In today’s dynamic financial landscape, selecting the best broker for stocks trading is crucial for investors & traders seeking to optimize their strategies. With many options available, it can be overwhelming to discern which platform offers the best features, pricing, and support.

However, one brokerage firm that stands out among the crowd is Interactive Brokers. before we delve into their features and offerings, let me explain why I picked them over the others.

Example:

You see, there are brokers who charge you a fee for each order you send, while others don’t charge anything. Why is that? And if you know about ECNs, you’ll know that some ECNs charge fees to add your order to their order book, while others pay you for adding your order. Your broker acts as a middleman, sending your order to these ECNs, and they have to pay those fees. So, how can they not charge you anything and still execute your order for free? How is this even financially possible?

So, to grasp what’s going on here, you need to understand what happens when you send an order to your broker. When you send an order to your broker, your broker is usually responsible for sending that order to the market.

Now, if you’re trading in the US, for example, there are lots of places your broker can send your order to. There are several exchanges like NYSE, NASDAQ, AMEX, but there are also many other places where you can trade called ECNs. These ECNs act like exchanges, so there are hundreds of them: BATS, ARCA, BYX, just to name a few. And there are also plenty of dark pools. So, your broker now has the option to send your order to any of these exchanges, and their responsibility is to get you the best execution possible. They have to do that.

So, there are all these exchanges, ECNs, and dark pools, and together they make up the order book.

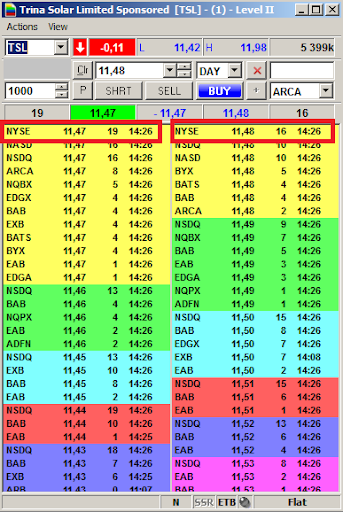

This is what the order book is going to look like. In an order book, you’re going to have all the buyers on one side and all the sellers on the other. At the same price, you’re going to have sellers at different venues. So, here somebody wants to sell 1,600 shares on NYSE (where 1 lot is equal to 100 shares) at $11.48, but then somebody else wants to sell only 1,000 shares at NASDAQ, and another person wants to sell 500 shares at BYX. So, you have all of these ECNs.

So, if you want to buy this stock at the market price and you send your order to a broker that doesn’t charge any commission, what do you think they do? Well, the best thing they could do is give you the choice to choose which ECN you want to buy from.

Now, the second best thing they could do is have a smart order router, which is an internal router they use to try to get you the best execution possible. They might say, “You want to buy 2,000 shares, so we’ll send 1,600 to NYSE and 400 to BATS so you get your 2,000 shares.” That might be a smart order router that they use, which, to be honest, most brokers have not-so-smart smart order routers because they don’t care about your execution but they care about the fees they get, not from you but from the ECNs because different ECNs are going to give them different fees.

But that’s not even what they do. What they are doing is selling your order to an HFT firm because they believe that this HFT firm is going to be able to get the best execution possible for you, even better than they would be able to.

Let’s take a look at what an HFT firm would do when they receive your order. For example, if they sell your order to Citadel, and Citadel gets your order to buy at $11.48, what they might do is they could buy it in a dark pool at the midpoint, let’s say $11.4750, getting it half a cent better. Then, they sell it to you at $11.48 but they bought it at the lower price.

Alternatively, they might try to buy it for you in an ECN that pays them fees. Some ECNs actually pay the person who buys on them. In this case, BYX pays them fees. If you want to learn more about these fees and ECNs, check out an article about ECNs. So, they would only try to buy from BYX because BYX would pay them.

But then, if you want to buy more shares, they’re not going to route anywhere else; they still want to buy at BYX. So, you might get slow execution because they’re trying to get executed and make money off your trade. They’re not trying to fill you at the best price; they’re just trying to get executed at a good price for them.

Now, let’s consider another scenario where you want to buy at the bid. So, you place an order at the bid and wait to get filled. Suppose you want to place your order; which exchange should you use? Well, you should place your order on the exchange that charges to add liquidity, so the person who removes liquidity actually gets paid. (Sending a limit order—that’s what adding liquidity means; removing liquidity means sending a market order.)

Now, which one of these charges to add liquidity? Well, actually BYX. BYX charges you if you add liquidity, and if you remove liquidity, they pay you. This line or queue, you can imagine it as a queue, is a queue that’s serviced really fast because everybody who wants to sell is going to sell on that ECN because they get paid for removing liquidity, and the person who was there is the one who is charged.

