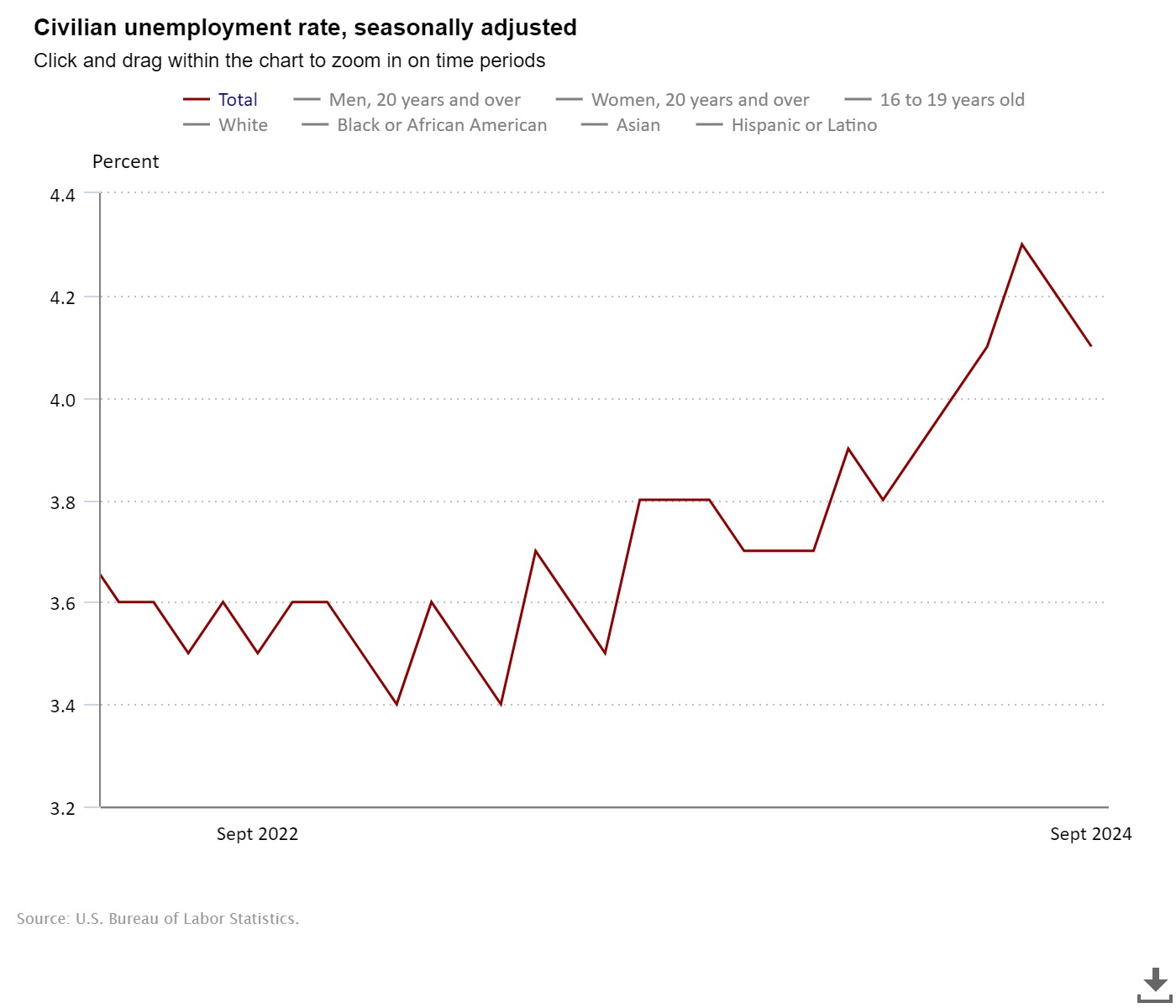

The U.S. unemployment rate recently dropped to 4.1%, a signal that the American labor market remains strong despite broader economic challenges. This development has sparked significant interest in how it could influence monetary policy and, in turn, the value of the U.S. dollar. Lower unemployment means higher consumer spending, which fuels economic growth but also raises concerns about inflation. As a result, the Federal Reserve’s approach to interest rates will play a crucial role in determining the next moves for the EURUSD currency pair.

