As the world welcomes 2024, the question on every crypto enthusiast’s mind is: will Bitcoin finally break free from its shackles and ascend to new heights?

Forecasting the future of this unpredictable asset isn’t a simple job, but in the financial realm, increasing the likelihood in our favor and putting our money on something has consistently yielded positive results.

But to achieve that, we must follow a plan, grasp what we’re investing in, so let’s delve into those aspects.

What is Bitcoin?

Bitcoin, often hailed as digital gold, is a decentralized digital currency that operates on a peer-to-peer network. Created in 2009 by an unknown entity named Satoshi Nakamoto, Bitcoin has revolutionized the world of finance by introducing blockchain technology to secure and transparently record transactions.

How Bitcoin Works?

Blockchain Technology:

Bitcoin transactions are recorded on a public ledger known as the blockchain. The blockchain is a decentralized and distributed database that consists of blocks, each containing a list of transactions. This technology ensures transparency, security, and immutability.

Mining:

Bitcoin mining is the process through which new bitcoins are created and transactions are added to the blockchain. Miners use powerful computers to solve complex mathematical puzzles, and the first miner to solve the puzzle gets the right to add a new block of transactions to the blockchain. This process helps maintain the integrity and security of the network.

Decentralization:

Unlike traditional currencies, Bitcoin operates on a decentralized network of computers (nodes). This means there is no central authority governing or controlling the currency. Decentralization enhances security and reduces the risk of censorship or manipulation.

Limited Supply:

Bitcoin has a capped supply of 21 million coins, creating a sense of scarcity. This scarcity is programmed into the system to mimic the scarcity of precious metals like gold. The fixed supply is expected to combat inflationary pressures over time.

Digital Wallets:

Users store their bitcoins in digital wallets, which can be software-based (online, desktop, mobile) or hardware-based (physical devices). Wallets facilitate the sending and receiving of bitcoins, and each user has a private key to access and control their funds.

Now, checkout our article if you like to learn more about cryptocurrencies.

I think by now you’ve got a simple understanding of what Bitcoin is – it’s just a thing that nobody can control. But, is that really true? You’ll find the answer to that question once you finish reading this article.

Thoughts on bitcoin

I can’t cover all the details about Bitcoin or how to analyze cryptocurrencies here – I’ve already shared that in another post. What I’ll do now is give you a glimpse of my perspective on Bitcoin, and you can decide for yourself if it makes sense or not.

Logic:

Let’s start with the basics. When you’re thinking about investing in something, it should have some value or a good reason to make it worthwhile. Now, let’s look at what makes Bitcoin special. Bitcoin is a unique asset because no one can manipulate or scam it. This is because it operates on a technology called blockchain. In this blockchain, there are nodes, computers, or miners – whatever you want to call them. They’re the ones who check and approve transactions in the blockchain, and they’re spread all over the world.

Individuals can’t lie about a transaction because it goes through multiple validators. If one person tries to cheat, the others won’t let it happen. This is because it takes a lot of energy and computational power to solve puzzles and validate a block. So, if someone lies, all that hard work becomes a waste of energy. It’s practically impossible to do that because the only way you can lie and fake a transaction is if you control more than 51% of the total validators worldwide. In simpler terms, you need more than half of all the people checking transactions to agree with you in order to fake one – which is extremely unlikely. This concept is known as proof of work.

This system makes Bitcoin decentralized. This means you can directly send money to someone else without involving a third party like banks. The system operates 24/7, and every transaction since the first block was created is publicly available. This makes Bitcoin the first-ever technology to come up with something this unique.

And there’s another important point – there’s only a set amount of Bitcoin available, not more than 21 million. This means no one can just decide to create more Bitcoins like governments can print more money. As time goes on, this limited supply makes its value likely to go up.

Adoption:

The widespread adoption of Bitcoin by institutional investors and businesses has been a key driver of its price in recent years. Companies like Tesla and Square have invested significant amounts in Bitcoin, bringing a level of legitimacy to the digital asset. If more businesses continue to integrate Bitcoin into their financial strategies, it could contribute to a positive trend in its value.

