Hello, and welcome to xlearn’s daily price action forex forecast for day traders. Today is September 6th, 2024, and as we approach the end of the first week of September, markets are factoring in potential rate cuts. There are two major events to watch today: the Unemployment Rate release and a speech by an FOMC member.

If this is your first time here, I recommend reading our guide on how to use our market analysis article before diving into this one. By following these articles, you can learn how to read prices and perform price action trading.

Before we get into the analysis, let’s quickly review the major economic events that could impact the market.

Key Economic Events Today

These events encompass important global news, macroeconomic reports, and economic indicators. For more details, you can check the forex factory.

- 8:30 ET: Canada is releasing its Unemployment Rate, which shows the percentage of the workforce that is unemployed and actively looking for jobs in the past month. The previous rate was 6.4%, and the forecast is 6.5%. If the ‘Actual’ rate is lower than the ‘Forecast,’ it’s positive for the currency. Even though it’s seen as a lagging indicator, the unemployment rate is an important sign of the economy’s health since consumer spending is closely linked to job market conditions. This can lead to high volatility in CAD currency pairs.

8:30 ET: The US is also releasing its Unemployment Rate, with the previous rate at 4.3% and a forecast of 4.2%. If the ‘Actual’ rate is lower than the ‘Forecast,’ it’s good for the currency. Unemployment is also a key factor for those shaping the country’s monetary policy. 11:00 ET: FOMC Member Waller will speak about the economic outlook at the University of Notre Dame in Indiana. Audience questions are expected. If his comments are more hawkish than expected, it’s good for the currency. FOMC members of the Federal Reserve decide on the nation’s key interest rates, and their public speeches often give hints about future monetary policy.