Understanding the Unemployment Rate and Its Economic Impact

The unemployment rate is more than just a measure of job availability. It’s a key economic indicator that reflects overall economic health. When unemployment falls, as it did in the U.S. 4.1%, it means more people are earning and spending, which helps businesses grow and encourages more investment in the economy. A healthy labor market is usually associated with stronger GDP growth, increased inflationary pressures, and changes in monetary policy.

In the U.S., the unemployment rate’s drop signals that the economy is resilient and may not require further interest rate cuts to stimulate growth. The Federal Reserve, tasked with balancing economic growth with inflation control, monitors this data closely. While lower unemployment can drive economic growth, it also risks pushing inflation higher as increased demand for goods and services puts upward pressure on prices. This is where the Federal Reserve steps in, using interest rates to control inflation by either making borrowing more expensive (raising rates) or more accessible (lowering rates).

Latest Developments in US Monetary Policy

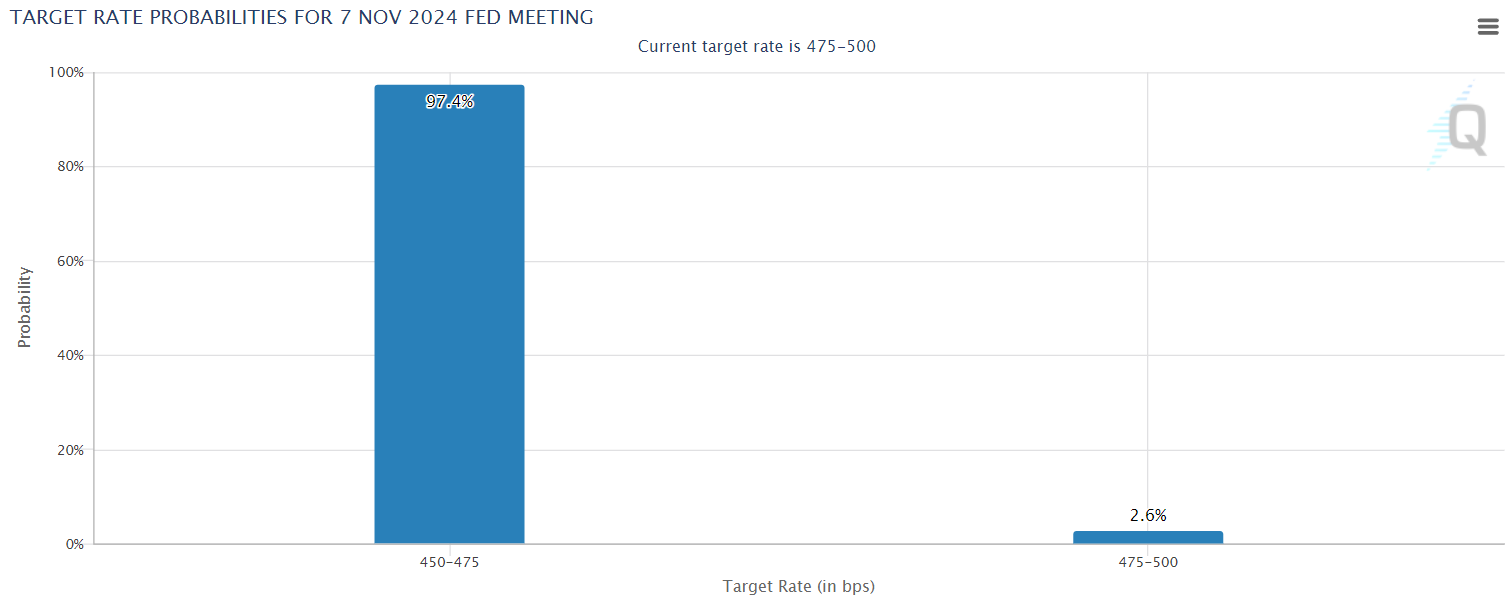

Recently, the Federal Reserve made a 50 basis point cut to interest rates, aiming to mitigate global economic risks. However, the drop in the unemployment rate complicates the Fed’s path forward. With a strengthening labor market, there’s less need to continue cutting rates. A strong job market can potentially lead to inflation, and if inflation expectations rise, the Fed may pivot toward maintaining or even raising rates, which would support the value of the U.S. dollar.

