Forex, short for foreign exchange, refers to the global marketplace where currencies are traded against each other. It’s the largest and most liquid financial market in the world, with trillions of dollars being traded every day.

We know that every country across the globe possesses its unique currency, such as the United States with the US dollar, Canada with the Canadian dollar, and the European Union with the euro, among many others.

Usually, when you’re in a certain country, you mainly use its currency for buying stuff and paying for services. You’ll have to change your money into the currency of the place you’re going to, but the rate isn’t always the same. It changes for different reasons, and we use this change, called the exchange rate, to earn money in forex trading.

Example:

Let’s consider a scenario where you’re going on vacation from the United States to Mexico. To spend in Mexico, you need to convert some of your US dollars into Mexican pesos. At the time, the exchange rate was 1 US dollar equals 20 pesos. So, when you convert $100 into pesos, you receive 2000 pesos.

During your vacation, you used your card for all expenses, and you still have the 2000 pesos with you when you return home.

Now, when you want to convert these pesos back into US dollars, you find that the exchange rate has changed. Let’s say it’s now 1 US dollar equals 16 pesos. This means that the peso has gained in value, and 1 US dollar can’t get you as many pesos as before because pesos are now more expensive.

So, how much US dollars can you get for your 2000 pesos now? You would receive 125 US dollars. This exchange results in a profit of 25 USD, just by holding onto the currency for some time and then converting it back.

If the exchange rate changed differently, for example, if the pesos that 1 US dollar can buy increased to 30 pesos, you would have experienced a loss. This is because, due to the exchange rate shift, pesos are no longer as valuable as they used to be.

This is the principle of forex trading. You can simply convert your money and hold onto it if your analysis suggests it will yield a profit.

What are Currency Pairs?

