![Price Action Forex Forecast [2024.09.04]: Key Price Levels and Trends for Major Forex Pairs - Navigate Market Moves Like a Pro!

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/Black-and-Yellow-Photocentric-Cryptocurrency-Market-Presentation-1.jpg)

Hello, and welcome to xlearn’s daily price action forex forecast for day traders. If this is your first time here, I recommend reading our guide on how to use our market analysis article before diving into this one.

In this Price Action Forex Forecast for [2024.09.04], we analyze key price levels and trends for major forex pairs. This report highlights important support and resistance zones to help you spot potential trade opportunities for pairs like EURUSD, GBPUSD, USDJPY, and more. Whether you’re experienced or new to price action trading, these insights will enhance your strategy by keeping you informed of key levels and current trends.

Before we get into the analysis, let’s quickly review the major economic events that could impact the market.

Key Economic Events Today

These events encompass important global news, macroeconomic reports, and economic indicators. For more details, you can check the forex factory.

- 9:45 ET: BOC Rate Statement

This is the Bank of Canada’s main way of sharing its monetary policy with investors. It includes their decision on interest rates and explains the economic factors behind it. More importantly, it provides insights into the economy’s outlook and hints at future rate changes. This event happens 8 times a year. Along with this, the Overnight Rate is released, which is the interest rate at which big financial institutions lend and borrow money overnight. The previous rate was 4.25%, and the forecast is 4.50%. If the actual rate is higher than the forecast, it’s good for the currency. Traders usually focus more on the BOC Rate Statement as it provides clues about future rate changes. Short-term interest rates play a major role in currency value, making this event very volatile for CAD pairs. - 10:30 ET: BOC Press Conference

The BOC Governor and Senior Deputy Governor will hold this press conference, which happens 8 times a year. If the tone is more hawkish (aggressive), it’s good for the currency. The press conference has two parts: first, a prepared statement is read, and then press questions follow. These questions often lead to unscripted answers, which can cause strong market movements. It’s webcasted on the BOC website. This event is a key way for the BOC to explain its monetary policy, including details on their recent interest rate decision, the economic outlook, and inflation. Most importantly, it gives clues about future policy, making it a volatile event for CAD pairs. - 22:00 ET: RBA Gov Bullock Speaks

Governor Bullock is set to speak at the Anika Foundation in Sydney, and audience questions are expected. If her tone is more hawkish (aggressive), it’s good for the currency. As the head of the central bank, which manages short-term interest rates, she has the most influence on the nation’s currency value. Traders pay close attention to her speeches because they often contain subtle hints about future monetary policy. This event can cause big movements in AUD pairs.

