This week, the forex market is poised for significant volatility as several high-impact events converge. The U.S. presidential election introduces substantial uncertainty, with potential implications for global trade and economic policies.

Simultaneously, the Federal Reserve (FOMC) is expected to announce a 25 basis point interest rate cut, aiming to sustain economic growth amid cooling inflation.

The Bank of England (BOE) and the Reserve Bank of Australia (RBA) are also set to release policy statements, which could influence currency valuations.

Additionally, upcoming unemployment data will provide insights into labor market health, further impacting forex dynamics. Traders should prepare for rapid market movements as these events unfold.

So let’s dive into our Forex Weekly Analysis and explore how major events like the U.S. election, FOMC rate decisions, and central bank updates could shape the markets this week.

Key Economic Events This Week

Only the key events are listed here. For the full schedule, check the Forex Factory Calendar for all events.

2024.11.04

- 22:30 ET: Reserve Bank of Australia (RBA) releases its monetary policy statement and interest rate decision, with both the previous and forecast rates at 4.35%. If the actual rate is higher than the forecast, it’s seen as positive for the currency. The rate decision is typically priced in, so focus often shifts to the RBA Rate Statement for hints on future policy.

2024.11.05

- The U.S. presidential election on November 5, 2024, between Vice President Kamala Harris and former President Donald Trump is a pivotal event with significant implications for global markets. Historically, election outcomes can influence market volatility, as investors react to potential policy changes and economic forecasts. While early vote counts and exit polls may provide initial projections, the official results could take days to finalize, especially in closely contested states. This period of uncertainty often leads to market fluctuations. Traders are advised to exercise caution, closely monitor developments, and consider implementing risk management strategies to navigate potential market turbulence during this time.

- 16:45 ET: New Zealand releases its Unemployment Rate, measuring the percentage of the total workforce that is unemployed and actively seeking work during the previous quarter. The previous rate was 4.6%, with a forecast of 5.0%. If the actual rate comes in lower than the forecast, it’s seen as positive for the currency.

2024.11.06

- On this day, there are no major events expected to significantly impact the forex market. Traders can anticipate a relatively calm session, though it’s always wise to stay alert for any unexpected news that could affect currency movements.

2024.11.07

- 7:00 ET: The Bank of England (BOE) will release its Monetary Policy Statement and Official Bank Rate, with the previous rate at 5.0% and the forecast at 4.75%. If the actual rate is higher than the forecast, it’s considered positive for the currency. While the rate decision is often already priced into the market, traders focus on the Monetary Policy Summary, which provides insights into future policy direction.

- 14:00 ET: The US FOMC statement will be released along with the interest rate decision, with the previous rate at 5.0% and the forecast at 4.75%. If the actual rate is higher than the forecast, it’s considered positive for the currency. As mentioned earlier, the rate decision is usually already priced into the market, so the focus often shifts to the FOMC Statement, which gives insights into future policy directions.

2024.11.08

- 8:30 ET: Canada will release its Unemployment Rate, with the previous rate at 6.5% and a forecast of 6.6%. If the actual rate is lower than the forecast, it’s considered positive for the currency.

Price Action Forex Forecast

Now, let’s dive into the analysis! If you’re new here, please check out our market analysis guide before continuing.