The more people start using it, the more it value grows.

Regulatory Developments:

The regulatory environment plays a crucial role in determining the future fluctuations of Bitcoin. Governments around the world are still grappling with how to regulate and tax cryptocurrencies.

Honestly, I don’t worry about regulations because Bitcoin was made to eliminate the need for third parties and traditional currencies. We prefer to trust the technology itself rather than relying on someone else. Until now, the technology has shown a lot of promise, and no matter who dislikes it, it’s going to stick around as long as it keeps proving its value on its own.

Market Sentiment:

The sentiment of the market and the wider public can heavily influence Bitcoin prices. Positive developments, such as increased public awareness, favorable media coverage, and positive sentiment on social media platforms, can drive demand and, subsequently, the price of Bitcoin. Conversely, negative news or sentiment can lead to a decline in prices.

Market sentiment is very useful when timing your purchases, meaning when more people wanna sell and when prices are falling that’s the best time you could buy it, because you can get it at a discounted price.

Analysis conclusion:

I began purchasing bitcoins when I first understood its technology and what it stands for. I didn’t pay attention to anything else. What I mentioned earlier are factors to think about when picking an investment – logic matters more than anything else. If it doesn’t have value, it’s not worth it. For instance, I’m not a fan of DOGE coin because it doesn’t aim to solve any problems; it seems more like a hype that has gone too far. I prefer Bitcoin because of its technology.

Price of a Bitcoin

Let’s look at the historical performance of bitcoin.

