would still take the trade if you hadn’t seen the original price.

3. Loss Aversion Bias

- Definition: The tendency to fear losses more intensely than the pleasure of equivalent gains.

- Trading Relevance: This can cause traders to hold losing positions too long or sell winning positions prematurely.

Example: You notice a small profit on a position and decide to exit to “lock in gains,” even though the technical and fundamental signals suggest further upside.

Solution: Diversify your trades, use stop-loss orders, and keep a risk-reward ratio in mind to balance potential gains and losses rationally.

4. Recency Bias

- Definition: Giving excessive weight to recent events or results, assuming they represent the long-term trend.

- Trading Relevance: Traders might extrapolate a short-term uptrend into a never-ending rally, or a short-term crash into a permanent downturn.

Example: After a series of bullish days, you enter trades solely based on the assumption that “the market is always going up,” ignoring historical volatility.

Solution: Review both long-term and short-term data. Blend various time frames in your analysis to avoid getting tunnel vision.

Core Principles of Emotional Control in Trading

Mastering emotional control begins with a foundation built on fundamental principles:

- Self-Awareness: Recognize emotional shifts early.

- Preparation: Have clear trading rules, risk management, and contingency plans.

- Objectivity: Base decisions on data and analysis rather than impulses.

- Consistency: Follow a repeatable process for planning and executing trades.

- Continuous Improvement: Use journals, mentorship, and regular reviews to refine both strategy and mindset.

These principles act as your guiding compass. Even if you deviate, you can recalibrate by returning to these fundamental concepts.

Building a Resilient Trading Mindset

A resilient mindset is your mental armor against market volatility. It enables you to adapt to changing conditions without succumbing to emotional swings.

1. Growth Mindset vs Fixed Mindset

- Growth Mindset: Believes in the ability to learn and adapt. Mistakes become opportunities for growth.

- Fixed Mindset: Feels threatened by challenges and may avoid them for fear of failure.

Why It Matters in Trading: A trader with a growth mindset learns from losses, refines strategies, and continuously improves. By contrast, a trader with a fixed mindset may label themselves a “bad trader” after a few losses and lose motivation.

Practical Steps to Develop a Growth Mindset

- Embrace Failure: Evaluate losing trades to understand what went wrong.

- Celebrate Small Wins: Recognize improvements in discipline or adherence to your trading plan.

- Seek Feedback: Engage in trading communities or mentorships where constructive criticism is given.

2. Developing Self-Awareness

Self-awareness involves recognizing your emotional states, triggers, and thought processes.

- Journaling Emotions: In addition to logging trades, note your emotional state before, during, and after each trade.

- Daily Check-Ins: Start each trading session by assessing your mental and emotional state. Acknowledge stressors or distractions.

- Introspective Questions: Ask yourself, “Am I trading because I see a valid setup, or am I reacting to fear/greed?”

The Role of Emotional Intelligence

Emotional Intelligence (EI) is the capacity to be aware of, control, and express one’s emotions, as well as handle interpersonal relationships empathetically. In trading, EI aids in:

- Managing Stress: Recognizing when stress is distorting judgment.

- Staying Composed: Retaining clarity of thought in fast-moving markets.

- Adaptability: Changing strategies or exiting positions promptly when market conditions shift.

How to Develop EI in Trading:

- Observe Patterns: Identify recurring emotional patterns that occur at specific times or under certain trading conditions.

- Active Listening: If you trade with a team or discuss ideas with mentors, truly listen to their perspectives rather than being locked into your viewpoint.

- Empathy: While this is often about understanding others, empathizing with fellow traders’ emotional struggles can help you recognize similar issues in yourself.

Practical Strategies for Emotional Control

While understanding emotions and biases is crucial, practical application cements those lessons. Here are actionable steps you can take to maintain discipline and profitability.

1. Create a Detailed Trading Plan

A trading plan should outline:

- Market(s) Traded: Stocks, forex, commodities, crypto, etc.

- Time Frames: Day trading, swing trading, position trading.

- Strategies & Indicators: Breakouts, mean reversion, moving averages, RSI.

- Risk Tolerance: Maximum percentage of capital risked per trade or per day.

- Profit Targets: Realistic objectives for each position.