Price Action Forex Forecast

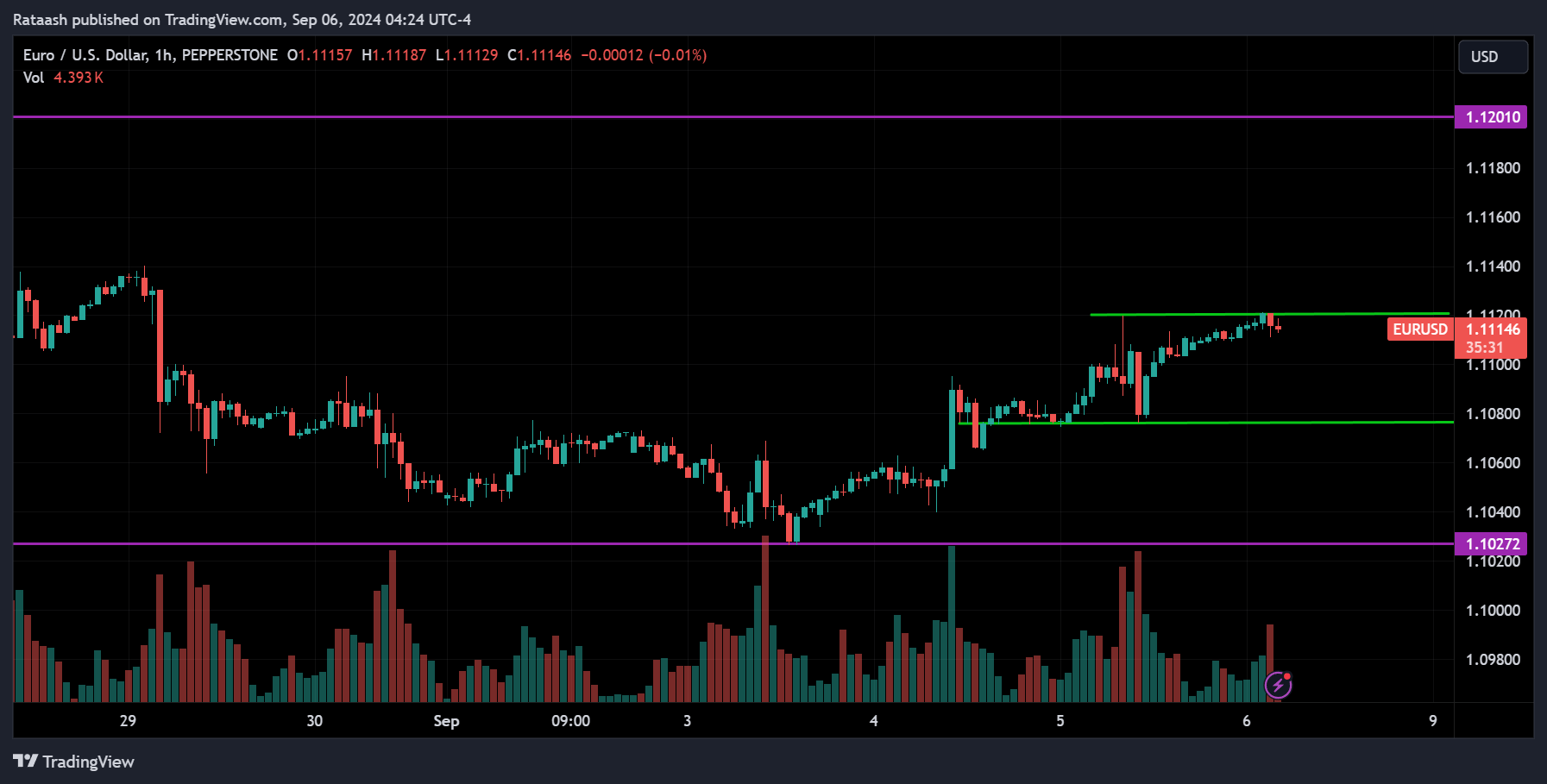

EURUSD:

EURUSD is in an uptrend. The price recently corrected from the resistance level of 1.12000, dropped to the 1.10200 range, and is now moving back up, suggesting the uptrend is resuming. There is a small resistance around 1.11200 and support around 1.10800. Since the price is trending up, we can expect it to break above the resistance and continue toward 1.12000. However, if the price drops from resistance, we might see it bounce back up from the 1.10800 support. If that level breaks, the price could fall to 1.10200.

USDCAD:

USDCAD is overall in a downtrend. After a pullback from the support level of 1.34400, the price moved up to the resistance around 1.35600 and is now starting to drop again. The price is currently near a support level at 1.34800. If it breaks below this level, we can expect the price to drop toward 1.34400. However, if the price starts to rise and breaks above the resistance at 1.35300, we can expect it to continue toward 1.35600.

USDJPY:

USDJPY is in a downtrend, and the price is approaching the major support level of 141.600. If the price breaks below this support, we can expect it to drop further. On the other hand, the price might reverse at this support and start moving back up toward the 144.00 resistance level. If the price manages to break above this resistance, we could see the beginning of a new uptrend or at least a correction.

