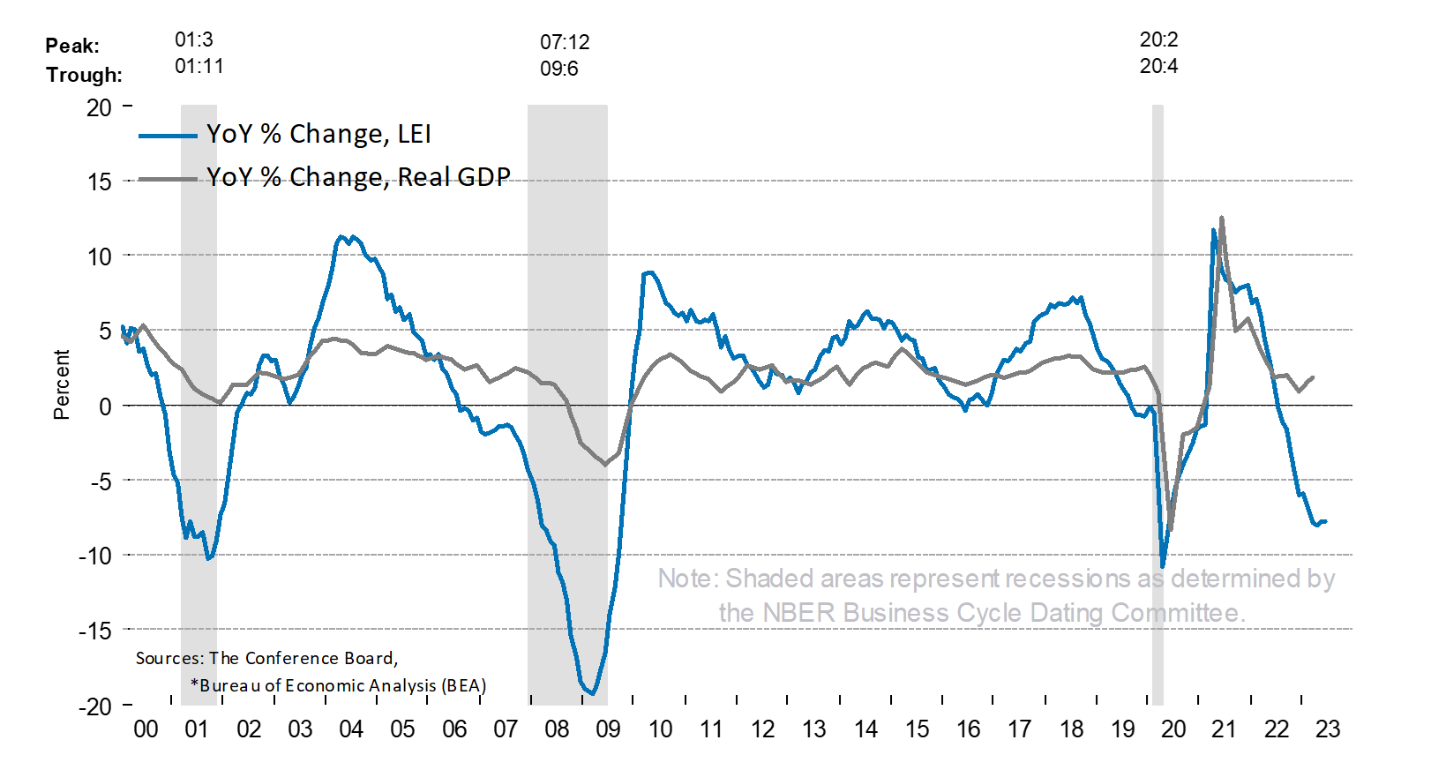

In economics, figuring out how the economy is doing now and guessing what might happen in the future is super important for government, investors, and businesses. There are lots of ways to do this, but one tool that’s really good at predicting economic stuff is called the Leading Economic Index (LEI). This article talks about what the LEI is, why it’s important, what things it looks at, how it’s calculated, and how it helps predict what’s going to happen in the economy.

What is the Leading Economic Index?

The Leading Economic Index (LEI) is a composite index consisting of ten distinct components. It is released by the Conference Board and is updated on a monthly basis, typically on the 28th of each month.