Why It Helps Emotional Control: When you have a predefined roadmap, you’re less prone to on-the-spot emotional decisions.

2. Set Clear Entry and Exit Rules

A well-structured plan should specify your entry triggers (e.g., a breakout above a resistance level) and exit triggers (e.g., a trailing stop, a profit target, or a break below support).

- Entry Rules: Could involve a confluence of indicators (e.g., MACD crossover + price crossing 20-day MA).

- Exit Rules: Should include clear signals for both profit-taking and cutting losses (stop-loss orders or mental stops).

Why It Helps: Clear rules reduce overthinking during critical market moments. If the market meets your criteria, you enter or exit—end of story.

3. Implement Strict Risk Management

Risk management is the bedrock of longevity in trading. Common techniques include:

- Position Sizing: Risking only 1-2% of total capital per trade.

- Stop-Loss Orders: Automatically closing a position when the price hits a predetermined level.

- Hedging: Using options or inverse positions to protect against adverse moves.

Why It Helps: Fear and panic often stem from taking on excessive risk. Proper risk management ensures no single trade can blow up your account.

4. Use Checklists to Minimize Errors

Having a step-by-step checklist ensures nothing is overlooked. Your checklist can include:

- Market Trend Check: Bullish, Bearish, or Range-bound?

- Indicator Confirmation: MACD, RSI, volume, etc.

- Risk-Reward Ratio: Is it acceptable (>1:2, for instance)?

- Position Size: In accordance with your rules.

- Stop-Loss Placement: Logical placement based on technical levels.

Why It Helps: Checklists structure your process, greatly reducing impulsive, emotionally-driven trades.

5. Practice Mindfulness and Meditation

Spending even a few minutes each day on mindfulness techniques can sharpen your emotional awareness and maintain calm under pressure.

Practical Tips:

- Guided Meditation Apps: Headspace, Calm, or specialized trading psychology apps.

- Breathing Exercises: 4-7-8 breathing (inhale for 4 seconds, hold for 7, exhale for 8) can quickly alleviate stress.

Why It Helps: Mindfulness teaches you to observe emotions without immediately reacting, a crucial skill in volatile market scenarios.

6. Adopt a Routine and Trading Journal

Routine: Start the day reviewing market news, updating watchlists, and mentally preparing for the trading session. End the day by reviewing performance.

Trading Journal: Document each trade with:

- Date & Time

- Asset & Position Size

- Entry/Exit Points

- Rationale for the Trade

- Emotional State

- Outcome and Lessons Learned

Why It Helps: Journaling aids in identifying recurring emotional patterns, successes, and failures, enabling continuous improvement.

Techniques for Managing Emotional Triggers

Emotional triggers are specific events or conditions that consistently evoke a strong emotional reaction. Identifying and mitigating these triggers is central to emotional control.

1. Identifying Personal Trigger Points

Common triggers might include:

- Price hitting a round number (e.g., $100)

- Market open or close

- Sudden spikes in volatility

- News headlines or social media rumors

How to Identify Yours: Review journal entries to see if certain market events or personal conditions (e.g., lack of sleep, external stress) correlate with bad trading decisions.

2. Cognitive Reframing

This involves changing how you view a situation to alter its emotional impact.

- Example: Turn a loss into a learning fee. Instead of labeling it as a “failure,” view it as an opportunity to refine your system.

- Technique: Write down the negative thought (“I lost money because I’m a bad trader.”) and replace it with a constructive angle (“This loss indicates a gap in my risk management; I’ll improve it.”).

3. Breathing and Relaxation Techniques

Simple breathing exercises can lower stress hormone levels and help reset your emotional state.

- Box Breathing: Inhale for 4 seconds, hold for 4, exhale for 4, hold for 4. Repeat several times.

- Progressive Muscle Relaxation: Tense and relax different muscle groups to release tension.

Why It Helps: Controlled breathing interrupts the fight-or-flight response, allowing you to regain focus.

4. Visualization and Mental Imagery

Professional athletes frequently visualize their performance ahead of time. Traders can do the same.

- Pre-Market Visualization: Imagine calmly reacting to various scenarios (breakouts, sudden price drops, news events).

