Financial statements are formal reports that provide an overview of a company’s financial performance and position over a specific period.

It is typically released by companies on a quarterly basis, with each company having a designated release date.

The three primary financial statements are the income statement, balance sheet, and cash flow statement.

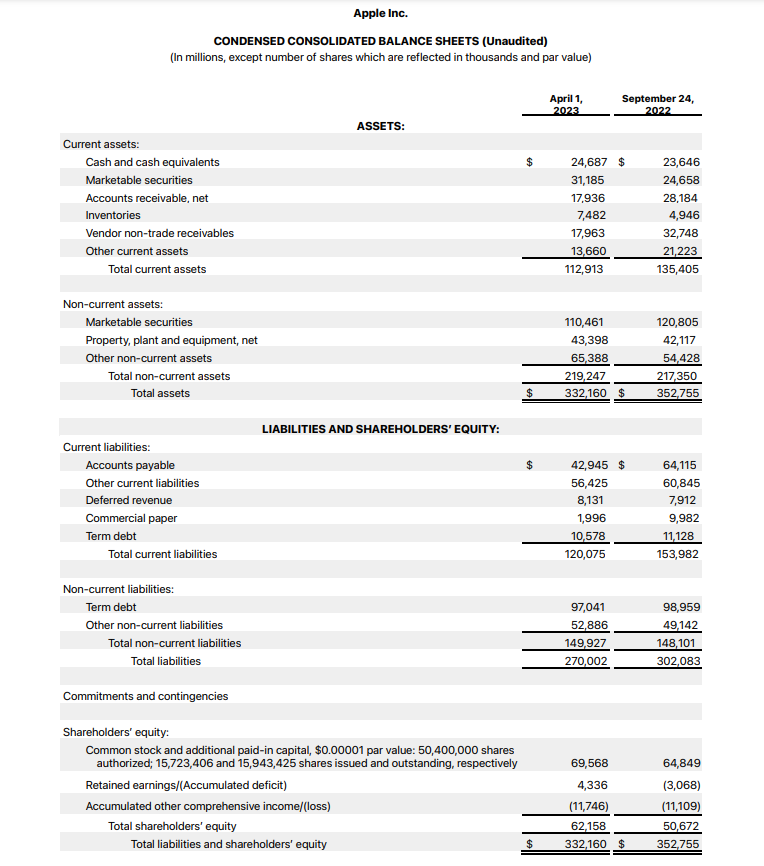

What is a Balance Sheet?

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It presents a summary of what a company owns (assets), what it owes (liabilities), and the residual value available to shareholders (shareholders’ equity).

The balance sheet follows a fundamental accounting equation:

Assets = Liabilities + Equity

This equation ensures that the balance sheet is always in balance, where the total value of assets equals the sum of liabilities and shareholders’ equity.

Assets:

Assets represent what a company owns and controls. They are categorized into current assets and non-current assets.

Current assets are those expected to be converted into cash or used within one year, such as cash, accounts receivable, inventory, and short-term investments.

Non-current assets are long-term assets expected to provide value beyond one year, including property, plant, and equipment, intangible assets, and long-term investments.

Liabilities:

Liabilities represent what a company owes to external parties. Like assets, liabilities are also categorized into current liabilities and non-current liabilities.

Current liabilities are obligations due within one year, such as accounts payable, short-term loans, and accrued expenses. Non-current liabilities are long-term obligations expected to be settled over a period exceeding one year, like long-term loans, deferred tax liabilities, and pension obligations.

Shareholder’s Equity:

Shareholders’ equity represents the residual interest in the company’s assets after deducting liabilities.

It consists of two main components: contributed capital and retained earnings.

Contributed capital includes the value of common and preferred stock issued by the company. Retained earnings represent the cumulative net profits or losses retained in the business over time, including dividends paid to shareholders.

You can access this information on Yahoo Finance.

By analyzing a balance sheet, stakeholders can assess a company’s financial health and stability. For example, they can determine the company’s liquidity (ability to meet short-term obligations), solvency (ability to meet long-term obligations), and the proportion of debt financing versus equity financing.

Comparing balance sheets over different periods also allows for trend analysis, highlighting changes in assets, liabilities, and shareholders’ equity over time.

