Business cycles are a key part of today’s economies, influencing how economies grow, how many people have jobs, and how prices change. Knowing about these cycles is really important for government leaders, businesses, and regular people because they affect jobs, money decisions, and what governments do.

In this article, we’ll talk about what are business cycles, looking at different parts they have, why they happen, and what they mean.

What is Economic Cycle?

The economic cycle, also known as the business cycle or trade cycle, refers to the natural and recurring pattern of economic expansion and contraction that an economy experiences over time.

When we think about the whole economy, it definitely affects the stock market. When the economy is doing well, the stock market usually goes up, but when there’s a recession, the stock market tends to go down.

Knowing how the economy works is super important because it affects the stock market for a long time.

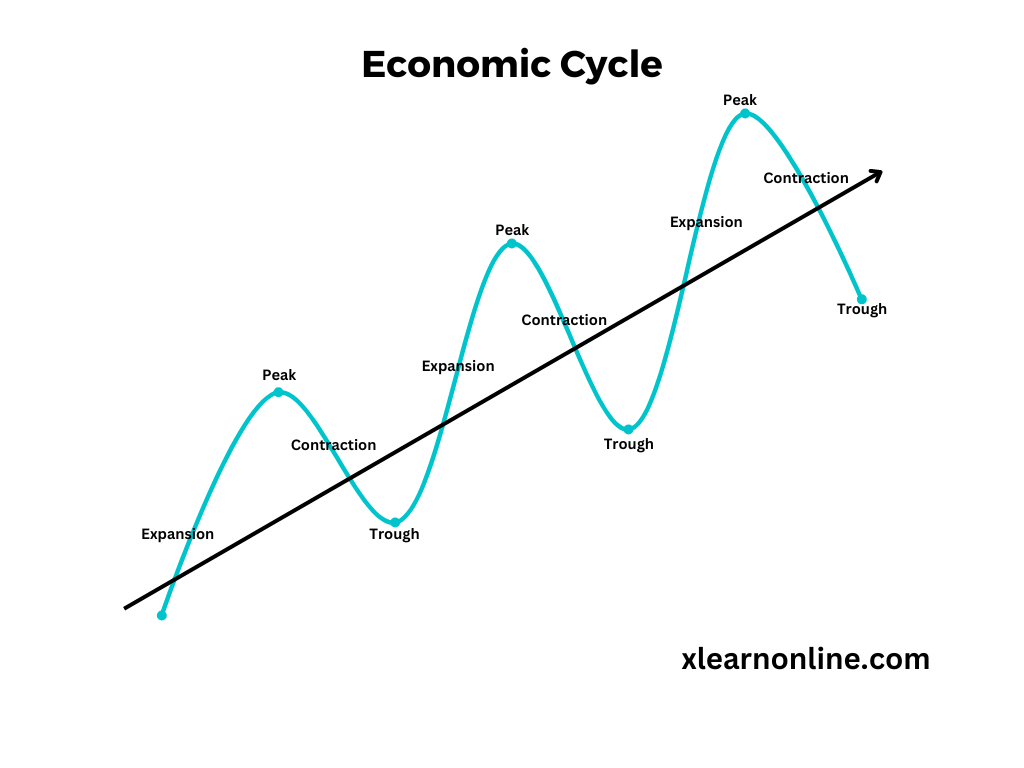

The economy operates in cycles, typically characterized by phases of expansion, peak, contraction, and trough.

The economy doesn’t just keep growing in a straight line forever; it has ups and downs, kind of like how stock prices go up and down. It’s totally normal and important for the economy to have these ups and downs because it shows that the economy is healthy and balanced.

Usually, when the economy is growing, we call it an expansion phase. But at some point, it reaches its highest point, or peak, where growth slows down. Then comes a contraction phase, when things start to decline. Eventually, it hits a low point, or trough, and the cycle starts all over again.

Expansion:

During the expansion phase, the economy experiences a period of growth and increased economic activity. Key indicators, such as GDP, rise, and there is a general sense of optimism and confidence in the economy. Businesses thrive, leading to more job opportunities and higher consumer spending. This phase is often associated with low unemployment rates and increased investments.