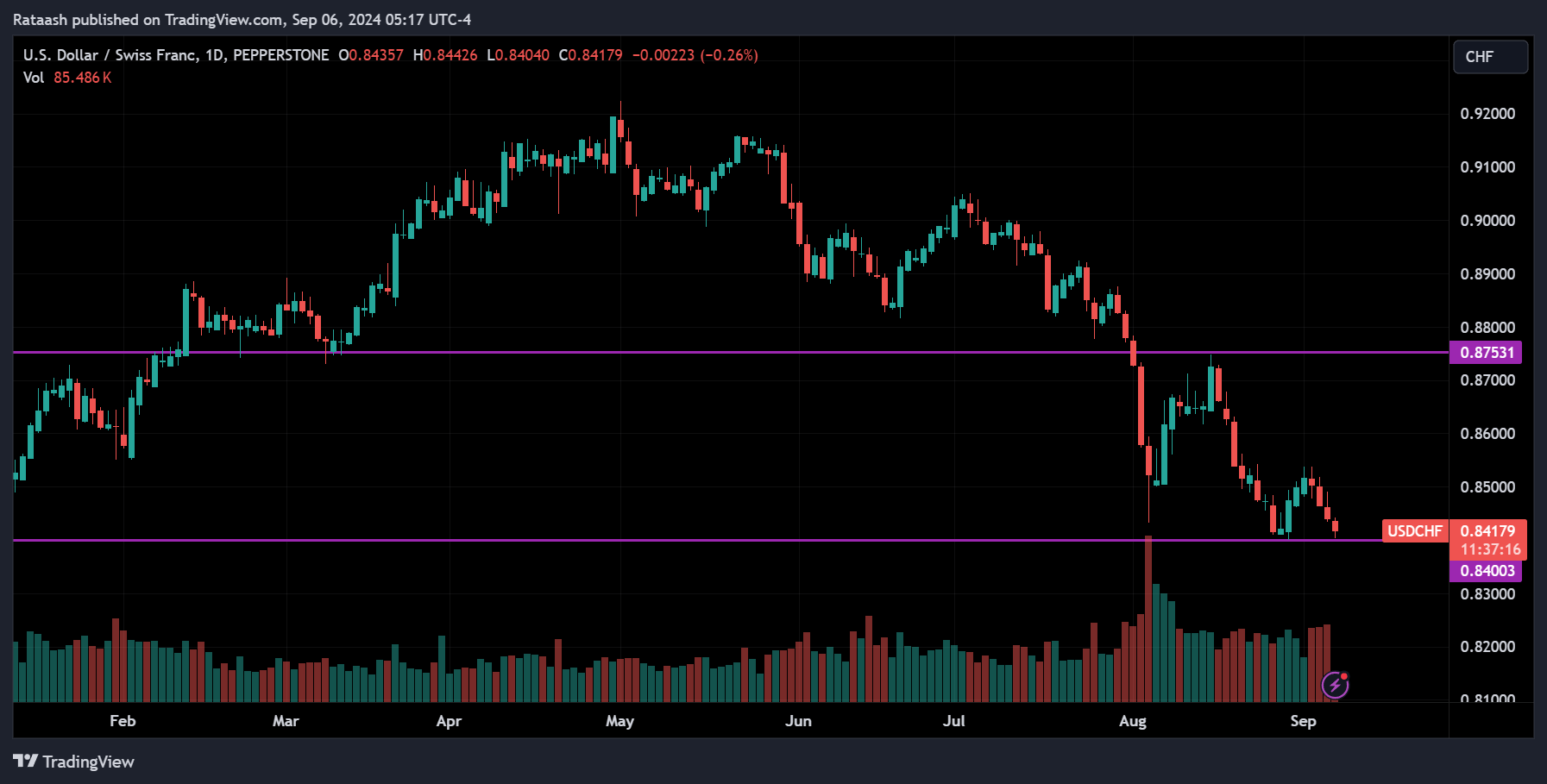

USDCHF:

USDCHF is also in a downtrend, and the price is at the major support level of 0.84000. We can expect a possible reversal around this support, with the price starting to move back up, potentially heading toward 0.85000. However, if the price breaks below this support, it may continue to drop further.

GBPUSD:

GBPUSD is overall in an uptrend. The price recently corrected to the support level of 1.31000 and is now starting to move back up. Currently, it is around the resistance level of 1.32000. If the price breaks above this 1.32000 level, we can expect it to continue toward the 1.32700 range. On the other hand, if the price breaks below the small support around 1.31400, we can expect it to drop back to the 1.31000 level.

AUDUSD:

AUDUSD is overall trending up, but the price pulled back from the resistance level of 0.68200 and dropped to the support at 0.66800. It’s currently consolidating between the small support at 0.67200 and resistance at 0.67400. If the price breaks either of these levels, that will likely indicate the next direction, probably upwards. You can confirm the uptrend if the price breaks above 0.67600. On the other hand, if the price breaks the support, it could reverse around 0.67000 or 0.66800. If both of these levels are broken, the price may continue to drop further.

NZDUSD:

NZDUSD is trending up. The price recently went through a correction from the resistance at 0.63000 to the support around 0.61800 and is now starting to rise again. It is currently nearing the resistance level of 0.62400. If the price breaks above this resistance, we can expect it to continue toward 0.63000, although it will need to pass two other resistance levels at 0.62600 and 0.62800. While a reversal from these levels is possible, it’s unlikely since the overall trend is up—but it’s always good to stay cautious.

Conclusion & Disclaimer

Subscribe to our Telegram channel to get instant updates on new articles.

Please provide your feedback on how we can improve this article. Thank you!

These analyses are here to help you understand how to analyze the market. They’re not about giving buy or sell signals. It’s simply about observing price action market behavior. I don’t recommend when to buy or sell because trading doesn’t work that way. You need a strategy to guide your decisions about when to enter or exit positions. That’s the key to making consistent profits in the financial markets over time.

The information provided in this market analysis is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any securities or investments.

All investments involve risk, and past performance is not indicative of future results. The analysis provided may not be suitable for all investors and should be used at their own discretion.

Readers are encouraged to conduct their own research.

Trading and investing in financial markets carry inherent risks, including the risk of losing invested capital. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.

GOOD LUCK✌!!!

![Price Action Forex Forecast [2024.09.06]: Key Price Levels and Trends for Major Forex Pairs - EURUSD, USDCAD, USDJPY, and More! Stay Ahead of the Market xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/Black-and-Yellow-Photocentric-Cryptocurrency-Market-Presentation-2-1024x576.jpg)