![Price Action Forex Forecast [2024.09.03]: Key Price Levels and Trends for Major Forex Pairs - EURUSD Correction or Entering Downtrend?

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/Black-and-Yellow-Photocentric-Cryptocurrency-Market-Presentation.jpg)

Hello, and welcome to xlearn’s daily price action forex forecast for day traders. If this is your first time here, I recommend reading our guide on how to use our market analysis article before diving into this one.

By following these articles, you can learn how to read prices and perform price action trading.

Before we get into the analysis, let’s quickly review the major economic events that could impact the market.

Key Economic Events Today

These events encompass important global news, macroeconomic reports, and economic indicators. For more details, you can check the forex factory.

- 21:30 ET: Australia will release its quarterly GDP data, showing the change in the value of all goods and services produced, adjusted for inflation. The previous figure was 0.1%, and the forecast is 0.2%. If the actual number is higher than the forecast, it’s good for the currency. This report is released every quarter, about 65 days after the quarter ends, and is the main measure of economic activity, so it will impact AUD pairs.

Price Action Forex Forecast

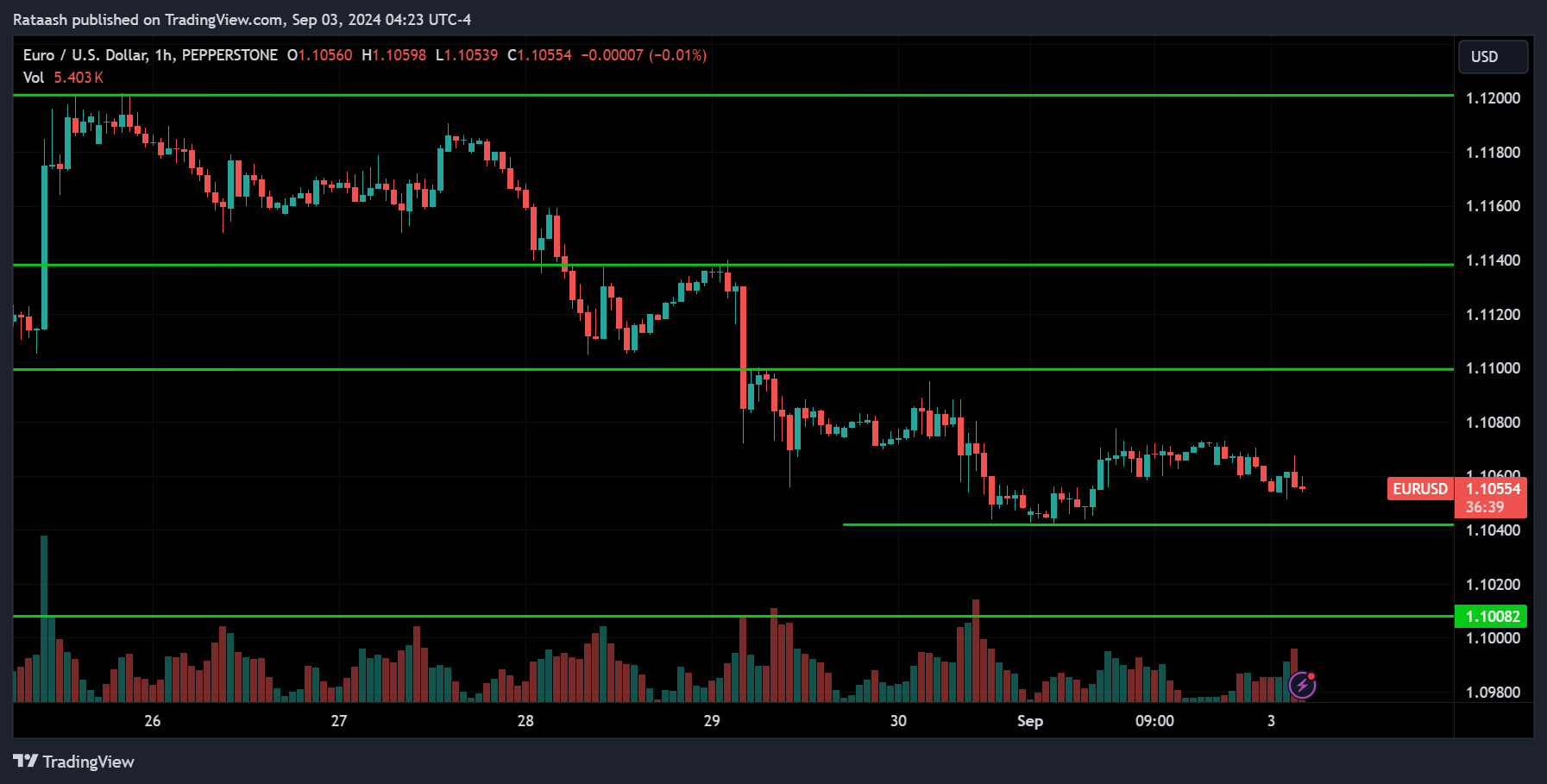

EURUSD:

EURUSD was trending up, but now the price is in a correction phase. It pulled back from the resistance at 1.12000 and is now at the support level of 1.10400. If the correction continues, the price might break below 1.10400 and head toward 1.10000. However, if the price starts rising again and breaks above the resistance at 1.11000, the correction phase could be over, and the price might go up toward 1.11400.

USDCAD:

USDCAD is trending down, with the price pulling back from the support level of 1.34400. Now, the price is near the resistance at 1.35400. If it breaks above this level, we can expect the price to move toward the 1.36000 range. However, if the price falls back below 1.35000, we can expect it to continue its downtrend to 1.34400, and if that level is also broken, it may drop further.

USDJPY:

USDJPY was trending down, pulling back from the support level at 143.500 and rising to the resistance at 147.500 before pulling back again. It is now sitting around the 145.500 support range. If the price breaks below this support, we can expect it to drop toward 143.500. However, if the price starts going up and breaks above 146.500, we can expect it to continue rising toward 147.500 and possibly 148.000.

USDCHF:

