Investing can be a powerful way to build wealth over time, but for beginners, the landscape can seem complex and daunting. This guide will break down the fundamentals of investing, including both active and passive strategies, to help you how to start investing in stock market.

Understanding Investment Basics

What is Investing?

Investing involves putting your money into financial instruments or assets with the expectation of earning a return. Common investment vehicles include stocks, bonds, mutual funds, real estate, and more. The goal is to grow your wealth over time, either through capital appreciation (increasing value of assets) or income generation (dividends, interest, rent).

Risk and Return

All investments carry some level of risk—the possibility of losing some or all of your investment. Typically, higher potential returns come with higher risks. Understanding your risk tolerance is crucial; it will help you decide which types of investments are suitable for you.

The stock market is risky, but not as risky as cryptocurrencies. The level of risk changes based on how you invest in stocks. It’s helpful to explain the different types of investing approaches to understand the risks better.

Beating the Market

Before we talk about how to start investing, it’s important to understand a key idea: “beating the market.” But what does that mean? “Beating the market” means getting a higher return on your investments than the average return of the stock market.

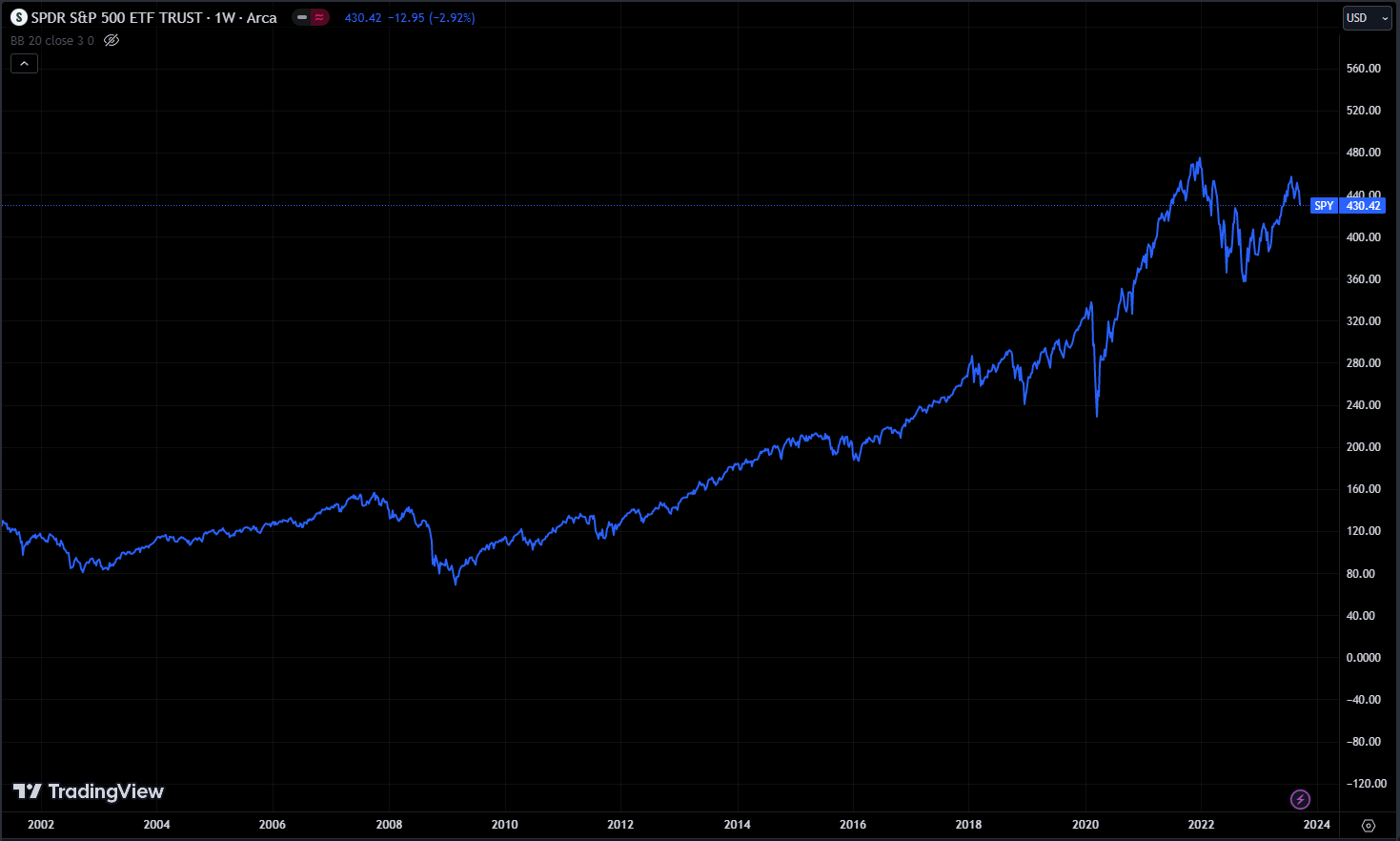

The stock market S&P 500 usually gives an average annual return of about 10%. When we say “beating the market,” we mean getting returns that are higher than this 10% each year.

As an investor, it’s important to decide if you want to try to get higher returns than the stock market usually gives or if you’re happy with the market’s average returns.

Remember, aiming for higher returns means you could also end up with lower returns than the market. Investing is a long-term game, and even small gains can add up over time. So, whether you try to beat the market or accept its average returns is up to you.

Beating the market is very hard, even for experts. Most investors, about 90%, find it best to go with what the market offers.