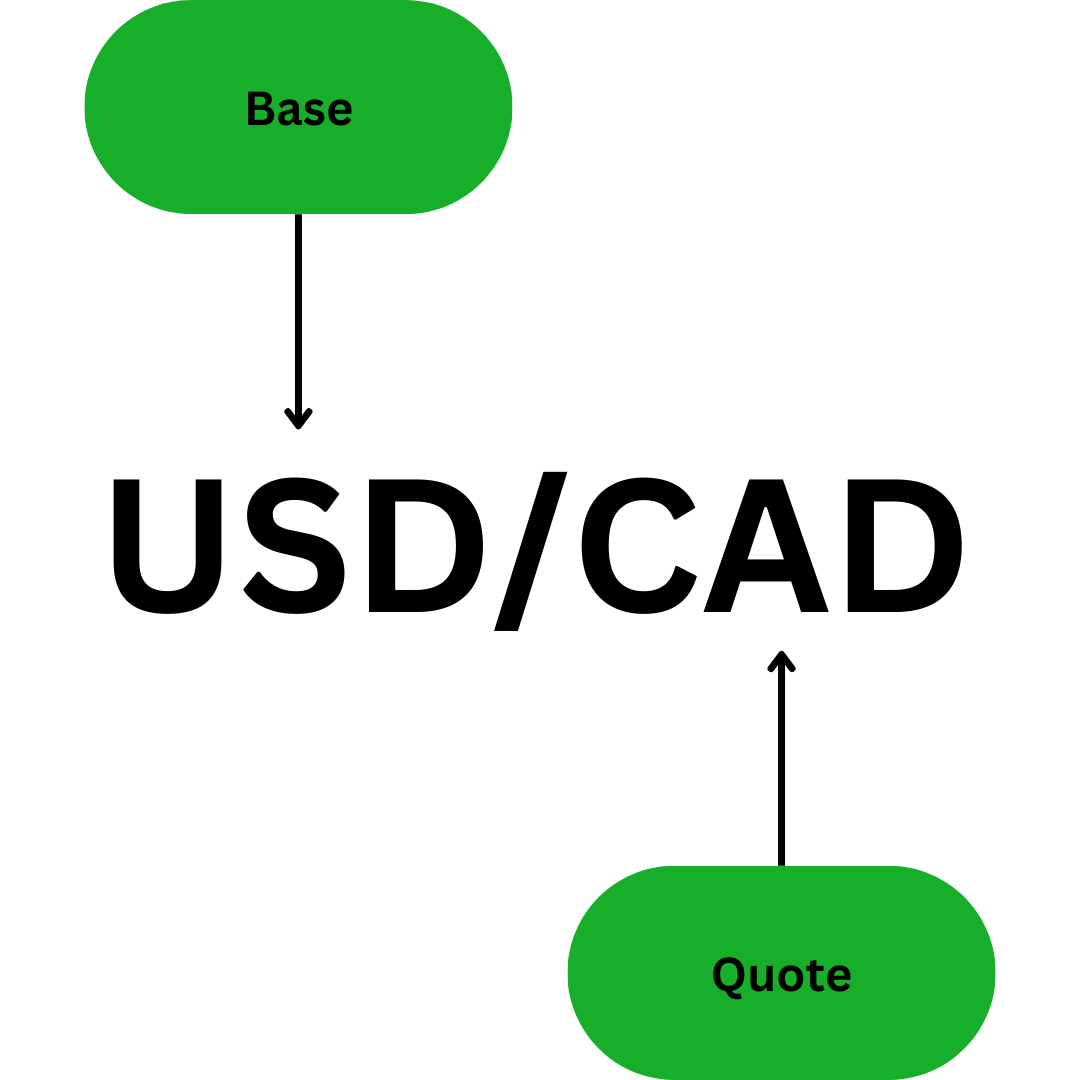

When referring to a currency in relation to another currency, we use the term “currency pair.”

So, a currency pair essentially involves quoting one currency against another. For instance, when comparing the US dollar to the Canadian dollar, it’s denoted as USDCAD.

Now in this currency pair, there are 2 currencies, you have the base currency and the quote currency. the first one is gonna be the base currency and the second one is gonna be your quote currency. for example in USDCAD, USD is the base currency, and CAD is the quote currency.

The way this works is that the base currency unit is always set at 1. Therefore, it signifies how much of the quote currency can be obtained with one unit of the base currency. For instance, if the USDCAD exchange rate is currently 1.36396, it means that 1 USD can be exchanged for 1.36396 CAD.

The method of representing currency pairs relies on ISO currency codes. ISO currency codes are three-letter alphabetic codes that represent specific currencies recognized by the International Organization for Standardization (ISO).

These codes make identifying and referencing currencies in international transactions, financial markets, and data systems easier.

For example, USD stands for the United States Dollar, EUR for the Euro, and JPY for the Japanese Yen.

What are Major Currencies?

Currencies vary in terms of liquidity, meaning not all of them are traded as extensively as others. You are likely aware that the most actively traded currency in the world is the US dollar.

We refer to the currencies that experience the highest trading volumes as “Major Currencies.”

- USD(US dollar)

- EUR(Euro)

- JPY(Japanese yen)

- GBP(British pound)

- AUD(Australian dollar)

- CAD(Canadian dollar)

- CHF(Swiss franc)

Due to this distinction, we have what we refer to as major currency pairs, which are essentially pairs of currencies known for their exceptionally high liquidity.

- GBP/USD

- USD/CAD

- AUD/USD

- USD/CHF

- USD/JPY

- EUR/USD

- NZD/USD

You might be curious about why currency pairs like USD/CAD exist instead of CAD/USD or why the order sometimes places USD first and other times second. Well, there’s a convention that governs this, and it follows a specific rule.

The rule is as follows: if a currency pair includes the euro, the euro will be designated as the base currency. The second priority is the pound sterling. Therefore, if a pair includes both the euro and pound sterling, the euro will be the base currency, and the pound will be the quote currency.