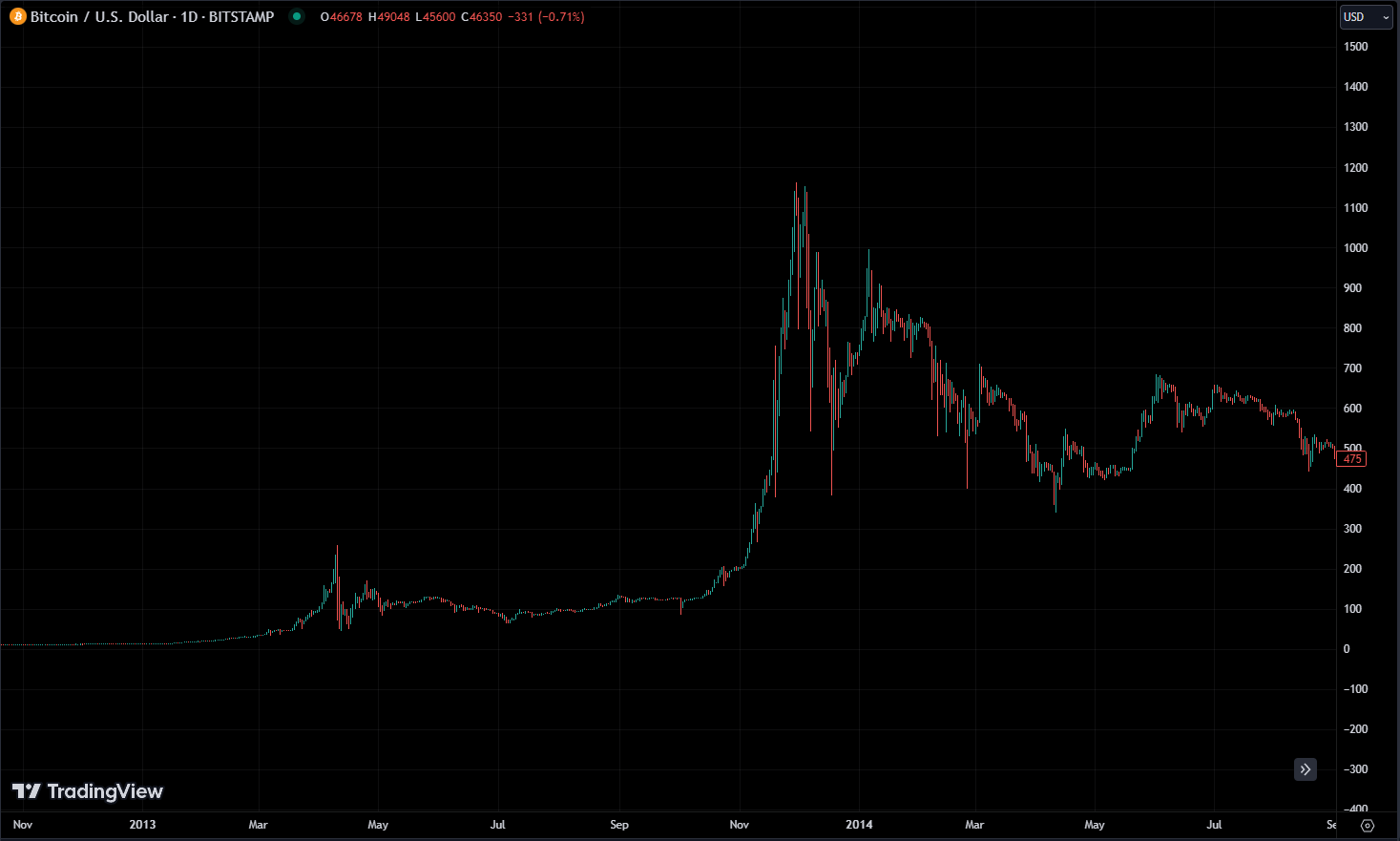

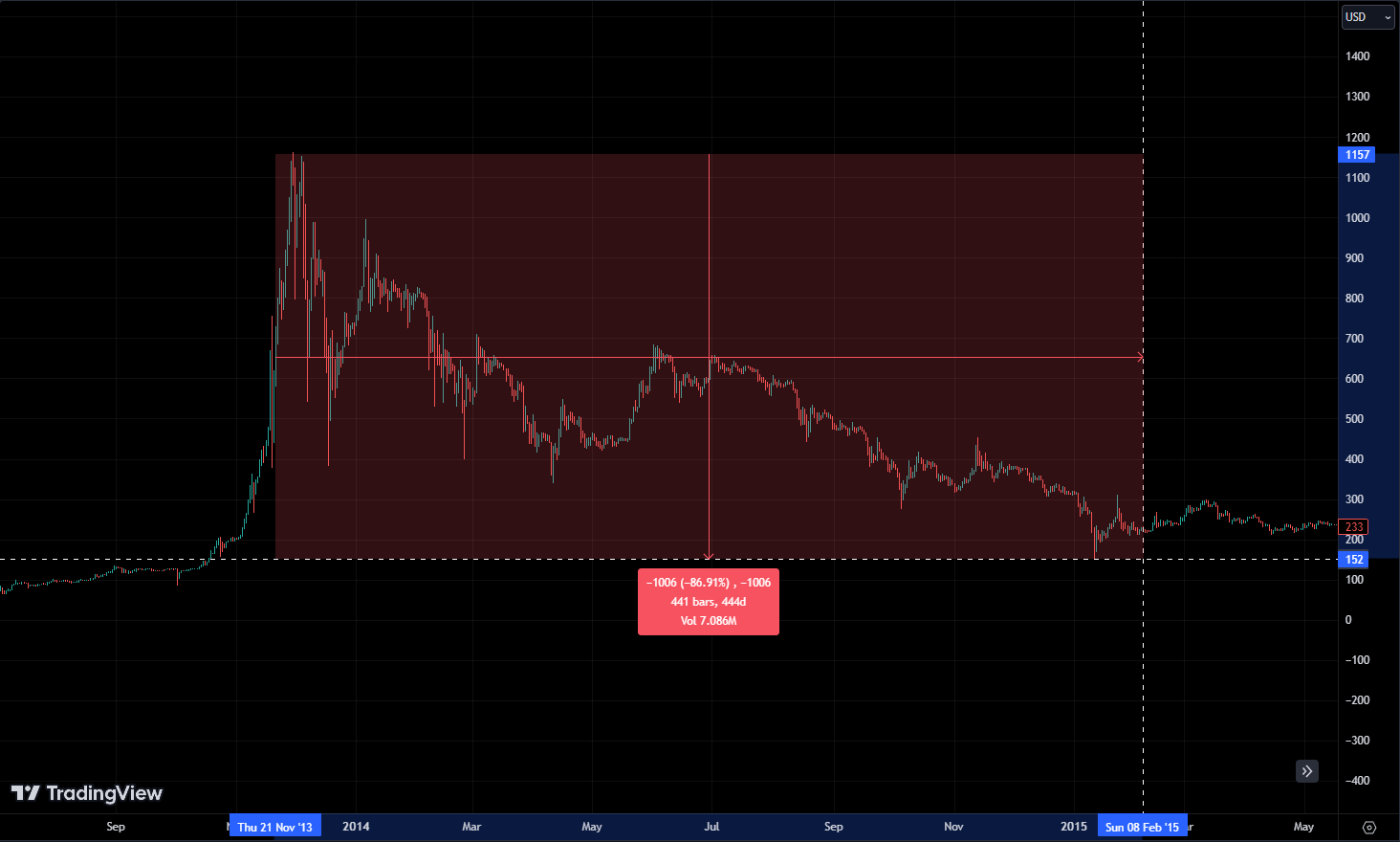

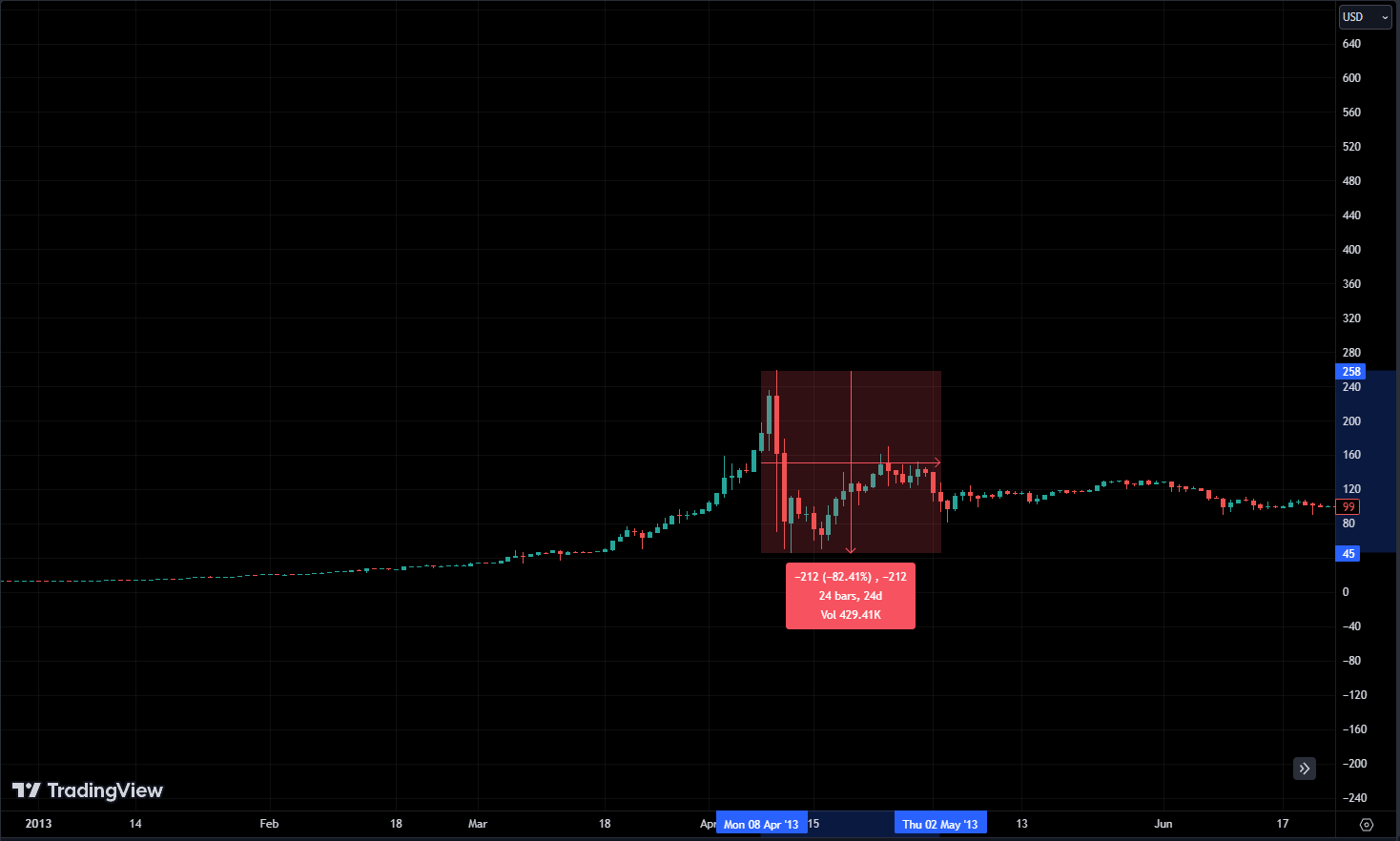

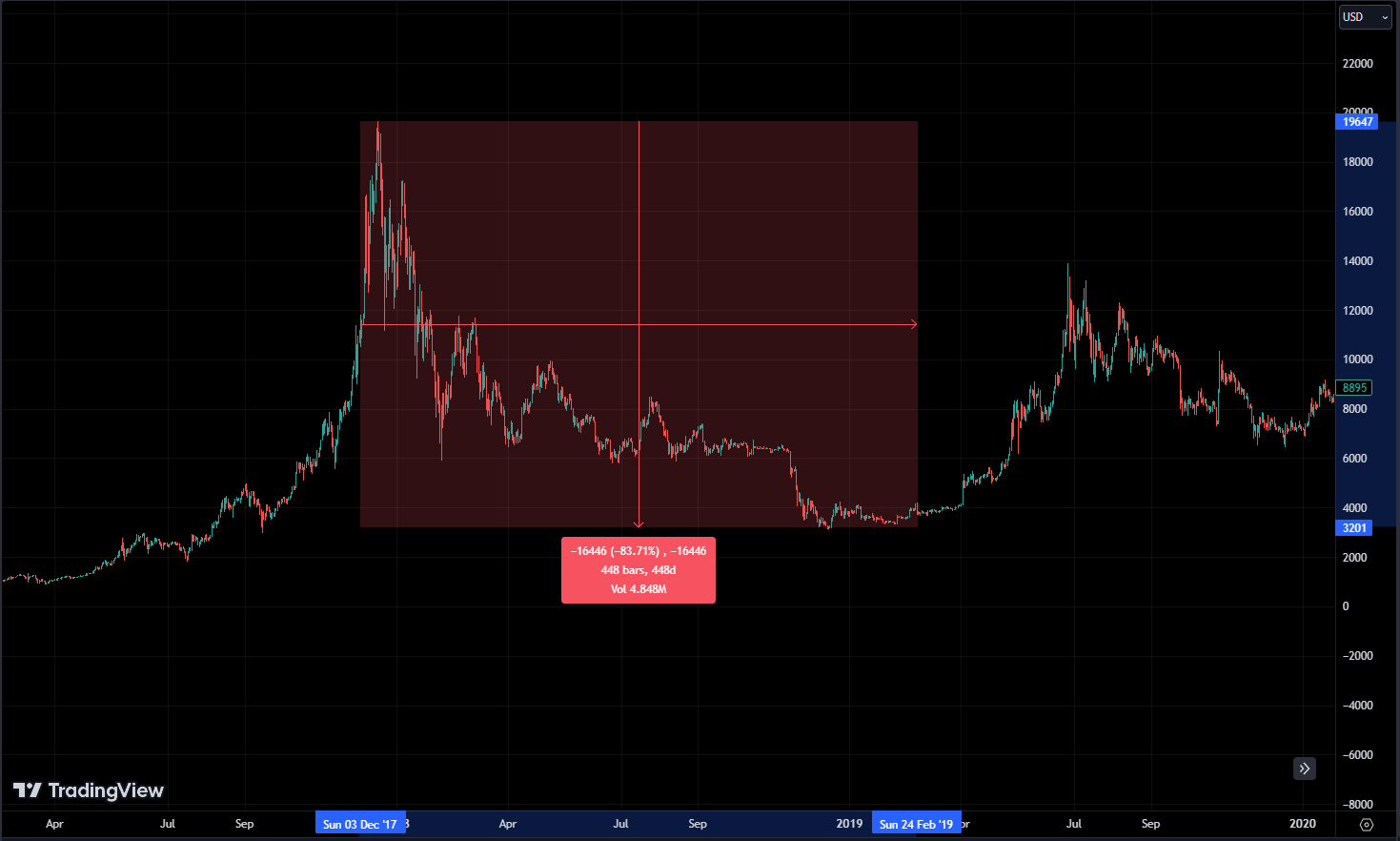

You can see that Bitcoin had a peak in 2017 when the price reached nearly 20,000 USD and then dropped. It happened again in 2021 when the price went up to 65,000 USD and then dropped once more. A similar sequence occurred in early April 2013 when the price reached around 250 USD and then crashed. Again, in late 2013, the price went up to almost 1,200 USD and then crashed.

When you check just the prices, it might not make much sense, but if you look at the percentage changes in prices during those times, it all starts to come together.