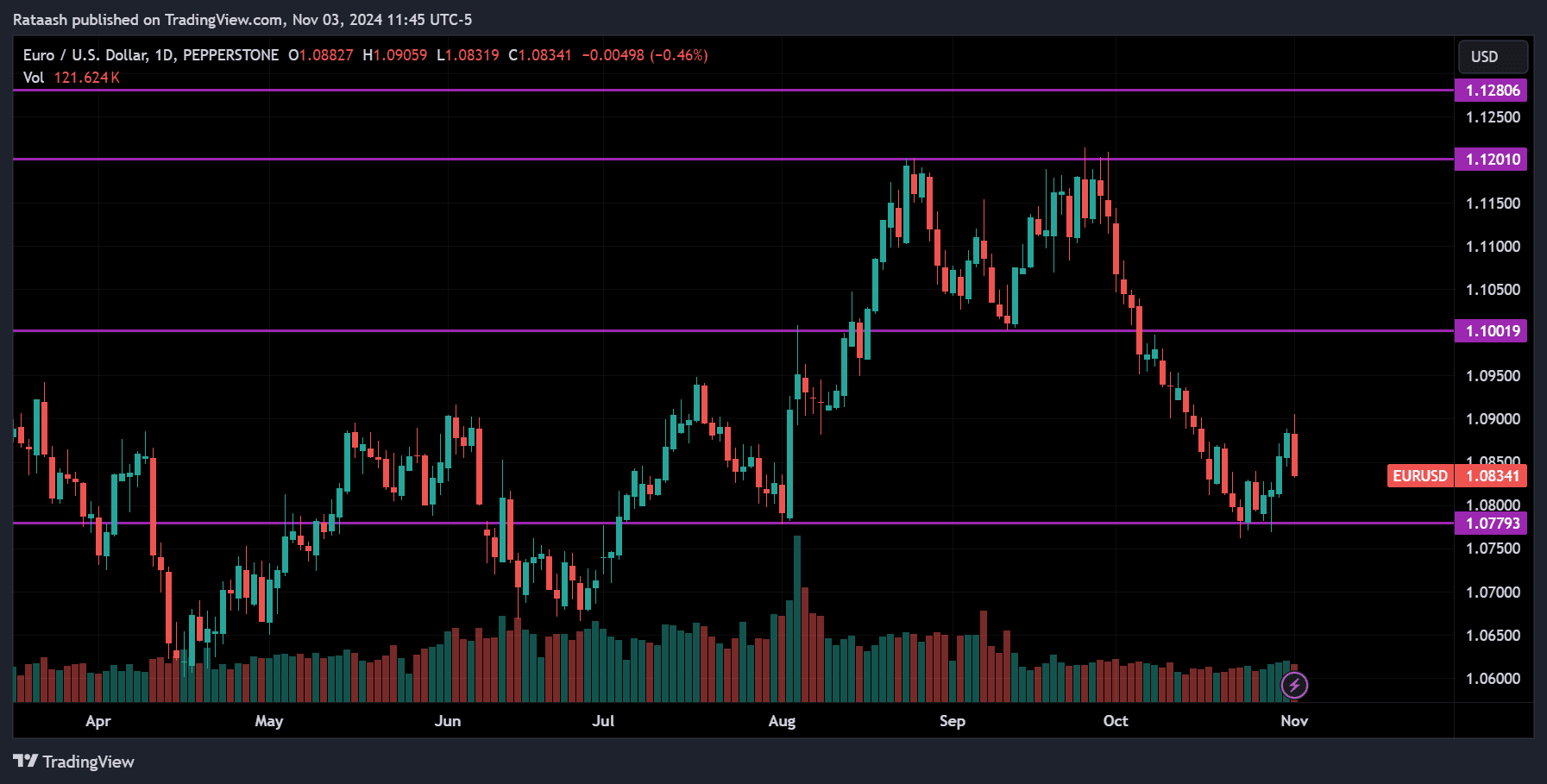

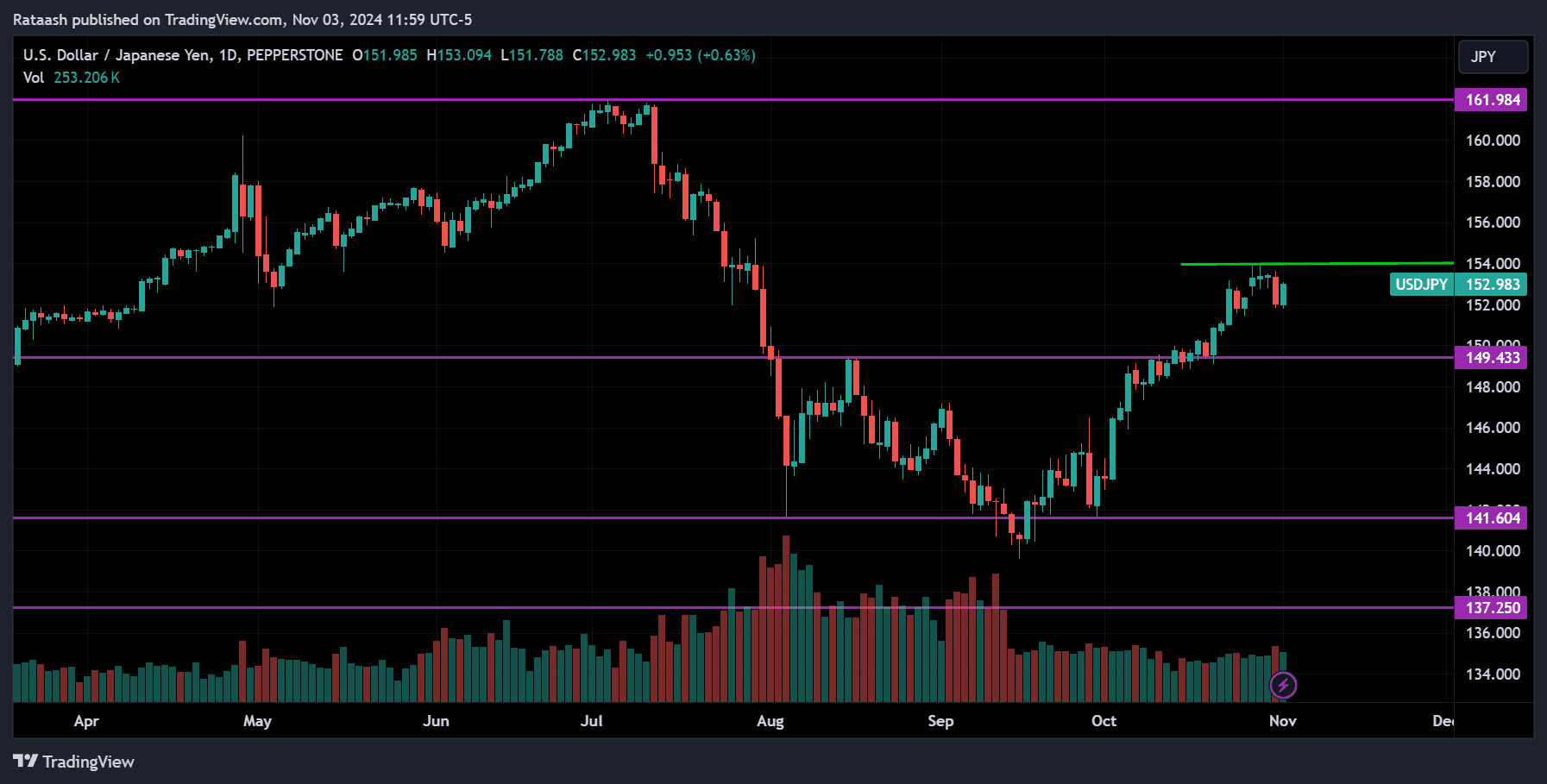

EURUSD:

Observing the recent price action of EURUSD, it’s clear that the USD is strengthening in anticipation of a possible 25-basis-point rate cut. Should this rate cut occur as expected, we may see EURUSD begin to rise. However, if an unexpected 50-basis-point cut takes place (which is unlikely), the pair could fall sharply.

In addition to the FOMC’s upcoming decision, the presidential election plays a role. If Trump wins, he’s likely to push for stronger economic growth, possibly encouraging the Fed to lower rates further, which could boost EURUSD. Nevertheless, the Fed remains focused on its mandate and will continue its monetary policy objectives regardless of election outcomes. This