It is widely recognized that trading is a zero-sum game. for every winner, there is a loser. Also, It is a commonly acknowledged fact that the majority of individuals in trading tend to be wrong and end up losing money, while only a small fraction of people are right and achieve significant financial gains. So, You have to understand that when you are trading, it’s a game of supply and demand. and one of the ways to understand market supply and demand is by understanding market sentiment.

In this article, we’ll discover what is market sentiment, how to gauge it, and the concept of contrarian investing.

What is Market Sentiment?

Market sentiment refers to the overall attitude or collective psychology of market participants towards a particular financial instrument, such as stocks, currencies, or commodities.

It reflects the general mood, perception, and emotions prevailing in the market. Market sentiment can be influenced by various factors, including economic news, geopolitical events, corporate earnings reports, and investor behavior.

Types of Market Sentiment

Bullish Sentiment:

Bullish sentiment prevails when investors are optimistic about the future performance of a market or asset. This optimism is often fueled by positive economic indicators, strong corporate earnings, favorable government policies, or other catalysts that suggest potential growth and profitability. During bullish market conditions, investors are more inclined to buy assets, leading to rising prices and overall market upswings.

Bearish Sentiment:

Conversely, bearish sentiment emerges when investors hold a pessimistic outlook on the market or asset. This negativity may stem from poor economic data, geopolitical tensions, corporate losses, or any other factors indicating potential downturns or risks ahead. During bearish market conditions, investors tend to sell off assets, leading to declining prices and increased market volatility.

Neutral Sentiment:

Neutral sentiment prevails when investors adopt a more cautious or indifferent stance towards the market. This may occur during periods of uncertainty or when conflicting signals make it difficult to determine the market’s direction. In neutral market conditions, trading activity may be subdued, and prices may exhibit sideways movement as investors await clearer signals or catalysts.

Factors Influencing Market Sentiment

Economic Indicators: Key economic indicators such as GDP growth, unemployment rates, inflation, and consumer confidence surveys can significantly influence market sentiment. Positive economic data often fosters bullish sentiment, while negative indicators may fuel bearish sentiments.

Corporate Earnings: The financial performance of companies, as reflected in their earnings reports, can impact investor sentiment towards specific stocks or sectors. Strong earnings growth typically boosts bullish sentiment, while declining profits may trigger bearish sentiment.

Geopolitical Events: Geopolitical tensions, wars, trade disputes, and political instability can introduce uncertainty into financial markets, leading to shifts in investor sentiment. Negative geopolitical developments often result in increased risk aversion and bearish sentiment.

News and Media Coverage: News headlines, media reports, and social media discussions can sway investor sentiment by shaping perceptions and influencing market narratives. Positive or negative news stories can trigger emotional reactions among investors, impacting their behavior and market sentiment.

Market Sentiment Indicators: Various indicators and tools are used to gauge market sentiment, including sentiment surveys, put/call ratios, volatility indexes (such as the VIX), and technical analysis indicators (like moving averages or relative strength index). These tools provide insights into the prevailing sentiment and help traders anticipate market trends.

Implications of Market Sentiment

Price Movements: Market sentiment directly influences asset prices, driving trends and fluctuations in the financial markets. Bullish sentiment tends to push prices higher, while bearish sentiment can lead to price declines and increased volatility.

Trading Strategies: Investors often adjust their trading strategies based on prevailing market sentiment. In bullish markets, investors may adopt long positions or buy-and-hold strategies, while in bearish markets, they may opt for short-selling or defensive strategies to hedge against potential losses.

Risk Management: Market sentiment can impact risk perceptions and appetite among investors. During periods of heightened bullish sentiment, investors may become complacent and overlook risks, whereas during bearish sentiment, risk aversion may increase, prompting investors to seek safer assets or diversify their portfolios.

Market Psychology: Market sentiment reflects the collective psychology of investors, including their emotions, biases, and herd behavior. Understanding market psychology can help investors identify market trends, sentiment shifts, and potential opportunities or risks.

Understanding Market Sentiment

When you see a stock that everyone thinks is amazing, with lots of people saying it’s the best and expecting its value to go up, does this positive vibe mean the stock is more likely to go up or down?

Why do stock prices change? We’ve learned that prices go up when people buy things, pushing the prices higher.