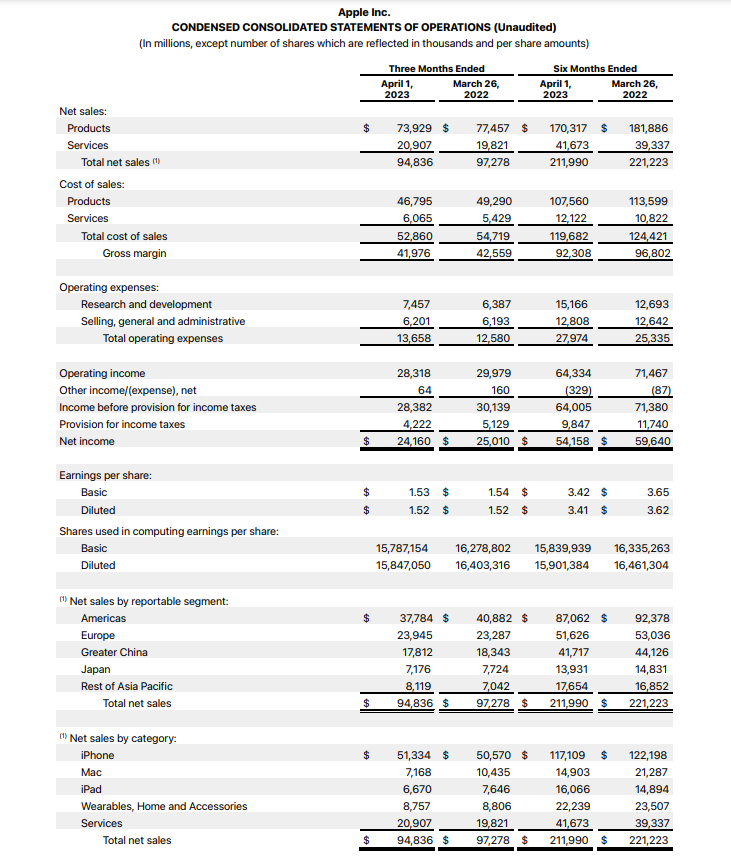

What is an Income Statement?

The income statement, also known as the profit and loss statement, is a financial statement that summarizes a company’s revenues, expenses, and net income (or net loss) over a specific period, typically a fiscal quarter or year.

This is the earnings statement that investors closely monitor in the stock market.

Income statement contains the followings:

Revenue / Sales:

This represents the total amount of money generated from the sale of goods or services. It is the primary source of income for a company.

Cost of Goods Sold(COGS):

COGS includes the direct costs associated with producing or delivering goods or services. It encompasses expenses such as raw materials, direct labor, and manufacturing overhead. Subtracting COGS from revenue provides the gross profit.

Gross Profit:

Gross profit is the difference between revenue and the cost of goods sold. It represents the amount of money left after accounting for the direct costs of producing goods or services.

Operating Expenses:

These are expenses incurred in the regular course of business operations, excluding COGS. Operating expenses can include salaries, rent, utilities, marketing costs, research and development expenses, and other administrative expenses.

Operating Income:

Operating income, also known as operating profit, is the result of subtracting operating expenses from gross profit. It indicates the profitability of a company’s core operations before considering interest and taxes.

Other Income and Expenses:

This section includes non-operating income and expenses, such as interest income, interest expenses, gains or losses from investments, and any extraordinary or one-time items.

Income Before Taxes:

Income before taxes is the operating income combined with other income and expenses. It represents the company’s profit or loss before accounting for income taxes.

Net Income:

Net income, also referred to as net profit or net earnings, is the final figure on the income statement. It represents the company’s profit or loss after deducting all expenses, including taxes.

You can refer to Yahoo Finance to access this statement.