- Post-Trade Visualization: Reinforce successful behaviors by envisioning how you executed a perfect trade.

Why It Helps: This primes your mind to respond according to your plan rather than reverting to panic or impulsive behavior.

Risk Management as a Tool for Emotional Control

At its core, risk management is designed to prevent catastrophic losses and help you sleep at night. When you know exactly how much you stand to lose on any single trade, fear diminishes. This in turn helps you trade more objectively. Some advanced forms of risk management include:

- Position Correlation Analysis: Ensuring that your trades are not all in the same sector or highly correlated assets.

- Volatility-Based Position Sizing: Adjusting position sizes according to volatility levels. Higher volatility assets get smaller position sizes.

- Diversification: Spreading capital across different asset classes or strategies so that no single event can wreak havoc on your entire portfolio.

By systematically limiting downside risk, you free yourself from the psychological burden of “do or die” trades, which often push traders toward emotional meltdown when the market moves against them.

Keeping a Trading Journal and Self-Reflection

We’ve touched on the trading journal earlier, but its importance cannot be overstated. A well-maintained journal is your personal database of what works and what doesn’t, both in terms of strategy and emotional response.

Detailed Logging

- Pre-Trade Analysis: Market conditions, reason for entry, target exit, stop-loss.

- During Trade: Emotional state, any sudden changes in market conditions, updated stop-loss or take-profit levels.

- Post-Trade Review: Outcome, lessons learned, emotional state after closure.

Regular Review

Set aside time weekly or monthly to review all trades. Look for patterns in:

- Strategy Success Rates

- Risk-Reward Ratios

- Emotional Triggers

- Market Conditions (e.g., was it a trending or choppy market?)

Over time, this data can reveal subtle trends about your performance, from which you can extract valuable lessons to refine both your trading strategies and emotional discipline.

Balancing Trading With Lifestyle and Well-Being

Trading can be mentally and emotionally taxing. Long-term success requires balance.

- Physical Health: Regular exercise, balanced diet, and proper sleep can significantly improve emotional control.

- Mental Health Breaks: Taking days off to recharge can prevent burnout.

- Social Connections: Engaging with friends, family, or a trading community can provide emotional support and fresh perspectives.

- Setting Realistic Goals: Unrealistic financial targets can lead to pressure and emotional breakdowns.

A balanced lifestyle ensures that you’re at your best mentally. The markets will test your emotional resilience daily, and being physically and mentally fit is a critical advantage.

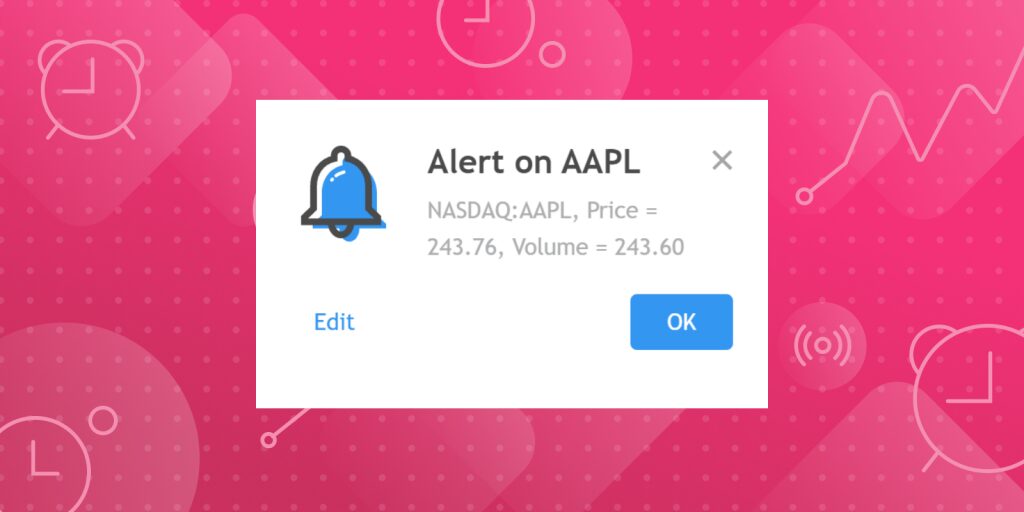

Technology and Tools to Aid Emotional Control

Modern traders have access to numerous tools that can help maintain discipline:

- Trading Platforms with Alerts: Set up automatic alerts that remind you to enter or exit a trade, reducing the emotional “shock” of sudden price moves.

