Coincident indicators are essential tools used in economics and finance to gauge the current state of an economy or a specific sector. These indicators provide real-time or near-real-time data, offering insights into the present economic conditions, which are crucial for policymakers, investors, and analysts alike.

In this article, we’ll delve into what are coincident indicators, explore their significance, and understand how they are used to assess the health of economies.

What are Coincident Indicators?

Coincident indicators are economic indicators that provide real-time or near-real-time information about the current state of an economy.

They reflect the current state of economic activity and are typically used to confirm the direction in which the economy is heading.

Unlike lagging indicators, which trail behind the economic cycle, and leading indicators, which anticipate future economic trends, coincident indicators provide a snapshot of the present situation.

Real-Time Data: Coincident indicators offer timely information about economic activity, often with minimal lag. They provide insights into the current state of the economy, helping stakeholders make informed decisions.

Broad Coverage: Coincident indicators encompass various aspects of economic activity, including production, employment, income, and sales. By considering multiple dimensions, they offer a comprehensive view of the economy’s health.

Correlation with Business Cycle: These indicators move in concert with the overall business cycle. During periods of economic expansion, coincident indicators tend to rise, signaling robust growth. Conversely, they decline during economic contractions.

Examples of Coincident Indicators

Employment Rate: The employment rate, often represented as the percentage of people who are employed compared to the total labor force, is a strong coincident indicator. During economic upswings, employment rates tend to rise as businesses expand and hire more workers. Conversely, during downturns, employment rates decline as businesses cut back on hiring or even lay off workers.

Industrial Production: This indicator measures the total output of an economy’s manufacturing, mining, and utilities sectors. During periods of economic growth, industrial production tends to increase as businesses produce more goods to meet rising demand. Conversely, during economic downturns, industrial production decreases due to reduced demand.

Retail Sales: Retail sales indicate consumer spending on goods and services. In a healthy economy, retail sales tend to rise as people have more disposable income to spend. During economic downturns, consumer confidence may wane, leading to lower retail sales.

Personal Income: Personal income reflects the earnings of individuals and households. When the economy is doing well, personal incomes generally rise due to increased employment and wage growth. During economic downturns, personal incomes may stagnate or decrease as job opportunities become scarce and wages are constrained.

Gross Domestic Product (GDP): While GDP is considered a comprehensive measure of economic activity, it can also be a coincident indicator. When GDP is growing, the economy is expanding, and when it contracts, the economy is in a downturn.

If you’re interested in assessing the present state of the economy, your focus would be on coincident indicators. However, examining each of these indicators individually and conducting comprehensive analyses can be quite a task.

Fortunately, the Conference Board has taken care of this aspect on our behalf. I’m sure you’re familiar with the Leading Economic Index (LEI), and much like the LEI, the Conference Board releases the Coincident Economic Index (CEI) as well. This CEI, which is usually made available around the 28th of each month, simplifies the process by consolidating multiple coincident indicators into a single measurement.

What is Coincident Economic Index?

A Coincident Economic Index is a composite economic indicator that combines several coincident indicators to provide a comprehensive snapshot of the current economic health of a country or region. Unlike individual coincident indicators that focus on specific aspects of the economy, a coincident economic index aggregates multiple indicators into a single measure to offer a more holistic view of the overall economic activity.

The primary purpose of a coincident economic index is to gauge the current state of the business cycle and to determine whether the economy is in an expansion, contraction, or stabilization phase.

The construction of a coincident economic index typically involves selecting a set of coincident indicators that are known to move in line with the overall economic activity. These indicators should be relatively unaffected by short-term fluctuations and noise. Commonly used coincident indicators, as mentioned above, include employment rates, industrial production, personal income, and retail sales.

The process of creating a coincident economic index involves assigning weights to each of the selected indicators based on their relative importance and impact on the economy. These weights are determined through statistical analysis and expert judgment. The individual indicators are then combined, usually using a mathematical formula, to create a single composite index. This index provides a concise and easily interpretable measure of the current economic situation.

The resulting composite index value would give an indication of the overall economic activity. Positive values would suggest economic expansion, while negative values would indicate contraction. Values close to zero might indicate a stable or neutral economic phase.

To access the Coincident Economic Index, all you need to do is visit the Conference Board website. Within their press releases, you can easily locate this index.

The LEI helps forecast economic trends by identifying potential turning points before they occur, while the CEI provides a real-time view of the current economic situation. By understanding the relationships between these indexes and their historical behaviors, you can make more informed predictions about the direction of the economy.