However, if there is no euro but another currency present, and the pound sterling is in the pair, then the pound takes the role of the base currency, and the other currency becomes the quote currency.

The third in line is the Australian dollar, and if it’s not present, the fourth is the New Zealand dollar. Following this sequence, the fifth is the United States dollar, and it continues with the Canadian dollar, Swiss franc, Japanese yen, and so forth.

Here is the list :

- Euro

- Pound sterling

- Australian dollar

- New Zealand dollar

- United States dollar

- Canadian dollar

- Swiss franc

- Japanese yen

Now, when it comes to other currencies, such as pesos or any other we call minor currencies, they are typically quoted against the US dollar. For instance, you might see a pair like USD/MXN.

However, if a currency pair doesn’t include the US dollar, we refer to it as a cross pair. For example, CAD/JPY is considered a cross pair.

What is the Forex Market?

The Forex (foreign exchange) market is primarily an Over-the-Counter (OTC) market, which means that it operates decentralized and transactions are conducted directly between participants without a centralized exchange.

As a result of this, the execution price may fluctuate. However, when you engage in online trading, price variations will still occur, but they will be minimal.

Interbank market, where major banks conduct transactions with each other. These large banks can engage in transactions using platforms like EBS Electronic Broking Services or Thomson Reuters.

Essentially, these platforms provide an order book for prominent banks such as Deutsche Bank, UBS, Citigroup, JP Morgan, Bank of America, RBS, HSBC, and others. These major banks collectively account for 60 to 70% of the total forex market volume. They have access to an order book where they can trade among themselves.

It’s important to note that this exclusive access is reserved for these major banks; individuals like you and me cannot participate because the transactions involve billions of dollars every second, and we are considered too small to enter this market.