- Automated Trading Systems or Algorithmic Trading: Remove human emotions altogether by letting a bot execute trades based on predefined criteria.

- Mobile Apps for Mindfulness: Tools like Headspace or Calm for quick meditation during breaks.

- Portfolio Tracking Apps: Keep an eye on your entire portfolio without obsessively watching every tick on a single asset.

Caution: While technology can help, it can also become a crutch or even a distraction. Automation and alerts are only as good as the strategy and discipline behind them. Always combine technological tools with robust trading psychology and risk management principles.

Real-Life Examples of Emotional Trading (and How to Overcome)

Learning from real-life cases can provide actionable insights into how to control emotions in trading.

Case Study 1: Revenge Trading

- Scenario: A forex day trader loses $1,000 after a sudden EUR/USD reversal. Feeling wronged, they immediately open a larger position to recoup the loss. The market continues against them, doubling the loss.

- What Went Wrong: Emotional reaction (anger, frustration) led to a violation of risk management rules.

- How to Overcome: Implement a “cool-down” rule: if you lose a certain amount or have a set number of consecutive losses, stop trading for the day. Reflect in your journal on what triggered the revenge trade.

Case Study 2: FOMO (Fear of Missing Out)

- Scenario: A stock is skyrocketing, fueled by social media hype. A trader enters late at a much higher price, hoping the rally continues. The price reverses shortly after.

- What Went Wrong: Emotional response to market euphoria, ignoring risk-reward analysis and technical signals.

- How to Overcome: Predefine acceptable entry points and avoid chasing price. Focus on trades that align with your plan, even if it means missing some opportunities.

Lessons From These Examples

- Don’t Chase: Markets will always present new opportunities.

- Have a Cool-Down Mechanism: If you find yourself emotionally charged, step away.

- Stay Disciplined: Continually refer back to your trading plan and journal.

Recommended Books on Controlling Emotions in Trading

If you want to dive deeper into trading psychology and emotional control, these books provide valuable insights:

“Trading in the Zone” – Mark Douglas

“The Disciplined Trader” – Mark Douglas

“The Daily Trading Coach” – Brett N. Steenbarger

“Thinking, Fast and Slow” – Daniel Kahneman

“Market Wizards” – Jack D. Schwager

“Atomic Habits” – James Clear (for developing discipline and habits essential for trading success)

These books cover key psychological aspects of trading, including emotional resilience, mindset, and discipline, helping traders refine their mental approach to the markets.

Conclusion: The Path to Emotional Mastery and Profitability

Controlling emotions in trading is not a one-time achievement but an ongoing journey. Each trade provides data not only about market patterns but also about your psychological tendencies—what triggers you, how you react under stress, and which environments best support your trading success. By integrating psychological concepts, risk management strategies, and rigorous self-reflection, you lay the groundwork for disciplined and consistent profitability.

Key Takeaways for Ongoing Success

- Self-Awareness Is the First Step: Understand which emotions and biases affect your decisions.

- Structure Minimizes Emotion: Detailed trading plans, checklists, and journals create a framework for disciplined action.

- Risk Management Is Emotional Insurance: Limit your downside so fear and greed have less power over you.

- Continuous Improvement: A growth mindset ensures you learn from every trade—win or lose.

- Balance & Well-Being Matter: A healthy body and mind significantly bolster your resilience in high-pressure trading scenarios.

By diligently applying these principles, you can transform from a trader who reacts emotionally to one who operates with confidence and composure. Over time, emotional mastery becomes a competitive edge, allowing you to thrive in markets where many fall prey to their own psychology. This edge, more than any specific strategy or indicator, is what sets consistently profitable traders apart.

Final Word

Achieving emotional control in trading doesn’t mean you will never feel fear or excitement. It means recognizing when emotions arise, understanding their implications, and using a set of proven strategies—both psychological and practical to ensure those emotions don’t derail your trading plan. Master this skill, and you’ll be well on your way to disciplined, profitable trading in any market condition.