week, these two major events—the FOMC decision and the election—are set to fuel market movements, so keep an eye on them.

Currently, the price has broken below the 1.08400 support level and is heading toward 1.08200. At this level, we might see a pullback or reversal; however, if it breaks below 1.08200, the next target could be around 1.07800. Should the price breach this level as well, further declines are likely.

Since the 1.08400 level has now become resistance, if the price begins to rise and breaks above this point again, it’s less likely to fall back below it, signaling a potential continuation of the upward move. Stay attentive to any breakouts, as the price is likely to follow the direction of these breakouts.

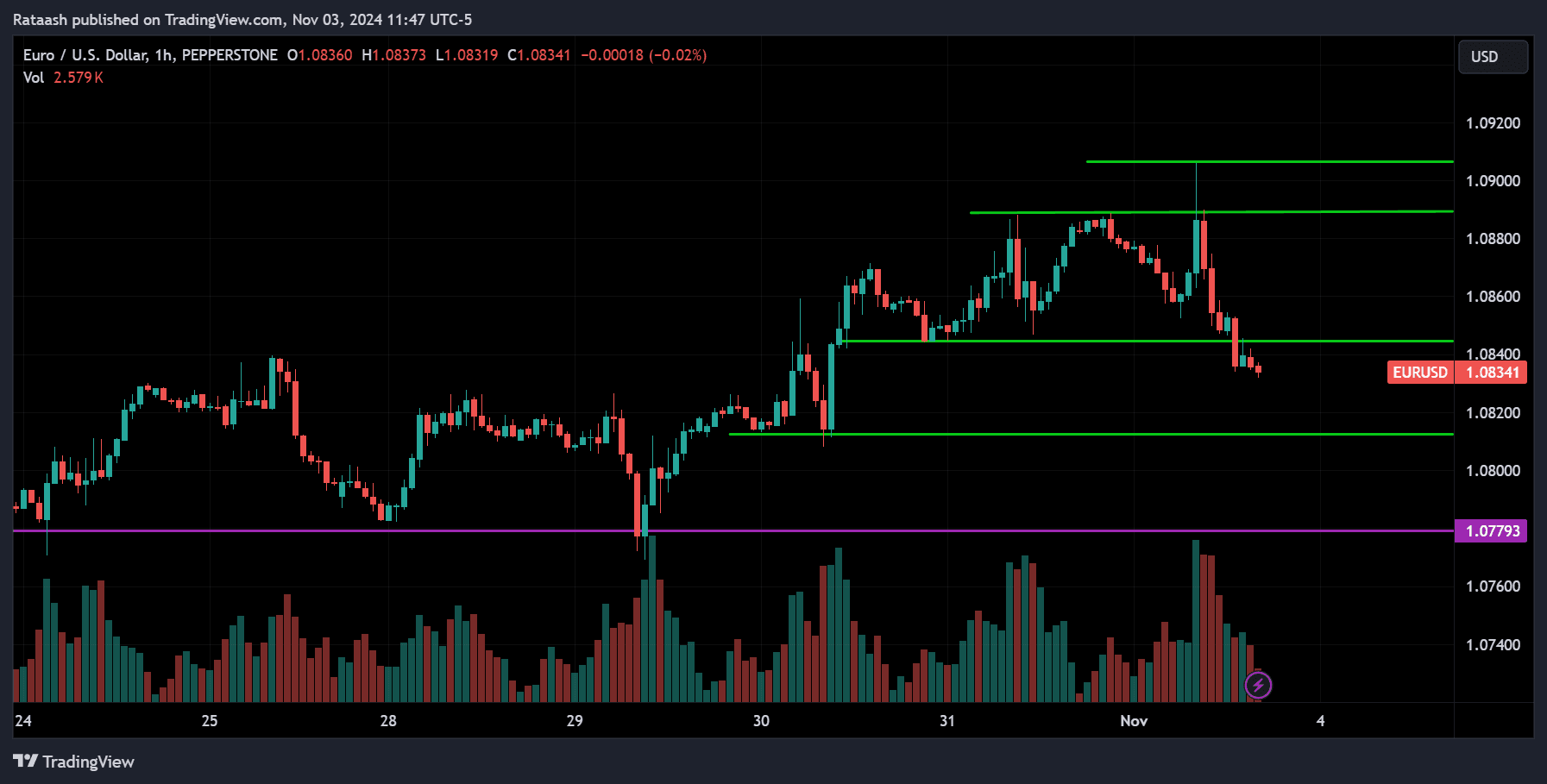

USDCAD:

USD/CAD is currently in a bull run, trading just above the significant resistance level at 1.3950. On Friday, Canada will release its unemployment report, providing insights into the health of its economy. Any surprises in this data could lead to sharp price movements. However, it’s worth noting that the CAD typically shows less volatility in response to economic data compared to the USD. This week, both the upcoming unemployment report and the U.S. presidential election could influence USD/CAD’s price action.

Analyzing the price action, we see the pair maintaining its uptrend just above the 1.3950 resistance level. The next resistance is around 1.3980, where we might see the price head before a potential pullback or, if broken, a continuation of the upward trend. If the price falls back below the 1.3950 support, we could see it drop further to the 1.3900 level.

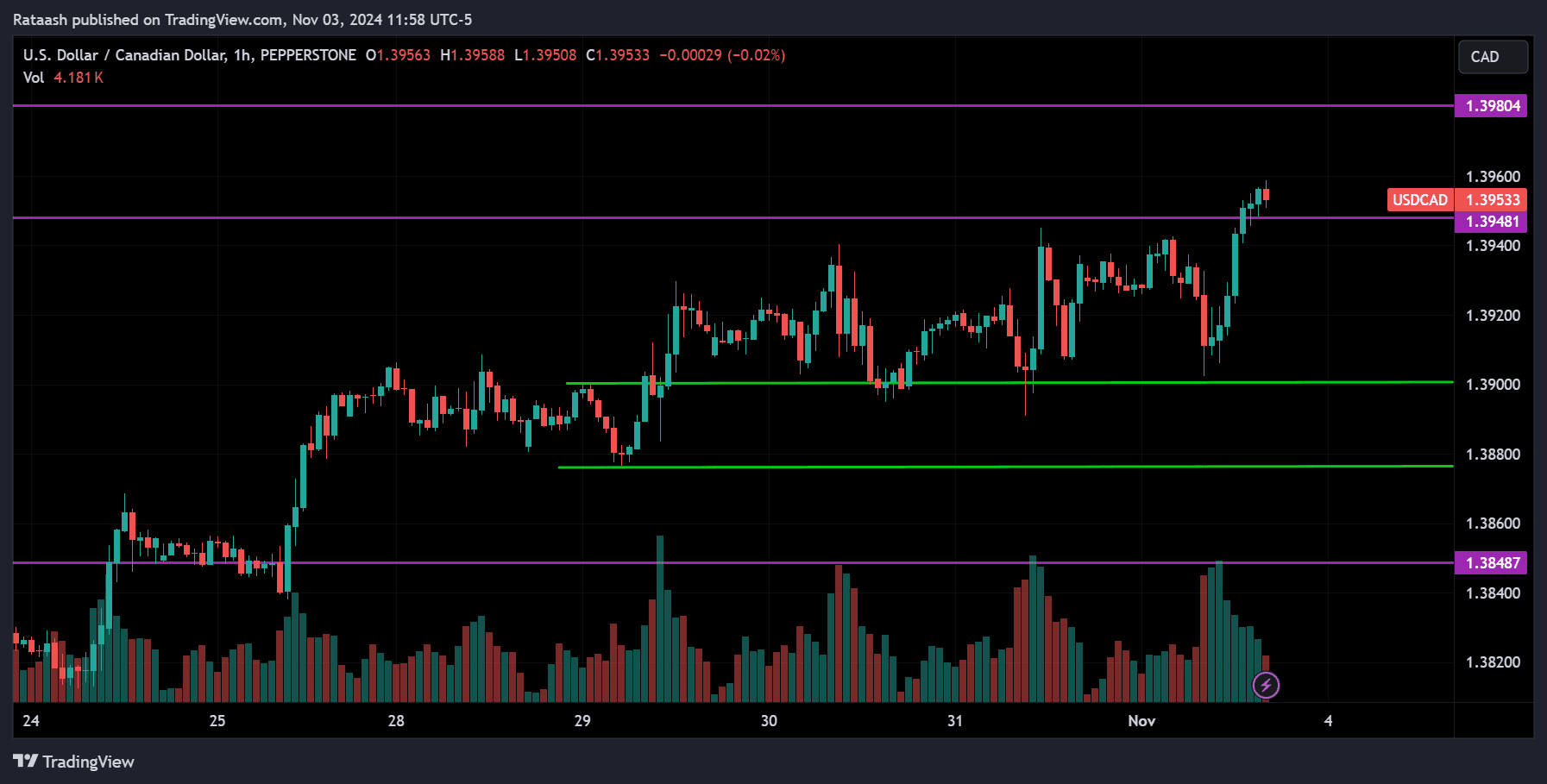

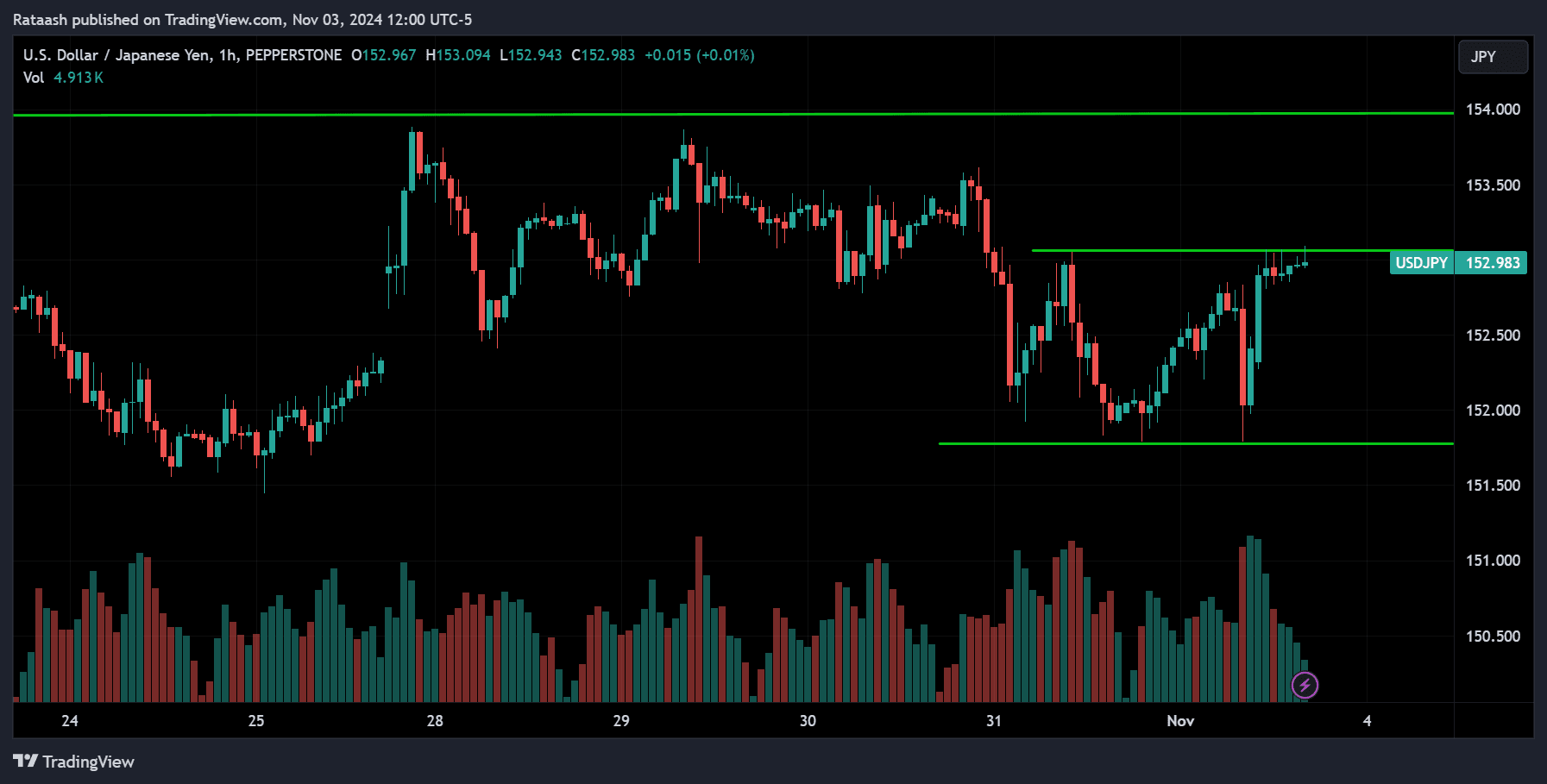

USDJPY:

The USD/JPY, like all major pairs involving the USD, is expected to be influenced by this week’s U.S. presidential election, which could impact the dollar across multiple pairs. Other than this, there are no significant economic events in Japan this week likely to affect the yen, so the focus remains on USD-related developments.

Analyzing the price action, USD/JPY recently rose from the 141.600 support level and broke above resistance at 150. The pair is currently pulling back from the 154 resistance level and consolidating around a minor resistance near 153 on the 1-hour chart. If the price breaks above 153, it could retest the 154 level, possibly pulling back again or breaking higher to continue the uptrend. Alternatively, if the price fails at 153 and drops, we may see it approach the support level at 151.750, with a further decline likely if it breaks below this support level.

Keep an eye on any breakouts, as they may signal the direction of the next significant move.