We are already familiar with indexes, which are essentially collections of stocks. When the prices of individual stocks within the index change, the index value also adjusts accordingly. The Leading Economic Index operates on a similar concept, but instead of stocks, it is a compilation of various economic reports that collectively reflect changes in the economy.

Components of the Leading Economic Index

The Leading Economic Index (LEI) is made up of ten different components. These components are carefully selected to represent various sectors of the economy and capture the overall economic activity.

Average weekly hours worked by manufacturing workers: This component reflects the level of production and demand in the manufacturing sector, which is a significant driver of economic growth.

Average weekly initial claims for unemployment insurance: A decrease in unemployment claims may indicate an improving labor market and economic conditions.

Manufacturers’ new orders for consumer goods and materials: This component measures the demand for goods from manufacturers, providing insights into consumers’ spending patterns.

The Institute for Supply Management (ISM) Index of New Orders: The ISM index is a measure of new business orders in the manufacturing sector, which can indicate future economic activity.

Manufacturers’ new orders for non-defense capital goods: This component reflects the level of investment in capital goods by businesses, offering insights into their confidence and expansion plans.

Building permits for new private housing units: An increase in building permits suggests potential growth in the construction sector and the overall economy.

Stock prices of 500 common stocks: This component uses the S&P 500 index to reflect investors’ expectations about future economic conditions.

Leading Credit Index: This component considers various credit-related indicators, such as changes in the availability of credit and interest rate spreads, to assess the overall credit conditions and its impact on economic activity.

Interest rate spread between 10-year Treasury bonds and federal funds: The yield curve’s shape can offer insights into market expectations about future interest rates and economic growth.

Consumer expectations for business conditions: This component measures consumer sentiment about future economic prospects.

The Conference Board’s Leading Economic Index combines these ten components using various weighting and statistical methods to create a single, composite index.

This indicator is classified as a leading indicator, indicating that these reports tend to precede changes in the economy. For instance, if there is a significant increase in building permits being issued or a surge in requests for new building permits, it suggests that the economy will likely experience growth in the future. These reports provide insights into the potential future economic situation.

Since we are aware that the Leading Economic Index (LEI) is constructed using these specific reports, analyzing the LEI index will provide a comprehensive understanding of the economy. The index effectively represents the economic situation as it is derived from the very reports used to gauge economic conditions.

If you wish to access this index, you can find it on the Conference Board website, available in their latest press release.

If the LEI is performing well, indicating an upward trend, it suggests that the economy will likely continue to grow. On the other hand, if the LEI is declining, it indicates that the economy is likely to experience further contraction, as the index acts as a leading indicator that forecasts the economic situation.

When people are concerned about the possibility of a recession or market crash, they often refer to the Leading Economic Index (LEI) because it has the ability to predict potential slowdowns in the economy or signal a market recovery.

The way they utilize the LEI is by observing its fluctuations. For instance, if they observe three consecutive months of the LEI declining, it suggests that an economic slowdown or even a recession may be approaching. Conversely, during a recession, if they notice three consecutive months of the LEI showing improvement, it indicates that the economy is starting to recover and perform better.

Importance of the Leading Economic Index

Policymakers:

Central banks and government agencies utilize the LEI to assess the state of the economy and formulate appropriate monetary and fiscal policies. Early warnings provided by the LEI enable policymakers to take preemptive measures to mitigate economic downturns or overheating.

Investors:

Financial market participants closely monitor the LEI as part of their investment strategy. Changes in the index can impact asset prices, influencing investment decisions across equities, bonds, and currencies.

Businesses:

Corporations rely on the LEI to anticipate future demand for their products and services. By incorporating LEI insights into strategic planning, businesses can adjust production levels, inventory, and hiring practices to align with expected economic conditions.

Conclusion

Basically, the Leading Economic Index helps us look ahead to see how the economy is doing. It gives us clues about what might happen next. By putting together lots of different economic signs into one big picture, the LEI helps government, investors, and businesses make smart choices in a world where things are always changing. As economies keep changing, the LEI stays super important for helping us figure out what might come next and how to deal with it.