Price Action Forex Forecast

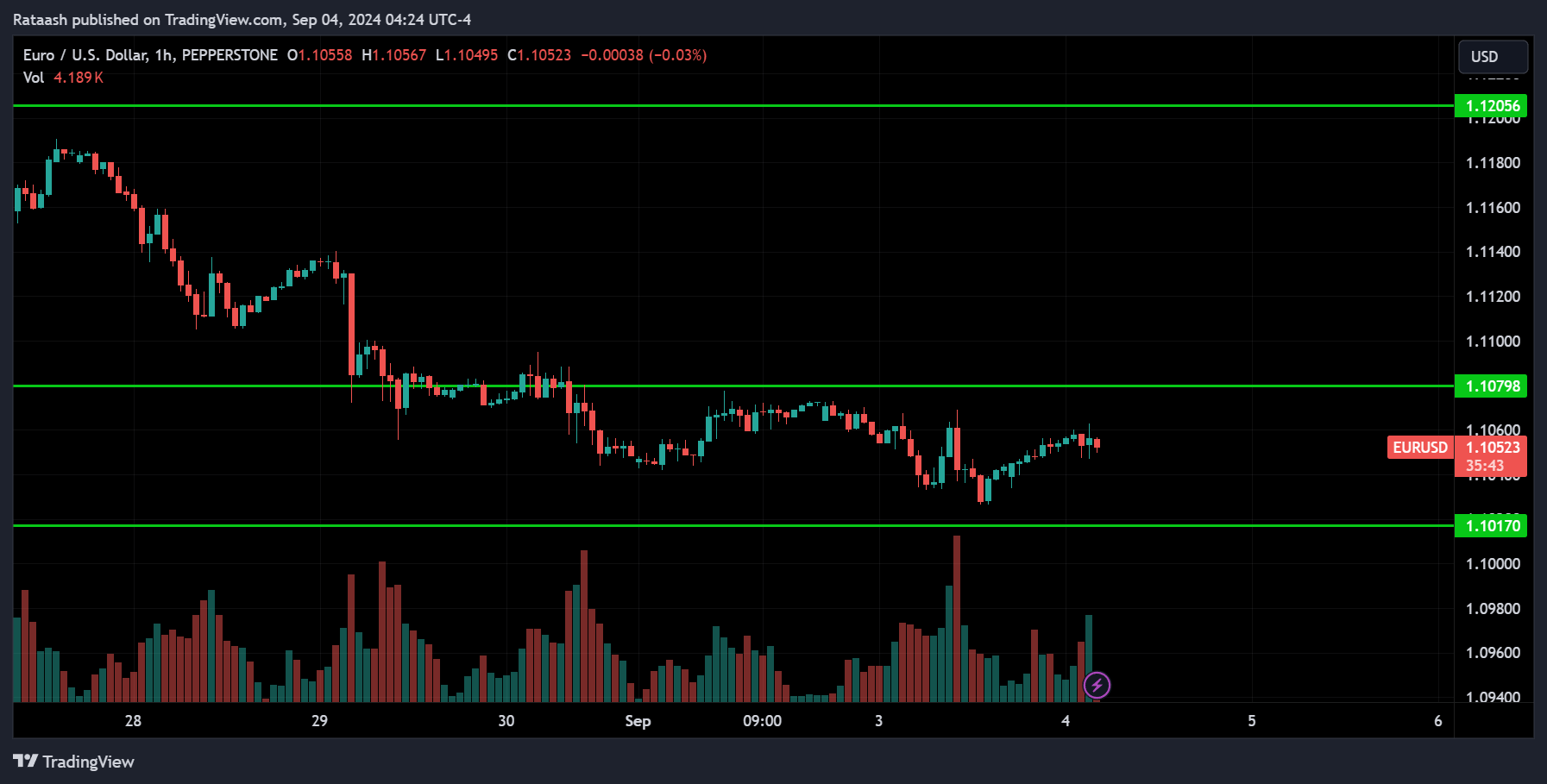

EURUSD:

EURUSD is pulling back from the major resistance level of 1.12000 and is now at the major support around 1.10000. On the 1-hour chart, there’s a small resistance near 1.10800. If the price breaks below the 1.10000 support, we can expect the downtrend to continue. However, if the price breaks above the 1.10800 resistance, we could see the price move back up toward 1.12000.

USDCAD:

USDCAD was trending down, but the price has started to rise from the 1.34400 support level. Now, the price is at the resistance level of 1.35600. If the price breaks above this level, we can expect it to move up to 1.36000 for either a pullback or a breakout. On the other hand, if the price breaks below the 1.35000 support, we could see it drop back to the 1.34400 level.

USDJPY:

USDJPY was trending down but started to rise around the support level of 141.600. The price recently pulled back from the resistance at 147.500 and is now at the support level of 144.500. If the price breaks below this support, we can expect it to drop to 143.500, and if that level is also broken, it could continue down to 141.600. On the other hand, we might see the price reverse from these support levels and move back up toward 147.500.

USDCHF:

USDCHF is in an overall downtrend, having recently pulled back from the major support level of 0.84000. Now, the price is trading between the resistance at 0.85400 and the support at 0.84600. Since the overall trend is bearish, we can expect the price to break below the 0.84600 support and drop toward 0.84000. However, if an uptrend has already started, this pullback could be a correction, and we might see the price rise from the 0.84600 support toward 0.85400, possibly pulling back again or breaking above that level to continue up toward 0.87500.

GBPUSD:

GBPUSD is overall trending up, but the price is currently pulling back from the resistance level of 1.32700. The next major support is around 1.30400. If the price breaks below the small support near 1.30800, we can expect it to drop towards 1.30400 and either pull back or break below. If it breaks below 1.30400, it could signal the start of a downtrend. On the other hand, if the price breaks above the resistance around 1.31600, it could end the correction phase and resume its uptrend towards the 1.32700 resistance range.

AUDUSD:

AUDUSD is overall trending up, with the price currently pulling back from the resistance level of 0.68200 and sitting at the support level of 0.67000. There’s a small support around 0.66800, and if the price breaks below this level, we can expect it to enter a downtrend. On the other hand, there’s a small resistance around 0.67300. If the price breaks above this level, we can expect the pullback to end and the price to continue its uptrend back towards 0.68200.

NZDUSD:

NZDUSD is overall trending up, with the price currently pulling back from the resistance at 0.63000. There is support around the 0.61600 range, and if the price breaks below this level, we can expect it to enter a deeper correction or even a downtrend, with the next major support around 0.60500. On the other hand, if the price starts to rise again and breaks above the 0.62200 resistance, we can expect it to continue moving up toward 0.63000.

Conclusion & Disclaimer

Subscribe to our Telegram channel to get instant updates on new articles.

Please provide your feedback on how we can improve this article. Thank you!

These analyses are here to help you understand how to analyze the market. They’re not about giving buy or sell signals. It’s simply about observing price action market behavior. I don’t recommend when to buy or sell because trading doesn’t work that way. You need a strategy to guide your decisions about when to enter or exit positions. That’s the key to making consistent profits in the financial markets over time.

The information provided in this market analysis is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any securities or investments.

All investments involve risk, and past performance is not indicative of future results. The analysis provided may not be suitable for all investors and should be used at their own discretion.

Readers are encouraged to conduct their own research.

Trading and investing in financial markets carry inherent risks, including the risk of losing invested capital. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.

GOOD LUCK✌!!!