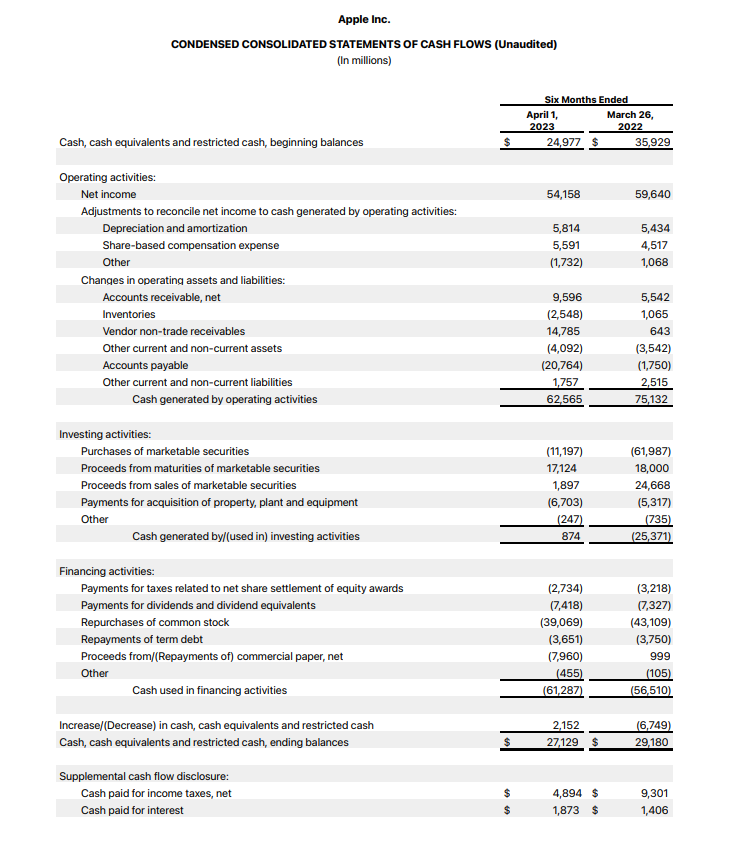

What is a Cash Flow Statement?

The cash flow statement holds significant importance as it serves as a safeguard against potential deception by companies. It prevents them from misleading stakeholders about their profitability by showcasing actual cash movements.

Let’s consider an example where a company sells a building and earns an additional $1 million. In this scenario, the company’s revenue would increase by $1 million, leading to a corresponding increase in net profits by the same amount. However, it’s crucial to note that this is not a regular occurrence, and the company cannot consistently generate such income. This $1 million gain is a one-time event resulting from the building sale. As investors, it is essential not to be misled by this temporary increase in income, as it does not reflect the company’s ongoing profitability or operating performance.

The cash flow statement is a financial statement that provides information about the cash inflows and outflows of a company during a specific period. It helps to analyze the sources and uses of cash, allowing stakeholders to assess the company’s ability to generate and manage cash.

The following key components typically found in a cash flow statements.

Operating Activities:

This section reports the cash flows from a company’s primary business operations. It includes cash receipts from sales, interest income, and dividends received, as well as cash payments for operating expenses, supplier payments, employee wages, and income taxes.

Investing Activities:

This section outlines the cash flows from the buying and selling of long-term assets and investments. It includes cash inflows from the sale of property, equipment, and investments, as well as cash outflows for the purchase of such assets. It also includes cash flows related to loans made to others or repayments received from borrowers.

Financial Activities:

This section shows the cash flows related to a company’s financing activities. It includes cash inflows from issuing debt or equity instruments, such as borrowing money or issuing shares, and cash outflows for debt repayments, share repurchases, and dividend payments.

Net Cash Flow:

This is the sum of the cash flows from operating, investing, and financing activities. It represents the net increase or decrease in cash during the reporting period.

Cash and Cash Equivalents:

This section reports the beginning and ending cash balance, as well as the cash equivalents held by the company, which are highly liquid short-term investments that can be easily converted into cash.

The cash flow statement provides insights into a company’s cash position, operating efficiency, and financial flexibility. It helps stakeholders understand how a company generates and uses cash, assess its ability to meet financial obligations, and evaluate its capacity for future investments and dividends.

By analyzing the cash flow statement along with other financial statements, investors can gain a comprehensive understanding of a company’s financial performance and make informed investment decisions.

As mentioned before, you can refer to Yahoo Finance to access the cash flow statement for a specific company.

Conclusion

As we discussed earlier, conducting fundamental analysis does not necessarily require reading all the financial statements in detail.

It’s more important to have a good understanding of the statements and how they can impact the stock price. When a financial statement is released, it provides valuable information that influences people’s trading behavior.

For instance, if a company fails to meet earnings estimates, it often leads to a decline in the stock price. On the other hand, if a company exceeds earnings estimates, it tends to attract more buyers, driving up the stock price. By being aware of these dynamics, traders can make informed decisions based on the implications of financial statements and their potential effects on stock prices.