In all these downturns, it dropped nearly the same, around 80%. Cryptocurrencies are volatile assets. Just looking at the raw price won’t really help to grasp how their value changes. That’s why, for volatile assets, using logarithmic charts is really useful. It removes the raw numbers and uses percentages to show performance.

You can notice that the value of BTC continued to rise. The crashes are almost the same – a drop from 65,000 USD to 20,000 USD is similar to a crash from 260 USD to 46 USD. It’s just bigger numbers, that’s all.

What this tells us is that Bitcoin can drop by more than 80% of its value and still bounce back, and that’s normal. In late 2022, the price hit 15,500 USD, which is nearly a 77% drop, and then it started to rise again. At the time of writing this article, the price was at 46,000 USD. So, the trend of price fluctuations is evident and can be clearly seen.

In finance, something that follows a pattern is more likely to keep following that pattern. I’m not saying it won’t change, but the chance of it changing is very low. After every drop, it reached a new high. In the next few years, reaching 100,000 might be possible. There could be another drop before it hits 100,000, but it will eventually get there if it keeps proving its technology.

Conclusion

I want to bring up one more point before wrapping up, and that’s the Efficient Market Hypothesis. I won’t dive into it much here, but it essentially means that the market price reflects all available data about the asset. You might have heard about companies or individuals buying a lot of Bitcoin, like MicroStrategy or Tesla. They own a significant amount, and the market is aware of this concentration. The market won’t let just a few people benefit from it. So, if the price needs to go up, more and more people have to be willing to buy at a high demand.

Reaching 100,000 or even 1 million is possible for Bitcoin, but it might not happen as quickly as we think. It could take decades. When everyone agrees that Bitcoin’s price should be 1 million, that’s when it will reach 1 million. Until then, it’s going to go up and down. My main point is that while Bitcoin or blockchain might be the invention of the century, it could take decades or maybe even a century to become the real gold standard.

Bitcoin has its share of issues, like slow transaction speed, some transparency concerns, and more. I’m not saying it’s perfect, but it’s better than what we are currently using. I strongly believe that the technology has the potential to fix a lot of problems in our current economy.