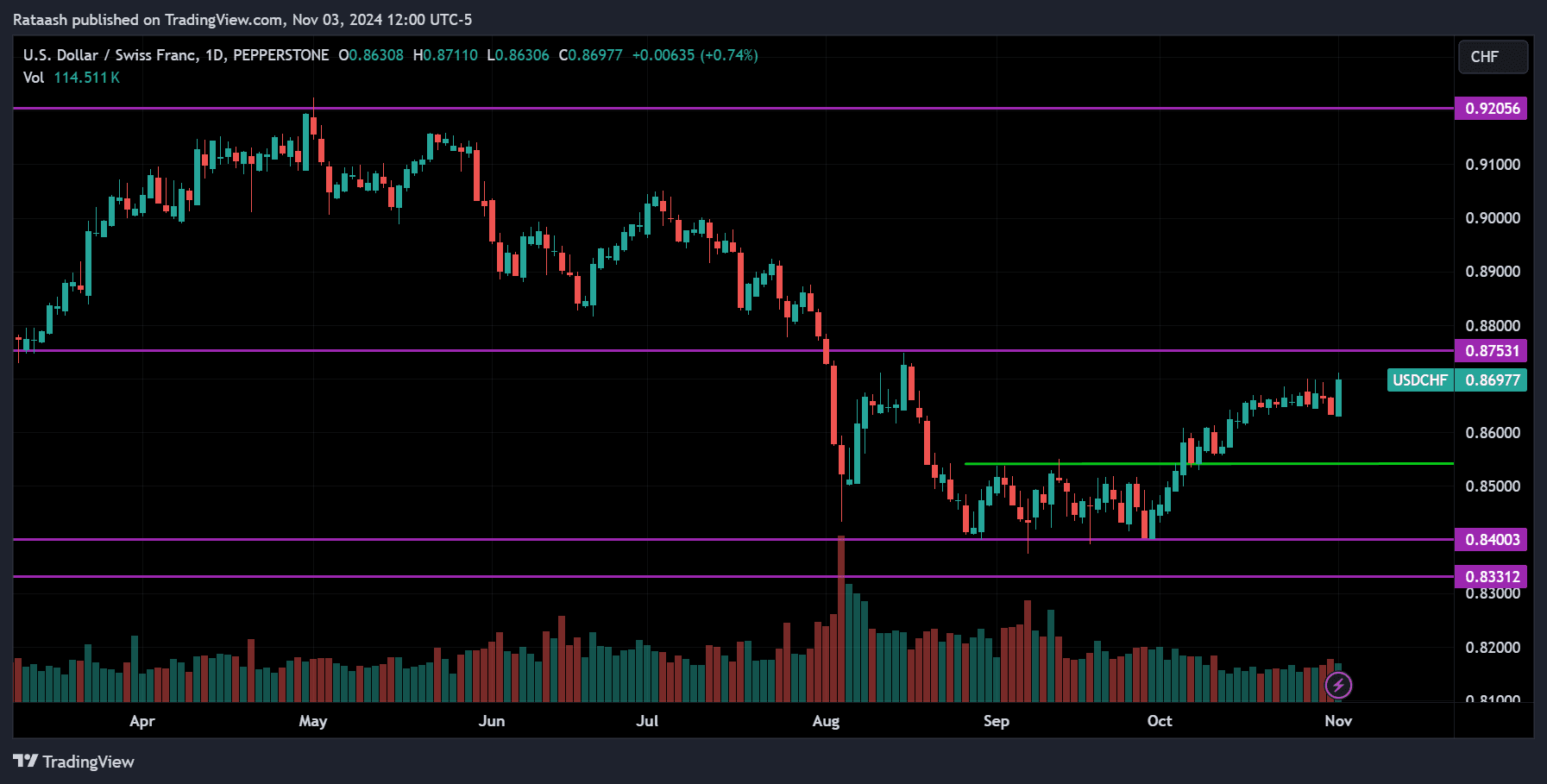

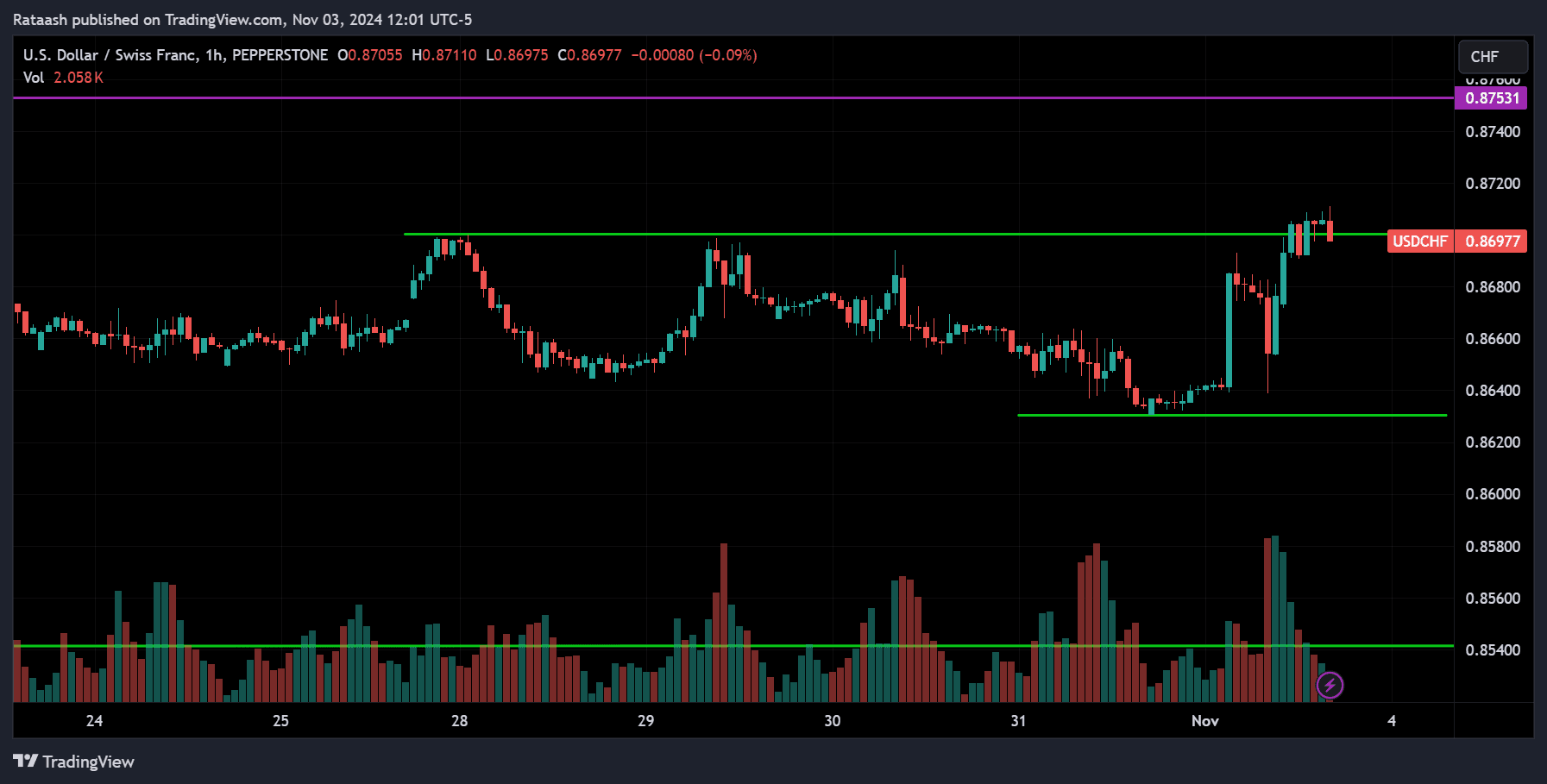

USDCHF:

The recent price action of USD/CHF shows that, after consolidating around 0.8400, the price has begun to climb and is now approaching a resistance level near 0.8750. On the 1-hour chart, the price is encountering minor resistance around 0.8700. If the uptrend continues, we may see the price move toward the 0.8750 range, where it could either pull back or break higher to continue the upward momentum.

However, if the price reverses and drops below the support level around 0.8640, it could signal further declines, potentially reaching the 0.8540 range. Keep an eye on these levels, as they may guide the next major movement.