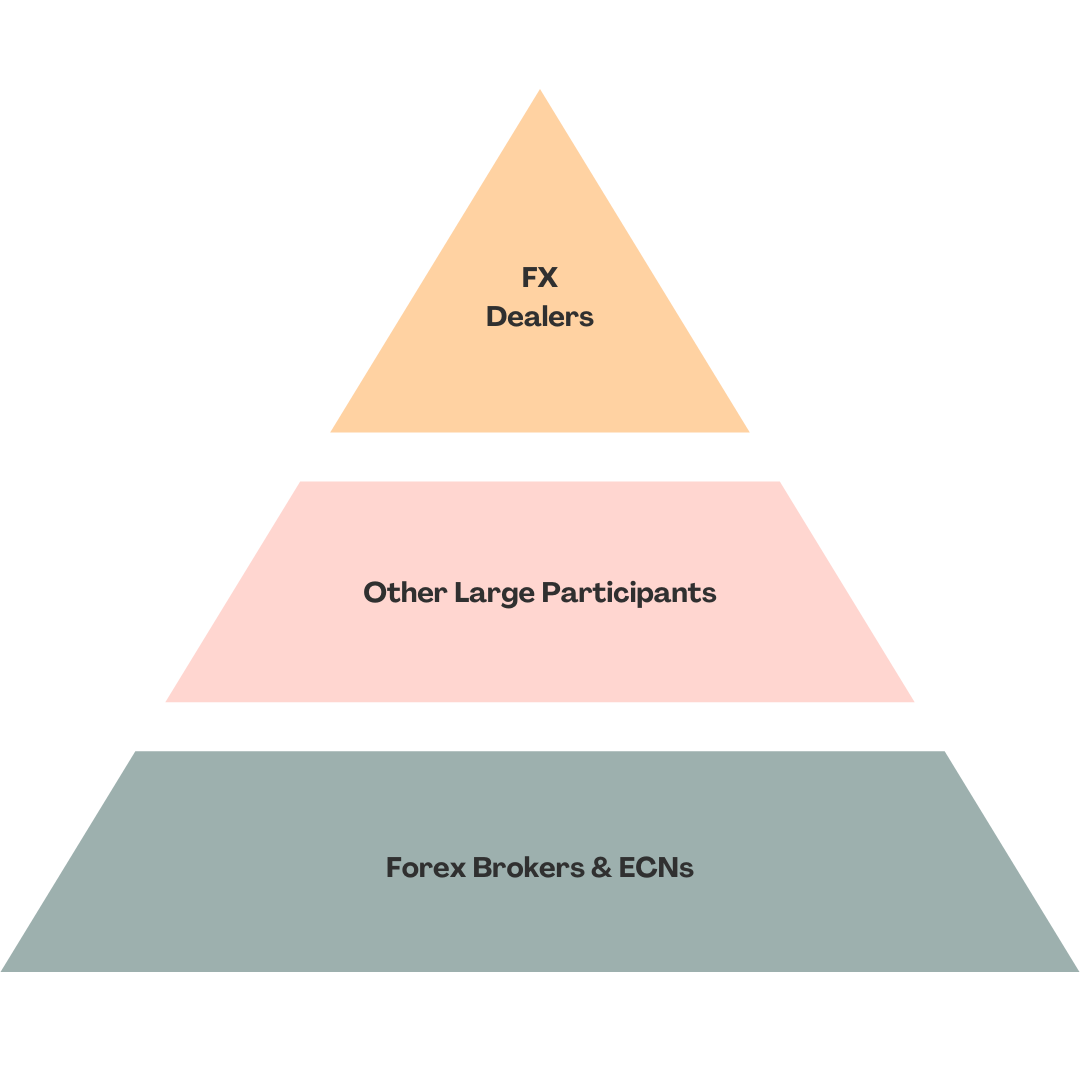

Those banks are considered elite FX dealers, occupying the highest echelon of the industry. It’s not straightforward for other market participants to directly engage in trading with them. If you wish to participate in the market, you’ll need to go through one of these top-tier banks. This forms the first level.

Moving to the second level, we have other substantial participants, which can encompass smaller banks, large corporations, and sizable hedge funds. These entities typically approach one of the top-tier banks to execute their trades.

Finally, at the third level, we have forex brokers and retail ECNs (Electronic Communication Networks). Forex brokers act as the intermediaries responsible for executing your trading orders.

As a trader, you must go through one of these forex brokers to have your orders fulfilled, and they, in turn, conduct their trades through the second-level participants.

What are Pips?

A pip signifies a currency’s shift by 0.0001, and typically, currencies don’t undergo significant movements. In many instances, they fluctuate in values equivalent to cents, and sometimes they even remain within a one-cent range. This is why we focus on leveraging very minor fluctuations, such as 0.0001, to make gains in the market.

As an illustration, consider the EURUSD trading at 1.07000 initially, and after a period, it rises to 1.07100. This represents a movement of 10 pips.

What are Lots?

In currency trading, a “lot” serves as the standard unit of measurement.

Specifically, it signifies the purchase of 100,000 units of the base currency. For instance, when you acquire 1 lot of EURUSD, you are effectively buying 100,000 Euros.

Calculating the Pip Value

The calculation of pip value involves two key components: pips and lots. When determining pip value, you’re essentially figuring out how much profit or loss you stand to make in dollars for every pip movement that occurs in a given currency pair.

The calculation of pip value is expressed in the quote currency.

For instance, let’s take USDCAD, currently trading at 1.35251. To obtain 1 lot of this currency pair, we recognize that 1 lot equals 100,000 units of the base currency, which amounts to $100,000 in US dollars. In Canadian dollars, this translates to $135,251, which is the contract value or the amount it would cost us to acquire 1 lot.

The pip value represents the profit or loss you’ll encounter for each pip’s worth of movement. Suppose, for instance, the USDCAD price increases to 1.35261, signifying a 1 pip shift. At this point, the contract value for the price 1.35261 amounts to 135,261 Canadian dollars, as compared to the initial 135,251 Canadian dollars. Therefore, the pip value is the difference between these two contract values, which equals 10 Canadian dollars.