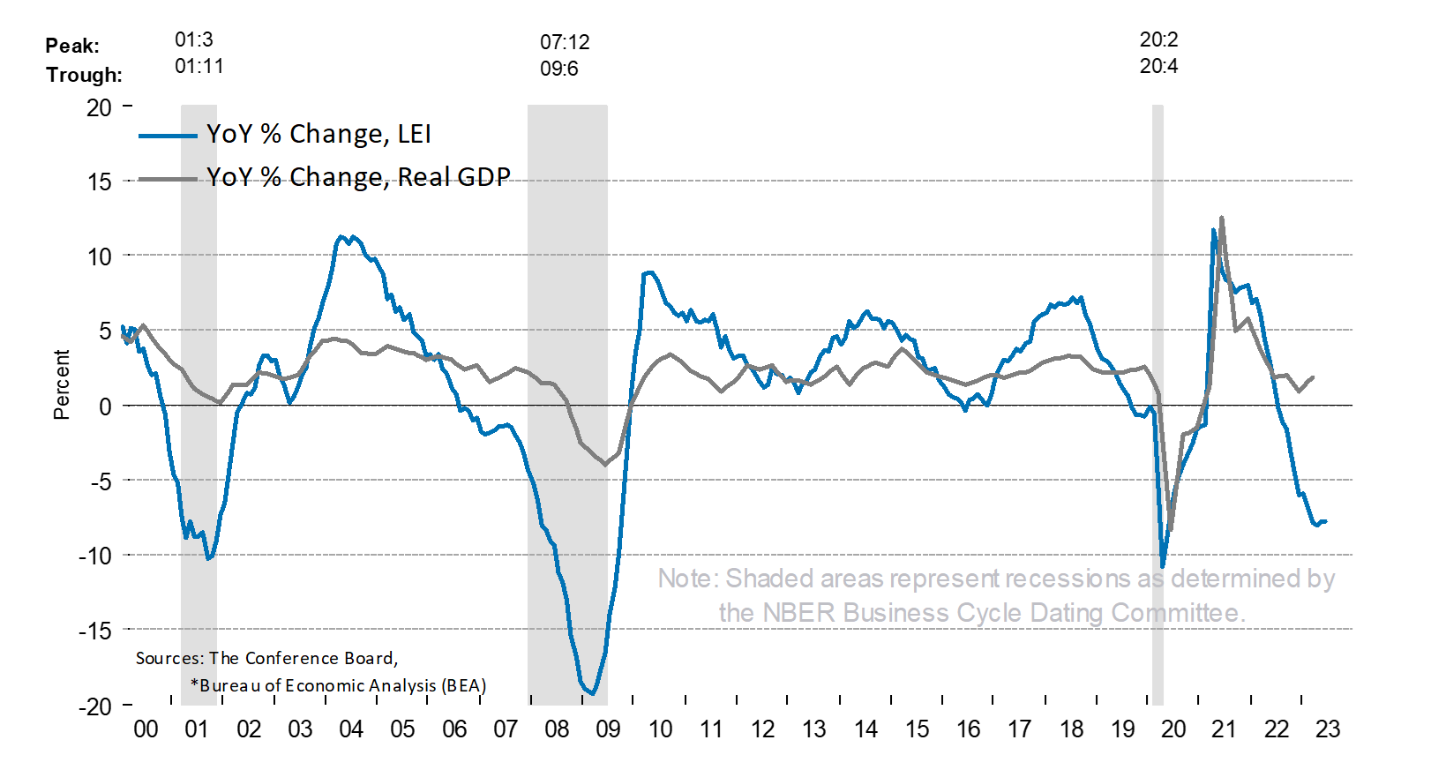

The link between the coincident economic index and real GDP is really strong, showing they move in similar ways. Interestingly, the leading economic index goes down before real GDP does. By putting together both the Leading Economic Index (LEI) and the Coincident Economic Index (CEI), we can expect when the market might go down and foresee when an economic recession might start.

Importance and Application

Coincident indicators play a vital role in economic analysis and policymaking due to their ability to offer real-time insights into the current state of the economy.

Here are some key reasons why these indicators are important:

Monitoring Economic Health: By tracking coincident indicators, policymakers, economists, and investors can monitor the economy’s health in real-time. This allows for timely interventions or adjustments to monetary and fiscal policies as needed.

Forecasting Future Trends: While coincident indicators primarily reflect current conditions, they can also provide clues about future economic trends. Sustained movements in these indicators may signal the onset of a new phase in the business cycle, such as an impending recession or recovery.

Informing Investment Decisions: Investors rely on coincident indicators to assess the current economic environment and make informed investment decisions. These indicators help identify sectors that are poised for growth or contraction, guiding asset allocation strategies.

Business Planning: For businesses, coincident indicators serve as valuable tools for strategic planning and decision-making. By understanding the prevailing economic conditions, firms can adjust their production levels, hiring strategies, and marketing efforts accordingly.

Conclusion

Coincident indicators are indispensable tools for assessing the current state of an economy or a specific sector. By offering real-time insights into economic activity, these indicators enable policymakers, investors, and businesses to make informed decisions. Whether it’s monitoring GDP growth, employment trends, or retail sales figures, coincident indicators play a crucial role in understanding the dynamics of the business cycle and navigating the complexities of the modern economy.