Peak:

The peak marks the highest point of economic activity during the expansion phase. It is the period when economic growth levels off and begins to slow down. While the economy is still expanding, it does so at a diminishing rate. At this stage, inflation may start to rise as demand increases and resources become more constrained.

Contraction:

Following the peak, the economy enters the contraction phase, characterized by a decline in economic activity. Key indicators, such as GDP and employment, start to fall, leading to reduced consumer spending and business investments. This phase is commonly referred to as a recession when the decline is more prolonged and severe.

Trough:

The trough is the lowest point of the economic cycle. It is the bottommost phase of the contraction where economic activity reaches its minimum. At this stage, the economy has experienced a period of decline, and various economic indicators have bottomed out. However, the trough also marks the turning point from contraction to expansion.

After the trough, the economic cycle starts again with a new phase of expansion, and the cycle repeats itself. The duration of each phase can vary significantly and is influenced by various factors.

You’ll see that a strong and lasting growth pattern has ups and downs, just like the one we talked about. This is better because if growth keeps going up without any breaks, it could suddenly crash, which isn’t good for the economy. For growth to be healthy and steady, it should move at a sensible speed. Growing too fast and too much can lead to a crash, so it’s important to keep a balanced and steady pace.

What Characterize a Good Economy?

A good economy is characterized by several key factors that indicate its health, stability, and overall well-being.

1. Steady Economic Growth

A good economy experiences consistent and sustainable economic growth over time. This growth is reflected in increasing Gross Domestic Product (GDP), which measures the total value of goods and services produced within a country.

2. Low Unemployment

A healthy economy aims to keep unemployment rates low. This indicates that a significant portion of the labor force is employed, which boosts consumer spending, tax revenue, and overall economic activity.

3. Price Stability

A good economy maintains price stability, avoiding excessive inflation or deflation. Moderate and controlled inflation rates allow for predictable price increases and support overall economic stability.

4. Strong Consumer Spending

Robust consumer spending is a sign of a healthy economy. When consumers feel confident about their financial well-being and future prospects, they tend to spend more, driving demand and business growth.

5. Sound Fiscal and Monetary Policies

Effective fiscal policies (government taxation and spending) and prudent monetary policies (central bank actions) are essential for maintaining economic stability and avoiding extreme fluctuations.

6. Stable Financial Markets

A good economy is characterized by stable and well-functioning financial markets. These markets facilitate the flow of capital and investments, supporting economic growth.

7. Trade Balance

A good economy strives for a balanced trade, where exports and imports are well-matched. A positive trade balance indicates that a country is exporting more than it imports, contributing to economic growth.

Causes of Business Cycles

Several factors contribute to business cycles, with the two most important ones being monetary policy and fiscal policy.

Monetary Policy:

Central banks influence the business cycle through monetary policy measures such as interest rate adjustments and open market operations. Lowering interest rates stimulates borrowing and spending, fueling economic expansion, while raising rates can dampen inflationary pressures but may also lead to a slowdown.

Fiscal Policy:

Government spending and taxation policies play a significant role in shaping the business cycle. Expansionary fiscal policies, such as increased government spending or tax cuts, can boost aggregate demand during downturns, while contractionary policies aim to curb inflationary pressures during periods of expansion.

External Shocks:

Economic cycles can be influenced by external factors such as geopolitical events, natural disasters, technological advancements, and shifts in global trade patterns. These shocks can disrupt supply chains, affect consumer confidence, and impact investment decisions, amplifying the volatility of business cycles.

Business Confidence and Expectations:

Sentiments among businesses and consumers can influence economic behavior and contribute to the cyclical nature of economic activity. Positive expectations about future growth prospects can fuel investment and spending, while pessimism can lead to retrenchment and contraction.

Conclusion

When we look at the whole economy, it’s important to understand that there’s something called an economic cycle. Growth doesn’t happen steadily and smoothly; it goes up and down, and we need to know how to deal with each stage. For traders like us, knowing where we are in this cycle is really important because it affects how we trade and invest. And that can change a lot depending on whether the economy is growing, slowing down, or going down.

To keep the economy’s growth in check, countries use different strategies to control how fast it’s growing. If it’s growing too fast, they try to slow it down. But if it’s slowing down or going down, they try to boost it up again. They do this mainly by using two tools: monetary policies and fiscal policies.