So, yes, you get charged a bit, but you get serviced fast. But if you post your order somewhere like, let’s say, NASDAQ, well, you know what? If you add liquidity, you get paid, and the person who removes gets charged. So, nobody wants to remove liquidity from NASDAQ.

So, basically, if you want to get filled fast, you’ve got to go to one of these ECNs that charge to add liquidity and pay to remove liquidity. Now, there is a conflict of interest because the HFT wants to get the most rebates possible, so they’re going to send your order to an ECN where you’re less likely to get executed. But if you do get executed, you’ll be the last person to get executed because people go there last since it’s the most expensive place. So, you’re not going to get a good execution, but when you do get the execution, they make the rebate off of you.

And not only that, there are high-frequency traders with latencies in nanoseconds. So, when you send a market order, they can front-run you. They see your order coming, manipulate the price, and make money off your trades.

Many brokers sell order flow to HFT firms. They all do it; that’s how they make money. That’s how they’re able to offer you commission-free trading. This is what happens behind the scenes.

Best Broker for Stocks Trading

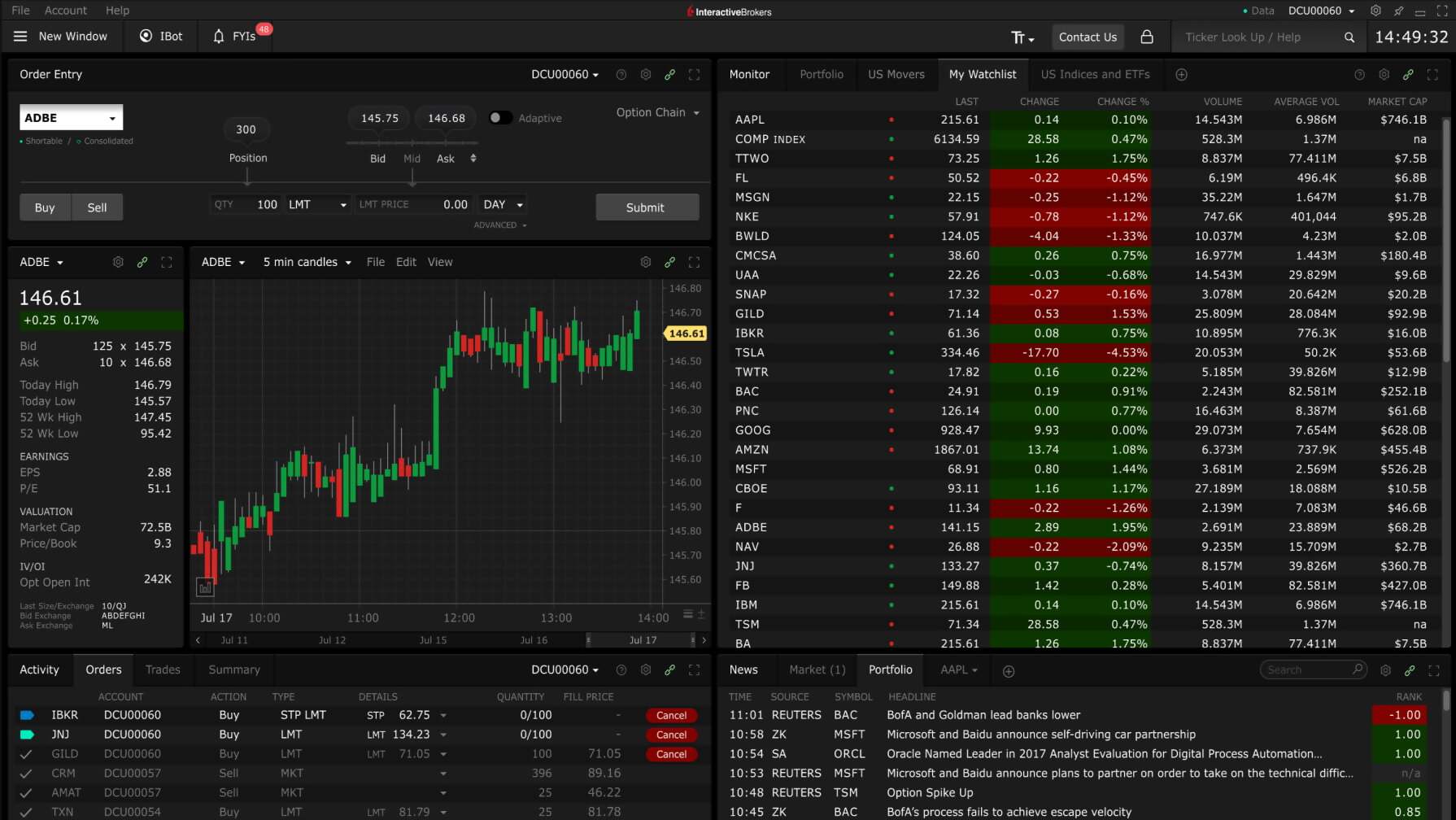

Now, what sets Interactive Brokers apart is that they allow you to choose which ECN to send your order to, and they have access to a variety of ECNs, as well as some dark pools. Retail traders typically cannot access dark pools, but IBKR allows access to certain dark pools for retail traders. This is one of the main reasons I chose IBKR as my broker.