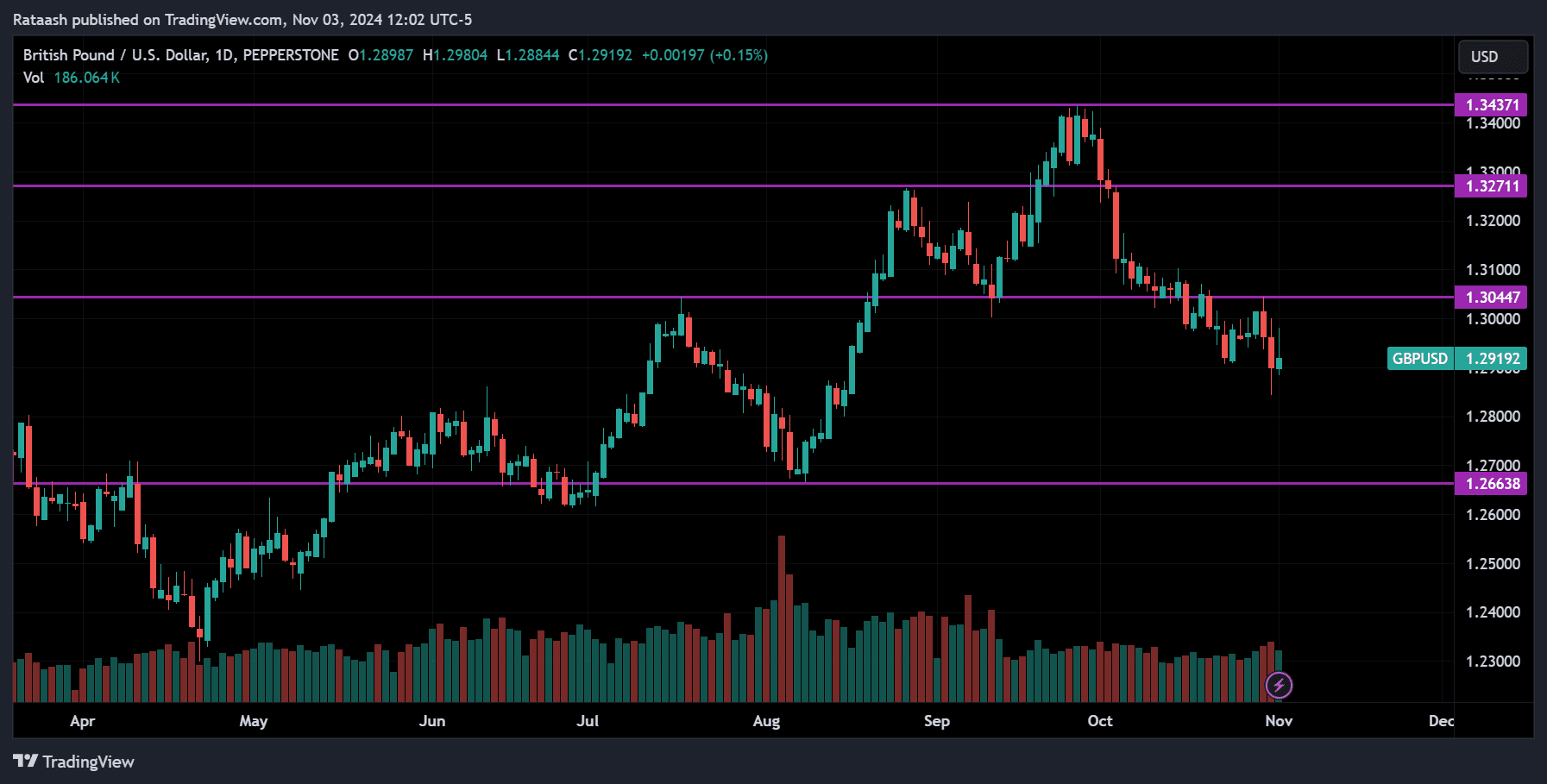

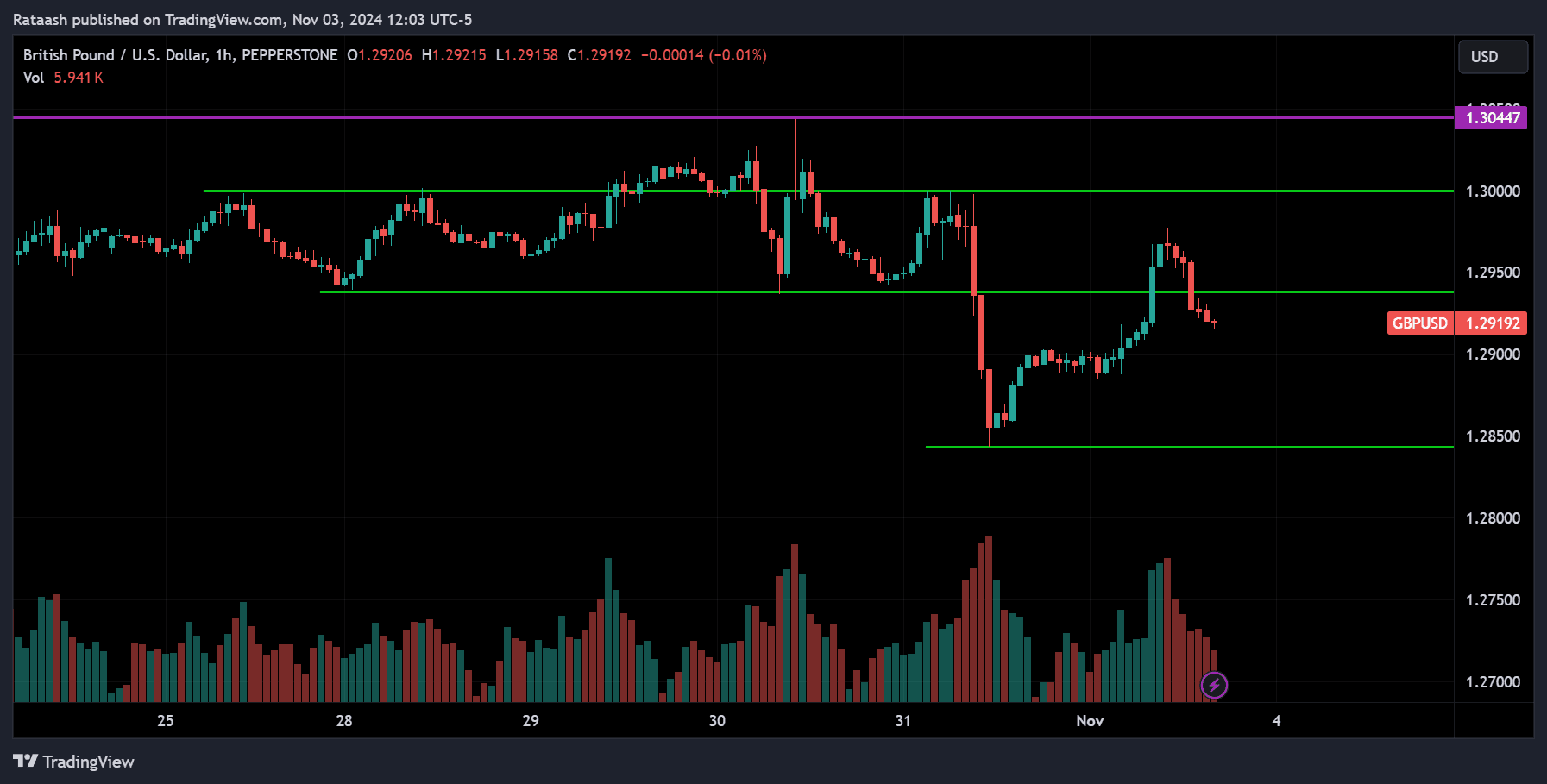

GBPUSD:

On Thursday, the Bank of England’s Monetary Policy Statement and the FOMC Statement will be released, both of which are highly impactful events for the GBP/USD pair. With both the USD and GBP anticipating a 0.25% rate cut, any surprise deviation could lead to heightened volatility, making Thursday an exceptionally active day for GBP/USD.

In terms of price action, GBP/USD is currently in a downtrend, heading toward the 1.2665 support level. On the 1-hour chart, the price recently consolidated, then broke below support, dropping to 1.2850. It then rebounded, temporarily breaking above the previous support before pulling back below it, reinforcing bearish momentum. This suggests strong downward pressure, and we may see the price continue its decline toward the 1.2850 level, where it could either pull back or, if broken, continue its descent.