Now, if everyone is saying great things about a certain stock, it suggests they’ve already bought it.

What really matters isn’t what those who already bought think, but rather what those who haven’t bought yet think. It’s their interest in buying that could push the price up.

Once everyone who wants to buy has done so, those who bought earlier will eventually sell, putting pressure to sell. But what we’re really interested in is whether there will be new buyers.

Because if there aren’t, prices won’t go up.

So, if everyone around you is hyping up a company, telling you to buy its stock, chances are they’ve already bought it. It’s important to know they’ll eventually need to sell to make a profit, which adds selling pressure.

And since everyone who could make prices go up has already bought, there might not be enough momentum left to buy.

That’s why when everyone agrees on something, it often goes the other way. This brings us to contrarian investing.

Market sentiment isn’t just about hard facts but also about how people feel, what they expect, and how they act. It’s affected by things like fear, greed, news, rumors, and what others are doing.

Traders and investors often look at market sentiment to help them make decisions, as it can give clues about where the market might be headed.

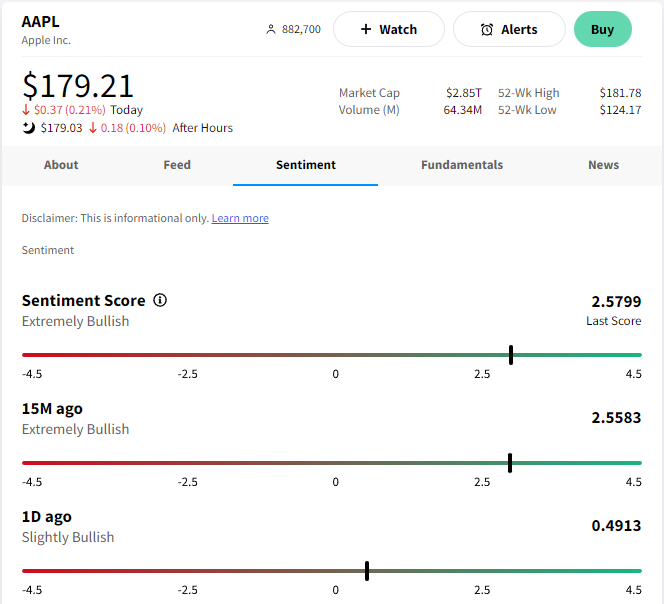

If you find yourself in a situation where almost everyone feels really good about the market (like 99% of people), you know that they are already bought the stock. and you can guess what might happen next.

Percentages like 70% or 80% are usually fine, but once it goes over 90% or 95%, things get more complicated.

If market sentiment goes above 95%, it might be smart to think about selling what you have, assuming you’ve already bought something. Such really high levels of sentiment could mean the stock has used up all its energy.

Traders acquire market sentiment from diverse sources such as Reddit, Quora, investing forums, and so on. One of them is stocktwits. here by conducting a search for the stock, you can quickly gauge whether the market sentiment surrounding it is strong or weak.

What is Contrarian Investing?

Contrarian investing is a strategy where you do the opposite of what most people are doing in the market. Contrarian investors think that when most people think the same way, it might mean the market is too high or too low. They look for chances to buy when most people are feeling really negative or sell when most people are feeling really positive.

Contrarian investors often act this way because they believe markets sometimes react too much to news, which makes prices wrong. They try to make money from these mistakes by doing the opposite of what most people are doing. So, if everyone is buying, they might sell, and if everyone is selling, they might buy. The main idea of contrarian investing is to buy when others are selling and sell when others are buying.

Contrarians use a mix of research, market signs, and sentiment signs to find these chances. They search for stocks or assets that they think are either too cheap or too expensive, based on their research. And they’re confident enough in their judgment to go against what most people are thinking.

Contrarian investing needs patience, sticking to the plan, and having faith in your analysis. It’s a strategy that goes against following the crowd and looks for chances when market sentiment doesn’t match up with the real value. The contrarian way makes a lot of sense. It uses market sentiment to figure out what the opposite of the majority is thinking.

Warren Buffett is a well-known contrarian investor.

Conclusion

Your objective is to purchase assets prior to the majority of people and once they bought, that’s when you sell.

Market sentiment and the contrarian approach are closely tied to psychology. As you deepen your understanding of these concepts, you will gradually develop the ability to make informed and confident decisions in the financial markets.