Bitcoin has recently surged to unprecedented levels, with its price surpassing $93,000 and edging closer to the $100,000 milestone. This remarkable ascent has been fueled by a confluence of factors, including favorable political developments, increased institutional adoption, and evolving market dynamics. For investors contemplating entry into the cryptocurrency market, the current landscape presents compelling reasons to consider investing in Bitcoin and other digital assets.

Political Developments Favoring Cryptocurrency

The recent re-election of Donald Trump as U.S. President has significantly bolstered the cryptocurrency market. Trump’s administration is anticipated to implement crypto-friendly policies, including the potential establishment of a national Bitcoin reserve and the appointment of a pro-crypto Securities and Exchange Commission (SEC) chair. These initiatives are expected to create a more supportive regulatory environment, fostering growth and innovation within the cryptocurrency sector.

Institutional Adoption and Market Confidence

Institutional interest in Bitcoin has surged, with significant investments flowing into Bitcoin exchange-traded funds (ETFs) and related financial products. Notably, BlackRock’s iShares Bitcoin Trust ETF has experienced substantial inflows, reflecting growing confidence among institutional investors. This trend underscores the increasing acceptance of Bitcoin as a legitimate asset class and a potential hedge against traditional market volatility.

Market Dynamics and Price Predictions

Analysts are optimistic about Bitcoin’s trajectory, with some forecasting it could reach $100,000 by year’s end and potentially hit $200,000 by the end of 2025. This bullish outlook is backed by technical analyses and the anticipated effects of the upcoming Bitcoin halving, which historically has led to significant price appreciation.