Now, let’s talk about how to start investing. Once you understand the basics, you’ll be better equipped to decide if you want to try beating the market or not.

There are different investment products like stocks, bonds, and commodities. You can invest in individual stocks, mutual funds, index funds, and ETFs. If you buy an individual stock, you own a piece of that company directly. You can also invest through mutual funds.

When you invest in individual stocks or mutual funds, your goal is usually to get returns higher than the market. If you choose index funds or ETFs, your goal is to match the market’s performance. When the market goes up, your returns go up with it; when it goes down, your returns go down too.

If you aim to beat the market, you want higher gains when the market is up and smaller losses when the market is down. This is harder to achieve, but it’s possible to try even with ETFs or index funds.

Now, let’s talk about the two main ways of investing: active and passive.

Active and Passive Investing

Active and passive investing are two distinct approaches to managing investments in financial markets. Here is a brief introduction table about the two main investment approaches:

| Feature | Active Investing | Passive Investing |

|---|---|---|

| Involvement Level | High | Low |

| Management Style | Hands-on | Hands-off |

| Costs | Higher fees and trading costs | Lower fees and minimal trading |

| Performance Goal | Outperform the market | Match market returns |

| Risk | Higher due to frequent trading | Lower due to diversification |

| Time Commitment | Significant | Minimal |

What is Active Investing?

Strategy:

Active investing involves actively selecting and managing individual investments or securities with the goal of outperforming the overall market or a specific benchmark index. Active investors believe they can use their knowledge, research, and analysis to make informed decisions that lead to higher returns.

Decision-Making:

Active investors frequently buy and sell assets within their portfolio based on their analysis of market conditions, economic trends, and company performance. They aim to identify undervalued or overvalued securities and adjust their portfolio accordingly.

Costs:

Active investing typically incurs higher costs compared to passive investing. These costs include trading fees, management fees for actively managed funds, and potentially higher taxes due to frequent buying and selling.

Risk:

Active investing carries a higher level of risk because success depends on the investor’s ability to make accurate investment decisions. If the investor’s choices are incorrect, they may underperform the market and experience losses.

Time Commitment:

Active investing demands a significant time commitment for research, monitoring, and decision-making. It often requires continuous attention to the portfolio and the financial markets.

What is Passive Investing?

Strategy:

Passive investing, in contrast, involves building a diversified portfolio of assets with the primary goal of matching the performance of a specific market index or benchmark. Passive investors aim to “ride the market” rather than trying to beat it.

Decision-Making:

Passive investors make fewer investment decisions. They typically invest in index funds or exchange-traded funds (ETFs) that track a specific market index. These investments are designed to replicate the performance of the underlying index.

Costs:

Passive investing tends to have lower costs because it involves minimal trading and management fees. ETFs and index mutual funds are popular choices for passive investors.

Risk:

Passive investing is often associated with lower risk because it does not rely on the investor’s ability to make successful stock selections or market timing decisions. Instead, it aims to provide returns in line with the broader market.

Time Commitment:

Passive investing requires less time commitment compared to active investing. Investors periodically rebalance their portfolio to maintain the desired asset allocation but do not need to constantly monitor individual securities.

How to Start Investing in Stock Market?

The two main ways to start investing are passive investing and active investing. Your choice depends on whether you want a hands-off approach or a more involved strategy to try and beat the market.

In passive investing, you invest in an index fund that tracks the market, adding money regularly over time. This method requires less decision-making and is great for those who want a stable, long-term strategy. The goal is to consistently match the market’s performance.

Active investing, on the other hand, is more hands-on. It involves trying to outperform the market by picking specific stocks, rebalancing your portfolio, and adjusting your investments based on market conditions.

Keep in mind that beating the market is very hard. For most investors, passive investing is recommended because it reliably matches the market’s returns without the complexities of active management.

However, some people with a strong understanding of financial markets and expertise choose active investing. They do this because they hope to achieve returns that are higher than the market’s average.

You might see people on social media promoting various investment strategies like “invest in this” or “buy and hold.” Be careful because many of these methods may not lead to long-term financial success.

When investing your money, it’s important to understand what you’re investing in. If you don’t, it’s best not to invest, as you could risk losing your money.

If you’re a beginner and want a simple approach without getting into complex strategies, passive investing might be best for you. With passive investing, you invest a small amount of money each month. A popular method is to buy shares of an ETF like SPY, which tracks the overall market, and continue to buy more shares every month. Over time, your earnings grow through compounding. its simple as that.

This approach is one of the simplest and best ways to build wealth. It requires patience and time, which is why many people don’t choose it. But if you stick with it, by the time you retire, you’ll likely be more financially secure than those who didn’t invest.

If you want to grow your wealth through active investing, which involves more effort, research, and portfolio management, there’s no easy path. It takes time and dedication to learn and apply these strategies successfully.

If you’re motivated to take on this challenge, it’s worth trying. You can learn more about active investing through resources like xlearn’s investing module, which will provide you with the knowledge and tools you need.

Conclusion

The moment you start selecting stocks, you become an active investor.

Deciding between active and passive investing depends on your individual preferences, goals, and risk tolerance. Active investing may be suitable if you enjoy research, are comfortable taking on more risk, and have the time to manage your portfolio actively. Conversely, if you prefer a more hands-off approach with lower costs and a focus on long-term growth, passive investing could be the better option.

Regardless of the path you choose, starting with a clear understanding of each strategy and aligning it with your financial goals will help you build a robust investment portfolio. Remember, the most important step is to start investing early and stay committed to your investment plan.