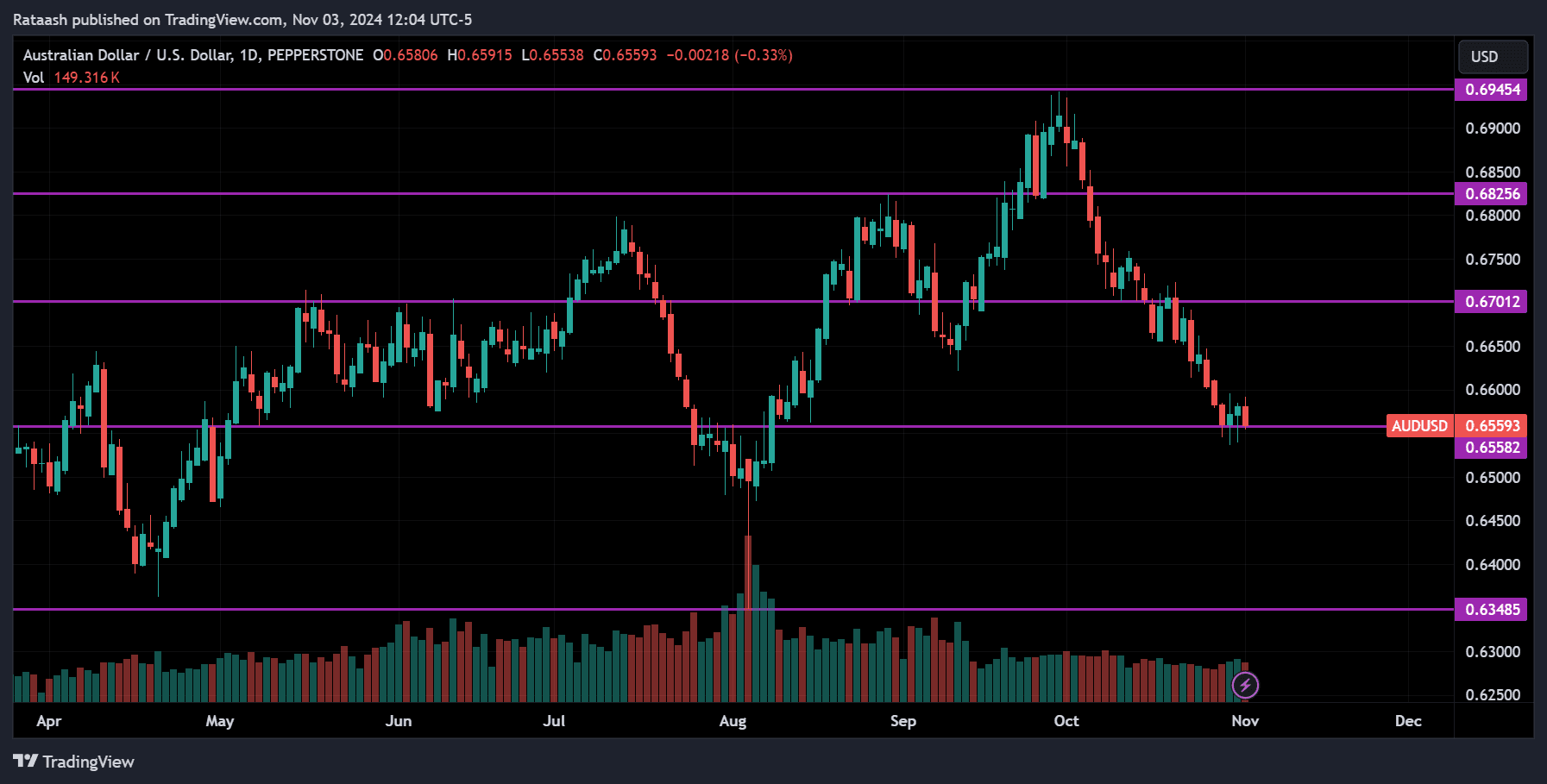

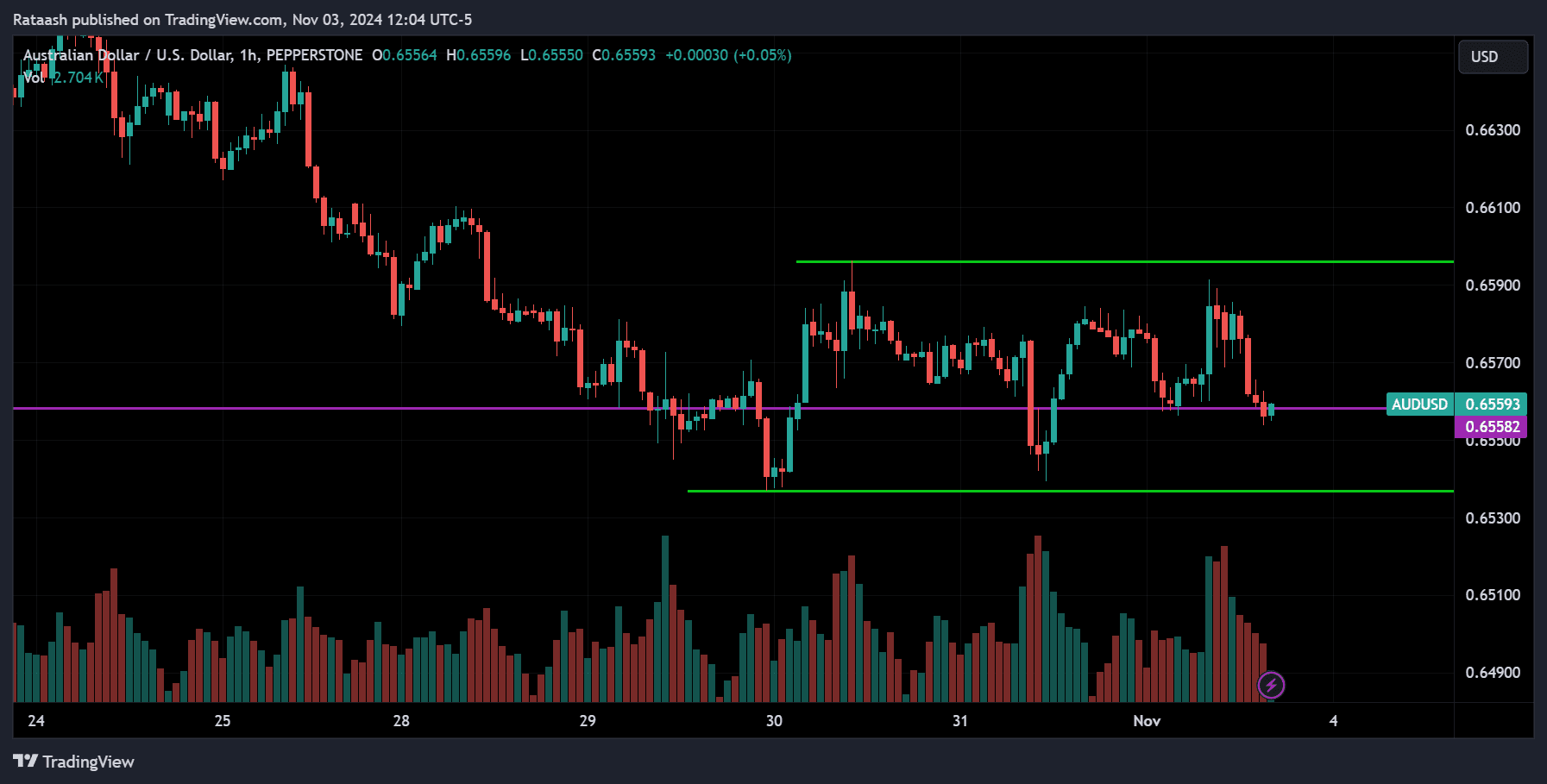

AUDUSD:

On Monday, the Reserve Bank of Australia (RBA) will release its Monetary Policy Statement along with its rate decision. The market expects no changes to the current interest rate of 4.35%. However, if there is an unexpected move, it could lead to significant volatility. Keep this in mind as the statement approaches.

Analyzing the price action, AUD/USD remains in a downtrend. On the 1-hour chart, the price has reached a major support level around 0.6530 and has been consolidating within the 0.6590 resistance range. Given that this is a key support level, the breakout will likely indicate the next major movement. If the price breaks below the 0.6530 support, we can expect the downtrend to continue. Conversely, if the price moves back up and breaks above the resistance, it could signal the start of a new uptrend.