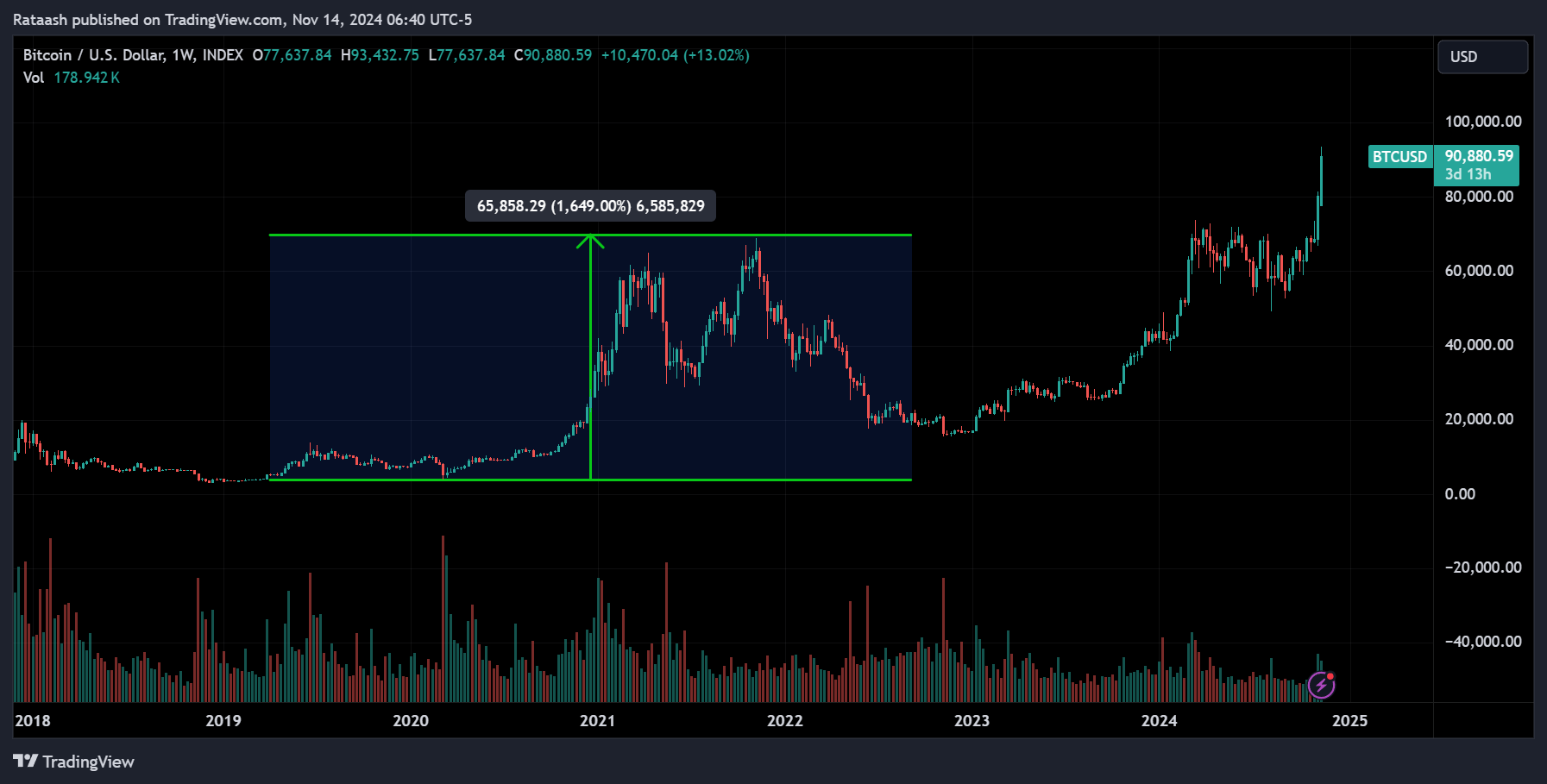

Looking at Bitcoin’s history, each major crash has been followed by a recovery phase that pushes the price to new highs, often far exceeding the previous peak. Here’s how Bitcoin’s major cycles have played out, leading us to the current phase:

- 2011 Crash: Bitcoin’s price first rallied from under $1 to around $32, only to fall dramatically by about 94%, bottoming out at $2. This drop marked the start of a long accumulation phase, followed by a bull run that would see Bitcoin reach new highs.

- 2013-2015 Cycle: After soaring to $1,100 in 2013, Bitcoin experienced a major correction, dropping about 85% to $200 by early 2015. This crash led to another prolonged bear phase, yet once the market bottomed, Bitcoin surged again, reaching new heights during the next cycle.

- 2017 Crash: Bitcoin’s meteoric rise in 2017 took it close to $20,000. Following this peak, it saw an 84% correction, falling to around $3,200 by December 2018. This low set the stage for another bull run, ultimately leading Bitcoin to break $20,000 and continue higher.

- 2021-2022 Crash: In November 2021, Bitcoin hit its all-time high of approximately $69,000. However, it soon crashed nearly 77%, bottoming out at around $15,500 in late 2022. This correction is consistent with Bitcoin’s historical pattern of steep declines followed by accumulation and, eventually, a powerful recovery.

Current Market Cycle and Potential Path Ahead

Given these historical cycles, Bitcoin’s recent low near $15,500 might signal the beginning of the next major bull phase. If Bitcoin continues to follow its pattern of post-crash rallies, the next peak could realistically push beyond $100,000.

- Short-Term Target: Bitcoin’s next psychological barrier will likely be $100,000. Breaking through this level could accelerate momentum, potentially pushing prices higher.

- Medium-Term Outlook: If the current bull phase continues, Bitcoin may aim for new highs between $150,000 and $200,000, possibly within the next two years, as the halving event and institutional interest fuel demand.

Summary

Each of Bitcoin’s crashes has ultimately paved the way for new highs, and the current cycle appears poised to follow suit. While $100,000 seems within reach, history suggests the potential for even higher levels. However, it’s essential to remember that Bitcoin’s journey to new heights is likely to be punctuated by corrections. Historically, each bull run has come with 30-50% pullbacks along the way, and, as always, investors should be prepared for volatility.

With Bitcoin currently trading around $90,000, the long-term trend remains promising, aligning with its established cycle of crashes, recoveries, and record-setting peaks.

Advantages of Investing in Cryptocurrency

Investing in cryptocurrencies like Bitcoin offers several potential benefits:

- Diversification: Cryptocurrencies provide an alternative asset class that can diversify an investment portfolio, potentially reducing overall risk.

- Inflation Hedge: With a capped supply, Bitcoin is often viewed as a hedge against inflation, preserving value over time.

- Accessibility: Cryptocurrencies enable seamless, low-cost transactions across borders, enhancing financial inclusion.

Considerations and Risks

While the prospects are promising, it’s essential to approach cryptocurrency investments with caution:

- Volatility: Cryptocurrency markets are highly volatile, with prices subject to rapid fluctuations.

- Regulatory Uncertainty: Despite positive developments, regulatory landscapes can change, potentially impacting market dynamics.

- Security Risks: Investors must be vigilant about security, as the digital nature of cryptocurrencies can make them susceptible to cyber threats.

Conclusion

The convergence of favorable political developments, increased institutional adoption, and positive market dynamics positions Bitcoin on a promising path toward the $100,000 mark. For investors, this juncture presents a compelling opportunity to consider entering the cryptocurrency market. However, it’s crucial to conduct thorough research, assess individual risk tolerance, and stay informed about market trends and regulatory changes to make well-informed investment decisions.