In this scenario, a 1 pip movement for 1 lot of USDCAD corresponds to a value of 10 Canadian dollars.

A straightforward formula to compute pip value is:

Amount of lots you are trading * 10

What is Leverage in Forex?

Forex trading typically involves the use of leverage, which essentially means that your broker provides you with funds to trade with.

The reason behind this is that in the foreign exchange market, as you’ve observed, price movements are relatively small. To generate significant profits or losses, you need to trade with larger positions. However, unless you have substantial capital, it may not be possible. Therefore, you borrow a substantial sum of money from your broker to engage in larger trades, thereby amplifying the impact of your trading decisions.

| LEVERAGE | MARGIN REQUIREMENT | 1 LOT REQ IN $ |

|---|---|---|

| 1:1 | 100% | $100000 |

| 2:1 | 50% | $50000 |

| 10:1 | 10% | $10000 |

| 50:1 | 2% | $2000 |

| 100:1 | 1% | $1000 |

| 200:1 | 0.5% | $500 |

| 400:1 | 0.25% | $250 |

| 800:1 | 0.125% | $125 |

| 1000:1 | 0.1% | $100 |

When discussing leverage, you’ll often come across ratios like 1:1, 1:100, or 1:50. These ratios indicate the extent to which you’re amplifying your trading capital. In the case of 1:1 leverage, it means you’re not receiving any additional funds, and your trading capital remains exactly as is.

To clarify further, a 1:1 leverage ratio corresponds to a 100% margin requirement. The margin represents the amount you must deposit to access the desired trading position. For example, if you intend to trade with a position worth $100,000, and the margin requirement is set at 20%, you would need to deposit $20,000 to secure that $100,000 position. However, when dealing with 1:1 leverage, the margin requirement is 100%, meaning you must provide the full $100,000 to initiate a trade for 1 lot.

With a 2:1 leverage ratio, it signifies that for every unit of capital you contribute, you’re receiving an additional unit. In this scenario, the margin requirement is 50%, meaning you have to provide 50% of the total amount, and your broker covers the other 50%. So, if you intend to purchase 1 lot, you would need to invest $50,000 because your broker is contributing the remaining $50,000 on your behalf.

At a leverage ratio of 100:1, you’re only required to commit 1% of the total to initiate your trade. So, in this context, to obtain 1 lot, you would only need to invest $1,000

Some brokers provide exceptionally high leverages, reaching as high as 1000:1 or even 2000:1, but these levels of leverage come with significant risks. The recommended and generally considered ideal leverage range falls between 50:1 and 100:1. Allow me to elaborate on the reasons behind this preference.

Consider a scenario where you’re observing the USDCAD pair. If you invest $100 with a leverage of 1000:1, it means you can access 1 lot for just $100. As we’ve previously calculated, trading 1 lot in this case equates to earning $10 per pip.

Now, think that you enter the market at 1.3350, and the currency pair climbs to 1.3400. This would translate to a gain of 50 pips. So, with your initial $100 investment and a 50-pip increase, you’d realize a profit of $500.

However, it’s important to note that if the market moves against your position, it doesn’t take much to result in losses. For instance, a mere 10-pip drop would lead to a loss of 10 pips multiplied by $10, which equals $100. This is equivalent to your entire $100 capital, resulting in a complete loss.

In such cases, your broker initiates a stop-out, reclaiming their loaned funds, and you’re left with losses. In this arrangement, the risk predominantly lies with you, as the broker isn’t assuming any substantial risk.

Leverage is akin to a two-sided blade; it necessitates meticulous risk management and a clear understanding of the appropriate level of leverage to employ.

Conclusion

Forex pairs are among the various assets available for trading, but similar to other assets such as stocks and cryptocurrencies, they require a well-defined strategy to generate profits.