Rate Cut Expectations: Before the latest unemployment data, markets were expecting more aggressive rate cuts to stimulate the U.S. economy. However, the drop in unemployment suggests the economy is faring better than expected. This could delay future rate cuts, as the Fed may adopt a more cautious approach to avoid overheating the economy and fueling inflation. Should inflation remain in check, the Fed may maintain the current rate levels, keeping borrowing costs steady and supporting the dollar’s strength.

USD Impact: A stronger labor market typically boosts the U.S. dollar as it signals economic resilience. the U.S. dollar will likely continue to appreciate against other currencies, including the euro. A stronger dollar puts downward pressure on the EURUSD pair, as the dollar becomes more attractive to investors looking for stable returns.

But anything could happen, so all we can do is prepare!

How the Drop in Unemployment Could Impact the Market

- Inflation and Interest Rates: A healthy labor market can push inflation higher as consumer demand increases. If inflation begins to rise, the Federal Reserve may opt to keep interest rates steady or even consider hikes to prevent the economy from overheating. This would further boost the value of the U.S. dollar.

- Stock Market Response: Strong employment figures generally support growth in the stock market. Companies benefit from increased consumer spending, which drives up earnings and attracts investors. A rising stock market can further attract foreign capital inflows, strengthening the U.S. dollar and applying downward pressure on the EURUSD exchange rate.

- Monetary Policy Divergence: The European Central Bank (ECB) has been cutting rates in response to the Eurozone’s weaker economic performance. With the U.S. labor market proving resilient and inflationary pressures potentially rising, the Fed may not need to continue cutting rates. This divergence in monetary policy between the ECB and Fed could lead to a widening interest rate differential, causing further drops in EURUSD.

EURUSD: Potential Impact and Outlook

The EURUSD currency pair is driven by the relative strength of the U.S. dollar and the euro. With the U.S. unemployment rate falling, the Fed’s policy outlook becomes more hawkish, making the dollar more attractive to investors. At the same time, the ECB is maintaining a more dovish stance, with recent rate cuts aimed at stimulating the Eurozone’s weak economic growth. This creates a perfect storm for EURUSD to trend lower.

- ECB Monetary Policy: The ECB’s decision to maintain or further reduce interest rates contrasts sharply with the Fed’s potential rate pause or hikes. This divergence makes U.S. assets more attractive to investors, drawing capital away from the Eurozone and supporting the U.S. dollar.

- Capital Flows: As U.S. interest rates stabilize or rise, capital inflows to the U.S. increase. Global investors seeking higher returns are likely to invest in dollar-denominated assets, further strengthening the dollar and pushing EURUSD lower.

Looking at the current price action, EURUSD has dropped below the key support level of 1.10000. The next major support levels are 1.09000 and 1.08000. If the price breaks through those levels in the coming days, we could see further declines. The direction will largely depend on the Federal Reserve’s upcoming rate decision, which could significantly impact the pair’s movement.

What to Watch Next?

The U.S. unemployment data signals a more resilient economy, potentially forcing the Federal Reserve to pause further rate cuts and possibly consider tightening if inflation accelerates. Traders will closely watch upcoming inflation reports and Federal Reserve meetings for more clarity on interest rates. Additionally, ECB decisions will also be important as the Eurozone navigates its own economic challenges.

In conclusion, the drop in U.S. unemployment has added complexity to the monetary policy outlook, suggesting that the Fed may hold off on further rate cuts. For EURUSD traders, this creates opportunities to capitalize on a strong dollar as the ECB continues its dovish policies. By monitoring both central banks’ actions and inflation trends, traders can better position themselves in this evolving market environment.