USDCHF is overall trending down. The price pulled back from the support at 0.84000 and is now at the resistance around 0.85500. If the price breaks above this resistance, we can expect it to continue rising toward 0.87000. However, if a reversal happens around 0.85500, we could see the price drop back toward 0.84000.

GBPUSD:

GBPUSD is trending up but is currently going through a correction phase. The price pulled back from the resistance at 1.32600 and is now at the support level of 1.31000. If the price breaks below this support, we can expect it to continue dropping to the 1.30600 level. On the other hand, there is resistance around the 1.31500 range. If the price breaks above it, we can expect it to continue toward 1.32000.

AUDUSD:

AUDUSD is uptrending, but the price is currently in a correction phase. It pulled back from the resistance at 0.68200 and is now below the support at 0.67600, with the next major support around 0.67000. We can expect the price to reverse around the 0.67000 support and start going back up. However, if the price breaks below this level, it could drop further and start a downtrend.

NZDUSD:

NZDUSD is trending up, currently pulling back from the resistance at 0.63000 and now at the support of 0.62000. Since it’s downtrending in the medium term, we can expect the price to break below the support and head toward 0.61600. However, if the price goes back to the 0.62200 level and breaks above it, we can expect it to head toward 0.62500.

Conclusion & Disclaimer

Subscribe to our Telegram channel to get instant updates on new articles.

Please provide your feedback on how we can improve this article. Thank you!

These analyses are here to help you understand how to analyze the market. They’re not about giving buy or sell signals. It’s simply about observing price action market behavior. I don’t recommend when to buy or sell because trading doesn’t work that way. You need a strategy to guide your decisions about when to enter or exit positions. That’s the key to making consistent profits in the financial markets over time.

The information provided in this market analysis is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any securities or investments.

All investments involve risk, and past performance is not indicative of future results. The analysis provided may not be suitable for all investors and should be used at their own discretion.

Readers are encouraged to conduct their own research.

Trading and investing in financial markets carry inherent risks, including the risk of losing invested capital. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.

GOOD LUCK✌!!!