Global Access:

Interactive Brokers provides traders with unparalleled global access to financial markets, with offerings spanning across 135 markets in 33 countries.

This extensive market coverage allows traders to diversify their portfolios and capitalize on opportunities around the world. Whether trading stocks, options, futures, forex, or bonds, IBKR offers access to a diverse range of asset classes across different regions, providing traders with the flexibility to pursue their investment goals on a global scale.

Trading Platform:

At the core of Interactive Brokers offering is its sophisticated trading platform, the Trader Workstation (TWS).

TWS is a powerful desktop application equipped with advanced charting tools, customizable dashboards, real-time market data, and a wide range of order types. With its intuitive interface and robust functionality, TWS empowers traders to execute trades with precision and efficiency, while providing access to advanced trading tools such as options analytics, risk management tools, and algorithmic trading strategies.

Research and Analysis:

Interactive Brokers offers a wealth of research and analysis tools to help traders make informed investment decisions.

The IBKR Traders’ Academy provides free online courses, webinars, and tutorials covering a wide range of topics, from basic trading concepts to advanced strategies. Additionally, IBKR offers access to third-party research reports, market analysis, and financial news, enabling traders to stay informed about market trends and developments.

Margin Rates:

Interactive Brokers offers competitive margin rates, allowing traders to leverage their capital and maximize returns.

With margin rates as low as 0.75% for accounts with balances over $1 million, IBKR provides traders with the flexibility to amplify their trading power while managing risk effectively. Moreover, IBKR offers portfolio margin, which allows traders to optimize margin requirements based on the specific risk profile of their portfolios.

Regulation and Security:

As a leading brokerage firm, Interactive Brokers prioritizes regulatory compliance and security. IBKR is regulated by top-tier authorities such as the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), providing traders with peace of mind knowing that their funds are protected and their transactions are conducted in a secure and transparent manner.

Additionally, Interactive Brokers employs stringent security measures, including multi-factor authentication, encryption, and account protection features, to safeguard against unauthorized access and fraud.

API Support:

Interactive Brokers offers comprehensive API support, allowing traders to automate their trading strategies and integrate third-party applications seamlessly.

With APIs for trading, market data, and account management, IBKR provides developers with the tools and resources they need to build custom trading solutions tailored to their specific requirements.

Whether developing automated trading algorithms, executing complex trading strategies, or integrating with external platforms, IBKR’s API support enables traders to unlock new opportunities and enhance their trading experience.

Short Selling Availability:

Interactive Brokers offers extensive short selling availability, allowing traders to profit from downward price movements in the market.

When you short a stock, you need to borrow it first and with Interactive Brokers’ vast client base, you gain access to borrow almost any company’s stock.

IBKR provides traders with the flexibility to capitalize on bearish market conditions and hedge against downside risk. Moreover, Interactive Brokers offers competitive rates and flexible borrowing terms, enabling traders to execute short selling strategies with precision and confidence.

Other than that, the platform allows you to conveniently check the availability of these shortable stocks directly on their website.

Customer Service:

Interactive Brokers is committed to providing exceptional customer service and support to its clients. With a dedicated team of knowledgeable professionals available 24/7 via phone, email, and live chat, IBKR ensures that traders receive prompt assistance and guidance whenever needed.

Whether navigating the trading platform, resolving technical issues, or addressing account-related inquiries, Interactive Brokers’ customer service team is always ready to assist traders with their needs.

I have personally never encountered significant issues with them, and in the rare instances where there were problems, they have been quick to address and resolve them. This aspect of their service is something that I genuinely appreciate.

Conclusion

In conclusion, Interactive Brokers emerges as the best broker for stock trading, offering a comprehensive suite of features and services designed to meet the diverse needs of traders. With its advanced trading platform, global access, robust research and analysis tools, competitive margin rates, strong regulatory framework, API support, short selling availability, and exceptional customer service, IBKR provides traders with the tools and support they need to succeed in today’s fast-paced financial markets. Whether you’re a seasoned trader or just starting out, Interactive Brokers offers the perfect combination of features, reliability, and support to help you achieve your investment goals.