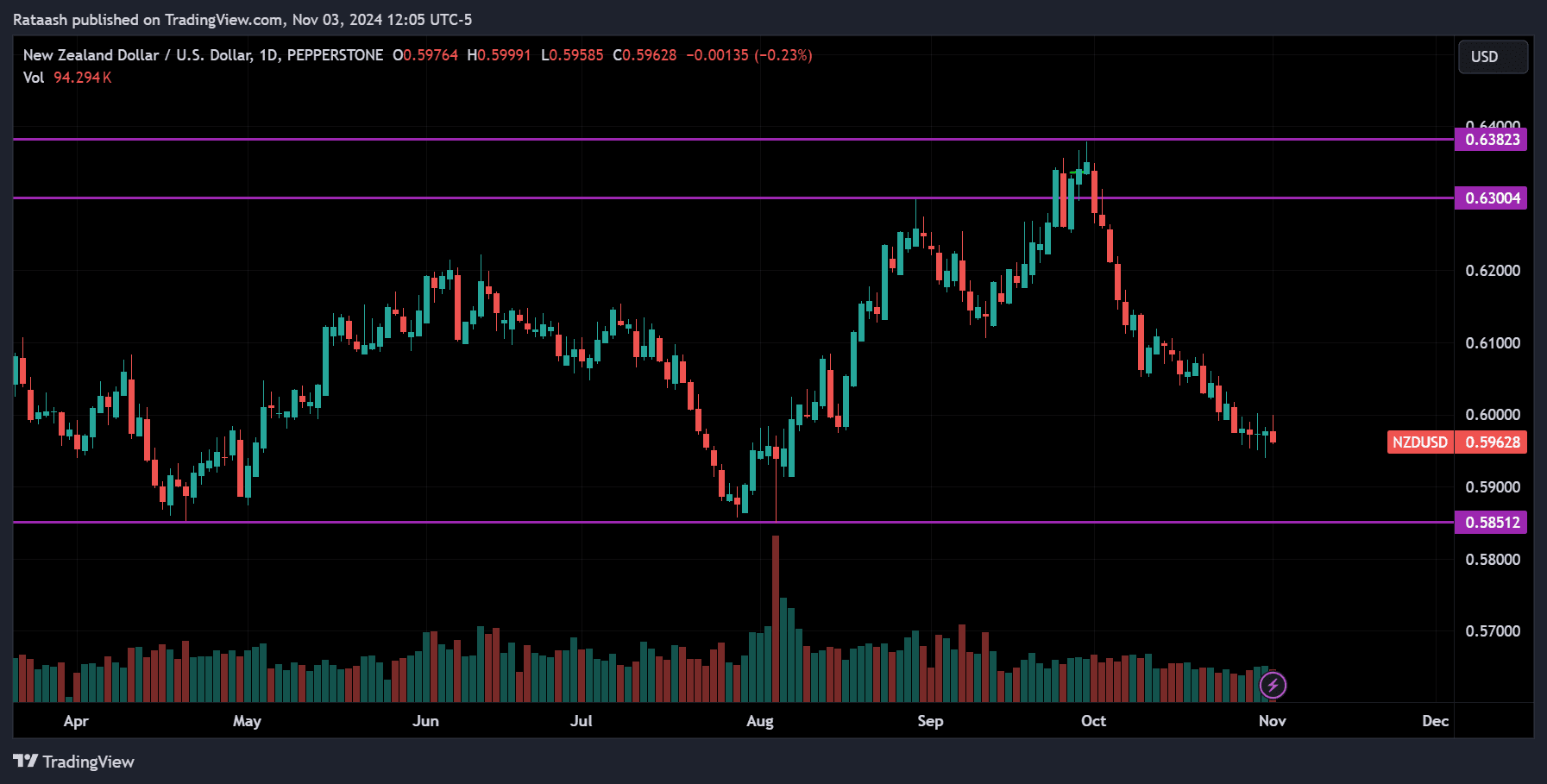

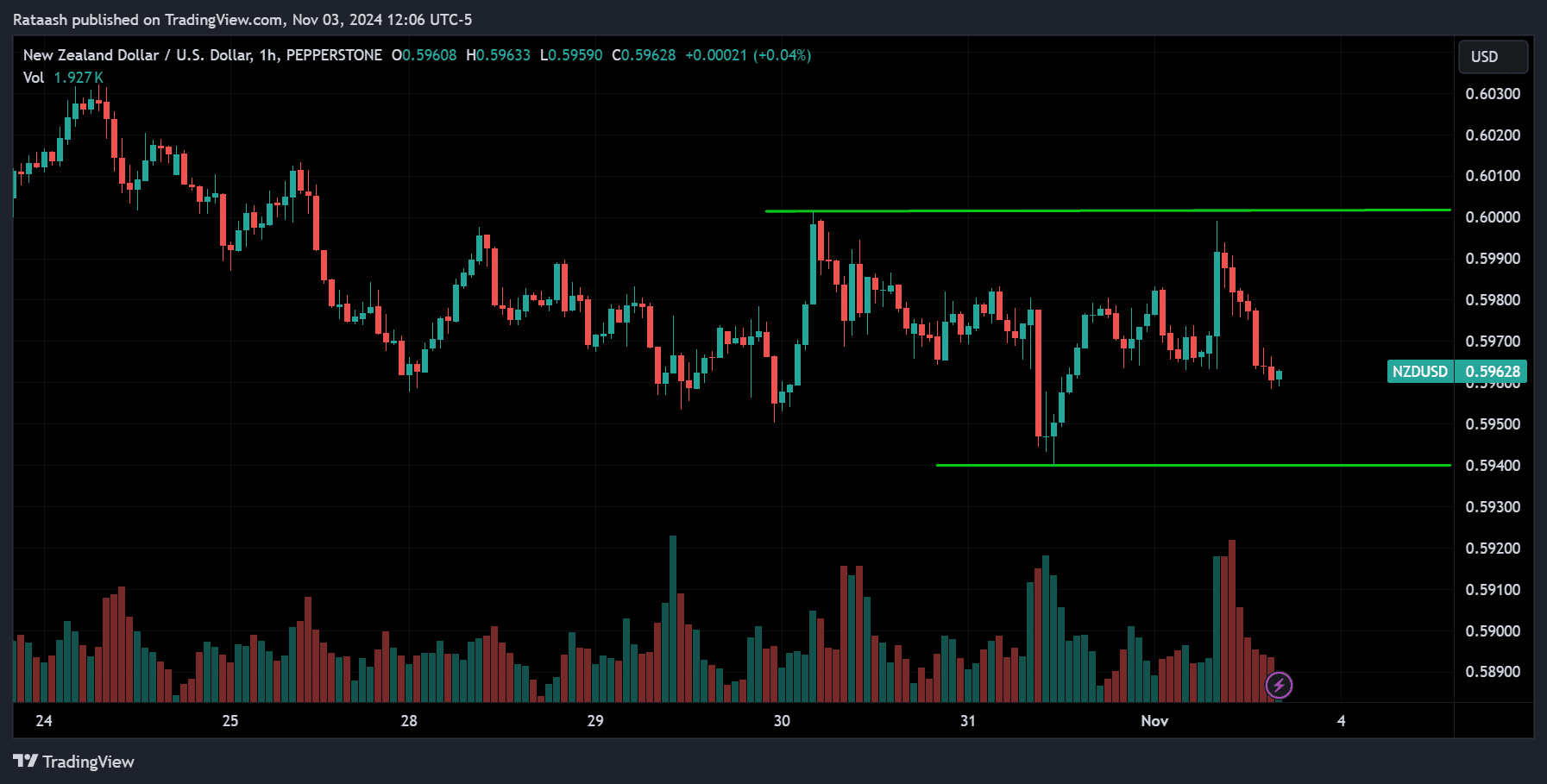

NZDUSD:

On Tuesday, New Zealand will release its unemployment data, which could impact NZD/USD, though likely to a limited extent. However, it’s still worth noting. I recommend checking the forecasted versus actual data and observing how it affects the market; it’s an invaluable lesson you can only gain through experience, so make the most of it.

Looking at the 1-hour chart, NZD/USD is in a downtrend, with the next major support around 0.5850. The price has been consolidating between the 0.5940 support and the 0.6000 resistance. Given the downtrend, a break below the 0.5940 support could signal a move toward the major support at 0.5850. However, be cautious if the price breaks above the resistance, as this could indicate a potential trend reversal.

Conclusion

In conclusion, this week presents a unique mix of high-impact events that are likely to create substantial volatility in the forex market. Traders should stay alert to the U.S. presidential election and its potential economic implications, along with key policy statements from the Federal Reserve, Bank of England, and Reserve Bank of Australia. Additionally, upcoming unemployment data from New Zealand and Canada will provide insights into the labor market’s health, potentially influencing currency moves. With various support and resistance levels being tested across major pairs, the outcomes of these events may drive decisive price actions, making strategic positioning and risk management crucial during this period.

Subscribe to our Telegram channel to get instant updates on new articles.

Disclaimer

These analyses are here to help you understand how to analyze the market. They’re not about giving buy or sell signals. It’s simply about observing price action market behavior. I don’t recommend when to buy or sell because trading doesn’t work that way. You need a strategy to guide your decisions about when to enter or exit positions. That’s the key to making consistent profits in the financial markets over time.

The information provided in this market analysis is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any securities or investments.

All investments involve risk, and past performance is not indicative of future results. The analysis provided may not be suitable for all investors and should be used at their own discretion.

Readers are encouraged to conduct their own research.

Trading and investing in financial markets carry inherent risks, including the risk of losing invested capital. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.

GOOD LUCK✌!!!